Stay Ahead in Fast-Growing Economies.

Browse Reports NowKetchup Market – Overview and Outlook by Potential Growth

Ketchup also called Catsup is a popular condiment that is usually made using ripened tomatoes as the primary component. Several ingredients are used in making ketchup including tomatoes, vinegar, sugar, salt, allspice, cloves, cinnamon, and a few others as per the flavor such as onions, celery, and other spices. In some countries and regions, ketchup is commonly referred to as tomato sauce also.

IMR Group

Description

Ketchup Market Synopsis

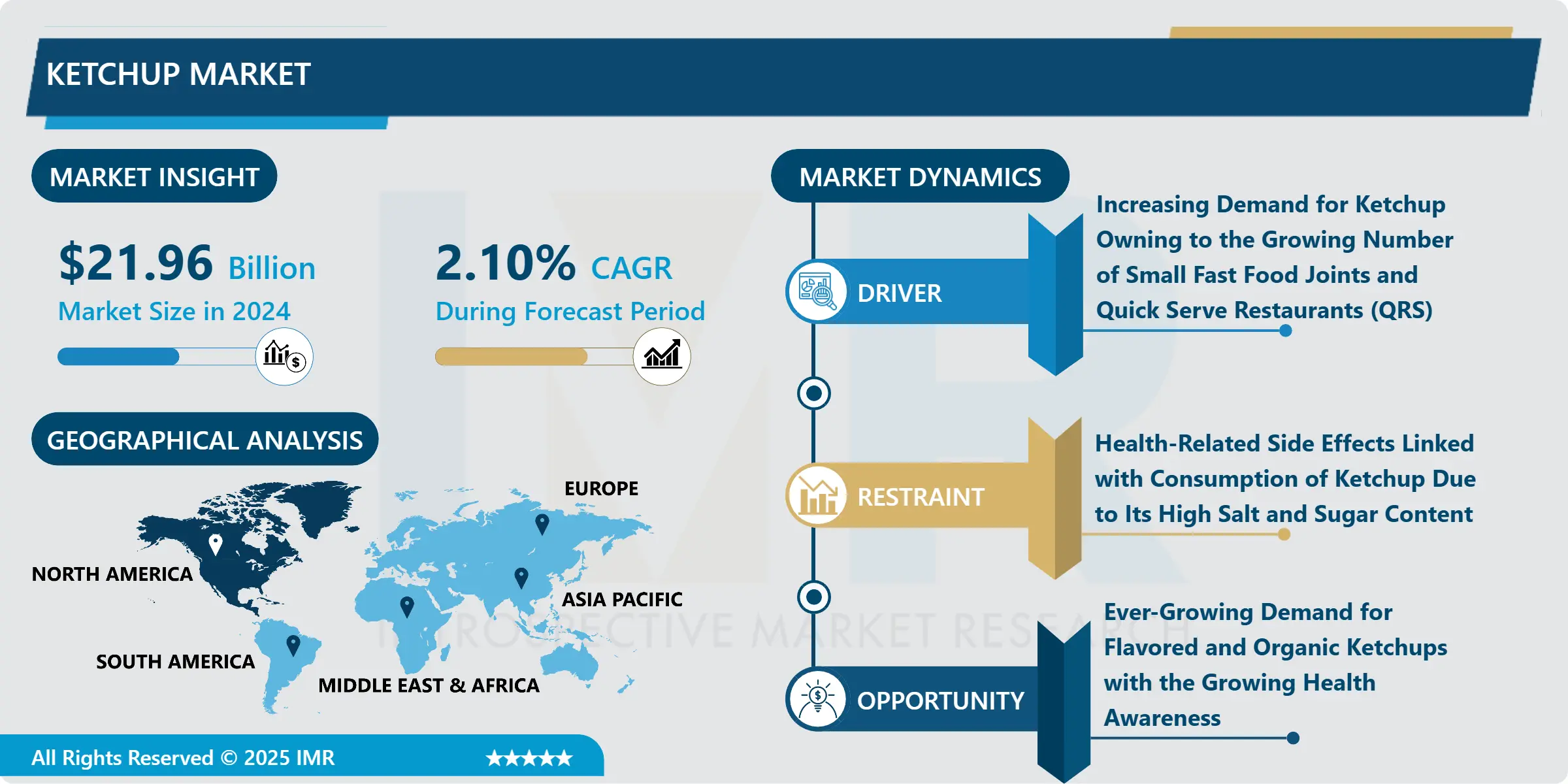

The Ketchup Market size is estimated at 21.96 billion USD in 2024 and is expected to reach 25.93 billion USD by 2032, growing at a CAGR of 2.10% during the forecast period (2025-2032)

Ketchup also called Catsup is a popular condiment that is usually made using ripened tomatoes as the primary component. Several ingredients are used in making ketchup including tomatoes, vinegar, sugar, salt, allspice, cloves, cinnamon, and a few others as per the flavor such as onions, celery, and other spices. In some countries and regions, ketchup is commonly referred to as tomato sauce also. Traditionally, ketchup was made of mushrooms or fish brine with herbs and spices, some popular early main ingredients were anchovy, oyster, lobster, walnut, kidney bean, cranberry cucumber, and grapes.

Today, 16.79% of restaurants offer Ketchup on their menus, ketchup is taking place everywhere and the reason is its favoritism. People across the world love ketchup with their meals, in America ketchup, has become an ineluctable part of people all day meals.

Further, the same consumers prefer Ketchup with the Snack, ketchup provides great color and flavoring, and also an appealing smell and texture that makes it loved by the most. Ketchup contrasts perfectly with salty, a little spicy, and fatty flavors by enhancing the sweet notes in most popular fast foods and snacks. Also, the way ingredients are grown and the way ketchup is processed and packed are proving to be decisive factors behind the growing popularity of ketchup.

Keeping in mind today’s mass production, standardization, and the dominance of ketchup in vegan diets, it can be simply considered that ketchup is rapidly gaining its place across all regions worldwide, may it be for domestic use or for food businesses. And lastly, the Shelf stability and Quality along with cleanliness and low cost provided by the market players, that people have always valued in their food will lead to the use of ketchup in food and cooking in all parts of the world in coming time.

The Ketchup Market Trend Analysis

Ketchup Market Drivers- Increasing Demand for Ketchup Owning to the Growing Number of Small Fast Food Joints and Quick Serve Restaurants (QRS)

The growing demand for ketchup is the most significant market trend that is driving the sales of ketchup across the globe. Since the last few years the market is gaining traction with the new launches of flavors and types, the flavors that are loved by people to mix well with the taste of their salty and spicy snacks are offering greater growth to the market.

The rising demand for ketchup can be attributed to the growing number of fast-food joints and restaurants that serve snacks and foods that usually goes with condiments and mostly with ketchup. And hence, the rising number of such restaurants are directly leading to the growth of ketchup consumption. For instance, presently, there are 541,642 Global Fast Food Restaurants businesses as of 2023, and the number of such restaurants is steadily increasing by 0.3% per year over the five years period between 2018 – 2023.

Additionally, the takeaway and food delivery services for other restaurants than fast-food chains also provide ketchup pouches and packs to be served with meals which is also driving the market growth of Ketchup.

Ketchup Market Opportunities- Ever-Growing Demand for Flavored and Organic Ketchups with the Growing Health Awareness

With the expanding consumption of ketchup across all the regions, consumers are asking for additional flavors as per their choice to add to their favorite foods and snacks like burgers and fries and also in sauces, meatloaf, beans, and stews.

The Ketchup Manufacturing Industry has a lot of space to experiment with a lot of ingredients to provide consumers with their demands which is to boost the demand for ketchup in the upcoming days.

Nowadays, the market for ketchup is being driven by the new generation with changed lifestyles, this generation with changed eating habits prefer to eat outside. Further, these are the same people with more physique-oriented and health-conscious behavior which is driving the demand for organic ketchup types and the demand is even expected to rise with the rising number of people getting more aware regarding their Health.

Segmentation Analysis Of The Ketchup Market

Ketchup market segments cover the Product Type, Nature, Application and Distribution Channel. By Nature, the Organic segment is Anticipated to Dominate the Market Over the Forecast period.

Organic ketchup is made from organic tomatoes and other organically produced ingredients. Its emergence is primarily the result of growing health awareness and fitness trends. Organic ketchup that is produced nowadays also contains sweeteners, salt, vinegar, and flavors and spices but the contents are organic, for example, organic sugar instead of high-fructose corn syrup is used, which makes it a better choice for people looking for the same fun along with the health benefits.

The demand for organic ketchup is primarily driven by the health consciousness of people abetted by global pandemics and environmental changes. Organic Ketchup has a thicker consistency and texture than conventional ketchup and has a deep red color. Organic tomatoes have higher amounts of beneficial antioxidants like lycopene, polyphenols, and minerals such as magnesium and iron, because of such health benefits people are shifting more towards buying organic ketchup rather than conventional ketchup.

Moreover, this conjecture of people of non-organic ketchup being unhealthy and low quality is well addressed by the manufacturers by offering them their desired ketchup made with organic ingredients which is boosting the revenue growth of the organic ketchup segment in the market.

Regional Analysis of The Ketchup Market

North America Region Dominates the Market and It is Expected to Maintain Its Dominance Over the Forecast period.

North America Region with its modern population majorly residing in developed countries like the United States and Canada, holds the largest consumption as compared to other parts of the world. Today, most revenue in the Global Ketchup Market is generated in the United States which is around USD $5,813.00 million.

Around, 97% of Americans always have a ketchup bottle in the fridge, and the annual sales of ketchup is up to 10 billion ounces, Canada is the next most ketchup-consuming country, the communities residing in Canada prefer tomato ketchup everywhere, they even make food items such as ketchup cakes, such huge consumption in North American Countries makes it the biggest market for Ketchup

Not only the consumption but the region is also the largest market when it comes to the production of ketchup. The United States is the biggest exporter of ketchup and other tomato sauces in North America. In 2016, it exported nearly USD 379 million worth or 21 percent of all trade in the product category in the region of which only 1.9%(USD 7.3 million) was exported to Europe, and a big part 60%($228 million) was exported to Canada.

Top Key Players Covered in The Ketchup Market

Conagra Brands Inc. (US)

The Kraft Heinz Company (US)

General Mills Inc. (US)

Unilever PLC. (UK)

Trader Joe’s (US)

Nestlé S.A. (Switzerland)

Sprouts Farmers Market Inc (US)

Del Monte Foods Holdings Limited (US)

Target Corporation (US)

GD Foods (India)

Carl Kühne KG GmbH & Co. (Germany)

Sky Valley Foods (US)

Red Duck Foods. (US) And Other Active Players

Key Industry Developments in the Ketchup Market

In August 2023, Campbell Soup Company announced its plan to acquire tomato sauce group Sovos Brands Inc. in a deal valued at $2.7 Billion.

In May 2022, Heinz, America’s beloved food company Launched its New Cold Ketchup. Heinz Cold Ketchup is designed by keeping in mind the people who like it cold, the new ketchup is the same slow-pouring ketchup with an unmistakable taste, just colder. Heinz is launching this ketchup in Canada to target targeting more of a condiment budget and bold intrusion.

In May 2022, ConAgra Foods, one of the largest food companies announced the launch of Hunt’s, the company’s flagship ketchup with a ‘Perfect Squeeze Ketchup system’ pack, as stated by the company this is the first and only hassle-free ketchup. The Perfect Squeeze System features a new, inverted, easy-grip bottle and vacuum-action cap that dispenses Hunt’s Ketchup easily and neatly with no waiting, no shaking, and no mess with the help of its inverted design and a vacuum-action cap. Heinz is among the biggest producers, with a market share of 80 percent in Europe – via factories in the U.K., Netherlands and elsewhere and 60 percent in the U.S.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ketchup Market by Product Type (2018-2032)

4.1 Ketchup Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Regular

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flavored

Chapter 5: Ketchup Market by Nature (2018-2032)

5.1 Ketchup Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Conventional

Chapter 6: Ketchup Market by Application (2018-2032)

6.1 Ketchup Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Household

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

Chapter 7: Ketchup Market by Packaging (2018-2032)

7.1 Ketchup Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Bottled

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pouch

Chapter 8: Ketchup Market by Distribution Channel (2018-2032)

8.1 Ketchup Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarkets & Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Specialty Stores

8.5 Convenience Stores

8.6 Online Retail

8.7 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Ketchup Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 HONEYWELL INTERNATIONAL INC (US)

9.4 LIFE ALERT EMERGENCY RESPONSE INC. (US)

9.5 ALERTONE SERVICE INC. (US)

9.6 MEDICALERT FOUNDATION (US)

9.7 ADT SECURITY SERVICES INC. (US)

9.8 BAY ALARM MEDICAL (US)

9.9 SHENZHEN GIFTSHINE TECHNOLOGY CO. LTD. (CHINA)

9.10 NORTEK SECURITY & CONTROL LLC (US)

9.11 GALAXY MEDICAL ALERT SYSTEMS LTD. (CANADA)

9.12 MEDICAL GUARDIAN LLP (US)

9.13 ROPE INNOVATION CO. LTD. (CHINA)

9.14 ELECTRONIC CAREGIVER INC. (US)

9.15 NINGBO HI-TECH PARK JABO ELECTRONICS CO. LTD (CHINA)

9.16 VANGUARD WIRELESS (AUSTRALIA)

9.17 TYNETEC LTD. (UK)

Chapter 10: Global Ketchup Market By Region

10.1 Overview

10.2. North America Ketchup Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Regular

10.2.4.2 Flavored

10.2.5 Historic and Forecasted Market Size by Nature

10.2.5.1 Organic

10.2.5.2 Conventional

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Household

10.2.6.2 Commercial

10.2.7 Historic and Forecasted Market Size by Packaging

10.2.7.1 Bottled

10.2.7.2 Pouch

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Supermarkets & Hypermarkets

10.2.8.2 Specialty Stores

10.2.8.3 Convenience Stores

10.2.8.4 Online Retail

10.2.8.5 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Ketchup Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Regular

10.3.4.2 Flavored

10.3.5 Historic and Forecasted Market Size by Nature

10.3.5.1 Organic

10.3.5.2 Conventional

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Household

10.3.6.2 Commercial

10.3.7 Historic and Forecasted Market Size by Packaging

10.3.7.1 Bottled

10.3.7.2 Pouch

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Supermarkets & Hypermarkets

10.3.8.2 Specialty Stores

10.3.8.3 Convenience Stores

10.3.8.4 Online Retail

10.3.8.5 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Ketchup Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Regular

10.4.4.2 Flavored

10.4.5 Historic and Forecasted Market Size by Nature

10.4.5.1 Organic

10.4.5.2 Conventional

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Household

10.4.6.2 Commercial

10.4.7 Historic and Forecasted Market Size by Packaging

10.4.7.1 Bottled

10.4.7.2 Pouch

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Supermarkets & Hypermarkets

10.4.8.2 Specialty Stores

10.4.8.3 Convenience Stores

10.4.8.4 Online Retail

10.4.8.5 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Ketchup Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Regular

10.5.4.2 Flavored

10.5.5 Historic and Forecasted Market Size by Nature

10.5.5.1 Organic

10.5.5.2 Conventional

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Household

10.5.6.2 Commercial

10.5.7 Historic and Forecasted Market Size by Packaging

10.5.7.1 Bottled

10.5.7.2 Pouch

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Supermarkets & Hypermarkets

10.5.8.2 Specialty Stores

10.5.8.3 Convenience Stores

10.5.8.4 Online Retail

10.5.8.5 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Ketchup Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Regular

10.6.4.2 Flavored

10.6.5 Historic and Forecasted Market Size by Nature

10.6.5.1 Organic

10.6.5.2 Conventional

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Household

10.6.6.2 Commercial

10.6.7 Historic and Forecasted Market Size by Packaging

10.6.7.1 Bottled

10.6.7.2 Pouch

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Supermarkets & Hypermarkets

10.6.8.2 Specialty Stores

10.6.8.3 Convenience Stores

10.6.8.4 Online Retail

10.6.8.5 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Ketchup Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Regular

10.7.4.2 Flavored

10.7.5 Historic and Forecasted Market Size by Nature

10.7.5.1 Organic

10.7.5.2 Conventional

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Household

10.7.6.2 Commercial

10.7.7 Historic and Forecasted Market Size by Packaging

10.7.7.1 Bottled

10.7.7.2 Pouch

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Supermarkets & Hypermarkets

10.7.8.2 Specialty Stores

10.7.8.3 Convenience Stores

10.7.8.4 Online Retail

10.7.8.5 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Ketchup Market research report?

A1: The forecast period in the Ketchup Market research report is 2025-2032.

Q2: Who are the key players in Ketchup Market?

A2: Conagra Brands Inc. (US), The Kraft Heinz Company (US), General Mills Inc. (US), Unilever PLC. (UK), Trader Joe's (US), Nestlé S.A. (Switzerland), Sprouts Farmers Market Inc (US), Del Monte Foods Holdings Limited (US), Target Corporation (US), GD Foods (India), Carl Kühne KG GmbH & Co. (Germany), Sky Valley Foods (US), Red Duck Foods. (US) And Other Active Players.

Q3: What are the segments of the Ketchup Market?

A3: The Ketchup Market is segmented into Product Type, Nature, Distribution Channel, and region. By Product Type, the market is categorized into Regular, Flavored. By Application, the market is categorized into Household, Commercial. By Nature, the market is categorized into Organic, Conventional. By Distribution Channel, the market is categorized into Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others. By region, it is analyzed across • North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA)

Q4: What is the Ketchup Market?

A4: Ketchup also called Catsup is a popular condiment that is usually made using ripened tomatoes as the primary component. Several ingredients are used in making ketchup including tomatoes, vinegar, sugar, salt, allspice, cloves, cinnamon, and a few others as per the flavor such as onions, celery, and other spices. In some countries and regions, ketchup is commonly referred to as tomato sauce also. Traditionally, ketchup was made of mushrooms or fish brine with herbs and spices, some popular early main ingredients were anchovy, oyster, lobster, walnut, kidney bean, cranberry cucumber, and grapes.

Q5: How big is the Ketchup Market?

A5: The Ketchup Market size is estimated at 21.96 billion USD in 2024 and is expected to reach 25.93 billion USD by 2032, growing at a CAGR of 2.10% during the forecast period (2025-2032)

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!