Stay Ahead in Fast-Growing Economies.

Browse Reports NowIQF Vegetables Market – Overview and Outlook by Potential Growth

Frozen foods have high nutritional value and good quality product. In fact, some frozen vegetables such as corn, beans, green peas may be superior in flavor to fresh produce is witnessing a rise in demand. The high quality of frozen food is mainly due to innovation and development of technology is known as Individual quick-frozen (IQF) method. Water turns into ice crystals around 30-25degree Fahrenheit or -1 to -4 degree Celsius and final product dose not frozen into solid form with maintain its quality. Furthermore, IQF technology is used for preservation of vegetable and vegetables-based products, food sustainability, vegetable transportation and others which is gaining popularity in food processing industry.

IMR Group

Description

IQF Vegetables Market Synopsis

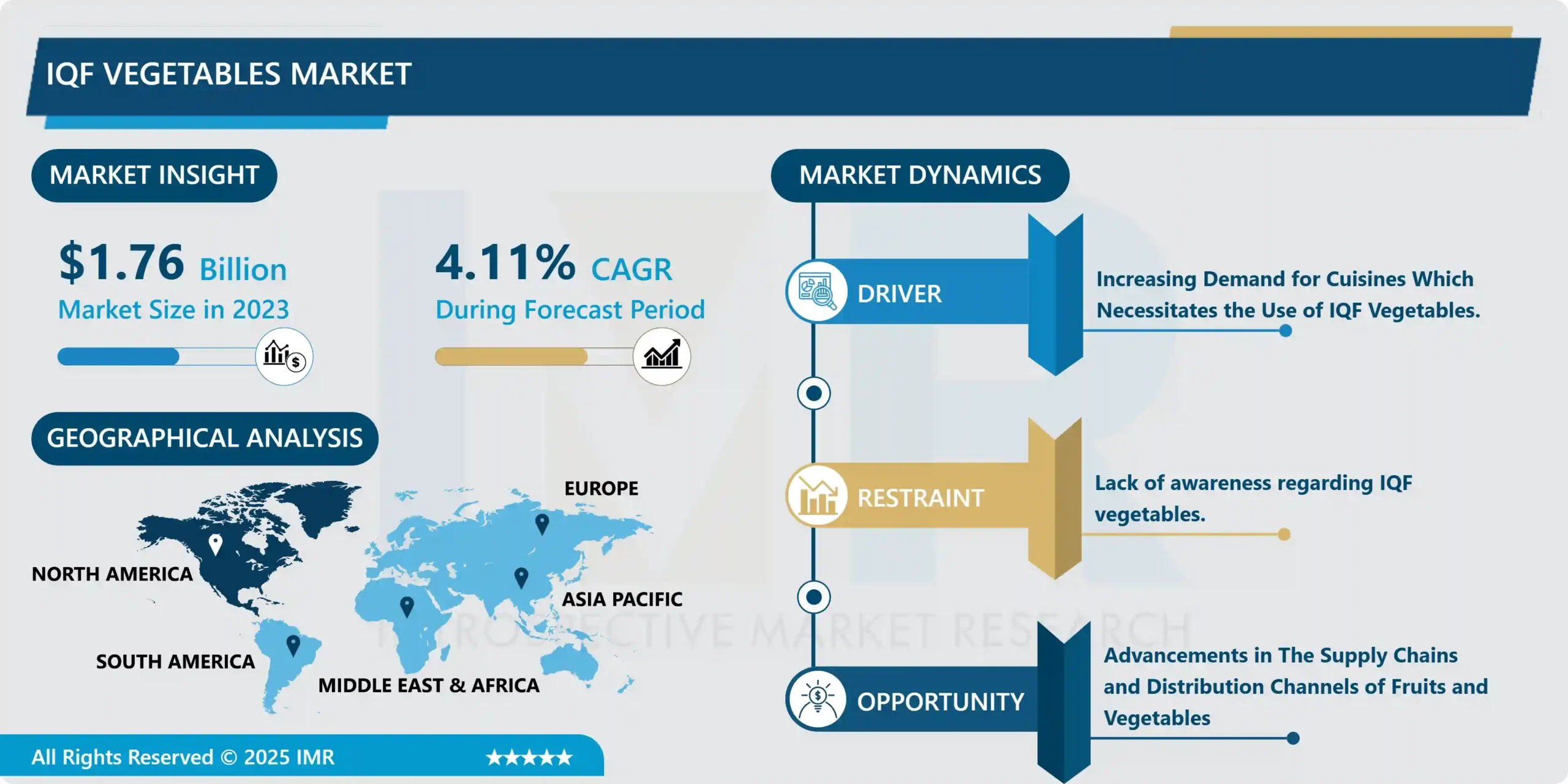

IQF Vegetables Market Size Was Valued at USD 1.76 Billion in 2023 and is Projected to Reach USD 2.53 Billion by 2032, Growing at a CAGR of 4.11% From 2024-2032.

Frozen foods have high nutritional value and good quality products. Some frozen vegetables such as corn, beans, and green peas may be superior in flavor to fresh produce is witnessing a rise in demand. The high quality of frozen food is mainly due to the innovation and development of a technology known as the Individual quick-frozen (IQF) method.

The ultra-cold, ultra-fast freezing methodology results in tiny crystal formation to freeze the product. Water turns into ice crystals around 30-25 degrees Fahrenheit or -1 to -4 degrees Celsius and the final product does not freeze into solid form to maintain its quality. Furthermore, IQF technology is used for the preservation of vegetable and vegetable-based products, food sustainability, vegetable transportation, and others which is gaining popularity in the food processing industry.

IQF Vegetables Market Trend Analysis

Increasing Demand for Cuisines Which Necessitates the Use of IQF Vegetables.

Global culinary tastes become more diverse, and there is a growing interest in various international cuisines that heavily rely on a range of vegetables. IQF vegetables provide an easy and convenient solution for both home cooks and professional chefs to access a variety of vegetables year-round, irrespective of their seasonal availability. This method of freezing preserves the quality, taste, and nutritional value of the vegetables, making them ideal for use in a wide range of dishes.

Increasing Demand for Ready-to-Cook and Ready-to-Eat Products: With the fast-paced lifestyle of the modern consumer, there’s a rising preference for quick and easy meal options. IQF vegetables fit perfectly into this trend as they are pre-washed, pre-cut, and ready to cook. This eliminates the time and effort required for vegetable preparation, making them highly attractive for quick meal solutions.

Advancements in The Supply Chains and Distribution Channels of Fruits and Vegetables

The IQF method freezes individual pieces of vegetables separately, preserving their nutritional value, taste, and texture. This technology is a game-changer in the supply chain of fruits and vegetables, as it allows for longer shelf life and reduces the risk of spoilage during transportation. This is particularly beneficial for global distribution, as it enables the transportation of vegetables over long distances without compromising quality. Moreover, the use of IQF technology can lead to reduced food waste, as it allows for more efficient inventory management. Distributors and retailers can store and sell these products for extended periods, which is especially advantageous in regions where certain vegetables are not available year-round.

IQF vegetable market has opened up new avenues for exporters and importers, enabling them to reach markets that were previously inaccessible due to the perishable nature of fresh produce. This technology allows for a wider variety of vegetables to be available to consumers globally, regardless of seasonal constraints.

IQF Vegetables Market Segment Analysis:

IQF Vegetables Market Segmented on the basis of Product Type, Equipment Type, Distribution Channel, and Application.

By Type, Leafy Vegetables segment is expected to dominate the market during the forecast period

Leafy vegetables, such as spinach, kale, and lettuce, are increasingly popular due to their health benefits and versatility in various cuisines. The rise in health consciousness among consumers has led to a surge in demand for these nutrient-rich vegetables. The IQF technology complements this trend perfectly, as it preserves the nutritional value, taste, and texture of these vegetables while offering the convenience of easy storage and quick preparation.

Leafy vegetables are typically more perishable than other types of vegetables, making them harder to transport and store over long periods. The IQF process addresses these challenges effectively by extending the shelf life and maintaining the quality of these vegetables. This advantage is crucial for suppliers and retailers, as it reduces the risk of spoilage and waste, which is particularly significant for leafy vegetables.

By Application, Commercial segment held the largest share of 48.9% in 2022

The commercial segment, which includes restaurants, hotels, caterers, and other food service providers, has shown a strong preference for IQF vegetables. This is largely due to the convenience and consistency these products offer. In the fast-paced food service industry, where time and efficiency are crucial, IQF vegetables provide a quick and easy solution without compromising on quality.

These products overcome seasonal limitations, ensuring a continuous supply of various types of vegetables regardless of their natural growing season. This is particularly beneficial for commercial establishments that need to maintain a consistent menu throughout the year. Furthermore, the IQF process ensures that each piece of vegetable retains its flavor, nutritional value, and texture, offering a quality that is often comparable to fresh produce. This consistency is crucial for commercial kitchens that aim to provide a consistent culinary experience to their customers.

IQF Vegetables Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

In North America, there is a high level of disposable income among consumers, which translates into greater spending power on food choices that offer both convenience and quality. The busy lifestyles of a significant portion of the population, especially in urban areas, drive the demand for quick and easy meal solutions.

North America boasts a highly developed and efficient cold chain infrastructure, which is crucial for the distribution and storage of IQF vegetables. This infrastructure includes advanced freezing technologies, transportation facilities equipped with refrigeration capabilities, and widespread cold storage warehouses. This robust system ensures that IQF vegetables are maintained at optimal temperatures throughout the supply chain, preserving their quality and extending their shelf life.

IQF Vegetables Market Top Key Players:

B&G Foods Holdings Corp. (United States)

ConAgra Foods Inc. (United States)

Dole Food Co. (United States)

J.R. Simplot Co. (United States)

Pinnacle Foods, Inc. (United States)

Lamb Weston (United States)

Birds Eye (United States)

Green Giant (United States)

McCain Foods (Canada)

Greenyard NV (Belgium)

Kerry Group Plc. (Ireland)

Nomad Foods (United Kingdom)

Ardo (Belgium)

bofrost(Germany)

Greenyard Foods (Belgium)

Asia-Pacific:

Yukijirushi Seedlings (Japan)

Vanuit Group (Thailand)

CP Foods (Thailand)

Ajinomoto (Japan)

Sahara Group (India)

ITC Limited (India)

Simplot Middle East (Australia)

Latin America:

Gelagri Brasil (Brazil)

Frigorífico Rio Grande (Brazil)

Middle East:

Majid Al Futtaim Group (United Arab Emirates)

Agricool (France)

Key Industry Developments in the IQF Vegetables Market:

In January 2024, Conagra announced a strategic partnership with Dolly Parton to create a new line of retail food products. The collaboration aimed to bring Dolly’s signature flavors to the market, with a range that included frozen, refrigerated, grocery, and snack items. This partnership blended Dolly’s beloved Southern recipes with Conagra’s expertise in food manufacturing. Together, they sought to offer consumers high-quality, convenient meal options inspired by Dolly’s culinary heritage.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: IQF Vegetables Market by Product (2018-2032)

4.1 IQF Vegetables Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Type

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Leafy Vegetables

4.5 Beans

4.6 Potato

4.7 Onion

4.8 Tomato

4.9 Broccoli

4.10 Others

Chapter 5: IQF Vegetables Market by Equipment Type (2018-2032)

5.1 IQF Vegetables Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Spiral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tunnel

Chapter 6: IQF Vegetables Market by Distribution Channel (2018-2032)

6.1 IQF Vegetables Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarket

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 Online Platforms

6.6 Others

Chapter 7: IQF Vegetables Market by Application (2018-2032)

7.1 IQF Vegetables Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Commercial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Residential

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 IQF Vegetables Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 WILD PLANET FOODS (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SAFE CATCH FOODS (U.S.)

8.4 OCEAN NATURALS (CANADA)

8.5 BUMBLE BEE SEAFOODS (U.S.)

8.6 WILD CAUGHT (U.S.)

8.7 ANOVA FOOD (U.S.)

8.8 GOOD CATCH FOODS (U.S.)

8.9 WM. UNDERWOOD CO. (U.S.)

8.10 BJM SEAFOOD (FRANCE)

8.11 CF GRUPO (SPAIN)

8.12 ORTIZ (SPAIN)

8.13 TONHAY BAY (FRANCE)

8.14 OCEAN HUG (U.K.)

8.15 TONNO CALLIPO(ITALY)

8.16 ORTIZ EL CONSORCIO (SPAIN)

8.17 BELA SIRENA (PORTUGAL)

8.18 CROWN PRINCE (DENMARK)

8.19 THAI UNION GROUP (THAILAND)

8.20 CENTURY TUNA (PHILIPPINES)

8.21 MATIZ (SOUTH KOREA)

8.22 GETUNA (THAILAND)

8.23 NG? PHÚC (VIETNAM)

Chapter 9: Global IQF Vegetables Market By Region

9.1 Overview

9.2. North America IQF Vegetables Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Type

9.2.4.2 Leafy Vegetables

9.2.4.3 Beans

9.2.4.4 Potato

9.2.4.5 Onion

9.2.4.6 Tomato

9.2.4.7 Broccoli

9.2.4.8 Others

9.2.5 Historic and Forecasted Market Size by Equipment Type

9.2.5.1 Spiral

9.2.5.2 Tunnel

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Supermarket

9.2.6.2 Specialty Stores

9.2.6.3 Online Platforms

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Commercial

9.2.7.2 Residential

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe IQF Vegetables Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Type

9.3.4.2 Leafy Vegetables

9.3.4.3 Beans

9.3.4.4 Potato

9.3.4.5 Onion

9.3.4.6 Tomato

9.3.4.7 Broccoli

9.3.4.8 Others

9.3.5 Historic and Forecasted Market Size by Equipment Type

9.3.5.1 Spiral

9.3.5.2 Tunnel

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Supermarket

9.3.6.2 Specialty Stores

9.3.6.3 Online Platforms

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Commercial

9.3.7.2 Residential

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe IQF Vegetables Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Type

9.4.4.2 Leafy Vegetables

9.4.4.3 Beans

9.4.4.4 Potato

9.4.4.5 Onion

9.4.4.6 Tomato

9.4.4.7 Broccoli

9.4.4.8 Others

9.4.5 Historic and Forecasted Market Size by Equipment Type

9.4.5.1 Spiral

9.4.5.2 Tunnel

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Supermarket

9.4.6.2 Specialty Stores

9.4.6.3 Online Platforms

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Commercial

9.4.7.2 Residential

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific IQF Vegetables Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Type

9.5.4.2 Leafy Vegetables

9.5.4.3 Beans

9.5.4.4 Potato

9.5.4.5 Onion

9.5.4.6 Tomato

9.5.4.7 Broccoli

9.5.4.8 Others

9.5.5 Historic and Forecasted Market Size by Equipment Type

9.5.5.1 Spiral

9.5.5.2 Tunnel

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Supermarket

9.5.6.2 Specialty Stores

9.5.6.3 Online Platforms

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Commercial

9.5.7.2 Residential

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa IQF Vegetables Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Type

9.6.4.2 Leafy Vegetables

9.6.4.3 Beans

9.6.4.4 Potato

9.6.4.5 Onion

9.6.4.6 Tomato

9.6.4.7 Broccoli

9.6.4.8 Others

9.6.5 Historic and Forecasted Market Size by Equipment Type

9.6.5.1 Spiral

9.6.5.2 Tunnel

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Supermarket

9.6.6.2 Specialty Stores

9.6.6.3 Online Platforms

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Commercial

9.6.7.2 Residential

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America IQF Vegetables Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Type

9.7.4.2 Leafy Vegetables

9.7.4.3 Beans

9.7.4.4 Potato

9.7.4.5 Onion

9.7.4.6 Tomato

9.7.4.7 Broccoli

9.7.4.8 Others

9.7.5 Historic and Forecasted Market Size by Equipment Type

9.7.5.1 Spiral

9.7.5.2 Tunnel

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Supermarket

9.7.6.2 Specialty Stores

9.7.6.3 Online Platforms

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Commercial

9.7.7.2 Residential

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the IQF Vegetables Market research report?

A1: The forecast period in the IQF Vegetables Market research report is 2024-2032.

Q2: Who are the key players in the IQF Vegetables Market?

A2: B&G Foods Holdings Corp. (United States), ConAgra Foods Inc. (United States), Dole Food Co. (United States), J.R. Simplot Co. (United States), Pinnacle Foods, Inc. (United States), Lamb Weston (United States), Birds Eye (United States), Green Giant (United States), McCain Foods (Canada), Greenyard NV (Belgium), Kerry Group Plc. (Ireland), Nomad Foods (United Kingdom), Ardo (Belgium), bofrost (Germany), Greenyard Foods (Belgium), Yukijirushi Seedlings (Japan), Vanuit Group (Thailand), CP Foods (Thailand), Ajinomoto (Japan), Sahara Group (India), ITC Limited (India), Simplot Middle East (Australia), Gelagri Brasil (Brazil), Frigorífico Rio Grande (Brazil), Majid Al Futtaim Group (United Arab Emirates), Agricool (France), and Other Major Players.

Q3: What are the segments of the IQF Vegetables Market?

A3: The IQF Vegetables Market is segmented into Product Type, Equipment Type, Distribution Channel, Application, and region. By Type, the market is categorized into Leafy Vegetables, Beans, Potato, Onion, Tomato, Broccoli, and Others. By Equipment Type, the market is categorized into Spiral and tunnel. By Distribution Channel, the market is categorized into Supermarkets, Specialty Markets, Online Platforms, and Others. By Application, the market is categorized into Commercial and residential. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the IQF Vegetables Market?

A4: Frozen foods have high nutritional value and good quality products. Some frozen vegetables such as corn, beans, and green peas may be superior in flavor to fresh produce, which is witnessing a rise in demand. The high quality of frozen food is mainly due to the innovation and development of a technology known as the Individual quick-frozen (IQF) method.

Q5: How big is the IQF Vegetables Market?

A5: IQF Vegetables Market Size Was Valued at USD 1.76 Billion in 2023 and is Projected to Reach USD 2.53 Billion by 2032, Growing at a CAGR of 4.11% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!