Stay Ahead in Fast-Growing Economies.

Browse Reports NowIoT Operating Systems Market | Industry Growth Analysis

IoT Operating Systems (IoT OS) are software platforms that manage and facilitate the communication and operation of Internet of Things (IoT) devices. They provide a framework for connecting and controlling IoT devices, ensuring seamless interaction between hardware and software components. IoT OS optimizes resource utilization, enhances security, and supports various industry-specific IoT implementations, including smart homes, industrial automation, healthcare, and agriculture.

IMR Group

Description

IoT Operating Systems Market Synopsis

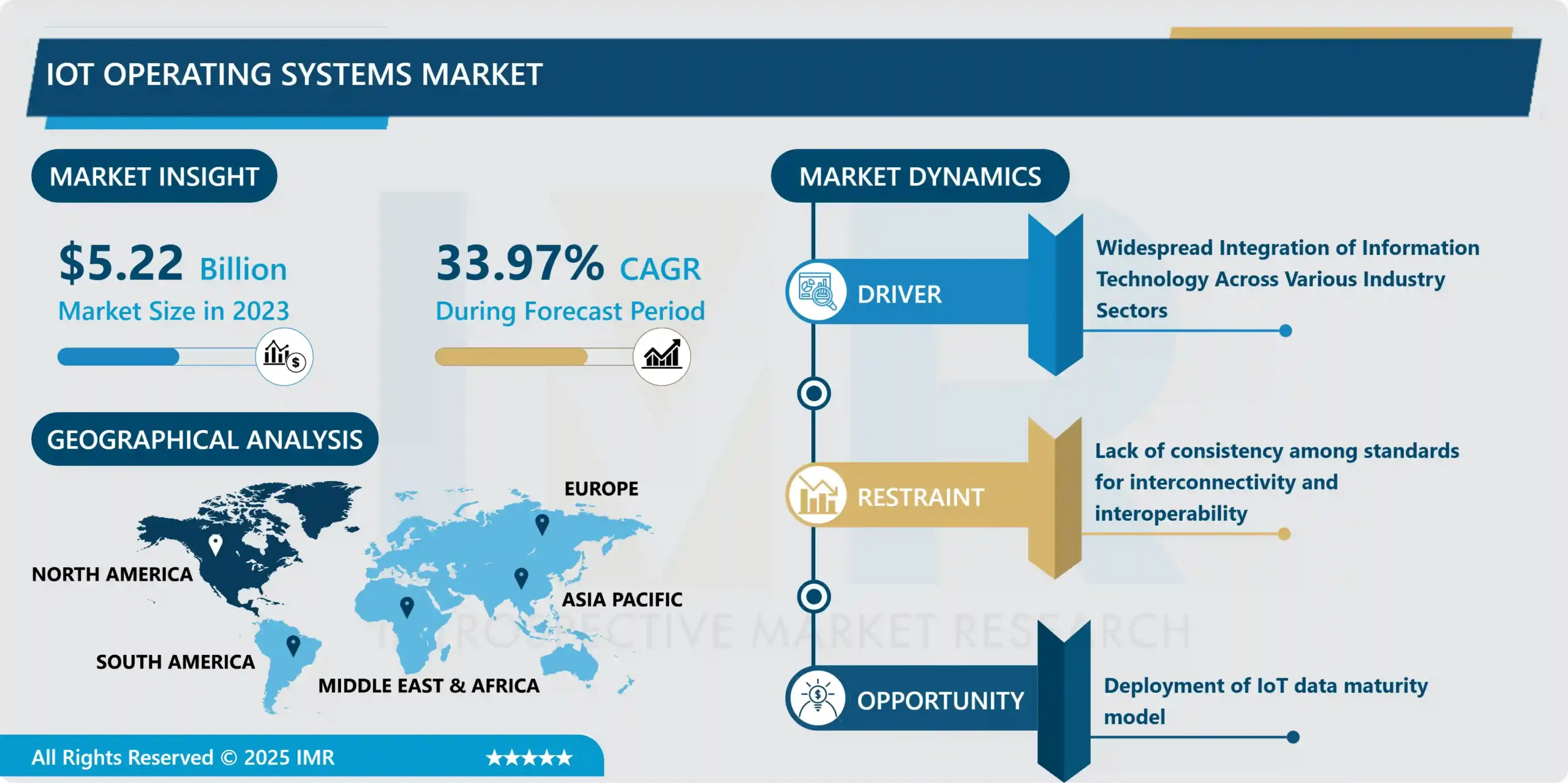

Global IoT Operating Systems Market Size Was Valued at USD 5.22 Billion in 2023 and is Projected to Reach USD 72.57 Billion by 2032, Growing at a CAGR of 33.97 % From 2024-2032.

IoT Operating Systems (IoT OS) are software platforms that manage and facilitate the communication and operation of Internet of Things (IoT) devices. They provide a framework for connecting and controlling IoT devices, ensuring seamless interaction between hardware and software components. IoT OS optimizes resource utilization, enhances security, and supports various industry-specific IoT implementations, including smart homes, industrial automation, healthcare, and agriculture.

IoT Operating Systems (IoT OS) offer several advantages, reflecting current market trends and growing demand. Firstly, these systems streamline device management, enhancing interoperability and communication among diverse IoT devices. They contribute to increased efficiency by optimizing resource utilization and providing a cohesive framework for seamless integration.

Market trends in IoT OS indicate a growing emphasis on security features, addressing concerns related to data privacy and unauthorized access. The demand for robust security measures is driven by the proliferation of IoT devices in critical sectors such as healthcare, industrial automation, and smart cities.

IoT landscape evolves, and there is a noticeable trend toward lightweight and scalable IoT operating systems, ensuring compatibility with resource-constrained devices. Real-time operating systems (RTOS) are gaining popularity, especially in applications requiring rapid data processing and response times.

Demand for IoT OS is fueled by the expanding adoption of IoT across diverse industries, including smart homes, agriculture, healthcare, and industrial sectors. With an increasing number of connected devices, there is a need for sophisticated operating systems that can efficiently manage the complexity of IoT ecosystems.

IoT Operating Systems Market Trend Analysis:

Widespread Integration of Information Technology Across Various Industry Sectors

Extensive Incorporation of Information Technology (IT) across a spectrum of industry sectors plays a pivotal role in propelling the adoption of IoT Operating Systems (IoT OS). As industries embrace digital technologies, there is a growing need for effective communication and connectivity. IoT OS emerges as a crucial element in this context, providing a unified framework to manage the intricate network of interconnected devices, sensors, and systems.

Various sectors, including manufacturing, healthcare, agriculture, and logistics, experience significant advantages from the seamless data exchange facilitated by IoT OS. For instance, in manufacturing, IoT OS enhances the coordination of smart machines, contributing to increased production efficiency. In healthcare, it supports the integration of medical devices for streamlined patient care. Agriculture benefits from precision farming through connected devices, while logistics gains improved supply chain visibility.

Recognizing the transformative potential of IoT in optimizing operations, reducing costs, and boosting productivity, the widespread integration of information technology serves as a driving force, catalyzing the increasing adoption of IoT Operating Systems. This shift marks a significant evolution in how industries leverage interconnected devices for enhanced decision-making and operational excellence.

Deployment of IoT data maturity model

The utilization of the IoT Data Maturity Model represents a notable chance to advance the capabilities inherent in IoT Operating Systems. This model, encompassing stages from fundamental data collection to advanced analytics and decision-making, offers a structured framework for organizations to evaluate and enhance their approaches to IoT data. By integrating this model into IoT Operating Systems, businesses can seize opportunities to elevate data governance, quality, and utilization.

Commencing with basic data capture and progressing through stages of connectivity and integration, the model facilitates seamless communication between IoT devices and operating systems. As organizations traverse the model, they can harness sophisticated analytics and machine learning, extracting valuable insights from the amassed data. This opens avenues for predictive maintenance, real-time monitoring, and heightened decision support within IoT applications.

Moreover, the deployment of the IoT Data Maturity Model encourages innovation, propelling the creation of more intelligent and adaptive IoT Operating Systems. This not only meets the present demand for data-driven insights but positions organizations to navigate the evolving landscape of the Internet of Things, ensuring continual optimization and efficiency across diverse industry verticals.

IoT Operating Systems Market Segment Analysis:

The IoT Operating Systems Market is Segmented on the basis of User Type, Application, Operating Systems, and Deployment Mode.

By User Type, Large Enterprises segment is expected to dominate the market during the forecast period

Dominance expected in the IoT Operating Systems market by the Large Enterprises segment during the forecast period can be elucidated by various factors. Large enterprises, possessing substantial financial resources, exhibit a heightened demand for sophisticated and scalable operating systems to meet their intricate IoT infrastructure requirements. These organizations often implement IoT solutions across diverse departments, necessitating advanced operating systems capable of efficiently managing expansive networks of interconnected devices.

Moreover, the emphasis placed by large enterprises on comprehensive solutions, encompassing features like advanced analytics, robust security, and seamless integration, aligns with the core attributes of IoT Operating Systems. The magnitude of operations and the imperative for real-time data processing in large enterprises accentuate the significance of high-performance operating systems.

Incorporating IoT applications into core business processes is increasingly vital for large enterprises, positioning them as pioneers in adopting these technologies to gain a competitive edge. Their capacity to invest in cutting-edge IoT Operating Systems establishes them as major contributors to innovation and efficiency within the IoT landscape, reinforcing the anticipated dominance of the Large Enterprises segment in the market.

By Operating Systems, Real-Time Operating Systems (RTOS) segment is expected to dominate the market during the forecast period

Anticipated dominance of the Real-Time Operating Systems (RTOS) segment in the IoT Operating Systems market over the forecast period can be explained by its fundamental role in addressing critical needs. RTOS is specifically crafted for applications that require instantaneous response times, precise timing, and consistent reliability. In the context of IoT, where real-time data processing is paramount, RTOS stands out as the preferred solution for seamlessly managing and controlling interconnected devices.

Industries such as healthcare, manufacturing, and automotive, heavily reliant on IoT applications, prioritize RTOS to ensure prompt decision-making and operational efficiency. The deterministic nature of RTOS, providing predictable and guaranteed response times, becomes particularly crucial in scenarios where system failures or delays are unacceptable.

Furthermore, as IoT applications advance and encompass mission-critical functions like autonomous vehicles and industrial automation, the demand for RTOS is poised to escalate. Its dominance is rooted in its capacity to meet the rigorous performance requirements of these applications, solidifying RTOS as a pivotal force driving innovation and efficiency within the IoT Operating Systems market.

IoT Operating Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is anticipated to maintain dominance in the IoT Operating Systems market throughout the forecast period, owing to several converging factors. The region, notably the United States and Canada, leads in driving technological advancements and widespread adoption of IoT. North America hosts a mature and technologically proficient business environment where industries across various sectors actively incorporate IoT solutions to boost efficiency and productivity. Favorable regulatory frameworks and initiatives supporting smart infrastructure further propel the swift integration of IoT Operating Systems.

Additionally, substantial investments by key market players, coupled with a strong focus on cybersecurity measures, reinforce North America’s leadership position. As industries such as healthcare, manufacturing, and smart cities continue to embrace IoT technologies, the region is well-positioned to sustain its role in spearheading innovation, shaping market dynamics, and unlocking the full potential of IoT Operating Systems.

IoT Operating Systems Market Top Key Players:

Apple Inc. (U.S.)

Google Inc. (U.S.)

Green Hills Software LLC (U.S.)

Cypress (U.S.)

Mentor Graphics Corporation (U.S.)

Microsoft Corporation (U.S.)

Wind River Systems, Inc. (U.S.)

Silicon Laboratories (U.S.)

AMD (Advanced Micro Devices, Inc.) (U.S.)

Altera Corp (now part of Intel Corporation) (U.S.)

Atmel (acquired by Microchip Technology) (U.S.)

BlackBerry Limited (Canada)

ARM Limited (U.K.)

Canonical Group Limited (U.K.)

SYSGO GmbH (Germany)

WITTENSTEIN SE (Germany)

Siemens (Germany)

ENEA AB (Sweden)

Contiki (Sweden)

Kaspersky Lab (Russia)

Amperex Technology (China)

Samsung Electronics (South Korea)

eSol Co., Ltd. (Japan)

Advantech (Taiwan), and Other Major Players.

Key Industry Development

In November 2023, AWS and Siemens expanded their alliance to seamlessly connect physical devices to the cloud. With improved collaboration, AWS IoT Site Wise Edge software can be installed directly from the Siemens Industrial Edge Marketplace.

In June 2023, Rockwell and PTC expanded their partnership to emphasize sales of PTC’s IoT and AR software. Rockwell Automation continues to resell PTC Thing Worx IoT software, which includes a digital performance management (DPM) manufacturing solution, to new and existing customers in the process and discrete manufacturing industries.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: IoT Operating Systems Market by User Type (2018-2032)

4.1 IoT Operating Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Large Enterprises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Small & Medium Enterprises (SME’s)

Chapter 5: IoT Operating Systems Market by Application (2018-2032)

5.1 IoT Operating Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Smart Building

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Smart Utilities

5.5 Smart Healthcare

5.6 Industrial Manufacturing and Automation

5.7 Vehicle Telematics

5.8 IoT Wearables

Chapter 6: IoT Operating Systems Market by Operating Systems (2018-2032)

6.1 IoT Operating Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Real-Time Operating Systems (RTOS)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Linux-Based IoT Operating Systems

6.5 Windows-Based IoT Operating Systems

Chapter 7: IoT Operating Systems Market by Deployment Mode (2018-2032)

7.1 IoT Operating Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 On-Premise

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Cloud-Based

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 IoT Operating Systems Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMAZON WEB SERVICES INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROSOFT (UNITED STATES)

8.4 GOOGLE (UNITED STATES)

8.5 CISCO SYSTEMS INC. (UNITED STATES)

8.6 IBM (UNITED STATES)

8.7 ORACLE (UNITED STATES)

8.8 SALESFORCE INC. (UNITED STATES)

8.9 PTC (UNITED STATES)

8.10 GE DIGITAL (UNITED STATES)

8.11 PARTICLE INDUSTRIES INC. (UNITED STATES)

8.12 BOSCH.IO GMBH (GERMANY)

8.13 SIEMENS (GERMANY)

8.14 TELIT (UNITED KINGDOM)

8.15 ALIBABA CLOUD (CHINA)

8.16 ACCENTURE PLC (IRELAND)

Chapter 9: Global IoT Operating Systems Market By Region

9.1 Overview

9.2. North America IoT Operating Systems Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by User Type

9.2.4.1 Large Enterprises

9.2.4.2 Small & Medium Enterprises (SME’s)

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Smart Building

9.2.5.2 Smart Utilities

9.2.5.3 Smart Healthcare

9.2.5.4 Industrial Manufacturing and Automation

9.2.5.5 Vehicle Telematics

9.2.5.6 IoT Wearables

9.2.6 Historic and Forecasted Market Size by Operating Systems

9.2.6.1 Real-Time Operating Systems (RTOS)

9.2.6.2 Linux-Based IoT Operating Systems

9.2.6.3 Windows-Based IoT Operating Systems

9.2.7 Historic and Forecasted Market Size by Deployment Mode

9.2.7.1 On-Premise

9.2.7.2 Cloud-Based

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe IoT Operating Systems Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by User Type

9.3.4.1 Large Enterprises

9.3.4.2 Small & Medium Enterprises (SME’s)

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Smart Building

9.3.5.2 Smart Utilities

9.3.5.3 Smart Healthcare

9.3.5.4 Industrial Manufacturing and Automation

9.3.5.5 Vehicle Telematics

9.3.5.6 IoT Wearables

9.3.6 Historic and Forecasted Market Size by Operating Systems

9.3.6.1 Real-Time Operating Systems (RTOS)

9.3.6.2 Linux-Based IoT Operating Systems

9.3.6.3 Windows-Based IoT Operating Systems

9.3.7 Historic and Forecasted Market Size by Deployment Mode

9.3.7.1 On-Premise

9.3.7.2 Cloud-Based

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe IoT Operating Systems Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by User Type

9.4.4.1 Large Enterprises

9.4.4.2 Small & Medium Enterprises (SME’s)

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Smart Building

9.4.5.2 Smart Utilities

9.4.5.3 Smart Healthcare

9.4.5.4 Industrial Manufacturing and Automation

9.4.5.5 Vehicle Telematics

9.4.5.6 IoT Wearables

9.4.6 Historic and Forecasted Market Size by Operating Systems

9.4.6.1 Real-Time Operating Systems (RTOS)

9.4.6.2 Linux-Based IoT Operating Systems

9.4.6.3 Windows-Based IoT Operating Systems

9.4.7 Historic and Forecasted Market Size by Deployment Mode

9.4.7.1 On-Premise

9.4.7.2 Cloud-Based

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific IoT Operating Systems Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by User Type

9.5.4.1 Large Enterprises

9.5.4.2 Small & Medium Enterprises (SME’s)

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Smart Building

9.5.5.2 Smart Utilities

9.5.5.3 Smart Healthcare

9.5.5.4 Industrial Manufacturing and Automation

9.5.5.5 Vehicle Telematics

9.5.5.6 IoT Wearables

9.5.6 Historic and Forecasted Market Size by Operating Systems

9.5.6.1 Real-Time Operating Systems (RTOS)

9.5.6.2 Linux-Based IoT Operating Systems

9.5.6.3 Windows-Based IoT Operating Systems

9.5.7 Historic and Forecasted Market Size by Deployment Mode

9.5.7.1 On-Premise

9.5.7.2 Cloud-Based

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa IoT Operating Systems Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by User Type

9.6.4.1 Large Enterprises

9.6.4.2 Small & Medium Enterprises (SME’s)

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Smart Building

9.6.5.2 Smart Utilities

9.6.5.3 Smart Healthcare

9.6.5.4 Industrial Manufacturing and Automation

9.6.5.5 Vehicle Telematics

9.6.5.6 IoT Wearables

9.6.6 Historic and Forecasted Market Size by Operating Systems

9.6.6.1 Real-Time Operating Systems (RTOS)

9.6.6.2 Linux-Based IoT Operating Systems

9.6.6.3 Windows-Based IoT Operating Systems

9.6.7 Historic and Forecasted Market Size by Deployment Mode

9.6.7.1 On-Premise

9.6.7.2 Cloud-Based

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America IoT Operating Systems Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by User Type

9.7.4.1 Large Enterprises

9.7.4.2 Small & Medium Enterprises (SME’s)

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Smart Building

9.7.5.2 Smart Utilities

9.7.5.3 Smart Healthcare

9.7.5.4 Industrial Manufacturing and Automation

9.7.5.5 Vehicle Telematics

9.7.5.6 IoT Wearables

9.7.6 Historic and Forecasted Market Size by Operating Systems

9.7.6.1 Real-Time Operating Systems (RTOS)

9.7.6.2 Linux-Based IoT Operating Systems

9.7.6.3 Windows-Based IoT Operating Systems

9.7.7 Historic and Forecasted Market Size by Deployment Mode

9.7.7.1 On-Premise

9.7.7.2 Cloud-Based

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the IoT Operating Systems Market research report?

A1: The forecast period in the IoT Operating Systems Market research report is 2024-2032.

Q2: Who are the key players in the IoT Operating Systems Market?

A2: Apple Inc. (U.S.), Google Inc. (U.S.), Green Hills Software LLC (U.S.), Cypress (U.S.), Mentor Graphics Corporation (U.S.), Microsoft Corporation (U.S.), Wind River Systems, Inc. (U.S.), Silicon Laboratories (U.S.), AMD (Advanced Micro Devices, Inc.) (U.S.), Altera Corp (now part of Intel Corporation) (U.S.), Atmel (acquired by Microchip Technology) (U.S.), BlackBerry Limited (Canada), ARM Limited (U.K.), Canonical Group Limited (U.K.), SYSGO GmbH (Germany), WITTENSTEIN SE (Germany), Siemens (Germany), ENEA AB (Sweden), Contiki (Sweden), Kaspersky Lab (Russia), Amperex Technology (China), Samsung Electronics (South Korea), eSol Co., Ltd. (Japan), Advantech (Taiwan) and Other Major Players.

Q3: What are the segments of the IoT Operating Systems Market?

A3: The IoT Operating Systems Market is segmented into User Type, Application, Operating Systems, Deployment Mode, and region. By User Type, the market is categorized into Large Enterprises and Small & Medium Enterprises (SMEs). By Application, the market is categorized into Smart buildings, Smart Utilities, Smart Healthcare, Industrial Manufacturing and Automation, Vehicle Telematics, and IoT Wearables. By Operating Systems, the market is categorized into Real-Time Operating Systems (RTOS), Linux-Based IoT Operating Systems, and Windows-Based IoT Operating Systems. By Deployment Mode, the market is categorized into On-Premises and Cloud-Based. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the IoT Operating Systems Market?

A4: IoT Operating Systems (IoT OS) are software platforms that manage and facilitate the communication and operation of Internet of Things (IoT) devices. They provide a framework for connecting and controlling IoT devices, ensuring seamless interaction between hardware and software components. IoT OS optimizes resource utilization, enhances security, and supports various industry-specific IoT implementations, including smart homes, industrial automation, healthcare, and agriculture.

Q5: How big is the IoT Operating Systems market?

A5: Global IoT Operating Systems Market Size Was Valued at USD 5.22 Billion in 2023 and is Projected to Reach USD 72.57 Billion by 2032, Growing at a CAGR of 33.97% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!