Stay Ahead in Fast-Growing Economies.

Browse Reports NowIntegration Platform as a Service (IPaaS) Market Report 2024-2032

Integration Platform as a Service (iPaaS) is a platform for developing and deploying integrations within the cloud and between the cloud and the enterprise. Users can use iPaaS to create integration flows that connect applications in the cloud or on-premises, and then deploy them without installing or managing any hardware or middleware. Most businesses use multiple systems, particularly in their sales, marketing, and customer service departments.

IMR Group

Description

Global Integration Platform as a Service Market Overview

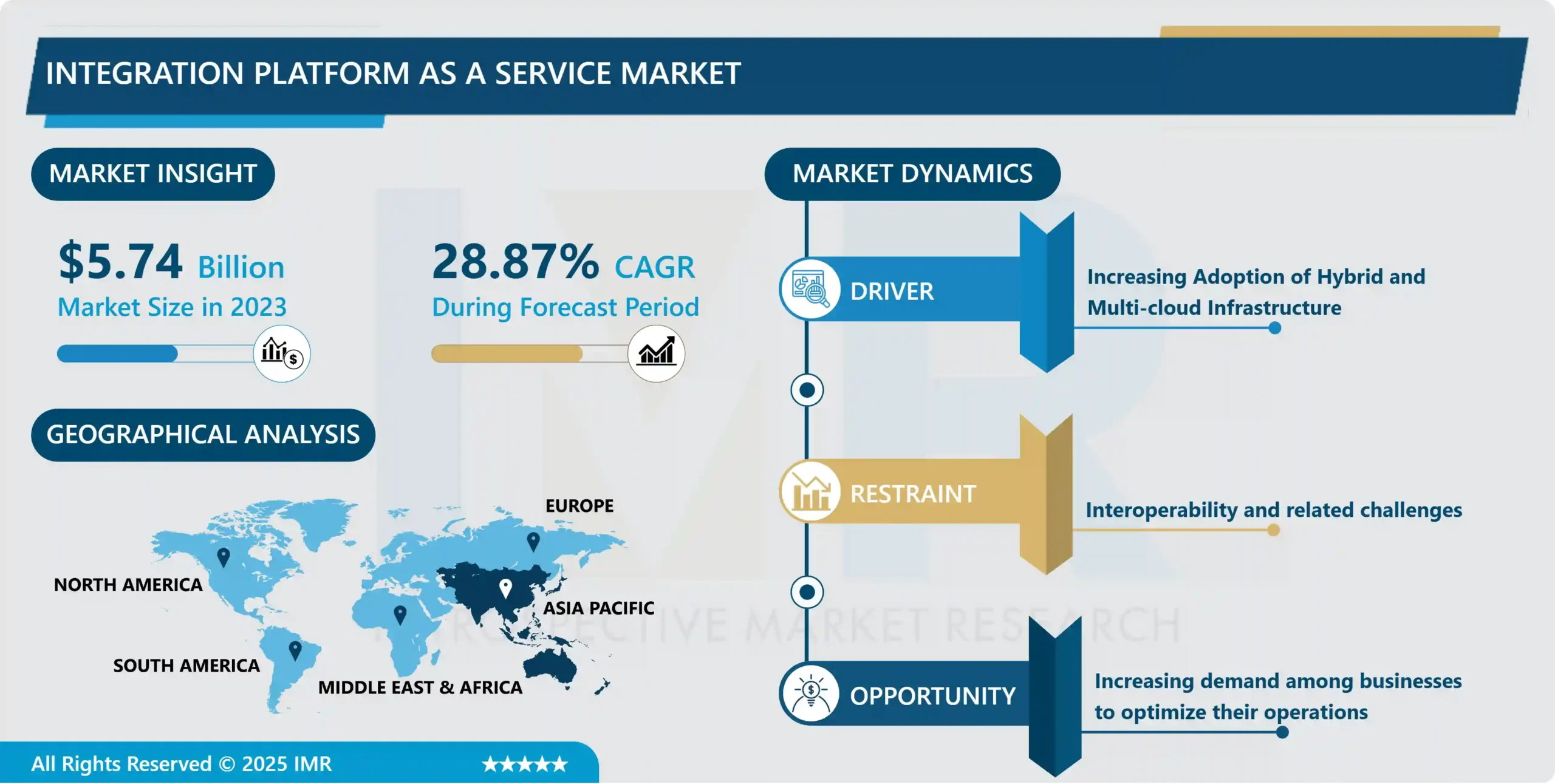

The Global Integration Platform as a Service Market Was Estimated at USD 5.74 Billion In 2023 And Is Projected to Reach USD 56.27 Billion By 2032, Growing at A CAGR of 28.87% Over The Analysis Period 2024-2032.

Integration Platform as a Service (iPaaS) is a platform for developing and deploying integrations within the cloud and between the cloud and the enterprise. Users can use iPaaS to create integration flows that connect applications in the cloud or on-premises, and then deploy them without installing or managing any hardware or middleware. Most businesses use multiple systems, particularly in their sales, marketing, and customer service departments. iPaaS improves communication between different silos by integrating software to better share data within the organization. iPaaS also allows a company to expand its offering without having to build out additional services. Instead, it can integrate with another software that already provides that service to provide customers with a unified, more robust solution.

Using an integration platform makes sense for growing enterprises since it standardizes how to monitor, maintain, and update processes across applications that are being added and changed on a daily basis. Companies can quickly integrate applications into business processes, eliminating the need to reinvent the wheel when it comes to building integration functionality. Both line-of-business and technical users can build, manage, and maintain integration with the right iPaaS thus, strengthening the expansion of the integration platform as a service market over the forecasted period.

Market Dynamics And Factors For Integration Platform as a Service Market

Drivers

Increasing Adoption of Hybrid and Multi-cloud Infrastructure

Several organizations are expected to adopt hybrid and multi-cloud strategies in the coming years as these systems trend in their respective sectors. Organizations are expected to choose these strategies because they do not want to depend on a single cloud provider. IBM Corp. according to data, 98% of organizations plan to adopt multiple hybrid clouds by 2021. Hybrid cloud offers the benefits of both public and private clouds, increasing the flexibility to work between both cloud solutions. In addition, it allows organizations to protect their confidential data by storing it in a private cloud while using the public cloud to store public data. The requirements for individual applications and functions vary as specialized services increase. This, in turn, encourages business managers to choose multi-cloud and hybrid solutions to use the system effectively and efficiently. In addition, it is cost-effective and reduces the risk of losing business. The adoption of a hybrid cloud will also influence the growth of the integration platform as a service (IPaaS) market. The hybrid model requires proper integration to ensure the smooth operation of the business over time and thus promote market growth.

Restraints

Interoperability and related challenges

iPaaS provides a platform for the integration of application, data, and process integration projects involving cloud-based applications, APIs, and on-premises systems. However, such integrations are not possible with existing traditional machines, which are highly interoperable. Traditional applications that manage critical data such as consumer data and employee data are not compatible with the latest cloud integration system, so integration with iPaaS requires replacing the existing system with a new, updated system. Those interoperability capabilities make it difficult for businesses to adopt iPaaS.

Challenges

Violent competition among leading vendors

The emerging iPaaS market has both established and specialist vendors. Large vendors have made progress integrating data into iPaaS, while SMBs have opened up by expanding their middleware. Thus, most iPaaS vendors are fragmented, and vendors expand integration solutions, focusing beyond their core competencies to improve localization and cloud-based applications and the integration process. Most iPaaS vendors struggle to establish themselves in a fragmented market. For example, major vendors such as Boomi, Informatica, MuleSoft, and SnapLogic offer the largest market share worldwide. Therefore, there is intense competition between the big players, which hinders the growth of SMEs. Thus, it is difficult for these vendors to compete with the large iPaaS vendors.

Opportunities

Increasing demand among businesses to optimize their operations

Despite the challenges and limitations in adopting iPaaS, companies prefer it as a standalone cloud-based and on-premise service platform for application integration because it offers better integration flow management, cost-effectiveness, faster delivery, and reliability. In addition, the integration of SaaS and iPaaS platforms can be done with the help of cloud companies that offer companies the ability to share data and processes from anywhere to improve business efficiency. The iPaaS market is emerging and has the potential to boost business during the forecast period. Therefore, iPaaS is likely to increase the market among enterprises to streamline business processes.

Integration Platform as a Service (IPaaS) Market Segment Analysis:

Integration Platform as a Service (IPaaS) Market Segmented based on Deployment, Application, and End-Use Industry.

By Deployment, the Public Cloud segment is expected to dominate the market during the forecast period.

Public cloud refers to a cloud computing model where resources are available to multiple users by sharing them over the Internet. It is a standard model that allows service providers to provide access to resources such as applications and storage that are publicly available on the Internet. Public cloud services can be offered for free or on a per-user basis, depending on the needs of end users. The reason for the widespread use of the public cloud among cloud storage service providers is ease of use and faster deployment. The public cloud service model offers businesses various advantages such as scalability, reliability, flexibility, and remote access. It is preferred by companies that have fewer regulatory barriers and are willing to outsource all or part of their inventory. The biggest concern with the public cloud is data security, which is why many companies are switching to private and hybrid cloud storage solutions. Public cloud is expected to hold the largest market share in the iPaaS market. This is the most common type of cloud deployment. A third-party cloud service provider owns and manages cloud resources (such as servers and storage) that are shared over the Internet. The cloud service provider owns and manages all the hardware, software, and other supporting infrastructure in the public cloud. In addition, it provides a wide range of data recovery capabilities and infrastructure such as hardware, operating systems, software, and middleware servers to run applications on multiple platforms. Businesses prefer to use public cloud services because they are easy to use.

By Application, API Management segment held the largest share of in 2023

As more consumers and businesses incorporate web and mobile applications into their daily routines, companies are finding valuable new uses for previously closed data sources. APIs (Application Programming Interfaces) are the tools that enable companies to use this data, inspiring innovative developers to create new business opportunities and improve existing products, systems, and functions. APIs are a way to integrate business systems and often enable iPaaS solutions. API management is the process of tracking and managing these APIs throughout their lifecycle, from design, release, documentation, analysis, and more. Full API lifecycle management solutions allow you to build and deploy APIs and manage, secure, and manage those APIs. API management solutions ensure visibility across an organization’s application interfaces and that each API is properly secured, maintained, and resolved when errors occur. These solutions also provide the ability to easily access and locate APIs across the organization for reuse in other projects. API management solutions offer a variety of features such as API design studios, API analytics, can act as an API gateway, and even API stores.

Integration Platform as a Service (IPaaS) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

Growth is driven by the increasing adoption of cloud and mobile trends in China, Australia and New Zealand (ANZ), India, and Japan. Government initiatives to promote digital infrastructure are also driving the adoption of iPaaS in the region. The APAC region is expected to gain significant traction for iPaaS modules due to increasing demand for local manufacturing and high energy demand. The proliferation of cloud and mobile technologies and changing work dynamics have led to the adoption of iPaaS in various industries such as manufacturing, energy and utilities, retail and consumer goods, BFSI and telecommunications, and the adoption of iPaaS in China, Japan, Singapore, and Australia, for example. Companies such as Boomi, SAP, Oracle, Microsoft, and IBM are the key players focused on serving the APAC iPaaS market.

The rapid growth of the Asia-Pacific region is because the region is home to many SMEs that are heavily involved in iPaaS development and deployment. China is one of the largest e-commerce markets in the world. Industry expansion is a major driver for the adoption of iPaaS solutions. The rapid growth of e-commerce operating on B2B and B2C platforms has required companies to address many areas such as online sales, ordering, and inventory management. IPaaS solutions can provide a seamless e-commerce integration solution to connect back-end processes, ERP systems, and the web. These integration tools enable the free flow of information between front-end and back-end systems and at the same time significantly reduce IT costs.

Key Players

Informatica (US)

Boomi Inc. (US)

SAP SE (Germany)

Oracle Corporation (US)

MuleSoft LLC (US)

Jitterbit Inc. (US)

Workato Inc. (US)

SnapLogic Inc. (US)

Software AG (Germany)

IBM Corporation (US)

Microsoft Corporation (US)

Tibco (US), Celigo (US)

Zapier (US)

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Integration Platform as a Service (IPaaS) Market by Deployment (2018-2032)

4.1 Integration Platform as a Service (IPaaS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Public Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Cloud

4.5 Private Cloud

Chapter 5: Integration Platform as a Service (IPaaS) Market by Application (2018-2032)

5.1 Integration Platform as a Service (IPaaS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 API Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Application Integration

5.5 Cloud Integration

5.6 Data Integration

5.7 B2B Integration

5.8 Others

Chapter 6: Integration Platform as a Service (IPaaS) Market by End-Use Industry (2018-2032)

6.1 Integration Platform as a Service (IPaaS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Healthcare & Life Sciences

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSI

6.5 Energy & Utilities

6.6 Manufacturing

6.7 Government & Public Sectors

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Integration Platform as a Service (IPaaS) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAXTER (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DUPONT(U.S.)

7.4 MINIGRIP (U.S.)

7.5 SMITH MEDICAL (U.S.)

7.6 BD (U.S.)

7.7 CARDINAL HEALTH (U.S.)

7.8 SIPPEX IV BAG (FRANCE)

7.9 B. BRAUN MEDICALS (GERMANY)

7.10 NEOTEC MEDICAL INDUSTRIES (SINGAPORE)

7.11 SSY GROUP LIMITED (HONG KONG)

7.12 NIPRO (JAPAN)

7.13 TECHNOFLEX (JAPAN)

7.14 TERUMO MEDICAL CORPORATION (JAPAN)

7.15 FORLONG MEDICAL COLTD. (CHINA)

7.16 AMCOR PLC (AUSTRALIA)

7.17 MRK HEALTHCARE PRIVATE LIMITED (INDIA)

7.18

Chapter 8: Global Integration Platform as a Service (IPaaS) Market By Region

8.1 Overview

8.2. North America Integration Platform as a Service (IPaaS) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment

8.2.4.1 Public Cloud

8.2.4.2 Hybrid Cloud

8.2.4.3 Private Cloud

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 API Management

8.2.5.2 Application Integration

8.2.5.3 Cloud Integration

8.2.5.4 Data Integration

8.2.5.5 B2B Integration

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by End-Use Industry

8.2.6.1 Healthcare & Life Sciences

8.2.6.2 BFSI

8.2.6.3 Energy & Utilities

8.2.6.4 Manufacturing

8.2.6.5 Government & Public Sectors

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Integration Platform as a Service (IPaaS) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment

8.3.4.1 Public Cloud

8.3.4.2 Hybrid Cloud

8.3.4.3 Private Cloud

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 API Management

8.3.5.2 Application Integration

8.3.5.3 Cloud Integration

8.3.5.4 Data Integration

8.3.5.5 B2B Integration

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by End-Use Industry

8.3.6.1 Healthcare & Life Sciences

8.3.6.2 BFSI

8.3.6.3 Energy & Utilities

8.3.6.4 Manufacturing

8.3.6.5 Government & Public Sectors

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Integration Platform as a Service (IPaaS) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment

8.4.4.1 Public Cloud

8.4.4.2 Hybrid Cloud

8.4.4.3 Private Cloud

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 API Management

8.4.5.2 Application Integration

8.4.5.3 Cloud Integration

8.4.5.4 Data Integration

8.4.5.5 B2B Integration

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by End-Use Industry

8.4.6.1 Healthcare & Life Sciences

8.4.6.2 BFSI

8.4.6.3 Energy & Utilities

8.4.6.4 Manufacturing

8.4.6.5 Government & Public Sectors

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Integration Platform as a Service (IPaaS) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment

8.5.4.1 Public Cloud

8.5.4.2 Hybrid Cloud

8.5.4.3 Private Cloud

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 API Management

8.5.5.2 Application Integration

8.5.5.3 Cloud Integration

8.5.5.4 Data Integration

8.5.5.5 B2B Integration

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by End-Use Industry

8.5.6.1 Healthcare & Life Sciences

8.5.6.2 BFSI

8.5.6.3 Energy & Utilities

8.5.6.4 Manufacturing

8.5.6.5 Government & Public Sectors

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Integration Platform as a Service (IPaaS) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment

8.6.4.1 Public Cloud

8.6.4.2 Hybrid Cloud

8.6.4.3 Private Cloud

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 API Management

8.6.5.2 Application Integration

8.6.5.3 Cloud Integration

8.6.5.4 Data Integration

8.6.5.5 B2B Integration

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by End-Use Industry

8.6.6.1 Healthcare & Life Sciences

8.6.6.2 BFSI

8.6.6.3 Energy & Utilities

8.6.6.4 Manufacturing

8.6.6.5 Government & Public Sectors

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Integration Platform as a Service (IPaaS) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment

8.7.4.1 Public Cloud

8.7.4.2 Hybrid Cloud

8.7.4.3 Private Cloud

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 API Management

8.7.5.2 Application Integration

8.7.5.3 Cloud Integration

8.7.5.4 Data Integration

8.7.5.5 B2B Integration

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by End-Use Industry

8.7.6.1 Healthcare & Life Sciences

8.7.6.2 BFSI

8.7.6.3 Energy & Utilities

8.7.6.4 Manufacturing

8.7.6.5 Government & Public Sectors

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be forecast period in the Integration Platform as a Service Market research report?

A1: The forecast period in the Integration Platform as a Service Market research report is 2024-2032.

Q2: Who are the key players in Integration Platform as a Service Market?

A2: Informatica (US), Boomi Inc. (US), SAP SE (Germany), Oracle Corporation (US), MuleSoft LLC (US), Jitterbit Inc. (US), Workato Inc. (US), SnapLogic Inc. (US), Software AG (Germany), IBM Corporation (US), Microsoft Corporation (US), Tibco (US), Celigo (US), Zapier (US)

Q3: What are the segments of Integration Platform as a Service Market?

A3: The Integration Platform as a Service Market is segmented into Deployment, Application, End-Use Industry, and Region. By Deployment the market is categorized into Hybrid Cloud, Public Cloud, and Private Cloud. By Application the market is categorized into API Management, Application Integration, Cloud Integration, Data Integration, B2B Integration, and Others. By End-Use Industry the market is categorized into Healthcare & Life Sciences, BFSI, Energy & Utilities, Manufacturing, Government & Public Sectors, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Q4: What is the Integration Platform as a Service Market?

A4: The Integration Platform as a Service Market is segmented into Deployment, Application, End-Use Industry, and Region. By Deployment the market is categorized into Hybrid Cloud, Public Cloud, and Private Cloud. By Application the market is categorized into API Management, Application Integration, Cloud Integration, Data Integration, B2B Integration, and Others. By End-Use Industry the market is categorized into Healthcare & Life Sciences, BFSI, Energy & Utilities, Manufacturing, Government & Public Sectors, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Q5: How big is the Integration Platform as a Service Market?

A5: The Global Integration Platform as a Service Market Was Estimated at USD 5.74 Billion In 2023 And Is Projected to Reach USD 56.27 Billion By 2032, Growing at A CAGR of 28.87% Over The Analysis Period 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!