Stay Ahead in Fast-Growing Economies.

Browse Reports NowInfant Nutrition Ingredients Market- Global Size & Upcoming Industry Trends

Infant nutrition ingredients are the numerous components used to manufacture baby formula and other products meant to address infants’ nutritional needs. A mix of proteins, carbs, fats, vitamins, minerals, and other nutrients is carefully selected and combined together to create a balanced and healthy food.

IMR Group

Description

Infant Nutrition Ingredients Market Synopsis

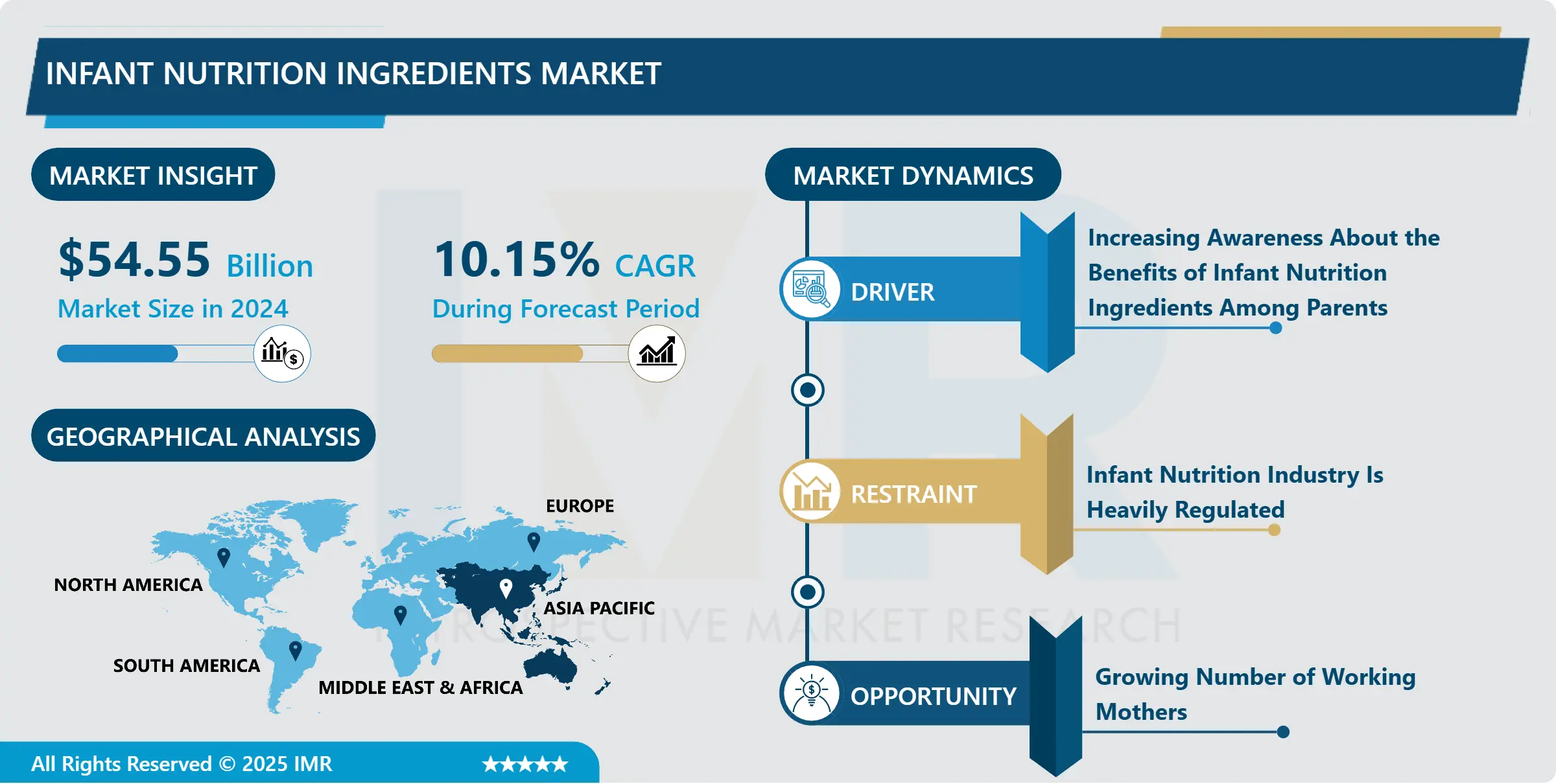

The Infant Nutrition Ingredients Market size is estimated at 54.55 billion USD in 2024 and is expected to reach 118.21 billion USD by 2032, growing at a CAGR of 10.15 % during the forecast period (2025-2032).

Infant nutrition ingredients are the numerous components used to manufacture baby formula and other products meant to address infants’ nutritional needs. A mix of proteins, carbs, fats, vitamins, minerals, and other nutrients is carefully selected and combined together to create a balanced and healthy food.

Infant nutrition ingredients are designed to mimic the nutritional composition of human milk as closely as possible, as breast milk is widely recognized as the ideal source of nutrition for infants. However, for a variety of reasons, some mothers are unable or choose not to breastfeed their babies, and infant formula provides a safe and effective alternative.

Milk, soy, or other plant sources are commonly used to produce the proteins that are a vital part of infant formula. These proteins have been through extensive processing and treatment to make them suitable for baby consumption, and they have been prepared to include the appropriate amount of each necessary amino acid.

Carbohydrates such as lactose and maltodextrin are also commonly used in infant formula, along with a range of vitamins and minerals that are necessary for proper growth and development. Lipids, including vegetable oils and other sources of fat, are also an important component of infant formula, as they provide a source of energy and help support the development of the brain and nervous system.

The Infant Nutrition Ingredients Market Trend Analysis

Infant Nutrition Ingredients Market Drivers- Increasing Awareness About the Benefits of Infant Nutrition Ingredients Among Parents

Increasing awareness about the benefits of infant nutrition ingredients among parents is one of the key drivers of the infant nutrition ingredients market.

To enhance the nutritional content of infant formula or baby food and to ensure that infants get the nutrients they need for healthy growth and development, a number of different ingredients are added. Protein, fat, carbohydrate, vitamin, mineral, and prebiotic are all examples of such components.

There has been a growing awareness among parents about the importance of providing proper nutrition to their infants, particularly in the first few years of life when the infant’s brain and body are rapidly developing. This has led to an increased demand for infant nutrition ingredients, as parents look for ways to provide the best possible nutrition to their babies.

Furthermore, the increasing number of working mothers, busy lifestyles, and the rise in the number of nuclear families have resulted in a growing demand for infant formula and baby food, further driving the growth of the infant nutrition ingredients market.

In addition, there has been a growing trend towards organic and natural ingredients in infant formula and baby food, as parents are becoming more concerned about the safety and health of their babies. This has led to an increased demand for natural and organic infant nutrition ingredients, such as organic proteins, natural sweeteners, and natural flavors.

Overall, the increasing awareness about the benefits of infant nutrition ingredients among parents, coupled with the growing demand for infant formula and baby food, is expected to drive the growth of the infant nutrition ingredients market in the coming years.

Infant Nutrition Ingredients Market Opportunities- Growing Number of Working Mothers

The growing number of working mothers is a significant opportunity for the infant nutrition ingredients market. With the increasing number of women entering the workforce, many families are looking for convenient and healthy options to feed their babies. This has led to rising demand for infant nutrition products and ingredients that provide the essential nutrients necessary for healthy growth and development.

Infant nutrition ingredients are used in a variety of products, including infant formula, baby food, and dietary supplements. These products are designed to provide the nutrients that babies need during their first year of life when they are growing and developing rapidly. Infant nutrition ingredients include proteins, carbohydrates, fats, vitamins, and minerals.

Organic and all-natural infant food has become increasingly popular in recent years. There is a growing market for goods that are devoid of dangerous chemicals and additives since many working moms are worried about the safety and quality of the food they are giving their newborns. Because of this, many are looking for more organic and natural options for newborn nourishment.

The emphasis on innovation and product differentiation is another key trend in the market for baby nutrition components. Companies are spending vast sums on R&D to produce cutting-edge innovations that will appeal to modern customers. Products that are fortified with extra nutrients or formulated for infants with allergies or digestive difficulties fall into this category.

Overall, the growing number of working mothers is driving the demand for convenient, healthy, and high-quality infant nutrition products and ingredients. This presents a significant opportunity for companies operating in this market to develop innovative products and capture a larger share of this rapidly growing market.

Segmentation Analysis Of The Infant Nutrition Ingredients Market

Infant Nutrition Ingredients market segments cover the Type, Age Group. By Type, the Alpha-Lactalbumin segment is Anticipated to Dominate the Market Over the Forecast period.

Alpha-lactalbumin is a protein that is commonly used in infant formula and is one of the key components of human milk.

• Proteins, carbs, lipids, vitamins, and minerals are just a few of the many elements that make up the baby-feeding ingredients industry. Different regions have different tastes, cultural standards, and nutritional needs, all of which affect the demand for these items.

Alpha-lactalbumin is a valuable ingredient in infant formula due to its high nutritional quality and its ability to help regulate the pH of the infant’s digestive system. It is also relatively easy to digest, making it a suitable option for infants with sensitive stomachs.

Regional Analysis of The Infant Nutrition Ingredients Market

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

In terms of the worldwide market for infants’ nutrient ingredients, Asia-Pacific is a significant participant. The high birth rate in nations like China and India, along with a growing understanding of the significance of early childhood nutrition, is primarily responsible for this trend.

Some of the key players in the global infant nutrition ingredients market include companies based in the United States, Europe, and Asia-Pacific, such as Abbott Laboratories, BASF SE, DuPont de Nemours, Inc., Royal FrieslandCampina N.V., and Arla Foods amba.

Whey protein and casein, two examples of protein-based components, are in particularly high demand because of their significance in baby feeding. Countries like the United States, New Zealand, and the European Union generate large amounts of dairy-based substances like milk and lactose that are often used in infant formula.

Top Key Players Covered in The Infant Nutrition Ingredients Market

Danone S.A. (France)

Cargill Inc. (United States)

Arla Foods (Denmark)

Fonterra Co-operative Group Limited (New Zealand)

Proliant Inc. (United States)

APS Biogroup (United States)

Nestle S.A. (Switzerland)

Groupe Lactalis (France)

Koninklijke DSM (Netherlands)

Saputo Inc. (Canada) and Other Active Players

Key Industry Developments in the Infant Nutrition Ingredients Market

In September 2023: Nestlé identified myelin as a crucial nutrient found in breast milk and launched Nutrilearn Connect in Hong Kong. This formula contains a unique myelin blend, aiming to support cognitive development.

In May 2023: Arla Foods Ingredients introduced Lacprodan Alpha-50, an alpha-lactalbumin-rich infant formula ingredient. This low-protein option allows for the addition of higher levels of HMOs, promoting immune system development and gut health.

In April 2023: Danone Manifesto Ventures invested in Israeli cell-based breast milk startup Wilk, paving the way for potential personalized infant nutrition based on individual needs.

In January 2023: Timios introduced its “Made to Order Porridge” for infants and toddlers, offering customizable options based on specific nutrient requirements

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Infant Nutrition Ingredients Market by Type (2018-2032)

4.1 Infant Nutrition Ingredients Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alpha-Lactalbumin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Casein Glycomacropeptide

4.5 Milk Minerals

4.6 Lactose

4.7 Hydrolysates

4.8 Others

Chapter 5: Infant Nutrition Ingredients Market by Age Group (2018-2032)

5.1 Infant Nutrition Ingredients Market Snapshot and Growth Engine

5.2 Market Overview

5.3 0-6 Months

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 6-12 Months

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Infant Nutrition Ingredients Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 QIAGEN(GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 F.HOFFMANN-LA ROCHE LTD (SWITZERLAND)

6.4 SEEGENE INC (SOUTH KOREA)

6.5 SOLGENT CO. LTD (SOUTH KOREA)

6.6 CURETIS (GERMANY)

6.7 KURBO INDUSTRIES LTD. (JAPAN)

6.8 DEVEX (U.S.)

6.9 THERMO FISHER SCIENTIFIC INC (U.S.)

6.10 MYLAB DISCOVERY SOLUTIONS PVT. LTD (INDIA)

6.11 ABBOTT (U.S.)

6.12 GETEIN BIOTECH INC (CHINA)

Chapter 7: Global Infant Nutrition Ingredients Market By Region

7.1 Overview

7.2. North America Infant Nutrition Ingredients Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Alpha-Lactalbumin

7.2.4.2 Casein Glycomacropeptide

7.2.4.3 Milk Minerals

7.2.4.4 Lactose

7.2.4.5 Hydrolysates

7.2.4.6 Others

7.2.5 Historic and Forecasted Market Size by Age Group

7.2.5.1 0-6 Months

7.2.5.2 6-12 Months

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Infant Nutrition Ingredients Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Alpha-Lactalbumin

7.3.4.2 Casein Glycomacropeptide

7.3.4.3 Milk Minerals

7.3.4.4 Lactose

7.3.4.5 Hydrolysates

7.3.4.6 Others

7.3.5 Historic and Forecasted Market Size by Age Group

7.3.5.1 0-6 Months

7.3.5.2 6-12 Months

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Infant Nutrition Ingredients Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Alpha-Lactalbumin

7.4.4.2 Casein Glycomacropeptide

7.4.4.3 Milk Minerals

7.4.4.4 Lactose

7.4.4.5 Hydrolysates

7.4.4.6 Others

7.4.5 Historic and Forecasted Market Size by Age Group

7.4.5.1 0-6 Months

7.4.5.2 6-12 Months

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Infant Nutrition Ingredients Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Alpha-Lactalbumin

7.5.4.2 Casein Glycomacropeptide

7.5.4.3 Milk Minerals

7.5.4.4 Lactose

7.5.4.5 Hydrolysates

7.5.4.6 Others

7.5.5 Historic and Forecasted Market Size by Age Group

7.5.5.1 0-6 Months

7.5.5.2 6-12 Months

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Infant Nutrition Ingredients Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Alpha-Lactalbumin

7.6.4.2 Casein Glycomacropeptide

7.6.4.3 Milk Minerals

7.6.4.4 Lactose

7.6.4.5 Hydrolysates

7.6.4.6 Others

7.6.5 Historic and Forecasted Market Size by Age Group

7.6.5.1 0-6 Months

7.6.5.2 6-12 Months

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Infant Nutrition Ingredients Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Alpha-Lactalbumin

7.7.4.2 Casein Glycomacropeptide

7.7.4.3 Milk Minerals

7.7.4.4 Lactose

7.7.4.5 Hydrolysates

7.7.4.6 Others

7.7.5 Historic and Forecasted Market Size by Age Group

7.7.5.1 0-6 Months

7.7.5.2 6-12 Months

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Infant Nutrition Ingredients Market research report?

A1: The forecast period in the Infant Nutrition Ingredients Market research report is 2025-2032.

Q2: Who are the key players in the Infant Nutrition Ingredients Market?

A2: Danone S.A. (France), Cargill Inc. (United States), Arla Foods (Denmark), Fonterra Co-operative Group Limited (New Zealand), Proliant Inc. (United States), APS Biogroup (United States), Nestle S.A. (Switzerland), Groupe Lactalis (France), Koninklijke DSM (Netherlands), Saputo Inc. (Canada) and Other Active Players.

Q3: What are the segments of the Infant Nutrition Ingredients Market?

A3: The Infant Nutrition Ingredients Market has been segmented into Type, Age Group and region. By Type, the market is categorized into Alpha-Lactalbumin, Casein Glycomacropeptide, Milk Minerals, Lactose, Hydrolysates, and Others. By Age Group, the market is categorized into 0-6 months, and 6-12 months. By region, it is analyzed across• North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA)

Q4: What is the Infant Nutrition Ingredients Market?

A4: Infant nutrition ingredients are the numerous components used to manufacture baby formula and other products meant to address infants’ nutritional needs. A mix of proteins, carbs, fats, vitamins, minerals, and other nutrients is carefully selected and combined together to create a balanced and healthy food.

Q5: How big is the Infant Nutrition Ingredients Market?

A5: The Infant Nutrition Ingredients Market size is estimated at 54.55 billion USD in 2024 and is expected to reach 118.21 billion USD by 2032, growing at a CAGR of 10.15 % during the forecast period (2025-2032).

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!