Stay Ahead in Fast-Growing Economies.

Browse Reports NowIndia CNG Vehicles Market-Latest Advancement & Future Trends (2024-2032)

CNG is an alternate fuel to Petrol, Diesel, and Auto LPG. Economic benefits come along when users switch over to CNG, besides of course contributing to a greener, cleaner environment. CNG-powered vehicles are more economical and efficient compared to other fuel-driven options.

IMR Group

Description

India CNG Vehicles Market Synopsis:

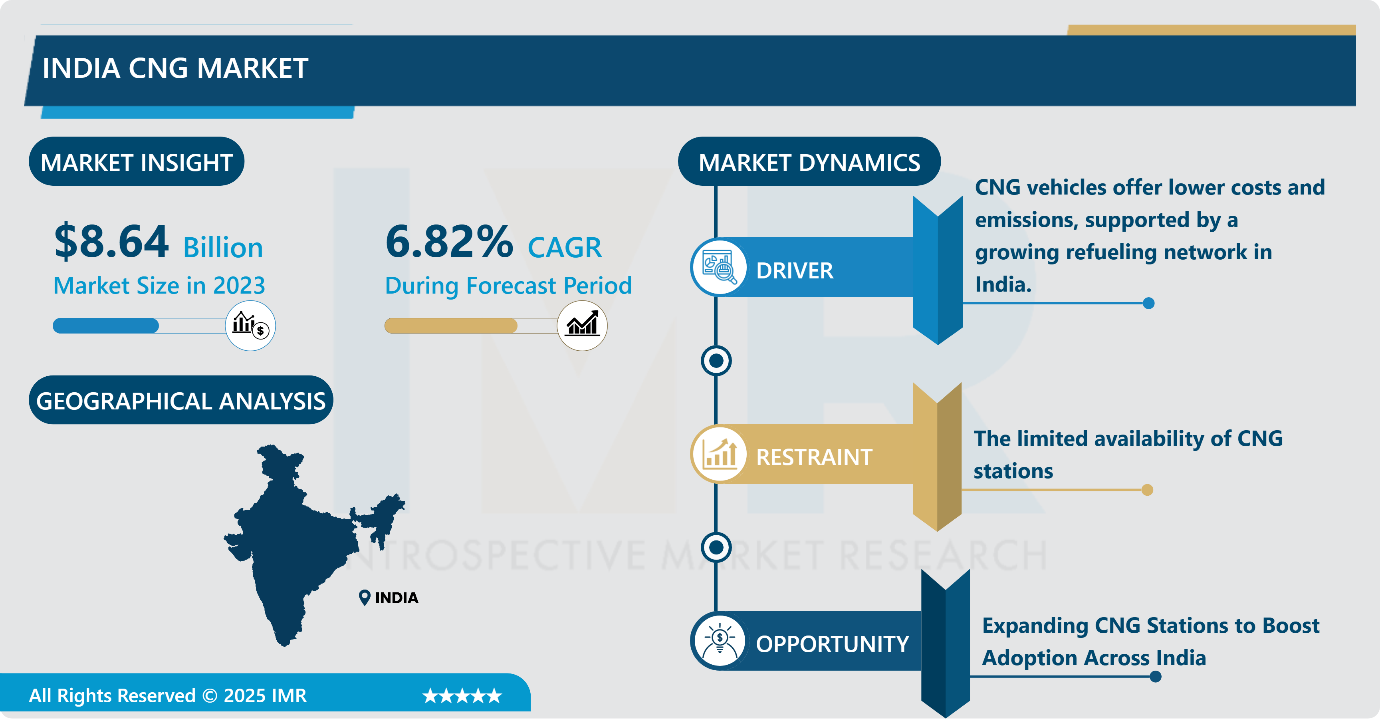

India CNG Vehicles Market Size Was Valued at USD 8.64 Billion in 2023 and is Projected to Reach USD 15.65 Billion by 2032, Growing at a CAGR of 6.82% From 2024-2032.

CNG is an alternate fuel to Petrol, Diesel, and Auto LPG. Economic benefits come along when users switch over to CNG, besides of course contributing to a greener, cleaner environment. CNG-powered vehicles are more economical and efficient compared to other fuel-driven options. The Indian automotive market, based on fuel type, is undergoing a fascinating revolution as India grapples with rising air pollution and its commitment to reducing greenhouse gas emissions, the need for cleaner and more sustainable transportation solutions has become increasingly crucial. While petrol and diesel have dominated the Indian automotive scene for decades, a wave of alternative fuel options is emerging, offering both environmental and economic benefits.

With recurring hikes in the prices of petrol and diesel over the last few years, the smart Indian consumer has generously embraced CNG for its proven cost-effectiveness. The market of CNG-powered vehicles has grown more promising year on year with the demand of CNG vehicles continuing to outgrow the supply.

India CNG Vehicles Market Growth and Trend Analysis:

CNG vehicles offer lower costs and emissions, supported by a growing refueling network in India.

CNG fuel stands at approximately one-half of the price levels of both petrol and diesel. The current market price for CNG equals roughly fifty percent of what petrol and diesel costs. People adopt CNG-powered vehicles mainly due to these vehicles reduce their fuel expenses. A CNG-powered vehicle requires fuel expenses that cost much less than what petrol/diesel-driven vehicles need. Individuals paying to operate CNG cars should expect to spend 2.2 rupees (USD 0.02) per kilometer whereas drivers of petrol and diesel vehicles need to pay approximately 5.45 rupees (USD 0.06) per kilometer.

CNG vehicles emit minimal carbon emissions which establishes these vehicles as highly environmentally friendly energy sources. CNG-powered vehicles receive preference because they combine low running costs with energy conservation and pollution-reducing abilities.

An accelerated development of the CNG gas filling station network throughout India has made CNG vehicle ownership simpler than previously possible. The number of existing CNG gas stations exceeds 5899 nationwide so drivers can easily use CNG vehicles for travel beyond short distances. The Indian government aims to establish 10,000 CNG filling stations throughout Indian territory within a decade to encourage transportation of CNG vehicles.

The limited availability of CNG stations

The availability of CNG refueling stations remains insufficient, especially in rural areas. As of 2024, there are approximately 5899 natural gas refueling stations in India, compared to about 70,000 petrol and diesel outlets. This disparity makes it challenging for potential buyers to consider CNG vehicles, as the scarcity of refueling stations can lead to concerns about the convenience and feasibility of using such vehicles.

CNG vehicles generally have a higher upfront cost compared to their gasoline or diesel counterparts. This price difference can be a significant barrier to adoption, particularly for price-sensitive consumers. The additional cost is often attributed to the specialized components required for CNG vehicles, such as reinforced fuel tanks and modified engine systems. Despite the potential for lower operating costs over time, the higher initial purchase price can deter many consumers from making the switch to CNG vehicles.

Expanding CNG Stations to Boost Adoption Across India

In 2023 India operated 5,899 CNG stations while the petrol/diesel station count exceeded 80,000 thus indicating insufficient distribution of gas stations throughout the nation. The major cities Delhi and Mumbai benefit from good CNG station availability yet countless rural and distant locations face a shortage of refueling stations. The practicality of CNG automobiles extends to a wider customer base when the government and private companies create additional CNG filling stations. The government of Karnataka intends to develop 1,414 new CNG stations during the following 8 to 10 years to boost CNG adoption and accessibility across the state.

India CNG Vehicles Market Segment Analysis:

India CNG Vehicles Market is segmented based on Vehicle type, Kit type, and region

By Vehicle Type, Passenger Vehicles segment is expected to dominate the market during the forecast period

The CNG car segment grew by 59% in H1 2024 to register a share of 16.4%. Growth was largely driven by new products like Tata Punch with dual-CNG tank, and Maruti Fronx, both launched in H2-2023. The rest of the growth came from higher sales of Maruti products: Ertiga (+19%), Dzire (+12%) and Brezza (+10%).

CNG still caters to low-value product offerings with an average sales price of ? 8.9 lakhs (10,215.28 USD), with a large contribution from fleet operators.

Maruti remains a dominant player with 72% of the CNG market share, and Maruti Ertiga (MUV) was the best seller at 14% and the preferred choice among fleet operators.

Source: Vahan

The CNG industry experienced a significant 33% year-on-year (YoY) growth in sales during the first half (H1) of 2024, rising from 4,14,366 units in H1 2023 to 5,52,070 units in H1 2024. Passenger vehicles led the growth with a 49% increase, reaching 2,42,289 units compared to 1,62,585 units in the previous year. The 3-wheeler segment saw a modest rise of 11%, increasing from 1,56,961 units to 1,73,480 units, while goods carriers registered an 8% growth, reaching 43,889 units from 40,630 units.

Notably, buses & vans recorded the highest growth of 71%, jumping from 52,725 units to 90,308 units, likely driven by an increased adoption of CNG in public transport. The ‘Others’ category also grew by 44%, though in smaller absolute numbers. The overall increase in CNG vehicle sales reflects a strong shift towards cleaner fuel alternatives, particularly in the passenger and commercial transport segments. The data, sourced from Vahan and reported on July 3, 2024, highlights the growing momentum of CNG adoption across various vehicle categories.

By Application, the Retro Fitment segment held the largest share in 2023

Retro Fitment Kits will demonstrate the highest compound annual growth rate for the forecast period. Retro fitment kits experience better market demand than venturi kits due to they confer improved fuel efficiency with enhanced emission management in automobiles. The central Government plans to approve the installation of BS-VI petrol car CNG kits that will decrease fuel usage by 40-50%.

The road transport ministry proposed a draft notification that described the standards for emissions when vehicles receive retrofitting modifications. The government has taken beneficial action by adopting CNG as fuel since it decreases fuel costs for the public.

The rapid growth of CNG gas filling stations across the country now enables people to operate CNG-powered vehicles more easily. More than 3,700 CNG gas station locations have been established across the nation and this enables owners of CNG vehicles to undertake distant road trips. The Indian government intends to develop 10,000 CNG stations throughout the nation during the next 10 years to promote CNG vehicle usage.

India CNG Vehicles Market Active Players:

Ashok Leyland Limited

Audi

Bajaj Auto Limited

FIAT Motors

Force Motors

Ford India

General Motors

Greaves Cotton Limited (Ampere Vehicles)

Honda

Hyundai Motor India Limited

Mahindra & Mahindra Limited

Maruti Suzuki India Limited

Nissan

Piaggio Vehicles Pvt Ltd

Skoda

Swaraj Mazda

Tata Motors Limited

Toyota Motors

VE Commercial Vehicles Limited (Eicher & Volvo JV)

Volkswagen

Other Active Players

Key Industry Developments in the India CNG Vehicles Market:

In September 2024, the new Maruti Suzuki Swift CNG was launched in India. The new Swift is a CNG one with more torque, better fuel efficiency, and some additional variants. With the latest Swift CNG, Maruti Suzuki, the largest carmaker, has 14 CNG models in its portfolio.

In July 2024, Bajaj Auto launched the world’s first CNG-powered bike. The Bajaj Freedom CNG motorcycle offers significant fuel cost savings, potentially reducing expenses by around 50% compared to petrol motorcycles

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: India CNG Vehicles Market by Product Type

4.1 India CNG Vehicles Market Snapshot and Growth Engine

4.2 India CNG Vehicles Market Overview

4.3 OEM and Car Modification

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 OEM and Car Modification: Geographic Segmentation Analysis

Chapter 5: India CNG Vehicles Market by Application

5.1 India CNG Vehicles Market Snapshot and Growth Engine

5.2 India CNG Vehicles Market Overview

5.3 Personal Use

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Personal Use: Geographic Segmentation Analysis

5.4 Commercial Use

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Use: Geographic Segmentation Analysis

Chapter 6: India CNG Vehicles Market by Kit Type

6.1 India CNG Vehicles Market Snapshot and Growth Engine

6.2 India CNG Vehicles Market Overview

6.3 Retro Fitment

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Retro Fitment: Geographic Segmentation Analysis

6.4 Venturi

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Venturi: Geographic Segmentation Analysis

6.5 and sequential

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and sequential: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 India CNG Vehicles Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ASHOK LEYLAND LIMITED

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AUDI

7.4 BAJAJ AUTO LIMITED

7.5 FIAT MOTORS

7.6 FORCE MOTORS

7.7 FORD INDIA

7.8 GENERAL MOTORS

7.9 GREAVES COTTON LIMITED (AMPERE VEHICLES)

7.10 HONDA

7.11 HYUNDAI MOTOR INDIA LIMITED

7.12 MAHINDRA & MAHINDRA LIMITED

7.13 MARUTI SUZUKI INDIA LIMITED

7.14 NISSAN

7.15 PIAGGIO VEHICLES PVT LTD

7.16 SKODA

7.17 SWARAJ MAZDA

7.18 TATA MOTORS LIMITED

7.19 TOYOTA MOTORS

7.20 VE COMMERCIAL VEHICLES LIMITED (EICHER & VOLVO JV)

7.21 VOLKSWAGEN

7.22 OTHER ACTIVE PLAYERS.

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the India CNG Vehicles Market research report?

A1: The forecast period in the India CNG Vehicles Market research report is 2024-2032.

Q2: Who are the key players in the India CNG Vehicles Market?

A2: Ashok Leyland Limited, Audi, Bajaj Auto Limited, FIAT Motors, Force Motors, Ford India, General Motors, Greaves Cotton Limited (Ampere Vehicles), Honda, Hyundai Motor India Limited, Mahindra & Mahindra Limited, Maruti Suzuki India Limited, Nissan, Piaggio Vehicles Pvt Ltd, Skoda, Swaraj Mazda, Tata Motors Limited, Toyota Motors, VE Commercial Vehicles Limited (Eicher & Volvo JV), Volkswagen, and Other Active Players.

Q3: What are the segments of the India CNG Vehicles Market?

A3: The India CNG Vehicles Market is segmented into Type, Nature, Application, and Region. By Vehicle Type, the market is categorized into Commercial Vehicles, Trucks, and Passenger Vehicles. By Kit Type, it is categorized into Retro Fitment, Venturi, and Sequential.

Q4: What is the India CNG Vehicles Market?

A4: CNG is an alternate fuel to Petrol, Diesel, and Auto LPG. Economic benefits come along when users switch over to CNG, besides of course contributing to a greener, cleaner environment. CNG-powered vehicles are more economical and efficient compared to other fuel-driven options.

Q5: How big is the India CNG Vehicles Market?

A5: India CNG Vehicles Market Size Was Valued at USD 8.64 Billion in 2023 and is Projected to Reach USD 15.65 Billion by 2032, Growing at a CAGR of 6.82% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!