Stay Ahead in Fast-Growing Economies.

Browse Reports NowHydrogen Electrolysers Market- Global Industry Growth and Trend Analysis

Hydrogen Electrolysis are machines that divide water molecules into hydrogen and oxygen gasses by electrolysis using electricity. Water molecules disintegrate when an electric current is sent through them; hydrogen gas is collected at the cathode and oxygen gas is collected at the anode.

IMR Group

Description

Hydrogen Electrolysers Market Synopsis

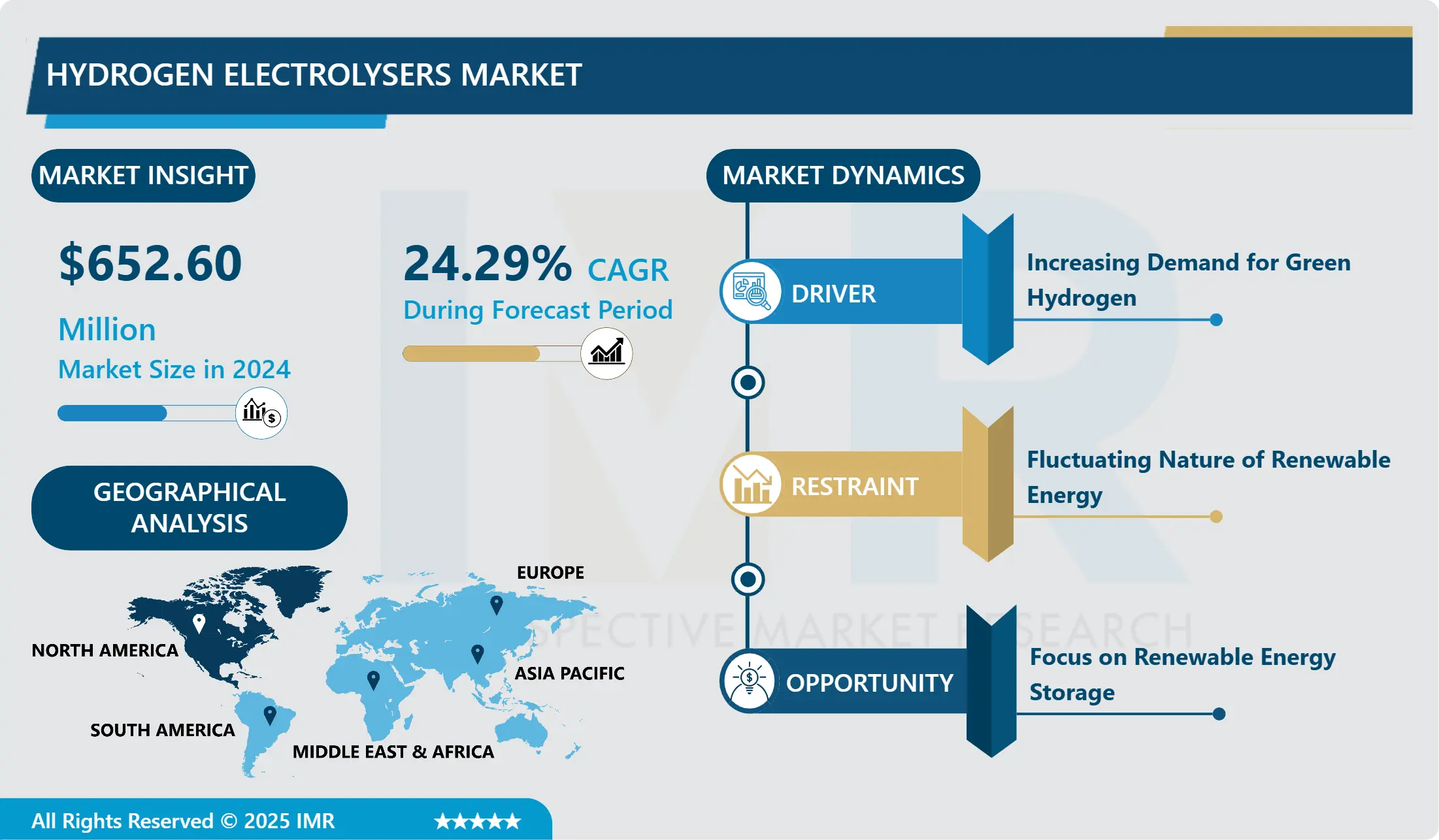

Hydrogen Electrolysers Market Size Was Valued at USD 652.60 Million in 2024 and is Projected to Reach USD 3716.52 Million by 2032, Growing at a CAGR of 24.29% From 2025-2032.

Hydrogen Electrolysis are machines that divide water molecules into hydrogen and oxygen gasses by electrolysis using electricity. Water molecules disintegrate when an electric current is sent through them; hydrogen gas is collected at the cathode and oxygen gas is collected at the anode. The production of pure hydrogen for several industrial uses and energy storage options depends heavily on these electrolyzers.

Electrolysis-generated hydrogen is becoming a sustainable energy carrier for various applications, including transportation, industrial operations, power production, and energy storage. This demand for high-quality hydrogen is driving significant investments in Electrolysers technology by both private and public sectors. For Instance, Europe aims to produce and import 20 million tons of renewable hydrogen by 2030, requiring a significant expansion of hydrogen technologies across sectors and the development of a dedicated European infrastructure for hydrogen production, storage, and transport.

As the number of countries committed to achieving net zero emissions continues to rise, 131 countries, covering 88% of global greenhouse gas emissions, have announced targets by April 2022. The goal is to limit the global temperature increase to 1.5°C by 2050. This requires mitigating emissions from all energy end uses, with 70% achieved through energy efficiency, electrification, and renewables. For instance, Electrolysers are crucial for producing low-emission hydrogen from renewable or nuclear electricity. In 2022, the pace of new capacity entering operation slowed down by 45%, but Electrolysers manufacturing capacity increased by over 25%, reaching nearly 11 GW per year. The realization of all pipeline projects could lead to an installed electrolyser capacity of 170-365 GW by 2030.

The need for hydrogen electrolysers is predicted to expand as a result of global carbon neutrality initiatives, government regulations, and investments. Industries are turning to hydrogen to satisfy decarbonization goals, and hydrogen infrastructure development is accelerating. Strategic collaborations and technical advancements boost market growth.

Hydrogen Electrolysers Market Trend Analysis

Hydrogen Electrolysers Market Growth Driver- Increasing Demand for Green Hydrogen

The market for hydrogen Electrolysers is expanding significantly due to the rising need for green hydrogen. This shift is the result of a global movement toward renewable energy sources and decarbonization. Reducing carbon emissions is an important goal for governments and organizations in the fight against climate change, and green hydrogen is emerging as an essential part of the provide. By generating up to 10 million tons of green hydrogen by 2030, for instance, the European Union’s ambitious hydrogen policy seeks to drastically reduce CO2 emissions. ?

For instance, Globally, the industry has announced more than 1,000 large-scale project proposals as of the end of January 2023. Since the previous publication, more than 350 new proposals have been announced. Of the total, 795 aim to be fully or partially commissioned through 2030 and represent total investments of USD 320 billion of direct investments into hydrogen value chains through 2030 (up from USD 240 billion).

Green hydrogen is being increasingly adopted by industries like steel, chemicals, and transportation to decarbonize operations. In the steel industry, green hydrogen can replace coal, reducing carbon emissions. For Instance, the HYBRIT initiative, run by SSAB, LKAB, and Vattenfall, is focusing on producing a fossil-free sponge using green hydrogen, potentially cutting Sweden’s total carbon emissions by 10%. In transportation, fuel cell vehicles powered by green hydrogen offer a zero-emission alternative to traditional internal combustion engines, with companies like Toyota and Hyundai leading the charge in commercializing hydrogen fuel cell vehicles.

Based on the pie chart provided, the green hydrogen production capacity until 2030 is distributed as follows, North America, with 70% of the capacity, followed by Asia-Pacific at 17%, Middle East and Africa at 8%, and Europe at 5%. This demonstrates North America’s significant investment and commitment to renewable energy and decarbonization. The Asia-Pacific region, with its growing industrial base and renewable energy initiatives, also shows significant capacity. The Middle East and Africa, with their abundant renewable resources, contribute to the global green hydrogen landscape.

Hydrogen Electrolysers Market Opportunity- Focus on Renewable Energy Storage

Electrolysers and hydrogenation technologies are widely used in industries and public life to achieve carbon neutrality. Electrochemical battery storage and hydrogen energy storage are used in vehicles, community energy supply, and grid stabilization due to their environment-friendly characteristics. Electrochemical battery storage stores electricity and discharges it for demand coverage, while hydrogen energy storage supplies power and heat through fuel cells with by-product water. Hydrogen is suitable for long-term storage, such as seasonal and annual storage, due to its high gravimetric density and stability.

For Instance, Germany’s WindGas project converts wind energy into hydrogen through electrolysis, which is then injected into the natural gas grid or used in industrial applications. In Australia, the Yara Pilbara Fertilizer plant uses solar power to produce green hydrogen, which is stored and used in ammonia production, demonstrating the potential of hydrogen storage to support both energy and industrial needs.

Hydrogen storage is a promising solution for decentralized energy systems, allowing local storage and renewable energy usage. It reduces the need for costly grid infrastructure upgrades, benefiting rural and remote areas. The scalability of hydrogen storage allows for large-scale projects to store significant amounts of energy, supporting national grids, while smaller systems can be implemented in localized settings. This flexibility caters to diverse energy needs, from industrial complexes to individual households.

Hydrogen Electrolysers Market Segment Analysis:

Hydrogen Electrolysers Market is segmented on the basis of Type, Application, End-users, and Region.

By Type, Proton Exchange Membrane Electrolysers segment is expected to dominate the market during the forecast period

Proton exchange membrane (PEM) electrolysis is a crucial industrial method for capturing high-purity hydrogen for chemical applications and energy storage. This method is increasingly popular in Europe and other regions due to higher renewable energy penetration. Hydrogen can be used for power generation, natural gas grid supplementation, vehicle fueling, and as a high-value chemical feedstock for green fertilizer production. The cost and energy used in PEM Electrolysers manufacturing are primarily due to cell stack manufacturing processes. electrolysis technology uses liquid electrolyte and ion exchange membranes, which overcome the disadvantages of alkaline liquid systems by using deionized water as the carrier fluid and enabling differential pressure operation.

PEM Electrolyserss are safe, reliable, and low-maintenance, making them suitable for various applications, including small-scale distributed hydrogen production units. They offer fast response times, making them ideal for dynamic operation and grid balancing. Their modular design allows for easy adaptation to varying production needs, making them a leading choice for hydrogen production, and ensuring market dominance in the forecast period.and

By Application, Low Capacity segment held the largest share in 2024

The low segment is expected to largest share of the hydrogen Electrolysers market due to its versatility and compatibility with various applications. These Electrolyserss are ideal for hydrogen refueling stations, industrial processes, and energy storage systems. The demand for low outlet pressure Electrolysers, especially for fuel cell electric vehicles (FCEVs), is driven by the expansion of hydrogen refueling infrastructure. Low-pressure Electrolyserss are crucial for on-site hydrogen production at refueling stations, providing convenient and efficient refueling experiences for FCEV drivers.

Their affordability, versatility, and technological advancements. These smaller Electrolysers are ideal for residential and commercial users and suitable for heating, power generation, and transportation. They can be easily integrated into existing infrastructure, making them more competitive and reliable for decentralized hydrogen production. This segment holds the largest share of the hydrogen electrolyzers market.

Hydrogen Electrolysers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the hydrogen electrolyzers market due to its focus on clean energy initiatives and decarbonization in industries like transportation, power generation, and manufacturing. The US has invested in hydrogen-related projects, such as hydrogen fueling stations and partnerships between automakers and energy companies. Additionally, North America’s robust technological infrastructure and established research and development ecosystem enable continuous innovation and improvement of hydrogen electrolysis technologies, making them more efficient and cost-effective over time. Advanced Electrolysers technologies are being deployed in pilot projects and commercial applications, showcasing their scalability and reliability.

The U.S. government cemented its commitment to hydrogen and clean fuel technologies in 2023, aligning to achieve a carbon-neutral power sector by 2035 and net zero emissions by 2050. In addition, The Department of Energy (DOE) has launched a USD 7 billion program to develop regional clean hydrogen hubs across the US. These hubs aim to integrate hydrogen production, consumption, and distribution networks, reducing clean hydrogen costs and establishing a sustainable hydrogen market. The DOE selected specific projects for funding negotiations in October 2023 after a thorough evaluation process. North America’s diverse industrial base uses hydrogen for refining, chemicals, steel, and transportation. Hydrogen Electrolyserss offer cost-effective, environmentally friendly hydrogen production, reducing emissions and enhancing energy efficiency.

Hydrogen Electrolysers Market Top Key Players:

Giner Inc. (U.S.)

Plug Power Inc. (U.S.)

Bloom Energy (U.S.)

Next Hydrogen (Canada)

Ballard Power Systems (Canada)

Siemens AG (Germany)

iGas Energy GmbH (Germany)

Enapter (Germany)

ITM Power Plc (UK)

Pure Energy Centre (UK)

McPhy Energy (France)

Air Liquide (France)

Gaztransport & Technigaz (France)

GreenHydrogen Systems (Denmark)

Nel Hydrogen (Norway)

Idroenergy (Italy)

Erredue S.p.A (Italy)

SwissHydrogen SA (Switzerland)

Tianjin Mainland Hydrogen Equipment Co. Ltd (China)

Beijing CEI Technology Co., Ltd. (China)

Shandong Saikesaisi Hydrogen Energy Co Ltd. (China)

Other Active Players

Key Industry Developments in the Hydrogen Electrolysers Market:

In May 2024, Plug Power Inc. a global leader in comprehensive hydrogen solutions for the green hydrogen economy, announced the signing of a memorandum of understanding (MOU) with Allied Green Ammonia (AGA), an Australian Company focused on green ammonia production, to supply up to 3 gigawatts (GW) of Plug Electrolysers capacity for AGA’s upcoming hydrogen to ammonia facility proposed for the Northern Territory of Australia.

In November 2023, Air Liquide and Siemens Energy officially inaugurated their joint venture gigawatt Electrolysers factory today in Berlin. The mass production of Electrolysers components will allow the manufacturing of low-carbon hydrogen at an industrial scale and competitive cost, and foster an innovative European ecosystem. The state-of-the-art gigawatt factory will ramp up to an annual production capacity of three gigawatts by 2025. With two global leading companies in their field combining their expertise, this Franco-German partnership plays a pivotal role in the emergence of a sustainable hydrogen economy needed to forge the energy transition

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hydrogen Electrolysers Market by Type (2018-2032)

4.1 Hydrogen Electrolysers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Proton Exchange Membrane Electrolysers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Alkaline Electrolysers

4.5 Solid Oxide Electrolysers

Chapter 5: Hydrogen Electrolysers Market by Capacity (2018-2032)

5.1 Hydrogen Electrolysers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Low ( 1mW)

Chapter 6: Hydrogen Electrolysers Market by Outlet Pressure (2018-2032)

6.1 Hydrogen Electrolysers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Low ( 40 Bar)

Chapter 7: Hydrogen Electrolysers Market by End User (2018-2032)

7.1 Hydrogen Electrolysers Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Methanol

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Refining/ Hydrocarbon

7.5 Ammonia

7.6 Electronics

7.7 Food & Beverage

7.8 Others

Chapter 8: Hydrogen Electrolysers Market by Distribution Channel (2018-2032)

8.1 Hydrogen Electrolysers Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Direct Sales

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Indirect Sales

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Hydrogen Electrolysers Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 GINER INC. (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 PLUG POWER INC. (U.S.)

9.4 BLOOM ENERGY (U.S.)

9.5 NEXT HYDROGEN (CANADA)

9.6 BALLARD POWER SYSTEMS (CANADA)

9.7 SIEMENS AG (GERMANY)

9.8 IGAS ENERGY GMBH (GERMANY)

9.9 ENAPTER (GERMANY)

9.10 ITM POWER PLC (UK)

9.11 PURE ENERGY CENTRE (UK)

9.12 MCPHY ENERGY (FRANCE)

9.13 AIR LIQUIDE (FRANCE)

9.14 GAZTRANSPORT & TECHNIGAZ (FRANCE)

9.15 GREENHYDROGEN SYSTEMS (DENMARK)

9.16 NEL HYDROGEN (NORWAY)

9.17 IDROENERGY (ITALY)

9.18 ERREDUE S.P.A (ITALY)

9.19 SWISSHYDROGEN SA (SWITZERLAND)

9.20 TIANJIN MAINLAND HYDROGEN EQUIPMENT CO. LTD (CHINA)

9.21 BEIJING CEI TECHNOLOGY COLTD. (CHINA)

9.22 SHANDONG SAIKESAISI HYDROGEN ENERGY CO LTD. (CHINA)

9.23

Chapter 10: Global Hydrogen Electrolysers Market By Region

10.1 Overview

10.2. North America Hydrogen Electrolysers Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Proton Exchange Membrane Electrolysers

10.2.4.2 Alkaline Electrolysers

10.2.4.3 Solid Oxide Electrolysers

10.2.5 Historic and Forecasted Market Size by Capacity

10.2.5.1 Low ( 1mW)

10.2.6 Historic and Forecasted Market Size by Outlet Pressure

10.2.6.1 Low ( 40 Bar)

10.2.7 Historic and Forecasted Market Size by End User

10.2.7.1 Methanol

10.2.7.2 Refining/ Hydrocarbon

10.2.7.3 Ammonia

10.2.7.4 Electronics

10.2.7.5 Food & Beverage

10.2.7.6 Others

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Direct Sales

10.2.8.2 Indirect Sales

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Hydrogen Electrolysers Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Proton Exchange Membrane Electrolysers

10.3.4.2 Alkaline Electrolysers

10.3.4.3 Solid Oxide Electrolysers

10.3.5 Historic and Forecasted Market Size by Capacity

10.3.5.1 Low ( 1mW)

10.3.6 Historic and Forecasted Market Size by Outlet Pressure

10.3.6.1 Low ( 40 Bar)

10.3.7 Historic and Forecasted Market Size by End User

10.3.7.1 Methanol

10.3.7.2 Refining/ Hydrocarbon

10.3.7.3 Ammonia

10.3.7.4 Electronics

10.3.7.5 Food & Beverage

10.3.7.6 Others

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Direct Sales

10.3.8.2 Indirect Sales

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Hydrogen Electrolysers Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Proton Exchange Membrane Electrolysers

10.4.4.2 Alkaline Electrolysers

10.4.4.3 Solid Oxide Electrolysers

10.4.5 Historic and Forecasted Market Size by Capacity

10.4.5.1 Low ( 1mW)

10.4.6 Historic and Forecasted Market Size by Outlet Pressure

10.4.6.1 Low ( 40 Bar)

10.4.7 Historic and Forecasted Market Size by End User

10.4.7.1 Methanol

10.4.7.2 Refining/ Hydrocarbon

10.4.7.3 Ammonia

10.4.7.4 Electronics

10.4.7.5 Food & Beverage

10.4.7.6 Others

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Direct Sales

10.4.8.2 Indirect Sales

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Hydrogen Electrolysers Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Proton Exchange Membrane Electrolysers

10.5.4.2 Alkaline Electrolysers

10.5.4.3 Solid Oxide Electrolysers

10.5.5 Historic and Forecasted Market Size by Capacity

10.5.5.1 Low ( 1mW)

10.5.6 Historic and Forecasted Market Size by Outlet Pressure

10.5.6.1 Low ( 40 Bar)

10.5.7 Historic and Forecasted Market Size by End User

10.5.7.1 Methanol

10.5.7.2 Refining/ Hydrocarbon

10.5.7.3 Ammonia

10.5.7.4 Electronics

10.5.7.5 Food & Beverage

10.5.7.6 Others

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Direct Sales

10.5.8.2 Indirect Sales

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Hydrogen Electrolysers Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Proton Exchange Membrane Electrolysers

10.6.4.2 Alkaline Electrolysers

10.6.4.3 Solid Oxide Electrolysers

10.6.5 Historic and Forecasted Market Size by Capacity

10.6.5.1 Low ( 1mW)

10.6.6 Historic and Forecasted Market Size by Outlet Pressure

10.6.6.1 Low ( 40 Bar)

10.6.7 Historic and Forecasted Market Size by End User

10.6.7.1 Methanol

10.6.7.2 Refining/ Hydrocarbon

10.6.7.3 Ammonia

10.6.7.4 Electronics

10.6.7.5 Food & Beverage

10.6.7.6 Others

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Direct Sales

10.6.8.2 Indirect Sales

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Hydrogen Electrolysers Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Proton Exchange Membrane Electrolysers

10.7.4.2 Alkaline Electrolysers

10.7.4.3 Solid Oxide Electrolysers

10.7.5 Historic and Forecasted Market Size by Capacity

10.7.5.1 Low ( 1mW)

10.7.6 Historic and Forecasted Market Size by Outlet Pressure

10.7.6.1 Low ( 40 Bar)

10.7.7 Historic and Forecasted Market Size by End User

10.7.7.1 Methanol

10.7.7.2 Refining/ Hydrocarbon

10.7.7.3 Ammonia

10.7.7.4 Electronics

10.7.7.5 Food & Beverage

10.7.7.6 Others

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Direct Sales

10.7.8.2 Indirect Sales

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Hydrogen Electrolysers Market research report?

A1: The forecast period in the Hydrogen Electrolysers Market research report is 2025-2032.

Q2: Who are the key players in the Hydrogen Electrolysers Market?

A2: Giner Inc. (U.S.), Plug Power Inc. (U.S.), Bloom Energy (U.S.), Next Hydrogen (Canada), Ballard Power Systems (Canada), Siemens AG (Germany),iGas Energy GmbH (Germany), Enapter (Germany), ITM Power Plc (UK), Pure Energy Centre (UK), McPhy Energy (France), Air Liquide (France), Gaztransport & Technigaz (France), GreenHydrogen Systems (Denmark), Nel Hydrogen (Norway), Idroenergy (Italy), Erredue S.p.A (Italy), SwissHydrogen SA (Switzerland), Tianjin Mainland Hydrogen Equipment Co. Ltd (China), Beijing CEI Technology Co., Ltd. (China),Shandong Saikesaisi Hydrogen Energy Co Ltd. (China), and Other Active Players.

Q3: What are the segments of the Hydrogen Electrolysers Market?

A3: The Hydrogen Electrolysers Market is segmented into Type, Capacity, Outlet Pressure, End User, Distribution Channel, and Region. By Type, the market is categorized into Proton Exchange Membrane Electrolysers, Alkaline Electrolysers, and Solid Oxide Electrolysers. By Nature, the market is categorized into Low ( 1 mW). By Outlet Pressure, the market is categorized into Low ( 40 Bar). By End User, the market is categorized into Methanol, Refining/ Hydrocarbon, Ammonia, Electronics, Food & Beverage, and Others. By Distribution Channel, the market is categorized into Direct Sales and Indirect Sales. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; South Korea; Malaysia; Thailand; Vietnam; The Philippines; Australia; New Zealand; Rest of APAC), Middle East & Africa (Türkiye; Bahrain; Kuwait; Saudi Arabia; Qatar; UAE; Israel; South Africa), South America (Brazil; Argentina; Rest of SA).

Q4: What is the Hydrogen Electrolysers Market?

A4: Hydrogen electrolyzers are machines that divide water molecules into hydrogen and oxygen gasses by electrolysis using electricity. Water molecules disintegrate when an electric current is sent through them; hydrogen gas is collected at the cathode and oxygen gas is collected at the anode. The production of pure hydrogen for several industrial uses and energy storage options depends heavily on these electrolyzers.

Q5: How big is the Hydrogen Electrolysers Market?

A5: Hydrogen Electrolysers Market Size Was Valued at USD 652.60 Million in 2024 and is Projected to Reach USD 3716.52 Million by 2032, Growing at a CAGR of 24.29% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!