Stay Ahead in Fast-Growing Economies.

Browse Reports NowHigh Thermal Conductivity Graphite Market | Latest Advancement And Industry Analysis 2032

The High Thermal Conductivity Graphite Market refers to the market for graphite materials that exhibit high thermal conductivity properties. Graphite is a form of carbon with a unique structure that allows for efficient heat transfer. High thermal conductivity graphite is used in various applications where heat dissipation is crucial, such as electronics, automotive, aerospace, and industrial sectors. The market for high thermal conductivity graphite is driven by the increasing demand for thermal management solutions in various industries. It offers benefits like improved heat transfer, reliability, and enhanced performance.

IMR Group

Description

High Thermal Conductivity Graphite Market Synopsis

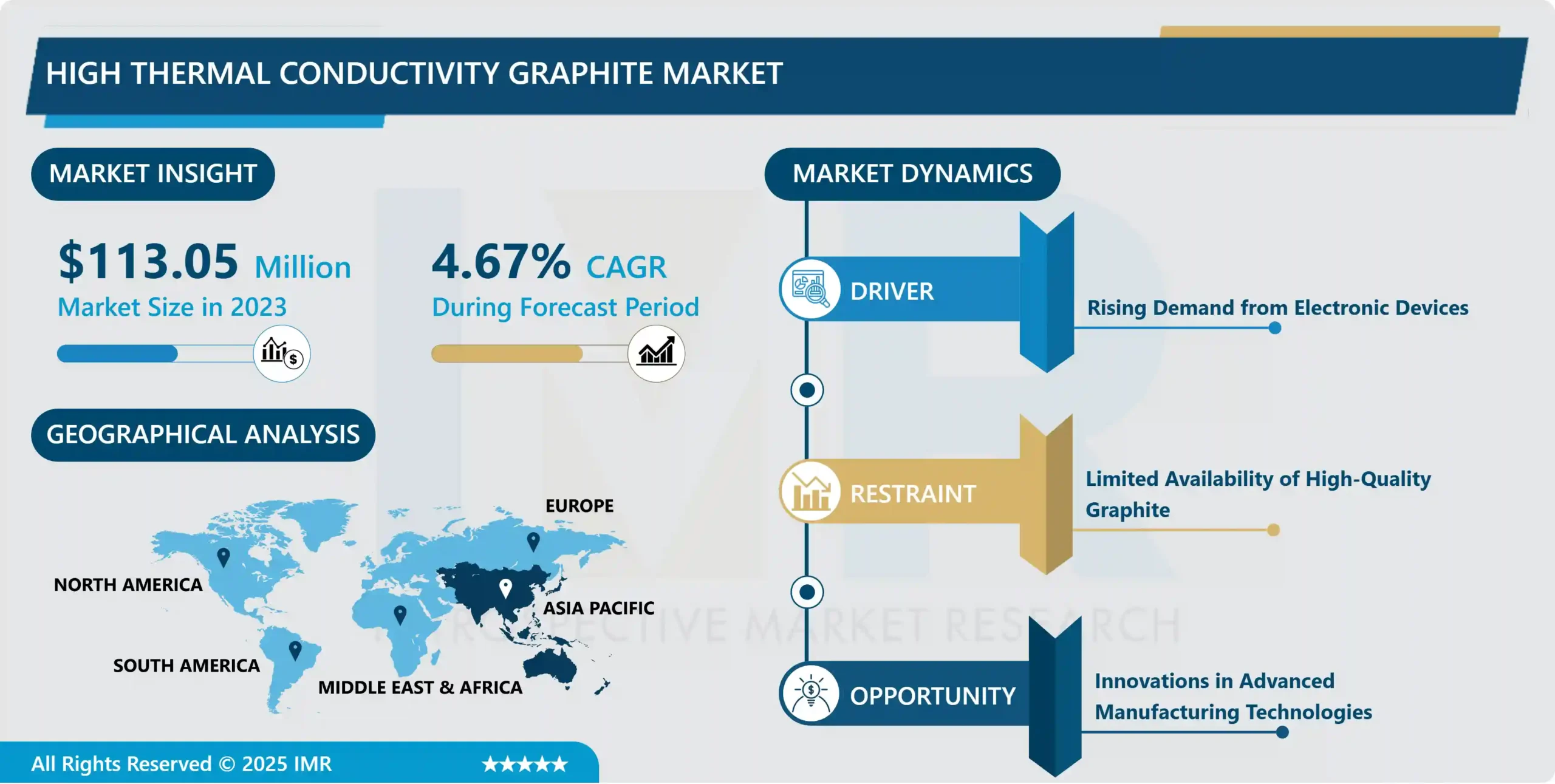

The high Thermal Conductivity Graphite Market Size Was Valued at USD 113.05 Million in 2023 and is Projected to Reach USD 170.48 Million by 2032, Growing at a CAGR of 4.67 % From 2024-2032.

The High Thermal Conductivity Graphite Market refers to the market for graphite materials that exhibit high thermal conductivity properties. Graphite is a form of carbon with a unique structure that allows for efficient heat transfer. High thermal conductivity graphite is used in various applications where heat dissipation is crucial, such as electronics, automotive, aerospace, and industrial sectors. The market for high thermal conductivity graphite is driven by the increasing demand for thermal management solutions in various industries. It offers benefits like improved heat transfer, reliability, and enhanced performance.

Graphite electrodes play a pivotal role in electric arc furnaces used for steelmaking, providing the high-temperature environment necessary for melting scrap steel and other raw materials. Moreover, the automotive industry is a major consumer of graphite, employing it in brake linings, gaskets, seals, and lubricants.

In the electronics and electrical sector, graphite is indispensable, being used in carbon brushes, electrical contacts, thermal management materials, and battery anodes. This demand is fueled by the proliferation of consumer electronics, telecommunications devices, and renewable energy technologies, which rely on graphite’s unique properties.

As emerging markets and technologies, such as electric aviation, 5G telecommunications, wearable electronics, and additive manufacturing, gain traction, graphite-based materials are expected to play a pivotal role due to their advanced properties and versatility. However, challenges such as supply chain constraints, environmental regulations, and competition from alternative materials may influence market dynamics in the foreseeable future.

High Thermal Conductivity Graphite Market Trend Analysis

Rising Demand from Electronic Devices

The growing market for graphite is mostly being driven by the increasing demand from electrical devices. The necessity for effective heat management solutions grows as consumer electronics continue to advance and permeate more aspects of daily life. Because of its remarkable thermal conductivity, graphite is a perfect material for dispersing heat produced by electronic components, which guarantees the longevity and optimal functioning of those components.

The increasing compactness and power of electronic gadgets like laptops, tablets, smartphones, and high-performance computer systems is generating more heat in smaller areas. Traditional cooling techniques are under threat from this development, which makes sophisticated thermal management solutions essential.

The need for graphite-based thermal management systems is predicted to increase due to the continued spread of cutting-edge technologies including wearable electronics, automotive electronics, and Internet of Things (IoT) devices.

In conclusion, the growing requirement for sophisticated thermal management solutions to handle heat dissipation issues in ever-smaller, ever-more-powerful electronic devices is a major factor driving the graphite industry. Because of its exceptional heat conductivity and other advantageous qualities, graphite is a crucial material for satisfying the electronics industry’s changing needs.

Innovations in advanced manufacturing technologies

Technological advancements in advanced manufacturing provide substantial prospects for the graphite industry. These technologies, which include sophisticated machining, precise engineering methods, and additive manufacturing (3D printing), open up new possibilities for creating intricate graphite-based structures and components that are more effective and efficient.

Graphite-based materials are used in a variety of industries in a way that has been completely transformed by additive manufacturing in particular. With the use of this technology, complex geometries and unique designs that were previously difficult or impossible to accomplish with conventional manufacturing techniques can now be fabricated.

Design optimization and manufacture of graphite components are made easier by the incorporation of digital technologies such as computer-aided design (CAD), computer-aided manufacturing (CAM), and simulation tools. Thanks to these digital technologies, producers may simulate performance under different conditions, iterate designs quickly, and improve manufacturing processes for efficiency and cost-effectiveness.

Generally, the production of high-performance, customized graphite structures and components that are suited to particular application needs is made possible by advancements in sophisticated manufacturing methods, which presents potential for the graphite market.

High Thermal Conductivity Graphite Market Segment Analysis:

High Thermal Conductivity Graphite Market Segmented on the basis of Type, Product Type, Application, End-Use Industry.

By Type, Natural Graphite segment is expected to dominate the market during the forecast period

Due to its abundance, affordability, and superior thermal conductivity qualities, natural graphite is expected to dominate the market for high thermal conductivity graphite throughout the forecast period. Because natural graphite is produced from naturally existing mineral deposits, the supply chain is steady and trustworthy. Because of its abundance, producers looking for affordable solutions for thermal management applications find it to be a desirable alternative.

Because natural graphite requires fewer extraction and purification steps during production than synthetic graphite, it is usually produced at a lesser cost. Its cost advantage increases its attractiveness to enterprises searching for cost-effective and efficient thermal management solutions.

In most cases, its abundance, affordability, superior thermal conductivity qualities, variety of uses, and environmental concerns are what account for the Natural Graphite segment’s dominance in the High Thermal Conductivity Graphite market throughout the projection period. All of these elements work together to make natural graphite the material of choice for thermal management solutions in a variety of industries, guaranteeing its supremacy in the market.

By Product Type, Graphite Sheets segment held the largest share

Several important variables are responsible for the graphite sheets segment’s dominance in the high thermal conductivity graphite market. Graphite sheets are a desirable option for many industries due to their special advantages in thermal management applications.

primarily because the superior thermal conductivity of graphite sheets enables effective heat dissipation in electronic gadgets, vehicle parts, and machinery. The market demand for graphite sheets is fueled by these applications’ increased performance and dependability as a result of their efficient heat transmission.

When considering other materials for thermal control, including ceramics or metals, graphite sheets might be more affordable. They are an affordable option for many organizations looking for cost-effective thermal management solutions because of their comparatively low production costs and excellent manufacturing procedures.

Overall, the superior thermal conductivity qualities, adaptability, lightweight design, stability, dependability, and affordability of graphite sheets are what propel them to the top of the High Thermal Conductivity Graphite market. Because of these advantages, graphite sheets are the material of choice for thermal management solutions in a variety of industries, guaranteeing their dominant market share.

High Thermal Conductivity Graphite Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Growing Manufacturing and Industrialization: The Asia-Pacific region is home to several industrialized countries with thriving manufacturing sectors, including China, Japan, South Korea, and India. The need for high thermal conductivity graphite in a variety of applications, including electronics, automotive, aerospace, and energy, is fueled by the region’s industrial boom.

Asia Pacific is renowned for its lightning-fast rate of technological advancement, especially in sectors like semiconductor production and electronics. These sectors create a large amount of demand in the area because they mostly rely on high thermal conductivity graphite for thermal management solutions.

Asia Pacific will dominate the High Thermal Conductivity Graphite market for the duration of the forecast period due to several factors, including the region’s rapidly industrializing population, fast-paced technological advancements, growing electronics, and electric vehicle (EV) markets, investments in renewable energy, strategic government initiatives, and the region’s concentration of large manufacturing facilities. Together, these elements establish Asia Pacific as a dominant force in the global market for high thermal conductivity graphite, fueling the region’s sustained dominance and projected expansion.

Based on the graphical data of leading countries based on reserves of graphite worldwide in 2023, China holds the highest reserves with 78 million metric tons, followed closely by Brazil with 74 million metric tons. This indicates that these two countries possess significant natural resources of graphite, which can potentially support their graphite industries and contribute to global supply. Mozambique and Madagascar also hold considerable reserves, with 25 million and 24 million metric tons respectively, suggesting their potential as emerging players in the graphite market. Other countries such as Tanzania, Russia, India, Turkey, Canada, and Mexico have varying but comparatively smaller reserves of graphite, highlighting the diverse geographical distribution of graphite resources worldwide.

High Thermal Conductivity Graphite Market Top Key Players:

GrafTech International Ltd. (US)

Toyo Tanso Co. Ltd. (Japan)

Mersen (France)

SGL Carbon (Germany)

Entegris Inc. (US)

Poco Graphite Inc. (US)

Gee Graphite Ltd. (United Kingdom)

XRD Graphite Manufacturing Co. Ltd. (China)

Panasonic Corporation (Japan)

Hexagon Composites ASA (Norway)

Beijing Great Wall Co. Ltd. (China)

Momentive Performance Materials Inc. (US)

Teadit (Brazil)

Saint-Gobain Performance Plastics (France)

Pyrotek Inc. (US)

ZOLTEK Corporation (US)

Thermal Transfer Composites LLC (US)

Kureha Corporation (Japan)

Shenzhen Topray Solar Co. Ltd. (China)

GrafMax Technologies Inc. (US)

Ibiden Co. Ltd. (Japan)

Shin-Etsu Chemical Co. Ltd. (Japan)

Triton Systems Inc. (US)

Lydall Inc. (US)

Advanced Energy Industries Inc. (US), and other Major Players

Key Industry Developments in the High Thermal Conductivity Graphite Market:

In March 2024, Mersen announced it received over €12 million in subsidies from the French government under the Important Project of Common European Interest in MicroElectronics and Communication Technologies (IPCEI ME/CT).

In March 2023, SGL Carbon announced the new SIGRAFIL® C T50-4.9/235 carbon fiber, set to debut at JEC World 2023. This 50k fiber offers high strength (4.9 GPa) and elongation (2.0%), previously achievable only with lower filament counts. Developed from SGL’s extensive experience, it enhances process efficiency and supports sustainable mobility applications, such as hydrogen pressure vessels and fuel cells, according to Roland Nowicki, Head of Carbon Fibers.

In July 2023, Mersen inaugurated its Columbia site in the United States, expanding its graphite manufacturing capacities. The 240,000-square-meter site employed about 80 people and planned to hire more to meet growing demand, particularly in semiconductors. Acquired in July 2019, the Maury County plant saw nearly USD 70 million in investments over four years to reshape and modernize. It quickly reached an annual capacity of 4,000 tons of extruded graphite and 2,000 tons of isostatic graphite.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Thermal Conductivity Graphite Market by Type (2018-2032)

4.1 High Thermal Conductivity Graphite Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Processed

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unprocessed

Chapter 5: High Thermal Conductivity Graphite Market by Product Type (2018-2032)

5.1 High Thermal Conductivity Graphite Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Power Generation

5.5 Residential

5.6 Commercial

5.7 Transportation

Chapter 6: High Thermal Conductivity Graphite Market by Application (2018-2032)

6.1 High Thermal Conductivity Graphite Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Consumer Electronics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 LED Lighting

6.6 Industrial

6.7 Aerospace & Defense

Chapter 7: High Thermal Conductivity Graphite Market by End-Use Industry (2018-2032)

7.1 High Thermal Conductivity Graphite Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Electronics and Semiconductor Manufacturing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Automotive and Transportation

7.5 Aerospace and Defense

7.6 Energy and Power Generation

7.7 Telecommunications

7.8 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 High Thermal Conductivity Graphite Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 HIDRATESPARK(USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 LUMOS LABS (USA)

8.4 EMBER (USA)

8.5 HYDRO FLASK (USA)

8.6 TRAGO STUDIO (USA)

8.7 GATORADE GX (USA)

8.8 NALGENE WIDE MOUTH OASIS (USA)

8.9 CAMELBAK EDDY(USA)

8.10 YETI RAMBLER HYDRATION BOTTLE (USA)

8.11 COCA-COLA SMARTBOTTLE (USA)

8.12 PEPSI SPIRE (USA)

8.13 EVIAN REHYDRATION COACH (FRANCE)

8.14 LIPTON ICE TEA SMART CAP (USA)

8.15 STARBUCKS REUSABLE CUP (USA)

8.16 ADHERETECH SMARTDOSE CAP (USA)

8.17 EQUA SMARTFLASK (GERMANY)

8.18 LIXADA SMART BOTTLE (SPAIN)

8.19 THERMOS ONETOUCH BOTTLE (FRANCE)

8.20 AOOYOO SMART WATER BOTTLE (ITALY)

8.21 MOSH BOTTLE (SWEDEN)

8.22 YUNMAI SMART BOTTLE (CHINA)

8.23 MINIMO WATER BOTTLE (KOREA)

8.24 THERMOS SMART HYDRATION BOTTLE (JAPAN)

8.25 HIDRATEME FRUIT INFUSER BOTTLE (AUSTRALIA)

8.26 EQUA SMART CUP (INDIA)

Chapter 9: Global High Thermal Conductivity Graphite Market By Region

9.1 Overview

9.2. North America High Thermal Conductivity Graphite Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Processed

9.2.4.2 Unprocessed

9.2.5 Historic and Forecasted Market Size by Product Type

9.2.5.1 Industrial

9.2.5.2 Power Generation

9.2.5.3 Residential

9.2.5.4 Commercial

9.2.5.5 Transportation

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Consumer Electronics

9.2.6.2 Automotive

9.2.6.3 LED Lighting

9.2.6.4 Industrial

9.2.6.5 Aerospace & Defense

9.2.7 Historic and Forecasted Market Size by End-Use Industry

9.2.7.1 Electronics and Semiconductor Manufacturing

9.2.7.2 Automotive and Transportation

9.2.7.3 Aerospace and Defense

9.2.7.4 Energy and Power Generation

9.2.7.5 Telecommunications

9.2.7.6 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe High Thermal Conductivity Graphite Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Processed

9.3.4.2 Unprocessed

9.3.5 Historic and Forecasted Market Size by Product Type

9.3.5.1 Industrial

9.3.5.2 Power Generation

9.3.5.3 Residential

9.3.5.4 Commercial

9.3.5.5 Transportation

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Consumer Electronics

9.3.6.2 Automotive

9.3.6.3 LED Lighting

9.3.6.4 Industrial

9.3.6.5 Aerospace & Defense

9.3.7 Historic and Forecasted Market Size by End-Use Industry

9.3.7.1 Electronics and Semiconductor Manufacturing

9.3.7.2 Automotive and Transportation

9.3.7.3 Aerospace and Defense

9.3.7.4 Energy and Power Generation

9.3.7.5 Telecommunications

9.3.7.6 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe High Thermal Conductivity Graphite Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Processed

9.4.4.2 Unprocessed

9.4.5 Historic and Forecasted Market Size by Product Type

9.4.5.1 Industrial

9.4.5.2 Power Generation

9.4.5.3 Residential

9.4.5.4 Commercial

9.4.5.5 Transportation

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Consumer Electronics

9.4.6.2 Automotive

9.4.6.3 LED Lighting

9.4.6.4 Industrial

9.4.6.5 Aerospace & Defense

9.4.7 Historic and Forecasted Market Size by End-Use Industry

9.4.7.1 Electronics and Semiconductor Manufacturing

9.4.7.2 Automotive and Transportation

9.4.7.3 Aerospace and Defense

9.4.7.4 Energy and Power Generation

9.4.7.5 Telecommunications

9.4.7.6 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific High Thermal Conductivity Graphite Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Processed

9.5.4.2 Unprocessed

9.5.5 Historic and Forecasted Market Size by Product Type

9.5.5.1 Industrial

9.5.5.2 Power Generation

9.5.5.3 Residential

9.5.5.4 Commercial

9.5.5.5 Transportation

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Consumer Electronics

9.5.6.2 Automotive

9.5.6.3 LED Lighting

9.5.6.4 Industrial

9.5.6.5 Aerospace & Defense

9.5.7 Historic and Forecasted Market Size by End-Use Industry

9.5.7.1 Electronics and Semiconductor Manufacturing

9.5.7.2 Automotive and Transportation

9.5.7.3 Aerospace and Defense

9.5.7.4 Energy and Power Generation

9.5.7.5 Telecommunications

9.5.7.6 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa High Thermal Conductivity Graphite Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Processed

9.6.4.2 Unprocessed

9.6.5 Historic and Forecasted Market Size by Product Type

9.6.5.1 Industrial

9.6.5.2 Power Generation

9.6.5.3 Residential

9.6.5.4 Commercial

9.6.5.5 Transportation

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Consumer Electronics

9.6.6.2 Automotive

9.6.6.3 LED Lighting

9.6.6.4 Industrial

9.6.6.5 Aerospace & Defense

9.6.7 Historic and Forecasted Market Size by End-Use Industry

9.6.7.1 Electronics and Semiconductor Manufacturing

9.6.7.2 Automotive and Transportation

9.6.7.3 Aerospace and Defense

9.6.7.4 Energy and Power Generation

9.6.7.5 Telecommunications

9.6.7.6 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America High Thermal Conductivity Graphite Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Processed

9.7.4.2 Unprocessed

9.7.5 Historic and Forecasted Market Size by Product Type

9.7.5.1 Industrial

9.7.5.2 Power Generation

9.7.5.3 Residential

9.7.5.4 Commercial

9.7.5.5 Transportation

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Consumer Electronics

9.7.6.2 Automotive

9.7.6.3 LED Lighting

9.7.6.4 Industrial

9.7.6.5 Aerospace & Defense

9.7.7 Historic and Forecasted Market Size by End-Use Industry

9.7.7.1 Electronics and Semiconductor Manufacturing

9.7.7.2 Automotive and Transportation

9.7.7.3 Aerospace and Defense

9.7.7.4 Energy and Power Generation

9.7.7.5 Telecommunications

9.7.7.6 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the High Thermal Conductivity Graphite Market research report?

A1: The forecast period in the High Thermal Conductivity Graphite Market research report is 2024-2032.

Q2: Who are the key players in the High Thermal Conductivity Graphite Market?

A2: GrafTech International Ltd. (US), Toyo Tanso Co. Ltd. (Japan), Mersen (France), SGL Carbon (Germany), Entegris Inc. (US), Poco Graphite Inc. (US), Gee Graphite Ltd. (United Kingdom), XRD Graphite Manufacturing Co. Ltd. (China), Panasonic Corporation (Japan), Hexagon Composites ASA (Norway), Beijing Great Wall Co. Ltd. (China), Momentive Performance Materials Inc. (US), Teadit (Brazil), Saint-Gobain Performance Plastics (France), Pyrotek Inc. (US), ZOLTEK Corporation (US), Thermal Transfer Composites LLC (US), Kureha Corporation (Japan), Shenzhen Topray Solar Co. Ltd. (China), GrafMax Technologies Inc. (US), Ibiden Co. Ltd. (Japan), Shin-Etsu Chemical Co. Ltd. (Japan), Triton Systems Inc. (US), Lydall Inc. (US), Advanced Energy Industries Inc. (US), and Other Major Players.

Q3: What are the segments of the High Thermal Conductivity Graphite Market?

A3: The High Thermal Conductivity Graphite Market is segmented into Type, Product Type, Application, End-Use Industry, and region. By Type, the market is categorized into Natural Graphite and Synthetic Graphite. By Product Type, the market is categorized into Graphite Sheets, Graphite Films, Expanded Natural Graphite and Pyrolytic Graphite. By Application, the market is categorized into Consumer Electronics, Automotive, LED Lighting, Industrial and Aerospace & Defense. By End-Use Industry, the market is categorized into Electronics and Semiconductor Manufacturing, Automotive and Transportation, Aerospace and Defense, Energy and Power Generation, Telecommunications, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the High Thermal Conductivity Graphite Market?

A4: The High Thermal Conductivity Graphite Market refers to the market for graphite materials that exhibit high thermal conductivity properties. Graphite is a form of carbon with a unique structure that allows for efficient heat transfer. High thermal conductivity graphite is used in various applications where heat dissipation is crucial, such as electronics, automotive, aerospace, and industrial sectors. The market for high thermal conductivity graphite is driven by the increasing demand for thermal management solutions in various industries. It offers benefits like improved heat transfer, reliability, and enhanced performance

Q5: How big is the High Thermal Conductivity Graphite Market?

A5: The high Thermal Conductivity Graphite Market Size Was Valued at USD 113.05 Million in 2023 and is Projected to Reach USD 170.48 Million by 2032, Growing at a CAGR of 4.67 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!