Stay Ahead in Fast-Growing Economies.

Browse Reports NowHigh Temperature Superconductors Market Size & Outlook 2025-2032

High temperature superconductors function as materials that show zero electrical resistance and magnetic field expulsion at advanced temperatures than regular superconductors. The field of superconductivity experienced a breakthrough with different ceramic compounds that allowed useful and economic applications across multiple industries.

IMR Group

Description

High Temperature Superconductors Market Synopsis:

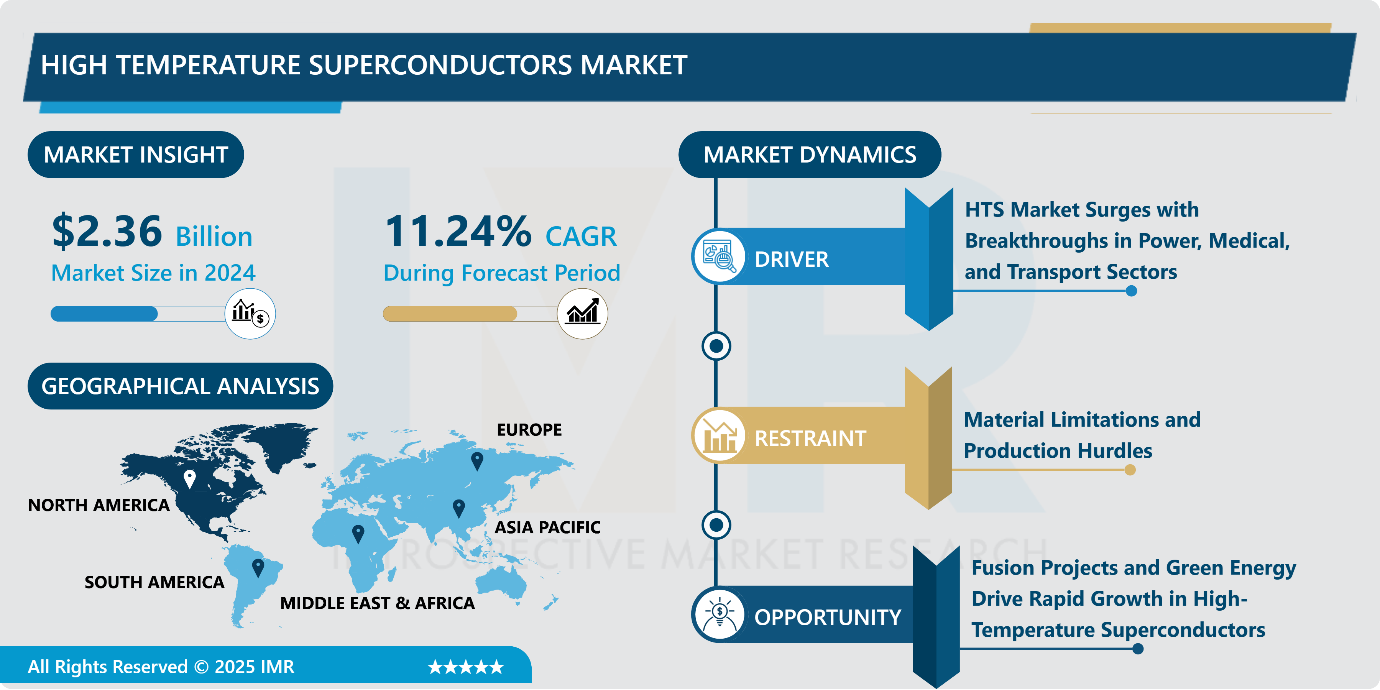

High Temperature Superconductors Market Size Was Valued at USD 2.36 Billion in 2024 and is Projected to Reach USD 5.53 Billion by 2032, Growing at a CAGR of 11.24% From 2025-2032.

High temperature superconductors function as materials that show zero electrical resistance and magnetic field expulsion at advanced temperatures than regular superconductors. The field of superconductivity experienced a breakthrough with different ceramic compounds that allowed useful and economic applications across multiple industries.

The high temperature superconductors (HTS) market is experiencing significant growth, driven by the unique properties and wide range of applications of HTS materials. The ongoing scientific exploration of hydrogen-based superconductors combined with layered structures enhances high-temperature superconductivity while creating new market possibilities requiring minimal power consumption and maximum operational efficiency. The developing electric aircraft industry sector acts as a force that strengthens the need to adopt HTS technologies. The propulsion systems of Airbus and other major aerospace companies now incorporate high temperature superconductors according to their net-zero emission goals which showcase the technology’s sustainable aviation potential.

High Temperature Superconductors Market Growth and Trend Analysis:

HTS Market Surges with Breakthroughs in Power, Medical, and Transport Sectors

The global high-temperature superconductors (HTS) market is advancing rapidly, driven by research breakthroughs in superconducting materials, leading to higher transition temperatures and enhanced application efficiency. The market expansion occurs through the advancement of high-temperature superconductor cuprates that show considerable potential in power transmission applications together with energy storage and high-performance electronic devices. These materials operate above the boiling point of liquid nitrogen which leads to substantial cost reduction making HTS suitable for industrial usage.

The HTS market expands due to medical imaging technologies such as MRI scanners are now using superconducting magnets at an increasing rate. Advanced magnets with high performance have produced important advancements in both imaging precision and reliability technology. The use of HTS technology in power grids represents a fundamental trend due to fault-current limiters enhance the reliability along with efficiency in electric distribution systems.

HTS technology plays an essential role in next-generation superconducting magnetic levitation (SCMaglev) trains that are developing in the transportation sector. The trains implement magnetic fields to eliminate friction while delivering better speeds and charging efficiency.

Material Limitations and Production Hurdles

Market challenges in global high-temperature semiconductors depend on material properties and production obstacles and economic aspects. Due to their brittle ceramic nature cuprate high-temperature superconductors have limited potential to develop into suitable long flexible wires needed for large-scale power applications. Achieving high critical current densities and operational conditions necessary for superconductor maintenance stands as essential obstacles in this field.

Fusion Projects and Green Energy Drive Rapid Growth in High-Temperature Superconductors

High-temperature superconductors (HTS) are experiencing a surge in demand, largely driven by advancements in fusion energy, wind turbines, and electric aviation. Large-scale projects like the Commonwealth Fusion SPARC reactor require vast superconducting cables, accelerating cost reductions through economies of scale. HTS is making inroads into key applications, including MRI machines, where helium-free designs can offer cost savings and portability, as well as wind turbines, which benefit from high-efficiency superconducting generators.

Lack of Infrastructure and Skilled Workforce Slows Market Expansion

The high temperature superconductors market faces replacement challenges due to both sparse necessary infrastructure along insufficient trained personnel specialized in handling elaborate HTS structures. Developing economies, together with other regions, face barriers to HTS implementation because they lack proper facilities alongside technical specialists for manufacturing along with installation, and maintenance. The absence of supportive infrastructure, with a lack of expert personnel, causes operational issues for potential technology adopters who experience delays in deploying the technology across critical domains, including power grids and healthcare sectors. Specialized training, with infrastructure shortages, poses an immense hurdle that obstructs the HTS market expansion.

High Temperature Superconductors Market Segment Analysis:

High Temperature Superconductors Market is segmented based on type, application, end-use industry, and region

By Application, Power Cables segment is expected to dominate the market during the forecast period

The dominance of power cables in the High-Temperature Superconductors (HTS) market is driven by the growing demand for efficient, high-capacity, and low-loss power transmission solutions. Unlike conventional copper or aluminum cables, HTS cables leverage superconducting materials such as BSCCO, YBCO, and MgB?, which, when cooled to cryogenic temperatures, exhibit near-zero electrical resistance. This allows them to carry significantly higher currents—up to five times that of traditional cables with the same dimensions—while minimizing transmission losses.

A key advantage of HTS cables is their ability to be installed in existing underground infrastructure, such as gas, water, or railway corridors, reducing the need for large-scale excavation and making them ideal for densely populated urban environments. Their compact design, combined with low electromagnetic field emissions, enhances safety and mitigates interference with surrounding infrastructure. Additionally, superconducting DC cables are increasingly being explored for long-distance bulk power transmission, addressing the growing need for efficient interconnections in renewable energy grids.

Despite the requirement for continuous cooling using liquid nitrogen or helium, the overall efficiency of HTS cables makes them a preferred choice for grid modernization projects. Demonstrations and commercial installations, such as the Shingal Project in South Korea and the Long Island project in the U.S., have already showcased their feasibility, leading to increased adoption in high-voltage AC and DC systems.

By End-Use Industry, Power Utilities segment held the largest share in the projected period

The Power Utilities segment is currently leading the High-Temperature Superconductors (HTS) Market, driven by the urgent need for advanced transmission solutions amid rising electricity demand and the transition to renewable energy. The power industry widely adopts High-Temperature Superconductors for grid expansion challenges to achieve both operational reliability and efficiency targets.

Conventionally used power transmission infrastructure faces major obstacles due to limited access points and steep construction expenses as well as community resistance to high-rise power transmission devices. High Temperature Superconducting technology enables effective power transmission through its ability to transmit higher power levels at lower voltage levels thus requiring less new infrastructure. These technologies deploy smoothly into current grid networks which attracts utility companies desiring to improve their grid efficiency performance.

The U.S. faces grid connection waits for more than 10,000 renewable energy projects which drives power utilities to invest in HTS-based solutions as their preferred choice to increase transmission capabilities without increased timeframes or elevated expenses. The superconducting transmission system from VEIR illustrates how power utilities can operate transmission lines more efficiently with minimal environmental impact against traditional power lines. The power utility sector will expand its adoption of superconducting technologies to support surged electricity demand from data centers and artificial intelligence applications and electrification trends due to this ensures both grid stability and sustainability.

High Temperature Superconductors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America holds a prominent position in the market, driven by significant investments in research and development, particularly in the United States. Existing infrastructure and technological advancement made this region an important center for deploying superconducting technology. The regional market in North America will experience progressive development due to governments launched programs to boost energy conservation and upgrade their infrastructure.

The global high-temperature superconductors (HTS) market continues to be dominated by North America due to key investments like MetOx International’s receipt of USD 80 million in U.S. Department of Energy funding during October 2024. Next-generation HTS wire production will receive a significant boost from the newly developing Project Arch MetOx manufacturing plant which positions this facility as a major force for advancing HTS wire manufacturing for power grid efficiency and fusion energy applications and next-generation transportation systems. The region strengthens its global superconductors market position because HTS innovation receives expanding investment support throughout North America.

High Temperature Superconductors Market Active Players:

American Superconductor Corporation (AMSC) (USA)

Bruker Corporation (USA)

CAN Superconductors (Czech Republic)

Cryomagnetics, Inc. (USA)

Fujikura Ltd. (Japan)

Furukawa Electric Co., Ltd. (Japan)

Hyper Tech Research, Inc. (USA)

Japan Superconductor Technology, Inc. (Japan)

LS Cable & System Ltd. (South Korea)

MetOx Technologies, Inc. (USA)

Nexans S.A. (France)

Oxford Instruments plc (UK)

Shanghai Superconductor Technology Co., Ltd. (China)

Southwire Company, LLC (USA)

Sumitomo Electric Industries, Ltd. (Japan)

SuNAM Co., Ltd. (South Korea)

Superconductor Technologies Inc. (USA)

SuperOx (Russia)

SuperPower Inc. (USA – Subsidiary of Furukawa Electric)

Zenergy Power plc (UK)

Other Active Players

Key Industry Developments in the High Temperature Superconductors Market:

In September 2024, UK-based Tokamak Energy launched a new business division, TE Magnetics, to focus on the industrial deployment of high-temperature superconducting (HTS) magnet technology. HTS magnets enable powerful and efficient magnetic fields for a wide range of applications and can also enable the efficient operation of fusion energy devices by confining the extremely hot plasma of fuels.

In April 2024, Zenno Astronautics (Zenno) and Faraday Factory partnered to collaborate on the development of bespoke high-temperature superconductor (HTS) magnets for space applications.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: High Temperature Superconductors Market by Type

4.1 High Temperature Superconductors Market Snapshot and Growth Engine

4.2 High Temperature Superconductors Market Overview

4.3 1G HTS and 2G HTS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 1G HTS and 2G HTS: Geographic Segmentation Analysis

Chapter 5: High Temperature Superconductors Market by Application

5.1 High Temperature Superconductors Market Snapshot and Growth Engine

5.2 High Temperature Superconductors Market Overview

5.3 Power Cable

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Power Cable: Geographic Segmentation Analysis

5.4 Fault Current Limiter

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fault Current Limiter: Geographic Segmentation Analysis

5.5 and Transformer

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Transformer: Geographic Segmentation Analysis

Chapter 6: High Temperature Superconductors Market by End-Use Industry

6.1 High Temperature Superconductors Market Snapshot and Growth Engine

6.2 High Temperature Superconductors Market Overview

6.3 Power Utilities

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Power Utilities: Geographic Segmentation Analysis

6.4 Electronics Manufacturers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Electronics Manufacturers: Geographic Segmentation Analysis

6.5 Healthcare Providers

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare Providers: Geographic Segmentation Analysis

6.6 Transportation Companies

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Transportation Companies: Geographic Segmentation Analysis

6.7 and Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 High Temperature Superconductors Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMERICAN SUPERCONDUCTOR CORPORATION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BRUKER CORPORATION (USA)

7.4 FUJIKURA LTD. (JAPAN)

7.5 FURUKAWA ELECTRIC CO. LTD. (JAPAN)

7.6 SUPERCONDUCTOR TECHNOLOGIES INC. (USA)

7.7 JAPAN SUPERCONDUCTOR TECHNOLOGY INC. (JAPAN)

7.8 SUMITOMO ELECTRIC INDUSTRIES LTD. (JAPAN)

7.9 SUPERPOWER INC. (USA – SUBSIDIARY OF FURUKAWA ELECTRIC)

7.10 NEXANS S.A. (FRANCE)

7.11 SOUTHWIRE COMPANY LLC (USA)

7.12 LS CABLE & SYSTEM LTD. (SOUTH KOREA)

7.13 METOX TECHNOLOGIES INC. (USA)

7.14 OXFORD INSTRUMENTS PLC (UK)

7.15 ZENERGY POWER PLC (UK)

7.16 CRYOMAGNETICS INC. (USA)

7.17 HYPER TECH RESEARCH INC. (USA)

7.18 SUNAM CO. LTD. (SOUTH KOREA)

7.19 CAN SUPERCONDUCTORS (CZECH REPUBLIC)

7.20 SHANGHAI SUPERCONDUCTOR TECHNOLOGY CO. LTD. (CHINA)

7.21 SUPEROX (RUSSIA)

7.22 OTHER ACTIVE PLAYERS.

Chapter 8: Global High Temperature Superconductors Market By Region

8.1 Overview

8.2. North America High Temperature Superconductors Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 1G HTS and 2G HTS

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Power Cable

8.2.5.2 Fault Current Limiter

8.2.5.3 and Transformer

8.2.6 Historic and Forecasted Market Size By End-Use Industry

8.2.6.1 Power Utilities

8.2.6.2 Electronics Manufacturers

8.2.6.3 Healthcare Providers

8.2.6.4 Transportation Companies

8.2.6.5 and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe High Temperature Superconductors Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 1G HTS and 2G HTS

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Power Cable

8.3.5.2 Fault Current Limiter

8.3.5.3 and Transformer

8.3.6 Historic and Forecasted Market Size By End-Use Industry

8.3.6.1 Power Utilities

8.3.6.2 Electronics Manufacturers

8.3.6.3 Healthcare Providers

8.3.6.4 Transportation Companies

8.3.6.5 and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe High Temperature Superconductors Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 1G HTS and 2G HTS

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Power Cable

8.4.5.2 Fault Current Limiter

8.4.5.3 and Transformer

8.4.6 Historic and Forecasted Market Size By End-Use Industry

8.4.6.1 Power Utilities

8.4.6.2 Electronics Manufacturers

8.4.6.3 Healthcare Providers

8.4.6.4 Transportation Companies

8.4.6.5 and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific High Temperature Superconductors Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 1G HTS and 2G HTS

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Power Cable

8.5.5.2 Fault Current Limiter

8.5.5.3 and Transformer

8.5.6 Historic and Forecasted Market Size By End-Use Industry

8.5.6.1 Power Utilities

8.5.6.2 Electronics Manufacturers

8.5.6.3 Healthcare Providers

8.5.6.4 Transportation Companies

8.5.6.5 and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa High Temperature Superconductors Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 1G HTS and 2G HTS

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Power Cable

8.6.5.2 Fault Current Limiter

8.6.5.3 and Transformer

8.6.6 Historic and Forecasted Market Size By End-Use Industry

8.6.6.1 Power Utilities

8.6.6.2 Electronics Manufacturers

8.6.6.3 Healthcare Providers

8.6.6.4 Transportation Companies

8.6.6.5 and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America High Temperature Superconductors Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 1G HTS and 2G HTS

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Power Cable

8.7.5.2 Fault Current Limiter

8.7.5.3 and Transformer

8.7.6 Historic and Forecasted Market Size By End-Use Industry

8.7.6.1 Power Utilities

8.7.6.2 Electronics Manufacturers

8.7.6.3 Healthcare Providers

8.7.6.4 Transportation Companies

8.7.6.5 and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the High Temperature Superconductors Market research report?

A1: The forecast period in the High Temperature Superconductors Market research report is 2024-2032.

Q2: Who are the key players in the High Temperature Superconductors Market?

A2: American Superconductor Corporation (USA), Bruker Corporation (USA), Fujikura Ltd. (Japan), Furukawa Electric Co., Ltd. (Japan), Superconductor Technologies Inc. (USA), Japan Superconductor Technology, Inc. (Japan), Sumitomo Electric Industries, Ltd. (Japan), SuperPower Inc. (USA – Subsidiary of Furukawa Electric), Nexans S.A. (France), Southwire Company, LLC (USA), LS Cable & System Ltd. (South Korea), MetOx Technologies, Inc. (USA), Oxford Instruments plc (UK), Zenergy Power plc (UK), Cryomagnetics, Inc. (USA), Hyper Tech Research, Inc. (USA), SuNAM Co., Ltd. (South Korea), CAN Superconductors (Czech Republic), Shanghai Superconductor Technology Co., Ltd. (China), SuperOx (Russia), and Other Active Players.

Q3: What are the segments of the High Temperature Superconductors Market?

A3: The High Temperature Superconductors Market is segmented into Type, Nature, Application, End-Use Industry and Region. By Type, it is categorized into 1G HTS and 2G HTS. By Application, it is categorized into Power Cable, Fault Current Limiter, and Transformer. By End-Use Industry, it is categorized into Power Utilities, Electronics Manufacturers, Healthcare Providers, Transportation Companies, and Others. By Region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Q4: What defines the High Temperature Superconductors Market?

A4: High temperature superconductors function as materials that show zero electrical resistance and magnetic field expulsion at advanced temperatures than regular superconductors. The field of superconductivity experienced a breakthrough with different ceramic compounds that allowed useful and economic applications across multiple industries.

Q5: How big is the High Temperature Superconductors Market?

A5: High Temperature Superconductors Market Size Was Valued at USD 2.36 Billion in 2024 and is Projected to Reach USD 5.53 Billion by 2032, Growing at a CAGR of 11.24% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!