Stay Ahead in Fast-Growing Economies.

Browse Reports NowHematology Market Global Industry Analysis and Forecast (2024-2032)

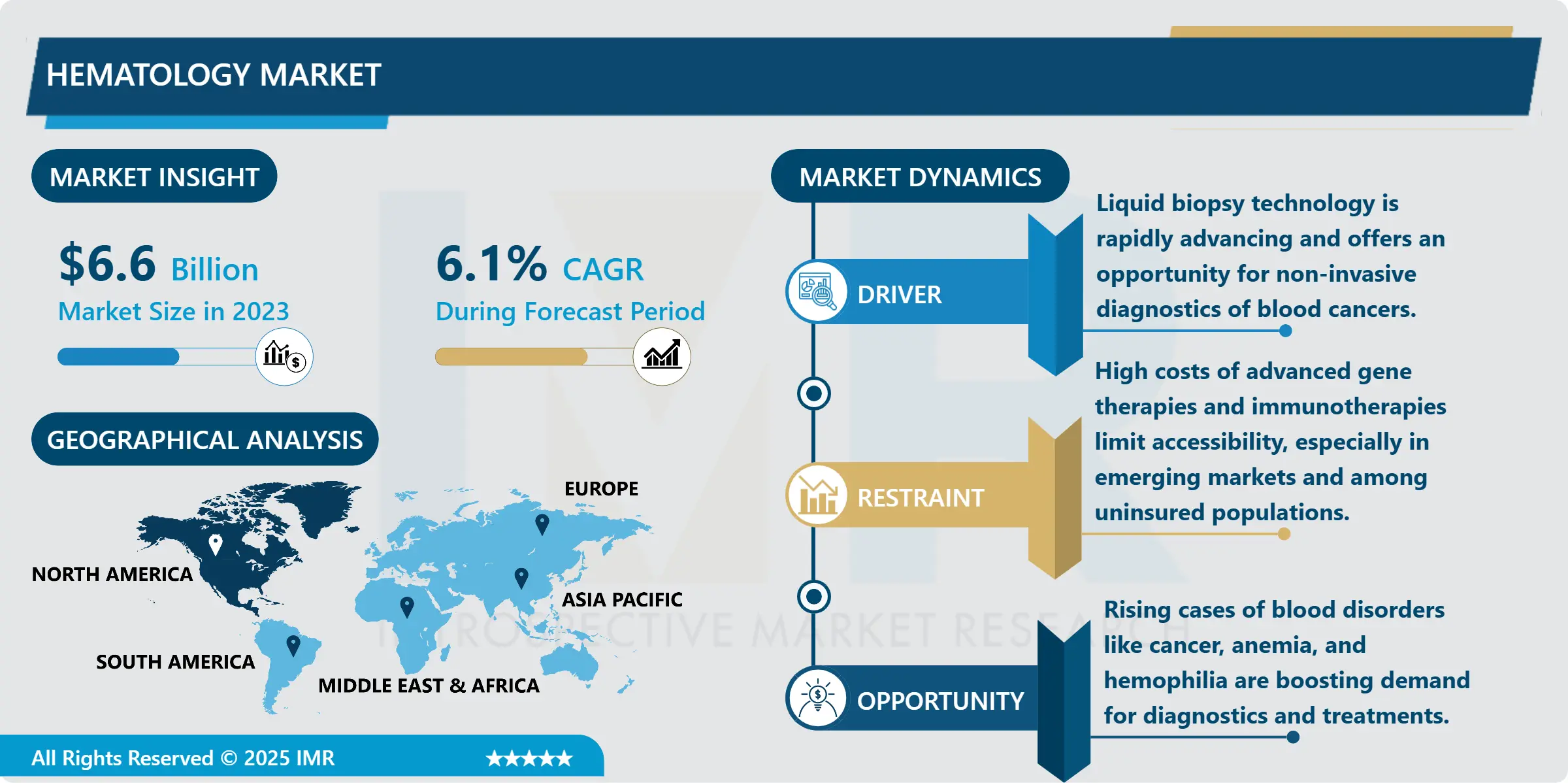

Hematology Market Size Was Valued at USD 6.6 Billion in 2023, and is Projected to Reach USD 12.1 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.

IMR Group

Description

Hematology Market Synopsis:

Hematology Market Size Was Valued at USD 6.6 Billion in 2023, and is Projected to Reach USD 12.1 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.

The hematology market refers to the worldwide market focused on blood disorders diagnosis, therapy, and management with products for anemia, blood cancer, hemophilia, sickle cell anemia, and thrombocytopenia. This market entails diagnostic instruments like Hematology analyzers, flow cytometers and coagulation analyzers for counting the number of blood cells or thrombocytes planning their coagulation ability and for detection of abnormality or diseases in the blood. That also includes therapeutic products like Chemotherapy drugs, gene therapies, targeted and immunotherapies, blood, transfusion products, and hemostatic agents. Market drivers include; global incidence of blood disorders, development in diagnostic tools, and increasing trend for personalized medicine particularly molecular diseases such as cancer and inherited blood disorders. The market can expand further based on advancements in gene editing, immunotherapy, and differentiation, in addition to enlarging access to healthcare in new areas. Currently, the largest markets are in North America, Europe, and Asia-Pacific area, although faster growth in the future is expected in the developing countries because of the increasing awareness, health care infrastructure advancements, and the increasing incidence of blood-related diseases. Other factors which define the hematology market include, expensive treatment procedures, bureaucratic policies, and inadequate health facilities to patients in developing countries. All in all, the market is predicted to grow as the advancement in technologies, unique treatments, and other solutions targeting patients are still yet to will into the market.

The global market for hematology is a relatively young segment of the overall healthcare industry that covers the diagnosis, treatment and monitoring of various diseases of blood, including anemia, leukemia, lymphoma, hemophilia, sickle cell anemia, and many other coagulation diseases. The market is comprised of a large range of diagnostic technology encompassing hematology analyzers, flow cytometers, and coagulation analyzers, which are utilized to conduct several basic blood tests that are essential to evaluate and treat a multitude of illnesses. Next-generation sequencing and Liquid Biopsy, in general, are enhancing the blood disease screening efficiency, including blood cancer detection. From the perceptive of therapeutics the market covers standard treatment techniques such as chemotherapy, blood transfusion and other more advanced treatment techniques such as immunotherapy, gene therapy and stem cell therapy. These innovations are particularly necessary in blood cancer and genetic diseases for which precision medicine is gradually replacing traditional treatments to adapt them to the characteristics of the patient.

The market is expected to have impressive growth characteristics due to increased incidence of blood disorders across the world especially among the geriatric population or in the developing countries with low health care access. Genetic sequencing and the specificity of medicine are improving the ways hematologic diseases can be cured; new hope has appeared for patients with such diseases as sickle-cell anemia, thalassemia, and leukemia. Also, an enhanced growth of the hematology market in emerging countries due to the factors such as increased accessibility and prevalence of affordable diagnostic products. However, the key factors that can have a negative impact on the market, and therefore hinder its growth, include high costs of treatment associated with gene therapies and biologics and regulatory issues that hinder market growth in some territories. North America and Europe continue to be the biggest markets with Asia-Pacific expected to grow fastest as healthcare provision in the region improves and incidence of blood disorders increases. Exploratory growth of the this global hematology market will be realized through new interventions and diagnostic procedures, as well as increased accessibility to proper healthcare, to effectively combat the increasing prevalence of blood disorders across the world.

Hematology Market Trend Analysis:

Rise of Liquid Biopsy in Blood Cancer Detection and Monitoring

The liquid biopsy has become more popular as a therm diagnostic tool in the diagnosis and staging of blood related diseases and tumor specific diseases such as leukemia, lymphoma and myeloma among others. Liquid biopsy differs from tissue biopsies that require extraction of tissues In Liquid biopsies, blood samples are taken from a patient and analyzed for ctDNA, CTCs, and exosomes – which are molecules that suggest the presence of tumor or provide information about its character. Some of the advantages of such technique include that it helps to identify underlying problems at an early stage, the procedure can also be done in a real-time mode, and the patients’ discomfort is going to be minimal.Liquid biopsy has been adopted because it is capable of identifying genetic mutations or changes in blood biochemistry, MRD, which are not easily measurable by other tests such as bone marrow aspirates. Given that blood cancers typically encompass alterations in genes of the blood cells, liquid biopsy may yield significant data concerning tumor evolution, therapy outcomes, and relapse prediction. It helps clinicians track how particular therapies are working without additional invasive approaches and manage patient’s treatments and tumor profile modifications individually.

More so, with regard to diagnostics, liquid biopsy is being adopted in clinical setting and more companies are innovating on liquid biopsy tools and companion diagnostics for precision medicine in hematologic malignancy. With the increase in the performance of these tests, liquid biopsy stands to be fundamental in not only diagnosing blood cancers at an early stage but also used in making decisions about how the treatments should be administered without relying on tissue biopsy techniques thus enhancing the quality of life of patients with these diseases. The benefits of the liquid biopsy in the detection of blood cancer coupled with the high demand for non-invasive and efficient diagnostic tools are expected to propel the market into immense growth as projected in the mentioned forecast period.

Gene Therapy Advancements Open New Doors

And gene therapies that have recently entered the hematology market has increased drastically hold a promise of assisting patients suffering from hereditary blood disorders like sickle cell anemia, thalassemia and hemophilia. Many of the existing treatments for your mentioned disorders include blood transfusion, medication or stem cell transplant which are not long lasting methods. However, advancements in genetic surgery and the=floating of genetic treatments are now offering prospects for eradication for these once difficult illnesses. As one of the innovative developments, scientists have tried using CRISPR-Cas9 methods to obtain pure samples with accurate DNA changes to treat genetic blood diseases. This technology has the potential of perhaps addressing the ‘root causes’ of genetic disease such as sickle cell anemia compared to simply providing symptomatic treatment.As for viral vectors, performers lentiviral vectors gene therapy is also increasing gradually, especially in thalassemia and hemophilia, with the patient’s stem cells are modified to create functional blood cells or clotting factors.

This approach has been beneficial with some patients having normal or near normal blood levels of cell count thus cutting down greatly on the occasions of transfusion and medication. These gene therapies are expected to create new opportunities for management of hematological diseases, especially in patients with relapsing or progressive disease status. It also specified that, as these therapies become transitioned out of the research into wider clinical practice, the market for hematology will expand and patients will gain better access to therapy that can dramatically change their lives.

Nevertheless, the challenges do exist: high gene therapy treatment cost, potential risks of making genetic changes to some organism, and market approval issues around the globe. However, these challenges are not hard to overcome due to the rising rate of innovation, the accumulating clinical data, and the rising patient’s demands for cure-oriented therapies, gene therapy is set to advance in the hematology arena. Therefore, gene therapy can be regarded as one of the potentially revolutionary fields in blood disorders treatment, which will allow providing long-term outcomes, minimizes treatment load, and increase patients’ quality of life in global scales.

Hematology Market Segment Analysis:

Hematology Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Hematology Diagnostics segment is expected to dominate the market during the forecast period

Hematology Diagnostics segment holds the largest share of the global market for hematology and is expected to continue to grow during the forecast period (2024-2032) due to rampant need for better diagnostic techniques that are efficacious, precise and less invasiven on the global platform. The increase in global health consciousness especially within the developing world is pushing for regular blood tests within patients as a method of early identification of diseases. Point of care, near patient diagnostic technologies encompassing devices such as hematology analyzers, flow cytometers, and coagulation analyzers are now more precise and rapid in offering diagnosis outcome of blood disorders including cancer, anemia and the like. In addition, the genetic testing by next-generation sequencing (NGS) and liquid biopsy for non invasive blood cancer diagnosis is showing increase in pervasiveness. Such technologies help clinicians to diagnose ailments on earlier stages, recommend individual therapies and assess the condition’s progress more effectively in … complex and hereditary diseases, such as sickle cell anemia and thalassemia, for instance. Diagnostic technologies are developing and their potential to provide molecular and genetic data will change the direction in the development of the hematology care, this proves the strongest position of the diagnostic segment.

There is also a very high utilization of repeated diagnosis of chronic blood conditions such as anemia, hemophilia, and coagulation disorders, which has also boosted the dominant position of the Hematology Diagnostics segment. For instance, patients suffering from chronic diseases need repeated blood analyses to control values such as haemoglobin, platelet count or clotting, dispelling the need for hematology analyser or other diagnostic devices. Also, the increased trends in Point of care (POC) testing devices which can diagnose in clinical and non- clinical settings are gradually increasing the availability of hematology diagnostic tools especially in developing nations. In the emerging targeted approach to therapies where supposedly drugs are designed and administered according to a patient’s genes and molecules, diagnostic methods gain critical roles in decision-making on treatment. Development of diagnostics will also remain the field that will attract a considerable amount of investment – analysis based on AI, development of digital highways, and various online platforms for determining diseases will be of paramount importance in terms of developing diagnostics and saving patients’ lives. Technological advancement, increasing complexity of the healthcare business, and continued need of patients for later management of the diseases guarantees that the Hematology Diagnostics segment will remain an active sector within the market throughout the forecast period.

By Application, Blood Cancer segment expected to held the largest share

The blood cancer indication is expected to occupy the largest market share in the hematology market for the years 2024 to 2032 owing to the growing cases of blood cancer globally, rising availability of novel therapeutics, and continued development in diagnostic tools. Leukemia, lymphoma and myeloma are classified under blood cancer and they among the most prevalent form of cancer in the modern world and whose incidences has been rapidly rising especially in the elderly. They secure early and accurate diagnostic methods and efficient treatments, which are the triggers of such a segment. Immunotherapy, CAR T cell therapies, and targeted therapies are now changing the landscape of treatment of blood cancers by giving better, targeted treatment options especially for people with relapsed and refractory cancers. These novelties, together with modernization of the genetic analysis and liquid biopsy allowing to detect blood diseases in the early stage and track the further development, help to increase patients’ survival and quality of life. Consequently, there is expected to be increased demand for both diagnostic equipment – namely Hematology analyzers, genetic tests, Biomarker assays and therapeutic products – including monoclonal antibodies, chemotherapy, and Gene therapies.

The Blood Cancer segment is also dominating due to escalating number of clinical trials and research activities to enhance the treatment outcomes and to launch new therapies for the blood cancer. CAR-T cell therapies have been proven useful in hematological malignancies including ALL and NHL and therefore development of both diagnostic techniques and producers of the therapies have encouraged more investment. The buzz around the development of novel targeted therapies allows concentrating on those therapies that work well with individual genetic markers and are less likely to cause side effects. Further, the global cases of blood cancer along with the increasing acceptance of new treatment methods is?? the contributive factor for the growth of the diagnostic as well as therapeutic blood cancer market. Another crucial fringe benefit includes the continued development of liquid biopsy and other non-invasive detection techniques to track patients’ response to treatments and to identify minimal residual disease (MRD) necessary for avoiding relapse in blood cancer. These factors of rising incidence rates, new treatment options, and early diagnostic facilities guarantee growth for the Blood Cancer segment that will help sustain the growth in the Hematology market in the future years.

Hematology Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to sustain its position as the largest region in the overall hematology market throughout the forecast period of 2024-2032 on account of effective healthcare client base requirement, increased need for the implementation of novel therapeutic approaches, and mounting emphasis towards R&D within the healthcare sector. The market leadership of particular countries will also remain unchanged: the USA owing to an effective system of healthcare, high spending on the healthcare and the growing incidence of haematologic neoplasms and anemias, coagulation diseases including leukemia, lymphoma, myeloma and others. The space is filled with established pharmaceutical and bio-technology companies investing in and researching innovative next generation of gene, Immuno-oncology therapies, CAR T cell therapies for hematological malignancies. The former is driving need for both treatment and diagnostics in the space, while the latter two represent further sources of growth for both hematology diagnostics and therapeutics in North America.

Similarly, North America has stable regulation laws; it has FDA that gives the direction for approval of new hematology therapies and innovative gene therapies and new biologic molecules. he current prevalence of clinical trials across the region, and specifically with regard to gene editing, immuno-oncology, and gene therapy of such blood disorders as haemophilia and thalassemia, thus retaining the leadership of the region in haematology treatment development. Market drivers for this hematology market in North America include the increasing incidence of blood cancers, especially amongst aging population, increasing demand for diagnostics tools and techniques such as liquid biopsy and Next Generation Sequencing (NGS). Moreover, the advanced insurance and reimbursement policies segment Chad region making the advanced treatments much more accessible than in other parts of the world which will further drive the market growth.North America also experiences high healthcare expenditure, to there is an increase in the demand for innovative diagnostic tools including the automatic hematology analyzer and genetic testing and better quality of therapeutic products including the monoclonal antibodies/ CAR T cell therapies. The global hematology market is poised to remain strategically positioned in North America due to sustained investment in vertical and horizontal healthcare advancement, and improved patient options for embracing innovative therapies. In addition, the developing cooperation between entrepreneurial pharmaceutical manufacturers and key academic-research facilities and healthcare centers across North America is promoting new ideas and the advancement of new-generation medications. Based on these factors, North America is anticipated to sustain this trend and remain the largest market for hematology diagnostics and therapeutics across the given timeframe.

Active Key Players in the Hematology Market:

Abbott Laboratories (United States)

AbbVie Inc. (United States)

Amgen Inc. (United States)

Bio-Rad Laboratories (United States)

Bristol-Myers Squibb Company (United States)

Celgene Corporation (now part of Bristol-Myers Squibb) (United States)

Danaher Corporation (United States)

Gilead Sciences, Inc. (United States)

HemoCue AB (a part of Danaher Corporation) (Sweden)

Johnson & Johnson (United States)

Medtronic plc (Ireland)

Novartis International AG (Switzerland)

Pfizer Inc. (United States)

Roche Diagnostics (Switzerland)

Sanofi S.A. (France)

Siemens Healthineers (Germany)

Thermo Fisher Scientific (United States)

Vertex Pharmaceuticals (United States)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hematology Market by Type

4.1 Hematology Market Snapshot and Growth Engine

4.2 Hematology Market Overview

4.3 Hematology Diagnostics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hematology Diagnostics: Geographic Segmentation Analysis

4.4 Hematology Therapeutic

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hematology Therapeutic: Geographic Segmentation Analysis

Chapter 5: Hematology Market by Application

5.1 Hematology Market Snapshot and Growth Engine

5.2 Hematology Market Overview

5.3 Blood Cancer

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Blood Cancer: Geographic Segmentation Analysis

5.4 Anaemia

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Anaemia: Geographic Segmentation Analysis

5.5 Haemophilia and Coagulation Disorders

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Haemophilia and Coagulation Disorders : Geographic Segmentation Analysis

5.6 Sickle Cell Disease and Thalassemia

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Sickle Cell Disease and Thalassemia: Geographic Segmentation Analysis

Chapter 6: Hematology Market by End User

6.1 Hematology Market Snapshot and Growth Engine

6.2 Hematology Market Overview

6.3 Hospitals and Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals and Clinics: Geographic Segmentation Analysis

6.4 Diagnostic Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostic Laboratories: Geographic Segmentation Analysis

6.5 Research and Academic Institutions

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research and Academic Institutions: Geographic Segmentation Analysis

6.6 Blood Banks

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Blood Banks: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Hematology Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBVIE INC. (UNITED STATES)

7.4 AMGEN INC. (UNITED STATES)

7.5 BIO-RAD LABORATORIES (UNITED STATES)

7.6 BRISTOL-MYERS SQUIBB COMPANY (UNITED STATES)

7.7 CELGENE CORPORATION (NOW PART OF BRISTOL-MYERS SQUIBB) (UNITED STATES)

7.8 DANAHER CORPORATION (UNITED STATES)

7.9 GILEAD SCIENCES INC. (UNITED STATES)

7.10 HEMOCUE AB (A PART OF DANAHER CORPORATION) (SWEDEN)

7.11 AND JOHNSON & JOHNSON (UNITED STATES)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Hematology Market By Region

8.1 Overview

8.2. North America Hematology Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Hematology Diagnostics

8.2.4.2 Hematology Therapeutic

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Blood Cancer

8.2.5.2 Anaemia

8.2.5.3 Haemophilia and Coagulation Disorders

8.2.5.4 Sickle Cell Disease and Thalassemia

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals and Clinics

8.2.6.2 Diagnostic Laboratories

8.2.6.3 Research and Academic Institutions

8.2.6.4 Blood Banks

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Hematology Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Hematology Diagnostics

8.3.4.2 Hematology Therapeutic

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Blood Cancer

8.3.5.2 Anaemia

8.3.5.3 Haemophilia and Coagulation Disorders

8.3.5.4 Sickle Cell Disease and Thalassemia

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals and Clinics

8.3.6.2 Diagnostic Laboratories

8.3.6.3 Research and Academic Institutions

8.3.6.4 Blood Banks

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Hematology Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Hematology Diagnostics

8.4.4.2 Hematology Therapeutic

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Blood Cancer

8.4.5.2 Anaemia

8.4.5.3 Haemophilia and Coagulation Disorders

8.4.5.4 Sickle Cell Disease and Thalassemia

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals and Clinics

8.4.6.2 Diagnostic Laboratories

8.4.6.3 Research and Academic Institutions

8.4.6.4 Blood Banks

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Hematology Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Hematology Diagnostics

8.5.4.2 Hematology Therapeutic

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Blood Cancer

8.5.5.2 Anaemia

8.5.5.3 Haemophilia and Coagulation Disorders

8.5.5.4 Sickle Cell Disease and Thalassemia

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals and Clinics

8.5.6.2 Diagnostic Laboratories

8.5.6.3 Research and Academic Institutions

8.5.6.4 Blood Banks

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Hematology Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Hematology Diagnostics

8.6.4.2 Hematology Therapeutic

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Blood Cancer

8.6.5.2 Anaemia

8.6.5.3 Haemophilia and Coagulation Disorders

8.6.5.4 Sickle Cell Disease and Thalassemia

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals and Clinics

8.6.6.2 Diagnostic Laboratories

8.6.6.3 Research and Academic Institutions

8.6.6.4 Blood Banks

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Hematology Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Hematology Diagnostics

8.7.4.2 Hematology Therapeutic

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Blood Cancer

8.7.5.2 Anaemia

8.7.5.3 Haemophilia and Coagulation Disorders

8.7.5.4 Sickle Cell Disease and Thalassemia

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals and Clinics

8.7.6.2 Diagnostic Laboratories

8.7.6.3 Research and Academic Institutions

8.7.6.4 Blood Banks

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Hematology Market research report?

A1: The forecast period in the Hematology Market research report is 2024-2032.

Q2: Who are the key players in the Hematology Market?

A2: Abbott Laboratories (United States), AbbVie Inc. (United States), Amgen Inc. (United States), Bio-Rad Laboratories (United States), Bristol-Myers Squibb Company (United States), Celgene Corporation (now part of Bristol-Myers Squibb) (United States), Danaher Corporation (United States), Gilead Sciences, Inc. (United States), HemoCue AB (a part of Danaher Corporation) (Sweden), Johnson & Johnson (United States), Medtronic plc (Ireland), Novartis International AG (Switzerland), Pfizer Inc. (United States), Roche Diagnostics (Switzerland), Sanofi S.A. (France), Siemens Healthineers (Germany), Thermo Fisher Scientific (United States), Vertex Pharmaceuticals (United States), and Other Active Players.

Q3: What are the segments of the Hematology Market?

A3: The Hematology Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Hematology Diagnostics, Hematology Therapeutic. By Application, the market is categorized into Blood Cancer, Anaemia, Haemophilia and Coagulation Disorders, Sickle Cell Disease and Thalassemia. By End User, the market is categorized into Hospitals and Clinics, Diagnostic Laboratories, Research and Academic Institutions, Blood Banks. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Hematology Market?

A4: The hematology market refers to the worldwide market focused on blood disorders diagnosis, therapy, and management with products for anemia, blood cancer, hemophilia, sickle cell anemia, and thrombocytopenia. This market entails diagnostic instruments like Hematology analyzers, flow cytometers and coagulation analyzers for counting the number of blood cells or thrombocytes planning their coagulation ability and for detection of abnormality or diseases in the blood. That also includes therapeutic products like Chemotherapy drugs, gene therapies, targeted and immunotherapies, blood, transfusion products, and hemostatic agents. Market drivers include; global incidence of blood disorders, development in diagnostic tools, and increasing trend for personalized medicine particularly molecular diseases such as cancer and inherited blood disorders. The market can expand further based on advancements in gene editing, immunotherapy, and differentiation, in addition to enlarging access to healthcare in new areas. Currently, the largest markets are in North America, Europe, and Asia-Pacific area, although faster growth in the future is expected in the developing countries because of the increasing awareness, health care infrastructure advancements, and the increasing incidence of blood-related diseases. Other factors which define the hematology market include, expensive treatment procedures, bureaucratic policies, and inadequate health facilities to patients in developing countries. All in all, the market is predicted to grow as the advancement in technologies, unique treatments, and other solutions targeting patients are still yet to will into the market.

Q5: How big is the Hematology Market?

A5: Hematology Market Size Was Valued at USD 6.6 Billion in 2023, and is Projected to Reach USD 12.1 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!