Stay Ahead in Fast-Growing Economies.

Browse Reports NowHealthcare Distribution Market Booming with Development Activities

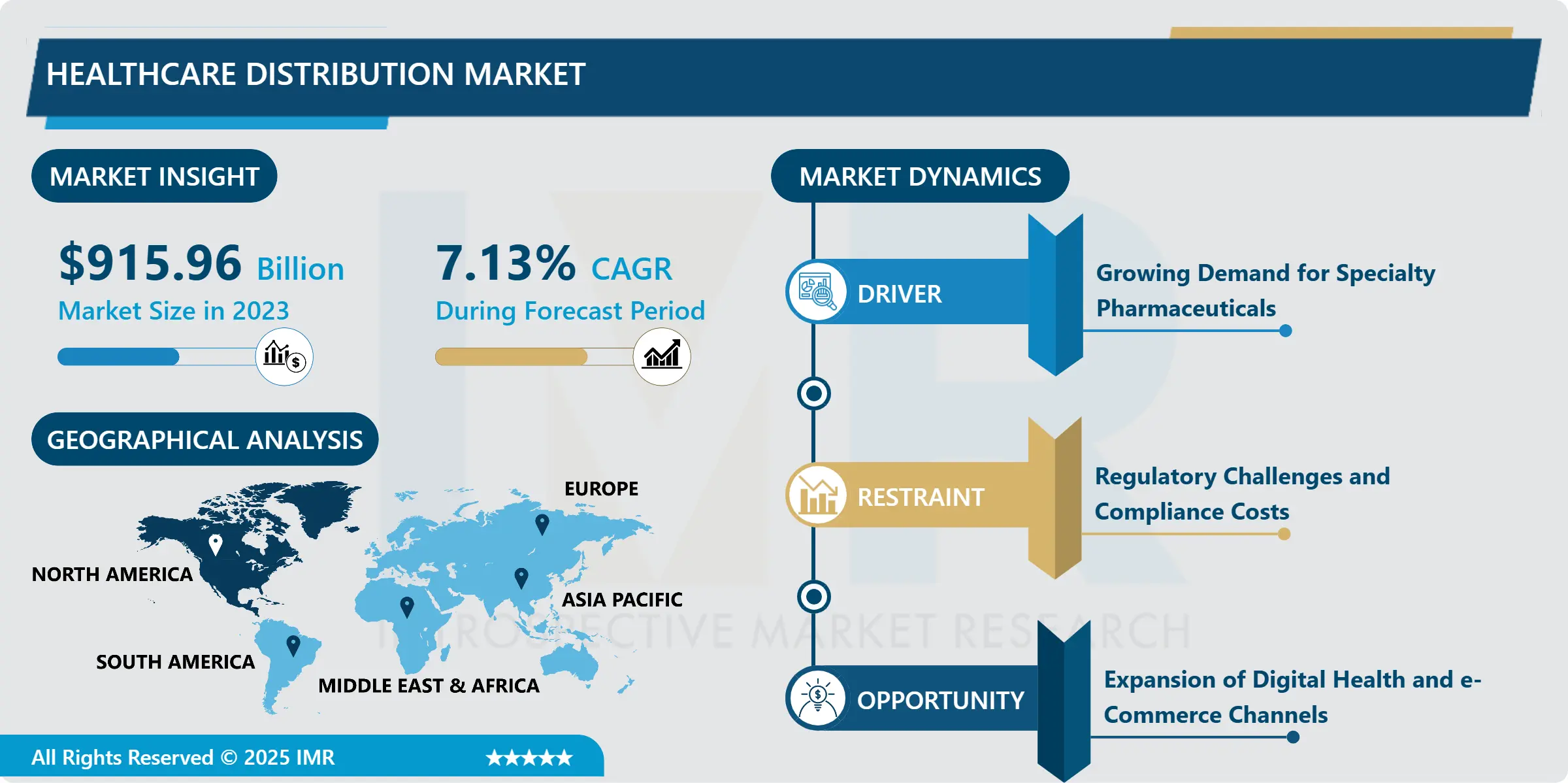

Healthcare Distribution Market Size Was Valued at USD 915.96 Billion in 2023, and is Projected to Reach USD 1,702.46 Billion by 2032, Growing at a CAGR of 7.13% From 2024-2032.

IMR Group

Description

Healthcare Distribution Market Synopsis:

Healthcare Distribution Market Size Was Valued at USD 915.96 Billion in 2023, and is Projected to Reach USD 1,702.46 Billion by 2032, Growing at a CAGR of 7.13% From 2024-2032.

The Healthcare Distribution Market refers to the distribution channels and logistics systems through which flow pharmaceuticals and medical products and all other products connected to the health sector and including related equipment, to the end consumers which include hospitals, retail pharmacies, clinics or any other point where the consumer is the final link. Of significance to this market is underpinning the efficiency of supply of medical products hence the implications to the global availability and cost of health care.

The healthcare distribution industry is an essential support column of the healthcare chain, bringing together manufacturers and suppliers, as well as healthcare organizations and patients. In the current context this market focuses on the increasing need for logistics networks particularly with the increasing number of compounded products like specialty drugs, biopharmaceuticals, and medical devices which require specialized handling, storage, and distribution channels. The current and extensive role of health care sector distributors also involves services ranging from traditional product delivery to inventory control, storage and transportation of perishable products through services such as cold chain distribution, and possibility of offering digital tracking solutions with respect to the products they sell to the health care firms.

Recent developments like the combination of AI and IoT are revolutionizing this global market, which enable better demand forecasting, better logistics, and better regulatory requirements. On the other side, increasing healthcare consumption mainly due to increased demographic aging alongside the enhancement of the healthcare technology is exerting more pressure on the dependability and robustness of the healthcare product distribution channels. Subsequently, distribution channels are also extending their reach to facilitate direct to patient solutions and online pharmaceutical stores given the growing trend towards home based patient centric care.

Healthcare Distribution Market Trend Analysis:

Increasing Adoption of Cold Chain Logistics

With the increased use of biologics and other products that require cold chain in their distribution, the trend in the healthcare industry is to extend the cold chain distribution. Vaccines, gene therapies, biosimilars & other biopharmaceuticals need careful temperature management while in transit & while in storage. Therefore, healthcare distributors are focusing more on building capacity and newer technologies and equipments that will fulfill these requirements.

This trend is revolutionizing the healthcare distribution market in the coming years by offering differentiated segments in the industry as parties involve are agreeing to invest in refrigerated vehicles, temperature-controlled warehousing, and real-time temperature variations. There is increased demand for such logistics capabilities, more so with the uptake of the vaccines across the world especially during disasters such as the covid-19 pandemic whereby there is need to distribute vaccines safely and timely. At the same time, there are new difficulties with the shift towards cold chain logistics that affects company’s operational models and forces them to perform constant training of employees, as well as adhere to strict regulatory requirements.

Expansion of Digital Health and e-Commerce Channels

The current healthcare distribution as influenced by digital health platforms and electronic commerce channels is a promising market. As discussed in prior segments, patient and healthcare provider interest in telemedicine and online pharmacies, as well as the company’s direct selling capabilities, have grown with the uptick in demand for its products. This shift is more indicative in the metropolitan areas and areas of high internet usage where digital health platforms are redefining how health products get to the clients.

For healthcare distributors this is the chance to establish cooperation with e-pharmacies or build distribution strategies which correspond to individual patients instead of focusing solely on healthcare organizations. Such partnerships help in creation of an environment to allow patients to order their prescriptions online, and have them delivered at their homes within shortest time possible. This trend is likely to increase more and more and, in return, it will increase the need for eleven delivery solutions to be provided by the distribution companies in the healthcare value chain.

Healthcare Distribution Market Segment Analysis:

Healthcare Distribution Market is Segmented on the basis of Product Type, End User, and Region

By Product Type, Biopharmaceutical segment is expected to dominate the market during the forecast period

The area of the market concerned with healthcare distribution entails distribution to a wide variety of products, including, the biopharmaceuticals, pharmaceuticals, as well as the medical devices products which have their own specific handling and logistic characteristics. Special types of products concerning their usage include for instance; biopharmaceuticals that have to be transported under temperature control due to their sensitivity to fluctuations in temperature. With these products becoming more popular like with the growth in the use of personalized medicine health care distributors are investing in equipment that can uphold the appropriate cold chain systems as demanded by the regulatory authorities.

While pharmaceuticals constitute the main component of healthcare distribution with fairly predictable consumption by hospitals, pharmacies and other healthcare facilities. The distribution of medical devices is also important, which is because they are used as diagnostic and treatment tools. Demanding logistic solutions are crucial in medical device distribution since a delay or unsatisfactory quality will affect the outcome of a patient’s condition. These product segments determine the nature and direction of the healthcare distribution market and thus need unique form of handling based on their demand, logistics, regulatory and storage requirements.

By End User, Hospital Pharmacies segment expected to held the largest share

Hospital pharmacies, retail pharmacies and other entities of healthcare distribution market representing themselves as end users in the market have different distribution requirements. Hospital pharmacies order large quantities of pharmaceutical and medical devices to address the patient needs in hospitals thus the need for consistent supply. This segment frequently involved special products like pharmaceuticals and medical instruments which requires precise compliance and correct order fulfillment from the distributors.

Retail pharmacy outlets on the other hand serve the general patient populace and depend on healthcare distributors for the supply of prescription and OTC drugs. As the number of e-pharmacies increases, this segment is shifting towards home delivery, and distributors have to build last-mile delivery solutions. The heterogeneous demand of these end consumers is an opportunity for the development of niche distribution services, which give healthcare distributors an ability to address all needs of their consumers depending on the latter’s specific demands.

Healthcare Distribution Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America holds the largest market of healthcare distribution due to the advanced healthcare structure, a high demand for specialty pharmaceuticals, and sound logistics systems. The United States especially, where there are a large and growing number of aging citizens and providers of health-care products and services require reliable distribution networks to address their needs. Further, increasing incidence of chronic diseases, coupled with availability of improved medical care delivery solutions, create need for efficient health care distribution channels.

Moreover, North America has a strong social framework and highly developed digital health technologies as well as cold chain systems for effective distribution of high value pharmaceutical goods and medical devices. The regulations support the healthcare distribution in NA and there is immense demand in the market which makes North America to set industry benchmarks that are usually adopted around the world.

Active Key Players in the Healthcare Distribution Market:

McKesson Corporation (USA)

Cardinal Health, Inc. (USA)

AmerisourceBergen Corporation (USA)

Owens & Minor, Inc. (USA)

Medline Industries, Inc. (USA)

Cencora (USA)

Henry Schein, Inc. (USA)

Phoenix Group (Germany)

Sinopharm Group Co., Ltd. (China)

Alfresa Holdings Corporation (Japan)

Cardinal Health Canada Inc. (Canada)

Zur Rose Group AG (Switzerland)

Other Active Players

Key Industry Developments in the Healthcare Distribution Market:

In January 2023, Open Medical announces a new partnership with Tamer Group to bring its award-winning, market-leading Digital Transformation (KSA) solution to the Kingdom of Saudi Arabia. Open Medical aims to support KSA’s leading innovators in their mission to redefine the effectiveness and quality of healthcare. This helped the company to expand its business.

January 2023: Amylyx Pharmaceuticals, Inc. entered into an exclusive license and distribution agreement with Neopharm. Here, Neopharm will commercialize, subject to regulatory review and approval, AMX0035 (sodium phenylbutyrate and ursodoxicoltaurine) for the treatment of amyotrophic lateral sclerosis (ALS) in Israel, Gaza, West Bank, and the Palestinian Authority.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Healthcare Distribution Market by Product Type

4.1 Healthcare Distribution Market Snapshot and Growth Engine

4.2 Healthcare Distribution Market Overview

4.3 Biopharmaceutical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Biopharmaceutical: Geographic Segmentation Analysis

4.4 Pharmaceutical

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Pharmaceutical: Geographic Segmentation Analysis

4.5 Medical Device

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Medical Device: Geographic Segmentation Analysis

Chapter 5: Healthcare Distribution Market by End User

5.1 Healthcare Distribution Market Snapshot and Growth Engine

5.2 Healthcare Distribution Market Overview

5.3 Hospital Pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospital Pharmacies: Geographic Segmentation Analysis

5.4 Retail Pharmacies

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Retail Pharmacies: Geographic Segmentation Analysis

5.5 Other

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Other: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Healthcare Distribution Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MCKESSON CORPORATION (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CARDINAL HEALTH INC. (USA)

6.4 AMERISOURCEBERGEN CORPORATION (USA)

6.5 OWENS & MINOR INC. (USA)

6.6 MEDLINE INDUSTRIES INC. (USA)

6.7 CENCORA (USA)

6.8 HENRY SCHEIN INC. (USA)

6.9 PHOENIX GROUP (GERMANY)

6.10 SINOPHARM GROUP CO. LTD. (CHINA)

6.11 ALFRESA HOLDINGS CORPORATION (JAPAN)

6.12 CARDINAL HEALTH CANADA INC. (CANADA)

6.13 ZUR ROSE GROUP AG (SWITZERLAND)

6.14 .

6.15 OTHER ACTIVE PLAYERS

Chapter 7: Global Healthcare Distribution Market By Region

7.1 Overview

7.2. North America Healthcare Distribution Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product Type

7.2.4.1 Biopharmaceutical

7.2.4.2 Pharmaceutical

7.2.4.3 Medical Device

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospital Pharmacies

7.2.5.2 Retail Pharmacies

7.2.5.3 Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Healthcare Distribution Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product Type

7.3.4.1 Biopharmaceutical

7.3.4.2 Pharmaceutical

7.3.4.3 Medical Device

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospital Pharmacies

7.3.5.2 Retail Pharmacies

7.3.5.3 Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Healthcare Distribution Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product Type

7.4.4.1 Biopharmaceutical

7.4.4.2 Pharmaceutical

7.4.4.3 Medical Device

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospital Pharmacies

7.4.5.2 Retail Pharmacies

7.4.5.3 Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Healthcare Distribution Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product Type

7.5.4.1 Biopharmaceutical

7.5.4.2 Pharmaceutical

7.5.4.3 Medical Device

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospital Pharmacies

7.5.5.2 Retail Pharmacies

7.5.5.3 Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Healthcare Distribution Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product Type

7.6.4.1 Biopharmaceutical

7.6.4.2 Pharmaceutical

7.6.4.3 Medical Device

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospital Pharmacies

7.6.5.2 Retail Pharmacies

7.6.5.3 Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Healthcare Distribution Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product Type

7.7.4.1 Biopharmaceutical

7.7.4.2 Pharmaceutical

7.7.4.3 Medical Device

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospital Pharmacies

7.7.5.2 Retail Pharmacies

7.7.5.3 Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Healthcare Distribution Market research report?

A1: The forecast period in the Healthcare Distribution Market research report is 2024-2032.

Q2: Who are the key players in the Healthcare Distribution Market?

A2: McKesson Corporation, Cardinal Health, AmerisourceBergen, Owens & Minor, Medline Industries, Cencora, Henry Schein, Phoenix Group, Sinopharm Group, Alfresa Holdings, Cardinal Health Canada, Zur Rose Group, and Other Active Players.

Q3: What are the segments of the Healthcare Distribution Market?

A3: The Healthcare Distribution Market is segmented into Type, End User and region. By Product Type, the market is categorized into Biopharmaceutical, Pharmaceutical, Medical Device. By End User, the market is categorized into Hospital Pharmacies, Retail Pharmacies, Other. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Healthcare Distribution Market?

A4: The Healthcare Distribution Market refers to the distribution channels and logistics systems through which flow pharmaceuticals and medical products and all other products connected to the health sector and including related equipment, to the end consumers which include hospitals, retail pharmacies, clinics or any other point where the consumer is the final link. Of significance to this market is underpinning the efficiency of supply of medical products hence the implications to the global availability and cost of health care.

Q5: How big is the Healthcare Distribution Market?

A5: Healthcare Distribution Market Size Was Valued at USD 915.96 Billion in 2023, and is Projected to Reach USD 1,702.46 Billion by 2032, Growing at a CAGR of 7.13% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!