Stay Ahead in Fast-Growing Economies.

Browse Reports NowFrozen Desserts Market – Comprehensive Study Report & Recent Trends 2024-2032

Frozen desserts are sweet, chilled treats made by freezing various mixtures of ingredients such as dairy products, fruits, sugars, and flavorings. This category includes ice cream, gelato, frozen yogurt, sorbet, and non-dairy or plant-based alternatives. Frozen desserts are popular because they offer indulgence, refreshment, and convenience, often appealing to a wide range of tastes and dietary preferences.

IMR Group

Description

Frozen Desserts Market Synopsis

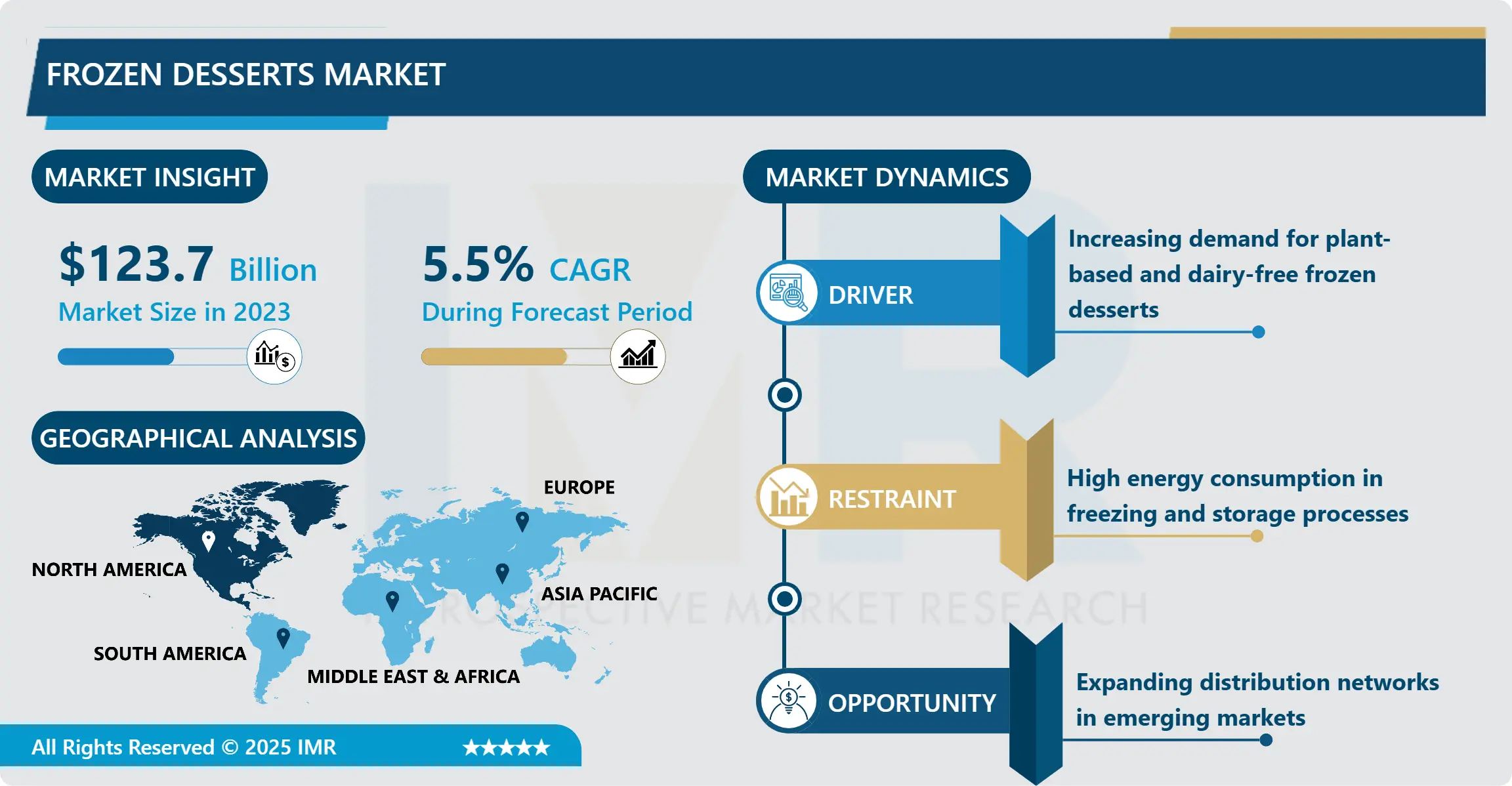

Frozen Desserts Market Size Was Valued at USD 123.7 Billion in 2023, and is Projected to Reach USD 195.5 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.

Frozen desserts are sweet, chilled treats made by freezing various mixtures of ingredients such as dairy products, fruits, sugars, and flavorings. This category includes ice cream, gelato, frozen yogurt, sorbet, and non-dairy or plant-based alternatives. Frozen desserts are popular because they offer indulgence, refreshment, and convenience, often appealing to a wide range of tastes and dietary preferences.

Their dominance in the global market is driven by several factors: increasing consumer demand for on-the-go and premium treats, rising disposable incomes, greater availability through supermarkets and quick-service restaurants, and innovations like plant-based and low-calorie options. Additionally, the expansion of cold chain logistics and aggressive marketing by major brands have made frozen desserts more accessible in emerging economies, further boosting their global popularity.

Frozen Desserts Market Trend Analysis:

Increase of Health-Conscious Consumers

The frozen dessert market is witnessing several key trends that are shaping its growth globally. Health-conscious consumers are driving demand for low-fat, low-sugar, and plant-based frozen desserts made with alternative ingredients like almond milk, coconut milk, and oat milk. Premiumization is another strong trend, with customers willing to pay more for artisanal, organic, and exotic-flavored products.

The popularity of vegan and allergen-free options is also expanding rapidly. In addition, technological advancements in freezing techniques and packaging innovations are improving product quality and shelf life, further supporting market growth. Seasonal promotions and collaborations between brands and popular influencers have also helped frozen desserts maintain high visibility and consumer engagement year-round, beyond traditional summer peaks.

Rising Urbanization and Disposable Incomes

The frozen dessert market offers immense opportunities for both established players and new entrants. Emerging markets in Asia-Pacific, Latin America, and the Middle East are experiencing rising urbanization and disposable incomes, creating a strong demand for frozen treats. There is also a growing opportunity in offering functional frozen desserts that incorporate probiotics, added proteins, vitamins, and even immunity-boosting ingredients.

Brands that focus on sustainability — such as eco-friendly packaging and ethically sourced ingredients — are likely to capture greater customer loyalty. Moreover, the rise of e-commerce and food delivery services provides an additional sales channel, allowing brands to reach consumers directly at home. Innovating with local flavors and catering to regional tastes can further help brands strengthen their market presence globally.

Frozen Desserts Market Segment Analysis:

Frozen Desserts Market is Segmented on the basis of Product, Distribution Channel.

By Product, Confectionaries & Candie segment is expected to dominate the market during the forecast period

Among the various product categories — Confectioneries & Candies, Ice Cream, Frozen Yogurts, and Others — ice cream continues to dominate the global frozen dessert market. Ice cream has long been the most popular frozen treat due to its widespread appeal across all age groups, variety of flavors, and continuous innovation in formats like cones, bars, tubs, and sandwiches. Premium and artisanal ice cream segments are growing especially fast, fueled by consumer willingness to explore unique flavors and healthier, high-quality options such as low-calorie or dairy-free varieties.

Although frozen yogurts and other alternatives are gaining popularity, especially among health-conscious consumers, they still hold a smaller market share compared to traditional ice cream. The combination of strong brand loyalty, nostalgia, aggressive marketing, and broad product accessibility keeps ice cream at the forefront of the frozen dessert industry.

By Distribution Channel, Supermarket/hypermarket segment expected to held the largest share

In the frozen dessert market, supermarkets and hypermarkets dominate as the primary distribution channel. These outlets offer consumers the convenience of purchasing a wide range of frozen desserts under one roof, often at competitive prices, and with attractive promotional offers. Supermarkets and hypermarkets provide better visibility for brands, allowing them to display products in organized, temperature-controlled sections that encourage impulse purchases.

While convenience stores also contribute significantly, especially for quick, on-the-go buying, and cafés & bakery shops are growing with the premium dessert experience trend, they still trail behind supermarkets in volume sales. Online channels are emerging rapidly due to the expansion of e-commerce and food delivery platforms, but they currently hold a smaller share compared to physical retail outlets. Nevertheless, as digital shopping habits continue to grow, the online segment is expected to gain momentum in the coming years.

Frozen Desserts Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the global frozen dessert market due to several strong factors. The region has a deeply rooted culture of consuming frozen treats like ice cream, frozen yogurt, and other specialty desserts throughout the year, not just seasonally. High disposable incomes, a strong preference for premium and innovative products, and a well-developed cold chain infrastructure support consistent demand. Moreover, consumers in North America are highly open to trying new flavors, health-focused variants (like low-fat, keto, and plant-based desserts), and indulgent premium offerings, encouraging continuous product innovation.

Major market players like Nestlé, Unilever, and General Mills are headquartered or heavily active in the region, which fuels intense marketing and easy availability of products. Additionally, the growing trend of home delivery and online grocery shopping has made frozen desserts even more accessible, helping North America maintain its leading position in the global market.

Active Key Players in the Frozen Desserts Market:

Amul (India)

Baskin-Robbins (United States)

Ben & Jerry’s (United States)

Blue Bell Creameries (United States)

Cold Stone Creamery (United States)

Dairy Queen (United States)

General Mills (United States)

Halo Top Creamery (United States)

Häagen-Dazs (United States)

Magnum (United Kingdom)

Nestlé (Switzerland)

Rich Products Corporation (United States)

Tillamook (United States)

Unilever (United Kingdom)

Wells Enterprises (United States)

Other key Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Frozen Desserts Market by Product

4.1 Frozen Desserts Market Snapshot and Growth Engine

4.2 Frozen Desserts Market Overview

4.3 Confectionaries & Candies

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Confectionaries & Candies: Geographic Segmentation Analysis

4.4 Icecream

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Icecream: Geographic Segmentation Analysis

4.5 Frozen Yogurts

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Frozen Yogurts: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Frozen Desserts Market by Distribution Channel

5.1 Frozen Desserts Market Snapshot and Growth Engine

5.2 Frozen Desserts Market Overview

5.3 Super/hyper

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Super/hyper: Geographic Segmentation Analysis

5.4 Convenience Store

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Convenience Store: Geographic Segmentation Analysis

5.5 Café & Bakery Shops

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Café & Bakery Shops: Geographic Segmentation Analysis

5.6 Online

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Online: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Frozen Desserts Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AMUL (INDIA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BASKIN-ROBBINS (UNITED STATES)

6.4 BEN & JERRY’S (UNITED STATES)

6.5 BLUE BELL CREAMERIES (UNITED STATES)

6.6 COLD STONE CREAMERY (UNITED STATES)

6.7 DAIRY QUEEN (UNITED STATES)

6.8 GENERAL MILLS (UNITED STATES)

6.9 HALO TOP CREAMERY (UNITED STATES)

6.10 HÄAGEN-DAZS (UNITED STATES)

6.11 MAGNUM (UNITED KINGDOM)

6.12 NESTLÉ (SWITZERLAND)

6.13 RICH PRODUCTS CORPORATION (UNITED STATES)

6.14 TILLAMOOK (UNITED STATES)

6.15 UNILEVER (UNITED KINGDOM)

6.16 WELLS ENTERPRISES (UNITED STATES)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Frozen Desserts Market By Region

7.1 Overview

7.2. North America Frozen Desserts Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Product

7.2.4.1 Confectionaries & Candies

7.2.4.2 Icecream

7.2.4.3 Frozen Yogurts

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size By Distribution Channel

7.2.5.1 Super/hyper

7.2.5.2 Convenience Store

7.2.5.3 Café & Bakery Shops

7.2.5.4 Online

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Frozen Desserts Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Product

7.3.4.1 Confectionaries & Candies

7.3.4.2 Icecream

7.3.4.3 Frozen Yogurts

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size By Distribution Channel

7.3.5.1 Super/hyper

7.3.5.2 Convenience Store

7.3.5.3 Café & Bakery Shops

7.3.5.4 Online

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Frozen Desserts Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Product

7.4.4.1 Confectionaries & Candies

7.4.4.2 Icecream

7.4.4.3 Frozen Yogurts

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size By Distribution Channel

7.4.5.1 Super/hyper

7.4.5.2 Convenience Store

7.4.5.3 Café & Bakery Shops

7.4.5.4 Online

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Frozen Desserts Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Product

7.5.4.1 Confectionaries & Candies

7.5.4.2 Icecream

7.5.4.3 Frozen Yogurts

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size By Distribution Channel

7.5.5.1 Super/hyper

7.5.5.2 Convenience Store

7.5.5.3 Café & Bakery Shops

7.5.5.4 Online

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Frozen Desserts Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Product

7.6.4.1 Confectionaries & Candies

7.6.4.2 Icecream

7.6.4.3 Frozen Yogurts

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size By Distribution Channel

7.6.5.1 Super/hyper

7.6.5.2 Convenience Store

7.6.5.3 Café & Bakery Shops

7.6.5.4 Online

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Frozen Desserts Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Product

7.7.4.1 Confectionaries & Candies

7.7.4.2 Icecream

7.7.4.3 Frozen Yogurts

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size By Distribution Channel

7.7.5.1 Super/hyper

7.7.5.2 Convenience Store

7.7.5.3 Café & Bakery Shops

7.7.5.4 Online

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Frozen Desserts Market research report?

A1: The forecast period in the Frozen Desserts Market research report is 2024-2032.

Q2: Who are the key players in the Frozen Desserts Market?

A2: Amul (India), Baskin-Robbins (United States), Ben & Jerry's (United States), Blue Bell Creameries (United States), Cold Stone Creamery (United States) and Other Major Players.

Q3: What are the segments of the Frozen Desserts Market?

A3: The Frozen Desserts Market is segmented into Product, Distribution Channel, and region. By Product, the market is categorized into Confectionaries & Candies, Icecream, Frozen Yogurts, Others. By Distribution Channel, the market is categorized into Supermarket/hypermarket, Convenience Store, Café & Bakery Shops, Online, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Frozen Desserts Market?

A4: Friedreich’s Ataxia (FA) is a rare, hereditary and progressive neurological disorder, caused by the mutation of the FXN gene which results in decreased levels of frataxin protein. The symptoms linked with this disorder include a loss of coordination especially balance and co-ordination (ataxia), muscle weakness, heart diseases and diabetes. FA tends to be still in some children and adolescents and progresses throughout the disease course, causing considerable reduction in the patients’ quality of life and life expectancy. Friedreich’s Ataxia is an orphan disease and, up to date, there is no specific treatment of the disease; therefore, existing approaches are limited to interventions aimed at relieving the symptoms and enhancing patient prognosis. The FA market therefore includes drugs, therapies and diagnostics aimed at meeting the medical needs of these patients and investing in the new therapeutic approaches to FA such as gene therapy with frataxin deficiency.

Q5: How big is the Frozen Desserts Market?

A5: Frozen Desserts Market Size Was Valued at USD 123.7 Billion in 2023, and is Projected to Reach USD 195.5 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!