Stay Ahead in Fast-Growing Economies.

Browse Reports NowFresh Seafood Packaging Market -Latest Advancement & Future Trends (2024-2032)

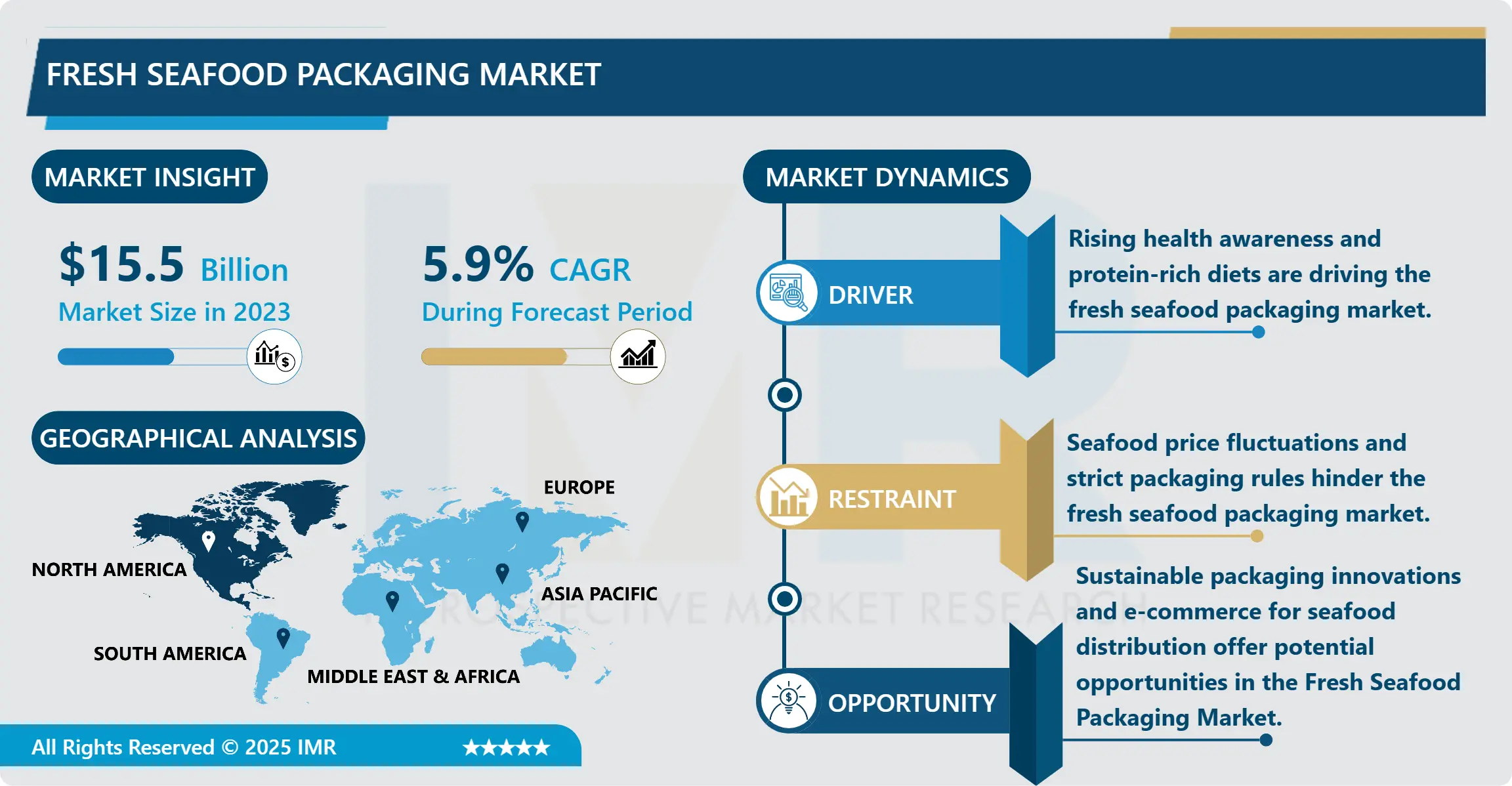

Fresh Seafood Packaging Market Size Was Valued at USD 15.5 Billion in 2023, and is Projected to Reach USD 26.5 Billion by 2032, Growing at a CAGR of 5.9% From 2024-2032.

IMR Group

Description

Fresh Seafood Packaging Market Synopsis:

Fresh Seafood Packaging Market Size Was Valued at USD 15.5 Billion in 2023, and is Projected to Reach USD 26.5 Billion by 2032, Growing at a CAGR of 5.9% From 2024-2032.

The packaging segment of fresh seafood is rapidly growing as customers are focusing on including healthy proteins in their diet and seafood is perfect ready-to-cook meals. Incorporation of innovative food packaging process technologies that enhance the shelf life of products has become important as more consumers are concerned with health hence opting for fresh seafoods. Technologies like vacuum packaging, MAP and biodegradable packaging helping in the important task of maintaining the quality and safety of seafoods.

Apart from the consumer preferences, fresh seafood packaging market is equally influenced by sustainability issues. Another key trend that is coming to light as part of the evaluation of impacts is the use of sustainable packaging to replace plastics and make packaging more recyclable. The above trend fall in line with similar steps taken towards sustainable fishing world over and decrease on negative impacts that fishing has on seafood. Industry is therefore seeking biodegradable films and reusable plastics to fulfil consumers’ expectations and regulators’ expectations.

Moreover, today’s technology has been improving the sustainability of new packaging materials for fresh seafood. Functioning temperature and freshness indicators in smart packaging solutions make it easy to provide consumers with fresh and quality goods. It is also worth noting that the application of technology increases the supply chain visibility and, at the same time, contribute to the favorable consumer experience. The size of fresh seafood packaging application market will also continue to grow steadily in the future as the market moves forward with innovation, sustainability, and consumer preferences.

Fresh Seafood Packaging Market Trend Analysis:

Sustainable Packaging Solutions

An emerging trend that is now driving the fresh seafood packaging market is the call for more sustainable packaging materials. The trend in packaging is also moving towards the use of environmentally sensitive paper to cater for the hearts of consumber who are now become very conscience on environmental issues. The market is answering to increased consumer concern by mimicking sustainable materials such as biodegradable, compostable or recyclable packaging. Development of sustainable films Common trends include plant-based films and new recyclable biodegradable containers enable seafood brands to address their consumers’ expectations and the sustainability of seafood sources. That not only aids in brand building but also assists companies in adhering to new regulation standards of limiting the use of plastics.

Smart Packaging Technologies

The smart packaging solutions for fresh seafood are effectively reshaping the packaging market due to improved safety and quality of the product. Intelligent packaging systems such as system with sensors and indicator can track seafood quality, temperature and shelf life at any given point in time. These technologies enable delivery of vital information to consumers and retailers on how best to store and deal with the seafood products in the supply system. Furthermore, smart packaging also comes with advantages in operating, selling and even avoid food wastage as it is able to inform the suppliers that there is an expiring stock available for sale. It will therefore be imperative for smart packaging technologies to become an SLA for food production for seafood.

Fresh Seafood Packaging Market Segment Analysis:

Fresh Seafood Packaging Market is Segmented on the basis of Material Type, Product Type, Application, and Region

By Material Type, Plastic segment is expected to dominate the market during the forecast period

In the fresh seafood packaging market, materials are categorized into four primary types: recyclable, non-recyclable, ferrous and non ferrous metals, plastic, paper and other products like wooden and glass. Plastic is the continued material of choice mainly because it is lighter in weight, long lasting, and maintains product freshness in addition to ease in handling and transporting the products. But the rise and growing awareness of environmental problems is pushing for sustainable packaging and more substance use of paper packaging hence environmentally friendly, Is biodegradable, and recyclable. The most used material is metal packaging, with a tendency to be used in canned seafoods where it offers great barriers that help to extend shelf life and prevent contamination. At the same time, another category – wood and glass, is aimed at specific segments that value the appearance and brand status. The changing demographics of users and the policies governing them are applying pressure for changes in these forms of materials to embrace safety and sustainability, as well as product quality.

By Application, Molluscs Packaging segment expected to held the largest share

In the fresh seafood packaging market, applications are primarily segmented into four categories: Fish packaging, crustaceans packaging, mollusks packaging and others, specialty items include jelly fish packaging. Fish packaging leads the segment because of the rising consumption of different species of fish in end-user markets; it is crucial to develop packaging materials that ensure the fish stay fresh and meet customers’ expectations. Shrimps and crab packing which is under crustaceans packaging also records high growth notes due to the increasing demand in seafood meals and the kind of packaging that is suitable for these delicate food items. The molluscs packaging like clam and oyster this benefits from the improved packaging techniques that improve shelf and safeguard the products. The ‘others’ although smaller has options such as jellyfish, which is on the rise in certain markets within the culinary niche. In all these applications, there are concerns with response to change in consumer preferences; convenience, as well as sustainability concerns such as shelf life and food safety.

Fresh Seafood Packaging Market Regional Insights:

Asia-Pacific dominates the Fresh Seafood Packaging Market

Due to the large coastline and high production and consumption of seafood, Asia-Pacific leads the demand of fresh seafood packaging. There is an established high demand for effec tive seafood packaging materials for countries – China, Japan and Thailand among others – involved in the seafo o d processing.. This has fueled growth of the industry in the region especially due to the rising concern with packaging sustainability where manufacturers embrace environment friendly materials that consumers demand, as well as other regulatory policies. Also, growth in the internet platform in the provision of seafood has increased the demand for better packaging that enhances sustainable quality in the supply chain. Consequently, there are opportunities for future growth of fresh seafood packaging in the Asia-Pacific region given its strong supply chain and improvement over packaging manufacturing technology.

Active Key Players in the Fresh Seafood Packaging Market:

DowDuPont Inc. (USA)

CoolSeal USA (USA)

Tri-Pack Plastics (USA)

Frontier Packaging (USA)

Sealed Air Corporation (USA)

Sixto Packaging (USA)

Victory Packaging (USA)

PPS Midlands Limited (UK)

Star-Box, Inc. (USA)

AEP Industries Inc. (USA)

Smurfit Kappa Group (Ireland)

Printpack Inc. (USA)

Orora Packaging Australia Pty Ltd. (Australia)

ULMA Packaging (Spain)

Wipak Oy (Finland)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fresh Seafood Packaging Market by Material Type

4.1 Fresh Seafood Packaging Market Snapshot and Growth Engine

4.2 Fresh Seafood Packaging Market Overview

4.3 Plastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Plastic: Geographic Segmentation Analysis

4.4 Paper

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Paper: Geographic Segmentation Analysis

4.5 Metal

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Metal: Geographic Segmentation Analysis

4.6 and Others (Wood

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Others (Wood: Geographic Segmentation Analysis

4.7 Glass

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Glass: Geographic Segmentation Analysis

4.8 and Others)

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 and Others): Geographic Segmentation Analysis

Chapter 5: Fresh Seafood Packaging Market by Product Type

5.1 Fresh Seafood Packaging Market Snapshot and Growth Engine

5.2 Fresh Seafood Packaging Market Overview

5.3 Boxes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Boxes: Geographic Segmentation Analysis

5.4 Bags

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Bags: Geographic Segmentation Analysis

5.5 Pouches

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pouches: Geographic Segmentation Analysis

5.6 Films

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Films: Geographic Segmentation Analysis

5.7 and Others (Cans

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 and Others (Cans: Geographic Segmentation Analysis

5.8 Trays

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Trays: Geographic Segmentation Analysis

5.9 and Others)

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 and Others): Geographic Segmentation Analysis

Chapter 6: Fresh Seafood Packaging Market by Application

6.1 Fresh Seafood Packaging Market Snapshot and Growth Engine

6.2 Fresh Seafood Packaging Market Overview

6.3 Fish Packaging

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Fish Packaging: Geographic Segmentation Analysis

6.4 Crustaceans Packaging

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Crustaceans Packaging: Geographic Segmentation Analysis

6.5 Molluscs Packaging

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Molluscs Packaging: Geographic Segmentation Analysis

6.6 and Others (Jelly Fish and Others)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 and Others (Jelly Fish and Others): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fresh Seafood Packaging Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DOWDUPONT INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COOLSEAL USA (USA)

7.4 TRI-PACK PLASTICS (USA)

7.5 FRONTIER PACKAGING (USA)

7.6 SEALED AIR CORPORATION (USA)

7.7 SIXTO PACKAGING (USA)

7.8 VICTORY PACKAGING (USA)

7.9 PPS MIDLANDS LIMITED (UK)

7.10 STAR-BOX INC. (USA)

7.11 AEP INDUSTRIES INC. (USA)

7.12 SMURFIT KAPPA GROUP (IRELAND)

7.13 PRINTPACK INC. (USA)

7.14 ORORA PACKAGING AUSTRALIA PTY LTD. (AUSTRALIA)

7.15 ULMA PACKAGING (SPAIN)

7.16 WIPAK OY (FINLAND)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Fresh Seafood Packaging Market By Region

8.1 Overview

8.2. North America Fresh Seafood Packaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Material Type

8.2.4.1 Plastic

8.2.4.2 Paper

8.2.4.3 Metal

8.2.4.4 and Others (Wood

8.2.4.5 Glass

8.2.4.6 and Others)

8.2.5 Historic and Forecasted Market Size By Product Type

8.2.5.1 Boxes

8.2.5.2 Bags

8.2.5.3 Pouches

8.2.5.4 Films

8.2.5.5 and Others (Cans

8.2.5.6 Trays

8.2.5.7 and Others)

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Fish Packaging

8.2.6.2 Crustaceans Packaging

8.2.6.3 Molluscs Packaging

8.2.6.4 and Others (Jelly Fish and Others)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fresh Seafood Packaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Material Type

8.3.4.1 Plastic

8.3.4.2 Paper

8.3.4.3 Metal

8.3.4.4 and Others (Wood

8.3.4.5 Glass

8.3.4.6 and Others)

8.3.5 Historic and Forecasted Market Size By Product Type

8.3.5.1 Boxes

8.3.5.2 Bags

8.3.5.3 Pouches

8.3.5.4 Films

8.3.5.5 and Others (Cans

8.3.5.6 Trays

8.3.5.7 and Others)

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Fish Packaging

8.3.6.2 Crustaceans Packaging

8.3.6.3 Molluscs Packaging

8.3.6.4 and Others (Jelly Fish and Others)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fresh Seafood Packaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Material Type

8.4.4.1 Plastic

8.4.4.2 Paper

8.4.4.3 Metal

8.4.4.4 and Others (Wood

8.4.4.5 Glass

8.4.4.6 and Others)

8.4.5 Historic and Forecasted Market Size By Product Type

8.4.5.1 Boxes

8.4.5.2 Bags

8.4.5.3 Pouches

8.4.5.4 Films

8.4.5.5 and Others (Cans

8.4.5.6 Trays

8.4.5.7 and Others)

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Fish Packaging

8.4.6.2 Crustaceans Packaging

8.4.6.3 Molluscs Packaging

8.4.6.4 and Others (Jelly Fish and Others)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fresh Seafood Packaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Material Type

8.5.4.1 Plastic

8.5.4.2 Paper

8.5.4.3 Metal

8.5.4.4 and Others (Wood

8.5.4.5 Glass

8.5.4.6 and Others)

8.5.5 Historic and Forecasted Market Size By Product Type

8.5.5.1 Boxes

8.5.5.2 Bags

8.5.5.3 Pouches

8.5.5.4 Films

8.5.5.5 and Others (Cans

8.5.5.6 Trays

8.5.5.7 and Others)

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Fish Packaging

8.5.6.2 Crustaceans Packaging

8.5.6.3 Molluscs Packaging

8.5.6.4 and Others (Jelly Fish and Others)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fresh Seafood Packaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Material Type

8.6.4.1 Plastic

8.6.4.2 Paper

8.6.4.3 Metal

8.6.4.4 and Others (Wood

8.6.4.5 Glass

8.6.4.6 and Others)

8.6.5 Historic and Forecasted Market Size By Product Type

8.6.5.1 Boxes

8.6.5.2 Bags

8.6.5.3 Pouches

8.6.5.4 Films

8.6.5.5 and Others (Cans

8.6.5.6 Trays

8.6.5.7 and Others)

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Fish Packaging

8.6.6.2 Crustaceans Packaging

8.6.6.3 Molluscs Packaging

8.6.6.4 and Others (Jelly Fish and Others)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fresh Seafood Packaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Material Type

8.7.4.1 Plastic

8.7.4.2 Paper

8.7.4.3 Metal

8.7.4.4 and Others (Wood

8.7.4.5 Glass

8.7.4.6 and Others)

8.7.5 Historic and Forecasted Market Size By Product Type

8.7.5.1 Boxes

8.7.5.2 Bags

8.7.5.3 Pouches

8.7.5.4 Films

8.7.5.5 and Others (Cans

8.7.5.6 Trays

8.7.5.7 and Others)

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Fish Packaging

8.7.6.2 Crustaceans Packaging

8.7.6.3 Molluscs Packaging

8.7.6.4 and Others (Jelly Fish and Others)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What is the Fresh Seafood Packaging Market?

A1: Fresh seafood packaging refers to the specialized materials and techniques used to protect, preserve, and transport seafood in its fresh state from the point of harvest to the end consumer. This packaging is designed to maintain the quality, freshness, and safety of the seafood by preventing contamination, spoilage, and physical damage. It often includes features like temperature control, moisture retention, and oxygen barriers, ensuring that the seafood remains fresh for an extended period. Common materials used in fresh seafood packaging include plastics, paper, and metal, with innovations focusing on sustainability and extended shelf life.

Q2: What are the segments of the Fresh Seafood Packaging Market?

A2: The Fresh Seafood Packaging Market is segmented into By Material Type, By Product Type, By Application and region. By Material Type (Plastic, Paper, Metal, and Others (Wood, Glass, and Others)), By Product Type (Boxes, Bags, Pouches, Films, and Others (Cans, Trays, and Others)), By Application (Fish Packaging, Crustaceans Packaging, Molluscs Packaging, and Others (Jelly Fish and Others)). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q3: Who are the key players in the Fresh Seafood Packaging Market?

A3: DowDuPont Inc. (USA), CoolSeal USA (USA), Tri-Pack Plastics (USA), Frontier Packaging (USA), Sealed Air Corporation (USA), Sixto Packaging (USA), Victory Packaging (USA), PPS Midlands Limited (UK), Star-Box, Inc. (USA), AEP Industries Inc. (USA), Smurfit Kappa Group (Ireland), Printpack Inc. (USA), Orora Packaging Australia Pty Ltd. (Australia), ULMA Packaging (Spain), Wipak Oy (Finland), and Other Active Players.

Q4: What would be the forecast period in the Fresh Seafood Packaging Market research report?

A4: The forecast period in the Fresh Seafood Packaging Market research report is 2024-2032.

Q5: How big is the Fresh Seafood Packaging Market?

A5: Fresh Seafood Packaging Market Size Was Valued at USD 15.5 Billion in 2023, and is Projected to Reach USD 26.5 Billion by 2032, Growing at a CAGR of 5.9% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!