Stay Ahead in Fast-Growing Economies.

Browse Reports NowFluoropolymer in Healthcare Market – Overview and Outlook by Potential Growth 2025-2032

The healthcare market for fluoropolymers is experiencing steady growth, driven by their exceptional properties such as high chemical resistance, thermal stability, biocompatibility, and low friction. These attributes make fluoropolymers ideal for critical medical applications like tubing, catheters, implants, surgical instruments, and drug delivery systems. Their non-reactive and durable nature supports the safe and long-term use of devices in sensitive clinical environments. As regulatory demands increase, fluoropolymers are becoming essential materials in medical product design and development.

IMR Group

Description

Fluoropolymer in Healthcare Market Synopsis:

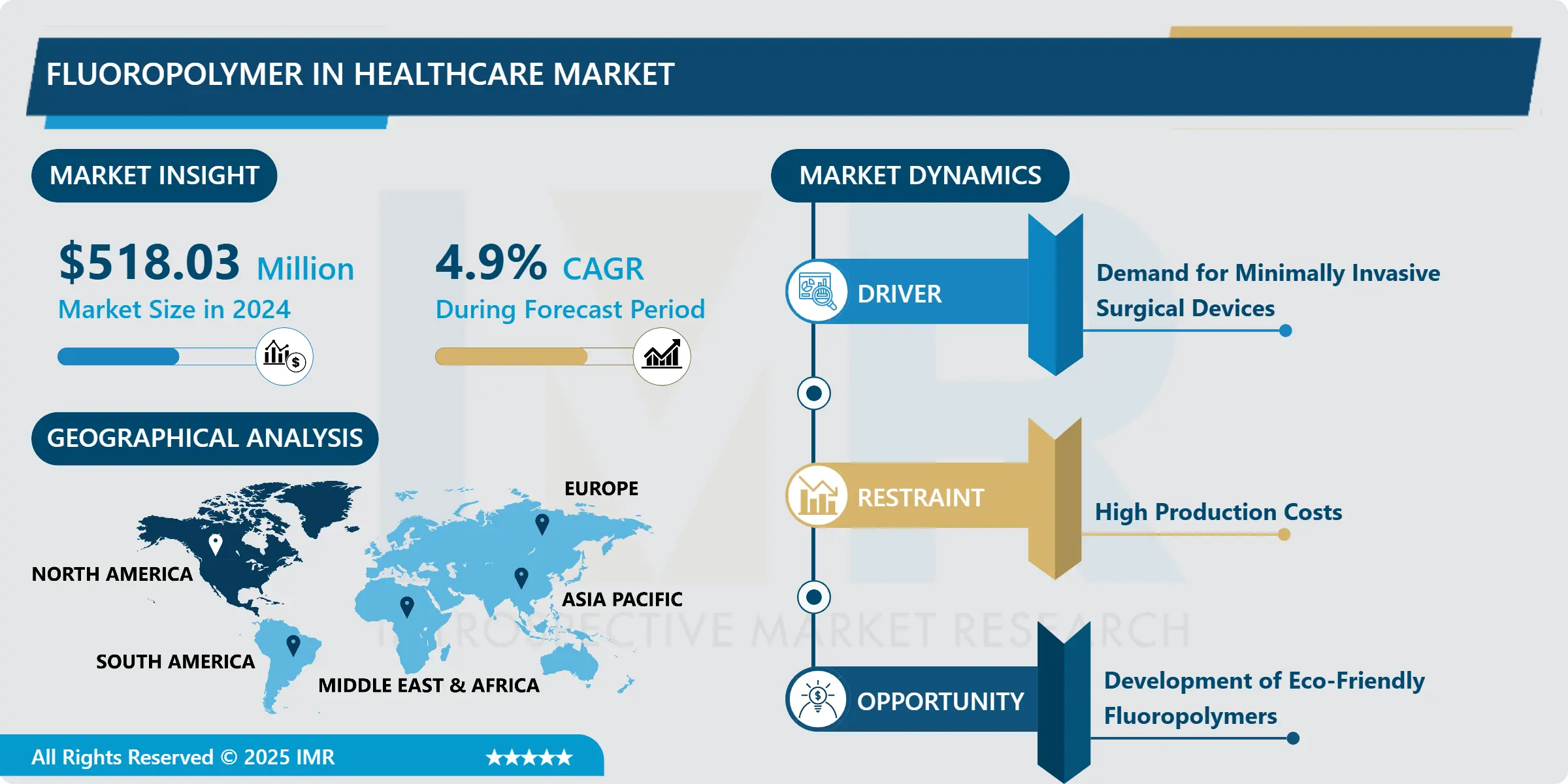

Fluoropolymer in Healthcare Market Size Was Valued at USD 518.03 Million in 2024, and is Projected to Reach USD 759.55 Million by 2032, Growing at a CAGR of 4.9% from 2025-2032.

The healthcare market for fluoropolymers is experiencing steady growth, driven by their exceptional properties such as high chemical resistance, thermal stability, biocompatibility, and low friction. These attributes make fluoropolymers ideal for critical medical applications like tubing, catheters, implants, surgical instruments, and drug delivery systems. Their non-reactive and durable nature supports the safe and long-term use of devices in sensitive clinical environments. As regulatory demands increase, fluoropolymers are becoming essential materials in medical product design and development.

Market expansion is fueled by the rising global demand for advanced healthcare solutions, especially amid increasing chronic disease prevalence and healthcare infrastructure growth in emerging economies. Innovation in fluoropolymer formulations is opening new avenues in precision medicine, minimally invasive procedures, and wearable medical technology. Additionally, strategic collaborations between healthcare providers and material science companies are accelerating the development of tailored solutions that enhance patient outcomes and device performance.

Sustainability and customization are emerging as key trends in the fluoropolymer healthcare market. Manufacturers are focusing on eco-friendly variants that reduce environmental impact while maintaining high performance. Personalized medical devices made from customizable fluoropolymer materials are gaining traction, aligning with the growing need for patient-specific solutions. As industries push for higher safety, efficiency, and regulatory compliance, fluoropolymers are poised to play an increasingly vital role in shaping the future of healthcare technology.

Fluoropolymer in Healthcare Market Growth and Trend Analysis:

Fluoropolymer in Healthcare Market Growth Driver

Demand for Minimally Invasive Surgical Devices

The growing adoption of minimally invasive surgeries (MIS) is a key driver of fluoropolymer use in healthcare. These procedures require devices that can navigate delicate anatomical pathways with minimal trauma. Fluoropolymers offer low friction, high flexibility, and excellent biocompatibility, making them ideal for catheters, guidewires, and tubing used in MIS. Their resistance to chemicals and ability to withstand repeated sterilization further enhance their utility in these applications.

As the global population ages and chronic conditions rise, there is increasing demand for safer, less invasive treatment options. Fluoropolymers play a vital role in enabling these innovations, contributing to faster recovery times, reduced hospital stays, and lower overall healthcare costs, thereby strengthening their position in the medical device market. ?

Fluoropolymer in Healthcare Market Limiting Factor

High Production Costs

One of the major restraints in the healthcare fluoropolymer market is the high cost associated with their production and processing. Unlike conventional polymers, fluoropolymers require advanced manufacturing technologies and stringent quality control to maintain their unique chemical and physical properties. This complexity results in elevated costs for raw materials, equipment, and skilled labor.

Moreover, the costs of regulatory compliance, especially for medical-grade applications, further increase the financial burden. As a result, many healthcare providers and manufacturers opt for more economical alternatives unless high performance is absolutely necessary. This pricing challenge limits widespread adoption, particularly in cost-sensitive markets such as public healthcare systems or developing regions, where budget constraints can outweigh the benefits of advanced materials like fluoropolymers.

Fluoropolymer in Healthcare Market Expansion Opportunity

Development of Eco-Friendly Fluoropolymers

Sustainability is emerging as a key opportunity for innovation in the fluoropolymer healthcare market. Traditional fluoropolymers, while high-performing, pose environmental concerns due to complex processing and potential persistence in ecosystems. In response, manufacturers are investing in greener alternatives that offer similar performance with a lower ecological footprint. These include recyclable fluoropolymers, bio-based variants, and low-emission production methods. As regulatory bodies and healthcare organizations prioritize environmental responsibility, eco-friendly materials are gaining traction.

Hospitals and manufacturers increasingly seek solutions that balance safety, performance, and sustainability. Companies that can deliver fluoropolymers meeting these demands stand to benefit from a competitive edge. This shift also opens avenues for research, partnerships, and niche product development tailored to environmentally conscious healthcare settings.

Fluoropolymer in Healthcare Market Challenge Barrier

Regulatory Compliance Complexity

Navigating complex regulatory requirements presents a significant challenge in the fluoropolymer healthcare market. Medical devices incorporating fluoropolymers must meet stringent global standards, including ISO 10993 for biocompatibility and FDA or EU MDR regulations. These assessments involve extensive clinical testing, long approval cycles, and detailed documentation, which demand high investment in time and resources.

The constantly evolving regulatory landscape adds further difficulty, as manufacturers must stay updated and compliant across multiple regions. For small and medium enterprises, this can become a substantial barrier to market entry and innovation. Additionally, variations in regulatory interpretations and documentation expectations across countries increase the risk of delays or rejections. This regulatory burden slows product launches and impacts the speed of bringing new technologies to market.

Fluoropolymer in Healthcare Market Segment Analysis:

Fluoropolymer in Healthcare Market is segmented based on Type of Fluoropolymer, End-Users, Application, and Region.

By Application, Medical devices Segment is Expected to Dominate the Market During the Forecast Period

The medical devices segment is expected to dominate the fluoropolymers in healthcare market during the forecast period, driven by their critical role in precision-engineered tools and implants. Fluoropolymers offer low friction, electrical insulation, and resistance to harsh sterilization, making them ideal for catheters, endoscopic tools, surgical robots, and artificial heart valves.

As chronic diseases rise and demand for minimally invasive procedures grows, manufacturers are integrating fluoropolymer coatings, tubing, and components into advanced medical technologies. The increasing use of robotic surgery, smart implants, and wearable medical devices further fuels this trend. While pharmaceutical packaging is expanding thanks to fluoropolymers’ use in vaccine containers, drug storage, and sterile packaging the superior performance and versatility of fluoropolymers in medical devices position this segment to lead the market throughout the forecast period.

By Type of Fluoropolymer, PTFE (polytetrafluoroethylene) Segment Held the Largest Share of in 2024

PTFE (polytetrafluoroethylene) segment held the largest share of the medical polymers market due to its exceptional non-stick properties, chemical inertness, high-temperature resistance, and biocompatibility. These attributes make PTFE ideal for use in catheters, guidewires, vascular grafts, and medical tubing, particularly in minimally invasive surgeries and implantable devices.

The demand for PTFE increased alongside advancements in cardiovascular implants, diagnostic tools, and bioelectronics. Manufacturers are also developing hybrid PTFE composites, reinforced membranes, and ceramic-based coatings to enhance performance and patient safety. Additionally, fluorinated ethylene propylene (FEP) gained traction for its use in pharmaceutical processing and disposable medical tubing, thanks to its purity and chemical resistance. As disposable devices and aseptic systems grow in popularity, PTFE’s unique properties ensured its leading position in 2024.

Fluoropolymer in Healthcare Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

Advanced healthcare infrastructure and strong presence of leading medical device manufacturers. The region sees high demand for minimally invasive procedures, smart implants, and biopharmaceutical innovations, all of which require high-performance fluoropolymer materials. The United States, in particular, leads with significant R&D investments, widespread adoption of advanced medical technologies, and a well-established regulatory environment supporting innovation.

Additionally, the growing need for drug delivery systems, diagnostic tools, and sterile pharmaceutical packaging further boosts fluoropolymer usage. The presence of major players and manufacturing hubs, along with continuous innovation in materials such as PTFE, FEP, and PVDF, positions North America as the key region driving market growth throughout the forecast period.

Fluoropolymer in Healthcare Market Active Players:

3M Company (Spain)

Arkema Canada Inc. (Canada)

C. Otto Gehrckens GmbH & Co. KG (Germany)

Daikin Finetech (Japan)

DuPont (USA)

ElringKlinger (Germany)

Forum Canada ULC (Canada)

GMM Pfaudler (India)

Gujarat Fluorochemicals Limited (GFL) (India)

HaloPolymer OJSC (Russia)

Hansa (China)

Harbour Industries Canada Ltd (Canada)

Honeywell International (USA)

Karl Späh GmbH & Co. KG (Germany)

Kurabe Co. Ltd. (Japan)

Kureha Corporation (Japan)

Nippon Fusso (Japan)

Solvay (USA)

SRF Limited (India)

The Chemours Canada Company (Canada)

The Chemours Company (USA)

Other Active Players

Key Industry Developments in the Fluoropolymer in Healthcare Market:

In May 2025, Chemours announced a partnership with Navin Fluorine to manufacture its Opteon™ two-phase immersion cooling fluid. The agreement aimed to support the growing cooling demands of AI-driven data centers and marked a key step in Chemours’ expanded Liquid Cooling Venture.

In June 2024, DuPont announced its agreement to acquire Donatelle Plastics Incorporated, a leading medical device contract manufacturer. The move was seen as a strategic step to strengthen DuPont’s healthcare portfolio, particularly in advanced medical device solutions.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Fluoropolymer in Healthcare Market by Type of Fluoropolymer (2018-2032)

4.1 Fluoropolymer in Healthcare Market Snapshot and Growth Engine

4.2 Market Overview

4.3 PTFE

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 FEP

4.5 PFA

4.6 ETFE

Chapter 5: Fluoropolymer in Healthcare Market by End User (2018-2032)

5.1 Fluoropolymer in Healthcare Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals and Clinics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Research Institutions

5.5 Pharmaceutical Companies

Chapter 6: Fluoropolymer in Healthcare Market by Application (2018-2032)

6.1 Fluoropolymer in Healthcare Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Medical Devices

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmaceutical Packaging

6.5 Laboratory Equipment

6.6 Protective Clothing

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fluoropolymer in Healthcare Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 3M COMPANY (SPAIN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ARKEMA CANADA INC. (CANADA)

7.4 C. OTTO GEHRCKENS GMBH & CO. KG (GERMANY)

7.5 DAIKIN FINETECH (JAPAN)

7.6 DUPONT (USA)

7.7 ELRINGKLINGER (GERMANY)

7.8 FORUM CANADA ULC (CANADA)

7.9 GMM PFAUDLER (INDIA)

7.10 GUJARAT FLUOROCHEMICALS LIMITED (GFL) (INDIA)

7.11 HALOPOLYMER OJSC (RUSSIA)

7.12 HANSA (CHINA)

7.13 HARBOUR INDUSTRIES CANADA LTD (CANADA)

7.14 HONEYWELL INTERNATIONAL (USA)

7.15 KARL SPÄH GMBH & CO. KG (GERMANY)

7.16 KURABE CO. LTD. (JAPAN)

7.17 KUREHA CORPORATION (JAPAN)

7.18 NIPPON FUSSO (JAPAN)

7.19 SOLVAY (USA)

7.20 SRF LIMITED (INDIA)

7.21 THE CHEMOURS COMPANY (USA)

7.22 OTHER ACTIVE PLAYERS

Chapter 8: Global Fluoropolymer in Healthcare Market By Region

8.1 Overview

8.2. North America Fluoropolymer in Healthcare Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Fluoropolymer in Healthcare Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Fluoropolymer in Healthcare Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Fluoropolymer in Healthcare Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Fluoropolymer in Healthcare Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Fluoropolymer in Healthcare Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

Q1: What is the Forecast Period Covered in the Fluoropolymer in Healthcare Market Research Report?

A1: The projected forecast period for the Fluoropolymer in Healthcare Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Fluoropolymer in Healthcare Market?

A2: 3M Company (Spain), Arkema Canada Inc. (Canada), C. Otto Gehrckens GmbH & Co. KG (Germany), Daikin Finetech (Japan), DuPont (USA), ElringKlinger (Germany), Forum Canada ULC (Canada), GMM Pfaudler (India), Gujarat Fluorochemicals Limited (GFL) (India), HaloPolymer OJSC (Russia), Hansa (China), Harbour Industries Canada Ltd (Canada), Honeywell International (USA), Karl Späh GmbH & Co. KG (Germany), Kurabe Co. Ltd. (Japan), Kureha Corporation (Japan), Nippon Fusso (Japan), Solvay (USA), SRF Limited (India), The Chemours Company (USA), and Other Active Players.

Q3: How is the Fluoropolymer in Healthcare Market segmented?

A3: The Fluoropolymer in Healthcare Market is segmented into Type of Fluoropolymer, End-Users, Application, and Region. By Type of Fluoropolymer, the market is categorized into PTFE, FEP, PFA, ETFE. By End-Users, the market is categorized into Hospitals and Clinics, Research Institutions, Pharmaceutical Companies. By Application, the market is categorized into Medical Devices, Pharmaceutical Packaging, Laboratory Equipment, Protective Clothing. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, Rest of SA.).

Q4: What defines the Fluoropolymer in Healthcare Market?

A4: The healthcare market for fluoropolymers is experiencing steady growth, driven by their exceptional properties such as high chemical resistance, thermal stability, biocompatibility, and low friction. These attributes make fluoropolymers ideal for critical medical applications like tubing, catheters, implants, surgical instruments, and drug delivery systems. Their non-reactive and durable nature supports the safe and long-term use of devices in sensitive clinical environments. As regulatory demands increase, fluoropolymers are becoming essential materials in medical product design and development

Q5: What is the market size of the Fluoropolymer in Healthcare Market?

A5: Fluoropolymer in Healthcare Market Size Was Valued at USD 518.03 Million in 2024, and is Projected to Reach USD 759.55 Million by 2032, Growing at a CAGR of 4.9% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!