Stay Ahead in Fast-Growing Economies.

Browse Reports NowFintech Blockchain Market – Global Demand & Analysis (2025- 2032)

Fintech blockchain is therefore used in financial technology commonly known as fintech. Blockchain is described as a celebrity, distributed, and ledger that can facilitate secure, transparent transactions that cannot be altered. In fintech, blockchain improves key services such as payment solutions, lending business, and asset management, minimizing fraud, speeding up transactions, and cutting costs.

IMR Group

Description

Fintech Blockchain Market Synopsis

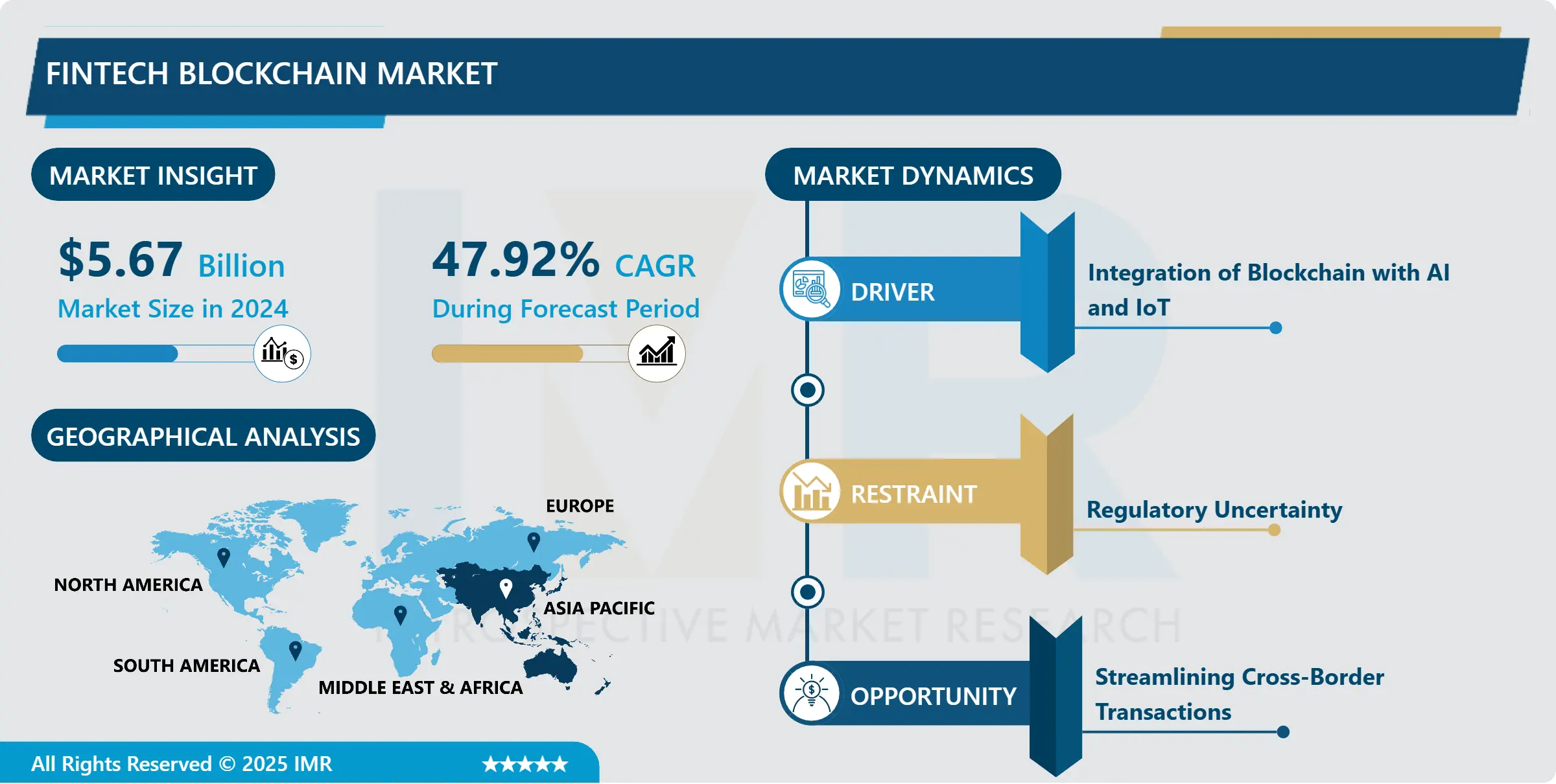

Fintech Blockchain Market Size Was Valued at USD 5.67 Billion in 2024 and is Projected to Reach USD 129.96 Billion by 2032, Growing at a CAGR of 47.92% From 2025-2032.

Fintech blockchain is therefore used in financial technology commonly known as fintech. Blockchain is described as a celebrity, distributed, and ledger that can facilitate secure, transparent transactions that cannot be altered. In fintech, blockchain improves key services such as payment solutions, lending business, and asset management, minimizing fraud, speeding up transactions, and cutting costs. It enables individuals to engage in transactions involving goods and services with other people directly, thus implying a higher level of effectiveness in the execution of financial activities. It is changing conventional paradigms in the field of finance by providing the option of inclusiveness and efficiency.

The Fintech Blockchain market has become one of the most promising markets in the sphere of financial services due to the mentioned benefits of the blockchain, including decentralization, transparency, adherence to security standards, and high speeds. Blockchain, being a distributed ledger technology, ensures that its users transact directly, eliminating the middlemen burying the costs, thus cutting down the number of transactions and the time taken. Fintech has blossomed in various sub-sectors of financial services such as; payment systems and remittances, smart contracts, identity, and compliance. The combination of blockchain with fintech has not only disrupted conventional financial systems but has also created new opportunities, especially in the area of increasing efficiency as well as security of financial transactions.

The Fintech Blockchain market has its drivers in; the need to transact faster, across borders, with more security, and at a lesser cost. These conventional financial systems have come with issues of slow networking, long delays, and very high charges for single transactions, particularly international payments. These problems are resolved by blockchain technology that is based on characteristics such as the ability to conduct immediate settlements without intermediaries. Furthermore, the use of digital currencies and the enhanced level of adoption of cryptocurrencies by financial institutions has also boosted the application of blockchain in fintech. Cryptography with the help of blockchain forms an independent entity to traditional centralized control money or fiat authorities which provides users with the opportunity for borderless optional payments including the unbanked population in the less developed countries.

In addition, the application of smart contracts on blockchain platforms has increased the efficiency of processes related to finance, as well as decreased the possibility of credit fraud. Software applications that execute business contracts and are coded in such a way that the terms of the contract are embedded are referred to as smart contracts. Originally, they performed contract duties and could even punish those who did not conform, thus preventing the need for intermediaries and conflict. This capability has extensive consequences for all the financial processes such as loaning, insurance, and investing.

The two other trends that have a positive impact on the Fintech Blockchain market are the focus on compliance with regulatory requirements and security. Banking and other financial organizations use blockchain to increase the transparency of transactions which is vital to fulfill the standards and prevent financial crimes like money laundering and fraud. Due to its characteristic of the distributed ledger, all the activities that occur within a blockchain are stored permanently, and it cannot be manipulated since it is encrypted.

The new generation of fintech startups and the traditional financial organizations’ partnerships are also extending the Fintech Blockchain market as well. Start-ups are innovative and fast-moving, while incant financial institutions are large, well-funded, and have legislative experience. This symbiosis is fueling the creation of brand-new blockchain solutions that meet the new challenges of the financial sector. In addition, there is also a high level of participation from venture capital firms and R and D activities which has boosted this market.

Nevertheless, the Fintech blockchain market has some common challenges like regulatory concerns, the problem of growth, and standards. Some of the legal structures governing the use of blockchain and cryptocurrencies differ from country to country, this creates a challenge for widespread use of the two innovations. Furthermore, the issues with the actual capacity of the blockchain networks as they are still questioning how many users or how much can be processed in the technology without slowing down.

Thus, it is possible to see that the Fintech Blockchain has the potential for significant development due to the increased demand for effective, trustworthy, and inexpensive financial services. Fintech has been significantly shifting with the incorporation of new features which is known as blockchain technology whereby the existing financial systems are being altered to adopt new models to fit the emerging floating technologies. Despite these challenges though, technological enhancements, regulatory changes, and innovative initiatives of startups interacting with traditional financial institutions shall overcome these barriers leading to a decentralized and transparent financial system.

Fintech Blockchain Market Trend Analysis

Fintech Blockchain Market Growth Drivers- Integration of Blockchain with AI and IoT

The application of blockchain together with AI and IoT in the fintech blockchain market has extended an unbelievable reform to the traditional financial sectors majorly in the area of security, transparency, and efficiency. Blockchain is a distributed database that allows ensuring credibility and data integrity, especially for financial operations. When integrated with AI, blockchain can improve its functionalities such as smart contract implementation, fraud prevention, and predictive analysis, consequently improving organizational decision-making and lowering operational costs. It is magnified by the significance that IoT devices bring in reporting data and results in real-time which is essential for smart contracts and automated financial dealings.

Sensors and smart devices which are part of IoT systems can input data directly into the blockchain so that all the transactions and processes are recorded in real-time and are irreversible. The integration of these three disruptive technologies: blockchain, AI, and IoT creates a more integrated and smarter financial environment putting in place aspects such as decentralized finance (DeFi), better risk management, and the perfect customer journey. Thus, the blockchain market in the context of fintech solutions is experiencing rapid development due to the attempts of financial organizations to apply these technologies to be competitive and to meet the customers’ needs of the digital economy.

Fintech Blockchain Market Opportunities- Streamlining Cross-Border Transactions

Optimizing the cross-border transactions in the Fintech Blockchain market therefore entails making use of the inherent features of blockchain; decentralization, transparency, and security to improve the financial flow across global borders. Blockchain means real-time settlement of transactions which deletes the time barrier and cost factor in cross-border payments. This is done by reducing the presence of middlemen including the correspondent banks and integrating smart contracts which have the capability of enforcing contract conditions thereby warranting the completion of deals.

In the same way, the ledger of blockchain makes it impossible for fraudsters to manipulate the transactions and gives it high security. Blockchain helps in providing better interoperability with the existing financial systems and currencies, which empowers businesses and people mainly in developing nations to get connected with the world markets. Digital assets and cryptocurrencies allow the transfer of value globally to be even hastened with further protection from fluctuations in currency and less conversion costs to be incurred. This is because the application of such technologies is becoming integrated into organizations’ operations as more legal structures are implemented to support these advancements; consequently, the use of blockchain technology in cross-border transactions will rise, thereby expanding the Fintech Blockchain market as well as revolutionizing the world economy.

Fintech Blockchain Market Segment Analysis:

Fintech Blockchain Market Segmented based on Application, Organization Size, and End-User.

By Application, Payments segment is expected to dominate the market during the forecast period

Some of the key applications of the Fintech blockchain market include; Payments can be another important application since using the features of the blockchain, such as speed, security, and low cost many cross-border transactions are possible. Smart Contracts are another realm closely tied to blockchain technology for applying automation in contracts so that they can be executed smoothly and independently, thus eliminating the role of an intermediate and increasing the overall trust in the various financial deals happening in an organization. Identity Management is also widely used where blockchain guarantees the trustworthy and irreversible confirmation of a subject’s identity, which is instrumental in combating fraudulent activities and protecting privacy. Blockchain helps in Compliance Management/KYC as the processes are transparent and once the data is written, it can’t be altered making the compliance and KYC procedures cheaper to implement.

Supply Chain Management of a product makes use of blockchain for improving the transparency, traceability, and real-time tracking and validation of products. Customers in insurance can also benefit from blockchain since it provides smart contracts to support the claims as well as providing risk appetites from an immutable ledger technology. Finally, through utilizing blockchain Trade Finance is transformed by providing better security and cutting the fraud risks, as well as optimizing the trade documentation and the processes of settlements. In summary, these applications depict how blockchain will revolutionize fintech through innovation, efficiency, and security.

By End-User, Investment Firms segment held the largest share in 2024

The opportunity analysis of the fintech blockchain market is based on several categories of end-users such as banks, NBFS, insurance providers, stock exchanges and investment companies, real estate, healthcare, retail & e-commerce, government, and others. Lending and banking institutions are adopting the blockchain to enable secure and faster transactions as well as cutting on expenses and durations of clearing settlements. NBFS entities are currently considering the use of blockchain technology to enhance the general aspect of transactions between their counterparties. Currently, insurance firms have focused on the following applications of blockchain; fraud detection, smart contracts, and even claims processing. Currently, blockchain is being utilized in trade settlements of equities as well as regulatory compliances by the stock exchanges. Blockchain benefits investment firms in both aspects of asset tokenization and trading in the market.

Real estate is considering blockchain for property sales, rents, and when conveying titles. Healthcare is adopting blockchain for record-keeping and supply chain management for patient data. Consumer goods & retail industries are leveraging blockchain to track supply chains and fight counterfeits, & payments. At the governmental level, blockchain is being used for ID, voting, and increasing the efficiency of public services. Other industries are also deploying blockchain for numerous emerging uses, thus, contributing to the market growth for fintech blockchain.

Fintech Blockchain Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The Fintech Blockchain market is expected to grow and has the potential to grow and Asia Pacific is anticipated to dominate the market over the forecast period. The factors that contributed to this region’s dominance include the following. First, the Asia Pacific has one of the biggest and fastest-growing populations worldwide, thus giving them better access to smartphones and the internet creates a conducive environment for the implementation of fintech. Chinese, Indian, and Singaporean financial services have been pioneers in applying blockchain technologies due to the government’s encouragement and efforts to update the financial sector.

Also, the rapidly evolving regulatory landscape of the region, which gradually shifts towards the adoption of blockchain-based fintech solutions, boosts the market growth. Because financial and technology companies are trying to apply blockchain technology in payment systems, smart contracts, and identity verification, the Asia Pacific area remains one of the most prospective global fintech blockchain markets in the future years.

Active Key Players in the Fintech Blockchain Market

Ripple Labs Inc. (USA)

Coinbase (USA)

Binance (Cayman Islands)

Bitmain Technologies Ltd. (China)

Bitfury Group Limited (Netherlands)

Circle Internet Financial Limited (USA)

ConsenSys AG (USA)

Gemini Trust Company LLC (USA)

Ledger SAS (France)

Kraken Digital Asset Exchange (USA), and Other Active Players

Key Industry Developments in the Fintech Blockchain Market

October 2022, Nubank: A Brazilian digital banking startup, Nubank, announced its plan to launch its cryptocurrency called Nucoin in Brazil by the first half of 2023. This move by Nubank is a significant step towards leveraging the transformative potential of blockchain technology and democratizing its benefits beyond just the buying, selling, and holding of cryptocurrencies in Nuapp.

October 2022: The Reserve Bank of India revealed its concept of a digital currency. The development of a Central Bank Digital Currency (CBDC) could provide the Indian public with a risk-free virtual currency that offers legitimate benefits without the risks of dealing in private virtual currencies. This move by the Reserve Bank of India shows the growing interest of central banks worldwide in exploring the potential of CBDCs to revolutionize how people use money

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Fintech Blockchain Market by Application (2018-2032)

4.1 Fintech Blockchain Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Payments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Smart Contracts

4.5 Identity Management

4.6 Compliance Management/KYC

4.7 Supply Chain Management

4.8 Insurance

4.9 Trade Finance

Chapter 5: Fintech Blockchain Market by Organization Size (2018-2032)

5.1 Fintech Blockchain Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Large Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Small and Medium-Sized Enterprises (SMEs)

Chapter 6: Fintech Blockchain Market by End-User (2018-2032)

6.1 Fintech Blockchain Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Banks

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Non-Banking Financial Services (NBFS)

6.5 Insurance Companies

6.6 Stock Exchanges

6.7 Investment Firms

6.8 Real Estate

6.9 Healthcare

6.10 Retail & E-commerce

6.11 Government

6.12 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Fintech Blockchain Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 RIPPLE LABS INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COINBASE (USA)

7.4 BINANCE (CAYMAN ISLANDS)

7.5 BITMAIN TECHNOLOGIES LTD. (CHINA)

7.6 BITFURY GROUP LIMITED (NETHERLANDS)

7.7 CIRCLE INTERNET FINANCIAL LIMITED (USA)

7.8 CONSENSYS AG (USA)

7.9 GEMINI TRUST COMPANY LLC (USA)

7.10 LEDGER SAS (FRANCE)

7.11 KRAKEN DIGITAL ASSET EXCHANGE (USA)

7.12 AND OTHER KEY PLAYERS

Chapter 8: Global Fintech Blockchain Market By Region

8.1 Overview

8.2. North America Fintech Blockchain Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Application

8.2.4.1 Payments

8.2.4.2 Smart Contracts

8.2.4.3 Identity Management

8.2.4.4 Compliance Management/KYC

8.2.4.5 Supply Chain Management

8.2.4.6 Insurance

8.2.4.7 Trade Finance

8.2.5 Historic and Forecasted Market Size by Organization Size

8.2.5.1 Large Enterprises

8.2.5.2 Small and Medium-Sized Enterprises (SMEs)

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Banks

8.2.6.2 Non-Banking Financial Services (NBFS)

8.2.6.3 Insurance Companies

8.2.6.4 Stock Exchanges

8.2.6.5 Investment Firms

8.2.6.6 Real Estate

8.2.6.7 Healthcare

8.2.6.8 Retail & E-commerce

8.2.6.9 Government

8.2.6.10 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Fintech Blockchain Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Application

8.3.4.1 Payments

8.3.4.2 Smart Contracts

8.3.4.3 Identity Management

8.3.4.4 Compliance Management/KYC

8.3.4.5 Supply Chain Management

8.3.4.6 Insurance

8.3.4.7 Trade Finance

8.3.5 Historic and Forecasted Market Size by Organization Size

8.3.5.1 Large Enterprises

8.3.5.2 Small and Medium-Sized Enterprises (SMEs)

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Banks

8.3.6.2 Non-Banking Financial Services (NBFS)

8.3.6.3 Insurance Companies

8.3.6.4 Stock Exchanges

8.3.6.5 Investment Firms

8.3.6.6 Real Estate

8.3.6.7 Healthcare

8.3.6.8 Retail & E-commerce

8.3.6.9 Government

8.3.6.10 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Fintech Blockchain Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Application

8.4.4.1 Payments

8.4.4.2 Smart Contracts

8.4.4.3 Identity Management

8.4.4.4 Compliance Management/KYC

8.4.4.5 Supply Chain Management

8.4.4.6 Insurance

8.4.4.7 Trade Finance

8.4.5 Historic and Forecasted Market Size by Organization Size

8.4.5.1 Large Enterprises

8.4.5.2 Small and Medium-Sized Enterprises (SMEs)

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Banks

8.4.6.2 Non-Banking Financial Services (NBFS)

8.4.6.3 Insurance Companies

8.4.6.4 Stock Exchanges

8.4.6.5 Investment Firms

8.4.6.6 Real Estate

8.4.6.7 Healthcare

8.4.6.8 Retail & E-commerce

8.4.6.9 Government

8.4.6.10 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Fintech Blockchain Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Application

8.5.4.1 Payments

8.5.4.2 Smart Contracts

8.5.4.3 Identity Management

8.5.4.4 Compliance Management/KYC

8.5.4.5 Supply Chain Management

8.5.4.6 Insurance

8.5.4.7 Trade Finance

8.5.5 Historic and Forecasted Market Size by Organization Size

8.5.5.1 Large Enterprises

8.5.5.2 Small and Medium-Sized Enterprises (SMEs)

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Banks

8.5.6.2 Non-Banking Financial Services (NBFS)

8.5.6.3 Insurance Companies

8.5.6.4 Stock Exchanges

8.5.6.5 Investment Firms

8.5.6.6 Real Estate

8.5.6.7 Healthcare

8.5.6.8 Retail & E-commerce

8.5.6.9 Government

8.5.6.10 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Fintech Blockchain Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Application

8.6.4.1 Payments

8.6.4.2 Smart Contracts

8.6.4.3 Identity Management

8.6.4.4 Compliance Management/KYC

8.6.4.5 Supply Chain Management

8.6.4.6 Insurance

8.6.4.7 Trade Finance

8.6.5 Historic and Forecasted Market Size by Organization Size

8.6.5.1 Large Enterprises

8.6.5.2 Small and Medium-Sized Enterprises (SMEs)

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Banks

8.6.6.2 Non-Banking Financial Services (NBFS)

8.6.6.3 Insurance Companies

8.6.6.4 Stock Exchanges

8.6.6.5 Investment Firms

8.6.6.6 Real Estate

8.6.6.7 Healthcare

8.6.6.8 Retail & E-commerce

8.6.6.9 Government

8.6.6.10 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Fintech Blockchain Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Application

8.7.4.1 Payments

8.7.4.2 Smart Contracts

8.7.4.3 Identity Management

8.7.4.4 Compliance Management/KYC

8.7.4.5 Supply Chain Management

8.7.4.6 Insurance

8.7.4.7 Trade Finance

8.7.5 Historic and Forecasted Market Size by Organization Size

8.7.5.1 Large Enterprises

8.7.5.2 Small and Medium-Sized Enterprises (SMEs)

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Banks

8.7.6.2 Non-Banking Financial Services (NBFS)

8.7.6.3 Insurance Companies

8.7.6.4 Stock Exchanges

8.7.6.5 Investment Firms

8.7.6.6 Real Estate

8.7.6.7 Healthcare

8.7.6.8 Retail & E-commerce

8.7.6.9 Government

8.7.6.10 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Fintech Blockchain Market research report?

A1: The forecast period in the Fintech Blockchain Market research report is 2025-2032.

Q2: Who are the key players in the Fintech Blockchain Market?

A2: Ripple Labs Inc. (USA), Coinbase (USA), Binance (Cayman Islands), Bitmain Technologies Ltd. (China), Bitfury Group Limited (Netherlands), Circle Internet Financial Limited (USA), and Other Active Players.

Q3: What are the segments of the Fintech Blockchain Market?

A3: The Fintech Blockchain Market is segmented into Application, Organization Size, End-User, and Region. By Application, the market is categorized into Payments, Smart Contracts, Identity Management, Compliance Management/KYC, Supply Chain Management, Insurance, and Trade Finance. By Organization Size, the market is categorized into Large Enterprises, Small and Medium-Sized Enterprises (SMEs). By End User, the market is categorized into Banks, Non-Banking Financial Services (NBFS), Insurance Companies, Stock Exchanges, Investment Firms, Real Estate, Healthcare, Retail & E-commerce, Government, and Others. By region, it is analyzed across • North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA)

Q4: What is the Fintech Blockchain Market?

A4: Fintech blockchain is therefore used in financial technology commonly known as fintech. Blockchain is described as a celebrity, distributed, and a ledger that can facilitate secure, transparent transactions that cannot be altered. In fintech, blockchain improves each of the key services such as payment solutions, lending business, and asset management, in terms of minimizing fraud, speeding up transactions, and cutting costs. It enables individuals to engage in transactions involving goods and services with other people directly, thus implying a higher level of effectiveness in the execution of financial activities. It is changing conventional paradigms in the field of finance by providing the option of inclusiveness and efficiency.

Q5: How big is the Fintech Blockchain Market?

A5: Fintech Blockchain Market Size Was Valued at USD 5.67 Billion in 2024 and is Projected to Reach USD 129.96 Billion by 2032, Growing at a CAGR of 47.92% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!