Stay Ahead in Fast-Growing Economies.

Browse Reports NowFilter Bags Market: Study Report with Recent Trends

Filter bags are fabric containers used to capture solid particles in gases or liquids. They’re crucial for maintaining product quality and protecting equipment in different industries and applications.

IMR Group

Description

Filter Bags Market Synopsis

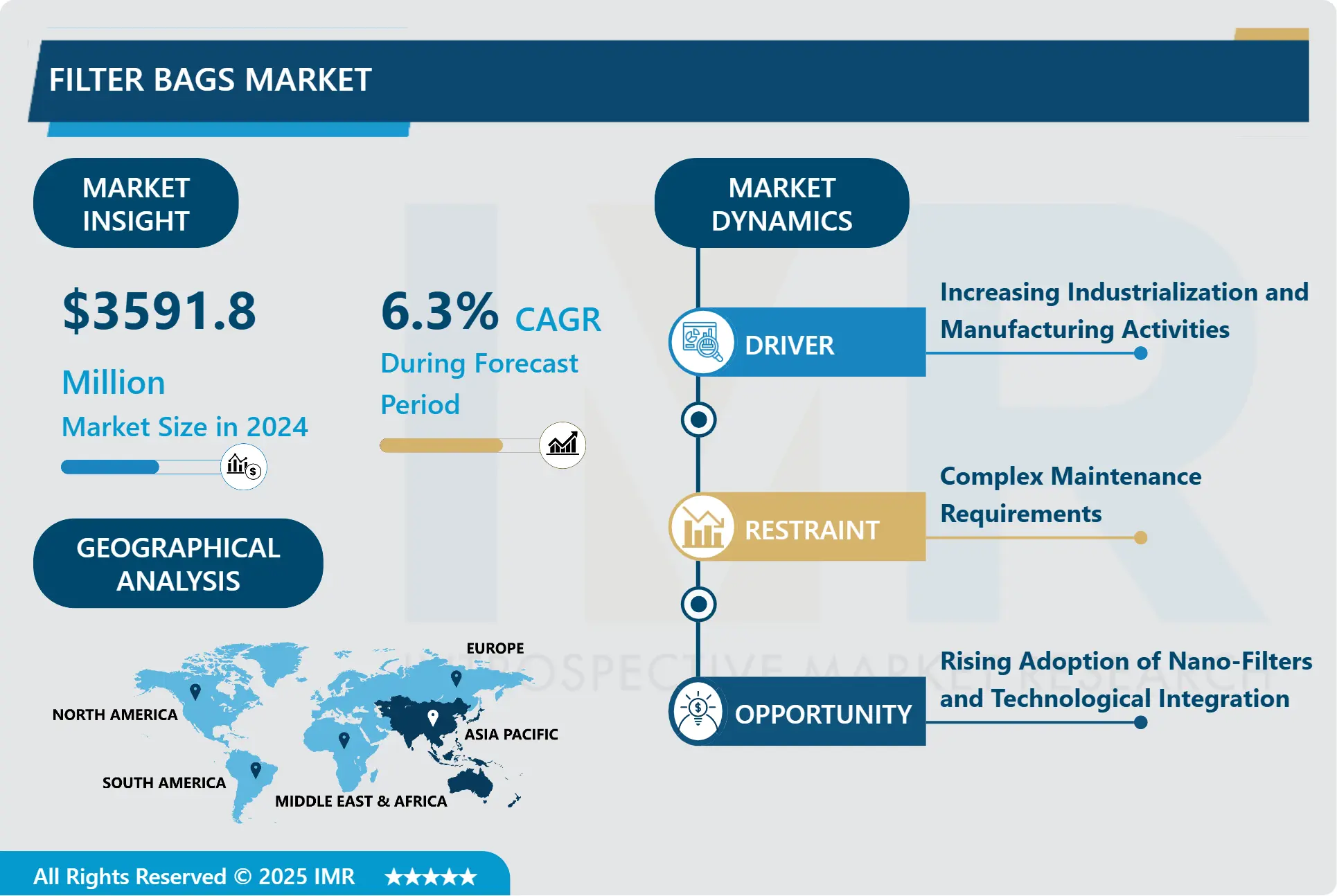

Filter Bags Market Size Was Valued at USD 3591.8 Million in 2024, and is Projected to Reach USD 5855.70 Million by 2032, Growing at a CAGR of 6.3% From 2025-2032.

Filter bags are fabric containers used to capture solid particles in gases or liquids. They’re crucial for maintaining product quality and protecting equipment in different industries and applications. Improvements in filter bag materials and production methods, such as PTFE and nanofiber coatings, have enhanced filtration effectiveness, longevity, and functionality. Business sectors are enhancing their filtration systems to capture smaller particles and improve longevity of operations.

Increased global awareness of air and water quality is driving industries and cities to invest in better filtration technologies to decrease emissions and improve environmental protection. Filter bags are essential in meeting cleaner air and water standards. Governments around the world are implementing stringent environmental laws to regulate emissions and encourage more eco-friendly manufacturing methods. Filter bags play a crucial role in sectors such as power generation and cement production by trapping particles and reducing harmful emissions.

The increasing demand for filter bags in production facilities is driven by the growing healthcare and pharmaceutical requirements for accurate filtration solutions to maintain sterility and product purity. Urban expansion and development of infrastructure result in higher need for building materials like cement, steel, and chemicals. Industries need filter bags and other efficient filtration solutions to comply with regulations and sustainably produce goods.

Filter bags are essential for collecting dust and gases from industrial operations to address air pollution issues. The need for filter bags is growing as power plants, steel mills, and other industries expand operations to meet emission regulations. Filters are required to reduce harmful emissions from high-temperature processes in industries such as oil and gas, metal and mining, and precious metal refining.

Filter Bags Market Trend Analysis

Filter Bags Market Growth Driver- Increasing Industrialization and Manufacturing Activities

Manufacturing industries like cement, steel, pharmaceuticals, food processing, chemicals, and power generation emit dust and pollutants. To comply with emission control requirements, they must use filter bags to capture and control these emissions. Governments enforce strict regulations to reduce air pollution and protect public health, leading to a higher demand for efficient filtration systems and filter bags in industries. Businesses are integrating eco-friendly manufacturing methods such as utilizing filter bags in their dust collection systems to lessen their ecological footprint and advance sustainability efforts.

Ensuring the health and safety of employees includes safeguarding them from industrial dust and pollutants to avoid respiratory problems. Utilizing filter bags can assist in keeping the work environment cleaner and ensuring adherence to regulations. Filter bags help industrial processes run continuously by trapping dust and particles, reducing downtime. This enhances efficiency and productivity by allowing operations to proceed without pause for cleaning. Furthermore, filter bags shield machinery from damage, decreasing upkeep expenses and prolonging the lifespan of equipment.

Improvements in filtration technology have led to advanced filter bags that offer superior efficiency and longevity. Progress in non-woven materials and fabric structures enhances their capacity to trap fine particles and endure tough environments. These filter bags are equipped with state-of-the-art dust collection systems in industrial plants to ensure top performance and simple upkeep. Urbanization and infrastructure development result in extensive construction activities creating dust and particulates. Filter bags are essential in construction dust collection systems to control emissions. Infrastructure projects like highways and airports also drive the demand for filter bags.

Filter Bags Market Opportunity- Rising Adoption of Nano-Filters and Technological Integration

Nano-filters are more energy efficient than traditional filters because they lower pressure drop and resistance. Businesses that are focused on sustainability and reducing their carbon footprint can take advantage of these cost savings. Some nano-filter technologies come equipped with self-cleaning or regeneration capabilities, which help to prolong the lifespan of the filter. This reduces expenses for upkeep and time without operation in vital sectors such as chemical processing and automotive production. Urbanization and the expansion of infrastructure lead to a high level of construction activities which generate dust and particulates.

Nano-filter technology enables customization in the production of filter bags to meet specific needs such as chemical resistance and temperature tolerance, allowing for entry into new markets outside of traditional sectors such as HVAC and manufacturing. Filter bags are necessary for managing emissions in construction dust collection systems. Filter bag demand is also boosted by infrastructure projects such as highways and airports.

Filters that come with built-in sensors provide immediate information on the condition of the filter for proactive maintenance. Filter bag producers can take advantage of the trend by offering IoT-enabled filters that improve operational effectiveness and reduce expenses for customers. Rising consciousness about air and water purity is boosting the need for cutting-edge filtration solutions, creating chances for filter bag producers to grow their market influence, attract funding for nano-filter advancements, and establish strategic alliances with stakeholders.

Filter Bags Market Segment Analysis:

Filter Bags Market is segmented on the basis of Product Type, Media, Material, Application, Distribution Channel, And Region.

By Type, Pulse Jet Segment is Expected to Dominate the Market During the Forecast Period

Pulse Jet Filter Bags are fabric filters utilized in dust collection systems, recognized for their effective cleaning method with high-pressure air bursts. They are efficient in trapping different sizes of particles, which makes them perfect for meeting rigorous air quality regulations in industrial operations. Systems function continuously with air pulse cleaning, eliminating the need for shutdowns for cleaning purposes. Versatile Pulse Jet filter bags can be utilized in a variety of industries including cement, power generation, chemicals, pharmaceuticals, food processing, and metalworking, opening up new market possibilities.

Pulse Jet filter bags require minimal maintenance due to their built-in self-cleaning mechanism. Reduces both operational downtime and expenses in comparison to alternative filter bags. Pulse Jet filter bag systems are smaller in size compared to shaker or reverse air systems, simplifying the process of installation and integration. Strict environmental regulations around the world, especially in the Asia-Pacific region, demand efficient dust control solutions. Pulse Jet filter bags are perfect for industries that prioritize meeting strict emissions standards.

Advancements in fabric filter materials and Pulse Jet technology have enhanced performance, durability, and market standing through new innovations. The cement, power generation, chemical, petrochemical, food, and pharmaceutical sectors all make use of Pulse Jet filter bags for efficient dust management. These filter bags aid in meeting environmental regulations, dealing with large amounts of dust, managing fine particles, and ensuring clean working environments in different industrial operations. Industries that need cleanliness and dust control depend on Pulse Jet filter bags to adhere to regulatory and safety criteria.

By Media, Non-Woven Segment Held the Largest Share in 2024

Non-woven filter bags are created by bonding fibers together using various treatments. Their intricate fiber matrix allows for superior filtration efficiency, trapping small particles effectively. These bags are versatile for various industries because they can be created using materials such as polypropylene and polyester. Their distinct characteristics make them ideal for filtration uses, providing improved effectiveness and flexibility. Non-woven filter bags are designed with improved dust release to simplify cleaning and regeneration, which is important for preserving the efficiency of Pulse Jet cleaning systems.

Non-woven materials provide an economical option for manufacturing and long-lasting quality. Non-woven filter bags are a cost-effective choice for industries due to their affordability. These materials are durable and resistant to tough elements such as high temperatures and chemicals, making them perfect for a wide range of industrial applications. Non-woven filter bags increase airflow in dust collection systems, improving filtration performance. They are readily adaptable for particular filtration requirements, such as thickness, weight, and surface treatments. This flexibility enables manufacturers to design filter bags customized for various industrial processes.

Non-woven filter bags adhere to environmental and health regulations and are lightweight and flexible. Easy to manage and set up, these devices make maintenance and replacement processes simpler, aiding industries in meeting emission regulations and ensuring a clean work environment for compliance. Filter bags are extensively used in various industries such as pharmaceuticals, food processing, chemicals, cement, and power generation. Advancements in non-woven technology, such as enhanced fiber combinations and surface coatings, enhance the effectiveness and longevity of filter bags, maintaining their market dominance in various filtration requirements.

Filter Bags Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The Asia-Pacific region has seen fast-paced industrialization, particularly in China, India, and Southeast Asian countries, leading to higher need for effective filtration systems to control industrial emissions and maintain air quality levels. Governments are implementing strict environmental rules to tackle pollution, mandating the use of advanced filtration solutions such as non-woven filter bags to reduce particulate emissions from industrial sources. Mining activities in this area, encompassing Australia, China, and India, are expanding, resulting in higher levels of dust production and an increased need for non-woven filter bags for dust control.

Improvements in filtration technology in Asia-Pacific, like effective non-woven materials, enhance the performance and longevity of filter bags. The affordability of production in nations such as China and India reduce costs, increasing the appeal of non-woven filter bags to industries and resulting in their widespread use. The Asia-Pacific region is currently seeing an increase in its manufacturing industry and urbanization, leading to a need for non-woven filter bags. Effective dust control solutions are needed in industries such as automotive, electronics, textiles, and chemicals. Infrastructure development initiatives also play a role in promoting cleaner environments and managing dust.

The Asia-Pacific region has a strong need for efficient filtration solutions such as non-woven filter bags in industries like cement, power generation, pharmaceuticals, food processing, and chemicals due to high demand and large amounts of dust and particulate matter. Investing more in research and development results in advancements in non-woven fabric technology, enhancing the quality of filter bags and boosting market expansion. In this region, industries prioritize health and safety in workplaces by utilizing advanced filtration systems such as non-woven filter bags to encourage cleanliness. The rise of renewable energy industry in the area demands efficient dust control methods, employing non-woven filter bags for emissions management.

Filter Bags Market Active Players

Eaton Corporation (Ireland)

Donaldson Company, Inc. (USA)

Camfil Group (Sweden)

BWF Envirotec (Germany)

Lenntech BV (Netherlands)

Thermax Limited (India)

Filtration Group (USA)

Parker Hannifin Corporation (USA)

Hengke Filtration Technology Co., Ltd. (China)

FLSmidth & Co. A/S (Denmark)

Mahavir Corporation (India)

Nederman Holding AB (Sweden)

Clarcor Industrial Air (USA)

Yuanchen Environmental Technology (China)

Shanghai Filterbag Factory Co., Ltd. (China)

Sefar AG (Switzerland)

Testori S.p.A. (Italy)

Albany International Corp. (USA)

Clear Edge Filtration Group (USA)

Ahlstrom-Munksjö (Finland)

Babcock & Wilcox Enterprises, Inc. (USA)

Sly Inc. (USA)

Filter Concept Pvt. Ltd. (India)

Sino Clean Sky (China)

Zhejiang Grace Envirotech (China)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Filter Bags Market by Product Type (2018-2032)

4.1 Filter Bags Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pulse Jet Filters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Reverse Air Filters

4.5 Shaker Filters

4.6 Cartridge Bag Filters

Chapter 5: Filter Bags Market by Media (2018-2032)

5.1 Filter Bags Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Woven

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-woven

5.5 Mesh

Chapter 6: Filter Bags Market by Material (2018-2032)

6.1 Filter Bags Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Polyester

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Polypropylene

6.5 Nylon

6.6 PTFE (Polytetrafluoroethylene)

6.7 Fiberglass

6.8 Others {cotton

6.9 polyethylene}

Chapter 7: Filter Bags Market by Application (2018-2032)

7.1 Filter Bags Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Chemical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical

7.5 Food & Beverage

7.6 Water Treatment

7.7 Metal Processing

7.8 Other {Power Generation

7.9 Building & Construction

7.10 Oil & Gas

7.11 Automotive}

Chapter 8: Filter Bags Market by Distribution Channel (2018-2032)

8.1 Filter Bags Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Offline Sales

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Online Sales

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Filter Bags Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 EATON CORPORATION (IRELAND)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 DONALDSON COMPANY INC. (USA)

9.4 CAMFIL GROUP (SWEDEN)

9.5 BWF ENVIROTEC (GERMANY)

9.6 LENNTECH BV (NETHERLANDS)

9.7 THERMAX LIMITED (INDIA)

9.8 FILTRATION GROUP (USA)

9.9 PARKER HANNIFIN CORPORATION (USA)

9.10 HENGKE FILTRATION TECHNOLOGY COLTD. (CHINA)

9.11 FLSMIDTH & CO. A/S (DENMARK)

9.12 MAHAVIR CORPORATION (INDIA)

9.13 NEDERMAN HOLDING AB (SWEDEN)

9.14 CLARCOR INDUSTRIAL AIR (USA)

9.15 YUANCHEN ENVIRONMENTAL TECHNOLOGY (CHINA)

9.16 SHANGHAI FILTERBAG FACTORY COLTD. (CHINA)

9.17 SEFAR AG (SWITZERLAND)

9.18 TESTORI S.P.A. (ITALY)

9.19 ALBANY INTERNATIONAL CORP. (USA)

9.20 CLEAR EDGE FILTRATION GROUP (USA)

9.21 AHLSTROM-MUNKSJÖ (FINLAND)

9.22 BABCOCK & WILCOX ENTERPRISES INC. (USA)

9.23 SLY INC. (USA)

9.24 FILTER CONCEPT PVT. LTD. (INDIA)

9.25 SINO CLEAN SKY (CHINA)

9.26 ZHEJIANG GRACE ENVIROTECH (CHINA)

Chapter 10: Global Filter Bags Market By Region

10.1 Overview

10.2. North America Filter Bags Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Product Type

10.2.4.1 Pulse Jet Filters

10.2.4.2 Reverse Air Filters

10.2.4.3 Shaker Filters

10.2.4.4 Cartridge Bag Filters

10.2.5 Historic and Forecasted Market Size by Media

10.2.5.1 Woven

10.2.5.2 Non-woven

10.2.5.3 Mesh

10.2.6 Historic and Forecasted Market Size by Material

10.2.6.1 Polyester

10.2.6.2 Polypropylene

10.2.6.3 Nylon

10.2.6.4 PTFE (Polytetrafluoroethylene)

10.2.6.5 Fiberglass

10.2.6.6 Others {cotton

10.2.6.7 polyethylene}

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Chemical

10.2.7.2 Pharmaceutical

10.2.7.3 Food & Beverage

10.2.7.4 Water Treatment

10.2.7.5 Metal Processing

10.2.7.6 Other {Power Generation

10.2.7.7 Building & Construction

10.2.7.8 Oil & Gas

10.2.7.9 Automotive}

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Offline Sales

10.2.8.2 Online Sales

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Filter Bags Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Product Type

10.3.4.1 Pulse Jet Filters

10.3.4.2 Reverse Air Filters

10.3.4.3 Shaker Filters

10.3.4.4 Cartridge Bag Filters

10.3.5 Historic and Forecasted Market Size by Media

10.3.5.1 Woven

10.3.5.2 Non-woven

10.3.5.3 Mesh

10.3.6 Historic and Forecasted Market Size by Material

10.3.6.1 Polyester

10.3.6.2 Polypropylene

10.3.6.3 Nylon

10.3.6.4 PTFE (Polytetrafluoroethylene)

10.3.6.5 Fiberglass

10.3.6.6 Others {cotton

10.3.6.7 polyethylene}

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Chemical

10.3.7.2 Pharmaceutical

10.3.7.3 Food & Beverage

10.3.7.4 Water Treatment

10.3.7.5 Metal Processing

10.3.7.6 Other {Power Generation

10.3.7.7 Building & Construction

10.3.7.8 Oil & Gas

10.3.7.9 Automotive}

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Offline Sales

10.3.8.2 Online Sales

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Filter Bags Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Product Type

10.4.4.1 Pulse Jet Filters

10.4.4.2 Reverse Air Filters

10.4.4.3 Shaker Filters

10.4.4.4 Cartridge Bag Filters

10.4.5 Historic and Forecasted Market Size by Media

10.4.5.1 Woven

10.4.5.2 Non-woven

10.4.5.3 Mesh

10.4.6 Historic and Forecasted Market Size by Material

10.4.6.1 Polyester

10.4.6.2 Polypropylene

10.4.6.3 Nylon

10.4.6.4 PTFE (Polytetrafluoroethylene)

10.4.6.5 Fiberglass

10.4.6.6 Others {cotton

10.4.6.7 polyethylene}

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Chemical

10.4.7.2 Pharmaceutical

10.4.7.3 Food & Beverage

10.4.7.4 Water Treatment

10.4.7.5 Metal Processing

10.4.7.6 Other {Power Generation

10.4.7.7 Building & Construction

10.4.7.8 Oil & Gas

10.4.7.9 Automotive}

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Offline Sales

10.4.8.2 Online Sales

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Filter Bags Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Product Type

10.5.4.1 Pulse Jet Filters

10.5.4.2 Reverse Air Filters

10.5.4.3 Shaker Filters

10.5.4.4 Cartridge Bag Filters

10.5.5 Historic and Forecasted Market Size by Media

10.5.5.1 Woven

10.5.5.2 Non-woven

10.5.5.3 Mesh

10.5.6 Historic and Forecasted Market Size by Material

10.5.6.1 Polyester

10.5.6.2 Polypropylene

10.5.6.3 Nylon

10.5.6.4 PTFE (Polytetrafluoroethylene)

10.5.6.5 Fiberglass

10.5.6.6 Others {cotton

10.5.6.7 polyethylene}

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Chemical

10.5.7.2 Pharmaceutical

10.5.7.3 Food & Beverage

10.5.7.4 Water Treatment

10.5.7.5 Metal Processing

10.5.7.6 Other {Power Generation

10.5.7.7 Building & Construction

10.5.7.8 Oil & Gas

10.5.7.9 Automotive}

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Offline Sales

10.5.8.2 Online Sales

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Filter Bags Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Product Type

10.6.4.1 Pulse Jet Filters

10.6.4.2 Reverse Air Filters

10.6.4.3 Shaker Filters

10.6.4.4 Cartridge Bag Filters

10.6.5 Historic and Forecasted Market Size by Media

10.6.5.1 Woven

10.6.5.2 Non-woven

10.6.5.3 Mesh

10.6.6 Historic and Forecasted Market Size by Material

10.6.6.1 Polyester

10.6.6.2 Polypropylene

10.6.6.3 Nylon

10.6.6.4 PTFE (Polytetrafluoroethylene)

10.6.6.5 Fiberglass

10.6.6.6 Others {cotton

10.6.6.7 polyethylene}

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Chemical

10.6.7.2 Pharmaceutical

10.6.7.3 Food & Beverage

10.6.7.4 Water Treatment

10.6.7.5 Metal Processing

10.6.7.6 Other {Power Generation

10.6.7.7 Building & Construction

10.6.7.8 Oil & Gas

10.6.7.9 Automotive}

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Offline Sales

10.6.8.2 Online Sales

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Filter Bags Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Product Type

10.7.4.1 Pulse Jet Filters

10.7.4.2 Reverse Air Filters

10.7.4.3 Shaker Filters

10.7.4.4 Cartridge Bag Filters

10.7.5 Historic and Forecasted Market Size by Media

10.7.5.1 Woven

10.7.5.2 Non-woven

10.7.5.3 Mesh

10.7.6 Historic and Forecasted Market Size by Material

10.7.6.1 Polyester

10.7.6.2 Polypropylene

10.7.6.3 Nylon

10.7.6.4 PTFE (Polytetrafluoroethylene)

10.7.6.5 Fiberglass

10.7.6.6 Others {cotton

10.7.6.7 polyethylene}

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Chemical

10.7.7.2 Pharmaceutical

10.7.7.3 Food & Beverage

10.7.7.4 Water Treatment

10.7.7.5 Metal Processing

10.7.7.6 Other {Power Generation

10.7.7.7 Building & Construction

10.7.7.8 Oil & Gas

10.7.7.9 Automotive}

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Offline Sales

10.7.8.2 Online Sales

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Filter Bags Market research report?

A1: The forecast period in the Filter Bags Market research report is 2025-2032.

Q2: Who are the key players in the Filter Bags Market?

A2: Eaton Corporation (Ireland), Donaldson Company, Inc. (USA), Camfil Group (Sweden), BWF Envirotec (Germany), Lenntech BV (Netherlands), Thermax Limited (India), Filtration Group (USA), Parker Hannifin Corporation (USA), Hengke Filtration Technology Co., Ltd. (China), FLSmidth & Co. A/S (Denmark), Mahavir Corporation (India), Nederman Holding AB (Sweden), Clarcor Industrial Air (USA), Yuanchen Environmental Technology (China), Shanghai Filterbag Factory Co., Ltd. (China), Sefar AG (Switzerland), Testori S.p.A. (Italy), Albany International Corp. (USA), Clear Edge Filtration Group (USA), Ahlstrom-Munksjö (Finland), Babcock & Wilcox Enterprises, Inc. (USA), Sly Inc. (USA), Filter Concept Pvt. Ltd. (India), Sino Clean Sky (China), Zhejiang Grace Envirotech (China)and Other Active Players.

Q3: What are the segments of the Filter Bags Market?

A3: The Filter Bags Market is segmented into Product Type, Media, Material, Application, Distribution Channel, Segment6, and region. By Product Type, the market is categorized into Pulse Jet Filters, Reverse Air Filters, Shaker Filters, Cartridge Bag Filters. By Media, the market is categorized into Woven, Non-woven, Mesh. By Material, the market is categorized into Polyester, Polypropylene, Nylon, PTFE (Polytetrafluoroethylene), Fiberglass, And Others {cotton, polyethylene}. By Application, the market is categorized into Chemical, Pharmaceutical, Food & Beverage, Water Treatment, Metal Processing, And Other {Power Generation, Building & Construction, Oil & Gas, Automotive}. By Distribution Channel, The Market Is Categorized Into Offline Sales, Online Sales. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Filter Bags Market?

A4: Filter bags are fabric containers used to capture solid particles in gases or liquids. They're crucial for maintaining product quality and protecting equipment in different industries and applications. Improvements in filter bag materials and production methods, such as PTFE and nanofiber coatings, have enhanced filtration effectiveness, longevity, and functionality. Business sectors are enhancing their filtration systems to capture smaller particles and improve longevity of operations.

Q5: How big is the Filter Bags Market?

A5: Filter Bags Market Size Was Valued at USD 3591.8 Million in 2024, and is Projected to Reach USD 5855.70 Million by 2032, Growing at a CAGR of 6.3% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!