Stay Ahead in Fast-Growing Economies.

Browse Reports NowFeed Amino Acids Market Size, Share, Growth & Forecast (2024-2032)

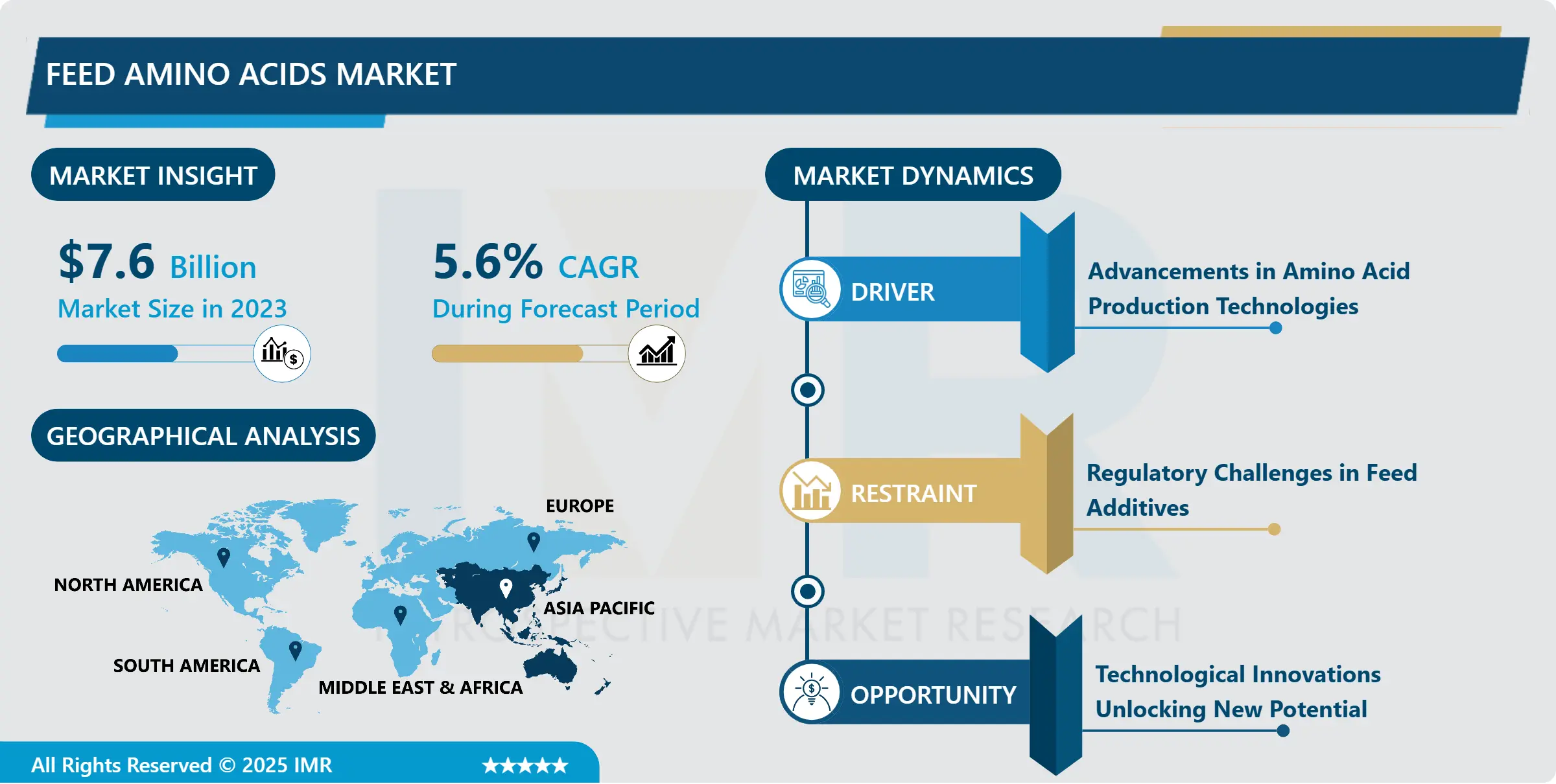

Feed Amino Acids Market Size Was Valued at USD 7.60 Billion in 2023, and is Projected to Reach USD 12.41 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

IMR Group

Description

Feed Amino Acids Market Synopsis:

Feed Amino Acids Market Size Was Valued at USD 7.60 Billion in 2023, and is Projected to Reach USD 12.41 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

Feed Amino Acids Market can be defined as the Animal Feed Amino Acid Specialized Segment that supplies amino acid additives including lysine, methionine, threonine and tryptophan. These nutrients improve feed conversion and stimulates the growth of grown stocks besides improving animal health and supporting the continuously growing global market for sustainable meat sources.

Population increase across the world and increase in middle income consumers’ desire healthy foods especially those derived from animals such as meat, poultry, and dairy products. This surge has led to increased demand for growth and production promoting feed additives for livestock. Soils are engrossed in enhancing feed conversion, which will decrease the feed cost and help farmers to fulfill protein requirements.

Increased awareness of the impact of environmental problems together with the depletion of natural resources has led to an awareness of sustainable farming. Such amino acids as lysine and methionine improve the protein deposited in animal tissues rather than in the urine, thus reducing pollution of animal farming. Prominent focus toward environment friendly solutions is driving feed amino acids in global market.

Feed Amino Acids Market Trend Analysis:

Technological Advancements in Production

Technological advancements in production are reshaping the feed amino acids market, enhancing both efficiency and quality. Automation, precision farming tools, and biotechnology are streamlining the manufacturing process, resulting in higher yields and more consistent product formulations. These innovations reduce costs, minimize waste, and improve the nutritional profile of animal feeds. As production processes become more sophisticated, manufacturers can offer customized solutions to meet specific dietary needs for livestock, poultry, and aquaculture, contributing to better feed conversion ratios and healthier animals.

The increasing demand for high-performance animal feed across various industries is fueling the growth of the feed amino acids market. With an expanding global population and rising meat consumption, the need for nutritious and cost-effective feed is more pressing than ever. Producers are adopting novel technologies to meet this demand, creating opportunities for market expansion. The integration of amino acids into feed formulations supports optimal growth rates, disease resistance, and overall productivity, reinforcing the role of technology in market development.

Expanding Market in Emerging Economies

The growing demand for animal feed in emerging economies presents a robust opportunity for the amino acids market. As these regions experience rising agricultural activity and increased consumption of livestock products, the need for high-quality feed ingredients becomes more crucial. Amino acids, being essential for animal growth and productivity, are becoming integral in feed formulations across the poultry, swine, and aquaculture industries. This demand reflects a broader trend of improving feed quality to support sustainable livestock production and enhance feed efficiency.

The expanding presence of the livestock sector in emerging markets accelerates the adoption of specialized feed additives. These economies, seeking to increase food security and boost their agricultural output, are increasingly relying on tailored nutritional solutions for animals. Amino acids serve as a key element in meeting the nutritional needs of livestock, ensuring faster growth rates, better health, and improved feed conversion ratios, leading to a direct impact on production efficiency and profitability in these regions.

Feed Amino Acids Market Segment Analysis:

Feed Amino Acids Market is Segmented based on type, Form, Application, and Region

By Type, Lysine segment is expected to dominate the market during the forecast period

The global Feed Amino Acids Market is expanding as the demand for livestock and poultry products continues to rise. Lysine, a crucial amino acid in animal nutrition, is anticipated to hold a prominent position in the market due to its role in promoting growth, enhancing feed efficiency, and improving meat quality. As livestock production systems evolve to meet growing consumer demand, the adoption of amino acid-based feed additives becomes more critical in optimizing animal health and performance.

The rising awareness about the benefits of amino acid supplementation is prompting livestock producers to seek more efficient ways to manage feed formulation. Lysine, known for its ability to support muscle growth in animals, is essential in enhancing protein synthesis. With regulatory pressures on feed ingredients and increasing costs of traditional feed materials, the market for amino acids in animal feed is expanding to ensure more cost-effective, sustainable, and high-quality production.

By Application, Growth Promotion segment expected to held the largest share

The Feed Amino Acids Market is poised for steady expansion as the demand for high-quality animal feed rises. The growth of this market is primarily supported by the increasing need for improved livestock productivity, which requires amino acids to enhance nutritional content and overall animal health. As livestock farming evolves to meet the rising demand for protein-rich food products, the emphasis on optimizing feed efficiency remains a key factor.

The largest share of this market is attributed to the growth promotion segment, where amino acids are crucial in fostering optimal growth and development in animals. As consumer awareness around the benefits of fortified feed grows, the market for amino acids is benefiting from the integration of these nutrients in various animal feed formulations. This trend is further supported by the adoption of advanced farming practices that prioritize animal welfare, boosting the demand for specialized and balanced nutritional solutions.

Feed Amino Acids Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is set to lead the global feed amino acids market during the forecast period, owing to the increasing demand for livestock products and growing awareness around animal nutrition. Rising meat consumption in countries like China, India, and Japan is driving the need for high-quality animal feed, enhancing the importance of feed additives like amino acids for improving growth and production efficiency. The expansion of livestock farming in this region has led to a higher need for optimized feed formulations that promote health, performance, and disease resistance in animals.

The growing focus on sustainable farming practices and the shift towards natural feed solutions in Asia Pacific are influencing market dynamics. This trend is fostering innovation in amino acid-based products, aiming to improve feed efficiency while minimizing environmental impacts. In response to evolving consumer preferences for safer and healthier animal-derived products, manufacturers are exploring new amino acid formulations that offer improved nutritional profiles for livestock and poultry.

Active Key Players in the Feed Amino Acids Market

Ajinomoto Co., Inc. (Japan)

Archer Daniels Midland Company (USA)

Cargill, Incorporated (USA)

CJ CheilJedang Corporation (South Korea)

Evonik Industries AG (Germany)

Fufeng Group (China)

Kemin Industries, Inc. (USA)

Meihua Holdings Group Co., Ltd. (China)

Novus International, Inc. (USA)

Sumitomo Chemical Co., Ltd. (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Feed Amino Acids Market by Type

4.1 Feed Amino Acids Market Snapshot and Growth Engine

4.2 Feed Amino Acids Market Overview

4.3 Lysine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Lysine: Geographic Segmentation Analysis

4.4 Methionine

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Methionine: Geographic Segmentation Analysis

4.5 Threonine

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Threonine: Geographic Segmentation Analysis

4.6 Tryptophan

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Tryptophan: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Feed Amino Acids Market by Form

5.1 Feed Amino Acids Market Snapshot and Growth Engine

5.2 Feed Amino Acids Market Overview

5.3 Dry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Dry: Geographic Segmentation Analysis

5.4 Liquid

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Liquid: Geographic Segmentation Analysis

Chapter 6: Feed Amino Acids Market by Application

6.1 Feed Amino Acids Market Snapshot and Growth Engine

6.2 Feed Amino Acids Market Overview

6.3 Growth Promotion

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Growth Promotion: Geographic Segmentation Analysis

6.4 Performance Enhancement

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Performance Enhancement: Geographic Segmentation Analysis

6.5 Health Maintenance

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Health Maintenance: Geographic Segmentation Analysis

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Feed Amino Acids Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AJINOMOTO CO. INC. (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARCHER DANIELS MIDLAND COMPANY (USA)

7.4 CARGILL INCORPORATED (USA)

7.5 CJ CHEILJEDANG CORPORATION (SOUTH KOREA)

7.6 EVONIK INDUSTRIES AG (GERMANY)

7.7 FUFENG GROUP (CHINA)

7.8 KEMIN INDUSTRIES INC. (USA)

7.9 MEIHUA HOLDINGS GROUP CO. LTD. (CHINA)

7.10 NOVUS INTERNATIONAL INC. (USA)

7.11 SUMITOMO CHEMICAL CO. LTD. (JAPAN)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Feed Amino Acids Market By Region

8.1 Overview

8.2. North America Feed Amino Acids Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Lysine

8.2.4.2 Methionine

8.2.4.3 Threonine

8.2.4.4 Tryptophan

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Form

8.2.5.1 Dry

8.2.5.2 Liquid

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Growth Promotion

8.2.6.2 Performance Enhancement

8.2.6.3 Health Maintenance

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Feed Amino Acids Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Lysine

8.3.4.2 Methionine

8.3.4.3 Threonine

8.3.4.4 Tryptophan

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Form

8.3.5.1 Dry

8.3.5.2 Liquid

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Growth Promotion

8.3.6.2 Performance Enhancement

8.3.6.3 Health Maintenance

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Feed Amino Acids Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Lysine

8.4.4.2 Methionine

8.4.4.3 Threonine

8.4.4.4 Tryptophan

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Form

8.4.5.1 Dry

8.4.5.2 Liquid

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Growth Promotion

8.4.6.2 Performance Enhancement

8.4.6.3 Health Maintenance

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Feed Amino Acids Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Lysine

8.5.4.2 Methionine

8.5.4.3 Threonine

8.5.4.4 Tryptophan

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Form

8.5.5.1 Dry

8.5.5.2 Liquid

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Growth Promotion

8.5.6.2 Performance Enhancement

8.5.6.3 Health Maintenance

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Feed Amino Acids Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Lysine

8.6.4.2 Methionine

8.6.4.3 Threonine

8.6.4.4 Tryptophan

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Form

8.6.5.1 Dry

8.6.5.2 Liquid

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Growth Promotion

8.6.6.2 Performance Enhancement

8.6.6.3 Health Maintenance

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Feed Amino Acids Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Lysine

8.7.4.2 Methionine

8.7.4.3 Threonine

8.7.4.4 Tryptophan

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Form

8.7.5.1 Dry

8.7.5.2 Liquid

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Growth Promotion

8.7.6.2 Performance Enhancement

8.7.6.3 Health Maintenance

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Feed Amino Acids Market research report?

A1: The forecast period in the Feed Amino Acids Market research report is 2024-2032.

Q2: Who are the key players in the Feed Amino Acids Market?

A2: Ajinomoto Co., Inc. (Japan), Archer Daniels Midland Company (USA), Cargill, Incorporated (USA), CJ CheilJedang Corporation (South Korea), Evonik Industries AG (Germany), Fufeng Group (China), Kemin Industries, Inc. (USA), Meihua Holdings Group Co., Ltd. (China), Novus International, Inc. (USA), Sumitomo Chemical Co., Ltd. (Japan), and Other Active Players.

Q3: What are the segments of the Feed Amino Acids Market?

A3: The Feed Amino Acids Market is segmented into by Type (Lysine, Methionine, Threonine, Tryptophan, Others), By Form (Dry, Liquid), and Application (Growth Promotion, Performance Enhancement, Health Maintenance, Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Q4: What is the Feed Amino Acids Market?

A4: Feed Amino Acids Market can be defined as the Animal Feed Amino Acid Specialized Segment that supplies amino acid additives including lysine, methionine, threonine and tryptophan. These nutrients improve feed conversion and stimulates the growth of grown stocks besides improving animal health and supporting the continuously growing global market for sustainable meat sources.

Q5: How big is the Feed Amino Acids Market?

A5: Feed Amino Acids Market Size Was Valued at USD 7.60 Billion in 2023, and is Projected to Reach USD 12.41 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!