Stay Ahead in Fast-Growing Economies.

Browse Reports NowExtrusion Sheet Market Growth Insights & Forecast Report to 2032

The Extrusion Sheet Market refers to the industry involved in producing plastic sheets through the extrusion process, where melted polymers are shaped into flat sheets.

IMR Group

Description

Extrusion Sheet Market Synopsis:

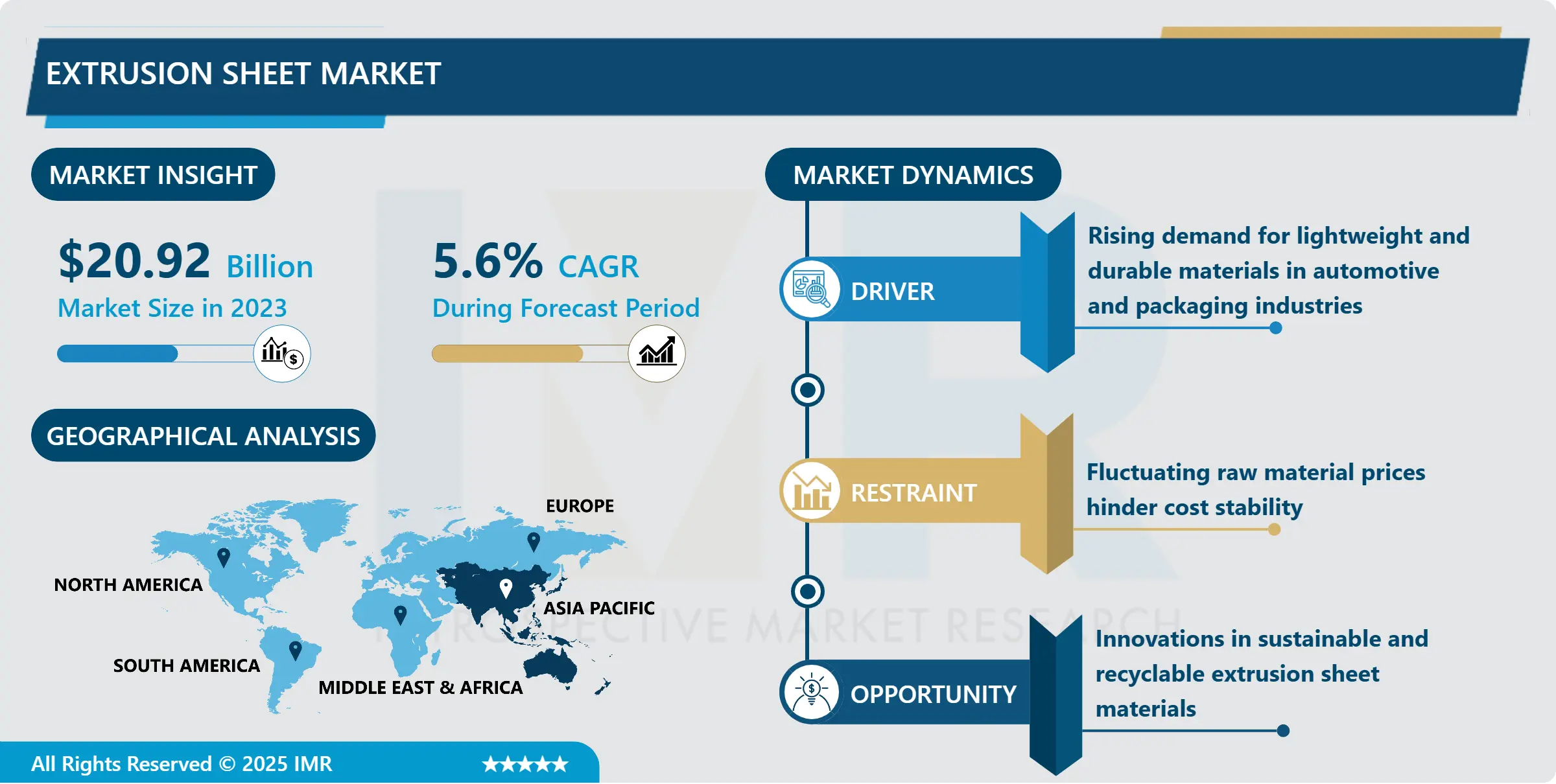

Extrusion Sheet Market Size Was Valued at USD 20.92 Billion in 2023, and is Projected to Reach USD 34.3 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

The Extrusion Sheet Market refers to the industry involved in producing plastic sheets through the extrusion process, where melted polymers are shaped into flat sheets. These sheets are used across packaging, automotive, construction, and consumer goods sectors due to their durability, versatility, and recyclability. Key materials include PET, PP, and PVC, offering varied performance characteristics.

The extrusion sheet market has experienced growth because of the rising need for lightweight, sustainable, and recurring materials in different applications. The construction industry itself accounts for most of the consumption, especially of corrugated and multi-wall sheets employed in roofing and cladding, insulation. Furthermore, automobile manufacturing employs these sheets for exteriors and interiors; it slimmed down to conserve resources such as gasoline. Betterment of the extrusion technologies has improved the sheet performance and open new characteristics such as UV stability, heat adsorption, and mechanical strength such as shock resistance, which has given a boon to the market.

The packaging industry is also a key industry that utilize extrusion sheets for protective and green packaging. As people’s awareness on usage of single use plastics rises, producers are shifting more towards biodegradable and recyclable forms in compliance with sustainable development goals. New regions including Asia-Pacific and Latin American countries are demanding since there is increasing industrialization, urbanization, and infrastructural advancements. However, governmental regulation towards the use of environmentally friendly packaging counts as the key incentive towards the industry’s development; making it a key player in the global plastics market.

Extrusion Sheet Market Trend Analysis:

Rising Demand for Polypropylene

Specifically, polypropylene (PP) is on the rise as the material of choice in extrusion sheet due to its remarkable chemical stability, affordable price and ease to recycle. Due to its light weight and versatility it is suitable for multiple uses including food and pharmaceuticals, automotive industry and in electronics with applications in vehicle interiors and medical equipment.

The increasing usage of PP in environmentally friendly packaging reflects the growing tendencies of and production of eco-products around the world. Development of new blends for PP as well as advancements in co-extrusion technologies enable related enhancement of the functions of these high value sheets, thereby making them valuable in contemporary applications.

Sustainability as a Catalyst

Environmental consciousness is the other factor that represents a good chance for the extrusion sheet market. There is an increasing trend towards the use of eco-friendly items, and hence we see more demand for recyclable and biodegradable sheet. Recent advancements in raw material development like bio-plastics, as well as enhanced recyclability of products, have let end-products meet competitive green standards to meet ecological regulations and customer demands.

Measures for the implementation of sustainable manufacturing also add to the increased scope for growth in this market as encouraged by various governments. Also, the circular economy model provides the incentives for manufacturers to establish the closed loop recycling system and to make the waste into the new materials.

Extrusion Sheet Market Segment Analysis:

Extrusion Sheet Market is Segmented on the basis of Type, Structure, Application, and Region

By Type, Polypropylene segment is expected to dominate the market during the forecast period

Polypropylene is likely to remain the largest growing extrusion sheet during the forecast period, owing to factors such as high chemical, and thermal resistance along with low cost and versatile nature. This segment has found wide acceptance in automotive, packaging, construction industries because of their lightweight and excellent impact strength. The need for polypropylene sheets grows in the same proportion due to their recyclability and reusability to avoid harming the natural environment.

The food packaging industry specifically gets the most value from polypropylene sheets because of their effectiveness in maintaining food qualities and their suitability to be used in different temperatures. The PP Sheets are gradually used in automotive interior trims and applications inside engine compartment to meet the forces of durability and cost in auto industry. That’s why, polypropylene is also expected to retain its leadership as industries keep moving toward finding lightweight yet highly effective materials.

By Structure, Corrugated segment expected to held the largest share

The corrugated segment will most likely dominate on the global extrusion sheet market as this kind of product has increased structural strength together with decreased weight and increased versatility. Corrugated sheets are common in construction in the capacity of roofing and cladding, due to their ability to resist all forms of weather and their insulating characteristics. These sheets also find the greatest application in packaging, particularly, in shipping containers, since they provide the best protection and padding in transit.

The agricultural sector is another type of consumer that uses corrugated sheets for panels of green houses as well as water tanks. Extrusion technology has improved to allow manufacturing of higher quality corrugated sheets that are more durable and have better abilities to resist ultraviolet light. Due to the increasing number of infrastructural projects and agricultural development, this segment remains well positioned to sustain its leadership.

Extrusion Sheet Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is projected to lead the global extrusion sheet market over the forecast period, supported by expanding industrial activity and increasing demand from end-use sectors such as construction, automotive, packaging, and electronics. Rising urbanization, favorable government policies for infrastructure development, and ongoing investments in manufacturing capacities have elevated the consumption of extrusion sheets across emerging economies like China, India, and Southeast Asian nations. The presence of cost-effective labor and raw materials also contributes to regional manufacturing competitiveness, attracting both domestic and international market participants.

Rapid economic development in the Asia Pacific is reshaping the landscape of materials processing and application. The extrusion sheet market is witnessing wider adoption due to its role in lightweight product design, improved durability, and cost efficiency. Local and regional producers are focusing on innovations in polymer technology and recycling to meet evolving quality standards and environmental expectations. This growth trajectory reinforces Asia Pacific’s position as a core production and consumption hub for extrusion sheets.

Active Key Players in the Extrusion Sheet Market

Arkema (France)

BASF SE (Germany)

Celanese Corporation (United States)

Chevron Phillips Chemical Company (United States)

Covestro AG (Germany)

Dow Inc. (United States)

ExxonMobil Corporation (United States)

Formosa Plastics Corporation (Taiwan)

INEOS Group (United Kingdom)

LG Chem (South Korea)

Mitsubishi Chemical Corporation (Japan)

SABIC (Saudi Arabia)

Solvay S.A. (Belgium)

Toray Industries, Inc. (Japan)

TotalEnergies SE (France)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Extrusion Sheet Market by Type

4.1 Extrusion Sheet Market Snapshot and Growth Engine

4.2 Extrusion Sheet Market Overview

4.3 Polypropylene

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Polypropylene: Geographic Segmentation Analysis

4.4 LDPE

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 LDPE: Geographic Segmentation Analysis

4.5 Polycarbonate

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Polycarbonate: Geographic Segmentation Analysis

4.6 HDPE

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 HDPE: Geographic Segmentation Analysis

4.7 Polystyrene

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Polystyrene: Geographic Segmentation Analysis

4.8 Acrylate

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Acrylate: Geographic Segmentation Analysis

4.9 Polyethylene

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Polyethylene: Geographic Segmentation Analysis

4.10 Others

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Others: Geographic Segmentation Analysis

Chapter 5: Extrusion Sheet Market by Structure

5.1 Extrusion Sheet Market Snapshot and Growth Engine

5.2 Extrusion Sheet Market Overview

5.3 Corrugated

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Corrugated: Geographic Segmentation Analysis

5.4 Solid & Textured

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solid & Textured: Geographic Segmentation Analysis

5.5 Hollow

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Hollow: Geographic Segmentation Analysis

5.6 Multiwall

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Multiwall: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Extrusion Sheet Market by Application

6.1 Extrusion Sheet Market Snapshot and Growth Engine

6.2 Extrusion Sheet Market Overview

6.3 Defence& Aerospace

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Defence& Aerospace: Geographic Segmentation Analysis

6.4 Building & Construction

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Building & Construction: Geographic Segmentation Analysis

6.5 Signages

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Signages: Geographic Segmentation Analysis

6.6 Medical

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Medical: Geographic Segmentation Analysis

6.7 Automotive

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Automotive: Geographic Segmentation Analysis

6.8 Electrical & Electronics

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Electrical & Electronics: Geographic Segmentation Analysis

6.9 Packaging

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Packaging: Geographic Segmentation Analysis

6.10 Others

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Extrusion Sheet Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARKEMA (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BASF SE (GERMANY)

7.4 CELANESE CORPORATION (UNITED STATES)

7.5 CHEVRON PHILLIPS CHEMICAL COMPANY (UNITED STATES)

7.6 COVESTRO AG (GERMANY)

7.7 DOW INC. (UNITED STATES)

7.8 EXXONMOBIL CORPORATION (UNITED STATES)

7.9 FORMOSA PLASTICS CORPORATION (TAIWAN)

7.10 INEOS GROUP (UNITED KINGDOM)

7.11 LG CHEM (SOUTH KOREA)

7.12 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

7.13 SABIC (SAUDI ARABIA)

7.14 SOLVAY S.A. (BELGIUM)

7.15 TORAY INDUSTRIES INC. (JAPAN)

7.16 TOTALENERGIES SE (FRANCE)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Extrusion Sheet Market By Region

8.1 Overview

8.2. North America Extrusion Sheet Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Polypropylene

8.2.4.2 LDPE

8.2.4.3 Polycarbonate

8.2.4.4 HDPE

8.2.4.5 Polystyrene

8.2.4.6 Acrylate

8.2.4.7 Polyethylene

8.2.4.8 Others

8.2.5 Historic and Forecasted Market Size By Structure

8.2.5.1 Corrugated

8.2.5.2 Solid & Textured

8.2.5.3 Hollow

8.2.5.4 Multiwall

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Defence& Aerospace

8.2.6.2 Building & Construction

8.2.6.3 Signages

8.2.6.4 Medical

8.2.6.5 Automotive

8.2.6.6 Electrical & Electronics

8.2.6.7 Packaging

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Extrusion Sheet Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Polypropylene

8.3.4.2 LDPE

8.3.4.3 Polycarbonate

8.3.4.4 HDPE

8.3.4.5 Polystyrene

8.3.4.6 Acrylate

8.3.4.7 Polyethylene

8.3.4.8 Others

8.3.5 Historic and Forecasted Market Size By Structure

8.3.5.1 Corrugated

8.3.5.2 Solid & Textured

8.3.5.3 Hollow

8.3.5.4 Multiwall

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Defence& Aerospace

8.3.6.2 Building & Construction

8.3.6.3 Signages

8.3.6.4 Medical

8.3.6.5 Automotive

8.3.6.6 Electrical & Electronics

8.3.6.7 Packaging

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Extrusion Sheet Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Polypropylene

8.4.4.2 LDPE

8.4.4.3 Polycarbonate

8.4.4.4 HDPE

8.4.4.5 Polystyrene

8.4.4.6 Acrylate

8.4.4.7 Polyethylene

8.4.4.8 Others

8.4.5 Historic and Forecasted Market Size By Structure

8.4.5.1 Corrugated

8.4.5.2 Solid & Textured

8.4.5.3 Hollow

8.4.5.4 Multiwall

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Defence& Aerospace

8.4.6.2 Building & Construction

8.4.6.3 Signages

8.4.6.4 Medical

8.4.6.5 Automotive

8.4.6.6 Electrical & Electronics

8.4.6.7 Packaging

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Extrusion Sheet Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Polypropylene

8.5.4.2 LDPE

8.5.4.3 Polycarbonate

8.5.4.4 HDPE

8.5.4.5 Polystyrene

8.5.4.6 Acrylate

8.5.4.7 Polyethylene

8.5.4.8 Others

8.5.5 Historic and Forecasted Market Size By Structure

8.5.5.1 Corrugated

8.5.5.2 Solid & Textured

8.5.5.3 Hollow

8.5.5.4 Multiwall

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Defence& Aerospace

8.5.6.2 Building & Construction

8.5.6.3 Signages

8.5.6.4 Medical

8.5.6.5 Automotive

8.5.6.6 Electrical & Electronics

8.5.6.7 Packaging

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Extrusion Sheet Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Polypropylene

8.6.4.2 LDPE

8.6.4.3 Polycarbonate

8.6.4.4 HDPE

8.6.4.5 Polystyrene

8.6.4.6 Acrylate

8.6.4.7 Polyethylene

8.6.4.8 Others

8.6.5 Historic and Forecasted Market Size By Structure

8.6.5.1 Corrugated

8.6.5.2 Solid & Textured

8.6.5.3 Hollow

8.6.5.4 Multiwall

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Defence& Aerospace

8.6.6.2 Building & Construction

8.6.6.3 Signages

8.6.6.4 Medical

8.6.6.5 Automotive

8.6.6.6 Electrical & Electronics

8.6.6.7 Packaging

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Extrusion Sheet Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Polypropylene

8.7.4.2 LDPE

8.7.4.3 Polycarbonate

8.7.4.4 HDPE

8.7.4.5 Polystyrene

8.7.4.6 Acrylate

8.7.4.7 Polyethylene

8.7.4.8 Others

8.7.5 Historic and Forecasted Market Size By Structure

8.7.5.1 Corrugated

8.7.5.2 Solid & Textured

8.7.5.3 Hollow

8.7.5.4 Multiwall

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Defence& Aerospace

8.7.6.2 Building & Construction

8.7.6.3 Signages

8.7.6.4 Medical

8.7.6.5 Automotive

8.7.6.6 Electrical & Electronics

8.7.6.7 Packaging

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Extrusion Sheet Market research report?

A1: The forecast period in the Extrusion Sheet Market research report is 2024-2032.

Q2: Who are the key players in the Extrusion Sheet Market?

A2: Arkema (France), BASF SE (Germany), Celanese Corporation (United States), Chevron Phillips Chemical Company (United States) and Other Major Players.

Q3: What are the segments of the Extrusion Sheet Market?

A3: The Extrusion Sheet Market is segmented into Type, Structure, Application and region. By Type, the market is categorized into Polypropylene, LDPE, Polycarbonate, HDPE, Polystyrene, Acrylate, Polyethylene, and Others. By Structure, the market is categorized into Corrugated, Solid & Textured, Hollow, Multiwall, and Others. By Application, the market is categorized into Defence& Aerospace, Building & Construction, Signages, Medical, Automotive, Electrical & Electronics, Packaging, and Others. By Region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Extrusion Sheet Market?

A4: The Extrusion Sheet Market refers to the industry involved in producing plastic sheets through the extrusion process, where melted polymers are shaped into flat sheets. These sheets are used across packaging, automotive, construction, and consumer goods sectors due to their durability, versatility, and recyclability. Key materials include PET, PP, and PVC, offering varied performance characteristics.

Q5: How big is the Extrusion Sheet Market?

A5: Extrusion Sheet Market Size Was Valued at USD 20.92 Billion in 2023, and is Projected to Reach USD 34.3 Billion by 2032, Growing at a CAGR of 5.6% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!