Stay Ahead in Fast-Growing Economies.

Browse Reports NowExtreme Ultraviolet (EUV) Lithography Market Size, Growth Dynamics & Forecast (2024-2032)

EUV Lithography is a modern technology in manufacturing semiconductors where manufacturing involves using extreme ultraviolet wavelength of 13.5 nm to create very thin patterns on a microchip. It helps in production of high-density- high-performance semiconductors needed in such features as AI, 5G, IoT & Advance computing.

IMR Group

Description

Extreme Ultraviolet (EUV) Lithography Market Synopsis:

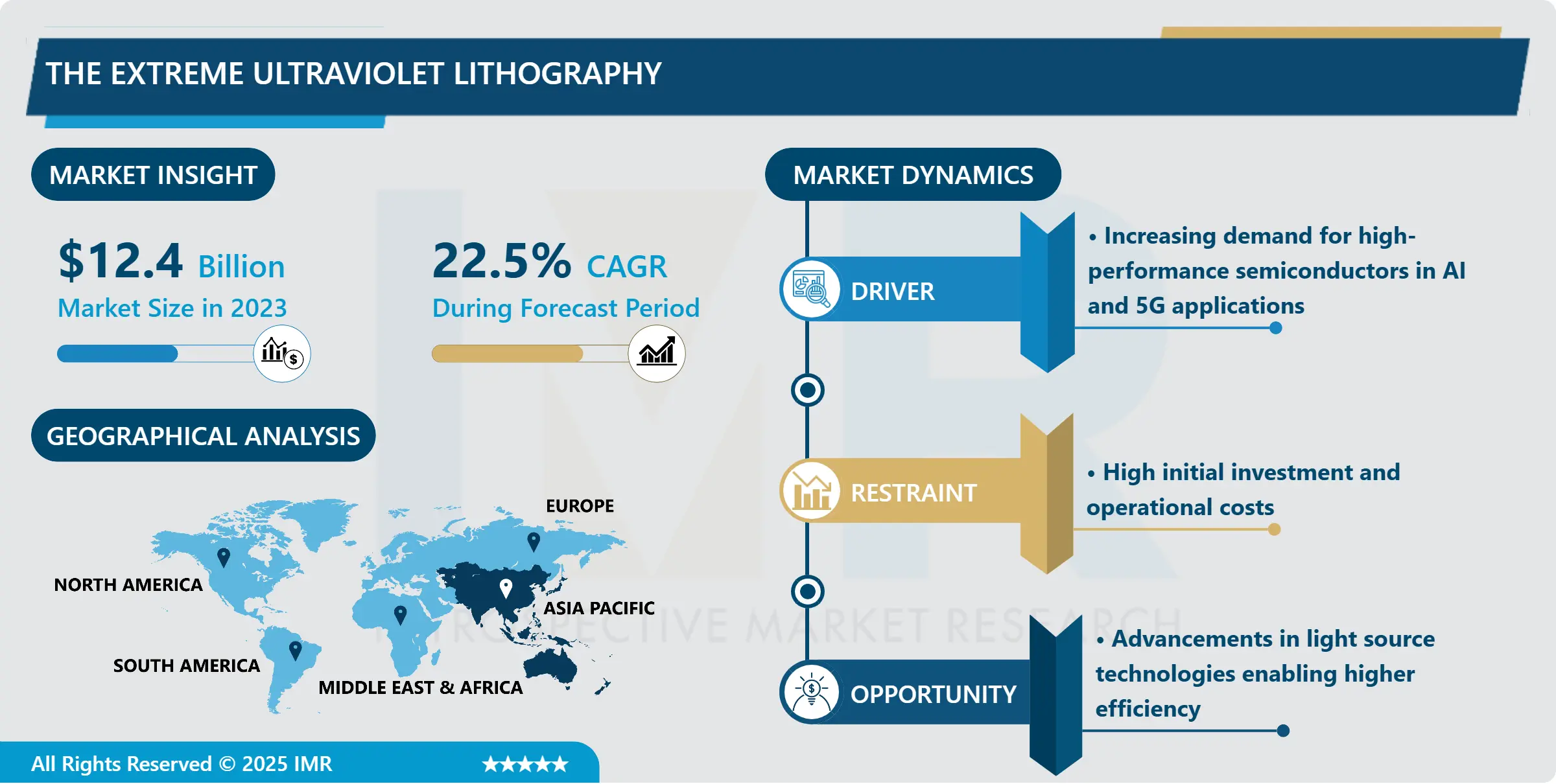

Extreme Ultraviolet (EUV) Lithography Market Size Was Valued at USD 12.4 Billion in 2023, and is Projected to Reach USD 63.3 Billion by 2032, Growing at a CAGR of 22.5% From 2024-2032.

EUV Lithography is a modern technology in manufacturing semiconductors where manufacturing involves using extreme ultraviolet wavelength of 13.5 nm to create very thin patterns on a microchip. It helps in production of high-density- high-performance semiconductors needed in such features as AI, 5G, IoT & Advance computing. EUV lithography brings in the concern of some the issues faced by photolithography techniques including achieving enhanced accuracy in etching the complex circuit patterns into wafers which are required for the advanced semiconductor nodes in the industry.

The EUV lithography market is seen to grow at an exponential rate because of economies of scale that are seen within the microelectronics industry with customers demanding smaller, faster, and more efficient chips. The emergence of ultra-national production in the global semiconductor industry has increased the usage of EUV lithography to generate feature sizes below 7nm, which could not be easily developed with earlier methods. This transition is done due to the needs of complexity in various software that is used in artificial intelligence, machine learning, or cloud services. State and non-state actors globally are investing significantly in semiconductor manufacturing facilities thus spurring on the need for more EUV lithography equipment.

It is also identified that the market also receives a boost from the rising inclination of the key semiconductor players toward EUV technology in Asia-Pacific and North America. Manufacturers are moving from the DUV lithography to EUV to distinguish themselves in terms of better performance and lower production cost. Moreover, a breakthrough with the current technologies, such as quantum computers and edge devices, which necessitate sophisticated semiconductors, guarantees increased usage of EUV lithography going forward.

Extreme Ultraviolet (EUV) Lithography Market Trend Analysis:

EUV Lithography in Advanced Node Chips

The Extreme Ultraviolet (EUV) Lithography market is expanding as chipmakers continue to push the limits of miniaturization in advanced node semiconductor manufacturing. EUV technology enables the production of smaller, faster, and more power-efficient chips required for next-generation applications in AI, high-performance computing, and 5G infrastructure. With growing investment from foundries and integrated device manufacturers, EUV lithography is becoming central to process nodes at 7nm, 5nm, and below. Key suppliers are scaling production capacity and refining tools to meet the increasing complexity of leading-edge chip designs.

In response to the evolving demand, equipment vendors are focusing on improving throughput, tool uptime, and resist performance. Strategic partnerships among technology firms, OEMs, and research institutes are reinforcing the innovation pipeline. Market activity is further shaped by regional investments in semiconductor independence, with Asia-Pacific, Europe, and North America enhancing local capabilities. EUV lithography is gaining momentum as a foundational technology in the global semiconductor supply chain.

Surge in AI and IoT Applications

The expanding adoption of AI and IoT technologies across industries is fueling demand for increasingly compact and high-performance semiconductor devices. This demand places greater pressure on chip manufacturers to push the boundaries of miniaturization and processing power. Extreme Ultraviolet (EUV) lithography offers a precise and scalable solution for advanced chip fabrication, enabling production at nodes below 7nm. As AI algorithms grow more complex and IoT applications multiply, the need for high-density, energy-efficient chips supports wider deployment of EUV systems in semiconductor fabs globally.

The EUV lithography market is responding to evolving requirements from next-generation data centers, edge computing platforms, and autonomous technologies. Foundries are ramping up investments in EUV tools to meet performance expectations while addressing the physical limitations of traditional photolithography. This transition aligns with the growing need for faster, smaller, and more power-efficient processors, positioning EUV technology as a core enabler in the semiconductor roadmap shaped by AI and IoT proliferation.

Extreme Ultraviolet (EUV) Lithography Market Segment Analysis:

Extreme Ultraviolet (EUV) Lithography Market is Segmented on the basis of Equipment, End Use, and Region

By Equipment, Light Source segment is expected to dominate the market during the forecast period

The Light Source segment is poised to lead the Extreme Ultraviolet (EUV) Lithography market throughout the forecast period due to ongoing investments in advanced semiconductor manufacturing. The transition to smaller node sizes in chip production demands precise and powerful light sources to enable patterning at atomic scales. Market players are intensifying R&D around EUV light source technology, as the efficiency and stability of the light source directly impact throughput and yield in high-volume semiconductor fabrication. Equipment vendors and chipmakers are prioritizing this segment to meet the performance and cost-efficiency requirements of next-generation chips.

The adoption of EUV lithography across logic and memory foundries reflects the industry’s pivot toward more complex and compact integrated circuits. Light source advancements are central to enabling this shift, as they help reduce multi-patterning steps and improve overlay control. As demand grows for advanced consumer electronics, AI hardware, and high-performance computing, the need for robust EUV platforms powered by reliable light sources continues to shape the competitive landscape.

By End Use, Light Source segment expected to held the largest share

The Light Source segment is poised to command the largest share of the Extreme Ultraviolet (EUV) Lithography Market due to its critical role in next-generation semiconductor manufacturing. As chipmakers transition to smaller nodes and higher-density designs, demand for advanced lithography tools has accelerated. EUV light sources, which enable finer patterning at sub-7nm scales, are central to maintaining productivity and performance in logic and memory devices. This requirement has intensified investment across the supply chain, with equipment manufacturers and foundries prioritizing light source innovation and scalability.

Market expansion is closely tied to the adoption of EUV lithography in high-volume production. Foundries and integrated device manufacturers are integrating EUV tools to meet technical and commercial requirements for advanced chips. The Light Source segment benefits from continuous R&D in plasma generation, collector optics, and power output. As fabs scale EUV deployment in 3nm and 2nm process nodes, light source reliability and throughput become core differentiators impacting production efficiency and cost per wafer.

Extreme Ultraviolet (EUV) Lithography Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Extreme Ultraviolet (EUV) Lithography market is advancing rapidly in response to rising demand for advanced semiconductor manufacturing technologies. Foundries and integrated device manufacturers across the Asia Pacific region are expanding capacity to meet the global push for smaller, more powerful chips. Countries such as Taiwan, South Korea, Japan, and China are prioritizing investments in EUV technology to reinforce their competitive positions in global semiconductor supply chains. This shift reflects the growing preference for EUV systems in sub-7nm node production processes, where precision and throughput directly influence production efficiency and yield.

Asia Pacific’s projected lead in the EUV lithography market stems from both industrial momentum and state-backed strategic initiatives. Local semiconductor ecosystems are increasingly focused on vertical integration and securing access to next-generation lithography tools. The region continues to attract technology partnerships and equipment suppliers, reinforcing its role in scaling EUV adoption. These developments position Asia Pacific as a central hub in the evolution of next-generation chip fabrication.

Active Key Players in the Extreme Ultraviolet (EUV) Lithography Market

ASML Holding (Netherlands)

Canon Inc. (Japan)

Carl Zeiss AG (Germany)

Cymer, LLC (USA)

Gigaphoton Inc. (Japan)

Intel Corporation (USA)

KLA Corporation (USA)

Lam Research Corporation (USA)

MediaTek Inc. (Taiwan)

Nikon Corporation (Japan)

NTT Advanced Technology Corporation (Japan)

Samsung Electronics Co., Ltd. (South Korea)

SK Hynix Inc. (South Korea)

Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

Tokyo Electron Limited (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Extreme Ultraviolet (EUV) Lithography Market by Equipment

4.1 Extreme Ultraviolet (EUV) Lithography Market Snapshot and Growth Engine

4.2 Extreme Ultraviolet (EUV) Lithography Market Overview

4.3 Light Source

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Light Source: Geographic Segmentation Analysis

4.4 Optics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Optics: Geographic Segmentation Analysis

4.5 Mask

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Mask: Geographic Segmentation Analysis

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Geographic Segmentation Analysis

Chapter 5: Extreme Ultraviolet (EUV) Lithography Market by End Use

5.1 Extreme Ultraviolet (EUV) Lithography Market Snapshot and Growth Engine

5.2 Extreme Ultraviolet (EUV) Lithography Market Overview

5.3 Light Source

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Light Source: Geographic Segmentation Analysis

5.4 Optics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Optics: Geographic Segmentation Analysis

5.5 Mask

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Mask: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Extreme Ultraviolet (EUV) Lithography Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ASML HOLDING (NETHERLANDS)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CANON INC. (JAPAN)

6.4 CARL ZEISS AG (GERMANY)

6.5 CYMER LLC (USA)

6.6 GIGAPHOTON INC. (JAPAN)

6.7 INTEL CORPORATION (USA)

6.8 KLA CORPORATION (USA)

6.9 LAM RESEARCH CORPORATION (USA)

6.10 MEDIATEK INC. (TAIWAN)

6.11 NIKON CORPORATION (JAPAN)

6.12 NTT ADVANCED TECHNOLOGY CORPORATION (JAPAN)

6.13 SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

6.14 SK HYNIX INC. (SOUTH KOREA)

6.15 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY (TSMC) (TAIWAN)

6.16 TOKYO ELECTRON LIMITED (JAPAN)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Extreme Ultraviolet (EUV) Lithography Market By Region

7.1 Overview

7.2. North America Extreme Ultraviolet (EUV) Lithography Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Equipment

7.2.4.1 Light Source

7.2.4.2 Optics

7.2.4.3 Mask

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size By End Use

7.2.5.1 Light Source

7.2.5.2 Optics

7.2.5.3 Mask

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Extreme Ultraviolet (EUV) Lithography Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Equipment

7.3.4.1 Light Source

7.3.4.2 Optics

7.3.4.3 Mask

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size By End Use

7.3.5.1 Light Source

7.3.5.2 Optics

7.3.5.3 Mask

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Extreme Ultraviolet (EUV) Lithography Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Equipment

7.4.4.1 Light Source

7.4.4.2 Optics

7.4.4.3 Mask

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size By End Use

7.4.5.1 Light Source

7.4.5.2 Optics

7.4.5.3 Mask

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Extreme Ultraviolet (EUV) Lithography Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Equipment

7.5.4.1 Light Source

7.5.4.2 Optics

7.5.4.3 Mask

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size By End Use

7.5.5.1 Light Source

7.5.5.2 Optics

7.5.5.3 Mask

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Extreme Ultraviolet (EUV) Lithography Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Equipment

7.6.4.1 Light Source

7.6.4.2 Optics

7.6.4.3 Mask

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size By End Use

7.6.5.1 Light Source

7.6.5.2 Optics

7.6.5.3 Mask

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Extreme Ultraviolet (EUV) Lithography Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Equipment

7.7.4.1 Light Source

7.7.4.2 Optics

7.7.4.3 Mask

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size By End Use

7.7.5.1 Light Source

7.7.5.2 Optics

7.7.5.3 Mask

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Extreme Ultraviolet (EUV) Lithography Market research report?

A1: The forecast period in the Extreme Ultraviolet (EUV) Lithography Market research report is 2024-2032.

Q2: Who are the key players in the Extreme Ultraviolet (EUV) Lithography Market?

A2: ASML Holding (Netherlands), Canon Inc. (Japan), Carl Zeiss AG (Germany), Cymer, LLC (USA), Gigaphoton Inc. (Japan), Intel Corporation (USA), KLA Corporation (USA), Lam Research Corporation (USA), MediaTek Inc. (Taiwan), Nikon Corporation (Japan), NTT Advanced Technology Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), SK Hynix Inc. (South Korea), Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan), Tokyo Electron Limited (Japan), and Other Active Players

Q3: What are the segments of the Extreme Ultraviolet (EUV) Lithography Market?

A3: The Extreme Ultraviolet (EUV) Lithography Market is segmented into Equipment, End Use, and region. By Equipment, the market is categorized into Light Source, Optics, Mask, Others. By End Use, the market is categorized into Light Source, Optics, Mask, Others. By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

Q4: What is the Extreme Ultraviolet (EUV) Lithography Market?

A4: EUV Lithography is a modern technology in manufacturing semiconductors, where manufacturing involves using an extreme ultraviolet wavelength of 13.5 nm to create very thin patterns on a microchip. It helps in the production of high-density, high-performance semiconductors needed in such features as AI, 5G, IoT, and advanced computing. EUV lithography brings in the concern of some of the issues faced by photolithography techniques, including achieving enhanced accuracy in etching the complex circuit patterns into wafers, which are required for the advanced semiconductor nodes in the industry.

Q5: How big is the Extreme Ultraviolet (EUV) Lithography Market?

A5: Extreme Ultraviolet (EUV) Lithography Market Size Was Valued at USD 12.4 Billion in 2023, and is Projected to Reach USD 63.3 Billion by 2032, Growing at a CAGR of 22.5% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!