Stay Ahead in Fast-Growing Economies.

Browse Reports NowEurope Autonomous Vehicles Market European Industry Analysis And Forecast (2025-2032)

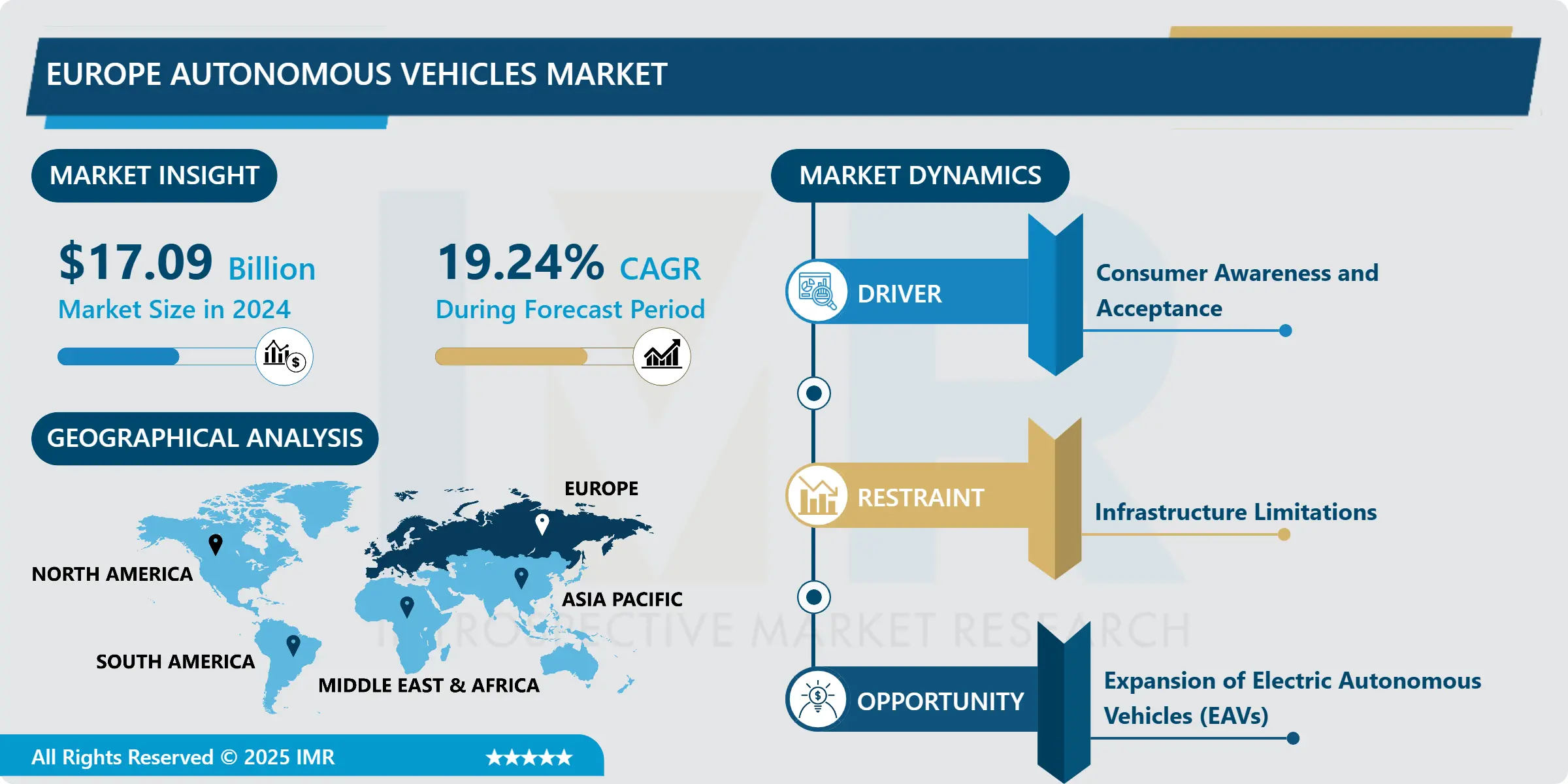

Europe Autonomous Vehicles Market Size Was Valued at USD 17.09 Billion in 2024 and is Projected to Reach USD 69.84 Billion by 2032, Growing at a CAGR of 19.24% from 2025-2032.

IMR Group

Description

Europe Autonomous Vehicles Market Synopsis:

Europe Autonomous Vehicles Market Size Was Valued at USD 17.09 Billion in 2024 and is Projected to Reach USD 69.84 Billion by 2032, Growing at a CAGR of 19.24% from 2025-2032.

Autonomous vehicles, also known as driverless cars, or self-driving cars, are vehicles that can move and navigate without human input. They can perceive their surroundings and location through a mixture of sensors, cameras, AI, and radar enabling them to travel independently. By using these systems, they can interpret the information they receive to detect obstacles and choose proper navigation paths and when to stop and start.

The Europe Autonomous Vehicles (AV) market is witnessing significant growth, driven by the region’s strong automotive heritage, rapid technological advancements, and supportive regulatory environment. Europe is home to several leading original equipment manufacturers (OEMs) such as Volkswagen, BMW, Daimler, and Renault, which are heavily investing in autonomous driving technologies to maintain competitive advantages in a rapidly evolving global market. The European Union (EU) and individual countries have been proactive in establishing regulatory frameworks and safety standards to facilitate the testing and deployment of autonomous vehicles on public roads. This regulatory clarity is encouraging both established players and startups to accelerate their research and development (R&D) efforts in the AV domain. However, the market holds strong in 2023, reaching nearly 18 million units, and reaching over18.7 million units in 2024.

Europe Autonomous Vehicles Market Growth and Trend Analysis:

Growth Driver

Consumer Awareness and Acceptance

Consumer awareness and acceptance play a crucial role in the adoption and growth of autonomous vehicles across Europe.

As the technology behind self-driving cars evolves from futuristic concepts to real-world applications, educating consumers about the benefits, safety features, and reliability of autonomous vehicles becomes essential.

Increased awareness helps to build trust in these advanced systems, which is necessary to overcome skepticism and apprehension related to handing over control to machines.

Various awareness campaigns, demonstrations, and pilot projects across European cities have contributed to gradually increasing public familiarity with autonomous vehicle technology.

Limiting Factor

Infrastructure Limitations

Infrastructure plays a pivotal role in the successful deployment and operation of autonomous vehicles (AVs). Despite Europe’s advanced road networks and technological prowess, significant infrastructure limitations pose challenges to widespread AV adoption.

Many European cities and regions lack the comprehensive smart infrastructure needed to support fully autonomous driving. This includes the insufficient availability of smart roads equipped with embedded sensors, reliable vehicle-to-everything (V2X) communication systems, and consistent road markings and signage designed specifically for AV detection and navigation.

Without these enhancements, AVs may struggle to interpret their surroundings accurately, which can compromise safety and operational efficiency.

Expansion Opportunity

Expansion of Electric Autonomous Vehicles (EAVs)

The convergence of electric vehicle (EV) technology with autonomous driving systems is creating a transformative opportunity within the European automotive landscape.

As governments across Europe aggressively push for carbon neutrality and stricter emissions regulations, the shift towards electric mobility is accelerating. This transition aligns perfectly with the development of autonomous vehicles, many of which are designed from the ground up as electric platforms.

Electric autonomous vehicles (EAVs) offer numerous advantages, including reduced environmental impact, lower operational costs, and enhanced integration with smart city infrastructure, positioning them as a key growth area in Europe’s AV market.

Challenge Barrier

High Development and Deployment Costs

The autonomous vehicles (AV) market in Europe faces substantial financial challenges stemming from the high costs associated with developing and deploying AV technologies. Designing, testing, and manufacturing autonomous vehicles requires significant investment in advanced hardware components such as LiDAR sensors, radar systems, cameras, and onboard computing units.

These components are not only expensive but also require continuous upgrades to enhance vehicle perception and decision-making capabilities.

Additionally, software development, including AI algorithms and machine learning models critical for autonomous driving, demands extensive research and specialized expertise, adding to the overall development cost.

Europe Autonomous Vehicles Market Segment Analysis:

Europe Autonomous Vehicles Market Is Segmented Based On Vehicle Type, Autonomy Level, Propulsion Type, End-Users, Sales Channels And Region

By Type, Passenger Vehicles Segment is Expected to Dominate the Market During the Forecast Period

The market’s segmentation includes passenger cars, and commercial vehicles. Among these, passenger vehicle is expected to dominate the market share due to rising consumer interest and increasing availability of semi-autonomous and fully autonomous models.

In the European autonomous vehicle market, passenger vehicles currently hold a larger share than commercial vehicles, with approximately 65-70% of the market revenue in 2024. This is because European consumers show strong interest in advanced driver-assistance systems (ADAS) and semi-autonomous features in personal vehicles, driving rapid adoption. The luxury and mainstream passenger car markets have embraced these technologies as selling points, appealing to safety, convenience, and status-conscious buyers

While commercial autonomous vehicles are a fast-growing segment, they face higher barriers to entry, including stricter safety regulations, higher upfront costs, and the need for specialized infrastructure. These factors have slowed their widespread adoption relative to passenger vehicles

However, the commercial vehicle segment is rapidly gaining traction as industries seek to leverage AVs for logistics efficiency, reduced operational costs, and enhanced safety.

By Propulsion Type, Internal Combustion Engine (ICE) Segment Held the Largest Share in 2024

In the European autonomous vehicle market, the Internal Combustion Engine (ICE) vehicle segment held the largest share in 2024, accounting for approximately 60% of the market. ICE-powered autonomous vehicles remain dominant due to their affordability, established refuelling infrastructure, and extended range, making them especially suitable for long-distance operations. This advantage has facilitated broader testing and adoption across diverse environments, particularly in early-stage research and deployment phases.

However Internal Combustion Engine (ICE) vehicles continue to hold the largest share of the market in 2024, but their dominance is declining as electric and hybrid vehicles gain traction.

Europe Autonomous Vehicles Market Regional Insights:

Western Europe is Expected to Dominate the Market Over the Forecast Period

The region is characterized by significant investments in R&D, city mobility programs, and green policies. Innovation hubs in cities like Munich and Gothenburg are advancing AI-powered mobility, and there is strong EU support for cross-border standardization and interoperability. The EU’s efforts to harmonize regulations across member states foster a unified approach to autonomous vehicle deployment, further accelerating market growth

Countries such as Germany, France, the Netherlands, and Sweden are at the forefront of adoption and innovation, driven by strong automotive industries, government support, and advanced infrastructure

Western Europe adopted a pace that is moderated by factors such as highly developed infrastructure, High investment levels, and regulatory readiness compared to Eastern Europe

Europe Autonomous Vehicles Market Active Players:

Audi (Germany)

BMW Group (Germany)

Daimler Ag / Mercedes-Benz (Germany)

Ford Motor Company (U.S.)

General Motors (U.S.)

Honda Motor Company (Japan)

Hyundai Motor Company (South Korea)

Iveco (Italy)

Man Truck & Bus (Germany)

Nissan Motor Corporation (Japan)

Renault Group (France)

Scania (Sweden)

Stellantis (Netherlands)

Tesla, Inc. (U.S.)

Toyota Motor Corporation (Japan)

Volkswagen Group (Germany)

Volvo Car Corporation (Sweden)

Other Active Players

Key Industry Developments in the European Autonomous Vehicles Market:

In March 2025, Renault, in collaboration with WeRide, is testing a driverless minibus in central Barcelona. The vehicle, equipped with 10 cameras and eight lidars, offers free rides on a 2.2 km circular route, demonstrating the viability of autonomous public transport in European cities.

In May 2025, The European Commission announced the launch of the European Connected and Autonomous Vehicle Alliance. This alliance brings together stakeholders from across the automotive value chain to develop shared software and hardware solutions, fostering collaboration and potentially paving the way for future strategic partnerships and consolidations

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Europe Autonomous Vehicles Market by Vehicle Type (2018-2032)

4.1 Europe Autonomous Vehicles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passenger Vehicles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Commercial Vehicles (Light Commercial Vehicles (LCVS)

4.5 Heavy Commercial Vehicles (HCVS))

Chapter 5: Europe Autonomous Vehicles Market by Autonomy Level (2018-2032)

5.1 Europe Autonomous Vehicles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Level 1 (Driver Assistance)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Level 2 (Partial Automation)

5.5 Level 3 (Conditional Automation)

5.6 Level 4 (High Automation)

5.7 Level 5 (Full Automation))

Chapter 6: Europe Autonomous Vehicles Market by Propulsion Type (2018-2032)

6.1 Europe Autonomous Vehicles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Electric Vehicles (EVS)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hybrid Vehicles

6.5 Internal Combustion Engine (ICE) Vehicle

6.6 Alternative Fuel Vehicles)

Chapter 7: Europe Autonomous Vehicles Market by End-User (2018-2032)

7.1 Europe Autonomous Vehicles Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Individual

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

Chapter 8: Europe Autonomous Vehicles Market by Sales Channels (2018-2032)

8.1 Europe Autonomous Vehicles Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Direct Sales

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Dealership Networks

8.5 Online Sales

8.6 Government & Public Tenders

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Europe Autonomous Vehicles Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 AUDI (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 BMW GROUP (GERMANY)

9.4 DAIMLER AG / MERCEDES-BENZ (GERMANY)

9.5 FORD MOTOR COMPANY (U.S.)

9.6 GENERAL MOTORS (U.S.)

9.7 HONDA MOTOR COMPANY (JAPAN)

9.8 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

9.9 IVECO (ITALY)

9.10 MAN TRUCK & BUS (GERMANY)

9.11 NISSAN MOTOR CORPORATION (JAPAN)

9.12 RENAULT GROUP (FRANCE)

9.13 SCANIA (SWEDEN)

9.14 STELLANTIS (NETHERLANDS)

9.15 TESLA

9.16 INC. (U.S.)

9.17 TOYOTA MOTOR CORPORATION (JAPAN)

9.18 VOLKSWAGEN GROUP (GERMANY)

9.19 VOLVO CAR CORPORATION (SWEDEN)

9.20 OTHER ACTIVE PLAYERS

Chapter 10: Global Europe Autonomous Vehicles Market By Region

10.1 Overview

10.2. Eastern Europe Europe Autonomous Vehicles Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 Russia

10.2.4.2 Bulgaria

10.2.4.3 The Czech Republic

10.2.4.4 Hungary

10.2.4.5 Poland

10.2.4.6 Romania

10.2.4.7 Rest of Eastern Europe

10.3. Western Europe Europe Autonomous Vehicles Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Germany

10.3.4.2 UK

10.3.4.3 France

10.3.4.4 The Netherlands

10.3.4.5 Italy

10.3.4.6 Spain

10.3.4.7 Rest of Western Europe

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Analyst Viewpoint and Conclusion

Chapter 14 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 15 Case Study

Chapter 16 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

Q1: What is the Forecast Period Covered in the Europe Autonomous Vehicles Market Research Report?

A1: The projected forecast period for the Europe Autonomous Vehicles Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Europe Autonomous Vehicles Market?

A2: Audi (Germany), BMW Group (Germany), Daimler Ag / Mercedes-Benz (Germany), Ford Motor Company (U.S.), General Motors (U.S.), Honda Motor Company (Japan), Hyundai Motor Company (South Korea), Iveco (Italy), Man Truck & Bus (Germany), Nissan Motor Corporation (Japan), Renault Group (France), Scania (Sweden), Stellantis (Netherlands), Tesla, Inc. (U.S.), Toyota Motor Corporation (Japan), Volkswagen Group (Germany), Volvo Car Corporation (Sweden), and Other Active Players.

Q3: How is the Europe Autonomous Vehicles Market segmented?

A3: The Europe Autonomous Vehicles Market is segmented into Type, Nature, Application, and Region. By Vehicle Type, the market is categorized into Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicles (LCVS), and Heavy Commercial Vehicles (HCVS))). By Autonomy Level, the market is categorized into Level 1 (Driver Assistance), Level 2 (Partial Automation), Level 3 (Conditional Automation), Level 4 (High Automation), and Level 5 (Full Automation). Propulsion Type, the market is categorized into Electric Vehicles (EVS), Hybrid Vehicles, Internal Combustion Engine (ICE) Vehicle, and Alternative Fuel Vehicles. By End-User, the market is categorized into Individual, Commercial, and Industrial. By Sales Channels, the market is categorized into Direct Sales, Dealership Networks, Online Sales, and Government & Public Tenders. By Region, it is analyzed across Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe)

Q4: What defines the Autonomous Vehicles Market?

A4: Autonomous vehicles, also known as driverless cars, or self-driving cars, are vehicles that can move and navigate without human input. They can perceive their surroundings and location through a mixture of sensors, cameras, AI, and radar enabling them to travel independently. By using these systems, they can interpret the information they receive to detect obstacles and choose proper navigation paths and when to stop and start.

Q5: What is the market size of the Europe Autonomous Vehicles Market?

A5: Europe's Autonomous Vehicles Market Size Was Valued at USD 17.09 Billion in 2024 and is Projected to Reach USD 69.84 Billion by 2032, Growing at a CAGR of 19.24% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!