Stay Ahead in Fast-Growing Economies.

Browse Reports NowEurope Autonomous Truck Market Industry Analysis and Forecast (2025-2032)

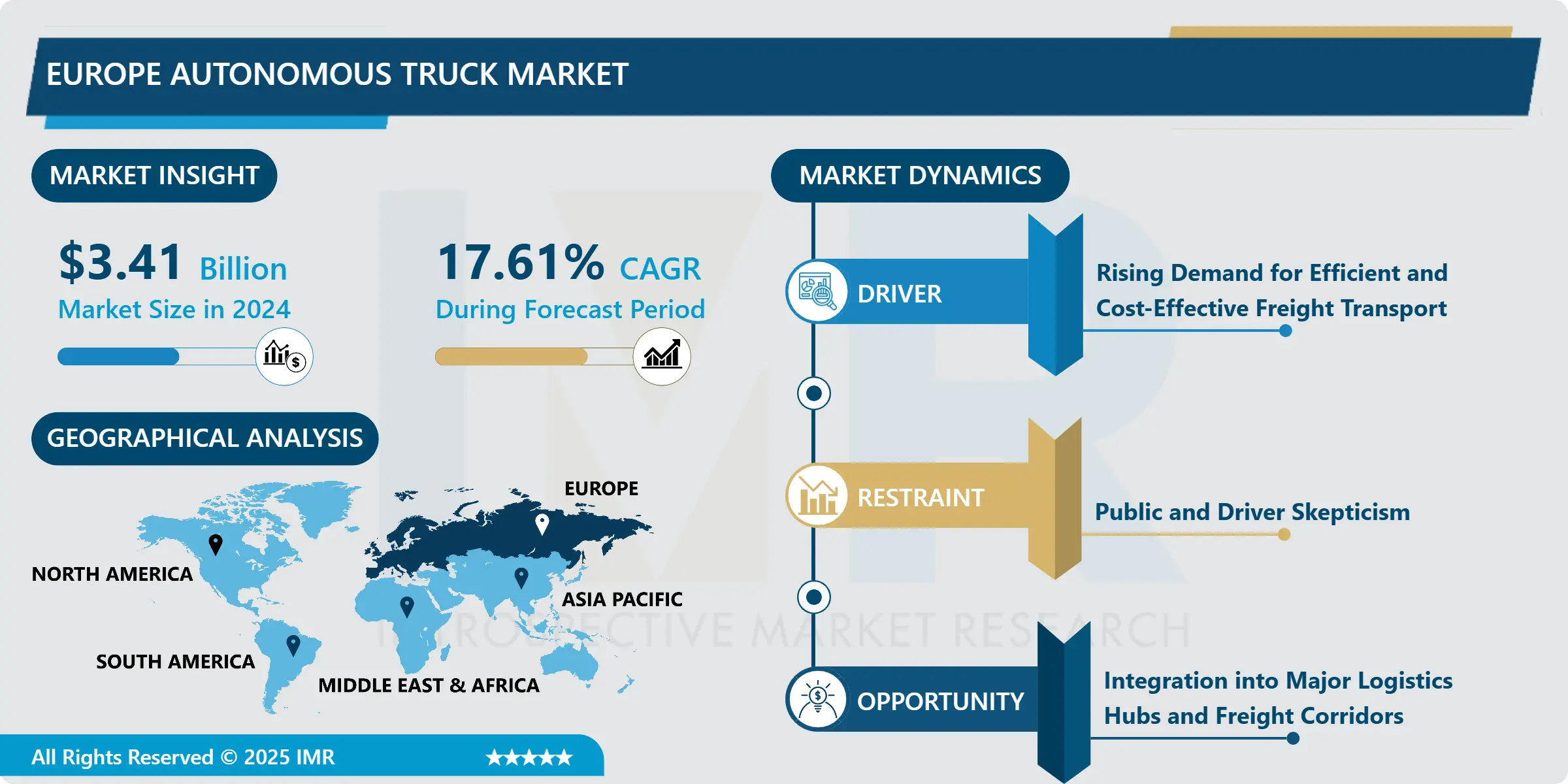

Europe Autonomous Truck Market Size Was Valued at USD 3.41 Billion in 2024, and is Projected to Reach USD 12.48 Billion by 2032, Growing at a CAGR of 17.61% from 2025-2032.

IMR Group

Description

Europe Autonomous Truck Market Synopsis:

Europe Autonomous Truck Market Size Was Valued at USD 3.41 Billion in 2024, and is Projected to Reach USD 12.48 Billion by 2032, Growing at a CAGR of 17.61% from 2025-2032.

The European autonomous truck market refers to the industry of developing, deploying and commercialising self-driving and heavy-duty vehicles for freight transportation in Europe. Level 4 trucks operate fully autonomously with no human intervention, or as hybrid vehicles partially helped by human interaction, using technologies such as sensors, artificial intelligence (AI), and machine learning (ML) to aid their operation.

Europe’s autonomous truck market is shaped by several key factors. The continent’s extensive and well-maintained highway infrastructure facilitates the deployment of autonomous trucks, especially for long-haul freight transport. Moreover, Europe’s robust logistics ecosystem, characterized by major ports like Rotterdam, Hamburg, and Antwerp, as well as numerous cross-border trade corridors, underscores the critical role trucks play in supply chain operations. Autonomous trucks have the potential to significantly increase efficiency in these hubs by enabling continuous operations, reducing driver shortages, and optimizing freight movement. In addition, stringent European Union regulations on vehicle emissions and road safety are accelerating the shift towards more sustainable and intelligent transportation solutions, making autonomous trucks an attractive proposition for fleet operators aiming to comply with these evolving standards.

However, the market also faces challenges that must be navigated for widespread adoption. Regulatory frameworks for autonomous vehicles in Europe are still evolving, with differing policies across member states adding complexity to cross-border operations

The graph above demonstrates the data on new commercial vehicle registrations in Europe from 2020 to 2024 reveals a steady recovery and growth trend, with units increasing from 25,37,257 in 2020 to 30,57,122 in 2024. This upward trajectory reflects a resilient commercial vehicle market, likely driven by rising demand for efficient logistics and transportation solutions.

Source: International Organization of Motor Vehicle Manufacturers

Europe Autonomous Truck Market Growth and Trend Analysis:

Growth Driver

Rising Demand for Efficient and Cost-Effective Freight Transport

The rapid growth of e-commerce, cross-border trade, and just-in-time manufacturing across Europe is driving an urgent need for more efficient and cost-effective freight transport solutions.

Traditional trucking operations are facing increasing pressure to deliver faster, more reliably, and at lower costs, all while navigating challenges such as urban congestion, driver shortages, and rising fuel prices.

Autonomous trucks present a compelling solution to this demand, offering the ability to operate continuously without mandated rest breaks, thereby significantly improving asset utilization and delivery timelines. Autonomous trucks are expected to optimize fuel efficiency through consistent driving patterns and route optimization algorithms.

Limiting Factor

Public and Driver Skepticism

One of the significant barriers to the widespread adoption of autonomous trucks in Europe is disbelief among both the general public and professional drivers. Despite advancements in autonomous driving technologies, many people remain wary of entrusting heavy-duty vehicles to machines, especially on shared roads.

Concerns over safety, such as the ability of autonomous systems to respond to unexpected situations or prevent accidents, contribute to resistance. High-profile incidents involving autonomous vehicles globally have amplified fears, leading to public hesitation about co-existing with driverless trucks on highways or in urban environments.

In parallel, professional truck drivers and labor unions often perceive autonomous trucks as a direct threat to job security.

Opportunity

Integration into Major Logistics Hubs and Freight Corridors

Europe’s highly developed network of logistics hubs and freight corridors presents a significant opportunity for the deployment of autonomous trucks.

Major ports like Rotterdam, Hamburg, and Antwerp, along with inland hubs in regions such as the Ruhr Valley and Northern Italy, serve as critical nodes in the continent’s supply chain. These areas handle immense volumes of goods and rely heavily on road transport to facilitate swift and efficient movement of freight.

Autonomous trucks are well-suited to operate on the well-maintained highways and dedicated freight routes connecting these hubs, especially for repetitive, high-volume routes where consistency and reliability are key.

Challenge

High Development and Deployment Costs

The development and deployment of autonomous trucks involve substantial financial investment, posing a significant challenge to their widespread adoption in Europe.

Building a functional autonomous truck requires the integration of numerous advanced technologies such as LiDAR sensors, high-resolution cameras, radar systems, onboard AI processors, and fail-safe backup systems.

These components are not only expensive individually but also require rigorous calibration and testing to ensure reliability and safety in diverse real-world conditions. Additionally, the costs of software development, including perception, navigation, decision-making algorithms, and cybersecurity measures, further add to the financial burden.

Europe Autonomous Truck Market Segment Analysis:

Europe Autonomous Truck Market is segmented based on Truck Type, Automation Level, Propulsion Type, Application, End-Users, Sales Channel and Region

By Truck Type, Heavy-Duty Truck Segment is Expected to Dominate the Market During the Forecast Period

Heavy-duty truck segment maintained and dominated their status as the major vehicle in the European autonomous truck sector, while also repeating their dominant global position in 2024. The strength of heavy-duty trucks in Europe focus on long-haul freight transport, where these vehicles will play a leading role.

The accelerated demand for sustainable and cost-efficient transport solutions have impacted the pace of heavy-duty truck deployments autonomously throughout Europe, with favorable AI, sensors, fleet management systems, etc. The integration of these trucks into construction and industrial logistics is growing, where they provide monitoring consistency, effective transport, and high payload.

By Application, Long-Haul Freight Segment Held the Largest Share in 2024

Long-Haul Freight Segment is expected to dominate the European autonomous truck market in 2024, reflecting the strong conditions for cross-border trade and international logistics. The need for efficient long-distance transport across multiple European nations makes long-haul routes particularly fit for autonomous trucking solutions.

However, supportive European policies, as outlined under the trans-European transport network, and increased investment in smart road infrastructure have improved the ability to incorporate autonomous technologies into long-haul operations. These factors will continue to facilitate Europe’s global leadership in the adoption and deployment of autonomous long-haul freight solutions.

Europe Autonomous Truck Market Regional Insights:

Western Europe is Expected to Dominate the Market Over the Forecast Period

Western Europe dominated the European autonomous truck market due to multiple structural and strategic advantages. The region’s automotive industry, which is large, helped accelerate the development of autonomous technologies.

The regulatory and investment roles of government in Western Europe stimulated the control for commercial freight, and autonomous truck commercialization. Governments have funded smart infrastructure, cooperated on pilot initiatives, and developed wide-ranging regulatory systems. Thus, the adoption and commercialization of autonomous freight in Western Europe was seamless.

Europe Autonomous Truck Market Active Players:

Daf trucks (Netherlands)

Einride (Sweden)

Iveco (Italy)

Man truck & bus (Germany)

Mercedes-benz (Germany)

Renault trucks (France)

Scania (Sweden)

Volvo trucks (Sweden)

Other Active Players

Key Industry Developments in the Europe Autonomous Truck Market:

In February 2025, Volvo Autonomous Solutions announced a partnership with Waabi under which Waabi will integrate its self-driving technology into Volvo’s autonomous trucks. This partnership targeted determined driver shortages and rising logistics costs, aligning with Europe’s growing push for automation in freight transport and supportive regulatory momentum.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter’s Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Europe Autonomous Truck Market by Truck Type (2018-2032)

4.1 Europe Autonomous Truck Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Light-duty trucks

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium-duty trucks

4.5 Heavy-duty trucks

Chapter 5: Europe Autonomous Truck Market by Automation Level (2018-2032)

5.1 Europe Autonomous Truck Market Snapshot and Growth Engine

5.2 Market Overview

5.3 level 1 (Driver Assistance)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Level 2 (Partial Automation)

5.5 Level 3 (Conditional Automation)

5.6 Level 4 (High Automation)

5.7 Level 5 (Full Automation)

Chapter 6: Europe Autonomous Truck Market by Propulsion Type (2018-2032)

6.1 Europe Autonomous Truck Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Electric

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hybrid

6.5 Diesel and Alternative Fuels

6.6 Hydrogen Fuel Cell

Chapter 7: Europe Autonomous Truck Market by Application (2018-2032)

7.1 Europe Autonomous Truck Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Long-Haul Freight

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Urban Logistics/Delivery

7.5 Port And Terminal Operations

7.6 Mining and Industrial Use

7.7 and Others

Chapter 8: Europe Autonomous Truck Market by End-User (2018-2032)

8.1 Europe Autonomous Truck Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Logistics Companies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Retail & E-Commerce

8.5 Mining & Construction Firms

8.6 Government/Military

8.7 Others

Chapter 9: Europe Autonomous Truck Market by Sales Channels (2018-2032)

9.1 Europe Autonomous Truck Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Direct Sales

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Dealership Networks

9.5 Online Sales

9.6 Government & Public Tenders

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Europe Autonomous Truck Market Share by Manufacturer/Service Provider(2024)

10.1.3 Industry BCG Matrix

10.1.4 PArtnerships, Mergers & Acquisitions

10.2 DAF TRUCKS (NETHERLANDS)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Recent News & Developments

10.2.10 SWOT Analysis

10.3 EINRIDE (SWEDEN)

10.4 IVECO (ITALY)

10.5 MAN TRUCK & BUS (GERMANY)

10.6 MERCEDES-BENZ (GERMANY)

10.7 RENAULT TRUCKS (FRANCE)

10.8 SCANIA (SWEDEN)

10.9 VOLVO TRUCKS (SWEDEN) AND OTHER ACTIVE PLAYERS

Chapter 11: Global Europe Autonomous Truck Market By Region

11.1 Overview

11.2. Eastern Europe Europe Autonomous Truck Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecast Market Size by Country

11.2.4.1 Russia

11.2.4.2 Bulgaria

11.2.4.3 The Czech Republic

11.2.4.4 Hungary

11.2.4.5 Poland

11.2.4.6 Romania

11.2.4.7 Rest of Eastern Europe

11.3. Western Europe Europe Autonomous Truck Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecast Market Size by Country

11.3.4.1 Germany

11.3.4.2 UK

11.3.4.3 France

11.3.4.4 The Netherlands

11.3.4.5 Italy

11.3.4.6 Spain

11.3.4.7 Rest of Western Europe

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 14 Analyst Viewpoint and Conclusion

Chapter 15 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Chapter 16 Case Study

Chapter 17 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

Q1: What is the Forecast Period Covered in the Europe Autonomous Truck Market Research Report?

A1: The projected forecast period for the Europe Autonomous Truck Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Europe Autonomous Truck Market?

A2: Daf trucks (Netherlands), Einride (Sweden), Iveco (Italy), Man truck & bus (Germany), Mercedes-benz (Germany), Renault trucks (France), Scania (Sweden), Volvo trucks (Sweden) and Other Active Players

Q3: How is the Europe Autonomous Truck Market segmented?

A3: The Europe Autonomous Truck Market is segmented into Truck Type, Automation Level, Propulsion Type, Application, End-Users, Sales Channel and Region. By Truck Type, the market is categorized into Light-duty trucks, Medium-duty trucks, Heavy-duty trucks. By Automation Level, the market is categorized into level 1: Driver Assistance, Level 2: Partial Automation, Level 3: Conditional Automation, Level 4: High Automation, Level 5: Full Automation. By Propulsion Type, the market is categorised into Electric, Hybrid, Diesel and Alternative Fuels, Hydrogen Fuel Cell. By Application, the market is categorized into Long-Haul Freight, Urban Logistics/Delivery, Port and Terminal Operations, Mining and Industrial Use. By End-User, the market is categorized into Logistics Companies, Retail & E-Commerce, Mining & Construction Firms, Government/Military. By Sales Channels, the market is categorized into Direct Sales, Dealership Networks, Online Sales, Government & Public Tenders. By Region, it is analyzed across Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe)

Q4: What defines the Europe Autonomous Truck Market?

A4: The European autonomous truck market refers to the industry of developing, deploying and commercializing self-driving heavy-duty vehicles for freight transportation in Europe. Level 4 trucks can operate either fully autonomously with no human intervention, or as hybrid vehicles partially aided by human interaction, using technologies such as sensors, artificial intelligence (AI), and machine learning (ML) to help their operation.

Q5: What is the market size of the Europe Autonomous Truck Market?

A5: Europe Autonomous Truck Market Size Was Valued at USD 3.41 Billion in 2024, and is Projected to Reach USD 12.48 Billion by 2032, Growing at a CAGR of 17.61% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!