Stay Ahead in Fast-Growing Economies.

Browse Reports NowEnterprise Risk Management Market Report 2025-2032 | Insights & Analysis

ERM can be described as a systematic approach used by an enterprise to handle different risks that might affect the accomplishment of goals and objectives. ERM relates all kinds of risks such as strategic risks, operational risks, financial risks, and compliance risks

IMR Group

Description

Enterprise Risk Management Market Synopsis

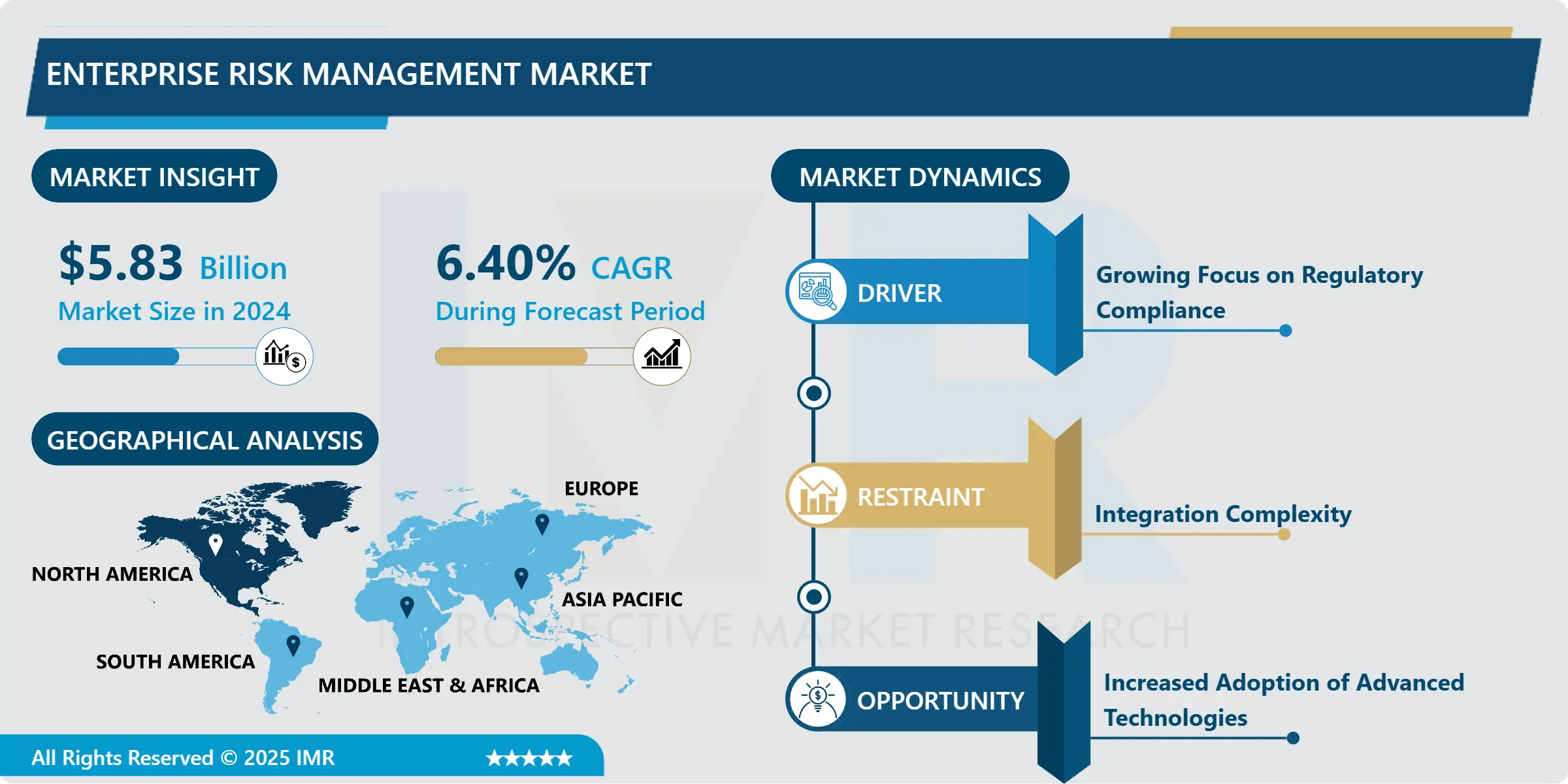

Enterprise Risk Management Market Size Was Valued at USD 5.83 Billion in 2024 and is Projected to Reach USD 9.58 Billion by 2032, Growing at a CAGR of 6.40% From 2025-2032.

ERM can be described as a systematic approach used by an enterprise to handle different risks that might affect the accomplishment of goals and objectives. ERM relates all kinds of risks such as strategic risks, operational risks, financial risks, and compliance risks and links risk management procedures to all aspects of working of the organization. ERM is therefore established as a process whose main objective is to maximize value through the improvement of the organisation’s capability to address risks and capitalize on opportunities.

The market of ERM is growing as quickly as organizations begin to evaluate the necessity for a productive framework to address risk management. ERM is the process of dealing with uncertainty and any risks attached to it and provides organizations with ways of achieving their goals, making sound decisions, and improving governance. Cos’ business activities are becoming more intricate, increase in legal requirements, and the focus on sustainable development are the main reasons for ERM usage across the fields of finance, healthcare, manufacturing, and technology.

The second factor affecting the ERM market is rising regulations or in other words, ‘’Regulatory pressures. ” Administrative authorities across the globe are focusing on the increased standard of risk operations to safeguard its structures and those involved in the financial markets. For instance, banks all over the world have been affected by the Basel III accord while the USA has been influenced by the practices that were put in place by the Sarbanes Oxley Act. Also, ERM is gaining more recognition among organizations for managing risks in different areas, thus reducing loss, increasing organizational efficiency, and sustaining competitive advantage. Increasing use of AI/ML and big data analytics in ERM solutions is also positively impacting market growth by offering better risk evaluation and risk modeling.

Coupled with this, the COVID-19 19pandemic has brought more emphasis on the effectiveness of ERM frameworks of organizations. The COVID-19 case has revealed weaknesses in supply chains, employees, and organizations’ financial stability, and as a result, risk management strategies have been reconsidered. Therefore, there is an increased demand for ERM solutions that are capable of offering risk analysis and assistance in continuity management. Businesses are paying much attention to constructing sustainable ERM frameworks that will help organizations handle existing risks and future risks as well.

The market for ERM is expanding fast because of increasing cloud solutions adoption. Some of the major benefits of cloud-based ERM platforms include; scalability, flexibility, and cost-effectiveness due to which organizations of all sizes display interest in getting them. These platforms facilitate real-time risk monitoring, reporting, and the coordination of tasks between different risk management teams and hence positively influence the efficiency of ERM processes. In the same vein, ERM implementation in compliance, internal audit, and governance functions is pushing the market for best practices in global organizations forward.

It can be said that the ERM market will experience significant growth in the future since organizations need expert help to solve the challenges of the contemporary business world. More and more enterprises have to follow stringent regulatory guidelines; & advanced technologies are driving the need for a robust ERM Market. Speaking of risk management, the need for effective and sophisticated, eco-friendly and integrated, and technologically advanced ERM solutions will grow as organizations keep on focusing on the issue in the future.

Enterprise Risk Management Market Trend Analysis

Enterprise Risk Management Market Growth Drivers- Growing Focus on Regulatory Compliance

Currently, the market of ERM solutions is gradually shifting towards focusing on compliance with the requirements of various jurisdictions, which has become more stringent in the context of the globalization of businesses and their growing awareness of operational risks. Different companies in all industries are increasingly appreciating the need to abide by the regulatory requirement because of legal repercussions, loss-making, and a blow to reputation. This trend is driving the need to find an ERM solution that is capable of including regulatory issues in its framework. These solutions help the firms to pursue effectiveness, monitor potential risks, and adhere to the new laws and regulations systematically.

The positive increase in the integration of other advanced technologies like artificial intelligence, machine learning, and data analysis in ERM platforms is also contributing towards better handling of compliance risk. This growing stress on legal compliance is not only assisting organizations to protect their interests but is also putting stress on risk consciousness. Therefore, the market of ERM is in a state of continuous development, and many companies have bought complex facilities or approaches aiming at enacting legitimate systems for achieving everlasting development.

Enterprise Risk Management Market Opportunities- Increased Adoption of Advanced Technologies

The higher risk management maturity for various businesses is the primary reason for the expansion of the Enterprise Risk Management (ERM) market, utilizing enhanced technologies. AI, ML, big data analytics, and blockchain are some of the innovations that have changed how organizations diagnose, analyze, and tackle risks. AI and ML facilitate the use of predictive analytic models as they help reach beyond the simplistic risk assessment and provide better risk insights with big data and pattern identification capabilities that may exist beyond the recognition of human analysts.

Big data is used to manage and isolate substantial amounts of data; therefore, it is useful in monitoring risk and making better decisions in real-time. Smart contracts provide data immutability, and, therefore, protect transactional information and data related to risks as transparent and unchangeable records. Furthermore, cloud computing has also been incorporated into most ERM solutions offering convenience and scalability to Organizations since risks can be managed from various locations and using different devices. These emerging technologies cover the effectiveness, quality, and reliability of ERM procedures, allowing organizations to identify and manage risks successfully, protect the company’s assets, and guarantee business sustainability in the interrelated business world.

Enterprise Risk Management Market Segment Analysis:

Enterprise Risk Management Market is Segmented based on Component, Deployment Mode, Organization Size, Risk Type, and Industry Vertical.

By Component, the service segment is expected to dominate the market during the forecast period

The Enterprise Risk Management (ERM) market is primarily segmented into two key components: software and services are the two categories of the IT industry that have been considered in this paper. ERMS software solutions include a broad category of tools that pertain to risk identification, evaluation, monitoring, and management in an organization. Such products may be risk assessment software, compliance management systems, and others that provide forecasts and analyses. On the other hand, ERM services define the consulting, implementation, training as well as support that is offered by either specialized ERM firms or organizations’ internal ERM teams.

This is because services are instrumental in refining ERM frameworks for the organization’s unique requirements, in facilitating the integration of software solutions for maximum effectiveness, and in the ongoing enhancement of the risk management processes. Overall, both software and services in the ERM market provide solutions for the rising need for effective risk management approaches that can boost organizational resistance and compliance with different standards on the international level.

By Risk Type, Strategic Risk segment held the largest share in 2024

The Enterprise Risk Management (ERM) market analysis divides risks into strategic, financial, operating, compliance, and brand risks. This entails risks arising from operation threats that are likely to impact any strategic plan and position of any firm within its market. When discussing financial risks, it is necessary to speak about the probability of facing a loss on the financial instrument because of fluctuations in the market, credit risks, along possible problems with sources of financing. Operational risks include the risks that are likely to threaten business operations due to internal factors such as processes, systems, or people.

Compliance risks are associated with the failure to follow the laws, rules as well as organizational policies, and this may end up costing the company monetarily or in terms of reputation. Richard’s reputational risk includes the possible unfavorable public opinion and reduced brand value expected due to unfavorable publicity, ethical scandal, or dissatisfied customers. The ERM market meets these various risk types by providing structures and solutions that allow firms to examine, evaluate, manage, and monitor risks so that they can adapt to change and increase resilience and sustainability in a business world that is periodically caught in the crosshairs of various risks.

Enterprise Risk Management Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The Study Objectives of this Enterprise Risk Management (ERM) market are as follows: Currently, North America is dominating the Enterprise Risk Management (ERM) market, but this is expected to remain so in the forecast period. This leadership is due to several factors, among them being the region’s strong NC requirement felt across industries due to strongly developed regulations. Furthermore, the North American region comprises a highly developed and technologically sound environment enabling the implementation of innovative yet advanced ERM solutions catering to the specific requirements of the organizations. The presence of such players and huge investments made in the Research & Development processes also help to strengthen the growth line of the market.

Also, increased consciousness about cyber risks and compliance standards has persisted to make more corporations in the region seek more advanced ERM solutions. While organizations are continuously trying to improve business continuity and protect against risks, the North American region continues to push developments and advance the knowledge on ERM, remaining the key enabler of market growth across the world.

Active Key Players in the Enterprise Risk Management Market

IBM Corporation – USA

SAP SE – Germany

Oracle Corporation – USA

Microsoft Corporation – USA

RSA Security LLC (a Dell Technologies company) – USA

MetricStream Inc. – USA

SAS Institute Inc. – USA

Lockpath Inc. – USA

LogicManager Inc. – USA, and Other Active Players

Key Industry Developments in the Enterprise Risk Management Market

In June 2023, Federal bank regulatory agencies jointly issued comprehensive guidance to assist banking organizations in managing risks associated with third-party relationships, including those involving financial technology firms. This guidance includes practical examples tailored to help community banks align their risk management strategies with the specific risks posed by their third-party relationships

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Enterprise Risk Management Market by Component (2018-2032)

4.1 Enterprise Risk Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Enterprise Risk Management Market by Deployment Mode (2018-2032)

5.1 Enterprise Risk Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-Premises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud-based

Chapter 6: Enterprise Risk Management Market by Organization Size (2018-2032)

6.1 Enterprise Risk Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium-sized Enterprises (SMEs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Enterprise Risk Management Market by Risk Type (2018-2032)

7.1 Enterprise Risk Management Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Strategic Risk

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Financial Risk

7.5 Operational Risk

7.6 Compliance Risk

7.7 Reputational Risk

Chapter 8: Enterprise Risk Management Market by Industry Vertical (2018-2032)

8.1 Enterprise Risk Management Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Banking

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Financial Services

8.5 and Insurance (BFSI)

8.6 Healthcare

8.7 Manufacturing

8.8 IT and Telecom

8.9 Government and Public Sector

8.10 Energy and Utilities

8.11 Retail and Consumer Goods

8.12 Transportation and Logistics

8.13 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Enterprise Risk Management Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 IBM CORPORATION – USA

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 SAP SE – GERMANY

9.4 ORACLE CORPORATION – USA

9.5 MICROSOFT CORPORATION – USA

9.6 RSA SECURITY LLC (A DELL TECHNOLOGIES COMPANY) – USA

9.7 METRICSTREAM INC. – USA

9.8 SAS INSTITUTE INC. – USA

9.9 LOCKPATH INC. – USA

9.10 LOGICMANAGER INC. – USA

9.11 AND OTHER KEY PLAYERS

Chapter 10: Global Enterprise Risk Management Market By Region

10.1 Overview

10.2. North America Enterprise Risk Management Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Component

10.2.4.1 Software

10.2.4.2 Services

10.2.5 Historic and Forecasted Market Size by Deployment Mode

10.2.5.1 On-Premises

10.2.5.2 Cloud-based

10.2.6 Historic and Forecasted Market Size by Organization Size

10.2.6.1 Small and Medium-sized Enterprises (SMEs)

10.2.6.2 Large Enterprises

10.2.7 Historic and Forecasted Market Size by Risk Type

10.2.7.1 Strategic Risk

10.2.7.2 Financial Risk

10.2.7.3 Operational Risk

10.2.7.4 Compliance Risk

10.2.7.5 Reputational Risk

10.2.8 Historic and Forecasted Market Size by Industry Vertical

10.2.8.1 Banking

10.2.8.2 Financial Services

10.2.8.3 and Insurance (BFSI)

10.2.8.4 Healthcare

10.2.8.5 Manufacturing

10.2.8.6 IT and Telecom

10.2.8.7 Government and Public Sector

10.2.8.8 Energy and Utilities

10.2.8.9 Retail and Consumer Goods

10.2.8.10 Transportation and Logistics

10.2.8.11 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Enterprise Risk Management Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Component

10.3.4.1 Software

10.3.4.2 Services

10.3.5 Historic and Forecasted Market Size by Deployment Mode

10.3.5.1 On-Premises

10.3.5.2 Cloud-based

10.3.6 Historic and Forecasted Market Size by Organization Size

10.3.6.1 Small and Medium-sized Enterprises (SMEs)

10.3.6.2 Large Enterprises

10.3.7 Historic and Forecasted Market Size by Risk Type

10.3.7.1 Strategic Risk

10.3.7.2 Financial Risk

10.3.7.3 Operational Risk

10.3.7.4 Compliance Risk

10.3.7.5 Reputational Risk

10.3.8 Historic and Forecasted Market Size by Industry Vertical

10.3.8.1 Banking

10.3.8.2 Financial Services

10.3.8.3 and Insurance (BFSI)

10.3.8.4 Healthcare

10.3.8.5 Manufacturing

10.3.8.6 IT and Telecom

10.3.8.7 Government and Public Sector

10.3.8.8 Energy and Utilities

10.3.8.9 Retail and Consumer Goods

10.3.8.10 Transportation and Logistics

10.3.8.11 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Enterprise Risk Management Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Component

10.4.4.1 Software

10.4.4.2 Services

10.4.5 Historic and Forecasted Market Size by Deployment Mode

10.4.5.1 On-Premises

10.4.5.2 Cloud-based

10.4.6 Historic and Forecasted Market Size by Organization Size

10.4.6.1 Small and Medium-sized Enterprises (SMEs)

10.4.6.2 Large Enterprises

10.4.7 Historic and Forecasted Market Size by Risk Type

10.4.7.1 Strategic Risk

10.4.7.2 Financial Risk

10.4.7.3 Operational Risk

10.4.7.4 Compliance Risk

10.4.7.5 Reputational Risk

10.4.8 Historic and Forecasted Market Size by Industry Vertical

10.4.8.1 Banking

10.4.8.2 Financial Services

10.4.8.3 and Insurance (BFSI)

10.4.8.4 Healthcare

10.4.8.5 Manufacturing

10.4.8.6 IT and Telecom

10.4.8.7 Government and Public Sector

10.4.8.8 Energy and Utilities

10.4.8.9 Retail and Consumer Goods

10.4.8.10 Transportation and Logistics

10.4.8.11 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Enterprise Risk Management Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Component

10.5.4.1 Software

10.5.4.2 Services

10.5.5 Historic and Forecasted Market Size by Deployment Mode

10.5.5.1 On-Premises

10.5.5.2 Cloud-based

10.5.6 Historic and Forecasted Market Size by Organization Size

10.5.6.1 Small and Medium-sized Enterprises (SMEs)

10.5.6.2 Large Enterprises

10.5.7 Historic and Forecasted Market Size by Risk Type

10.5.7.1 Strategic Risk

10.5.7.2 Financial Risk

10.5.7.3 Operational Risk

10.5.7.4 Compliance Risk

10.5.7.5 Reputational Risk

10.5.8 Historic and Forecasted Market Size by Industry Vertical

10.5.8.1 Banking

10.5.8.2 Financial Services

10.5.8.3 and Insurance (BFSI)

10.5.8.4 Healthcare

10.5.8.5 Manufacturing

10.5.8.6 IT and Telecom

10.5.8.7 Government and Public Sector

10.5.8.8 Energy and Utilities

10.5.8.9 Retail and Consumer Goods

10.5.8.10 Transportation and Logistics

10.5.8.11 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Enterprise Risk Management Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Component

10.6.4.1 Software

10.6.4.2 Services

10.6.5 Historic and Forecasted Market Size by Deployment Mode

10.6.5.1 On-Premises

10.6.5.2 Cloud-based

10.6.6 Historic and Forecasted Market Size by Organization Size

10.6.6.1 Small and Medium-sized Enterprises (SMEs)

10.6.6.2 Large Enterprises

10.6.7 Historic and Forecasted Market Size by Risk Type

10.6.7.1 Strategic Risk

10.6.7.2 Financial Risk

10.6.7.3 Operational Risk

10.6.7.4 Compliance Risk

10.6.7.5 Reputational Risk

10.6.8 Historic and Forecasted Market Size by Industry Vertical

10.6.8.1 Banking

10.6.8.2 Financial Services

10.6.8.3 and Insurance (BFSI)

10.6.8.4 Healthcare

10.6.8.5 Manufacturing

10.6.8.6 IT and Telecom

10.6.8.7 Government and Public Sector

10.6.8.8 Energy and Utilities

10.6.8.9 Retail and Consumer Goods

10.6.8.10 Transportation and Logistics

10.6.8.11 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Enterprise Risk Management Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Component

10.7.4.1 Software

10.7.4.2 Services

10.7.5 Historic and Forecasted Market Size by Deployment Mode

10.7.5.1 On-Premises

10.7.5.2 Cloud-based

10.7.6 Historic and Forecasted Market Size by Organization Size

10.7.6.1 Small and Medium-sized Enterprises (SMEs)

10.7.6.2 Large Enterprises

10.7.7 Historic and Forecasted Market Size by Risk Type

10.7.7.1 Strategic Risk

10.7.7.2 Financial Risk

10.7.7.3 Operational Risk

10.7.7.4 Compliance Risk

10.7.7.5 Reputational Risk

10.7.8 Historic and Forecasted Market Size by Industry Vertical

10.7.8.1 Banking

10.7.8.2 Financial Services

10.7.8.3 and Insurance (BFSI)

10.7.8.4 Healthcare

10.7.8.5 Manufacturing

10.7.8.6 IT and Telecom

10.7.8.7 Government and Public Sector

10.7.8.8 Energy and Utilities

10.7.8.9 Retail and Consumer Goods

10.7.8.10 Transportation and Logistics

10.7.8.11 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Enterprise Risk Management Market research report?

A1: The forecast period in the Enterprise Risk Management Market research report is 2025-2032.

Q2: Who are the key players in the Enterprise Risk Management Market?

A2: IBM Corporation – USA, SAP SE – Germany, Oracle Corporation – USA, Microsoft Corporation – USA, RSA Security LLC (a Dell Technologies company) – USA, MetricStream Inc. – USA, SAS Institute Inc. – USA, and Other Active Players.

Q3: What are the segments of the Enterprise Risk Management Market?

A3: The Enterprise Risk Management Market is segmented into Components, Deployment Mode, Organization Size, Risk Type, Industry Vertical, and Region. By Component, the market is categorized into Software and services. By Deployment Mode, the market is categorized into On-Premises and cloud-based. By Organization Size, the market is categorized into Small and Medium-sized Enterprises (SMEs) and large Enterprises. By Risk Type, the market is categorized into Strategic Risk, Financial Risk, Operational Risk, Compliance Risk, and Reputational Risk. By Industry Vertical, the market is categorized into Banking, Financial Services, and Insurance (BFSI), Healthcare, Manufacturing, IT and Telecom, Government and Public Sector, Energy and Utilities, Retail and Consumer Goods, Transportation and Logistics, and Others. By region, it is analyzed across• North America (U.S., Canada, Mexico) • Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) • Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe) • Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC) • Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) • South America (Brazil, Argentina, Rest of SA)

Q4: What is the Enterprise Risk Management Market?

A4: ERM can be described as a systematic approach used by an enterprise to handle different risks that might affect the accomplishment of goals and objectives. ERM relates all kinds of risks such as strategic risks, operational risks, financial risks, and compliance risks and links risk management procedures to all aspects of working of the organization. ERM is therefore established as a process whose main objective is to maximize value through the improvement of the organization’s capability to address risks and capitalize on opportunities.

Q5: How big is the Enterprise Risk Management Market?

A5: Enterprise Risk Management Market Size Was Valued at USD 5.83 Billion in 2024 and is Projected to Reach USD 9.58 Billion by 2032, Growing at a CAGR of 6.40% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!