Stay Ahead in Fast-Growing Economies.

Browse Reports NowEndpoint Detection and Response (EDR) Market Size, Share, Growth & Forecast (2024-2032)

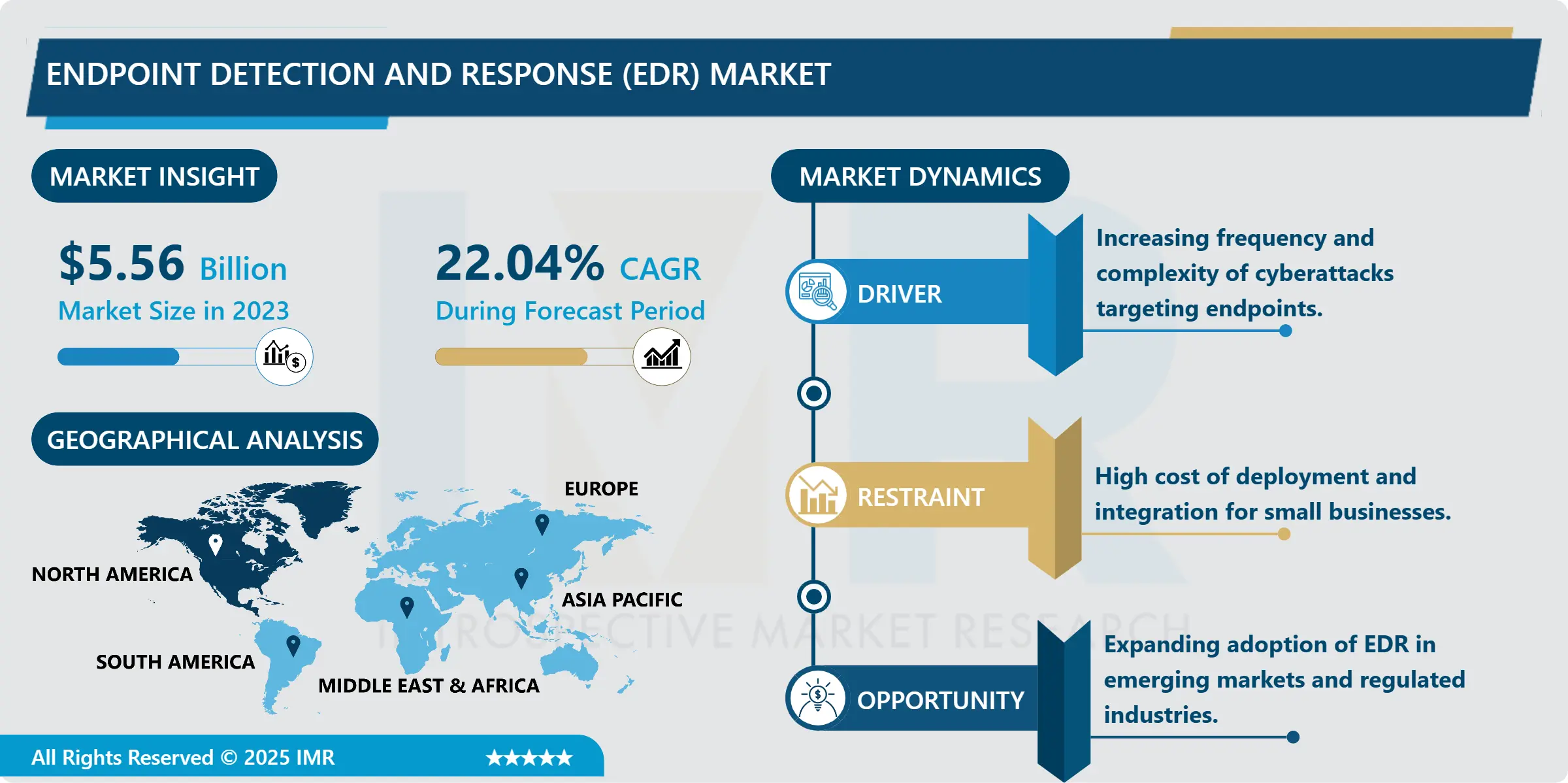

Endpoint Detection and Response (EDR) Market Size Was Valued at USD 5.56 Billion in 2023, and is Projected to Reach USD 33.39 Billion by 2032, Growing at a CAGR of 22.04 % From 2024-2032.

IMR Group

Description

Endpoint Detection and Response (EDR) Market Synopsis:

Endpoint Detection and Response (EDR) Market Size Was Valued at USD 5.56 Billion in 2023, and is Projected to Reach USD 33.39 Billion by 2032, Growing at a CAGR of 22.04 % From 2024-2032.

The Endpoint Detection and Response (EDR) market focuses on cybersecurity solutions designed to monitor, detect, and respond to advanced threats on endpoint devices such as laptops, desktops, and servers. EDR tools provide real-time continuous monitoring, threat intelligence, and automated response capabilities, helping organizations prevent data breaches, minimize damage, and strengthen overall security posture against sophisticated cyberattacks.

The EDR market has also grown rapidly mainly because of shifting cyber threats and organizational need for enhanced endpoint security in the contemporary more [connected world]. EDR solutions have received much attention by organizations across industries for many of their security functions due to new vulnerabilities that arise from COVID-19 related issues such as remote working and BYOD. The growing regulatory pressure that aims at safeguarding stakeholder’s data also drives the deployment of EDR systems. Further, several EDR solutions capable of applying artificial intelligence and machine learning features add to the system solutions’ effectiveness in detecting and minimizing novel and unique types of threats.

Because of advancement in cloud solutions, today’s EDR can be managed from the cloud and organizations can purchase access to usage of the EDR while eliminating added services they may not need. The reason for such solutions adoption is predicated primarily within the understanding of its cost as affordable for SMBs, while offering high quality security tools. However, there is integration between EDR vendors and MSSPs making these solutions available even further; organizations hire the services of MSSPs while such endpoints will always be protected.

Endpoint Detection and Response (EDR) Market Trend Analysis:

Growing Adoption of AI-Driven Threat Detection

The integration of Artificial Intelligence in the EDR systems became one more trend that change the approach to threats detection and elimination. Pre-integrated EDR solutions occur automatically when several endpoint datasets provide artificial intelligence analyzing anomalous traffic and even predicting threats. This approach is fundamentally quite preventive and it contributed to reducing response time and also enhanced the protection of the end point.

These threats become flexible, and AI can learn from them, and change to the newer threats – and this is why the incorporation of AI options into information security is without doubt essential for the todays world. Most of today’s leading vendors are keen to show a high level of commitment in order to make sure they invest on AI research & development with the view of countering in this ever-changing market.

Expanding Adoption in Healthcare and Financial Sectors

Healthcare and Financial along with other industries will be expected to drive most of the EDR market amongst all the industries. Because of hi-tech information and communication technology themes, these industries regulate the HHI of digital records in the health system and financial related systems. Threats in need of detection and reaction of these sectors were met with various solutions from EDR solutions.

Several of the large banks and other FS companies, energy organization and/or governmental organization from from various parts of the world are setting high standards for cybersecurity for these sectors which in turn is increasing the requirement for Edward Lynch & RS systems even more. Those that are connected to software outsourcing are in a special position to harness this opportunity and these are company that offer solutions to health care and financial industries.

Endpoint Detection and Response (EDR) Market Segment Analysis:

The Endpoint Detection and Response (EDR) Market is Segmented on the basis of component, deployment, End User, and Region

By Component, Solution segment is expected to dominate the market during the forecast period

As the threat activity at endpoints increases, the solution segment holds potential to dominate the EDR market in the forecast period. Real time monitoring is one of the technologies available in an organization’s security framework in addition to features like threat intelligence, auto remediation. It is today employed by organisations to boost the current offsets for ransomwares, malware, and zeroday attacks. These EDR solutions need to be designed and the ‘practical to set up’ EDR solutions that can be rolled out fast to fit the requirements of various enterprises because most of these organizations have their respective requirements. Also, continuous adoption of technologies on this segment are artificial intelligence and machine learning.

By Deployment, Cloud segment expected to held the largest share

The global cloud segment for Endpoint Detection and Response (EDR) for business is expected to show highest market share in the forecast period. This growth is particularly driven by the ever-growing cloud solution in the organizations due to challenges such as scalability, flexibility and cost of the solutions. Managed EDR services can be leveraged by businesses that do not require a large base of on-premise physical infrastructure to implement and manage endpoint security tools.

These solutions have real-time tracking and control, non-stop observance, and other cloud services compatibility which makes them perfect for enterprises experiencing remote work and hybrid space architectures. Mes can benefit a lot from the cloud deployment model because it offers them the kind of security tools, they need without a hefty price tag. The core concept of Transcend is that since more organisations are increasingly moving their processes to the cloud, there is a corresponding need for a cloud-native

Endpoint Detection and Response (EDR) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

At the same time, in terms of market share, North American region will lead the EDR market throughout the forecast period. The dominance can be explained by the fact that the region has a high and developed IT segment, high saturation of innovative and effectively protecting against cyber threats solutions, important actors of the market. The United States in particular has been a prime market for EDR as the rates and levels of cyber threats targeting enterprises, governments and critical infrastructures have gone up and the techniques The claimed increase is associated with the expectations in North America resulting from the optimization of regulations integrated with new regulations like CCPA and GDPR as a way of enhancing the security of data assets.

In addition, across the sill, the new flexible working trend together with cloud solutions have enhanced the demand for endpoint protection in North America. EDR solutions are emerging to high importance due to the issues that are associated with the coordination of distributed workers. Canada also has a major role in the region’s market as awareness of threat rises and government support enhances. North America will remain on the top for this market because of constant innovative projects improved through disclosed technology and steady focus on it.

Active Key Players in the Endpoint Detection and Response (EDR) Market

Bitdefender (Romania)

BlackBerry Limited (Canada)

Broadcom Inc. (United States)

Cisco Systems, Inc. (United States)

CrowdStrike Holdings, Inc. (United States)

Cybereason (United States)

FireEye, Inc. (United States)

Fortinet, Inc. (United States)

Kaspersky Lab (Russia)

McAfee, LLC (United States)

Microsoft Corporation (United States)

Palo Alto Networks, Inc. (United States)

SentinelOne, Inc. (United States)

Sophos Group plc (United Kingdom)

Trend Micro Incorporated (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Energy Harvesting System Market by Technology

4.1 Energy Harvesting System Market Snapshot and Growth Engine

4.2 Energy Harvesting System Market Overview

4.3 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting: Geographic Segmentation Analysis

Chapter 5: Energy Harvesting System Market by Application

5.1 Energy Harvesting System Market Snapshot and Growth Engine

5.2 Energy Harvesting System Market Overview

5.3 Consumer Electronics Building and Home Automation Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Consumer Electronics Building and Home Automation Industrial: Geographic Segmentation Analysis

5.4 Transportation Other

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Transportation Other: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Energy Harvesting System Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABB LTD. (SWITZERLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ANALOG DEVICES INC. (USA)

6.4 CYMBET CORPORATION (USA)

6.5 ENOCEAN GMBH (GERMANY)

6.6 FUJITSU LIMITED (JAPAN)

6.7 HONEYWELL INTERNATIONAL INC. (USA)

6.8 MAXIM INTEGRATED PRODUCTS INC. (USA)

6.9 MICROCHIP TECHNOLOGY INC. (USA)

6.10 POWERCAST CORPORATION (USA)

6.11 QORVO INC. (USA)

6.12 SCHNEIDER ELECTRIC SE (FRANCE)

6.13 STMICROELECTRONICS (SWITZERLAND)

6.14 TEXAS INSTRUMENTS INCORPORATED (USA)

6.15 TOSHIBA CORPORATION (JAPAN)

6.16 VOLTREE POWER INC. (USA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Energy Harvesting System Market By Region

7.1 Overview

7.2. North America Energy Harvesting System Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Technology

7.2.4.1 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Consumer Electronics Building and Home Automation Industrial

7.2.5.2 Transportation Other

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Energy Harvesting System Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Technology

7.3.4.1 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Consumer Electronics Building and Home Automation Industrial

7.3.5.2 Transportation Other

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Energy Harvesting System Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Technology

7.4.4.1 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Consumer Electronics Building and Home Automation Industrial

7.4.5.2 Transportation Other

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Energy Harvesting System Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Technology

7.5.4.1 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Consumer Electronics Building and Home Automation Industrial

7.5.5.2 Transportation Other

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Energy Harvesting System Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Technology

7.6.4.1 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Consumer Electronics Building and Home Automation Industrial

7.6.5.2 Transportation Other

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Energy Harvesting System Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Technology

7.7.4.1 Light Energy Harvesting Vibration Energy Harvesting Thermal Energy Harvesting RF Energy Harvesting

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Consumer Electronics Building and Home Automation Industrial

7.7.5.2 Transportation Other

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Endpoint Detection and Response (EDR) market research report?

A1: The forecast period in the Endpoint Detection and Response (EDR) Market Research Report is 2024-2032.

Q2: Who are the key players in the Endpoint Detection and Response (EDR) Market?

A2: Bitdefender (Romania), BlackBerry Limited (Canada), Broadcom Inc. (United States), Cisco Systems, Inc. (United States), CrowdStrike Holdings, Inc. (United States), Cybereason (United States), FireEye, Inc. (United States), Fortinet, Inc. (United States), Kaspersky Lab (Russia), McAfee, LLC (United States), Microsoft Corporation (United States), Palo Alto Networks, Inc. (United States), SentinelOne, Inc. (United States), Sophos Group plc (United Kingdom), Trend Micro Incorporated (Japan), and Other Active Players

Q3: What are the segments of the Endpoint Detection and Response (EDR) Market?

A3: The Endpoint Detection and Response (EDR) market is segmented into Component, Deployment, End User, and Region. By Component, the market is categorized into Solutions and Services. By Deployment, the market is categorized into Cloud-based and On-premise. By End User, the market is categorized into BFSI IT and Telecom, Manufacturing, Healthcare, Retail, and Others. By Region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC),Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa),South America (Brazil, Argentina, Rest of SA).

Q4: What is the Endpoint Detection and Response (EDR) Market?

A4: The Endpoint Detection and Response (EDR) market focuses on cybersecurity solutions designed to monitor, detect, and respond to advanced threats on endpoint devices such as laptops, desktops, and servers. EDR tools provide real-time continuous monitoring, threat intelligence, and automated response capabilities, helping organizations prevent data breaches, minimize damage, and strengthen overall security posture against sophisticated cyberattacks.

Q5: How big is the Endpoint Detection and Response (EDR) Market?

A5: Endpoint Detection and Response (EDR) Market Size Was Valued at USD 5.56 Billion in 2023, and is Projected to Reach USD 33.39 Billion by 2032, Growing at a CAGR of 22.04% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!