Stay Ahead in Fast-Growing Economies.

Browse Reports NowElectronic Thermostatic Radiator Valves Market | Global Report Analysis 2024-2032

Electronic Thermostatic Radiator Valves (TRVs) are devices used in heating systems to control the temperature of individual radiators in a room. They function by automatically adjusting the flow of hot water into the radiator based on the room’s temperature, as detected by a built-in sensor. This helps maintain a consistent and comfortable temperature while maximizing energy efficiency.

IMR Group

Description

Global Electronic Thermostatic Radiator Valves Market Overview

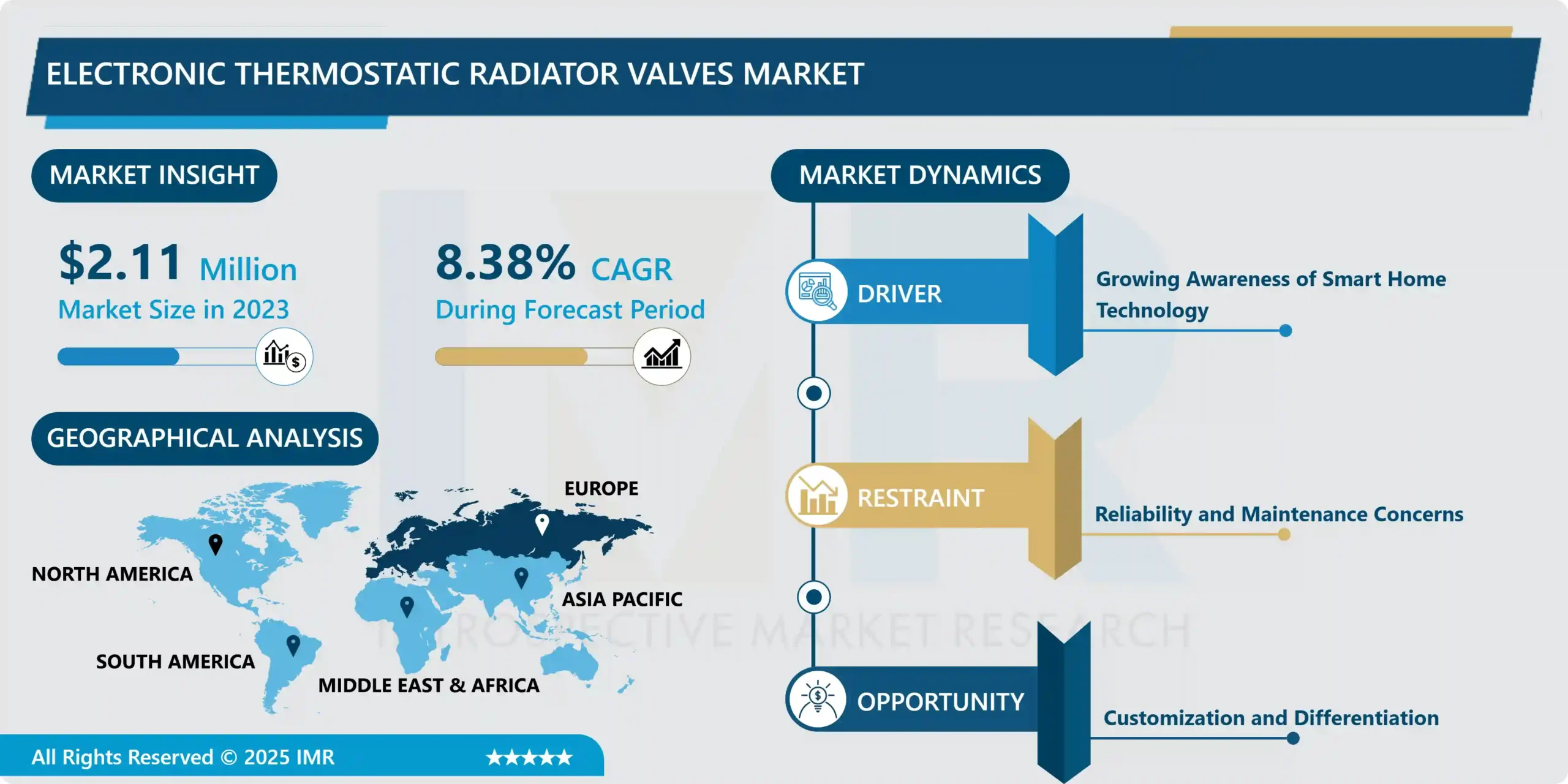

Global Electronic Thermostatic Radiator Valves Market size is expected to grow from USD 2.11 Million in 2023 to USD 4.35 Million by 2032, at a CAGR of 8.38% during the forecast period (2024–2032).

Electronic Thermostatic Radiator Valves (TRVs) are devices used in heating systems to control the temperature of individual radiators in a room. They function by automatically adjusting the flow of hot water into the radiator based on the room’s temperature, as detected by a built-in sensor. This helps maintain a consistent and comfortable temperature while maximizing energy efficiency.

Electronic Thermostatic Radiator Valves (TRVs) are widely used across various industries but are most commonly seen in residential and commercial buildings. They enable individual temperature control in rooms, helping to save energy by heating only the required areas. In larger buildings, such as offices or hotels, they offer zonal heating control, which optimizes energy consumption and provides comfort by heating different areas as required.

Electronic TRVs are a cost-effective and highly energy-efficient solution. They provide accurate temperature control, preventing overheating and saving energy. By allowing individual radiator control, they offer personalized heating to meet specific comfort needs in different rooms or zones. Automation reduces the need for manual adjustments, improving user convenience while saving time and energy.

Electronic Thermostatic Radiator Valves Market Trend Analysis:

Growing Awareness of Smart Home Technology

Electronic Thermostatic Radiator Valves (TRVs) are a type of smart heating solution that is gaining popularity as customers become more tech-savvy and seek ways to enhance efficiency and convenience at home. These valves can be easily integrated into the larger network of smart home devices, providing consumers with remote control of their heating systems through their smartphones or voice assistants.

Smart home technology offers several benefits, including increased control, flexibility and energy efficiency. Electronic TRVs are an excellent fit for this story as they maximize energy efficiency, improve comfort and allow users to control heating by room. These valves can be connected to smart thermostats and home automation systems, further enhancing their appeal by enabling centralized control and scheduling, which is particularly suited to the lifestyle choices of today’s consumers.

Moreover, the growing ecosystem of interconnected smart devices fosters a holistic approach to home management, where electronic TRVs play a crucial role in creating energy-efficient and comfortable living spaces. The awareness of these benefits, coupled with the desire for convenience and energy savings, continues to drive the demand for electronic TRVs within the expanding market of smart home technology. As more consumers recognize the value of these devices in enhancing both comfort and energy efficiency, the market for electronic TRVs is expected to witness sustained growth.

Customization and Differentiation

One area of potential expansion for heating system manufacturers is customizing their products to meet particular customer preferences and different situations. By providing a variety of features that cater to different needs and enable consumers to maximize their heating systems in ways that suit their lifestyles or building constraints, manufacturers can increase their profits.

Integrating smart technology is a way to stand out from competitors. Electronic TRVs can provide more convenience and control to consumers by integrating connectivity capabilities and being compatible with smart home systems. In a crowded market, features such as voice assistant compatibility, remote access through mobile apps, and customizable scheduling can make these valves more appealing to customers. Additionally, the ability to provide real-time data and analytics on energy usage and temperature trends can empower users to make informed decisions, further enhancing the value proposition.

Moreover, customization options such as design variations, sizes, and compatibility with different heating systems allow manufacturers to cater to diverse customer needs. Addressing specific requirements for residential, commercial, or industrial settings with tailored solutions can be a driving force in capturing various segments of the market. By emphasizing customization and differentiation through advanced features, connectivity, and tailored solutions, manufacturers can not only meet but exceed consumer expectations, ultimately driving growth and market expansion in the realm of electronic TRVs.

Global Electronic Thermostatic Radiator Valves Market Segment Analysis:

Global Electronic Thermostatic Radiator Valves Market Segmented on the basis of type and application.

By Type, Valve Heads segment is expected to dominate the market during the forecast period

The dominant position of electronic valve heads in the market is a result of their advanced features compared to conventional mechanical heads. Customers looking for increased comfort and energy efficiency are attracted to electronic valve heads as they offer precise temperature control and digital interfaces, sensors, and programmable settings. Furthermore, their interoperability with smart home systems and ability to integrate with digital thermostats and home automation solutions have reinforced their market dominance.

The demand for electronic valve heads has increased significantly due to the convenience of remote control via mobile apps and potential energy savings through more accurate temperature regulation. As a result, electronic valve heads dominate the current market segment and are driving future trends in TRV technology as consumers demand more customized and high-tech heating solutions.

Electronic Thermostatic Radiator Valves Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

European nations have been at the forefront of enforcing laws that promote energy-efficient heating systems and lower carbon emissions. This has created a regulatory environment that encourages the development of thermostatic radiator valves (TRVs), especially electronic ones, as they align with energy-saving goals.

The market for electronic TRVs has grown due to the prevalence of centralized heating systems in several European nations and a robust infrastructure that supports home automation and smart heating solutions. Europe is a leader in the electronic TRV market because it prefers cutting-edge technology and its consumers’ growing awareness of the benefits of personalized and energy-efficient heating solutions. Its importance is attributed to its concentration on energy efficiency, strict rules encouraging the use of sustainable heating solutions, and a significant focus on the use of smart home technologies.

Key Players Covered in Electronic Thermostatic Radiator Valves Market:

Honeywell (U.S.)

Watts Water Technologies (U.S.)

Danfoss (Denmark)

Giacomini (Italy)

Caleffi (Italy)

I.V.A.R. S.P.A. (Italy)

Eq-3 (Germany)

Eurotronic (Germany)

Vaillant (Germany)

Heimeier (Germany)

Bosch (Germany)

Devolo (Germany)

Oventrop (Germany)

Emmeti (UK)

Myson (UK)

Schneider Electric (France)

Netatmo (France)

Uponor (Finland)

Herz Armaturen Gmbh (Austria)

Zhejiang Huibo Valve Technology Co., Ltd. (China), And Other Major Players

Key Industry Developments in the Electronic Thermostatic Radiator Valves Market:

In January 2024, Honeywell announced the successful closure of a $300 million equity fundraising round for Quantinuum, the global leader in integrated quantum computing. The pre-money valuation stood at $5 billion. The round was primarily supported by Quantinuum’s key partner JPMorgan Chase, along with investments from Mitsui & Co., Amgen, and Honeywell, which maintains its majority stake. This funding brings Quantinuum’s total raised capital since inception to around $625 million.

In September 2023, Bosch completed the acquisition of TSI Semiconductors’ assets, expanding its global portfolio of SiC chips. The former TSI facility in Roseville, California, is now part of Robert Bosch Semiconductor LLC. Thorsten Scheer, an industry specialist, leads the new organization as plant manager of Roseville and regional president of the Bosch Automotive Electronics division in North America.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electronic Thermostatic Radiator Valves Market by Type (2018-2032)

4.1 Electronic Thermostatic Radiator Valves Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Head

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Valves Body

Chapter 5: Electronic Thermostatic Radiator Valves Market by Application (2018-2032)

5.1 Electronic Thermostatic Radiator Valves Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Electronic Thermostatic Radiator Valves Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DELL INC (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 APPLE INC (U.S.)

6.4 HP (U.S.)

6.5 RED DIGITAL CINEMA CAMERA COMPANY (U.S.)

6.6 VIEWSONIC CORPORATION (U.S.)

6.7 PHILIPS (NETHERLANDS)

6.8 LG ELECTRONICS INC (SOUTH KOREA)

6.9 SAMSUNG ELECTRONICS (SOUTH KOREA)

6.10 SHARP CORPORATION (JAPAN)

6.11 SONY CORPORATION (JAPAN)

6.12 CANON INC (JAPAN)

6.13 ASUS (TAIWAN)

6.14 ADMIRAL OVERSEA CORPORATION (TAIWAN)

6.15 MICRO-STAR INT’L COLTD (TAIWAN)

6.16 EVERDISPLAY OPTOELECTRONICS CORPORATION (TAIWAN)

6.17 INNOLUX CORPORATION (TAIWAN)

6.18 AU OPTRONICS (TAIWAN)

6.19 BOE TECHNOLOGY GROUP COLTD. (CHINA)

6.20 HKC DISPLAY TECHNOLOGY COLTD. (CHINA)

6.21 SHENZHEN LEYARD OPTOELECTRONICS COLTD. (CHINA)

6.22

Chapter 7: Global Electronic Thermostatic Radiator Valves Market By Region

7.1 Overview

7.2. North America Electronic Thermostatic Radiator Valves Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Head

7.2.4.2 Valves Body

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Residential

7.2.5.2 Commercial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Electronic Thermostatic Radiator Valves Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Head

7.3.4.2 Valves Body

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Residential

7.3.5.2 Commercial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Electronic Thermostatic Radiator Valves Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Head

7.4.4.2 Valves Body

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Residential

7.4.5.2 Commercial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Electronic Thermostatic Radiator Valves Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Head

7.5.4.2 Valves Body

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Residential

7.5.5.2 Commercial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Electronic Thermostatic Radiator Valves Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Head

7.6.4.2 Valves Body

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Residential

7.6.5.2 Commercial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Electronic Thermostatic Radiator Valves Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Head

7.7.4.2 Valves Body

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Residential

7.7.5.2 Commercial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be forecast period in the Thermostatic Radiator Valves market research report?

A1: The forecast period in the Thermostatic Radiator Valves market research report is 2024–2032..

Q2: Who are the key players in Electronic Thermostatic Radiator Valves market?

A2: Honeywell (U.S.), Watts Water Technologies (U.S.), Danfoss (Denmark), Giacomini (Italy), Caleffi (Italy), I.V.A.R. S.P.A. (Italy), Eq-3 (Germany), Eurotronic (Germany), Vaillant (Germany), Heimeier (Germany), Bosch (Germany), Devolo (Germany), Oventrop (Germany), Emmeti (UK), Myson (UK), Schneider Electric (France), Netatmo (France), Uponor (Finland), Herz Armaturen Gmbh (Austria), Zhejiang Huibo Valve Technology Co., Ltd. (China)

Q3: What are the segments of Electronic Thermostatic Radiator Valves market?

A3: The market is segmented by type into head and valves body, and by application into residential and commercial sectors. Regionally, it spans North America (U.S., Canada, Mexico), Eastern Europe (Bulgaria, Czech Republic, Hungary, Poland, Romania, and others), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, and others), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, Philippines, Australia, New Zealand, and others), the Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), and South America (Brazil, Argentina, and others).

Q4: What is the Electronic Thermostatic Radiator Valves market?

A4: Electronic Thermostatic Radiator Valves (TRVs) are devices used in heating systems to control the temperature of individual radiators in a room. They function by automatically adjusting the flow of hot water into the radiator based on the room's temperature, as detected by a built-in sensor. This helps maintain a consistent and comfortable temperature while maximizing energy efficiency.

Q5: How big is the Electronic Thermostatic Radiator Valves market?

A5: Global Electronic Thermostatic Radiator Valves Market size is expected to grow from USD 2.11 Million in 2023 to USD 4.35 Million by 2032, at a CAGR of 8.38% during the forecast period (2024–2032).

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!