Stay Ahead in Fast-Growing Economies.

Browse Reports NowElectronic Design Automation Tools (EDA) Market | Global Sales Analysis

Electronic Design Automation (EDA) tools are software tools that engineers use to design and analyze electronic systems. These tools are essential for the creation of integrated circuits (ICs), printed circuit boards (PCBs), and other electronic devices. Engineers can use EDA tools to automate various stages of the design process, including conceptualization, simulation, layout, and verification

IMR Group

Description

Electronic Design Automation Tools Market Synopsis

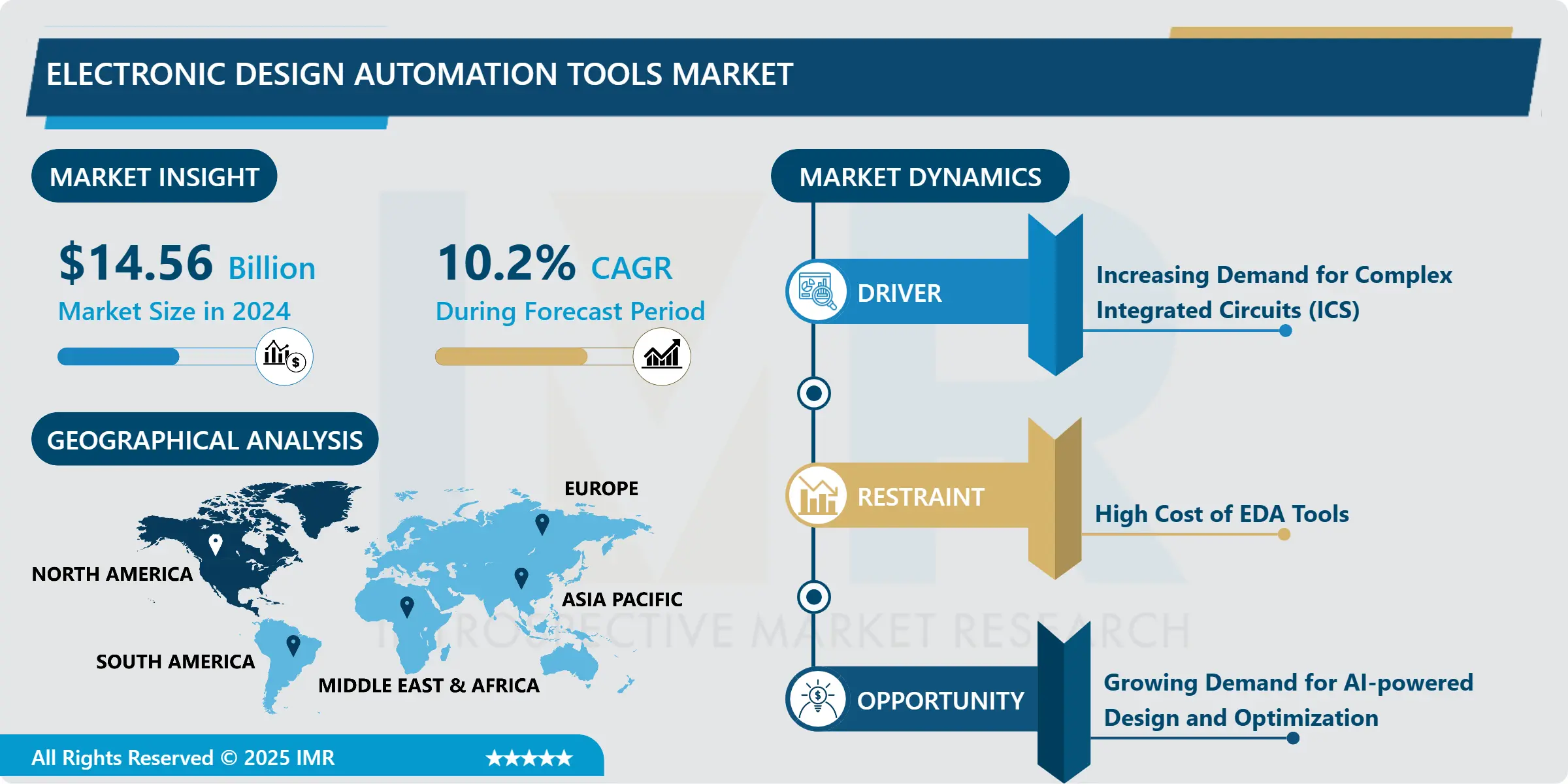

Electronic Design Automation Tools (EDA) Market Size Was Valued at USD 14.56 Billion in 2024, and is Projected to Reach USD 31.67 Billion by 2032, Growing at a CAGR of 10.2% From 2025-2032.

Electronic Design Automation (EDA) tools are software tools that engineers use to design and analyse electronic systems. These tools are essential for the creation of integrated circuits (ICs), printed circuit boards (PCBs), and other electronic devices. Engineers can use EDA tools to automate various stages of the design process, including conceptualization, simulation, layout, and verification.

EDA tools provide a wide range of capabilities, such as schematic capture for creating graphical representations of circuits, simulation for testing and optimizing designs, and layout tools for defining the physical arrangement of components on a PCB. EDA tools provide features such as synthesis, timing analysis, and power analysis to ensure that designs meet performance, timing, and power specifications.

The growing number of smart devices, automotive electronics, and wearable technology is accelerating the adoption of EDA tools in a variety of industries, including consumer electronics, automotive, aerospace, and healthcare. These tools allow designers to optimize performance, reduce power consumption, and improve reliability, thus meeting the demanding standards of modern electronic applications.

Semiconductor companies are designing more complex and power-efficient chips, and the demand for innovative EDA tools to meet these changing requirements is expected to remain high. In addition, incorporating machine learning and data analytics capabilities into EDA software opens up new opportunities for optimizing design workflows, improving design quality, and shortening time-to-market, propelling the EDA Tools market forward.

Electronic Design Automation Tools Market Trend Analysis:

Increasing demand for complex integrated circuits (ICs)

Electronic devices are becoming more advanced in terms of features and functionalities, requiring the development of integrated circuits that can support these capabilities. The increased demand for complex ICs is driving the adoption of sophisticated Electronic Design Automation (EDA) tools, which are required for designing, verifying, and manufacturing these intricate semiconductor components.

Additionally, Designers use EDA software to optimize IC performance, power efficiency, and reliability, ensuring that they meet today’s stringent electronic application requirements. Advanced technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G require specialized ICs with complex architectures, which drives the demand for advanced EDA tools.

The globalization of the semiconductor industry, as well as continuous advancements in manufacturing processes, are opening up new opportunities for EDA vendors to expand their market presence and meet the changing needs of the electronics market as the demand for electronic devices across various industries grows, so will the reliance on advanced EDA tools, driving the market forward.

Growing Demand for AI-powered Design and Optimization

The need for EDA tools that can automate manual tasks and improve the design process through predictive analytics is growing as the demand for intelligent tools with infused Artificial Intelligence (AI) and Machine Learning (ML) capabilities continues to advance. These tools can optimize designs for performance and power efficiency due to the integration of AI and ML, which will ultimately speed up the time to market for electronic products.

The integration of AI and ML algorithms into EDA tools enables designers to more successfully handle challenging design problems. These smart instruments can make deft judgments and provide insights that conventional approaches might miss by sifting through enormous volumes of data and looking for patterns. This capability meets the changing needs of contemporary technology applications while streamlining the design process and enhancing the overall quality and dependability of electronic systems.

The demand for intelligent EDA tools is expected to steadily increase as industries embrace digital transformation and automation. With the growing complexity of electronic systems and the proliferation of IoT devices, there is a critical need for tools capable of handling the complexities of system design and verification. As a result, the market for Electronic Design Automation Tools is expected to grow further as intelligent technologies become more widely adopted.

Electronic Design Automation Tools Market Segment Analysis:

Electronic Design Automation Tools Market Segmented on the basis of Type, Deployment mode, Business model, Application, and Region

By Type, Computer-aided Engineering (CAE) segment is expected to dominate the market during the forecast period

The increasing complexity and sophistication of electronic devices requires the use of sophisticated simulation and analysis tools to ensure their dependability and efficiency. Engineers can simulate and analyse many aspects of electronic designs, such as electromagnetic compatibility, thermal behaviour, and structural integrity, among others, with the help of Computer-aided Engineering (CAE) tools.

In Addition, the growing need for virtual prototyping and testing in the electronics sector is another factor contributing to the growing use of CAE tools. Engineers can use CAE to virtually build electronic system prototypes and test them closely in a variety of operating environments. Before physical prototypes are constructed, this virtual testing helps find design flaws and optimize performance, saving time and money.

Offered a common platform for design simulation and analysis, CAE tools promote collaboration among multidisciplinary teams, increasing overall productivity and efficiency. AI-Powered CAE solutions can improve the overall design process by automating intricate simulations, optimizing design parameters, and giving engineers useful insights. The need for CAE tools is anticipated to continue to be high as industries innovate and push the limits of electronic design.

By Application, Communication segment is expected to dominate the market during the forecast period

The communication sector dominates the Electronic Design Automation Tools market due to its critical role in enabling seamless connectivity and data transfer. Whether designing high-speed data networks, wireless communication systems, or next-generation telecommunications infrastructure, EDA tools are essential at every stage of the design cycle.

Moreover, with an increasing number of digital devices and the rise of data-intensive applications like streaming, online gaming, and cloud computing, there is an ongoing demand for faster and more efficient communication systems. This demand drives the development of novel communication technologies, necessitating the use of sophisticated EDA tools to design and optimize complex communication systems.

These tools help engineers ensure the reliability, performance, and scalability of communication systems by conceptualizing and simulating communication protocols, as well as verifying and optimizing signal integrity. The ongoing advancements in communication technologies, such as the deployment of 5G networks, the development of Internet of Things (IoT) devices, and the emergence of smart cities, are driving up demand for EDA tools in the communication sector.

Electronic Design Automation Tools Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America’s robust ecosystem of semiconductor companies and research institutions, which extends from Silicon Valley in the United States to tech clusters in Canada, encourages innovation and drives demand for advanced EDA tools. The large number of industry players creates an ideal environment for the adoption and advancement of electronic design automation technologies, establishing North America as a key hub for EDA market growth.

Additionally, with a strong focus on research and development (R&D), technological innovation, a thriving start-up culture, well-established technology clusters, and significant investments in R&D initiatives, the region remains at the forefront of semiconductor innovation. This culture of innovation fuels the demand for advanced EDA solutions that allow businesses to design and develop increasingly complex semiconductor chips and electronic systems.

Considering all factors, North American companies continue to push the boundaries of technological innovation, and demand for sophisticated EDA tools is expected to remain strong, resulting in sustained growth in the regional market. While the United States leads the region with its established semiconductor industry and technological prowess, Canada’s growing tech sector and Mexico’s emergence as a manufacturing hub add to the region’s overall EDA market dynamics.

Electronic Design Automation Tools Market Top Key Players:

Synopsys (US)

Cadence Design Systems (US)

Ansys (US)

Autodesk (US)

Silvaco (US)

Agilent EEsof (US)

Agnisys Inc (US)

Keysight Technologies (US)

Xilinx Inc. (US)

Avant! Corp. (US)

Innoveda Inc. (US)

IKOS Systems Inc. (US)

Ansoft (US)

Synplicity (US)

PTC (US)

Rambus (US)

Siemens EDA (Germany)

Lauterbach GmbH (Germany)

Dassault Systèmes (France)

Imagination Technologies (UK)

Pulsic (UK)

Cognidox (UK)

Altium Limited (Australia)

Zuken (Japan)

Protel International (New Zealand)

OneSpin Solutions (Israel)

Other Active Players

Key Industry Developments in the Electronic Design Automation Tools Market:

In Nov 2024, Keysight Technologies unveiled advanced Electronic Design Automation (EDA) solutions, empowering engineers to streamline the development of high-performance electronic products. The new tools enhance simulation accuracy, optimize design workflows, and accelerate time-to-market for innovations in sectors like telecommunications, automotive, and aerospace. By leveraging AI-driven capabilities, Keysight aims to address the growing complexity of modern electronics design. This launch underscores Keysight’s commitment to driving technological progress and supporting the engineering community worldwide.

In March 2024, HCLTech launched an Electronic Design Automation (EDA) solution in partnership with NetApp to streamline large-scale EDA implementations for the semiconductor industry. The solution leverages hybrid cloud technology to enhance scalability and performance, enabling faster design cycles and cost efficiency. This collaboration aims to address the growing demand for robust and flexible EDA infrastructure, empowering enterprises to accelerate innovation and stay competitive in the rapidly evolving semiconductor landscape.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electronic Design Automation Tools (EDA) Market by Type (2018-2032)

4.1 Electronic Design Automation Tools (EDA) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Computer-aided Engineering (CAE)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 IC Physical Design & Verification

4.5 Printed Circuit Board & Multi-chip Module (PCB and MCM)

4.6 Semiconductor Intellectual Property (SIP)

Chapter 5: Electronic Design Automation Tools (EDA) Market by Deployment Mode (2018-2032)

5.1 Electronic Design Automation Tools (EDA) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-premises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud-based

Chapter 6: Electronic Design Automation Tools (EDA) Market by Business Model (2018-2032)

6.1 Electronic Design Automation Tools (EDA) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Perpetual license

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Subscription

6.5 Open-source

Chapter 7: Electronic Design Automation Tools (EDA) Market by Application (2018-2032)

7.1 Electronic Design Automation Tools (EDA) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Communication

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Consumer Electronics

7.5 Automotive

7.6 Industrial

7.7 Aerospace & Defense

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Electronic Design Automation Tools (EDA) Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BALKRISHNA BOILERS PRIVATE LIMITED

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CFB BOILERS

8.4 SPIRAX-SARCO ENGINEERING

8.5 ATLANTIC BOILERS

8.6 SAZBOILERS

8.7 ATTSU

8.8 BOILERTECH PTY LTD

8.9 UNICAL

8.10 BOSCH INDUSTRIEKESSEL GMBH

8.11 BYWORTH BOILERS

8.12 ICI CALDAIE S.P.A

8.13 VIESSMANN WERKE GMBH & CO. KG

8.14 ZHENGZHOU BOILER

8.15 HURSTBOILER

8.16 BABCOCK WANSON SA

Chapter 9: Global Electronic Design Automation Tools (EDA) Market By Region

9.1 Overview

9.2. North America Electronic Design Automation Tools (EDA) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Computer-aided Engineering (CAE)

9.2.4.2 IC Physical Design & Verification

9.2.4.3 Printed Circuit Board & Multi-chip Module (PCB and MCM)

9.2.4.4 Semiconductor Intellectual Property (SIP)

9.2.5 Historic and Forecasted Market Size by Deployment Mode

9.2.5.1 On-premises

9.2.5.2 Cloud-based

9.2.6 Historic and Forecasted Market Size by Business Model

9.2.6.1 Perpetual license

9.2.6.2 Subscription

9.2.6.3 Open-source

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Communication

9.2.7.2 Consumer Electronics

9.2.7.3 Automotive

9.2.7.4 Industrial

9.2.7.5 Aerospace & Defense

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Electronic Design Automation Tools (EDA) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Computer-aided Engineering (CAE)

9.3.4.2 IC Physical Design & Verification

9.3.4.3 Printed Circuit Board & Multi-chip Module (PCB and MCM)

9.3.4.4 Semiconductor Intellectual Property (SIP)

9.3.5 Historic and Forecasted Market Size by Deployment Mode

9.3.5.1 On-premises

9.3.5.2 Cloud-based

9.3.6 Historic and Forecasted Market Size by Business Model

9.3.6.1 Perpetual license

9.3.6.2 Subscription

9.3.6.3 Open-source

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Communication

9.3.7.2 Consumer Electronics

9.3.7.3 Automotive

9.3.7.4 Industrial

9.3.7.5 Aerospace & Defense

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Electronic Design Automation Tools (EDA) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Computer-aided Engineering (CAE)

9.4.4.2 IC Physical Design & Verification

9.4.4.3 Printed Circuit Board & Multi-chip Module (PCB and MCM)

9.4.4.4 Semiconductor Intellectual Property (SIP)

9.4.5 Historic and Forecasted Market Size by Deployment Mode

9.4.5.1 On-premises

9.4.5.2 Cloud-based

9.4.6 Historic and Forecasted Market Size by Business Model

9.4.6.1 Perpetual license

9.4.6.2 Subscription

9.4.6.3 Open-source

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Communication

9.4.7.2 Consumer Electronics

9.4.7.3 Automotive

9.4.7.4 Industrial

9.4.7.5 Aerospace & Defense

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Electronic Design Automation Tools (EDA) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Computer-aided Engineering (CAE)

9.5.4.2 IC Physical Design & Verification

9.5.4.3 Printed Circuit Board & Multi-chip Module (PCB and MCM)

9.5.4.4 Semiconductor Intellectual Property (SIP)

9.5.5 Historic and Forecasted Market Size by Deployment Mode

9.5.5.1 On-premises

9.5.5.2 Cloud-based

9.5.6 Historic and Forecasted Market Size by Business Model

9.5.6.1 Perpetual license

9.5.6.2 Subscription

9.5.6.3 Open-source

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Communication

9.5.7.2 Consumer Electronics

9.5.7.3 Automotive

9.5.7.4 Industrial

9.5.7.5 Aerospace & Defense

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Electronic Design Automation Tools (EDA) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Computer-aided Engineering (CAE)

9.6.4.2 IC Physical Design & Verification

9.6.4.3 Printed Circuit Board & Multi-chip Module (PCB and MCM)

9.6.4.4 Semiconductor Intellectual Property (SIP)

9.6.5 Historic and Forecasted Market Size by Deployment Mode

9.6.5.1 On-premises

9.6.5.2 Cloud-based

9.6.6 Historic and Forecasted Market Size by Business Model

9.6.6.1 Perpetual license

9.6.6.2 Subscription

9.6.6.3 Open-source

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Communication

9.6.7.2 Consumer Electronics

9.6.7.3 Automotive

9.6.7.4 Industrial

9.6.7.5 Aerospace & Defense

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Electronic Design Automation Tools (EDA) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Computer-aided Engineering (CAE)

9.7.4.2 IC Physical Design & Verification

9.7.4.3 Printed Circuit Board & Multi-chip Module (PCB and MCM)

9.7.4.4 Semiconductor Intellectual Property (SIP)

9.7.5 Historic and Forecasted Market Size by Deployment Mode

9.7.5.1 On-premises

9.7.5.2 Cloud-based

9.7.6 Historic and Forecasted Market Size by Business Model

9.7.6.1 Perpetual license

9.7.6.2 Subscription

9.7.6.3 Open-source

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Communication

9.7.7.2 Consumer Electronics

9.7.7.3 Automotive

9.7.7.4 Industrial

9.7.7.5 Aerospace & Defense

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Electronic Design Automation Tools (EDA) Market research report?

A1: The forecast period in the Electronic Design Automation Tools (EDA) Market research report is 2025-2032.

Q2: Who are the key players in Electronic Design Automation Tools (EDA) Market?

A2: Synopsys (US), Cadence Design Systems (US), Ansys (US), Autodesk (US), Silvaco (US), Agilent EEsof (US), Agnisys Inc (US), Keysight Technologies (US), Xilinx Inc. (US), Avant! Corp. (US), Innoveda Inc. (US), IKOS Systems Inc. (US), Ansoft (US), Synplicity (US), PTC (US), Rambus (US), Siemens EDA (Germany), Lauterbach GmbH (Germany), Dassault Systèmes (France), Imagination Technologies (UK), Pulsic (UK), Cognidox (UK), Altium Limited (Australia), Zuken (Japan), Protel International (New Zealand), OneSpin Solutions (Israel) and Other Active Players.

Q3: What are the segments of Electronic Design Automation Tools (EDA) Market?

A3: The Electronic Design Automation Tools Market is segmented into Type, Deployment Mode, Business Model, Application, and region. By Type, the market is categorized into Computer-aided Engineering (CAE), IC Physical Design & Verification, Printed Circuit Board & Multi-chip Module (PCB and MCM), and Semiconductor Intellectual Property (SIP). By Deployment Mode, the market is categorized into On-premises and Cloud-based. By Business Model, the market is categorized into Perpetual license, Subscription, and Open-source. By Application, the market is categorized into Communication, Consumer Electronics, Automotive, Industrial, and Aerospace & Defense. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What is the Electronic Design Automation Tools (EDA) Market?

A4: Electronic Design Automation (EDA) tools are software tools that engineers use to design and analyze electronic systems. These tools are essential for the creation of integrated circuits (ICs), printed circuit boards (PCBs), and other electronic devices. Engineers can use EDA tools to automate various stages of the design process, including conceptualization, simulation, layout, and verification.

Q5: How big is Electronic Design Automation Tools (EDA) Market?

A5: Electronic Design Automation Tools (EDA) Market Size Was Valued at USD 14.56 Billion in 2024, and is Projected to Reach USD 31.67 Billion by 2032, Growing at a CAGR of 10.2% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!