Stay Ahead in Fast-Growing Economies.

Browse Reports NowElectric Vehicle Tire Market Size, Share, Growth & Forecast (2024-2032)

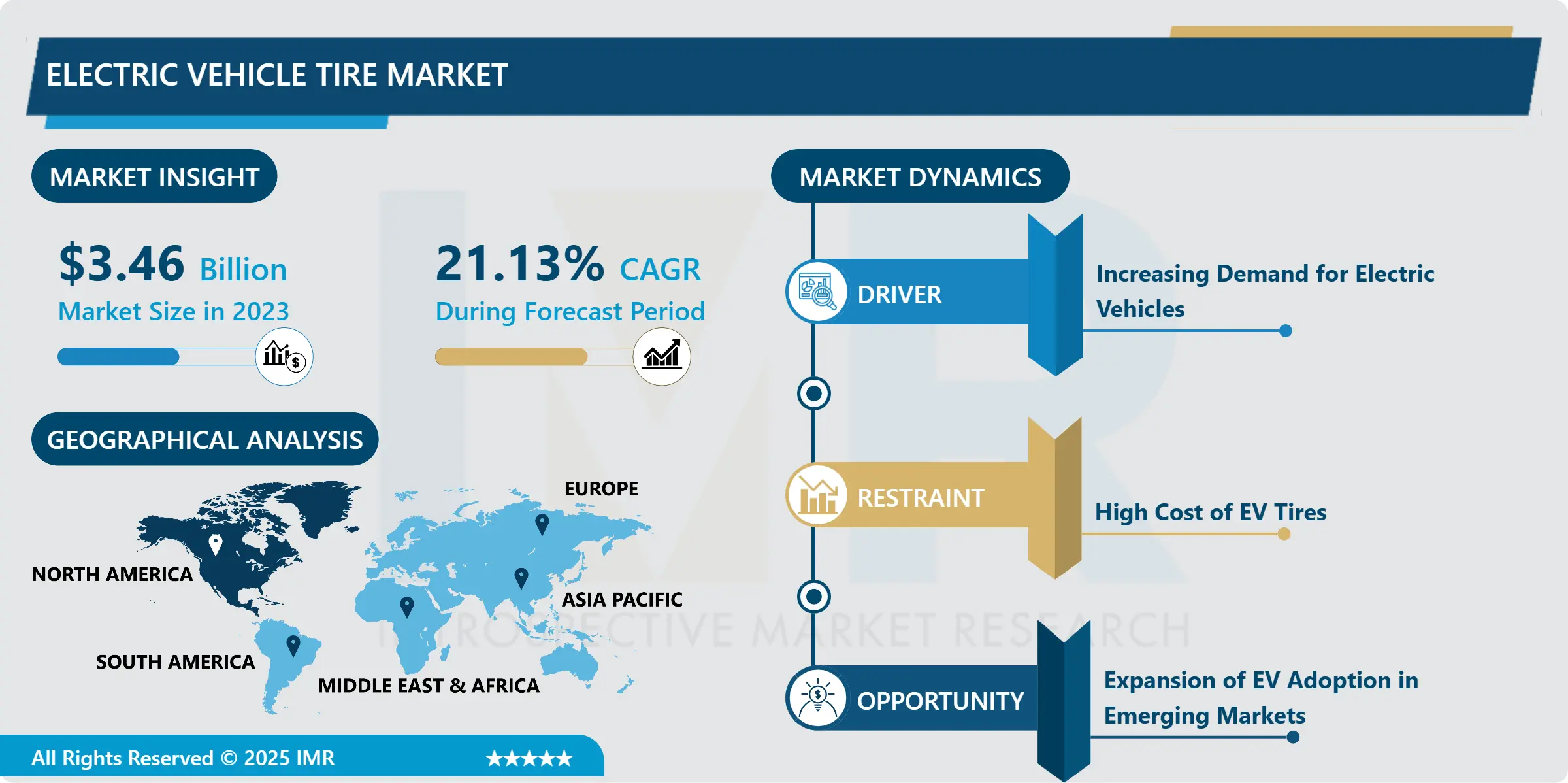

Electric Vehicle Tire Market Size Was Valued at USD 3.46 Billion in 2023, and is Projected to Reach USD 19.42 Billion by 2032, Growing at a CAGR of 21.13% From 2024-2032.

IMR Group

Description

Electric Vehicle Tire Market Synopsis:

Electric Vehicle Tire Market Size Was Valued at USD 3.46 Billion in 2023, and is Projected to Reach USD 19.42 Billion by 2032, Growing at a CAGR of 21.13% From 2024-2032.

The Electric Vehicle (EV) Tire Market is defined as the market of tires exclusively built for electric vehicles. They are specifically designed to satisfy the demand of an electrical vehicle, like the ability to manage and make a response to higher torque than traditional automobiles, the ability to optimise the power usage efficiently, and the ability to operate without creating loud noise typical of conventional automobiles.

It is factual for the global Electric Vehicle (EV) tire market has has been growing in the recent past as electric vehicles grow in popularity in the world market. As electric and self-driving vehicles become more popular, demand for tires that can efficiently complement these automobiles by providing higher torque, less rolling resistance as well as better performance output efficiency is increasing rapidly. EV tires on the other hand were created with firmed up side walls with capacities to handle the heft of the EV which is caused by their battering and motor power. The tires also have to be relatively non-energy absorbing so as not to eat up as much range as possible for the vehicle.

Electric vehicle tires are important in improving on the performance, quietness, noise pollution and general efficiency of the vehicle. The market is further boosted by factors such as environmental consciousness, new technologies, and a call to duty by various legislations on behalf of manufacturers to reduce on the emission of carbon- dioxyde, while increasing efficiency on the fuel. This in turn leads to greater innovation in the tire production process, such new materials for manufacture of tires, changes in tire designs that enhance their durability and suitability for use in EVs.

Electric Vehicle Tire Market Trend Analysis:

Integration of Smart Tire Technology

The utilization of smart tire technology is on the rise in the electric vehicles tire market. Such tires have tiny chips that can track pressure, temperature, tread depth and other aspects regarding tires. Smart tires give valuable information at the same time and make the driving experience better, safer and more energy efficient. This technology is especially valuable for EVs as it allows monitoring the tires’ health and makes sure the electric car stays in the efficient range that would allow to save as much battery power as possible.

The very concern for connected vehicles as well as IoT devices place smart tires as an appealing feature for EV manufacturers and consumers alike. Apart from that, the new tires enable enhanced performance, plus the potentiality for predictive maintenance. This information can be used to predict when a tire will require servicing before a breakdown happens thus saving costs from maintenance. Smart tire is going to have a significant impact as the EV industry is already moving forward towards digitization, thus leading to better growth rate coupled with customer satisfaction in electric vehicle tire market.

Expansion of EV Adoption in Emerging Markets

The continued growth of EV adoption particularly in new markets, then one of the greatest challenges in the electric vehicle tire market is something that could be viewed as opportunity. The market of electric vehicles is already showing promising results in developed countries like Europe, North America, and some parts of Asia, while it has not thrilled so much in developing countries. Currently, there are increasing legal requirements governing their environmental impacts in those regions as well as the provision of incentives for electric vehicle manufacturing and adoption is driving the market for electric vehicle tires in these regions.

This shift means a great prospect for tire manufacturers in an attempt to extend their market coverage and to develop cost-effective high-performance tires that will be appropriate for usage in EVs. Since the demands of the emerging markets include affordability, stability and easy access to the product, manufacturers of tires can appeal to the newly identified market. In addition, conditions that arise from the local production of EVs as seen in countries like China, India as well as Brazil will lead to increasing demand for unique tires appropriate for EVs hence creating market activities in these areas.

Electric Vehicle Tire Market Segment Analysis:

Electric Vehicle Tire Market is Segmented based on Vehicle Type, Tire Type, Rim Size, Distribution Channel, End User, and Region

By Vehicle Type, Passenger Vehicles segment is expected to dominate the market during the forecast period

The passenger vehicle segment has the largest share. New consumer interest in potential electric car models, for example, Tesla Model 3, Nissan Leaf, Chevrolet Bolt and other similarly oriented passenger EVs, has led to substantial growth for the tires aimed at passenger EV market. Passenger vehicles need tires that have low rolling resistance, high grip, and low noise to improve the driver’s experience, and extend their battery range.

With the start of traditional automotive companies entering the EV market, there is an increasing requirement for distinctive tires for passenger EEVs. This segment will also sustain steady expansion owing to increasing prospects of consumers adopting electric vehicles because of their lower operating costs and environmental impact, as well as government incentives. Also, enhanced tire solutions for sole Passenger EV’s which are still in development will aid in boosting the market size in this segment further.

By End User, Individual Consumers segment expected to held the largest share

The individual consumers are considered one of the major consumer groups for electric vehicle tire products. every person using electric vehicles for personal means, needs specialized tires for enhancing proper performance of vehicles and its efficiency. Tire makers are interested in creating tyres that require less energy, are comfortable to drive and suit the high torque and weight of electric vehicles.

Concern for environment has also reached individual consumers in their purchase decision they also want environmentally friendly products such as eco-friendly tires. Therefore, manufacturers are seeking for radical innovations in tire production including manufacturing tires from renewable sources or tires that are easier to recycle. This particular segment could also continue to drive growth of the market for electric vehicles as the adoption rate of EVs increases among individual consumers.

Electric Vehicle Tire Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America region emerges as a leading region in the electric vehicle tire market. It has been found that the region plays an important role in the electric vehicle industry, especially in the United States, which has had growth in the number of EVs. These factors include; political support, change in technology and a rising concern in the people of the region in the use of fuel-efficient vehicles.

North America EV sales are on the rise and as a result, tire manufacturers’ have already begun pursuing strategies that will enable them to address the needs of these particular vehicles here. The rising call for sustainable vehicles and significantly stringent emissions norms have placed the region on the global EV tire market map. Also the availability of leading EV manufacturers and greater investment in EV infrastructure would further bolster the market in North America.

Active Key Players in the Electric Vehicle Tire Market

Michelin (France)

Bridgestone (Japan)

Goodyear (USA)

Continental (Germany)

Pirelli (Italy)

Hankook Tire (South Korea)

Toyo Tires (Japan)

Sumitomo Rubber Industries (Japan)

Yokohama Rubber (Japan)

Balkrishna Industries (India)

Kumho Tire (South Korea)

Cooper Tire (USA)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Embedded Computing Market by Component

4.1 Embedded Computing Market Snapshot and Growth Engine

4.2 Embedded Computing Market Overview

4.3 Microprocessors (MPUs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Microprocessors (MPUs): Geographic Segmentation Analysis

4.4 Microcontrollers (MCUs)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Microcontrollers (MCUs): Geographic Segmentation Analysis

4.5 Digital Signal Processors (DSPs)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Digital Signal Processors (DSPs): Geographic Segmentation Analysis

4.6 Application-Specific Integrated Circuits (ASICs)

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Application-Specific Integrated Circuits (ASICs): Geographic Segmentation Analysis

4.7 Field-Programmable Gate Arrays (FPGAs)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Field-Programmable Gate Arrays (FPGAs): Geographic Segmentation Analysis

4.8 Software

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Software: Geographic Segmentation Analysis

4.9 Hardware

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Hardware: Geographic Segmentation Analysis

4.10 Services

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Services: Geographic Segmentation Analysis

Chapter 5: Embedded Computing Market by Application

5.1 Embedded Computing Market Snapshot and Growth Engine

5.2 Embedded Computing Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Automotive: Geographic Segmentation Analysis

5.4 Industrial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Industrial: Geographic Segmentation Analysis

5.5 Consumer Electronics

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Consumer Electronics: Geographic Segmentation Analysis

5.6 Healthcare

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Healthcare: Geographic Segmentation Analysis

5.7 Aerospace & Defense

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Aerospace & Defense: Geographic Segmentation Analysis

5.8 Telecommunications

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Telecommunications: Geographic Segmentation Analysis

5.9 Retail

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Retail: Geographic Segmentation Analysis

5.10 Others

5.10.1 Introduction and Market Overview

5.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.10.3 Key Market Trends, Growth Factors and Opportunities

5.10.4 Others: Geographic Segmentation Analysis

Chapter 6: Embedded Computing Market by End User

6.1 Embedded Computing Market Snapshot and Growth Engine

6.2 Embedded Computing Market Overview

6.3 Original Equipment Manufacturers (OEMs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Original Equipment Manufacturers (OEMs): Geographic Segmentation Analysis

6.4 Original Design Manufacturers (ODMs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Original Design Manufacturers (ODMs): Geographic Segmentation Analysis

6.5 System Integrators

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 System Integrators: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Embedded Computing Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INTEL CORPORATION (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TEXAS INSTRUMENTS INCORPORATED (UNITED STATES)

7.4 MICROCHIP TECHNOLOGY INC. (UNITED STATES)

7.5 NXP SEMICONDUCTORS N.V. (NETHERLANDS)

7.6 STMICROELECTRONICS N.V. (SWITZERLAND)

7.7 RENESAS ELECTRONICS CORPORATION (JAPAN)

7.8 BROADCOM INC. (UNITED STATES)

7.9 XILINX INC. (UNITED STATES)

7.10 INFINEON TECHNOLOGIES AG (GERMANY)

7.11 ANALOG DEVICES INC. (UNITED STATES)

7.12 ARM HOLDINGS (UNITED KINGDOM)

7.13 CYPRESS SEMICONDUCTOR CORPORATION (UNITED STATES)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Embedded Computing Market By Region

8.1 Overview

8.2. North America Embedded Computing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Component

8.2.4.1 Microprocessors (MPUs)

8.2.4.2 Microcontrollers (MCUs)

8.2.4.3 Digital Signal Processors (DSPs)

8.2.4.4 Application-Specific Integrated Circuits (ASICs)

8.2.4.5 Field-Programmable Gate Arrays (FPGAs)

8.2.4.6 Software

8.2.4.7 Hardware

8.2.4.8 Services

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Automotive

8.2.5.2 Industrial

8.2.5.3 Consumer Electronics

8.2.5.4 Healthcare

8.2.5.5 Aerospace & Defense

8.2.5.6 Telecommunications

8.2.5.7 Retail

8.2.5.8 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Original Equipment Manufacturers (OEMs)

8.2.6.2 Original Design Manufacturers (ODMs)

8.2.6.3 System Integrators

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Embedded Computing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Component

8.3.4.1 Microprocessors (MPUs)

8.3.4.2 Microcontrollers (MCUs)

8.3.4.3 Digital Signal Processors (DSPs)

8.3.4.4 Application-Specific Integrated Circuits (ASICs)

8.3.4.5 Field-Programmable Gate Arrays (FPGAs)

8.3.4.6 Software

8.3.4.7 Hardware

8.3.4.8 Services

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Automotive

8.3.5.2 Industrial

8.3.5.3 Consumer Electronics

8.3.5.4 Healthcare

8.3.5.5 Aerospace & Defense

8.3.5.6 Telecommunications

8.3.5.7 Retail

8.3.5.8 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Original Equipment Manufacturers (OEMs)

8.3.6.2 Original Design Manufacturers (ODMs)

8.3.6.3 System Integrators

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Embedded Computing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Component

8.4.4.1 Microprocessors (MPUs)

8.4.4.2 Microcontrollers (MCUs)

8.4.4.3 Digital Signal Processors (DSPs)

8.4.4.4 Application-Specific Integrated Circuits (ASICs)

8.4.4.5 Field-Programmable Gate Arrays (FPGAs)

8.4.4.6 Software

8.4.4.7 Hardware

8.4.4.8 Services

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Automotive

8.4.5.2 Industrial

8.4.5.3 Consumer Electronics

8.4.5.4 Healthcare

8.4.5.5 Aerospace & Defense

8.4.5.6 Telecommunications

8.4.5.7 Retail

8.4.5.8 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Original Equipment Manufacturers (OEMs)

8.4.6.2 Original Design Manufacturers (ODMs)

8.4.6.3 System Integrators

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Embedded Computing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Component

8.5.4.1 Microprocessors (MPUs)

8.5.4.2 Microcontrollers (MCUs)

8.5.4.3 Digital Signal Processors (DSPs)

8.5.4.4 Application-Specific Integrated Circuits (ASICs)

8.5.4.5 Field-Programmable Gate Arrays (FPGAs)

8.5.4.6 Software

8.5.4.7 Hardware

8.5.4.8 Services

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Automotive

8.5.5.2 Industrial

8.5.5.3 Consumer Electronics

8.5.5.4 Healthcare

8.5.5.5 Aerospace & Defense

8.5.5.6 Telecommunications

8.5.5.7 Retail

8.5.5.8 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Original Equipment Manufacturers (OEMs)

8.5.6.2 Original Design Manufacturers (ODMs)

8.5.6.3 System Integrators

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Embedded Computing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Component

8.6.4.1 Microprocessors (MPUs)

8.6.4.2 Microcontrollers (MCUs)

8.6.4.3 Digital Signal Processors (DSPs)

8.6.4.4 Application-Specific Integrated Circuits (ASICs)

8.6.4.5 Field-Programmable Gate Arrays (FPGAs)

8.6.4.6 Software

8.6.4.7 Hardware

8.6.4.8 Services

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Automotive

8.6.5.2 Industrial

8.6.5.3 Consumer Electronics

8.6.5.4 Healthcare

8.6.5.5 Aerospace & Defense

8.6.5.6 Telecommunications

8.6.5.7 Retail

8.6.5.8 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Original Equipment Manufacturers (OEMs)

8.6.6.2 Original Design Manufacturers (ODMs)

8.6.6.3 System Integrators

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Embedded Computing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Component

8.7.4.1 Microprocessors (MPUs)

8.7.4.2 Microcontrollers (MCUs)

8.7.4.3 Digital Signal Processors (DSPs)

8.7.4.4 Application-Specific Integrated Circuits (ASICs)

8.7.4.5 Field-Programmable Gate Arrays (FPGAs)

8.7.4.6 Software

8.7.4.7 Hardware

8.7.4.8 Services

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Automotive

8.7.5.2 Industrial

8.7.5.3 Consumer Electronics

8.7.5.4 Healthcare

8.7.5.5 Aerospace & Defense

8.7.5.6 Telecommunications

8.7.5.7 Retail

8.7.5.8 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Original Equipment Manufacturers (OEMs)

8.7.6.2 Original Design Manufacturers (ODMs)

8.7.6.3 System Integrators

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Electric Vehicle Tire Market research report?

A1: The forecast period in the Electric Vehicle Tire Market research report is 2024-2032.

Q2: Who are the key players in the Electric Vehicle Tire Market?

A2: Michelin (France), Bridgestone (Japan), Goodyear (USA), Continental (Germany), Pirelli (Italy), Hankook Tire (South Korea), Toyo Tires (Japan), Sumitomo Rubber Industries (Japan), Yokohama Rubber (Japan), Balkrishna Industries (India), Kumho Tire (South Korea), Cooper Tire (USA), and Other Active Players.

Q3: What are the segments of the Electric Vehicle Tire Market?

A3: The Electric Vehicle Tire Market is segmented into Vehicle Type, Tire Type, Rim Size, Distribution Channel, End User and Region. By Vehicle Type, the market is categorized into Passenger Vehicles, Commercial Vehicles. By Tire Type, the market is categorized into Radial Tires, Bias Ply Tires. By Rim Size, the market is categorized into 14–16 Inches, 17–18 Inches, 19–21 Inches, 22 Inches & Above. By Distribution Channel, the market is categorized into OEM (Original Equipment Manufacturer), Aftermarket. By End-User, the market is categorized into Individual Consumers and fleet Operators. By Region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe),Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Electric Vehicle Tire Market?

A4: The Electric Vehicle (EV) Tire Market is defined as the market of tires exclusively built for electric vehicles. They are specifically designed to satisfy the demand of an electrical vehicle like the ability to manage and make a response to higher torque than traditional automobiles, the ability to optimize the power usage efficiently, and the ability to operate without creating loud noise typical of conventional automobiles.

Q5: How big is the Electric Vehicle Tire Market?

A5: Electric Vehicle Tire Market Size Was Valued at USD 3.46 Billion in 2023, and is Projected to Reach USD 19.42 Billion by 2032, Growing at a CAGR of 21.13% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!