Stay Ahead in Fast-Growing Economies.

Browse Reports NowElectric Vehicle Power Inverter Market Size, Share, Growth & Forecast (2024-2032)

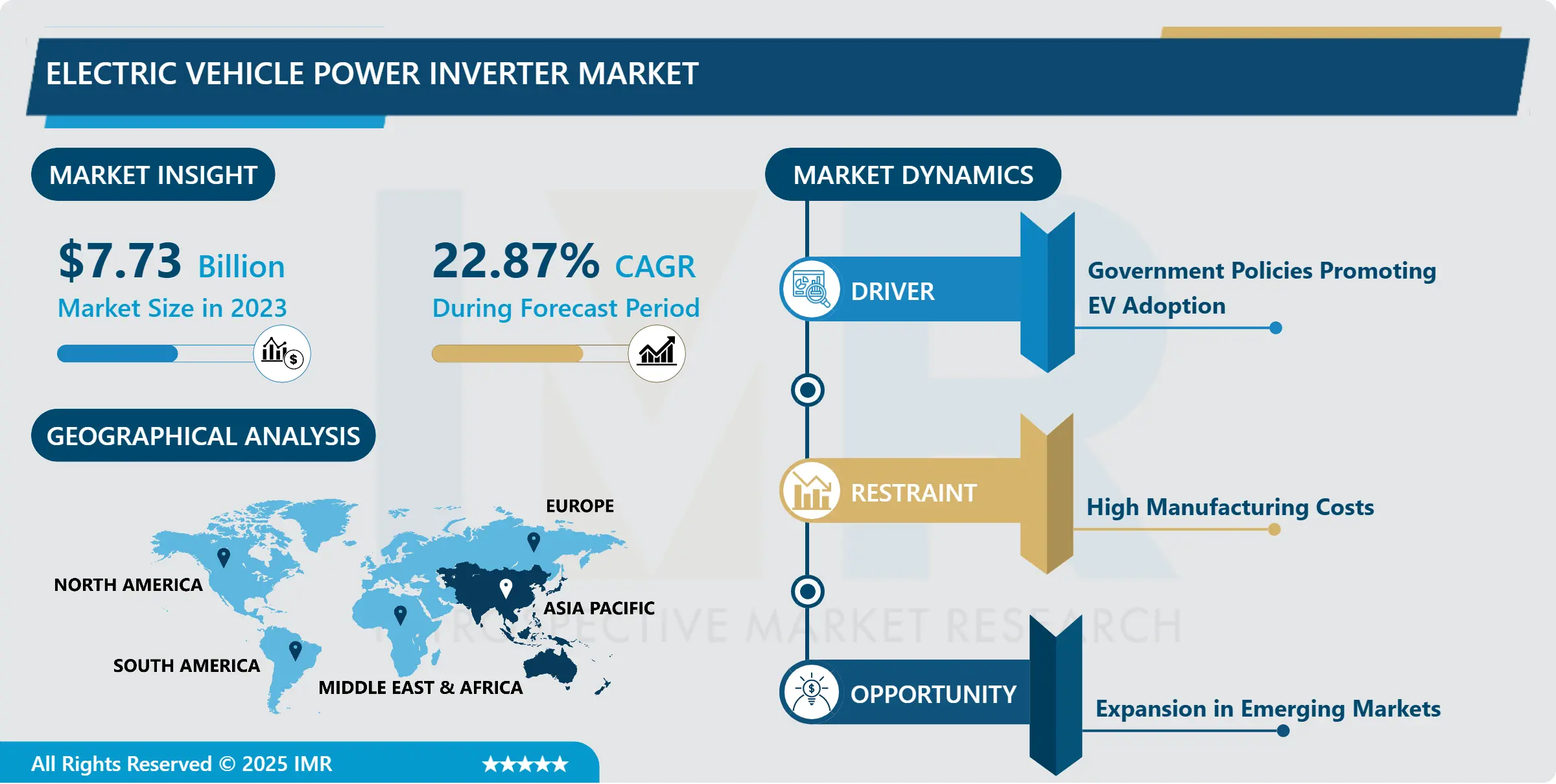

Electric Vehicle Power Inverter Market Size Was Valued at USD 7.73 Billion in 2023, and is Projected to Reach USD 49.34 Billion by 2032, Growing at a CAGR of 22.87% From 2024-2032.

IMR Group

Description

Electric Vehicle Power Inverter Market Synopsis:

Electric Vehicle Power Inverter Market Size Was Valued at USD 7.73 Billion in 2023, and is Projected to Reach USD 49.34 Billion by 2032, Growing at a CAGR of 22.87% From 2024-2032.

The electric vehicle power inverter is defined as the automotive segment that concentrates on those converters that transform direct current electricity from an electric vehicle battery to the alternating current electricity for the electric motor. Closely related to EV performance, efficiency and range, power inverters are essential in maintaining a clean DC-AC waveform, and in supporting regenerative braking.

The growth rate of the EV Power Inverter Market has been on an exponential rise in the past few years due to the rapidly improving electric vehicle market, rising standards for vehicle emissions, and constantly improving technologies for inverter markets. EV drivetrain, dynamics and efficiency of use depend on these devices, they are highly significant in an electric vehicle. The market includes inverters for specific propulsion types like Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs) and Plug-In Hybrid Electric Vehicles (PHEVs).

Examples include the Sic and Gan semiconductors that are better and advanced than prior inverter materials, making the inverters lighter, smaller and more efficient. This is important since auto makers continue to focus on range extension and cost cutting. Further, the shift towards renewable and sustainable energy and transportation also serves the requirement for high efficiency inverters.

The market is further classified by voltage range because the new generation of EVs requires inverters to operate at higher voltage levels due to the better power density and, therefore, efficiency. Major consumption areas of inverters are North America, Europe, and Asia-Pacific; however, Asia-Pacific has taken prominence in the manufacturing and consumption of inverters because of a prevalent automotive industry and appropriate government policies supporting the EV market.

Electric Vehicle Power Inverter Market Trend Analysis:

Rise of Silicon Carbide (SiC) Inverters

The silicon carbide inverters have started trending as the Silicon carbide power inverter market in EV are set experience a revolution. SiC technology has a higher efficient and thermal conductivity along with higher voltage tolerance as compared to a silicon-based inverter. Even such characteristics allow greater ranges, faster charging, as well as lower energy loss in EVs to be attained.

The use of SiC inverters is growing in the automobile sector and inverter manufacturers as car makers are incorporating efficient SiC inverters in high performing models of electrical vehicles. SiC technology, for instance, has been integrated into inverters of Tesla with records set by the conglomerate. This is expected to continue over time the same way the cost of SiC technology is decreasing which will trigger its use in mid and low range EVs hence fuelling the market growth.

Expansion in Emerging Markets

One of the highly/banner attractive opportunities identified for the EV power inverter market lies in emerging markets. Asia, Africa and South American countries have therefore joined the bandwagon with incentives offered to manufacturers and consumers, investment in infrastructure fabrication and enhanced awareness of sustainable mobility among others.

The increase in demand for affordable EVs that addresses these regions’ requirements might trigger the demand in cheap power inverters. Moreover, links between global manufacturers and domestic supply industries in these regions would also offer the solution of problems linked with price and infrastructure to access the vast markets the profit of which could help the companies enter.

Electric Vehicle Power Inverter Market Segment Analysis:

Electric Vehicle Power Inverter Market is Segmented on the basis of Propulsion Type, Voltage Range, Material, Vehicle Type, Distribution Channel, and Region.

By Propulsion Type, Battery Electric Vehicle (BEV) segment is expected to dominate the market during the forecast period

The Battery Electric Vehicle (BEV) segment is projected to dominate the Electric Vehicle (EV) Power Inverter Market throughout the forecast period, driven by increasing global demand for zero-emission vehicles and government incentives promoting clean energy transportation. BEVs rely entirely on electric power and require highly efficient power inverters to convert DC electricity from the battery into AC for the motor.

The rapid advancements in battery technology, falling battery costs, and expansion of charging infrastructure are also contributing to the accelerating adoption of BEVs. Major automotive manufacturers are focusing their R&D investments on BEV models, which is expected to boost the integration of advanced inverter technologies. These trends indicate that BEVs will maintain a leading position in the market, accounting for a significant share of the power inverter demand across key regions.

By Voltage Range, Up to 200V segment expected to held the largest share

The “Up to 200V” voltage range segment is expected to hold the largest share in the Electric Vehicle (EV) Power Inverter Market during the forecast period, primarily due to its widespread use in low- and mid-power electric vehicles, particularly in two-wheelers, three-wheelers, and compact electric passenger cars. These vehicles typically require lower voltage levels for efficient operation and cost-effectiveness, making up to 200V inverters an ideal choice.

The segment benefits from the growing popularity of urban mobility solutions and last-mile delivery applications, especially in emerging markets where affordability and efficiency are key considerations. The increasing adoption of small EVs in densely populated areas, coupled with ongoing technological improvements in low-voltage inverter design, is expected to further drive the dominance of this segment across the global EV ecosystem.

Electric Vehicle Power Inverter Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia-Pacific is the biggest region in the EV power inverter market due to a sound automotive industry, policy support, and industry players with mainland China, Japan, and South Korea. They already have countries like China that are pushing forwards EV manufacturing and usage through measures like subsidies and investments into charge points.

The growth within the region for improved semiconductor technologies also aids in the development of future inverters. Eupe is also expected to sustain its high market dominance as this region continues to pioneering setting the pace in the EV trend and the necessary charging infrastructure.

Active Key Players in the Electric Vehicle Power Inverter Market:

Robert Bosch GmbH (Germany)

Continental AG (Germany)

Delphi Technologies (United Kingdom)

Denso Corporation (Japan)

Hitachi, Ltd. (Japan)

Infineon Technologies AG (Germany)

Mitsubishi Electric Corporation (Japan)

Toshiba Corporation (Japan)

Valeo (France)

Fuji Electric Co., Ltd. (Japan)

STMicroelectronics (Switzerland)

Semikron International GmbH (Germany)

Other Active Players

Key Industry Developments in the Electric Vehicle Power Inverter Market:

In June 2024, Cissoid is supplying SiC-based inverter modules to Applied EV for its autonomous electric vehicles in industrial settings.June 2024: ABB launched the AMXE250 motor and HES580 three-level inverter package tailored for electric buses, designed to minimize motor losses by up to 12% compared to previous technologies over typical drive cycles.January 2024: Mitsubishi Electric Corporation introduced six new J3-Series power semiconductor modules for xEVs, featuring SiC-MOSFET or RC-IGBT designs, enhancing efficiency and scalability in EV and PHEV inverters.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Power Inverter Market by Propulsion Type

4.1 Electric Vehicle Power Inverter Market Snapshot and Growth Engine

4.2 Electric Vehicle Power Inverter Market Overview

4.3 Battery Electric Vehicle (BEV)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Battery Electric Vehicle (BEV): Geographic Segmentation Analysis

4.4 Hybrid Electric Vehicle (HEV)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hybrid Electric Vehicle (HEV): Geographic Segmentation Analysis

4.5 Plug-In Hybrid Electric Vehicle (PHEV)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Plug-In Hybrid Electric Vehicle (PHEV): Geographic Segmentation Analysis

Chapter 5: Electric Vehicle Power Inverter Market by Voltage Range

5.1 Electric Vehicle Power Inverter Market Snapshot and Growth Engine

5.2 Electric Vehicle Power Inverter Market Overview

5.3 Up to 200V

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Up to 200V: Geographic Segmentation Analysis

5.4 200V to 400V

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 200V to 400V: Geographic Segmentation Analysis

5.5 Above 400V

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Above 400V: Geographic Segmentation Analysis

Chapter 6: Electric Vehicle Power Inverter Market by Material

6.1 Electric Vehicle Power Inverter Market Snapshot and Growth Engine

6.2 Electric Vehicle Power Inverter Market Overview

6.3 Silicon

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Silicon: Geographic Segmentation Analysis

6.4 Silicon Carbide

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Silicon Carbide: Geographic Segmentation Analysis

6.5 Gallium Nitride

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Gallium Nitride: Geographic Segmentation Analysis

Chapter 7: Electric Vehicle Power Inverter Market by Vehicle Type

7.1 Electric Vehicle Power Inverter Market Snapshot and Growth Engine

7.2 Electric Vehicle Power Inverter Market Overview

7.3 Passenger Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Passenger Cars: Geographic Segmentation Analysis

7.4 Commercial Vehicles

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial Vehicles: Geographic Segmentation Analysis

Chapter 8: Electric Vehicle Power Inverter Market by Distribution Channel

8.1 Electric Vehicle Power Inverter Market Snapshot and Growth Engine

8.2 Electric Vehicle Power Inverter Market Overview

8.3 OEMs

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEMs: Geographic Segmentation Analysis

8.4 After

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 After: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electric Vehicle Power Inverter Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ROBERT BOSCH GMBH (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CONTINENTAL AG (GERMANY)

9.4 DELPHI TECHNOLOGIES (UNITED KINGDOM)

9.5 DENSO CORPORATION (JAPAN)

9.6 HITACHI

9.7 LTD. (JAPAN)

9.8 INFINEON TECHNOLOGIES AG (GERMANY)

9.9 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

9.10 TOSHIBA CORPORATION (JAPAN)

9.11 VALEO (FRANCE)

9.12 FUJI ELECTRIC CO. LTD. (JAPAN)

9.13 STMICROELECTRONICS (SWITZERLAND)

9.14 SEMIKRON INTERNATIONAL GMBH (GERMANY)

9.15 OTHER ACTIVE PLAYERS

Chapter 10: Global Electric Vehicle Power Inverter Market By Region

10.1 Overview

10.2. North America Electric Vehicle Power Inverter Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Propulsion Type

10.2.4.1 Battery Electric Vehicle (BEV)

10.2.4.2 Hybrid Electric Vehicle (HEV)

10.2.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.2.5 Historic and Forecasted Market Size By Voltage Range

10.2.5.1 Up to 200V

10.2.5.2 200V to 400V

10.2.5.3 Above 400V

10.2.6 Historic and Forecasted Market Size By Material

10.2.6.1 Silicon

10.2.6.2 Silicon Carbide

10.2.6.3 Gallium Nitride

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Passenger Cars

10.2.7.2 Commercial Vehicles

10.2.8 Historic and Forecasted Market Size By Distribution Channel

10.2.8.1 OEMs

10.2.8.2 After

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electric Vehicle Power Inverter Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Propulsion Type

10.3.4.1 Battery Electric Vehicle (BEV)

10.3.4.2 Hybrid Electric Vehicle (HEV)

10.3.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.3.5 Historic and Forecasted Market Size By Voltage Range

10.3.5.1 Up to 200V

10.3.5.2 200V to 400V

10.3.5.3 Above 400V

10.3.6 Historic and Forecasted Market Size By Material

10.3.6.1 Silicon

10.3.6.2 Silicon Carbide

10.3.6.3 Gallium Nitride

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Passenger Cars

10.3.7.2 Commercial Vehicles

10.3.8 Historic and Forecasted Market Size By Distribution Channel

10.3.8.1 OEMs

10.3.8.2 After

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electric Vehicle Power Inverter Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Propulsion Type

10.4.4.1 Battery Electric Vehicle (BEV)

10.4.4.2 Hybrid Electric Vehicle (HEV)

10.4.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.4.5 Historic and Forecasted Market Size By Voltage Range

10.4.5.1 Up to 200V

10.4.5.2 200V to 400V

10.4.5.3 Above 400V

10.4.6 Historic and Forecasted Market Size By Material

10.4.6.1 Silicon

10.4.6.2 Silicon Carbide

10.4.6.3 Gallium Nitride

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Passenger Cars

10.4.7.2 Commercial Vehicles

10.4.8 Historic and Forecasted Market Size By Distribution Channel

10.4.8.1 OEMs

10.4.8.2 After

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electric Vehicle Power Inverter Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Propulsion Type

10.5.4.1 Battery Electric Vehicle (BEV)

10.5.4.2 Hybrid Electric Vehicle (HEV)

10.5.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.5.5 Historic and Forecasted Market Size By Voltage Range

10.5.5.1 Up to 200V

10.5.5.2 200V to 400V

10.5.5.3 Above 400V

10.5.6 Historic and Forecasted Market Size By Material

10.5.6.1 Silicon

10.5.6.2 Silicon Carbide

10.5.6.3 Gallium Nitride

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Passenger Cars

10.5.7.2 Commercial Vehicles

10.5.8 Historic and Forecasted Market Size By Distribution Channel

10.5.8.1 OEMs

10.5.8.2 After

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electric Vehicle Power Inverter Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Propulsion Type

10.6.4.1 Battery Electric Vehicle (BEV)

10.6.4.2 Hybrid Electric Vehicle (HEV)

10.6.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.6.5 Historic and Forecasted Market Size By Voltage Range

10.6.5.1 Up to 200V

10.6.5.2 200V to 400V

10.6.5.3 Above 400V

10.6.6 Historic and Forecasted Market Size By Material

10.6.6.1 Silicon

10.6.6.2 Silicon Carbide

10.6.6.3 Gallium Nitride

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Passenger Cars

10.6.7.2 Commercial Vehicles

10.6.8 Historic and Forecasted Market Size By Distribution Channel

10.6.8.1 OEMs

10.6.8.2 After

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electric Vehicle Power Inverter Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Propulsion Type

10.7.4.1 Battery Electric Vehicle (BEV)

10.7.4.2 Hybrid Electric Vehicle (HEV)

10.7.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.7.5 Historic and Forecasted Market Size By Voltage Range

10.7.5.1 Up to 200V

10.7.5.2 200V to 400V

10.7.5.3 Above 400V

10.7.6 Historic and Forecasted Market Size By Material

10.7.6.1 Silicon

10.7.6.2 Silicon Carbide

10.7.6.3 Gallium Nitride

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Passenger Cars

10.7.7.2 Commercial Vehicles

10.7.8 Historic and Forecasted Market Size By Distribution Channel

10.7.8.1 OEMs

10.7.8.2 After

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Electric Vehicle Power Inverter Market research report?

A1: The forecast period in the Electric Vehicle Power Inverter Market research report is 2024-2032.

Q2: Who are the key players in the Electric Vehicle Power Inverter Market?

A2: Robert Bosch GmbH (Germany), Continental AG (Germany), Delphi Technologies (United Kingdom), Denso Corporation (Japan), Hitachi, Ltd. (Japan), Infineon Technologies AG (Germany), Mitsubishi Electric Corporation (Japan), Toshiba Corporation (Japan), Valeo (France), Fuji Electric Co., Ltd. (Japan), STMicroelectronics (Switzerland), Semikron International GmbH (Germany), and Other Active Players.

Q3: What are the segments of the Electric Vehicle Power Inverter Market?

A3: The Electric Vehicle Power Inverter Market is segmented into Propulsion Type, Voltage Range, Material, Vehicle Type, Distribution Channel and region. By Propulsion Type, the market is categorized into Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-In Hybrid Electric Vehicle (PHEV). By Voltage Range, the market is categorized into Up to 200V, 200V to 400V, Above 400V. By Material, the market is categorized into Silicon, Silicon Carbide, Gallium Nitride. By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles. By Distribution Channel, the market is categorized into OEMs, Aftermarket. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Electric Vehicle Power Inverter Market?

A4: The electric vehicle power inverter is defined as the automotive segment that concentrates on those converters that transform direct current electricity from an electric vehicle battery to the alternating current electricity for the electric motor. Closely related to EV performance, efficiency and range, power inverters are essential in maintaining a clean DC-AC waveform, and in supporting regenerative braking.

Q5: How big is the Electric Vehicle Power Inverter Market?

A5: Electric Vehicle Power Inverter Market Size Was Valued at USD 7.73 Billion in 2023, and is Projected to Reach USD 49.34 Billion by 2032, Growing at a CAGR of 22.87% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!