Stay Ahead in Fast-Growing Economies.

Browse Reports NowElectric Vehicle HV Cables Market – Global Industry Growth and Trend Analysis

The high-voltage electrical system of electric vehicles is primarily in charge of providing electricity for driving, starting, charging and discharging, and air conditioning. It primarily consists of the battery system, powertrain, charging system, high-voltage electronic control system, high-voltage equipment, and its wiring harness system. High-voltage lines are used in electric vehicles to transmit power between the charging port and the battery, the battery’s interior, the battery and the engine, and other parts, as well as the battery energy storage equipment and other domains.

IMR Group

Description

Electric Vehicle HV Cables Market Synopsis

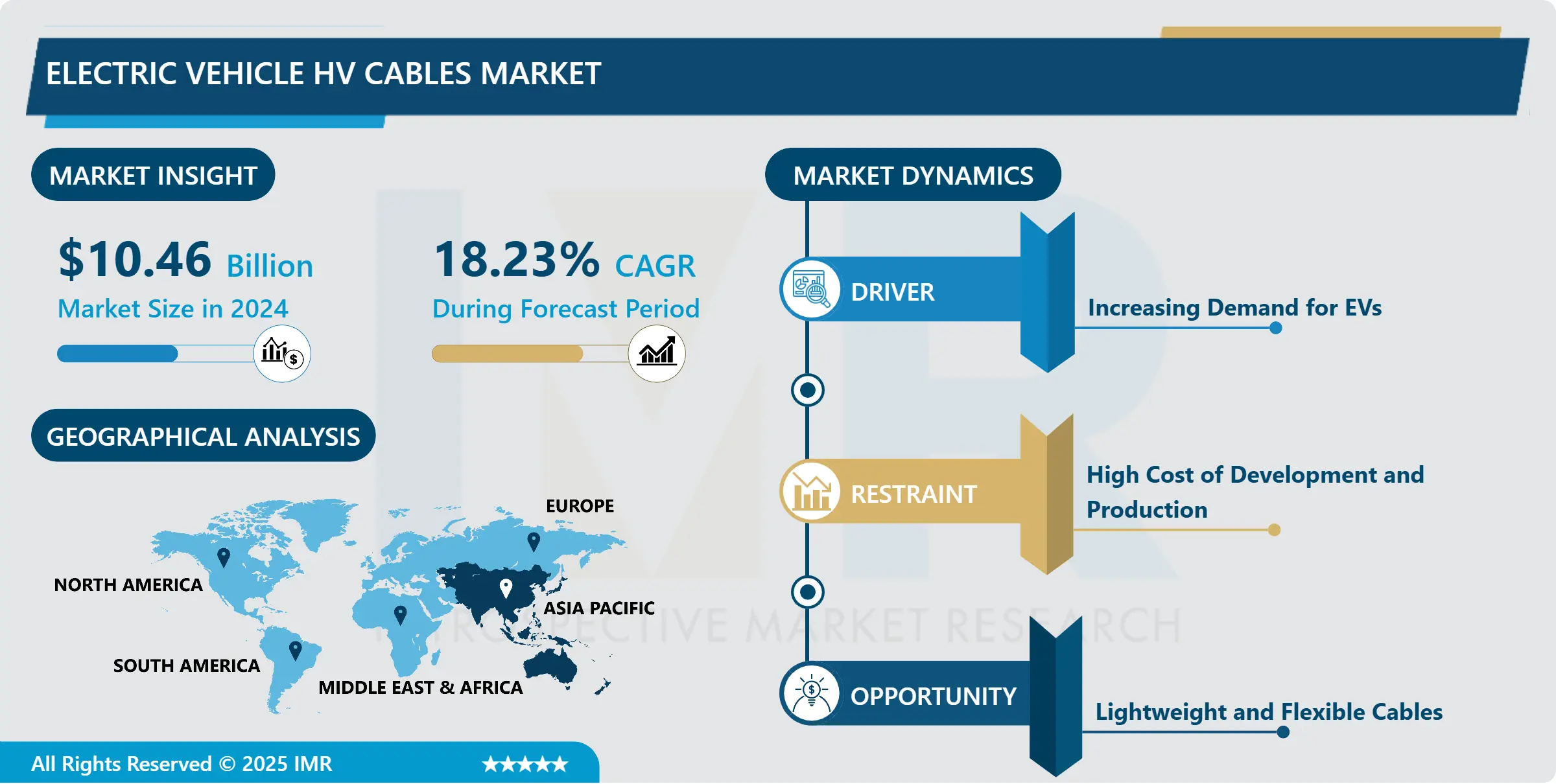

Electric Vehicle HV Cables Market Size Was Valued at USD 10.46 Billion in 2024 and is Projected to Reach USD 39.93 Billion by 2032, Growing at a CAGR of 18.23% From 2025-2032.

A high-voltage cable (HV cable), also known as a high-tension cable (HT cable), is designed for the transmission of electric power at high voltages. It consists of a conductor, typically made of materials like copper or aluminum, surrounded by layers of insulation to prevent energy loss and ensure safety. These cables are fully insulated to withstand high electrical stresses and are used in various applications, including power transmission, industrial systems, and renewable energy setups. HV cables play a critical role in efficient energy distribution, enabling long-distance power transmission while maintaining system reliability and reducing energy losses.

High-voltage (HV) cables are vital in electric vehicles (EVs), efficiently transmitting electricity from the battery to the motor and other critical systems. These cables are designed with safety as a priority, featuring high-quality insulation and shielding to prevent electrical leaks and ensure stability under extreme conditions. HV cables adhere to strict safety standards, making them reliable during accidents or intense loads. This safety-focused design protects the EV’s electrical systems and enhances passenger safety, reinforcing consumer confidence in EV technology.

The durability and efficiency of HV cables significantly contribute to the performance of electric vehicles. Constructed from robust materials such as Viton fluoroelastomers, HV cables withstand wear and tear, ensuring long-lasting reliability even in demanding environments. Their ability to resist high temperatures and exposure to oil makes them suitable for various applications, including car heaters, electric compressors, and HV heat pumps. Moreover, HV systems optimize energy transfer, improving efficiency, extending the vehicle’s range, and maintaining consistent performance over time.

Another critical advantage of HV cables lies in their adaptability and environmental resistance. These cables are designed to be flexible, enabling ease of installation and better accommodation of compact spaces within EV architectures. Additionally, they offer strong anti-interference properties, ensuring stable operation of the vehicle’s electrical systems by minimizing electromagnetic interference. With their combination of safety, efficiency, and resilience, HV cables play a pivotal role in advancing the capabilities and reliability of electric vehicles.

Electric Vehicle HV Cables Market Trend Analysis

Increasing Demand for EVs

3D printing materials are extensively used in the automotive industry to manufacture scaled models for testing. They are also used for components, such as bellows, front bumper, air conditioning ducting, suspension wishbone, dashboard interface, alternator mounting bracket, battery cover, etc. Automotive OEM manufacturers are using 3D printing materials for rapid prototyping. ?

Owing to the advantages of the 3D printing process, such as low cost, less manufacturing time, reduced material wastage, etc., automotive manufacturers are moving toward the usage of this process. Some of the largest automotive manufacturers in the world, such as AUDI, Rolls Royce, Porsche, Hackrod, and many others, are using these materials to manufacture spare parts and metal prototypes. ?

The current slowdown in global automotive production has affected the market for polyester staple fiber because of the decreased demand for automotive fibers. Additionally, the current slowdown in automotive sales in countries such as China is further expected to hinder the demand for 3D printing materials. ?

The pandemic has severely impacted the automotive sector globally; according to OICA (International Organization of Motor Vehicle Manufacturers), global production of vehicles in the third quarter of 2020 was around 50 million, a significant decrease compared to the production in the third quarter of 2019, which was around 65 million.

Lightweight and Flexible Cables

The Electric Vehicle (EV) High Voltage (HV) Cable market is rapidly evolving as the demand for energy-efficient and environmentally friendly transportation grows. HV cables are critical in transmitting power between various EV components, including the battery, inverter, and electric motor.

The development of lightweight and flexible HV cables is emerging as a key focus area within this market. These cables are designed to reduce overall vehicle weight, improve energy efficiency, and enable greater flexibility in vehicle design. With advancements in materials such as aluminum alloys and composite polymers, manufacturers are addressing challenges such as thermal management and electromagnetic compatibility while maintaining the structural integrity of cables.

Lightweight HV cables contribute significantly to improving the range and performance of EVs by reducing the energy consumption associated with vehicle weight. Their flexibility allows automotive engineers to design more compact and complex electrical architectures, accommodating the increasing electrification of vehicle subsystems. These cables also offer benefits during assembly and maintenance processes, as their pliability simplifies installation in tight spaces and intricate routing paths.

The market is witnessing significant innovation driven by major players and collaboration across the automotive and materials sectors. Companies are investing in research and development to produce cables that can withstand extreme temperatures, high voltages, and dynamic mechanical stress while remaining lightweight and durable. With regulatory bodies emphasizing energy efficiency and emissions reduction, the adoption of advanced HV cable technologies is poised to accelerate. As EV penetration increases globally, lightweight and flexible HV cables will play a pivotal role in shaping the next generation of sustainable and high-performance electric vehicles.

Electric Vehicle HV Cables Market Segment Analysis:

Electric Vehicle HV Cables Market Segmented based on Type, Application, End-users, and Region.

By Product Type, Shielded Cables segment is expected to dominate the market during the forecast period

The shielded cables used in the electric vehicle (EV) high-voltage (HV) cables market play a critical role in ensuring the safety and efficiency of power transmission systems within electric vehicles. Shielded cables are designed to protect sensitive electrical circuits from electromagnetic interference (EMI), which can disrupt the functioning of various electrical components.

These cables feature an additional layer of conductive material, often made of braided metal, foil, or a combination of both, which effectively blocks unwanted electrical signals. This shielding ensures that the high-voltage systems within the EV are protected from external electromagnetic noise, allowing for the seamless operation of crucial systems such as motor controllers, battery management, and charging interfaces. In terms of product types, the electric vehicle HV cables market offers various configurations based on the specific requirements of the vehicle’s electrical systems. The most common types of shielded HV cables include single-core and multi-core cables, each serving different applications within the vehicle.

Single-core cables are typically used for high-voltage connections between the battery pack and motor, while multi-core cables are often utilized for complex power distribution and control systems. Additionally, there are specialized cables that are designed for fast-charging systems, which require high current-carrying capacity and low resistive losses. These cables are typically constructed with enhanced insulation and advanced shielding materials to prevent overheating and ensure durability in harsh automotive environments.

By Application, Battery Management Systems (BMS) segment held the largest share in 2024

Battery Management Systems (BMS) play a crucial role in the Electric Vehicle (EV) sector by ensuring the safe and efficient operation of the vehicle’s battery. A BMS is responsible for monitoring various battery parameters, such as voltage, temperature, state of charge (SOC), state of health (SOH), and current, to prevent overcharging, overheating, and over-discharge, all of which could lead to battery failure or reduced lifespan. The system optimizes the charging and discharging cycles to prolong battery life, enhance performance, and improve the overall safety of the vehicle.

As electric vehicles gain market share, the demand for advanced and reliable BMS technology increases to manage the complexities of modern lithium-ion and solid-state batteries.In parallel, the Electric Vehicle HV (High Voltage) Cables Market is witnessing substantial growth due to the increasing adoption of electric vehicles. High-voltage cables are integral to the power delivery systems of EVs, transmitting electrical energy between the battery, inverter, and other critical components. These cables need to meet strict standards for safety, durability, and efficiency since they carry the high voltage required for the vehicle’s powertrain.

Innovations in cable insulation materials, such as cross-linked polyethylene (XLPE), and advancements in cable design to reduce weight and improve flexibility are driving the market forward. With the growing global shift toward sustainable transportation and stricter emissions regulations, the demand for HV cables, paired with efficient BMS, is expected to rise significantly in the coming years.

The synergy between Battery Management Systems and High Voltage Cables is essential for optimizing EV performance. A well-designed BMS ensures that the battery operates within safe limits, while the HV cables ensure seamless power transmission across the vehicle’s systems. As EV manufacturers continue to develop more powerful and efficient batteries, the need for robust BMS technology and high-quality cables becomes even more critical.

Electric Vehicle HV Cables Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia-Pacific region is leading the Electric Vehicle (EV) HV Cables market due to the rapidly expanding adoption of electric vehicles, supported by strong governmental initiatives, subsidies, and policies promoting sustainable transportation. Countries like China, Japan, and South Korea are major drivers, where both the demand for EVs and investments in infrastructure are growing exponentially. This has created a substantial market for high-voltage (HV) cables that connect electric vehicles to charging infrastructure and internal power systems.

In addition to government support, the rapid advancements in technology and the manufacturing capabilities in the region have bolstered the growth of the EV HV cables market. China, in particular, is the world’s largest EV market, with a strong push toward electrification, further fueling the demand for HV cables. The presence of key manufacturers and the integration of innovative cable materials such as advanced insulating materials have enhanced product performance and reliability, making the region a focal point for HV cable development.

Furthermore, the growing focus on environmental sustainability and the transition to renewable energy sources in the Asia-Pacific region has positioned the EV sector as a critical component of energy infrastructure. The expanding electric vehicle charging network and the need for efficient, high-capacity cables to ensure optimal energy flow have made HV cables indispensable. As governments continue to emphasize green technologies and investments in electric mobility, the Asia-Pacific market is expected to retain its dominance in the coming years.

Active Key Players in the Electric Vehicle HV Cables Market

Sumitomo Electric Industries Ltd. (Japan)

Prysmian Group (Italy)

Huber + Suhner (Switzerland)

Aptiv (Ireland)

Nexans (France)

ACOME (France)

JYFT (China)

Qingdao Cable (China)

Leoni (Germany)

Coroflex (Germany)

Champlain Cable (USA)

OMG (Italy)

Tition (Italy)

ZTT (China)

Molex (USA)

Other Active Players

Key Industry Developments in the Electric Vehicle HV Cables Market:

In January 2024, Siemens AG finalized the acquisition of Heliox, a leading provider of DC fast charging solutions for eBus and eTruck fleets, as well as passenger vehicles. Based in the Netherlands, Heliox employs around 330 people. The acquisition enhances Siemens’ eMobility charging portfolio with solutions ranging from 40 kilowatts (kW) to megawatt charging, targeting depot and en-route applications. This move bolstered Siemens’ presence in Europe and North America and strengthened its power electronics and digital capabilities. Heliox’s expertise in charger monitoring and energy management expanded Siemens’ IoT and software offerings. Siemens aims to scale Heliox’s production through its global network and infrastructure.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle HV Cables Market by Type Power Rating (2018-2032)

4.1 Electric Vehicle HV Cables Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Low Voltage Cables (Below 600V)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium Voltage Cables (600V–1

4.5 000V)

4.6 High Voltage Cables (Above 1

4.7 000V

Chapter 5: Electric Vehicle HV Cables Market by Product Type (2018-2032)

5.1 Electric Vehicle HV Cables Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Coaxial Cables

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Shielded Cables

5.5 Sub-Assemblies

5.6 Twisted Pairs

5.7 Unshielded Cables

Chapter 6: Electric Vehicle HV Cables Market by Material (2018-2032)

6.1 Electric Vehicle HV Cables Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Copper Cables

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aluminum Cables

6.5 Hybrid Cables

6.6 PVC

6.7 Rubber

6.8 Teflon

6.9 XLPE

Chapter 7: Electric Vehicle HV Cables Market by Design Type (2018-2032)

7.1 Electric Vehicle HV Cables Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Helical Cable Design

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Spiral Cable Design

7.5 Straight Cable Design

Chapter 8: Electric Vehicle HV Cables Market by Application (2018-2032)

8.1 Electric Vehicle HV Cables Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Battery Management Systems (BMS)

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Charging Systems

8.5 Electric Drive Systems

8.6 Heating

8.7 Ventilation

8.8 Air Conditioning (HVAC)

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electric Vehicle HV Cables Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ARBIN INSTRUMENTS

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ATESTEP GRUH

9.4 AVL (AUSTRIA)

9.5 BLUM- NOVOTET GMBH

9.6 BURKE PORTAR GROUP

9.7 CHROMA ATE ( TAIWAN)

9.8 COMEMSO ELECTRONICS GMBH

9.9 DEWESOFT

9.10 DURR GROUP (GERMANY)

9.11 DYNOMERK CONTROLS

9.12 FEV GROUP GMBH

9.13 FROUDE INC

9.14 HORIBA (JAPAN)

9.15 KUKAAG (KEY INNOVATOR)

9.16 TUV RHEINLAND (GERMANY)

9.17 KEYSIGHT TECHNOLOGIES (USA)

9.18 NATIONAL INSTRUMENTS (NI) (USA)

9.19 SIEMENS AG (GERMANY)

9.20 VECTOR INFORMATIK GMBH (GERMANY)

9.21 MACCOR INC. (USA)

9.22 OTHER KEY PLAYERS

Chapter 10: Global Electric Vehicle HV Cables Market By Region

10.1 Overview

10.2. North America Electric Vehicle HV Cables Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type Power Rating

10.2.4.1 Low Voltage Cables (Below 600V)

10.2.4.2 Medium Voltage Cables (600V–1

10.2.4.3 000V)

10.2.4.4 High Voltage Cables (Above 1

10.2.4.5 000V

10.2.5 Historic and Forecasted Market Size by Product Type

10.2.5.1 Coaxial Cables

10.2.5.2 Shielded Cables

10.2.5.3 Sub-Assemblies

10.2.5.4 Twisted Pairs

10.2.5.5 Unshielded Cables

10.2.6 Historic and Forecasted Market Size by Material

10.2.6.1 Copper Cables

10.2.6.2 Aluminum Cables

10.2.6.3 Hybrid Cables

10.2.6.4 PVC

10.2.6.5 Rubber

10.2.6.6 Teflon

10.2.6.7 XLPE

10.2.7 Historic and Forecasted Market Size by Design Type

10.2.7.1 Helical Cable Design

10.2.7.2 Spiral Cable Design

10.2.7.3 Straight Cable Design

10.2.8 Historic and Forecasted Market Size by Application

10.2.8.1 Battery Management Systems (BMS)

10.2.8.2 Charging Systems

10.2.8.3 Electric Drive Systems

10.2.8.4 Heating

10.2.8.5 Ventilation

10.2.8.6 Air Conditioning (HVAC)

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electric Vehicle HV Cables Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type Power Rating

10.3.4.1 Low Voltage Cables (Below 600V)

10.3.4.2 Medium Voltage Cables (600V–1

10.3.4.3 000V)

10.3.4.4 High Voltage Cables (Above 1

10.3.4.5 000V

10.3.5 Historic and Forecasted Market Size by Product Type

10.3.5.1 Coaxial Cables

10.3.5.2 Shielded Cables

10.3.5.3 Sub-Assemblies

10.3.5.4 Twisted Pairs

10.3.5.5 Unshielded Cables

10.3.6 Historic and Forecasted Market Size by Material

10.3.6.1 Copper Cables

10.3.6.2 Aluminum Cables

10.3.6.3 Hybrid Cables

10.3.6.4 PVC

10.3.6.5 Rubber

10.3.6.6 Teflon

10.3.6.7 XLPE

10.3.7 Historic and Forecasted Market Size by Design Type

10.3.7.1 Helical Cable Design

10.3.7.2 Spiral Cable Design

10.3.7.3 Straight Cable Design

10.3.8 Historic and Forecasted Market Size by Application

10.3.8.1 Battery Management Systems (BMS)

10.3.8.2 Charging Systems

10.3.8.3 Electric Drive Systems

10.3.8.4 Heating

10.3.8.5 Ventilation

10.3.8.6 Air Conditioning (HVAC)

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electric Vehicle HV Cables Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type Power Rating

10.4.4.1 Low Voltage Cables (Below 600V)

10.4.4.2 Medium Voltage Cables (600V–1

10.4.4.3 000V)

10.4.4.4 High Voltage Cables (Above 1

10.4.4.5 000V

10.4.5 Historic and Forecasted Market Size by Product Type

10.4.5.1 Coaxial Cables

10.4.5.2 Shielded Cables

10.4.5.3 Sub-Assemblies

10.4.5.4 Twisted Pairs

10.4.5.5 Unshielded Cables

10.4.6 Historic and Forecasted Market Size by Material

10.4.6.1 Copper Cables

10.4.6.2 Aluminum Cables

10.4.6.3 Hybrid Cables

10.4.6.4 PVC

10.4.6.5 Rubber

10.4.6.6 Teflon

10.4.6.7 XLPE

10.4.7 Historic and Forecasted Market Size by Design Type

10.4.7.1 Helical Cable Design

10.4.7.2 Spiral Cable Design

10.4.7.3 Straight Cable Design

10.4.8 Historic and Forecasted Market Size by Application

10.4.8.1 Battery Management Systems (BMS)

10.4.8.2 Charging Systems

10.4.8.3 Electric Drive Systems

10.4.8.4 Heating

10.4.8.5 Ventilation

10.4.8.6 Air Conditioning (HVAC)

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electric Vehicle HV Cables Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type Power Rating

10.5.4.1 Low Voltage Cables (Below 600V)

10.5.4.2 Medium Voltage Cables (600V–1

10.5.4.3 000V)

10.5.4.4 High Voltage Cables (Above 1

10.5.4.5 000V

10.5.5 Historic and Forecasted Market Size by Product Type

10.5.5.1 Coaxial Cables

10.5.5.2 Shielded Cables

10.5.5.3 Sub-Assemblies

10.5.5.4 Twisted Pairs

10.5.5.5 Unshielded Cables

10.5.6 Historic and Forecasted Market Size by Material

10.5.6.1 Copper Cables

10.5.6.2 Aluminum Cables

10.5.6.3 Hybrid Cables

10.5.6.4 PVC

10.5.6.5 Rubber

10.5.6.6 Teflon

10.5.6.7 XLPE

10.5.7 Historic and Forecasted Market Size by Design Type

10.5.7.1 Helical Cable Design

10.5.7.2 Spiral Cable Design

10.5.7.3 Straight Cable Design

10.5.8 Historic and Forecasted Market Size by Application

10.5.8.1 Battery Management Systems (BMS)

10.5.8.2 Charging Systems

10.5.8.3 Electric Drive Systems

10.5.8.4 Heating

10.5.8.5 Ventilation

10.5.8.6 Air Conditioning (HVAC)

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electric Vehicle HV Cables Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type Power Rating

10.6.4.1 Low Voltage Cables (Below 600V)

10.6.4.2 Medium Voltage Cables (600V–1

10.6.4.3 000V)

10.6.4.4 High Voltage Cables (Above 1

10.6.4.5 000V

10.6.5 Historic and Forecasted Market Size by Product Type

10.6.5.1 Coaxial Cables

10.6.5.2 Shielded Cables

10.6.5.3 Sub-Assemblies

10.6.5.4 Twisted Pairs

10.6.5.5 Unshielded Cables

10.6.6 Historic and Forecasted Market Size by Material

10.6.6.1 Copper Cables

10.6.6.2 Aluminum Cables

10.6.6.3 Hybrid Cables

10.6.6.4 PVC

10.6.6.5 Rubber

10.6.6.6 Teflon

10.6.6.7 XLPE

10.6.7 Historic and Forecasted Market Size by Design Type

10.6.7.1 Helical Cable Design

10.6.7.2 Spiral Cable Design

10.6.7.3 Straight Cable Design

10.6.8 Historic and Forecasted Market Size by Application

10.6.8.1 Battery Management Systems (BMS)

10.6.8.2 Charging Systems

10.6.8.3 Electric Drive Systems

10.6.8.4 Heating

10.6.8.5 Ventilation

10.6.8.6 Air Conditioning (HVAC)

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electric Vehicle HV Cables Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type Power Rating

10.7.4.1 Low Voltage Cables (Below 600V)

10.7.4.2 Medium Voltage Cables (600V–1

10.7.4.3 000V)

10.7.4.4 High Voltage Cables (Above 1

10.7.4.5 000V

10.7.5 Historic and Forecasted Market Size by Product Type

10.7.5.1 Coaxial Cables

10.7.5.2 Shielded Cables

10.7.5.3 Sub-Assemblies

10.7.5.4 Twisted Pairs

10.7.5.5 Unshielded Cables

10.7.6 Historic and Forecasted Market Size by Material

10.7.6.1 Copper Cables

10.7.6.2 Aluminum Cables

10.7.6.3 Hybrid Cables

10.7.6.4 PVC

10.7.6.5 Rubber

10.7.6.6 Teflon

10.7.6.7 XLPE

10.7.7 Historic and Forecasted Market Size by Design Type

10.7.7.1 Helical Cable Design

10.7.7.2 Spiral Cable Design

10.7.7.3 Straight Cable Design

10.7.8 Historic and Forecasted Market Size by Application

10.7.8.1 Battery Management Systems (BMS)

10.7.8.2 Charging Systems

10.7.8.3 Electric Drive Systems

10.7.8.4 Heating

10.7.8.5 Ventilation

10.7.8.6 Air Conditioning (HVAC)

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Electric Vehicle HV Cables Market research report?

A1: The forecast period in the Electric Vehicle HV Cables Market research report is 2025-2032.

Q2: Who are the key players in the Electric Vehicle HV Cables Market?

A2: Sumitomo Electric Industries Ltd. (Japan), Prysmian Group (Italy), Huber + Suhner (Switzerland), Aptiv (Ireland), Nexans (France), ACOME (France), JYFT (China), Qingdao Cable (China), Leoni (Germany), Coroflex (Germany), Champlain Cable (USA), OMG (Italy), Tition (Italy), ZTT (China), Molex (USA), Other Active Players

Q3: What are the segments of the Electric Vehicle HV Cables Market?

A3: The Electric Vehicle HV Cables Market is segmented into Type, Nature, Application, and region. By Type Power Rating, the market is categorized into Low Voltage Cables (Below 600V) and medium Voltage Cables (600V–1,000V), By Product Type, the market is categorized into Coaxial Cables, Shielded Cables, Sub-Assemblies, Twisted Pairs, and Unshielded Cables. By Material, the market is categorized into Copper Cables, Aluminum Cables, Hybrid Cables, PVC, Rubber, Teflon, and XLPE. By Design Type the market is categorized into Helical Cable Design, Spiral Cable Design, and Straight Cable Design, By Application the market is categorized into Battery Management Systems (BMS), Charging Systems, Electric Drive Systems, Heating, Ventilation, Air Conditioning (HVAC)), By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, Rest of SA.).

Q4: What is the Electric Vehicle HV Cables Market?

A4: A high-voltage cable (HV cable), also known as a high-tension cable (HT cable), is designed for the transmission of electric power at high voltages. It consists of a conductor, typically made of materials like copper or aluminum, surrounded by layers of insulation to prevent energy loss and ensure safety. These cables are fully insulated to withstand high electrical stresses and are used in various applications, including power transmission, industrial systems, and renewable energy setups. HV cables play a critical role in efficient energy distribution, enabling long-distance power transmission while maintaining system reliability and reducing energy losses. High-voltage (HV) cables are vital in electric vehicles (EVs), efficiently transmitting electricity from the battery to the motor and other critical systems. These cables are designed with safety as a priority, featuring high-quality insulation and shielding to prevent electrical leaks and ensure stability under extreme conditions.

Q5: How big is the Electric Vehicle HV Cables Market?

A5: Electric Vehicle HV Cables Market Size Was Valued at USD 10.46 Billion in 2024 and is Projected to Reach USD 39.93 Billion by 2032, Growing at a CAGR of 18.23% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!