Stay Ahead in Fast-Growing Economies.

Browse Reports NowEdible Insect Market -Overview & Outlook by Potential Growth

Edible insects are those which are used for consumption for human being and animal as nutrition. There are different varieties of insects available in nature which are edible to human as meal and snacks. With increasing demand for animal-based food and protein to provide large number of populations, insects are being used as source of meal and protein. Furthermore, edible insects are processed by different methods such as drying, roasting, steaming, curing, and others to obtain flour, low calorie protein that is used for low calorie energy bars and snacks. Also, they are used as ingredient and condiments which helps to the market over forecast period.

IMR Group

Description

Edible Insect Market Synopsis

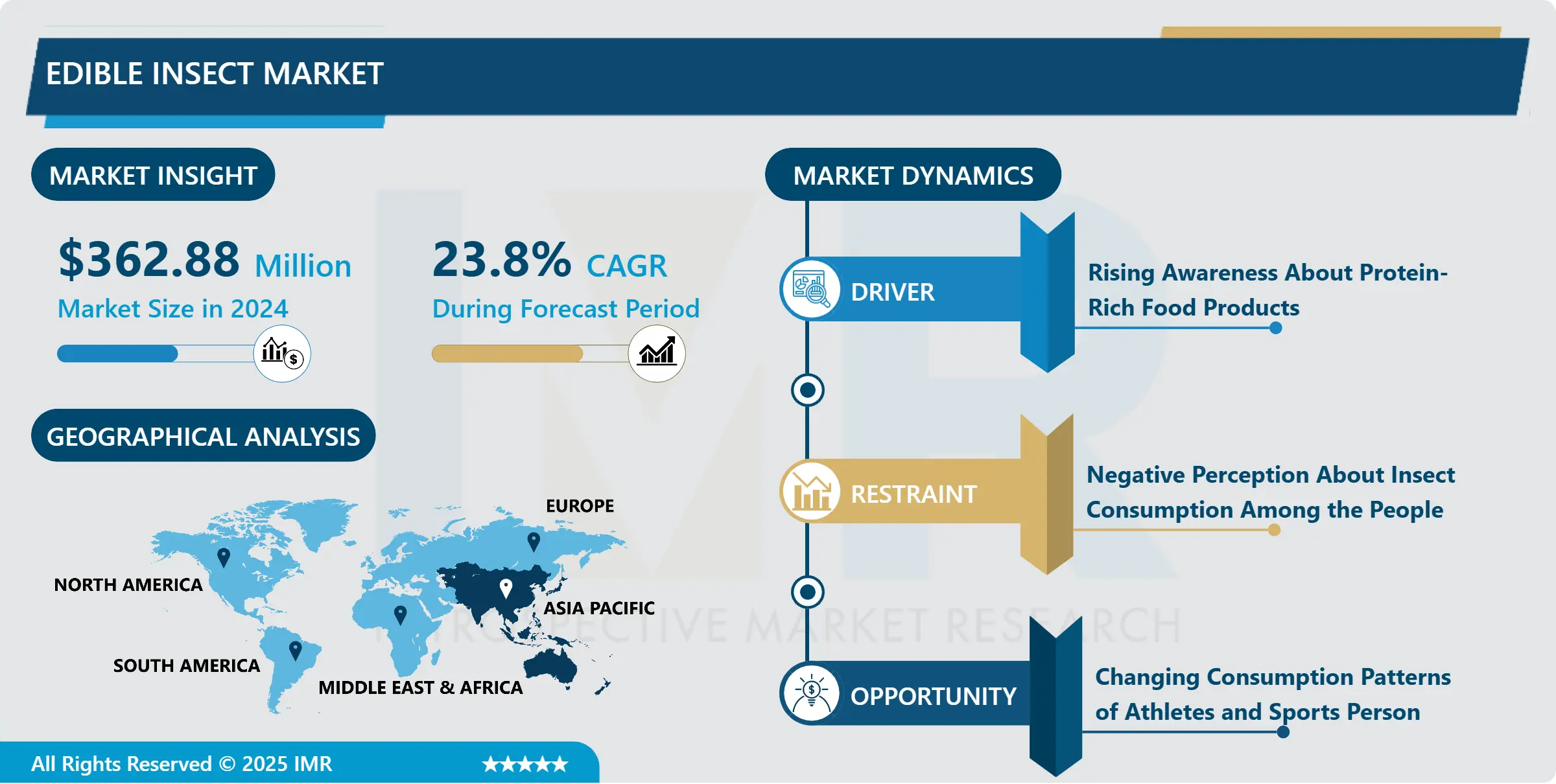

Edible Insect Market Size Was Valued at USD 362.88 Million in 2024, and is Projected to Reach USD 2002.30 Million by 2032, Growing at a CAGR of 23.8% From 2025-2032.

Edible insects are those which are used for consumption for human being and animal as nutrition. There are different varieties of insects available in nature which are edible to human as meal and snacks. With increasing demand for animal-based food and protein to provide large number of populations, insects are being used as source of meal and protein.

Edible insects, such as crickets, mealworms, and grasshoppers, are rich in protein, vitamins, and minerals, making them a nutritious and sustainable food option. As the world population continues to grow, there is a pressing need for protein sources that are both efficient and environmentally friendly. Insects have a much smaller ecological footprint compared to traditional livestock, requiring less land, water, and feed to produce the same amount of protein.

Furthermore, the edible insect market is gaining traction due to a growing awareness of the environmental impact of food production. Insects emit fewer greenhouse gases, consume less water, and produce less waste compared to traditional livestock, contributing to a more sustainable and eco-friendly food system. Consumers are increasingly drawn to products that align with their values of environmental responsibility and ethical consumption, and edible insects fit into this narrative.

In addition, the rise of the health and wellness trend has contributed to the popularity of edible insects. These insects are not only a sustainable protein source but also offer unique nutritional benefits, such as high-quality protein, healthy fats, and essential vitamins and minerals. As people become more conscious of their dietary choices, the nutritional profile of edible insects becomes a compelling factor in their adoption.

Edible Insect Market Trend Analysis

Rising Awareness About Protein-Rich Food Products

The growing awareness of protein-rich edible insect products is the increasing global demand for alternative protein sources. Traditional protein sources like meat and dairy are associated with environmental concerns such as deforestation, greenhouse gas emissions, and water usage. Insects, on the other hand, are highly efficient in converting feed into protein, requiring less land, water, and resources to produce. ?

Additionally, insects are rich in essential nutrients, including high-quality proteins, vitamins, and minerals. Consumers are becoming more educated about the nutritional benefits of edible insects, recognizing them as a viable and sustainable alternative to conventional protein sources. Edible insects such as crickets, mealworms, and grasshoppers are not only protein-dense but also contain healthy fats and important micronutrients. ?

The rise of fitness and wellness trends has also contributed to the increasing popularity of protein-rich foods, including edible insects. Athletes and fitness enthusiasts are seeking diverse and sustainable protein options to support their active lifestyles, and edible insects fit the bill by providing a complete and bioavailable protein source. ?

Moreover, the culinary landscape is evolving, and chefs are experimenting with incorporating edible insects into innovative and delicious dishes. As these insect-based products become more palatable and accessible, consumers are more willing to embrace them as part of their regular diet.

Changing Consumption Patterns of Athletes and Sports Person creates an opportunity for Edible Insect Market.

Edible insects are rich in high-quality protein, essential amino acids, vitamins, and minerals. They offer a sustainable and eco-friendly alternative to traditional protein sources, as insect farming generally requires fewer resources such as water, land, and feed compared to livestock farming. This aligns with the increasing emphasis on sustainable and ethical practices within the sports industry.

Athletes are increasingly recognizing the importance of a well-balanced and nutrient-dense diet to enhance their performance, support muscle recovery, and maintain overall health. Edible insects not only provide a nutritionally dense profile but also contribute to the diversification of dietary options. This diversification is crucial for athletes who may face dietary restrictions or preferences, allowing them to tailor their nutrition plans to meet specific goals.

Furthermore, the compact nature of edible insect products, such as protein bars or powders, makes them convenient for athletes with active lifestyles. The portability and long shelf life of insect-based products cater to the on-the-go nature of training and competition schedules, providing a practical solution for athletes looking for quick and sustainable nutrition.

Edible Insect Market Segment Analysis:

Edible Insect Market Segmented on the basis of Insect type, Product, Application and Region

By Insect Type, Grasshopper segment is expected to dominate the market during the forecast period

Grasshoppers are rich in protein, essential amino acids, and micronutrients, making them a nutritious and sustainable food source. As the global demand for alternative protein sources continues to rise, grasshoppers are gaining attention for their nutritional profile. Moreover, grasshoppers are ecologically advantageous, requiring minimal resources such as water and feed compared to traditional livestock. Their high reproduction rate and short life cycle contribute to a more efficient and sustainable production process. Additionally, grasshoppers are versatile in culinary applications, being easily incorporated into various dishes, appealing to consumers seeking diverse and eco-friendly protein options.

By Product, Bar segment held the largest share in 2024

There is an increasing awareness of the environmental and sustainability benefits of insect consumption. Edible insects are rich in proteins, vitamins, and minerals, making them an attractive alternative to traditional protein sources with a lower environmental footprint. Bars offer a convenient and palatable way for consumers to incorporate insects into their diets, overcoming the psychological barrier associated with consuming whole insects. Moreover, the snack bar format aligns with modern dietary trends, catering to on-the-go lifestyles. As consumers seek innovative and sustainable protein sources, insect-based bars emerge as a flavorful and eco-friendly choice, propelling the growth of this market segment.

Edible Insect Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia-Pacific region experiencing significant growth. In recent years, countries in Asia-Pacific, such as China, Thailand, Vietnam, and Cambodia, have witnessed a surge in the consumption of edible insects. These insects, rich in protein and other essential nutrients, are gaining popularity as a sustainable and nutritious food source. Cultural acceptance of insect consumption in many Asian countries plays a crucial role. Insects have been a traditional part of diets in some cultures, making it easier for these populations to adopt them as a mainstream food item. Additionally, the rising awareness of the environmental benefits of insect farming, including reduced greenhouse gas emissions and efficient land use, has fueled interest in edible insects.

Furthermore, government initiatives and policies supporting the insect farming industry have facilitated its growth. In some cases, subsidies and incentives have been provided to encourage entrepreneurs to invest in insect farming for both human consumption and animal feed.

Edible Insect Market Top Key Players:

Coalo Vally Farms (US)

Cricket Lab (U.K.)

JR Unique Foods Ltd., Part(Thailand)

Global Bugs Asia Co., Ltd. (Thailand)

Haocheng Mealworm Inc. (China)

Kreca Ento-Food BV (The Netherlands)

Aspire Food Group (US)

All Things Bugs, Llc (US)

Beta Hatch Inc. (US)

The Bühler Holding Ag (Switzerland)

Agriprotien Technologies (South Africa)

Chapul (US)

Thailand Unique (Thailand)

Six Foods (US)

Crowbar Protein (Iceland)

Gathr Foods (United Kingdom)

Protix (Netherlands)

Ynsect (France) and other Active players.

Key Industry Developments in the Edible Insect Market:

In October 2024, London witnessed the launch of its first-ever bug-based restaurant, Yum Bug, aiming to revolutionize dining with its eco-friendly and high-protein menu centered around edible insects. The founders sought to challenge perceptions and introduce a sustainable protein source to Western palates. By offering innovative dishes featuring insects as key ingredients, Yum Bug aspired to highlight their environmental benefits and nutritional value.

In November 2023, Singapore-based Entobel achieved a major milestone with the inauguration of Asia’s largest insect protein production facility in Vietnam. The cutting-edge plant, utilizing black soldier fly larvae (BSL), was designed to produce 10,000 tons of high-quality protein meal annually.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Edible Insect Market by Insect Type (2018-2032)

4.1 Edible Insect Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rhinoceros Beetles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ants

4.5 Grasshopper

4.6 Silkworms

4.7 Crickets

4.8 Others

Chapter 5: Edible Insect Market by Product (2018-2032)

5.1 Edible Insect Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Whole Insect

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Powder

5.5 Bar

5.6 Others

Chapter 6: Edible Insect Market by Application (2018-2032)

6.1 Edible Insect Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Human Consumption

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Animal Feed

6.5 Cosmetics

6.6 Pharmaceuticals

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Edible Insect Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HAIN CELESTIAL GROUP INC. (U.S)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KASLINK FOODS OY LTD (FINLAND)

7.4 LIVING HARVEST FOODS INC. (U.S)

7.5 ALPINA FOODS (U.S)

7.6 BLUE DIAMOND GROWERS INC. (U.S)

7.7 ELDEN FOODS INC. (U.S)

7.8 GROUPE DANONE (FRANCE)

7.9 DÖHLER GMBH (GERMANY)

7.10 EARTH’S OWN FOOD COMPANY INC. (CANADA)

7.11 FREEDOM FOODS GROUP LTD (AUSTRALIA)

7.12 GOYA FOODS (U.S)

7.13 GROUPE DANONE (NETHERLANDS)

7.14 LIWAYWAY HOLDINGS COMPANY LIMITED (CHINA)

7.15 MC CORMICK & CO. (U.S)

7.16 NATURA FOODS (U.S)

7.17 NUTRIOPS SL (SPAIN)

Chapter 8: Global Edible Insect Market By Region

8.1 Overview

8.2. North America Edible Insect Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Insect Type

8.2.4.1 Rhinoceros Beetles

8.2.4.2 Ants

8.2.4.3 Grasshopper

8.2.4.4 Silkworms

8.2.4.5 Crickets

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size by Product

8.2.5.1 Whole Insect

8.2.5.2 Powder

8.2.5.3 Bar

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Human Consumption

8.2.6.2 Animal Feed

8.2.6.3 Cosmetics

8.2.6.4 Pharmaceuticals

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Edible Insect Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Insect Type

8.3.4.1 Rhinoceros Beetles

8.3.4.2 Ants

8.3.4.3 Grasshopper

8.3.4.4 Silkworms

8.3.4.5 Crickets

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size by Product

8.3.5.1 Whole Insect

8.3.5.2 Powder

8.3.5.3 Bar

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Human Consumption

8.3.6.2 Animal Feed

8.3.6.3 Cosmetics

8.3.6.4 Pharmaceuticals

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Edible Insect Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Insect Type

8.4.4.1 Rhinoceros Beetles

8.4.4.2 Ants

8.4.4.3 Grasshopper

8.4.4.4 Silkworms

8.4.4.5 Crickets

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size by Product

8.4.5.1 Whole Insect

8.4.5.2 Powder

8.4.5.3 Bar

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Human Consumption

8.4.6.2 Animal Feed

8.4.6.3 Cosmetics

8.4.6.4 Pharmaceuticals

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Edible Insect Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Insect Type

8.5.4.1 Rhinoceros Beetles

8.5.4.2 Ants

8.5.4.3 Grasshopper

8.5.4.4 Silkworms

8.5.4.5 Crickets

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size by Product

8.5.5.1 Whole Insect

8.5.5.2 Powder

8.5.5.3 Bar

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Human Consumption

8.5.6.2 Animal Feed

8.5.6.3 Cosmetics

8.5.6.4 Pharmaceuticals

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Edible Insect Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Insect Type

8.6.4.1 Rhinoceros Beetles

8.6.4.2 Ants

8.6.4.3 Grasshopper

8.6.4.4 Silkworms

8.6.4.5 Crickets

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size by Product

8.6.5.1 Whole Insect

8.6.5.2 Powder

8.6.5.3 Bar

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Human Consumption

8.6.6.2 Animal Feed

8.6.6.3 Cosmetics

8.6.6.4 Pharmaceuticals

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Edible Insect Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Insect Type

8.7.4.1 Rhinoceros Beetles

8.7.4.2 Ants

8.7.4.3 Grasshopper

8.7.4.4 Silkworms

8.7.4.5 Crickets

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size by Product

8.7.5.1 Whole Insect

8.7.5.2 Powder

8.7.5.3 Bar

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Human Consumption

8.7.6.2 Animal Feed

8.7.6.3 Cosmetics

8.7.6.4 Pharmaceuticals

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Edible Insect Market research report?

A1: The forecast period in the Edible Insect Market research report is 2025-2032.

Q2: Who are the key players in the Edible Insect Market?

A2: Coalo Vally Farms (US), Aspire Food Group (US), All Things Bugs, LLC (US), Beta Hatch Inc. (US), Cricket Lab (U.K.), JR Unique Foods Ltd., Part (Thailand), Global Bugs Asia Co., Ltd. (Thailand), Haocheng Mealworm Inc. (China), Kreca Ento-Food BV (The Netherlands), The Bühler Holding AG (Switzerland), Agriprotien Technologies (South Africa), Chapul (U.S), Thailand Unique (Thailand), Six Foods (U.S), Crowbar Protein (Iceland), Gathr Foods (United Kingdom), Protix (Netherlands), Ynsect (France), and Other Active Players.

Q3: What are the segments of the Edible Insect Market?

A3: The Edible Insect Market is segmented into Type, Nature, Application, and region. By Insect Type, the market is categorized into Rhinoceros Beetles, Ants, Grasshopper, Silkworms, Crickets, Others. By Product, the market is categorized into Whole Insect, Powder, Bar, Others. By Application, the market is categorized into Human Consumption, Animal Feed, Cosmetics, Pharmaceuticals, Others. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What is the Edible Insect Market?

A4: Edible insects are those which are used for consumption for human being and animal as nutrition. There are different varieties of insects available in nature which are edible to human as meal and snacks. With increasing demand for animal-based food and protein to provide large number of populations, insects are being used as source of meal and protein.

Q5: How big is the Edible Insect Market?

A5: Edible Insect Market Size Was Valued at USD 362.88 Million in 2024, and is Projected to Reach USD 2002.30 Million by 2032, Growing at a CAGR of 23.8% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!