Stay Ahead in Fast-Growing Economies.

Browse Reports NowEarth Moving Equipment Market Size, Share, Growth & Forecast (2024-2032)

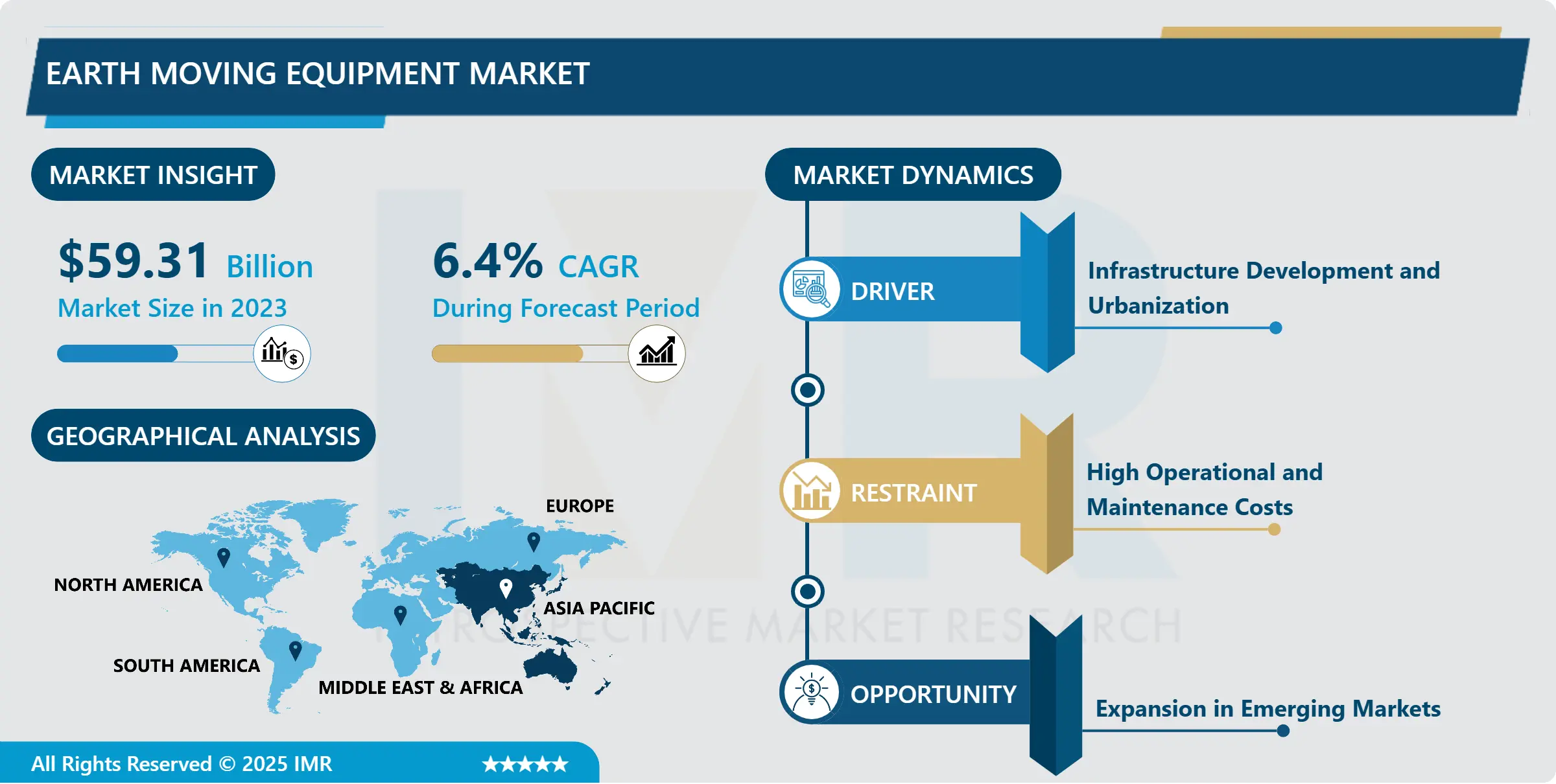

Earth Moving Equipment Market Size Was Valued at USD 59.31 Billion in 2023, and is Projected to Reach USD 103.66 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.

IMR Group

Description

Earth Moving Equipment Market Synopsis:

Earth Moving Equipment Market Size Was Valued at USD 59.31 Billion in 2023, and is Projected to Reach USD 103.66 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.

The Earth Moving Equipment Market refers to equipment, primarily for construction, mining, and infrastructure building, which focuses on efficient movement of enormous amounts of earth and other materials. Such a market will include equipment with excavators, loaders, bulldozers, and even more in the list which are used in digging, grading, lifting, among many heavy-duty operations.

The Earth Moving Equipment Market is a significant component of the construction and mining sectors, providing essential tools for any project, from small building activities to large-scale infrastructure construction. This market is primarily driven by the need for efficient and powerful machinery to reduce manual labor while optimizing the operation. The newer machines are more integrated with new technologies like IoT and telematics, which positively contribute to increased productivity, efficiency with safety, and real-time data analytics for operators and project managers.

Market growth rate has largely been propelled by international urbanization, which goes along with large investments in infrastructure and energy projects. The manufacturers would focus more on the developments of hybrid and electric machineries so that strict environmental regulations can be met or sustainability goals attained. More demand is seen within emerging nations, especially from the Asian-Pacific region due to the expansion of industries and urban space, making it one key growth contributor to this zone.

Earth Moving Equipment Market Trend Analysis:

Adoption of Smart and Autonomous Machinery

It has also revolutionized the earth-moving equipment industry with smart and autonomous earth-moving equipment, machines with AI and machine learning features. These machines have minimized the human intervention that had previously been required in various activities, such as automated grading systems and collision detection. Therefore, these advanced features significantly increase efficiency and safety of operation in high-risk environments such as mining and heavy construction.

Technological advancements in telematics, coupled with real-time monitoring solutions, enable operators to have performance metrics tracked remotely. Integration of these technologies brings fuel consumption and maintenance scheduling optimized and reduces downtime. Automation by construction and mining companies leads to a tremendous increase in intelligent earth-moving equipment demand within the next few years.

Expansion in Emerging Markets

The expansion of urban areas in emerging economies has created a major opportunity for the earth-moving equipment market. In Asian, African, and Latin American countries, governments are heavily investing in road construction, bridges, and urban housing projects to address the demands of growing populations and economic development. Thus, the demand for efficient earth-moving machinery has risen significantly.

Government initiatives for the modernization of infrastructure and industrial facilities also increase market potential. For instance, China’s Belt and Road Initiative and India’s Smart Cities Mission are driving large-scale construction activities, providing lucrative opportunities for equipment manufacturers to tap into these rapidly growing markets.

Earth Moving Equipment Market Segment Analysis:

Earth Moving Equipment Market is Segmented on the basis of Type, Application, Fuel Type, End User, and Region.

By Type, Excavators segment is expected to dominate the market during the forecast period

Earth-moving equipment market by type, namely excavators, loaders, bulldozers, motor graders, trenchers, scrapers and others, wherein excavators currently dominate the market due to multiple applications for digging, lifting, material handling and other purposes with these machines used in construction, mining projects, and become indispensable. The market shares in loaders and bulldozers are high due to earth preparation and movement of heavy material.

Specialized equipment like motor graders and trenchers provide specific tasks, including grading and trenching, in projects for precision and efficiency. Because of the increasing demand for multi-functional and hybrid machinery, manufacturers are diversifying their product portfolios to meet the needs of the market.

By Application, Digging segment expected to held the largest share

Earth-moving equipment is used through applications such as digging, lifting, grading, trenching, compaction, and so on. Digging and lifting remain the most popular applications, being largely supported by the enormous usage of excavators and loaders in construction and mining work. These applications hold significant market share, especially in larger infrastructure projects such as road and bridge construction.

Grading and compaction are very vital in road construction and land development. These activities necessitate the use of very precise machinery, such as motor graders and compactors. With increasingly complex construction projects, the need for specialized equipment for specific applications continues to grow, with ample opportunities for innovation and market expansion.

Earth Moving Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The earth-moving equipment market in the Asia-Pacific region holds dominance due to rapid urbanization and industrialization in countries such as China, India, and Southeast Asia. All of these countries are witnessing increases in infrastructure investments, for instance, roads, railways, and airports, led by economic growth and population expansions. Such factors contribute to advanced construction machinery demand.

India’s Smart Cities Mission and China’s Belt and Road Initiative have driven the market further, leading to growth. Major manufacturers present in the region along with the adoption of new age technologies place Asia-Pacific at the top of the contribution list in the global market.

Active Key Players in the Earth Moving Equipment Market:

Caterpillar Inc. (United States)

Komatsu Ltd. (Japan)

Volvo Construction Equipment (Sweden)

Hitachi Construction Machinery Co., Ltd. (Japan)

Liebherr Group (Switzerland)

Deere & Company (United States)

Doosan Infracore Co., Ltd. (South Korea)

JCB (United Kingdom)

CNH Industrial N.V. (United Kingdom)

Sany Group (China)

Hyundai Construction Equipment Co., Ltd. (South Korea)

XCMG Group (China), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Earth Moving Equipment Market by Type

4.1 Earth Moving Equipment Market Snapshot and Growth Engine

4.2 Earth Moving Equipment Market Overview

4.3 Excavators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Excavators: Geographic Segmentation Analysis

4.4 Loaders

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Loaders: Geographic Segmentation Analysis

4.5 Bulldozers

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Bulldozers: Geographic Segmentation Analysis

4.6 Motor Graders

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Motor Graders: Geographic Segmentation Analysis

4.7 Trenchers

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Trenchers: Geographic Segmentation Analysis

4.8 Scrapers

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Scrapers: Geographic Segmentation Analysis

4.9 Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Others: Geographic Segmentation Analysis

Chapter 5: Earth Moving Equipment Market by End-User

5.1 Earth Moving Equipment Market Snapshot and Growth Engine

5.2 Earth Moving Equipment Market Overview

5.3 Construction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Construction: Geographic Segmentation Analysis

5.4 Mining

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Mining: Geographic Segmentation Analysis

5.5 Agriculture

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Agriculture: Geographic Segmentation Analysis

5.6 Forestry

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Forestry: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Earth Moving Equipment Market by Application

6.1 Earth Moving Equipment Market Snapshot and Growth Engine

6.2 Earth Moving Equipment Market Overview

6.3 Digging

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Digging: Geographic Segmentation Analysis

6.4 Lifting

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Lifting: Geographic Segmentation Analysis

6.5 Grading

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Grading: Geographic Segmentation Analysis

6.6 Trenching

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Trenching: Geographic Segmentation Analysis

6.7 Compaction

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Compaction: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Earth Moving Equipment Market by Fuel Type

7.1 Earth Moving Equipment Market Snapshot and Growth Engine

7.2 Earth Moving Equipment Market Overview

7.3 Diesel

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Diesel: Geographic Segmentation Analysis

7.4 Electric

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Electric: Geographic Segmentation Analysis

7.5 Hybrid

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Hybrid: Geographic Segmentation Analysis

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Earth Moving Equipment Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CATERPILLAR INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 KOMATSU LTD. (JAPAN)

8.4 VOLVO CONSTRUCTION EQUIPMENT (SWEDEN)

8.5 HITACHI CONSTRUCTION MACHINERY CO. LTD. (JAPAN)

8.6 LIEBHERR GROUP (SWITZERLAND)

8.7 DEERE & COMPANY (UNITED STATES)

8.8 DOOSAN INFRACORE CO. LTD. (SOUTH KOREA)

8.9 JCB (UNITED KINGDOM)

8.10 CNH INDUSTRIAL N.V. (UNITED KINGDOM)

8.11 SANY GROUP (CHINA)

8.12 HYUNDAI CONSTRUCTION EQUIPMENT CO. LTD. (SOUTH KOREA)

8.13 XCMG GROUP (CHINA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Earth Moving Equipment Market By Region

9.1 Overview

9.2. North America Earth Moving Equipment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Excavators

9.2.4.2 Loaders

9.2.4.3 Bulldozers

9.2.4.4 Motor Graders

9.2.4.5 Trenchers

9.2.4.6 Scrapers

9.2.4.7 Others

9.2.5 Historic and Forecasted Market Size By End-User

9.2.5.1 Construction

9.2.5.2 Mining

9.2.5.3 Agriculture

9.2.5.4 Forestry

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Digging

9.2.6.2 Lifting

9.2.6.3 Grading

9.2.6.4 Trenching

9.2.6.5 Compaction

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By Fuel Type

9.2.7.1 Diesel

9.2.7.2 Electric

9.2.7.3 Hybrid

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Earth Moving Equipment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Excavators

9.3.4.2 Loaders

9.3.4.3 Bulldozers

9.3.4.4 Motor Graders

9.3.4.5 Trenchers

9.3.4.6 Scrapers

9.3.4.7 Others

9.3.5 Historic and Forecasted Market Size By End-User

9.3.5.1 Construction

9.3.5.2 Mining

9.3.5.3 Agriculture

9.3.5.4 Forestry

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Digging

9.3.6.2 Lifting

9.3.6.3 Grading

9.3.6.4 Trenching

9.3.6.5 Compaction

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By Fuel Type

9.3.7.1 Diesel

9.3.7.2 Electric

9.3.7.3 Hybrid

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Earth Moving Equipment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Excavators

9.4.4.2 Loaders

9.4.4.3 Bulldozers

9.4.4.4 Motor Graders

9.4.4.5 Trenchers

9.4.4.6 Scrapers

9.4.4.7 Others

9.4.5 Historic and Forecasted Market Size By End-User

9.4.5.1 Construction

9.4.5.2 Mining

9.4.5.3 Agriculture

9.4.5.4 Forestry

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Digging

9.4.6.2 Lifting

9.4.6.3 Grading

9.4.6.4 Trenching

9.4.6.5 Compaction

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By Fuel Type

9.4.7.1 Diesel

9.4.7.2 Electric

9.4.7.3 Hybrid

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Earth Moving Equipment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Excavators

9.5.4.2 Loaders

9.5.4.3 Bulldozers

9.5.4.4 Motor Graders

9.5.4.5 Trenchers

9.5.4.6 Scrapers

9.5.4.7 Others

9.5.5 Historic and Forecasted Market Size By End-User

9.5.5.1 Construction

9.5.5.2 Mining

9.5.5.3 Agriculture

9.5.5.4 Forestry

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Digging

9.5.6.2 Lifting

9.5.6.3 Grading

9.5.6.4 Trenching

9.5.6.5 Compaction

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By Fuel Type

9.5.7.1 Diesel

9.5.7.2 Electric

9.5.7.3 Hybrid

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Earth Moving Equipment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Excavators

9.6.4.2 Loaders

9.6.4.3 Bulldozers

9.6.4.4 Motor Graders

9.6.4.5 Trenchers

9.6.4.6 Scrapers

9.6.4.7 Others

9.6.5 Historic and Forecasted Market Size By End-User

9.6.5.1 Construction

9.6.5.2 Mining

9.6.5.3 Agriculture

9.6.5.4 Forestry

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Digging

9.6.6.2 Lifting

9.6.6.3 Grading

9.6.6.4 Trenching

9.6.6.5 Compaction

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By Fuel Type

9.6.7.1 Diesel

9.6.7.2 Electric

9.6.7.3 Hybrid

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Earth Moving Equipment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Excavators

9.7.4.2 Loaders

9.7.4.3 Bulldozers

9.7.4.4 Motor Graders

9.7.4.5 Trenchers

9.7.4.6 Scrapers

9.7.4.7 Others

9.7.5 Historic and Forecasted Market Size By End-User

9.7.5.1 Construction

9.7.5.2 Mining

9.7.5.3 Agriculture

9.7.5.4 Forestry

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Digging

9.7.6.2 Lifting

9.7.6.3 Grading

9.7.6.4 Trenching

9.7.6.5 Compaction

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By Fuel Type

9.7.7.1 Diesel

9.7.7.2 Electric

9.7.7.3 Hybrid

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Earth Moving Equipment Market research report?

A1: The forecast period in the Earth Moving Equipment Market research report is 2024-2032.

Q2: Who are the key players in the Earth Moving Equipment Market?

A2: Caterpillar Inc. (United States), Komatsu Ltd. (Japan), Volvo Construction Equipment (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), Liebherr Group (Switzerland), Deere & Company (United States), Doosan Infracore Co., Ltd. (South Korea),JCB (United Kingdom), and Other Active Players.

Q3: What are the segments of the Earth Moving Equipment Market?

A3: The Earth Moving Equipment Market is segmented into Type, Fuel Type, Application, End User and region. By Type, the market is categorized into Excavators, Loaders, Bulldozers, Motor Graders, Trenchers, Scrapers, Others. By End-User, the market is categorized into Construction, Mining, Agriculture, Forestry, Others. By Application, the market is categorized into Digging, Lifting, Grading, Trenching, Compaction, Others. By Fuel Type, the market is categorized into Diesel, Electric, Hybrid, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Earth Moving Equipment Market?

A4: The Earth Moving Equipment Market refers to equipment, primarily for construction, mining, and infrastructure building, which focuses on efficient movement of enormous amounts of earth and other materials. Such a market will include equipment with excavators, loaders, bulldozers, and even more in the list which are used in digging, grading, lifting, among many heavy-duty operations.

Q5: How big is the Earth Moving Equipment Market?

A5: Earth Moving Equipment Market Size Was Valued at USD 59.31 Billion in 2023, and is Projected to Reach USD 103.66 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!