Stay Ahead in Fast-Growing Economies.

Browse Reports NowE-Bike Charging Station Market Growth And Trend Analysis

E-Bike Charging Station is a public-use e-Bike charging system that provides a welcome amenity for owners of electric bikes who want a secure place to charge while parked. Designed to accommodate a wide range of personal e-Bike drive systems, each “charging dock” has a secure, user-accessible locker that contains a 120V or 240V outlet and space for each user’s personal bike charger.

IMR Group

Description

E-Bike Charging Station Market Synopsis

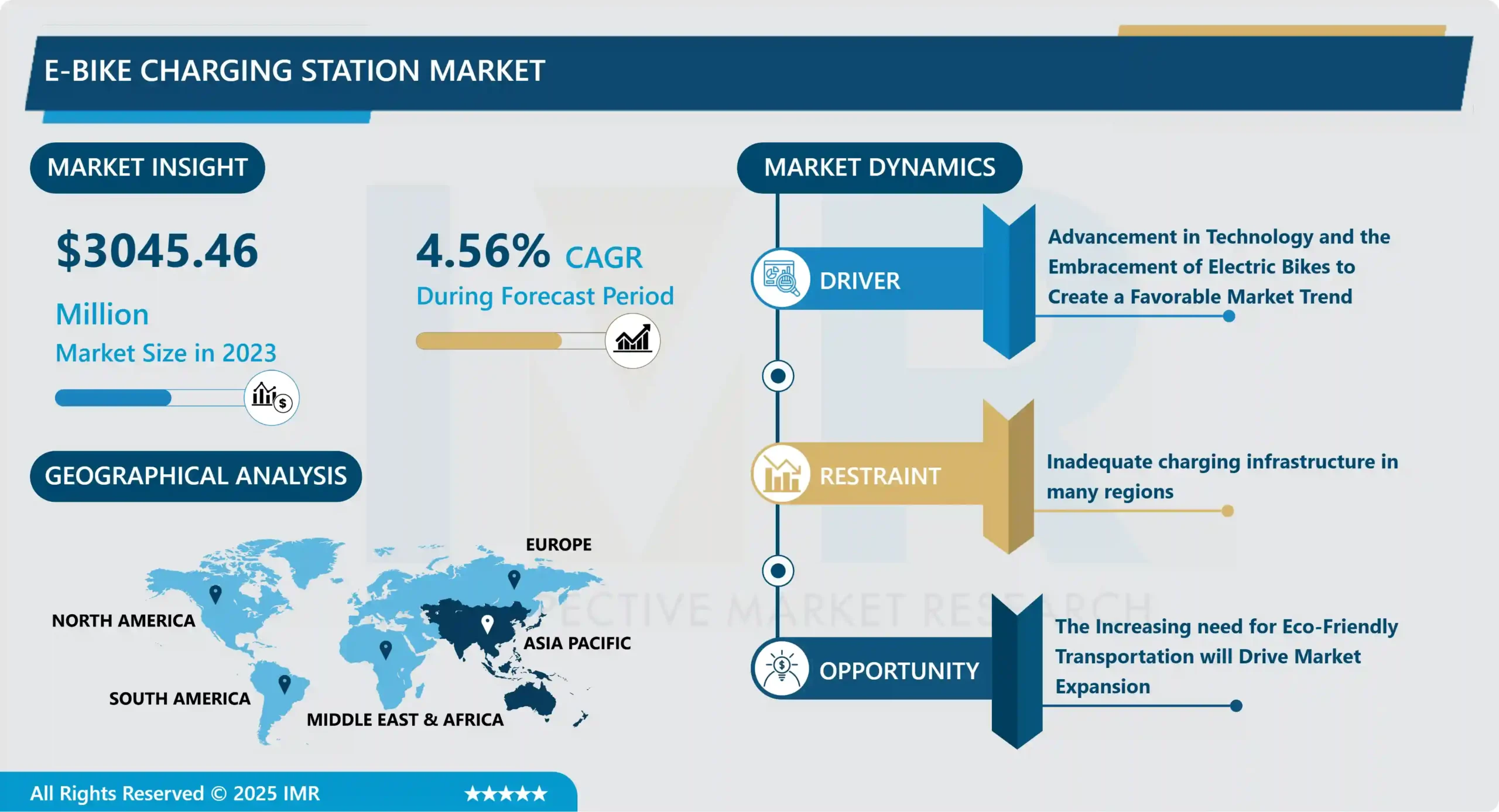

E-Bike Charging Station Market Size Was Valued at USD 3045.46 Million in 2023 and is Projected to Reach USD 4549.28 Million by 2032, Growing at a CAGR of 4.56 % From 2024-2032.

In addition to cars, motorcycles, or scooters, e-bikes are increasingly playing a role in domestic vehicle fleets. In contrast to a conventional bicycle, a tour with an e-bike allows for many more options, because inclines can also be mastered effortlessly. Around 1.4 million e-bikes were sold in Germany in 2019, which is around 39 percent more than in 2018. The market is growing steadily and with it the demand for en-route charging of e-bikes. As a result, the range of places where an electric bike can be charged on the go is also increasing. A standard battery has an output of 250-500Wh. So, the e-biker often cannot travel more than 100 kilometers. It’s then time to connect the bike to a charging station.

E-Bike Charging Station is a public-use e-Bike charging system that provides a welcome amenity for owners of electric bikes who want a secure place to charge while parked. Designed to accommodate a wide range of personal e-Bike drive systems, each “charging dock” has a secure, user-accessible locker that contains a 120V or 240V outlet and space for each user’s personal bike charger. Ambient conditions and low charging rates are important for growing the EV market (Makeen et al. 2022; Makeen, Ghali, and Memon 2020). The EVs market is projected to reach USD 974,102,5 million by 2027, developing at a robust compound annual growth rate from 2020 to 2027 (Ahmad et al. 2022), as a result of the efforts of various industries and governments around the globe. The paucity of infrastructure for fueling EVs is one of the most critical issues addressed in this study. Therefore, healthy charging infrastructure is the most important factor determining how EVs are used. It can be seen that China has the highest share of private chargers with almost 2.4 million chargers. In comparison, the USA has close to 1.56 million private chargers by 2019. Total 6.5 million chargers.

E-Bike Charging Station Market Trend Analysis

Advancement in Technology and the Embracement of Electric Bikes to Create a Favorable Market Trend

Smart charging technology is changing the way e-bikes operate, providing both convenience and effectiveness. These systems utilize IoT features to oversee charging, manage schedules, and deliver notifications through mobile applications. They maximize energy efficiency, reduce expenses, and prolong battery lifespan. This advantages users and promotes grid stability. The incorporation of intelligent technology is boosting the popularity of e-bikes, in line with what consumers prefer in terms of connectivity. Improvements in e-bike performance have been achieved through advancements in battery technology, including increased energy density, rapid charging, and longer-lasting lithium-ion batteries. Solid-state batteries provide increased energy density and safety, resulting in lighter, more efficient e-bikes with longer range, making them more suitable for daily commutes and long trips. Battery recycling technologies help to tackle environmental worries and lower the overall cost of owning an electric bike by cutting down on the frequency of battery changes and upkeep, making e-bikes more attractive to a broader audience.

Government policies and incentives play a crucial role in driving the growth of the e-bike industry. Nations provide subsidies, tax incentives, and funding to reduce expenses for both consumers and companies. Urban planning prioritizes the creation of bike lanes and infrastructure for e-bikes. The smooth incorporation of e-bikes into public transportation improves multimodal travel. Cities are creating integrated transportation options by introducing electric bicycle-sharing systems that are connected to public transportation services. Commuters can easily switch between modes of transportation, enhancing the efficiency and convenience of their journey.

Advancements in engineering and materials are driving the evolution of e-bike designs. Characteristics such as a lightweight structure, ergonomic layout, ability to fold, and spacious storage address a variety of requirements. E-bikes are becoming a popular environmentally friendly transportation choice due to safety improvements and better aesthetics.

The Increasing need for Eco-Friendly Transportation will Drive Market Expansion

More companies are adopting sustainable practices by introducing e-bike programs for commuting and delivery services. This not only lowers carbon footprint but also boosts employee well-being and corporate image. Governments worldwide are enacting measures and providing incentives to encourage the use of eco-friendly transportation such as e-bikes. These actions consist of subsidies, tax refunds, and infrastructure investments aimed at lowering expenses and enhancing ease of access, in line with wider environmental and public health objectives.

Cities are experiencing a rise in urbanization and traffic congestion, resulting in extended commutes and heightened pollution levels. E-bikes provide a convenient option by offering quicker and more effective mobility, aiding in decreasing traffic and enhancing air quality. E-bikes provide a variety of workout choices for riders, encouraging cardiovascular fitness, shedding pounds, and improving overall health. The growing use of them for health and fitness benefits is driven by their availability to a larger number of people, including those with physical restrictions.

Improvements in e-bike technology, such as enhanced battery longevity, quick charging, lightweight components, and intelligent functions, are increasing the popularity and usefulness of e-bikes for a broader range of people, including those who commute daily. Consumer preferences are shifting towards sustainable products such as e-bikes due to an increasing awareness of environmental issues. These vehicles with zero emissions meet the need for environmentally friendly options and aid in decreasing emissions from personal transportation. Cities integrate e-bike sharing with public transportation to improve urban travel, offering convenient and attractive options for users through unified payment methods and real-time information.

E-Bike Charging Station Market Segment Analysis:

The E-Bike Charging Station Market is Segmented based on Type, Infrastructure, Charger Type, Battery Type, and End-Use.

By Battery Type, Lithium-ion Segment Is Expected to Dominate the Market During the Forecast Period

Lithium-ion sector is expected to lead driven by the capability to offer a high power ratio. The e-bike industry is moving towards lithium-ion batteries because of their greater power-to-weight ratio, lighter and more compact layout, extended battery lifespan, and eco-friendly nature in comparison to lead-acid batteries. Lithium-ion batteries are well-suited for recreational and commuting e-bikes as they provide increased power and extended ranges. This shift demonstrates the sector’s emphasis on creating electric bikes that are both lighter and more efficient. The forecast indicates that lithium-ion batteries will maintain their market dominance due to their key advantages. The transportation industry in the Asia-Pacific region is shifting from lead acid batteries to lithium-ion batteries due to stricter environmental regulations, especially in China, which prioritize higher performance and greener practices.

The expected decline in lead acid batteries is attributed to their limited power capacity, high maintenance needs, heavy weight impacting e-bike performance, shorter lifespan necessitating frequent replacements, and environmental issues. Lower initial expenses do not make up for the drawbacks in the long run. Nickel-metal hydride (NiMH) batteries, categorized as ‘Other’ varieties, exhibit gradual expansion. Superior to lead acid yet not as effective or affordable as lithium-ion. The high price is a barrier to the widespread use of e-bikes.

The e-bike market is seeing significant growth in the lithium-ion segment because of its performance benefits and lower costs. These batteries are chosen for their effectiveness, eco-friendliness, and government backing. With the continuous advancement in technology, lithium-ion batteries are projected to increasingly dominate the e-bike market, leading to its expansion.

By Infrastructure, Dockless Segment Held the Largest Share In 2023

Dockless charging stations provide convenient and accessible charging options for e-bike riders, enabling charging at various spots without the need for permanent docking stations. This increased flexibility decreases the amount of time and energy needed, leading to a greater number of individuals utilizing e-bikes. Dockless charging stations cut infrastructure expenses by needing fewer permanent installations and making use of current urban infrastructure. This reduces the amount of money needed for capital expenditure and maintenance for both municipalities and private operators, allowing for the quick growth of charging networks.

Dockless charging stations provide significant advantages in terms of scalability and flexibility. Operators have the ability to adjust the quantity and placement of charging stations as needed for varying demand, seasonal fluctuations, and urban initiatives. This flexibility ensures that infrastructure can accommodate the increasing number of e-bikes. Dockless charging stations improve shared mobility programs by allowing easy charging anywhere, encouraging the use of e-bikes for transportation.

Dockless charging stations can be incorporated into smart city projects, utilizing IoT connectivity to enable live monitoring. Information collected from these stations has the potential to enhance transportation networks, alleviate traffic, and facilitate innovative functions for enhanced user satisfaction and effectiveness. Dockless charging stations enhance user experience by eliminating the requirement for designated docking stations. Mobile applications provide support to these platforms by giving real-time updates on availability and location details. With smartphones, users can effortlessly locate, book, and get directions to nearby charging stations. Dockless e-bike charging stations promote sustainability by increasing charging convenience, cutting greenhouse gas emissions, and reducing urban air pollution. These vehicles are effective in their use of energy and can be fueled by sustainable sources, contributing to eco-friendly efforts for long-lasting urban transportation.

E Bike Charging Station Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

Governments in the Asia-Pacific region are advocating for the use of electric motorcycles to decrease emissions and address pollution issues. Efforts, financial support, and rewards in nations such as China, Japan, India, and South Korea are propelling the expansion of the electric vehicle industry, enhancing air quality, and decreasing reliance on fossil fuels. China plays a crucial role in the electric two-wheeler market in the Asia-Pacific region due to its significant manufacturing and sales activities. Economic growth contributes to the development of technology and the expansion of electrification. The growth of the market is being driven by government backing for EVs in the form of subsidies and investments in charging infrastructure. China’s efforts to decrease urban pollution and support sustainable transportation are growing its network of charging stations.

Growing need for budget-friendly electric scooters in Asia-Pacific for short trips because of urbanization and traffic jams. Economical, environmentally friendly option to conventional vehicles leading to increased demand for charging stations and expansion in the electric two-wheeler infrastructure sector. The electric two-wheeler sector in India is expanding thanks to the strong desire for electric vehicles and well-developed charging facilities. Government regulations such as emission control and battery efficiency are pushing forward this increase. Businesses such as Automovil and Exicom are putting money into EV charging stations to help facilitate this growth.

Innovations in battery technology, charging speed, and smart charging solutions are fueling technological progress in the electric two-wheeler charging station market in the Asia-Pacific region. Fast chargers and the incorporation of renewable energy into the charging process ensure that EV charging is both sustainable and efficient, thus incentivizing more consumers to transition to electric two-wheelers. Key players are allocating resources to grow their operations and form alliances in order to control the market, as seen in Automovil’s partnership with Midgard Electric to construct EV charging points in India. Growing concern for the environment and efforts to promote sustainability are driving the trend toward electric two-wheelers, with the help of educational programs and government actions. This trend is increasing the need for electric cars and charging infrastructure, creating substantial growth prospects.

E-Bike Charging Station Market Active Players

Bosch e-Bike Systems (Germany)

Brose Fahrzeugteile SE & Co. KG (Germany)

Specialized Bicycle Components, Inc. (USA)

Yamaha Motor Corporation (Japan)

Panasonic Corporation (Japan)

Shimano Inc. (Japan)

Robert Bosch GmbH (Germany)

Giant Manufacturing Co. Ltd. (Taiwan)

Accell Group (Netherlands)

Trek Bicycle Corporation (USA)

Magnum Bikes (USA)

VanMoof (Netherlands)

Pedego Electric Bikes (USA)

Rad Power Bikes (USA)

Gogoro Inc. (Taiwan)

Mahindra & Mahindra Ltd (India)

Hero Electric Vehicles Pvt. Ltd. (India)

Ather Energy (India)

Yadea Group Holdings Ltd. (China)

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: E-Bike Charging Station Market by Type (2018-2032)

4.1 E-Bike Charging Station Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Portable Quick Charging Station

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Stationary Intelligent Charging Station

Chapter 5: E-Bike Charging Station Market by Infrastructure (2018-2032)

5.1 E-Bike Charging Station Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Dock

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dockless

Chapter 6: E-Bike Charging Station Market by Charger Type (2018-2032)

6.1 E-Bike Charging Station Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Level 1 Chargers {Standard Charging}

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Level 2 Chargers {Fast Charging}

6.5 Level 3 Chargers {Ultra-Fast Charging}

6.6 Battery Swapping Stations

6.7 Inductive {Wireless} Charging

Chapter 7: E-Bike Charging Station Market by Battery Type (2018-2032)

7.1 E-Bike Charging Station Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Lithium-ion

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Lead Acid

Chapter 8: E-Bike Charging Station Market by End-Use (2018-2032)

8.1 E-Bike Charging Station Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Individuals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Businesses

8.5 Municipalities and Governments

8.6 Commercial Establishments

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 E-Bike Charging Station Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BOSCH E-BIKE SYSTEMS (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BROSE FAHRZEUGTEILE SE & CO. KG (GERMANY)

9.4 SPECIALIZED BICYCLE COMPONENTS INC. (USA)

9.5 YAMAHA MOTOR CORPORATION (JAPAN)

9.6 PANASONIC CORPORATION (JAPAN)

9.7 SHIMANO INC. (JAPAN)

9.8 ROBERT BOSCH GMBH (GERMANY)

9.9 GIANT MANUFACTURING CO. LTD. (TAIWAN)

9.10 ACCELL GROUP (NETHERLANDS)

9.11 TREK BICYCLE CORPORATION (USA)

9.12 MAGNUM BIKES (USA)

9.13 VANMOOF (NETHERLANDS)

9.14 PEDEGO ELECTRIC BIKES (USA)

9.15 RAD POWER BIKES (USA)

9.16 GOGORO INC. (TAIWAN)

9.17 MAHINDRA & MAHINDRA LTD (INDIA)

9.18 HERO ELECTRIC VEHICLES PVT. LTD. (INDIA)

9.19 ATHER ENERGY (INDIA)

9.20 YADEA GROUP HOLDINGS LTD. (CHINA)

9.21 NIU TECHNOLOGIES (CHINA)

9.22 TQ SYSTEMS (GERMANY)

9.23 FREEWIRE TECHNOLOGIES (USA)

9.24 RIESE & MÜLLER (GERMANY)

9.25 BMZ GROUP (GERMANY)

9.26 GAZELLE (NETHERLANDS)

9.27 SCHNEIDER ELECTRIC (FRANCE)

9.28 SIEMENS AG (GERMANY)

9.29 ENVISION SOLAR (USA)

9.30 SMA SOLAR TECHNOLOGY AG (GERMANY)

9.31 ENERGICA MOTOR COMPANY S.P.A. (ITALY)

Chapter 10: Global E-Bike Charging Station Market By Region

10.1 Overview

10.2. North America E-Bike Charging Station Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Portable Quick Charging Station

10.2.4.2 Stationary Intelligent Charging Station

10.2.5 Historic and Forecasted Market Size by Infrastructure

10.2.5.1 Dock

10.2.5.2 Dockless

10.2.6 Historic and Forecasted Market Size by Charger Type

10.2.6.1 Level 1 Chargers {Standard Charging}

10.2.6.2 Level 2 Chargers {Fast Charging}

10.2.6.3 Level 3 Chargers {Ultra-Fast Charging}

10.2.6.4 Battery Swapping Stations

10.2.6.5 Inductive {Wireless} Charging

10.2.7 Historic and Forecasted Market Size by Battery Type

10.2.7.1 Lithium-ion

10.2.7.2 Lead Acid

10.2.8 Historic and Forecasted Market Size by End-Use

10.2.8.1 Individuals

10.2.8.2 Businesses

10.2.8.3 Municipalities and Governments

10.2.8.4 Commercial Establishments

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe E-Bike Charging Station Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Portable Quick Charging Station

10.3.4.2 Stationary Intelligent Charging Station

10.3.5 Historic and Forecasted Market Size by Infrastructure

10.3.5.1 Dock

10.3.5.2 Dockless

10.3.6 Historic and Forecasted Market Size by Charger Type

10.3.6.1 Level 1 Chargers {Standard Charging}

10.3.6.2 Level 2 Chargers {Fast Charging}

10.3.6.3 Level 3 Chargers {Ultra-Fast Charging}

10.3.6.4 Battery Swapping Stations

10.3.6.5 Inductive {Wireless} Charging

10.3.7 Historic and Forecasted Market Size by Battery Type

10.3.7.1 Lithium-ion

10.3.7.2 Lead Acid

10.3.8 Historic and Forecasted Market Size by End-Use

10.3.8.1 Individuals

10.3.8.2 Businesses

10.3.8.3 Municipalities and Governments

10.3.8.4 Commercial Establishments

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe E-Bike Charging Station Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Portable Quick Charging Station

10.4.4.2 Stationary Intelligent Charging Station

10.4.5 Historic and Forecasted Market Size by Infrastructure

10.4.5.1 Dock

10.4.5.2 Dockless

10.4.6 Historic and Forecasted Market Size by Charger Type

10.4.6.1 Level 1 Chargers {Standard Charging}

10.4.6.2 Level 2 Chargers {Fast Charging}

10.4.6.3 Level 3 Chargers {Ultra-Fast Charging}

10.4.6.4 Battery Swapping Stations

10.4.6.5 Inductive {Wireless} Charging

10.4.7 Historic and Forecasted Market Size by Battery Type

10.4.7.1 Lithium-ion

10.4.7.2 Lead Acid

10.4.8 Historic and Forecasted Market Size by End-Use

10.4.8.1 Individuals

10.4.8.2 Businesses

10.4.8.3 Municipalities and Governments

10.4.8.4 Commercial Establishments

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific E-Bike Charging Station Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Portable Quick Charging Station

10.5.4.2 Stationary Intelligent Charging Station

10.5.5 Historic and Forecasted Market Size by Infrastructure

10.5.5.1 Dock

10.5.5.2 Dockless

10.5.6 Historic and Forecasted Market Size by Charger Type

10.5.6.1 Level 1 Chargers {Standard Charging}

10.5.6.2 Level 2 Chargers {Fast Charging}

10.5.6.3 Level 3 Chargers {Ultra-Fast Charging}

10.5.6.4 Battery Swapping Stations

10.5.6.5 Inductive {Wireless} Charging

10.5.7 Historic and Forecasted Market Size by Battery Type

10.5.7.1 Lithium-ion

10.5.7.2 Lead Acid

10.5.8 Historic and Forecasted Market Size by End-Use

10.5.8.1 Individuals

10.5.8.2 Businesses

10.5.8.3 Municipalities and Governments

10.5.8.4 Commercial Establishments

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa E-Bike Charging Station Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Portable Quick Charging Station

10.6.4.2 Stationary Intelligent Charging Station

10.6.5 Historic and Forecasted Market Size by Infrastructure

10.6.5.1 Dock

10.6.5.2 Dockless

10.6.6 Historic and Forecasted Market Size by Charger Type

10.6.6.1 Level 1 Chargers {Standard Charging}

10.6.6.2 Level 2 Chargers {Fast Charging}

10.6.6.3 Level 3 Chargers {Ultra-Fast Charging}

10.6.6.4 Battery Swapping Stations

10.6.6.5 Inductive {Wireless} Charging

10.6.7 Historic and Forecasted Market Size by Battery Type

10.6.7.1 Lithium-ion

10.6.7.2 Lead Acid

10.6.8 Historic and Forecasted Market Size by End-Use

10.6.8.1 Individuals

10.6.8.2 Businesses

10.6.8.3 Municipalities and Governments

10.6.8.4 Commercial Establishments

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America E-Bike Charging Station Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Portable Quick Charging Station

10.7.4.2 Stationary Intelligent Charging Station

10.7.5 Historic and Forecasted Market Size by Infrastructure

10.7.5.1 Dock

10.7.5.2 Dockless

10.7.6 Historic and Forecasted Market Size by Charger Type

10.7.6.1 Level 1 Chargers {Standard Charging}

10.7.6.2 Level 2 Chargers {Fast Charging}

10.7.6.3 Level 3 Chargers {Ultra-Fast Charging}

10.7.6.4 Battery Swapping Stations

10.7.6.5 Inductive {Wireless} Charging

10.7.7 Historic and Forecasted Market Size by Battery Type

10.7.7.1 Lithium-ion

10.7.7.2 Lead Acid

10.7.8 Historic and Forecasted Market Size by End-Use

10.7.8.1 Individuals

10.7.8.2 Businesses

10.7.8.3 Municipalities and Governments

10.7.8.4 Commercial Establishments

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the E-Bike Charging Station Market research report?

A1: The forecast period in the E-Bike Charging Station Market research report is 2024-2032.

Q2: Who are the key players in the E-Bike Charging Station Market?

A2: Bosch e-Bike Systems (Germany), Brose Fahrzeugteile SE & Co. KG (Germany), Specialized Bicycle Components, Inc. (USA), Yamaha Motor Corporation (Japan), Panasonic Corporation (Japan), Shimano Inc. (Japan), Robert Bosch GmbH (Germany), Giant Manufacturing Co. Ltd. (Taiwan), Accell Group (Netherlands), Trek Bicycle Corporation (USA), Magnum Bikes (USA), VanMoof (Netherlands), Pedego Electric Bikes (USA), Rad Power Bikes (USA), Gogoro Inc. (Taiwan), Mahindra & Mahindra Ltd (India), Hero Electric Vehicles Pvt. Ltd. (India), Ather Energy (India), Yadea Group Holdings Ltd. (China), Niu Technologies (China), TQ Systems (Germany), FreeWire Technologies (USA), Riese & Müller (Germany), BMZ Group (Germany), Gazelle (Netherlands), Schneider Electric (France), Siemens AG (Germany), Envision Solar (USA), SMA Solar Technology AG (Germany), Energica Motor Company S.p.A. (Italy) and Other Active Players.

Q3: What are the segments of the E-Bike Charging Station Market?

A3: The E-Bike Charging Station Market is segmented into Type, Infrastructure, Charger Type, Battery Type, End-Use, and region. By Type, the market is categorized into Portable Quick Charging Stations and Stationary Intelligent Charging Stations. By Infrastructure, the market is categorized into Dock, Dockless. By Charger Type, the market is categorized into Level 1 Chargers {Standard Charging}, Level 2 Chargers {Fast Charging}, Level 3 Chargers {Ultra-Fast Charging}, Battery Swapping Stations, Inductive {Wireless} Charging. By Battery Type, the market is categorized into Lithium-ion, Lead Acid, and Battery. By End-Use, The Market Is Categorized Into Individuals, Businesses, Municipalities and Governments, and Commercial Establishments. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the E-Bike Charging Station Market?

A4: E-Bike Charging Station is a public-use e-Bike charging system that provides a welcome amenity for owners of electric bikes who want a secure place to charge while parked. Designed to accommodate a wide range of personal e-bike drive systems, each “charging dock” has a secure, user-accessible locker that contains a 120V or 240V outlet and space for each user’s bike charger.

Q5: How big is the E-Bike Charging Station Market?

A5: E-Bike Charging Station Market Size Was Valued at USD 3045.46 Million in 2023 and is Projected to Reach USD 4549.28 Million by 2032, Growing at a CAGR of 4.56 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!