Stay Ahead in Fast-Growing Economies.

Browse Reports NowDirt Hole Auger Market Insights, Size, Share & Growth Forecast to 2032

The dirt hole auger market refers to the industry for the equipment for boring a hole in the ground such as in construction processes, landscaping and agricultural activities. They are available as manual and power types and these augers are used to drill deep holes for some purposes as planting and installation and foundation work.

IMR Group

Description

Dirt Hole Auger Market Synopsis:

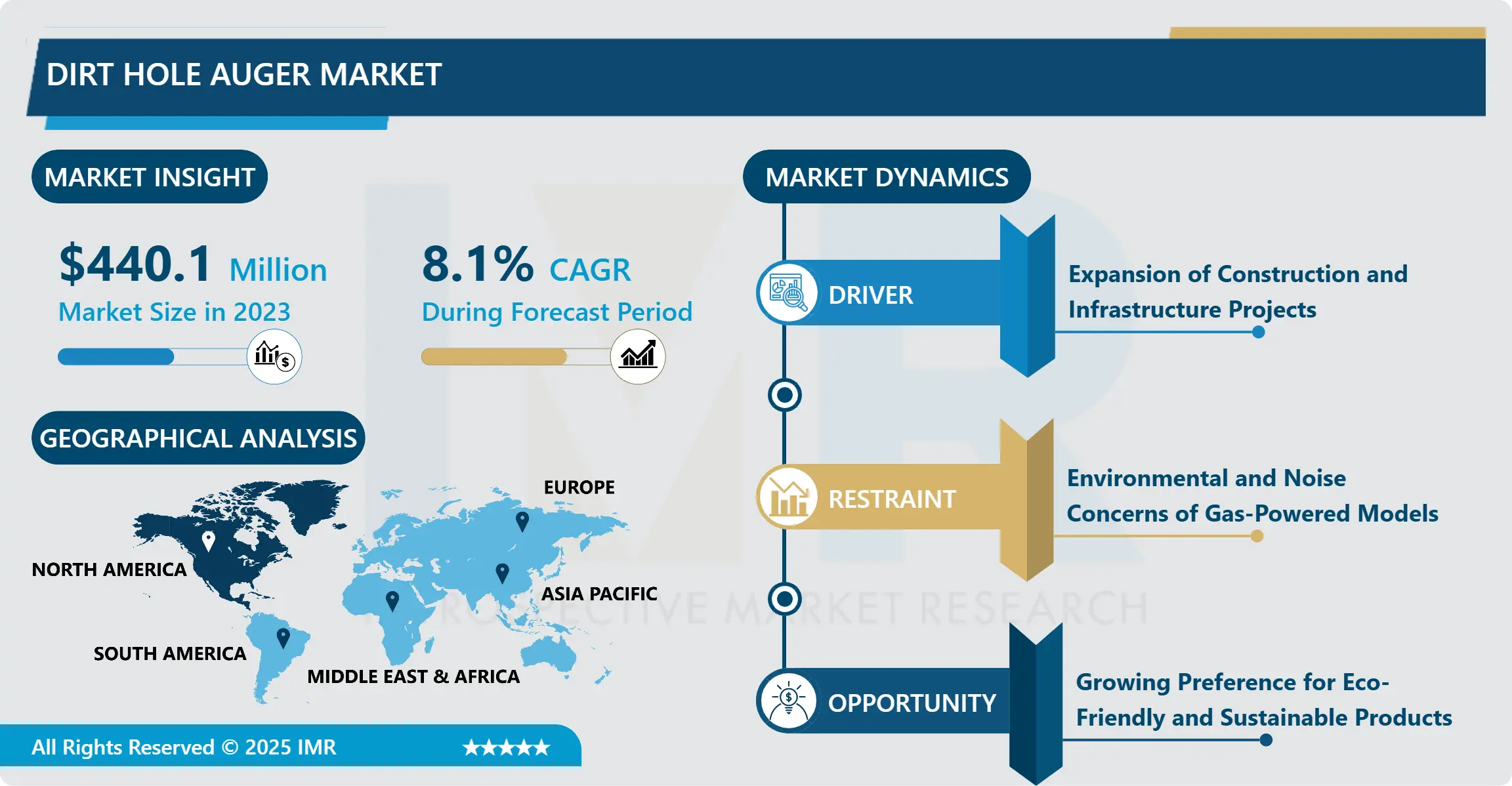

Dirt Hole Auger Market Size Was Valued at USD 440.10 Million in 2023, and is Projected to Reach USD 886.93 Million by 2032, Growing at a CAGR of 8.10% From 2024-2032.

The dirt hole auger market refers to the industry for the equipment for boring a hole in the ground such as in construction processes, landscaping and agricultural activities. They are available as manual and power types and these augers are used to drill deep holes for some purposes as planting and installation and foundation work. Due to the increasing requirement of improved ground excavation tools, there has been both development in technology and variety of products.

The main factor for the growth of the dirt hole auger market is in the need for effective equipments that are time-saving in industries of construction, farming, and horticulture. In the light of developing infrastructures throughout the world especially in the urban areas, construction work hastened and the need for efficient solutions of hole digging is inherent. Also, the increasing demand for urban farming and landscaping projects has also fuelled the creation of demand of this dirt hole augers.

The other is the improvement on technology use in powered augers as a means of increasing reliability. Offering advances in the design of the engine powering the auger, the batteries used, and automation to make powered augers easier to use and cheaper. Thus, as these tools become lighter, more efficient, and more versatile they find more and more use in both commercial applications and use by amateur do-it-your-self enthusiasts thereby increasing tool hire market depth.

Dirt Hole Auger Market Trend Analysis:

Technological Advancements in Powered Augers

There is a fast-growing popularity in the use of powered dirt hole augers because of improvements in battery and fuel technology. Electric and hybrid-powered augers are becoming more widespread for the same reason they are environmentally friendly and more convenient to use in urban areas because of the level of noise and emissions they produce. The efficiency and sustainability of these tools are believed to increase at a constant rate thus their use expands it the various domains and fields starting from construction and landscaping.

Another interesting trend observed is the use of dirt hole augers by DIY operators and home owners. In gardening, landscaping and various other jobs such as minor construction work, the market for the easy to operate hand and small electric augers has evolved. One of the reasons why growth can be observed in the consumer segment of the portable power tools market is the emergence of compact, low-cost models appropriate for household usage.

Focus on Eco-Friendly and Sustainable Products

The market has numerous opportunities for the development for dirt hole auger as the emerging markets like Asia-Pacific and Latin America. Owing to high growth area in construction sector due to increasing infrastructure activities with increasing trend of urbanization in countries such as China, India and Brazil; the requirement of construction tools including dirt hole augers is expected to boost up in the near future. This trend is well supported by expanding construction and agricultural sectors which offer good platforms for introduction of new products and enter new regions.

The increasing trend regarding environmentally sustainable tools offer the manufacturers of dirt hole augers an opportunity to improve on sustainability. This development of electric and battery-powered augers embody and are in tandem with the drift toward sustainability and reducing emissions on construction and landscaping sites. It is important for companies to exploit this areain order tohave a competitive edge and make their product green.

Dirt Hole Auger Market Segment Analysis:

Dirt Hole Auger Market Segmented on the basis of Type, Material, Application, End User, and Region.

By Type, Manual Dirt Hole Augers segment is expected to dominate the market during the forecast period

The dirt hole auger market is segmented into two main types: They were manned by manual dirt hole augers and powered dirt hole augers. Small and low use jobs, usually require manual augers, which are cheaper and quite easy to transport. These tools can be preferred by local gardeners will be those who are tending to residential gardens or small-scale landscapes. While gas and electric powered dirt hole augers are equipped for more extensive work with the ground, powered dirt hole augers are built for the intensive operations. These augers are more efficient, fast and powerful to use and are perfect for constructions and also big agricultural businesses.

By Application, Agriculture segment expected to held the largest share

The dirt hole auger market is also classified on the basis of the application and the main applications include agriculture, construction landscaping and the others include forestry. In agriculture, most uses of dirt hole augers are used for planting trees, installing underground irrigation systems and preparing the ground for large scale farming. On construction sites, these tools are used in driving holes for the foundation, posts and other construction purposes. Dirt hole augers assist the landscaping companies especially when planting trees, shrubs and flowers at desirable points. The other category of auger application is in forestry since the equipment is used to plant trees in reforestation and nurture holes for the young trees.

Dirt Hole Auger Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The North American region holds maximum shares of the dirt hole auger market due to higher development in the urban structure. The United States and Canada are leading consumers of dirt hole augers across construction sites and farming industry.

North America is also interested in sophisticated technologies, and because of wide use of powered augers, the market in this area is increased. In addition, the increase in landscaping and gardening activities that are done by individuals has also contributed to the region’s already dominant market share.

Active Key Players in the Dirt Hole Auger Market:

Ariens Company (USA)

DEWALT (USA)

ECHO (USA)

Honda Motor Co. (Japan)

Husqvarna Group (Sweden)

Makita Corporation (Japan)

Shindaiwa (Japan)

STIHL (Germany)

Toro Company (USA)

Trenchless Equipment (USA)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dirt Hole Auger Market by Type

4.1 Dirt Hole Auger Market Snapshot and Growth Engine

4.2 Dirt Hole Auger Market Overview

4.3 Manual Dirt Hole Augers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Manual Dirt Hole Augers: Geographic Segmentation Analysis

4.4 Powered Dirt Hole Augers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Powered Dirt Hole Augers: Geographic Segmentation Analysis

Chapter 5: Dirt Hole Auger Market by Material

5.1 Dirt Hole Auger Market Snapshot and Growth Engine

5.2 Dirt Hole Auger Market Overview

5.3 Steel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Steel: Geographic Segmentation Analysis

5.4 Aluminum

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Aluminum: Geographic Segmentation Analysis

5.5 Others (Plastic

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others (Plastic: Geographic Segmentation Analysis

5.6 etc.)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 etc.): Geographic Segmentation Analysis

Chapter 6: Dirt Hole Auger Market by Application

6.1 Dirt Hole Auger Market Snapshot and Growth Engine

6.2 Dirt Hole Auger Market Overview

6.3 Agriculture

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Agriculture: Geographic Segmentation Analysis

6.4 Construction

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Construction: Geographic Segmentation Analysis

6.5 Landscaping

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Landscaping: Geographic Segmentation Analysis

6.6 Others (Forestry

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others (Forestry: Geographic Segmentation Analysis

6.7 etc.)

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 etc.): Geographic Segmentation Analysis

Chapter 7: Dirt Hole Auger Market by End User

7.1 Dirt Hole Auger Market Snapshot and Growth Engine

7.2 Dirt Hole Auger Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Residential: Geographic Segmentation Analysis

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Geographic Segmentation Analysis

7.5 Industrial

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Industrial: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Dirt Hole Auger Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 STIHL (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 HUSQVARNA GROUP (SWEDEN)

8.4 HONDA MOTOR CO. (JAPAN)

8.5 MAKITA CORPORATION (JAPAN)

8.6 TORO COMPANY (USA)

8.7 DEWALT (USA)

8.8 ECHO (USA)

8.9 SHINDAIWA (JAPAN)

8.10 TRENCHLESS EQUIPMENT (USA)

8.11 ARIENS COMPANY (USA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Dirt Hole Auger Market By Region

9.1 Overview

9.2. North America Dirt Hole Auger Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Manual Dirt Hole Augers

9.2.4.2 Powered Dirt Hole Augers

9.2.5 Historic and Forecasted Market Size By Material

9.2.5.1 Steel

9.2.5.2 Aluminum

9.2.5.3 Others (Plastic

9.2.5.4 etc.)

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 Agriculture

9.2.6.2 Construction

9.2.6.3 Landscaping

9.2.6.4 Others (Forestry

9.2.6.5 etc.)

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Dirt Hole Auger Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Manual Dirt Hole Augers

9.3.4.2 Powered Dirt Hole Augers

9.3.5 Historic and Forecasted Market Size By Material

9.3.5.1 Steel

9.3.5.2 Aluminum

9.3.5.3 Others (Plastic

9.3.5.4 etc.)

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 Agriculture

9.3.6.2 Construction

9.3.6.3 Landscaping

9.3.6.4 Others (Forestry

9.3.6.5 etc.)

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Dirt Hole Auger Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Manual Dirt Hole Augers

9.4.4.2 Powered Dirt Hole Augers

9.4.5 Historic and Forecasted Market Size By Material

9.4.5.1 Steel

9.4.5.2 Aluminum

9.4.5.3 Others (Plastic

9.4.5.4 etc.)

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 Agriculture

9.4.6.2 Construction

9.4.6.3 Landscaping

9.4.6.4 Others (Forestry

9.4.6.5 etc.)

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Dirt Hole Auger Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Manual Dirt Hole Augers

9.5.4.2 Powered Dirt Hole Augers

9.5.5 Historic and Forecasted Market Size By Material

9.5.5.1 Steel

9.5.5.2 Aluminum

9.5.5.3 Others (Plastic

9.5.5.4 etc.)

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 Agriculture

9.5.6.2 Construction

9.5.6.3 Landscaping

9.5.6.4 Others (Forestry

9.5.6.5 etc.)

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Dirt Hole Auger Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Manual Dirt Hole Augers

9.6.4.2 Powered Dirt Hole Augers

9.6.5 Historic and Forecasted Market Size By Material

9.6.5.1 Steel

9.6.5.2 Aluminum

9.6.5.3 Others (Plastic

9.6.5.4 etc.)

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 Agriculture

9.6.6.2 Construction

9.6.6.3 Landscaping

9.6.6.4 Others (Forestry

9.6.6.5 etc.)

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Dirt Hole Auger Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Manual Dirt Hole Augers

9.7.4.2 Powered Dirt Hole Augers

9.7.5 Historic and Forecasted Market Size By Material

9.7.5.1 Steel

9.7.5.2 Aluminum

9.7.5.3 Others (Plastic

9.7.5.4 etc.)

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 Agriculture

9.7.6.2 Construction

9.7.6.3 Landscaping

9.7.6.4 Others (Forestry

9.7.6.5 etc.)

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Dirt Hole Auger Market research report?

A1: The forecast period in the Dirt Hole Auger Market research report is 2024-2032.

Q2: Who are the key players in the Dirt Hole Auger Market?

A2: STIHL (Germany), Husqvarna Group (Sweden), Honda Motor Co. (Japan), Makita Corporation (Japan), Toro Company (USA), DEWALT (USA), ECHO (USA), Shindaiwa (Japan), Trenchless Equipment (USA), Ariens Company (USA). and Other Active Players.

Q3: What are the segments of the Dirt Hole Auger Market?

A3: The Dirt Hole Auger Market is segmented into by Type (Manual Dirt Hole Augers, Powered Dirt Hole Augers), Material (Steel, Aluminum, Others (Plastic, etc.)), Application (Agriculture, Construction, Landscaping, Others (Forestry, etc.)), End User (Residential, Commercial, Industrial). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Dirt Hole Auger Market?

A4: The dirt hole auger market refers to the industry for the equipment for boring a hole in the ground such as in construction processes, landscaping and agricultural activities. They are available as manual and power types and these augers are used to drill deep holes for some purposes as planting and installation and foundation work. Due to the increasing requirement of improved ground excavation tools, there has been both development in technology and variety of products.

Q5: How big is the Dirt Hole Auger Market?

A5: Dirt Hole Auger Market Size Was Valued at USD 440.10 Million in 2023, and is Projected to Reach USD 886.93 Million by 2032, Growing at a CAGR of 8.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!