Stay Ahead in Fast-Growing Economies.

Browse Reports NowDigital Agriculture Market-Global Size, Share & Industry Trends

Digital Agriculture also known as e-agriculture or smart farming is a tool that collects, stores, analyzes, and shares electronic data and information in agriculture digitally. It is the integration of digital technology into crop management and livestock and other processes related to managing food resources and cultivating activities.

IMR Group

Description

Digital Agriculture Market Synopsis

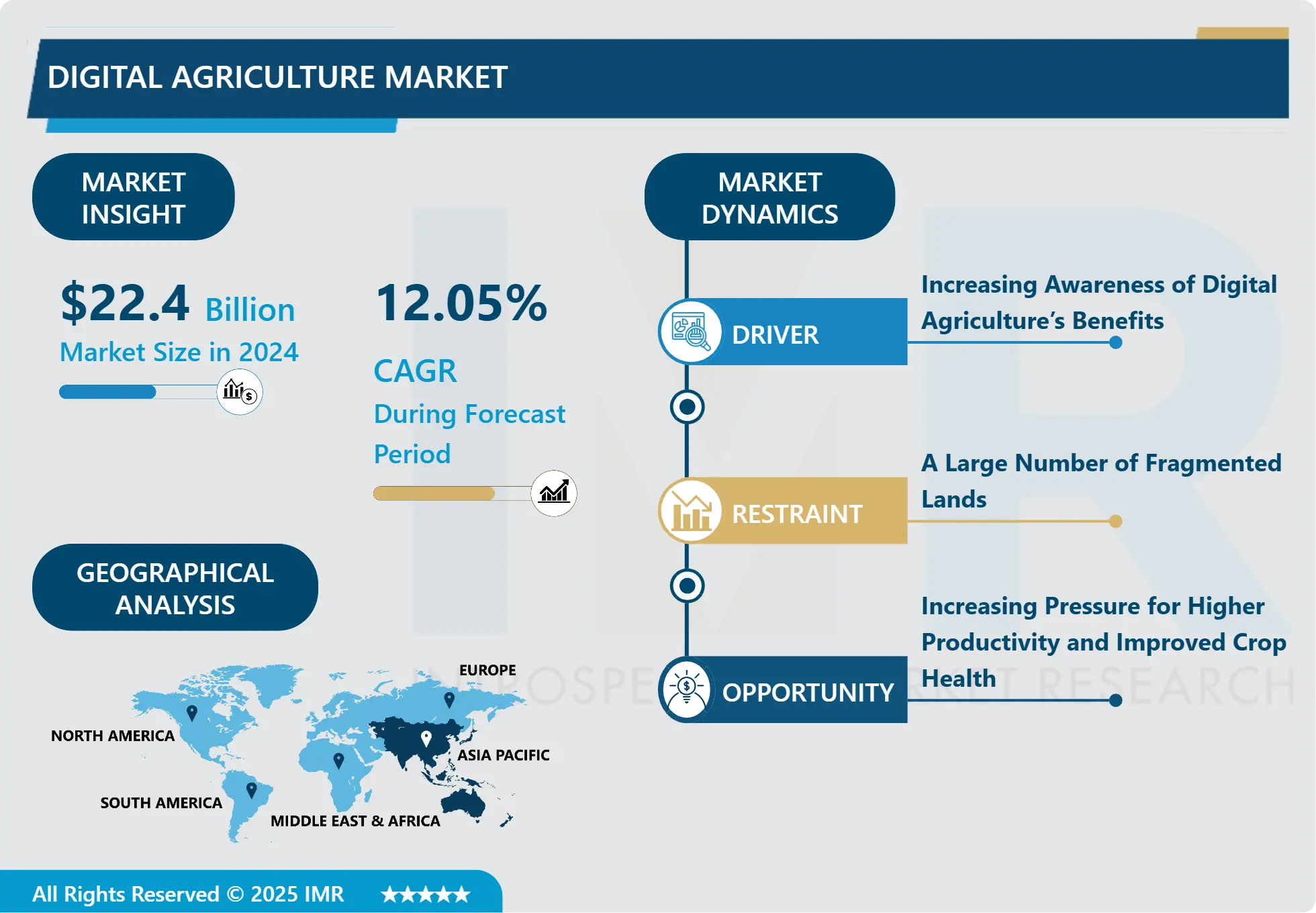

The Global Digital Agriculture Market size is expected to grow from USD 22.4 billion in 2024 to USD 55.66 billion by 2032, at a CAGR of 12.05% during the forecast period (2025-2032).

Digital Agriculture also known as e-agriculture or smart farming is a tool that collects, stores, analyzes, and shares electronic data and information in agriculture digitally. It is the integration of digital technology into crop management and livestock and other processes related to managing food resources and cultivating activities.

Digital agriculture includes precision agriculture. Unlike precision agriculture, digital agriculture impacts the entire agri-food value chain before, during, or after on-farm production. Therefore, on-farm technologies, like yield mapping, GPS guidance systems, and variable-rate applications, fall under the domain of precision agriculture and digital agriculture.

Digital technologies involved in e-extension services, e-commerce platforms, warehouse receipt systems, tractor rental apps, blockchain-enabled food traceability systems, etc. fall under the section of digital agriculture.

By digitizing the operations, farmers can easily fill out the required forms directly from mobile devices. Forms can include captured GPS coordinates, allow for the uploading of videos and photos, and even include digital signature boxes. Agricultural biotechnology is a range of tools, including traditional breeding techniques, that alter living organisms or parts of organisms, to make or modify products, improve plants or animals, or develop microorganisms for specific agricultural uses.

Digital Agriculture supports and Prevents soil degradation, reduces chemical application in crop production, increases agriculture productivity, Changes the socio-economic status of farmers, and Efficient use of water resources.

The Digital Agriculture Market Trend Analysis- Increasing Awareness of Digital Agriculture’s Benefits

Rise in the understanding of the public in the ways by which digital agriculture improves and enhances crop yield has contributed to the growth of the Digital Agriculture market of goods and services.

Farmers rapidly started using digital agriculture technologies to complete the requirement of increasing demand for food which is ultimately the result of the growing global population.

Many strategic policies for digital agriculture are initiated by the government regarding precision farming encouraging farmers to make use of associated technology. These services are helpful in closing the knowledge gap between academia and industry. These technologies are increasing the use of new and creative technology.

Farmers are increasing production by making more effective use of resources reducing losses. This is the primary driver driving the market of digital agriculture.

Increasing Pressure for Higher Productivity and Improved Crop Health

There is constant pressure on the farmers to produce more food and animal feed with lesser amounts of chemicals. At the same time, it is essential to use less energy and labor while improving the management of environmental land and water. With the population growing rapidly, it is becoming very difficult to feed the increasing population, thereby creating high pressure to increase agricultural productivity. The use of software such as precision farming, along with the Internet of Things (IoT) tools, is a solution to all these requirements.

Precision farming helps farmers know the seeds that have to be planted, the number of fertilizers that need to be applied, the best time to harvest the crops, and the expected output.

The Digital Agriculture application analyzes five sets of databases, like manure management, livestock, fields, feed, and energy consumption, by analyzing animal productivity (growth, fertility, and marketing age), total annual fuel consumption, feed purchased, manure quantities and management, number of trees and thickets, shrubs, hedges, grass strips, stone piles and stone walls, and water bodies on the farm. Thus, the use of precision farming software, such as AgDNA, MapShots, AgroSense, and others, will help increase crop productivity, thereby improving soil health and driving the requirement for digital agriculture in other regions of the world.

Segmentation Analysis of The Digital Agriculture Market

Digital Agriculture market segments cover the Type, Technology, and Applications. By Type, the Crop Monitoring segment is Anticipated to Dominate the Market Over the Forecast period.

Crop monitoring allows farmers to rapidly and accurately assess the growth, health, and yield of crops over large areas of land. This help the farmers to make informed decisions about where and when to apply pesticides and fertilizers, as well as where to focus the efforts for the best results.

The demand for crop monitoring is increasing as their important role in controlling different weeds or pests, or diseases in crops. This is useful to provide the current state of the crop and help the farmer to detect the next issue in the crop.

Crop monitoring is not only in demand just because of its prevention nature in the production and spread of pests, but also give a guarantee that they are kept under control by applying corrective measure. Also, Crop monitoring helps the farmer manage multiple fields at the same time.

Regional Analysis of The Digital Agriculture Market

Asia Pacific is Expected to Dominate the Market Over the Forecast period.

Recent years have seen a revolutionary shift in the adoption of smart farming techniques in the Chinese agricultural sector. Although sensor-based technologies, such as Internet of Things (IoT) cellular devices, gear tooth sensor-based irrigation and fertilization equipment, and valve position sensors, among others, are still relatively new in the field, the nation has recently seen a rise in the demand for sensors, largely as a result of the farmers’ adoption of more sophisticated agricultural techniques and a higher rate of mechanization.

China’s contribution rate to agricultural science and technology advancement reveals the nation’s modernization plan for the sector. The Chinese central government started the “digital village” pilot project in 2020 with the goal of promoting the use of technology to boost domestic consumption and spark a boom in the mobile internet-driven economy. China’s sci-tech departments have made much progress in biotechnology. Also, the government of China has implemented sci-tech programs to aware people of new technologies ed in the agriculture sector.

Similarly, to this, attempts are being made to digitize the current value chain in response to the growing demand for digitization in Indian agriculture. In order to advance digital agriculture through pilot projects, the Union Minister of Agriculture & Farmers Welfare signed five memorandums of understanding (MoUs) with CISCO, Ninjacart, Jio Platforms Limited, ITC Limited, and NCDEX e-markets Limited (NeML) in September 2021. Many Agriculture mission held in India aims to accelerate and support based on several new technologies.

Top Key Players Covered in The Digital Agriculture Market

Deere & Company (U.S.)

IBM Corporation(U.S.)

CNH Industrial (U.S.)

Microsoft Corporation (U.S.)

AGCO Corporation (U.S.)

Raven Industries (U.S.)

COFCO International (Switzerland)

Agrofy (South Africa)

Eden Farm (Indonesia)

HummingBird Technologies (England)

Bayer CropScience (Germany)

Monsanto (now part of Bayer) (U.S.)

Trimble Inc. (U.S.)

Yara International (Norway)

SST Software (U.S.)

Taranis (Israel)

Climate FieldView (U.S.)

FarmLogs (U.S.)

Aker Solutions (Norway)

Cranswick PLC (U.K) and Other Major Active Players.

Key Industry Developments in the Digital Agriculture Market

In November 2023, John Deere (US) announced the launch of its new Exact Apply RS sprayer, which uses AI and machine learning to adjust application rates on the go. This technology can reduce pesticide and fertilizer use by up to 20%, saving farmers money and protecting the environment.

In October 2023, IBM Food Trust (US) and Bayer (Germany) partnered to launch a blockchain-powered platform for tracking food provenance and ensuring food safety. This platform will allow consumers to trace the origin of their food and verify its authenticity.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Agriculture Market by Type (2018-2032)

4.1 Digital Agriculture Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Crop Monitoring

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Artificial Intelligence

4.5 Precision Farming

Chapter 5: Digital Agriculture Market by Technology (2018-2032)

5.1 Digital Agriculture Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Peripheral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Core

Chapter 6: Digital Agriculture Market by Application (2018-2032)

6.1 Digital Agriculture Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Field Mapping

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Crop Scouting

6.5 Weather Tracking

6.6 Drone Analytics

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Digital Agriculture Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 OMNICOM GROUP INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INTERPUBLIC GROUP OF COMPANIES INC. (US)

7.4 CDM (US)

7.5 FCB HEALTH NETWORK (US)

7.6 WEBER SHANDWICK (US)

7.7 EDELMAN (US)

7.8 MCCANN HEALTH (US)

7.9 SYNEOS HEALTH (US)

7.10 W2O GROUP (US)

7.11 SAATCHI & SAATCHI WELLNESS (US)

7.12 GREY GROUP (US)

7.13 GSW ADVERTISING (US)

7.14 CDM PRINCETON (US)

7.15 GOLIN (US)

7.16 WPP PLC (UK)

7.17 HAVAS GROUP (FRANCE)

7.18 ACCENTURE (IRELAND)

7.19 PUBLICIS GROUPE (FRANCE)

7.20 DENTSU GROUP INC. (JAPAN)

7.21

Chapter 8: Global Digital Agriculture Market By Region

8.1 Overview

8.2. North America Digital Agriculture Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Crop Monitoring

8.2.4.2 Artificial Intelligence

8.2.4.3 Precision Farming

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Peripheral

8.2.5.2 Core

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Field Mapping

8.2.6.2 Crop Scouting

8.2.6.3 Weather Tracking

8.2.6.4 Drone Analytics

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Digital Agriculture Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Crop Monitoring

8.3.4.2 Artificial Intelligence

8.3.4.3 Precision Farming

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Peripheral

8.3.5.2 Core

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Field Mapping

8.3.6.2 Crop Scouting

8.3.6.3 Weather Tracking

8.3.6.4 Drone Analytics

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Digital Agriculture Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Crop Monitoring

8.4.4.2 Artificial Intelligence

8.4.4.3 Precision Farming

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Peripheral

8.4.5.2 Core

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Field Mapping

8.4.6.2 Crop Scouting

8.4.6.3 Weather Tracking

8.4.6.4 Drone Analytics

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Digital Agriculture Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Crop Monitoring

8.5.4.2 Artificial Intelligence

8.5.4.3 Precision Farming

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Peripheral

8.5.5.2 Core

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Field Mapping

8.5.6.2 Crop Scouting

8.5.6.3 Weather Tracking

8.5.6.4 Drone Analytics

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Digital Agriculture Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Crop Monitoring

8.6.4.2 Artificial Intelligence

8.6.4.3 Precision Farming

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Peripheral

8.6.5.2 Core

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Field Mapping

8.6.6.2 Crop Scouting

8.6.6.3 Weather Tracking

8.6.6.4 Drone Analytics

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Digital Agriculture Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Crop Monitoring

8.7.4.2 Artificial Intelligence

8.7.4.3 Precision Farming

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Peripheral

8.7.5.2 Core

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Field Mapping

8.7.6.2 Crop Scouting

8.7.6.3 Weather Tracking

8.7.6.4 Drone Analytics

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Digital Agriculture Market research report?

A1: The forecast period in the Digital Agriculture Market research report is 2025-2032.

Q2: Who are the key players in Digital Agriculture Market?

A2: Deere & Company (U.S.),IBM Corporation(U.S.),CNH Industrial (U.S.),Microsoft Corporation (U.S.),AGCO Corporation (U.S.),Raven Industries (U.S.),COFCO International (Switzerland),Agrofy (South Africa),Eden Farm (Indonesia),HummingBird Technologies (England),Bayer CropScience (Germany),Monsanto (now part of Bayer) (U.S.),Trimble Inc. (U.S.),Yara International (Norway),SST Software (U.S.),Taranis (Israel),Climate FieldView (U.S.),FarmLogs (U.S.),Aker Solutions (Norway),Cranswick PLC (U.K) and Other Major Active Players.

Q3: What are the segments of the Digital Agriculture Market?

A3: The Digital Agriculture Market is segmented into Type, Technology, Application, and region. Type, the market is categorized into Crop Monitoring, Artificial Intelligence, and Precision Farming. By Technology, the market is categorized into Peripheral and Core. By application, the market is categorized into Field Mapping, Crop Scouting, Weather Tracking, Drone Analytics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Digital Agriculture Market?

A4: Digital Agriculture also known as e-agriculture or smart farming is a tool that collects, stores, analyses, and shares electronic data and information in agriculture digitally. It is the integration of digital technology into crop management and livestock and other processes related to managing food resources and cultivating activities.

Q5: How big is the Digital Agriculture Market?

A5: The Global Digital Agriculture Market size is expected to grow from USD 22.4 billion in 2024 to USD 55.66 billion by 2032, at a CAGR of 12.05% during the forecast period (2025-2032).

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!