Stay Ahead in Fast-Growing Economies.

Browse Reports NowDigestive Health Market: Future Outlook, Trends & Forecast Analysis (2024-2032)

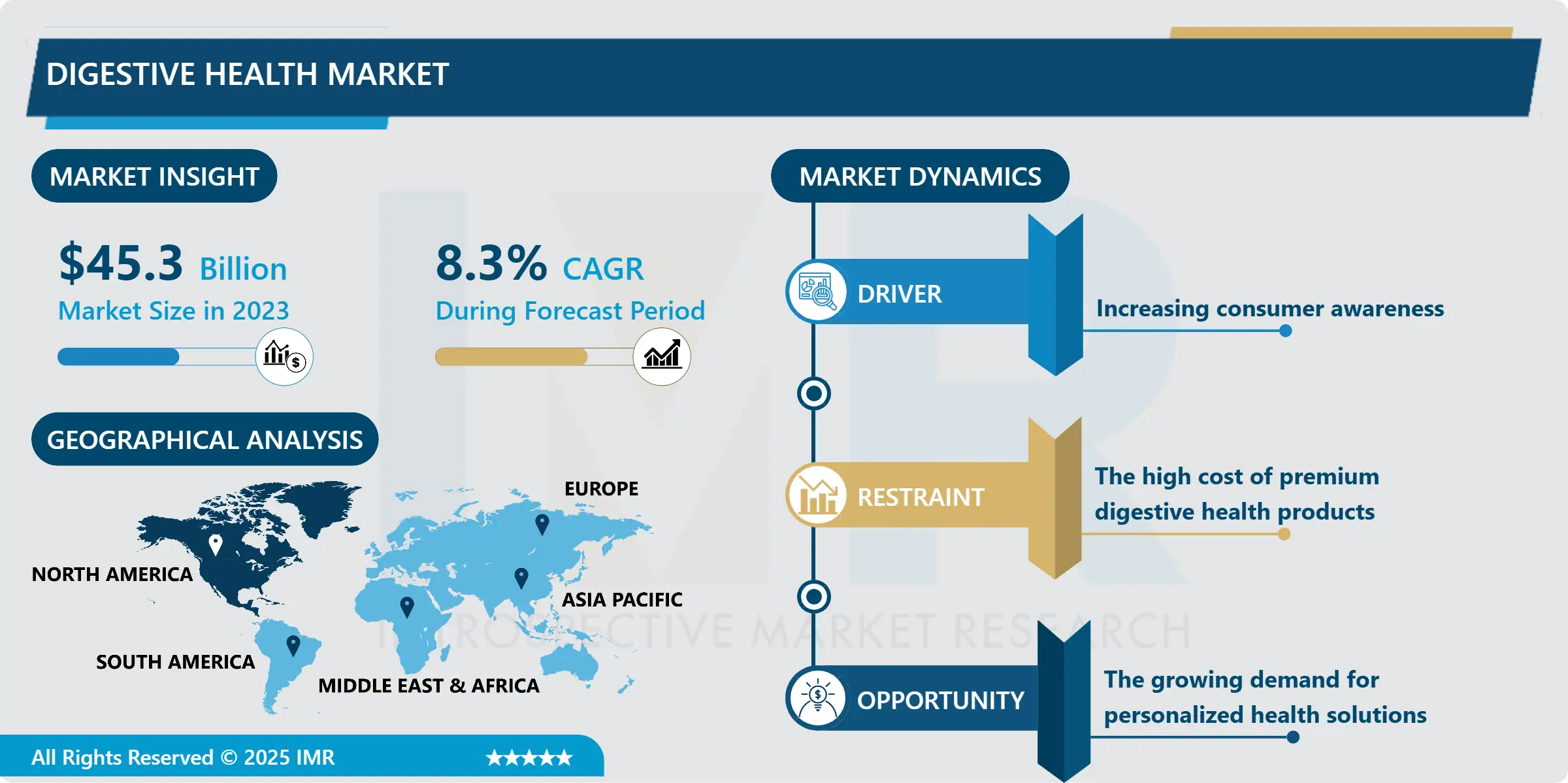

Digestive Health Market Size Was Valued at USD 45.3 Billion in 2023, and is Projected to Reach USD 92.8 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.

IMR Group

Description

Digestive Health Market Synopsis:

Digestive Health Market Size Was Valued at USD 45.3 Billion in 2023, and is Projected to Reach USD 92.8 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.

Digestive health products and services refer to market products and services which have to do with the enhancement and sustenance of good digestion. This market includes miscellaneous therapies and features like probiotic and prebiotic, enzymes, fibers, and other kinds of dietaries that can help improve digestion and gut health. Also, the market present prescription drugs, OTC medicines, functional foods, and beverages for enhancement of conditions such as IBS, bloating, constipation and other gastrointestinal disorder. One of the key factors that have boosted the growth of the market is awareness of the improved gut health as well as increased reclaiming of healthily in consuming people. Some of these factors are growth in knowledge about the gut microbiome and people’s preference for non-synthetic and organic products and a rise in chronic digestive disorders throughout the world.

The digestive health market has been on the rise within the last few years because consumers are now aware of how their gut health impacts their wellbeing. Demographic trends like increasing cost of health care, increasing population of the aging population and the escalating cases of life style induced digestive disorders are forcing people to seek for healthy supplements and meal modification. There has been ever increasing demand for natural and organic products in regard to digestive health as oppose to synthesized drugs and medications. In addition, the market has moved from the treatment towards the prevention with consumer taking probiotics and prebiotics for digestive health before experiencing problems.

Overall this market is expected to rise over the forecast period due to several factors. More and more health practitioners suggest the proper intake of gut health supplements to the population contributing to the market growth. Moreover, the increasing incidence of chronic digestive ailments including IBS, acid reflux and obesity is driving more people toward Use of digestive health products. This is accelerated by innovation on supplement formulations and the expansion of e-Health and Aged care services.

Digestive Health Market Trend Analysis:

The Shift Toward Gut Health Awareness

One key megatrend in the digestive health market is the increasing consumer knowledge of the gut flora. So, people start paying more attention to the balance of their gut and its impact on their immune system, metabolism rate, and mental health. These products are more and more considered not only as cure remedies for certain diseases and disorders, but also as health prevention means for chronic and functional gastrointestinal disorders. Consequently, functional foods and beverages, especially those containing probiotics, are increasingly popular and has expanded a stock of corresponding products offered by retail chains. This trend is likely to remain so and is favored by the growing global phenomenon of health and wellness.

Rise in Consumer Demand for Personalized Health Products

There is more of available profitable opportunities which are associated with the rise of individualized health market place. Due to the enhancements in genetics and microbiome research, there are increasing opportunities to develop unique digestive health products. Special and targeted solutions for health management are making more sense now such as probiotics and prebiotics tailor-made for a specific gut microbe profile in consumers. Organisations that are in a position to exploit this data market with highly specific products seem to enjoy better market position. Artificial intelligence and microbiome testing to help companies reach out to the target market with tested and proven micro nutrients supplements remains a good business model for such organizations.

Digestive Health Market Segment Analysis:

Digestive Health Market Segmented on the basis of Type, Form, and Region.

By Type, Prebiotics segment is expected to dominate the market during the forecast period

Analyzing the specificity of the digestive health market segmentation, it is quite possible to forecast that during the approximate timespan the prebiotics segment will outpace all the others due to its higher demand as one of the critical components for the improvement of the gut microbiota. And, they are the food for the probiotics that aid in increasing the efficiency of the good bacterium in the intestines. There is a growing interest on taking prebiotics as people continue to be aware of the impact of good gut health to the human body. The consumption of prebiotics in functional foods and beverages has grown rapidly especially inulin, fructooligosaccharides (FOS) and galacto-oligosaccharides (GOS) have become incorporated in variety of food products.

By Form, Capsule segment expected to held the largest share

The advancement of electronic commerce platforms have contributed to the development of the capsule segment due to convenient aces to a wide and vast range of digestive health products in capsule form. Besides, capsules have a longer shelf life compared to powders, liquids and other forms of packaging; this makes capsules appropriate for large-scale production. This also makes the capsule form one of the most efficient and cheap production forms for manufactures and consumers equally. With an increase in the number of digestive health products being developed in capsule form, the segment should continue to contribute to the largest market share.

Digestive Health Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Market study conducted for the year 2023 projects that North America is likely to hold the largest market share for digestive health with a share of 40 to 45%. This dominance can be attributed to the greater health consciousness of North American consumers, the incumbent competitors and market stalwarts, and a sophisticated healthcare facility. An inclination towards preventive health care, coupled with a rising ardor for functional foods and supplements, has enhanced the appeal of digestive health goods. Likewise, the American people have embraced the use of probiotics, prebiotics, and other digestive health products in their increasing fashion. This has been augmented by persistent research and development on gut health with this trend set to propel the market in North America even further.

Active Key Players in the Digestive Health Market:

Amway (USA)

Arla Foods (Denmark)

Bayer AG (Germany)

Danone (France)

DSM Nutritional Products (Switzerland)

Ferring Pharmaceuticals (Switzerland)

General Mills, Inc. (USA)

Herbalife Nutrition Ltd. (USA)

Johnson & Johnson (USA)

Nestlé (Switzerland)

Procter & Gamble Co. (USA)

Reckitt Benckiser Group PLC (UK)

Symrise AG (Germany)

Unilever (UK/Netherlands)

Yakult Honsha Co., Ltd. (Japan)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digestive Health Market by Type

4.1 Digestive Health Market Snapshot and Growth Engine

4.2 Digestive Health Market Overview

4.3 Prebiotics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Prebiotics: Geographic Segmentation Analysis

4.4 Probiotics

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Probiotics: Geographic Segmentation Analysis

4.5 Digestive Enzymes

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Digestive Enzymes: Geographic Segmentation Analysis

Chapter 5: Digestive Health Market by Form

5.1 Digestive Health Market Snapshot and Growth Engine

5.2 Digestive Health Market Overview

5.3 Capsule

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Capsule: Geographic Segmentation Analysis

5.4 Tablet

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Tablet: Geographic Segmentation Analysis

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Digestive Health Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AMWAY (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARLA FOODS (DENMARK)

6.4 BAYER AG (GERMANY)

6.5 DANONE (FRANCE)

6.6 DSM NUTRITIONAL PRODUCTS (SWITZERLAND)

6.7 FERRING PHARMACEUTICALS (SWITZERLAND)

6.8 GENERAL MILLS INC. (USA)

6.9 HERBALIFE NUTRITION LTD. (USA)

6.10 JOHNSON & JOHNSON (USA)

6.11 NESTLÉ (SWITZERLAND)

6.12 PROCTER & GAMBLE CO. (USA)

6.13 RECKITT BENCKISER GROUP PLC (UK)

6.14 SYMRISE AG (GERMANY)

6.15 UNILEVER (UK/NETHERLANDS)

6.16 YAKULT HONSHA CO. LTD. (JAPAN)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Digestive Health Market By Region

7.1 Overview

7.2. North America Digestive Health Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Prebiotics

7.2.4.2 Probiotics

7.2.4.3 Digestive Enzymes

7.2.5 Historic and Forecasted Market Size By Form

7.2.5.1 Capsule

7.2.5.2 Tablet

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Digestive Health Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Prebiotics

7.3.4.2 Probiotics

7.3.4.3 Digestive Enzymes

7.3.5 Historic and Forecasted Market Size By Form

7.3.5.1 Capsule

7.3.5.2 Tablet

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Digestive Health Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Prebiotics

7.4.4.2 Probiotics

7.4.4.3 Digestive Enzymes

7.4.5 Historic and Forecasted Market Size By Form

7.4.5.1 Capsule

7.4.5.2 Tablet

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Digestive Health Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Prebiotics

7.5.4.2 Probiotics

7.5.4.3 Digestive Enzymes

7.5.5 Historic and Forecasted Market Size By Form

7.5.5.1 Capsule

7.5.5.2 Tablet

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Digestive Health Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Prebiotics

7.6.4.2 Probiotics

7.6.4.3 Digestive Enzymes

7.6.5 Historic and Forecasted Market Size By Form

7.6.5.1 Capsule

7.6.5.2 Tablet

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Digestive Health Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Prebiotics

7.7.4.2 Probiotics

7.7.4.3 Digestive Enzymes

7.7.5 Historic and Forecasted Market Size By Form

7.7.5.1 Capsule

7.7.5.2 Tablet

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Digestive Health Market research report?

A1: The forecast period in the Digestive Health Market research report is 2024-2032.

Q2: Who are the key players in the Digestive Health Market?

A2: Amway (USA), Arla Foods (Denmark), Bayer AG (Germany), Danone (France), DSM Nutritional Products (Switzerland) and Other Active Players.

Q3: What are the segments of the Digestive Health Market?

A3: The Digestive Health Market is segmented into Type, Form, and region. By Type, the market is categorized into Prebiotics, Probiotics, Digestive Enzymes. By Form, the market is categorized into Capsule, Tablet, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Digestive Health Market?

A4: Digestive health products and services refer to market products and services which have to do with the enhancement and sustenance of good digestion. This market includes miscellaneous therapies and features like probiotic and prebiotic, enzymes, fibers, and other kinds of dietaries that can help improve digestion and gut health. Also, the market present prescription drugs, OTC medicines, functional foods, and beverages for enhancement of conditions such as IBS, bloating, constipation and other gastrointestinal disorder. One of the key factors that have boosted the growth of the market is awareness of the improved gut health as well as increased reclaiming of healthily in consuming people. Some of these factors are growth in knowledge about the gut microbiome and people’s preference for non-synthetic and organic products and a rise in chronic digestive disorders throughout the world.

Q5: How big is the Digestive Health Market?

A5: Digestive Health Market Size Was Valued at USD 45.3 Billion in 2023, and is Projected to Reach USD 92.8 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!