Stay Ahead in Fast-Growing Economies.

Browse Reports NowDiamond Cutting and Polishing Market – Trend, Growth, Forecast 2025-2032

The process of cutting a rough diamond crystal into a finished gem is sometimes referred to generally as diamond polishing.

IMR Group

Description

Diamond Cutting and Polishing Market Synopsis:

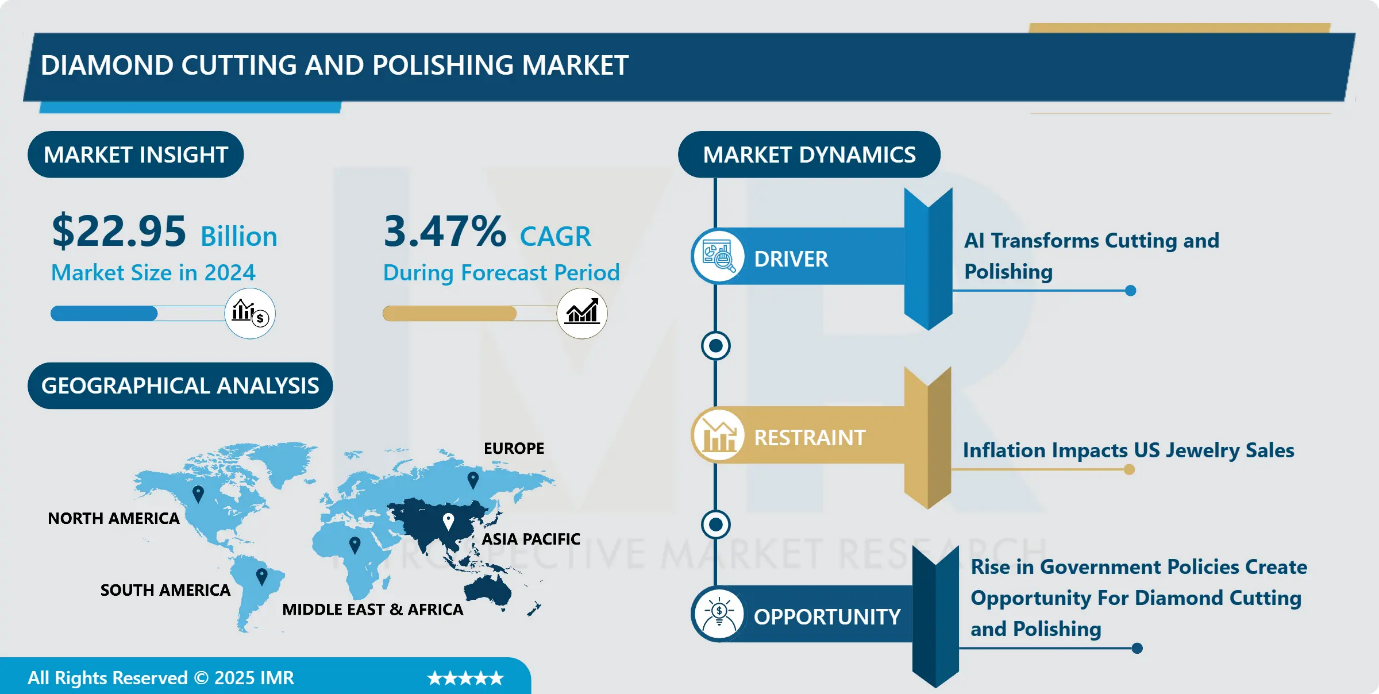

The Diamond Cutting and Polishing Market Was Valued at USD 22.95 Billion in 2024 and is Projected to Reach USD 30.15 Billion by 2032, Growing at a CAGR of 3.47% from 2024 to 2032.

The process of cutting a rough diamond crystal into a finished gem is sometimes referred to generally as diamond polishing. While the process of crafting a polished diamond involves many different steps, the final polishing of all the facets is a crucial step in determining the quality and beauty of the finished gem.

Rough diamonds need to be cut and polished due to they come in a natural, rough state, which often lacks the sparkle and shine that makes diamonds unique. Cutting and polishing help bring out their hidden beauty, making them more attractive and valuable. Additionally, this process gives them a standardized shape. This improves diamond clarity and maximizes their sparkle and brilliance, making them dazzling gems.

The global diamond industry is undergoing significant transformations, influenced by both natural and lab-grown diamond trends. The world’s largest diamond producer remains Russia which dominates 25% of global supply by mining 37.32 million carats in 2023. India leads the global diamond cutting and polishing operations by processing 75% of all cut and polished diamonds worldwide. Lab-grown diamonds are changing the market’s landscape due to their rising prominence. The emerging market pattern transforms worldwide marketplace operations while altering traditional diamond mining areas and manufacturing facilities. As the diamond cutting and polishing market continues to grow, industry players must adapt to evolving consumer preferences and technological advancements.

Diamond Cutting and Polishing Market Growth and Trend Analysis:

AI Transforms Cutting and Polishing

The diamond cutting and polishing industry’s growth depends significantly on technological advancements. Manufacturers have achieved precision and efficiency through new cutting and polishing techniques which produce diamonds with superior quality. The technological advancements have created various diamond shapes which customers actively seek due to their unique designs.

The diamond-cutting and polishing industry is undergoing a significant transformation with artificial intelligence (AI) integration. While traditional expertise remains vital, AI-powered technology is revolutionizing various stages of the manufacturing process, including scanning, planning, cutting, and polishing. The market is witnessing a paradigm shift as AI enhances efficiency, reduces waste, and optimizes precision, ultimately redefining industry standards.

For instance, in the polishing sector, AI is making significant advancements. Kiran Gems, a leading global diamond manufacturer, has employed AI-driven software to achieve a 90% precision rate in polishing melee diamonds as of 2024. This innovation allows for the precise assignment of rough stones to polishers according to their expertise, ensuring greater consistency in quality and improved yield optimization. As AI continues to learn and process more data, it is expected to reach near-perfect precision, further elevating industry benchmarks.

Inflation Impacts US Jewelry Sales

The US diamond and jewelry industry is coping with the challenges of rising inflation, the opening of alternate avenues with higher preference for experience-based spending has dampened the customer sentiment in the current fiscal year. Moreover, the increasing penetration of LGDs from engagement rings to the bridal jewellery segment has resulted in lower demand for CPD in the largest diamond jewelry market, which accounts for over 50 per cent of the diamond jewelry demand.

Emerging Markets Drive Diamond Demand

Polished diamond demand is increasing rapidly in emerging countries thus businesses need superior cutting and polishing capabilities. New laser cutting technology along with CNC precision tools boost efficiency and decrease operational expenses therefore businesses gain opportunities to improve their manufacturing output and financial returns. Lab-grown diamond adoption has expanded market potential as these synthetic stones need the same cutting and polishing methods as natural diamonds. The dominance of India in global diamond processing enables businesses that invest in workforce development together with automated systems and sustainable operations to benefit from rising market demand.

High Capital Investment

One of the primary barriers is the high capital investment required for advanced cutting, polishing machinery, and skilled labor, which restricts market entry for small players and limits modernization in traditional markets. Additionally, the industry struggles with fluctuating raw diamond prices and supply volatility, driven by geopolitical factors, mining regulations, and ethical sourcing concerns, which affect profitability and operational planning.

Diamond Cutting and Polishing Market Segment Analysis:

Diamond Cutting and Polishing Market is segmented based on diamond type, technology, product type, and region

By Diamond Type, Natural Diamonds segment is expected to dominate the market during the forecast period

Primary production of natural diamonds remains a key driver of the industry, supported by ongoing mining operations and potential brownfield expansions that could sustain supply if prices rise. Secondary supply from recycled diamonds, while contributing less than 10% of the total, adds to the availability of natural diamonds, with vintage jewelry becoming increasingly popular. On the demand side, long-term growth is influenced by rising global GDP, increasing disposable incomes, and shifting consumer preferences

Desirability remains a key factor, as diamonds continue to hold strong appeal in luxury markets, competing effectively with other gemstones and discretionary spending. Indian consumers are increasingly drawn to diamond jewelry due to modern design trends and retailer influence, while the rise of branded jewelry further drives demand, with brands capturing a larger share of diamond jewelry sales through marketing and consumer engagement.

The bar chart illustrates the natural diamond production volume in 2024, measured in million carats, for various countries. According to the data from the World Population Review, Russia is the leading producer, with a significant output of 41.92 million carats, far surpassing other nations. Botswana follows as the second-largest producer, contributing 24.5 million carats, while Canada ranks third with 16.24 million carats.

By Technology, Laser Diamond Cutting and Polishing segment held the largest share in projected period

Laser technology is dominating the diamond cutting and polishing market, transforming the industry with its unmatched precision and efficiency. Traditional mechanical cutting methods, which rely on diamond-tipped tools, often result in material wastage, prolonged processing times, and limitations in achieving complex cuts. In contrast, laser cutting ensures minimal material loss, faster processing, and enhanced accuracy, making it the preferred choice for manufacturers. Innovations like the Laser MicroJet and ultrafast laser systems allow for intricate shaping, superior edge quality, and reduced thermal damage, making them indispensable for both natural and lab-grown diamond processing.

The growing demand for high-quality, precisely cut diamonds has further fueled the adoption of laser technology in the industry. With advancements in fiber and ultrashort pulse lasers, manufacturers can now achieve flawless cuts with greater repeatability, optimizing the yield from rough diamonds. Laser-based polishing techniques also contribute to improving the final finish, ensuring better light reflection and brilliance. As a result, major diamond hubs, including India, Belgium, and Israel, are rapidly integrating laser automation to stay ahead in the competitive global market. This shift towards laser technology cements its position as the dominant force in modern diamond cutting and polishing.

Diamond Cutting and Polishing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is expected to dominate the market over the forecast period, driven by India’s significant role in the global diamond trade. Indian diamond exports, including diamond-studded jewellery, reach various markets worldwide, including the United States, Europe, the Middle East, and Asia. The diamond cutting and polishing industry in Surat operates as the global largest center offering employment to approximately 800,000 workers. The industry source of over three-quarters of cut and polished diamonds worldwide exists due to the widespread nature of cutting and polishing facilities in India.

India functions as a leading exporter of synthetic lab-grown diamonds along with coloured gemstones and multiple types of jewelry items. The worldwide demand for cultured diamonds continues to grow quickly throughout the US, Europe and Asia. Current projections indicate that the USD 26 billion market value of 2023 will expand to USD 50 billion within the following decade while manufacturing 40 million carats of Lab-made diamonds by Fiscal Year 2024. The manufacturing of lab-grown diamonds takes place primarily in China, India, the United States, Singapore, Europe, the Middle East and Russia.

The diamond industry relies heavily on India which produces 90% percent of the world’s manufactured polished diamonds. The Indian economy exports more than a hundred products that include cut and polished diamonds along with lab-grown synthetic diamonds and coloured gemstones as well as synthetic stones and plain and studded gold jewellery accompanied by silver and platinum jewellery and imitation jewellery and articles of gold silver and other precious materials. The traditional and synthetic diamond markets where India leads creates continuous global leadership for Asia Pacific as a vital area for diamond market development.

Diamond Cutting and Polishing Market Active Players:

Bharat Diamond Bourse (India)

Blue Star Diamonds (India)

Bonas Group (United Kingdom)

Constell Group (Belgium)

De Beers Group (United Kingdom)

Dianco Group (Belgium)

Hari Krishna Exports (India)

KGK Diamonds (India)

KGK Group (India)

Kiran Gems (India)

Kristall Production Corporation (Russia)

Laxmi Diamonds (India)

Mahalaxmi Diamonds (India)

Mehta Company (India)

Moshe Namdar Diamonds LTD (Israel)

Rosy Blue International (Belgium)

Shree Ramkrishna Exports Pvt. Ltd. (India)

Suashish Diamond Industry (India)

Synova (Switzerland)

Venus Jewellers (India)

Other Active Players

Key Industry Developments in the Diamond Cutting and Polishing Market:

In January 2025, the government of India introduced the Diamond Imprest Authorisation scheme, which allows duty-free import of cut and polished diamonds up to a specified limit, to boost exports and enhance value addition. The diamond industry is witnessing a steep decline in exports and job losses for the workers, the commerce ministry said. This scheme is expected to combat this trend and will rejuvenate the industry. It mandates export obligation with a value addition of 10 per cent.

In December 2023, Prime Minister of India inaugurated Surat Diamond Bourse (SDB), the world’s largest and modern centre for international diamond and jewellery business.???????

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Diamond Cutting and Polishing Market by Diamond Type

4.1 Diamond Cutting and Polishing Market Snapshot and Growth Engine

4.2 Diamond Cutting and Polishing Market Overview

4.3 Natural & Lab-Grown Diamonds

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Natural & Lab-Grown Diamonds: Geographic Segmentation Analysis

Chapter 5: Diamond Cutting and Polishing Market by Technology

5.1 Diamond Cutting and Polishing Market Snapshot and Growth Engine

5.2 Diamond Cutting and Polishing Market Overview

5.3 Laser Diamond Cutting and Polishing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Laser Diamond Cutting and Polishing: Geographic Segmentation Analysis

5.4 CNC Diamond Cutting and Polishing

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 CNC Diamond Cutting and Polishing: Geographic Segmentation Analysis

5.5 and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Others: Geographic Segmentation Analysis

Chapter 6: Diamond Cutting and Polishing Market by Product Type

6.1 Diamond Cutting and Polishing Market Snapshot and Growth Engine

6.2 Diamond Cutting and Polishing Market Overview

6.3 Automated & Semi-Automated

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Automated & Semi-Automated: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Diamond Cutting and Polishing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BLUE STAR DIAMONDS (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SYNOVA (SWITZERLAND)

7.4 BONAS GROUP (UNITED KINGDOM)

7.5 KGK GROUP (INDIA)

7.6 KRISTALL PRODUCTION CORPORATION (RUSSIA)

7.7 MOSHE NAMDAR DIAMONDS LTD (ISRAEL)

7.8 CONSTELL GROUP (BELGIUM)

7.9 DIANCO GROUP (BELGIUM)

7.10 KIRAN GEMS (INDIA)

7.11 DE BEERS GROUP (UNITED KINGDOM)

7.12 SHREE RAMKRISHNA EXPORTS PVT. LTD. (INDIA)

7.13 KGK DIAMONDS (INDIA)

7.14 LAXMI DIAMONDS (INDIA)

7.15 HARI KRISHNA EXPORTS (INDIA)

7.16 MAHALAXMI DIAMONDS (INDIA)

7.17 ROSY BLUE INTERNATIONAL (BELGIUM)

7.18 VENUS JEWELLERS (INDIA)

7.19 BHARAT DIAMOND BOURSE (INDIA)

7.20 SUASHISH DIAMOND INDUSTRY (INDIA)

7.21 MEHTA COMPANY (INDIA)

7.22 OTHER ACTIVE PLAYERS.

Chapter 8: Global Diamond Cutting and Polishing Market By Region

8.1 Overview

8.2. North America Diamond Cutting and Polishing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Diamond Type

8.2.4.1 Natural & Lab-Grown Diamonds

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 Laser Diamond Cutting and Polishing

8.2.5.2 CNC Diamond Cutting and Polishing

8.2.5.3 and Others

8.2.6 Historic and Forecasted Market Size By Product Type

8.2.6.1 Automated & Semi-Automated

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Diamond Cutting and Polishing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Diamond Type

8.3.4.1 Natural & Lab-Grown Diamonds

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 Laser Diamond Cutting and Polishing

8.3.5.2 CNC Diamond Cutting and Polishing

8.3.5.3 and Others

8.3.6 Historic and Forecasted Market Size By Product Type

8.3.6.1 Automated & Semi-Automated

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Diamond Cutting and Polishing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Diamond Type

8.4.4.1 Natural & Lab-Grown Diamonds

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 Laser Diamond Cutting and Polishing

8.4.5.2 CNC Diamond Cutting and Polishing

8.4.5.3 and Others

8.4.6 Historic and Forecasted Market Size By Product Type

8.4.6.1 Automated & Semi-Automated

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Diamond Cutting and Polishing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Diamond Type

8.5.4.1 Natural & Lab-Grown Diamonds

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 Laser Diamond Cutting and Polishing

8.5.5.2 CNC Diamond Cutting and Polishing

8.5.5.3 and Others

8.5.6 Historic and Forecasted Market Size By Product Type

8.5.6.1 Automated & Semi-Automated

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Diamond Cutting and Polishing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Diamond Type

8.6.4.1 Natural & Lab-Grown Diamonds

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 Laser Diamond Cutting and Polishing

8.6.5.2 CNC Diamond Cutting and Polishing

8.6.5.3 and Others

8.6.6 Historic and Forecasted Market Size By Product Type

8.6.6.1 Automated & Semi-Automated

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Diamond Cutting and Polishing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Diamond Type

8.7.4.1 Natural & Lab-Grown Diamonds

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 Laser Diamond Cutting and Polishing

8.7.5.2 CNC Diamond Cutting and Polishing

8.7.5.3 and Others

8.7.6 Historic and Forecasted Market Size By Product Type

8.7.6.1 Automated & Semi-Automated

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Diamond Cutting and Polishing Market research report?

A1: The forecast period in the Diamond Cutting and Polishing Market research report is 2024-2032.

Q2: Who are the key players in the Diamond Cutting and Polishing Market?

A2: Blue Star Diamonds (India), Synova (Switzerland), Bonas Group (United Kingdom), KGK Group (India), Kristall Production Corporation (Russia), Moshe Namdar Diamonds LTD (Israel), Constell Group (Belgium), Dianco Group (Belgium), Kiran Gems (India), De Beers Group (United Kingdom), Shree Ramkrishna Exports Pvt. Ltd. (India), KGK Diamonds (India), Laxmi Diamonds (India), Hari Krishna Exports (India), Mahalaxmi Diamonds (India), Rosy Blue International (Belgium), Venus Jewellers (India), Bharat Diamond Bourse (India), Suashish Diamond Industry (India), Mehta Company (India), and Other Active Players.

Q3: What are the segments of the Diamond Cutting and Polishing Market?

A3: The Diamond Cutting and Polishing Market is segmented into Type, Nature, Application, and Region. By Diamond Type, it is categorized into Natural & Lab-Grown Diamonds. By Technology it is categorized into Laser Diamond Cutting and Polishing, CNC Diamond Cutting and Polishing, and Others. By Product Type, it is categorized into Automated & Semi-Automated. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Diamond Cutting and Polishing Market?

A4: The process of cutting a rough diamond crystal into a finished gem is sometimes referred to generally as diamond polishing. While the process of crafting a polished diamond involves many different steps, the final polishing of all the facets is a crucial step in determining the quality and beauty of the finished gem.

Q5: How big is the Diamond Cutting and Polishing Market?

A5: The Diamond Cutting and Polishing Market Was Valued at USD 22.95 Billion in 2024 and is Projected to Reach USD 30.15 Billion by 2032, Growing at a CAGR of 3.47% from 2024 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!