Stay Ahead in Fast-Growing Economies.

Browse Reports NowDesktop as a Service (DaaS) Market Global Industry Growth & Deployment Analysis By 2032

The desktop environment and related application software are separated from the physical client device used to access them due to a software technology called desktop as a Service. A complete desktop environment management system can be created by combining desktop virtualization with user virtualization, application virtualization, and user profile management systems.

IMR Group

Description

Global Desktop as a Service (DaaS) Market Overview

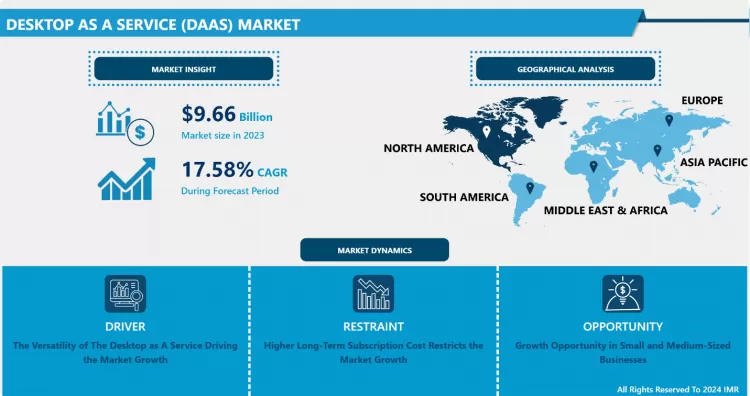

The Global Desktop as a Service (DAAS) Market size is expected to grow from USD 9.66 billion in 2023 to USD 41.49 billion by 2032, at a CAGR of 17.58% during the forecast period (2024-2032).

In a cloud computing service called desktop as a service (DaaS), a service provider gives end customers virtual desktops via the Internet that are licensed on a per-user basis. With Desktop as a Service (DaaS), the cloud services provider hosts the infrastructure, network resources, and storage in the cloud while streaming a virtual desktop to the user’s device. The user may then access the data and apps on the desktop through a web browser or other software. Through a subscription approach, businesses can buy as many virtual desktops as they require. Graphics-intensive apps have previously been challenging to utilize with DaaS since desktop applications stream over the Internet from a centralized server. This has changed with new technologies, and even programs like computer-aided design (CAD) that need a lot of processing power to display quickly may now be easily operated on DaaS. Therefore, the utilization of services such as DaaS in the Program development and IT sector likely to boost the demand for Desktop as a Service.

Market Dynamics and Factors for Desktop as a Service (DaaS) Market

Drivers:

The versatility of The Desktop as A Service Driving the Market Growth

For businesses of all sizes, managing a large number of desktop and laptop workstations with locally installed software is a significant task. Regular software updates, security patches, and other essential upgrades are required for every machine. Additionally, time is wasted on failure analysis and repair, data backup, and user assistance. These issues are solved by Desktop as a Service by moving everything into an enterprise or cloud data center. The user applications won’t need to be installed or executed locally on each device as a result. Additionally, users can quickly switch to another device and resume where they left off if any of the physical devices malfunction.

Additionally, enterprise data will be safer on the cloud which creates a plus point for the DaaS. The lack of data center space, financial constraints, and labor shortages are daily struggles for many IT teams. Even when the money allows, it can be challenging to find qualified administrators and architects because the team may already be oversubscribed. The management and maintenance tasks can be simply handled and managed in the cloud infrastructure with Desktop as a Service. For many jobs, it is no longer necessary to physically visit each desktop. Therefore, a large number of companies are switching towards the Desktop as a Service model to enhance work efficiency. For instance, According to Garter, the number of DaaS users is anticipated to grow by 150% between the period of 2020-2023 which showcases the rising growth of the Desktop as a Service Market.

Restraints:

Higher Long-Term Subscription Cost Restricts the Market Growth

In terms of initial investment, DaaS is cheaper than VDI, but the subscription costs associated with DaaS can become higher than VDI’s upfront costs over the period. Additionally, depending on the licensing model offered by the vendor, DaaS licensing costs may be higher given the overhead of hosting virtual desktops. Desktop as a Service averages USD 40-250 per virtual desktop per month. These prices may vary depending on several factors, including virtual desktop type, session length, and features desired. While most DaaS providers bundle the cost of operating system licensing and virtual desktops, organizations weigh their options and consider these factors if desktop as a service is the financially best approach. DaaS pricing is more predictable and consistent than VDI, but not necessarily cheaper in the long run.

Opportunity:

Growth Opportunity in Small and Medium-Sized Businesses

Setting up the appropriate infrastructure to meet the needs of their employees takes a lot of time and effort for SMBs. It costs a lot to establish servers and desktops, buy new hardware, and get rid of the old. Providers of desktop as a service provider managed services and assume control of all the challenging IT duties. The company does not need to set up office desktops and servers because the virtual desktops are hosted in the cloud. As a result, the company can reduce desktop and cable maintenance on other properties. Additionally, providers’ IT specialists perform all updating and upgrading tasks without interfering with working hours. Moreover, Using DaaS services for small businesses enables to switch from Capex to Opex because the enterprise can choose the providers’ pay-as-you-go strategy. With this strategy, the company can subscribe for a small fee on a monthly or annual basis. For instance, Facedrive Inc. (STEER), an integrated ESG technology platform, announces the successful rollout of its Delivery as a Service (“DaaS”) offering with over 200 small and medium-sized businesses (“SMBs”) and the subsequent marketing of such services to significant big box retailers. Therefore, such offerings for small and medium-sized businesses are likely to uplift the Desktop as a Service Market during the forecasted period.

Segmentation Analysis of Desktop as a Service (DaaS) Market

By Deployment, the Public Cloud segment dominates the Desktop as a Service Market. To provide a variety of “as-a-service” architecture, public clouds rely on standardization of the underlying computing, networking, storage, and operational software technologies. This is what’s causing the digital revolution of businesses that prioritize the cloud to dramatically accelerate. However, not all public clouds are made equal, particularly in the computing sector where variations among hyper-scalers have a considerable impact on the price and functionality of Desktop as a Service. Services can change depending on the region, even within the same hyper-scale cloud vendor. All public clouds have elasticity, unlike corporate data centers. On-demand, IT may adjust capacity in any part of the world. With the help of a desktop as a service solution, businesses may choose the best public cloud for their use cases based on factors such as cost and performance. Due to the substantial architectural and elasticity differences between public clouds, cloud-native solutions that can benefit from the finest attributes and costs of each public cloud aid in further expanding the market.

By Enterprise Size, the Small & Medium-sized Enterprises segment is likely to dominate the market. Currently, growing businesses are spending higher costs on administrative logistics to expand businesses via additional staffing in the demanding domains of the business. To enhance profitability, Businesses seeking to reduce the cost of laptops. Reducing the physical computers from the workspace can save substantial costing which is necessary for small and medium-sized businesses. Many information driver businesses where data security requires to be top-notch, are adapting towards Desktop as a Service. Such Businesses that seek to regulate employee access to data prohibit downloading files to personal PCs (financial institutions, government agencies, etc.) Also, growing enterprises with small and medium size operations seek to outsource as much of their security of data for the extra layer of protection for the company database. Moreover, Businesses that are seasonal or project-based, where it is impractical to provide computers to temporary workers or seasonal personnel and adoption of Desktop as a Service allow them to cut down costs. Therefore, the small and medium segments are likely to dominate in the Desktop as a Service Market.

By End User, IT & Telecommunications are expected to dominate the Desktop as a Service Market. IT companies are the most frequent enablers of the Desktop as a Service. Depending on unique requirements, new hires, mergers and acquisitions, and global growth, organizations can scale up or down quickly. Without having to interact directly with every endpoint, IT can more effectively integrate, consolidate, and deploy services and applications when and where they are required. Businesses can cut operating and capital expenses while also streamlining infrastructure management and IT support. Since data breaches are happening more frequently than ever, security is a major concern for almost all IT projects. By utilizing protocols to compress, encrypt, and encode data so that only images are delivered and data no longer lives on local devices, DaaS aids enterprises in meeting security policy requirements and compliance standards. enables the construction of environments designed for developers, giving them quick, safe access to end-user environments for smooth development and testing without hindering user productivity. For Instance, A Chicago-based IT business called Nerdio recently announced plans to grow internationally to meet the huge demand for its Windows 365 and Microsoft Azure Virtual Desktop (AVD) services.

Regional Analysis of Desktop as a Service (DaaS) Market

North America is dominating the Desktop as a Service Market. An expanding number of businesses and escalating outsourcing operations are driving the DaaS market in North America. While maintaining tight control over their data and source code, IT organizations are contracting out the creation of applications to other developers. In this situation, software developers can utilize DaaS to access a fully functional desktop that allows them to install development tools and reboot the machine without harming other users. Additionally, DaaS technology is frequently used by IT businesses to improve data security and lower hardware costs. The US aerospace and defense industry is likewise making use of DaaS technology’s advantages. For instance, the United States Air Force (USAF) uses DaaS technology since its desktop environment needs to be flexible. Additionally, the USAF is employing DaaS technology to lessen desktop support concerns while boosting operational stability daily. A significant element propelling the expansion of the DaaS market in the region is the expanding utility of virtualization.

Asia Pacific region is growing significantly in the Desktop as a Service Market and is expected to show a robust growth rate during the forecasted period. Some of the key nations driving this region’s desktop-as-a-service market growth include China, Japan, and India. The market for desktop-as-a-service in the Asia Pacific is expanding more quickly because of the rising number of start-ups and SMEs in the region. For instance, In April 2021, there were approximately 200 unicorn startups in the Asia Pacific, which was only surpassed by the United States in terms of startup valuation at $1 billion or more (290). Many of Asia’s greatest startups are making an influence on the world, whether it be by creating new business models like Grab and other Southeast Asian “super apps” or by tackling global challenges like Japan’s CogSmart. Such a start-up ecosystem is supporting the growth of Desktop as a Service Market

Top Key Players Covered in Desktop as a Service (DaaS) Market

Amazon Web ServicesInc

Cisco Systems Inc.

Citrix Systems Inc

dinCloud, Inc

IBM Corporation

Leostream Corporation

Microsoft Corporation

NetApp Inc. (Solidfire)

Oracle Corporation

VMware Inc

Evolve IP, LLC.

Quest Media & Supplies, Inc.

TekReach Solutions, LLC.

V2 Cloud Solutions, Inc.

VMware, Inc

Dizzion Inc.

Capgemini

Key Industry Development In The Desktop as a Service (DaaS) Market

In October 2023, HP Inc. hosted its first-ever HP Imagine event, where it unveiled more than 20 new devices and services designed to revolutionize how we live, work, and dream. The event showcased HP’s latest breakthrough innovations across Personal Systems, Printing Systems, and Workforce Solutions.

In September 2023, Advantech, a leading provider of intelligent systems, has recently launched a new cloud-based version of its DeviceOn-iService Suite SaaS for remote device management. This new version promises a more user-friendly and convenient remote device management experience, in addition to its predecessor’s comprehensive equipment and peripheral monitoring and management capabilities.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Desktop as a Service (DaaS) Market by Deployment (2018-2032)

4.1 Desktop as a Service (DaaS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Public Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Private Cloud

4.5 Hybrid Cloud

Chapter 5: Desktop as a Service (DaaS) Market by Enterprise Size (2018-2032)

5.1 Desktop as a Service (DaaS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium-sized Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Desktop as a Service (DaaS) Market by End Users (2018-2032)

6.1 Desktop as a Service (DaaS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 IT & Telecommunications

6.5 Government

6.6 Media & Entertainment

6.7 Manufacturing

6.8 Healthcare

6.9 Education

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Desktop as a Service (DaaS) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ST. BONIFACE PALLET

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMERICAN WOOD RESOURCES

7.4 AXPO GROUP

7.5 GREAT NORTHERN TIMBER

7.6 EVOWORLD GMBH

7.7 MITSUI & COLTDCOGENT FIBRE

7.8 ENVIVA PELLETS

7.9 OJI HOLDINGS

7.10 ORSTED A/S

7.11 SOJITZ CORPORATION

7.12 VERDO A/S

Chapter 8: Global Desktop as a Service (DaaS) Market By Region

8.1 Overview

8.2. North America Desktop as a Service (DaaS) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment

8.2.4.1 Public Cloud

8.2.4.2 Private Cloud

8.2.4.3 Hybrid Cloud

8.2.5 Historic and Forecasted Market Size by Enterprise Size

8.2.5.1 Small and Medium-sized Enterprises

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size by End Users

8.2.6.1 BFSI

8.2.6.2 IT & Telecommunications

8.2.6.3 Government

8.2.6.4 Media & Entertainment

8.2.6.5 Manufacturing

8.2.6.6 Healthcare

8.2.6.7 Education

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Desktop as a Service (DaaS) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment

8.3.4.1 Public Cloud

8.3.4.2 Private Cloud

8.3.4.3 Hybrid Cloud

8.3.5 Historic and Forecasted Market Size by Enterprise Size

8.3.5.1 Small and Medium-sized Enterprises

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size by End Users

8.3.6.1 BFSI

8.3.6.2 IT & Telecommunications

8.3.6.3 Government

8.3.6.4 Media & Entertainment

8.3.6.5 Manufacturing

8.3.6.6 Healthcare

8.3.6.7 Education

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Desktop as a Service (DaaS) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment

8.4.4.1 Public Cloud

8.4.4.2 Private Cloud

8.4.4.3 Hybrid Cloud

8.4.5 Historic and Forecasted Market Size by Enterprise Size

8.4.5.1 Small and Medium-sized Enterprises

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size by End Users

8.4.6.1 BFSI

8.4.6.2 IT & Telecommunications

8.4.6.3 Government

8.4.6.4 Media & Entertainment

8.4.6.5 Manufacturing

8.4.6.6 Healthcare

8.4.6.7 Education

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Desktop as a Service (DaaS) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment

8.5.4.1 Public Cloud

8.5.4.2 Private Cloud

8.5.4.3 Hybrid Cloud

8.5.5 Historic and Forecasted Market Size by Enterprise Size

8.5.5.1 Small and Medium-sized Enterprises

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size by End Users

8.5.6.1 BFSI

8.5.6.2 IT & Telecommunications

8.5.6.3 Government

8.5.6.4 Media & Entertainment

8.5.6.5 Manufacturing

8.5.6.6 Healthcare

8.5.6.7 Education

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Desktop as a Service (DaaS) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment

8.6.4.1 Public Cloud

8.6.4.2 Private Cloud

8.6.4.3 Hybrid Cloud

8.6.5 Historic and Forecasted Market Size by Enterprise Size

8.6.5.1 Small and Medium-sized Enterprises

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size by End Users

8.6.6.1 BFSI

8.6.6.2 IT & Telecommunications

8.6.6.3 Government

8.6.6.4 Media & Entertainment

8.6.6.5 Manufacturing

8.6.6.6 Healthcare

8.6.6.7 Education

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Desktop as a Service (DaaS) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment

8.7.4.1 Public Cloud

8.7.4.2 Private Cloud

8.7.4.3 Hybrid Cloud

8.7.5 Historic and Forecasted Market Size by Enterprise Size

8.7.5.1 Small and Medium-sized Enterprises

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size by End Users

8.7.6.1 BFSI

8.7.6.2 IT & Telecommunications

8.7.6.3 Government

8.7.6.4 Media & Entertainment

8.7.6.5 Manufacturing

8.7.6.6 Healthcare

8.7.6.7 Education

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Desktop as a Service (DAAS) Market research report?

A1: The forecast period in the Market research report is 2024-2032.

Q2: Who are the key players in the Desktop as a Service (DaaS) Market?

A2: Amazon Web ServicesInc, Cisco Systems Inc., Citrix Systems Inc, dinCloud, Inc, IBM Corporation, Leostream Corporation, Microsoft Corporation, NetApp Inc. (Solidfire), Oracle Corporation, VMware Inc, Evolve IP, LLC., Quest Media & Supplies, Inc., TekReach Solutions, LLC., V2 Cloud Solutions, Inc., VMware, Inc, Dizzion Inc., Capgemini,

Q3: What are the segments of the Desktop as a Service (DaaS) Market?

A3: The Desktop as a Service (DaaS) market is segmented into payment Deployment, Enterprise Size, End-Users, and region. By Deployment the market is categorized into Public Cloud, Private Cloud, Hybrid Cloud. By Enterprise Size, the market is categorized into Small and Medium-sized Enterprises Large Enterprises. By End-user, the market is categorized into BFSI, IT & Telecommunications, Government, Media & Entertainment, Manufacturing, Healthcare, Education, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Desktop as a Service (DaaS) market?

A4: The desktop environment and related application software are separated from the physical client device used to access them due to a software technology called desktop as a Service. A complete desktop environment management system can be created by combining desktop virtualization with user virtualization, application virtualization, and user profile management systems.

Q5: How big is the Desktop as a Service (DaaS) market?

A5: The Global Desktop as a Service (DAAS) Market size is expected to grow from USD 9.66 billion in 2023 to USD 41.49 billion by 2032, at a CAGR of 17.58% during the forecast period (2024-2032).

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!