Stay Ahead in Fast-Growing Economies.

Browse Reports NowData Center Liquid Immersion Cooling Market Comprehensive Analysis & Growth Outlook to 2032

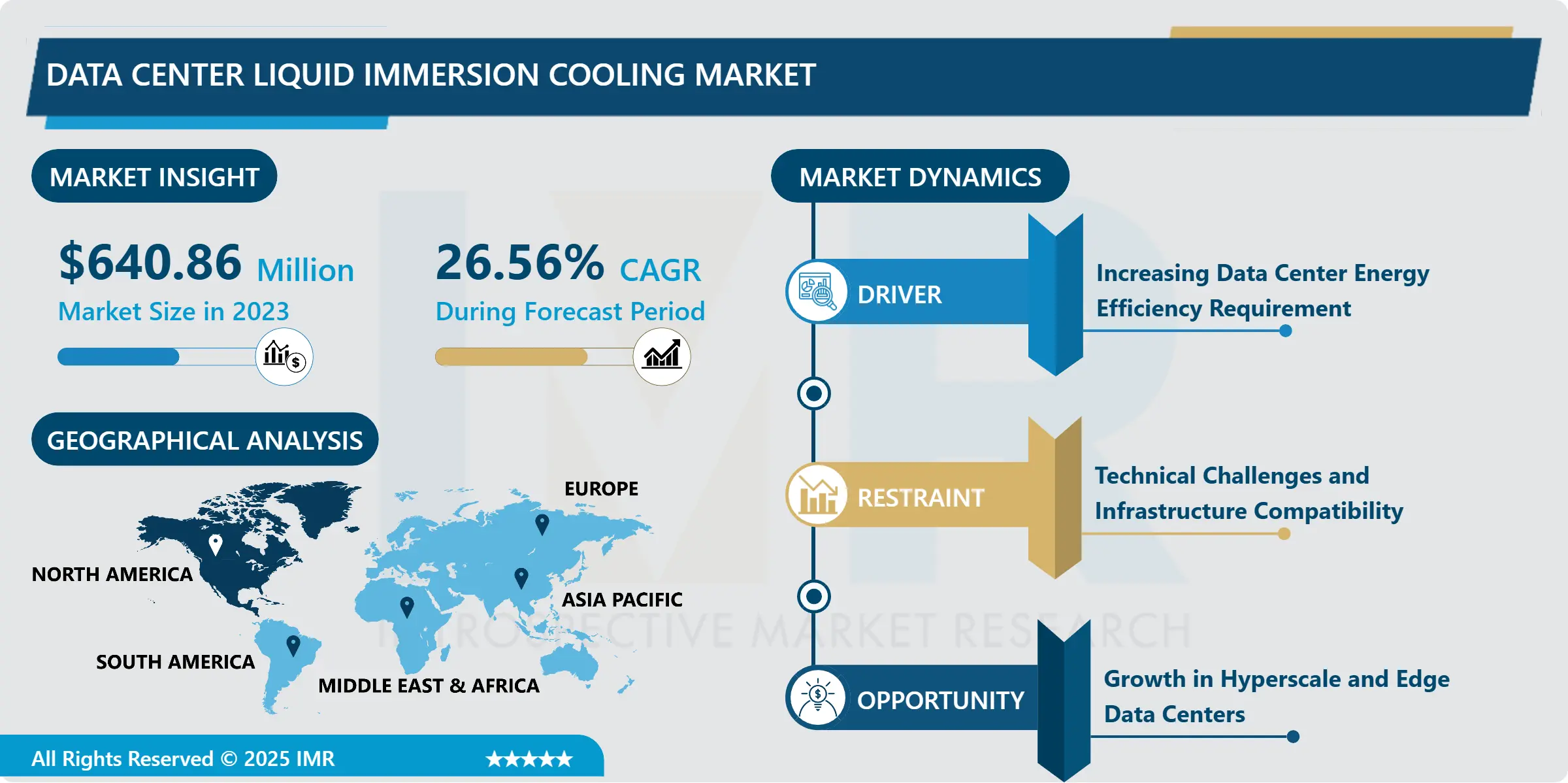

Data Center Liquid Immersion Cooling Market Size Was Valued at USD 640.86 Million in 2023, and is Projected to Reach USD 5338.65 Million by 2032, Growing at a CAGR of 26.56% From 2024-2032.

IMR Group

Description

Data Center Liquid Immersion Cooling Market Synopsis:

Data Center Liquid Immersion Cooling Market Size Was Valued at USD 640.86 Million in 2023, and is Projected to Reach USD 5338.65 Million by 2032, Growing at a CAGR of 26.56% From 2024-2032.

The Data Center Liquid Immersion Cooling Market is defined as the segment of the IT and data centre industries whose business proposition is to cool hardware through the submersion of electronic components or whole servers in non-conductive fluids. This method provided optimal cooling option that in the past saved a lot of energy compared to the air-based cooling system. It is gaining acceptance as data centers look for fresher and better performing cooling solutions to deal with rising data traffic and computational requirements.

The Data Center Liquid Immersion Cooling Market is on the rise because organizations require efficient ways of combating the problem of heat in data centers which include adopting a cheaper approach. Liquid immersion cooling refers to a process that directly immerses electronic components, servers as well as other sophisticated devices into a non-conductor coolant in order to cool them rather than utilizing air as it has been the conventional method. It can be really valuable in facing current and predicted high power densities of data centers with soaring requirements in Computing performance and efficiency. The consumers also derive some benefits like lesser energy consumption mean lower operational expenses and increased inherent reliability that is essentially a sell for the owners of the data markets. Further, liquid immersion cooling perfectly fits the trends for optimization of CO2 emissions, as it contributes to the reduction of the carbon footprint of cooling systems.

The implementation of liquid immersion cooling is enabled by the improvements in the formulation of the coolant, awareness of the environmental effects, and application of dense server designs. Players in the market are working on ways to improve the effectiveness and safety of immersion cooling systems. We are also seeing geographic market growth, specifically, high use in areas benefiting from high internet connectivity requiring high-performance computing, such as North America and Europe. In particular, AI and ML will be driving data center demand for immersion cooling since these applications are both computationally demanding and energy dense. However, it should be noted that as the market develops, regulatory requirements, and certifications will play a critical element in achieving safe liquid immersion cooling.

Data Center Liquid Immersion Cooling Market Trend Analysis:

Demand for Energy-Efficient Data Centers Drives Adoption of Liquid Immersion Cooling

New generating demand for efficient data centers has been a leading promoter of liquid immersion cooling technology. In this method the servers are submerged directly in the dielectric fluid which is a better cooling medium than air cooling common in many data centers today. Data centers, having an airflow management that cools the equipment reduces thermal injury to these components hence being ideal for the design of these centers. As more data center participants seek ways to cut carbon emission and enhance energy utilization, liquid immersion cooling has the potential of helping data centers become greener.

Improvements in the fluid chemistry and sealing solutions by manufacturers are adding to the robustness and effectiveness of liquid immersion cooling solutions. These enhancements provide added value to the technology for businesses aspiring to get value from their data centers. As more and more, high-performance computing, machine learning, AI, and other systems that produce massive amounts of heat for their given tasks are designed, so is the need for adequate cooling systems such as liquid immersion cooling. Thus, it is becoming increasingly possible to assume that the development of new technologies for air cooling will intensify and the coverage of this issue will expand, all of which should contribute to the more extensive usage of such progressive approaches in cooligency.

Environmental and Cost Advantages of Liquid Immersion Cooling

The use of the liquid immersion cooling technology involves cooling of the servers as well as the other related electronic devices by immersing them in any liquid that is non-conductor of heat. It reduces heat development; thereby improving the effectiveness of equipments used in data centers. Being an energy-intensive sector that also deals with rapidly growing concerns related to carbon footprint, liquid immersion cooling appears especially attractive in data centers. It enables data centers to operate optimally with regard to mechanical and electrical infrastructure, and at the same time scale with environmental laws. Since liquid immersion cooling eliminates the requirements of conventional air conditioning systems, which are power hungry, the power and operating expenses could be minimized.

Additionally, compute density resulting from growth in sectors such as IoT, big data, and AI requires new levels of cooling. Liquid immersion cooling is best suited to these demands as it cools effectively, especially in contained environments. This makes it good for today’s data centers planning to expand their operations without necessarily having to deteriorate on efficiency. The potential for expansion in this market is also driven by the continuing prevalence of edge computing for locations that necessitate processing energy nearer to the sources, which raises the importance of effective cooling systems.

Data Center Liquid Immersion Cooling Market Segment Analysis:

Data Center Liquid Immersion Cooling Market is Segmented on the basis of By Cooling Type, End-User Industries, and Region.

By Cooling Type, Direct Liquid Immersion Cooling segment is expected to dominate the market during the forecast period

Direct liquid immersion cooling is a kind of cooling method in which electronic components are immersed in nonconductive liquid coolant. This method is useful for power control and dissipation of heat loads since it is most suitable for high density power control and high heat loads data centers, and super computers. The liquid removes heat produced by operational currents in computer chips and other components to maintain the most efficient temperature levels and avoid burning out. This is especially helpful in settings where system redundancy is needed, including Information Technology (IT) and telecommunication industries, where networks and computers that host large amounts of date and perform large and complex computational jobs are common. Direct liquid immersion cooling further lowers the cooling infrastructure cost and improves total energy efficiency through the minimization of air-based cooling systems.

Direct liquid immersion cooling is especially beneficial in the cloud service provider field because it provides appropriate options for overseeing the growth of heat generation resulting from highly dense cloud servers. Absence of compromise on the ability to handle the power loads meaning that the server is preferred in cloud data centers where power reliability is paramount for customer satisfaction. Likewise, in the BFSI sector where system integrity and reliability are the key, direct liquid immersion cooling can guard important financial information by avoiding equipment failures due to heat conditions. The technology delivers reliable cooling that not only enhances system availability, but also minimizes energy use and carbon emissions to meet the sector’s environmental objectives.

By End-User Industries, IT and Telecom segment expected to held the largest share

IT and telecom are one of the first industries that use technologies such as liquid immersion cooling for better cooling of their devices. These industries experience many difficulties managing heat produced by high-power computing equipment including servers, network switches, and other related IT equipment as the data processing and networks’ performance requirements progressively increase. Direct and the hybrid system make direct liquid immersion cooling an efficient solution by encapsulating components in the non-conductive liquid coolant. This method facilitates better heat management with the components staying within suitable temperature profiles thus minimizing on overheating rates of the equipment and subsequent loss of data. They allow managing high power density level to cool these systems reliably and maintain system availability – an important factor for the IT and telecommunication industries where any power outage, no matter how brief, can mean hefty losses and customer dissatisfaction.

Furthermore, liquid immersion cooling helps reduce the cost of production and enhance the energy utilization of these sectors. It also tackles part of the operational woes that come with air-based cooling systems while doing away with energy requirements. This is especially the case as both sectors are coming under increasing pressure to deliver on sustainability targets and act to cut their overall emissions. As well as providing the ability to manage dense server deployments with different types of liquid cooling solutions, it is aimed at the stability of the system and fulfillment of environmental goals, such as the reduction of energy consumption and the improvement of the efficiency of data centers. This makes liquid immersion cooling an excellent solution to suit the needs of IT and telecommunications companies that seek to enhance the efficiency of their structures in connection with the problems of high server density.

Data Center Liquid Immersion Cooling Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

In North America especially the United States and Canada the Data Center Liquid Immersion Cooling Market is showing rapid adoption due to highly developed IT infrastructure and regulatory compliances over energy utilization. There is currently growing trend in need for high density data centers which call for proper cooling systems to cater for the heat produced hence leading to use of liquid immersion cooling technologies. These technologies are far more efficient than the conventional air-based cooling systems and practices which are in tune with the region’s power conservation strategy and lowering carbon emissions initiatives. In addition, the North America region has significant and engaged cool players in the creation of fresh cooling approaches that do not only decrease operational costs but also augment the data center performance, leading to massive market growth.

This has propelled the demand for liquid immersion cooling technologies in North America further enabled by technological advancement in the region and the need for a scalable solution for data centers. Over the last couple of years, as more and more companies adopt the cloud and the push for digital transformation advances, there has been a need for advanced data centers that can support large amounts of data in real-time. This shift is imposing the requirement for the development of cost-effective cooling, where liquid immersion cooling has the provision. Also, various authorized bodies across the region are enacting stricter requirements regarding energy utilization which in turn increases the demand for such innovative cooling solutions and strengthens the market’s growth trend.

Active Key Players in the Data Center Liquid Immersion Cooling Market:

Advanced Microgrid Solutions, Inc. (USA)

CoolIT Systems Inc. (Canada)

Cymatic Technologies (USA)

Green Revolution Cooling, Inc. (USA)

Iceotope Technologies Ltd. (UK)

Schneider Electric SE (France)

Vertiv Co (USA)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Center Liquid Immersion Cooling Market by Cooling Type

4.1 Data Center Liquid Immersion Cooling Market Snapshot and Growth Engine

4.2 Data Center Liquid Immersion Cooling Market Overview

4.3 Direct Liquid Immersion Cooling

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Direct Liquid Immersion Cooling: Geographic Segmentation Analysis

4.4 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling: Geographic Segmentation Analysis

Chapter 5: Data Center Liquid Immersion Cooling Market by End-User Industries

5.1 Data Center Liquid Immersion Cooling Market Snapshot and Growth Engine

5.2 Data Center Liquid Immersion Cooling Market Overview

5.3 and Telecom

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 and Telecom: Geographic Segmentation Analysis

5.4 Cloud Service Providers

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Cloud Service Providers: Geographic Segmentation Analysis

5.5 BFSI (Banking

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 BFSI (Banking: Geographic Segmentation Analysis

5.6 Financial Services

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Financial Services: Geographic Segmentation Analysis

5.7 and Insurance

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 and Insurance: Geographic Segmentation Analysis

5.8 Healthcare

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Healthcare: Geographic Segmentation Analysis

5.9 Colocation Providers and Others.

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Colocation Providers and Others.: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Data Center Liquid Immersion Cooling Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 VERTIV CO

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ICEOTOPE TECHNOLOGIES LTD.

6.4 SCHNEIDER ELECTRIC SE

6.5 COOLIT SYSTEMS INC.

6.6 GREEN REVOLUTION COOLING INC.

6.7 ADVANCED MICROGRID SOLUTIONS INC.

6.8 CYMATIC TECHNOLOGIES

6.9 OTHER ACTIVE PLAYERS

Chapter 7: Global Data Center Liquid Immersion Cooling Market By Region

7.1 Overview

7.2. North America Data Center Liquid Immersion Cooling Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Cooling Type

7.2.4.1 Direct Liquid Immersion Cooling

7.2.4.2 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

7.2.5 Historic and Forecasted Market Size By End-User Industries

7.2.5.1 and Telecom

7.2.5.2 Cloud Service Providers

7.2.5.3 BFSI (Banking

7.2.5.4 Financial Services

7.2.5.5 and Insurance

7.2.5.6 Healthcare

7.2.5.7 Colocation Providers and Others.

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Data Center Liquid Immersion Cooling Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Cooling Type

7.3.4.1 Direct Liquid Immersion Cooling

7.3.4.2 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

7.3.5 Historic and Forecasted Market Size By End-User Industries

7.3.5.1 and Telecom

7.3.5.2 Cloud Service Providers

7.3.5.3 BFSI (Banking

7.3.5.4 Financial Services

7.3.5.5 and Insurance

7.3.5.6 Healthcare

7.3.5.7 Colocation Providers and Others.

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Data Center Liquid Immersion Cooling Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Cooling Type

7.4.4.1 Direct Liquid Immersion Cooling

7.4.4.2 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

7.4.5 Historic and Forecasted Market Size By End-User Industries

7.4.5.1 and Telecom

7.4.5.2 Cloud Service Providers

7.4.5.3 BFSI (Banking

7.4.5.4 Financial Services

7.4.5.5 and Insurance

7.4.5.6 Healthcare

7.4.5.7 Colocation Providers and Others.

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Data Center Liquid Immersion Cooling Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Cooling Type

7.5.4.1 Direct Liquid Immersion Cooling

7.5.4.2 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

7.5.5 Historic and Forecasted Market Size By End-User Industries

7.5.5.1 and Telecom

7.5.5.2 Cloud Service Providers

7.5.5.3 BFSI (Banking

7.5.5.4 Financial Services

7.5.5.5 and Insurance

7.5.5.6 Healthcare

7.5.5.7 Colocation Providers and Others.

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Data Center Liquid Immersion Cooling Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Cooling Type

7.6.4.1 Direct Liquid Immersion Cooling

7.6.4.2 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

7.6.5 Historic and Forecasted Market Size By End-User Industries

7.6.5.1 and Telecom

7.6.5.2 Cloud Service Providers

7.6.5.3 BFSI (Banking

7.6.5.4 Financial Services

7.6.5.5 and Insurance

7.6.5.6 Healthcare

7.6.5.7 Colocation Providers and Others.

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Data Center Liquid Immersion Cooling Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Cooling Type

7.7.4.1 Direct Liquid Immersion Cooling

7.7.4.2 Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling

7.7.5 Historic and Forecasted Market Size By End-User Industries

7.7.5.1 and Telecom

7.7.5.2 Cloud Service Providers

7.7.5.3 BFSI (Banking

7.7.5.4 Financial Services

7.7.5.5 and Insurance

7.7.5.6 Healthcare

7.7.5.7 Colocation Providers and Others.

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Data Center Liquid Immersion Cooling Market research report?

A1: The forecast period in the Market research report is 2024-2032.

Q2: Who are the key players in the Data Center Liquid Immersion Cooling Market?

A2: Advanced Microgrid Solutions, Inc. (USA), CoolIT Systems Inc. (Canada), Cymatic Technologies (USA), Green Revolution Cooling, Inc. (USA), Iceotope Technologies Ltd. (UK), Schneider Electric SE (France), Vertiv Co (USA) and Other Active Players.

Q3: What are the segments of the Data Center Liquid Immersion Cooling Market?

A3: The Data Center Liquid Immersion Cooling Market is segmented into By Cooling Type, End-User Industries and region. By Cooling Type, the market is categorized into Direct Liquid Immersion Cooling, Indirect Liquid Immersion Cooling and Hybrid Liquid Immersion Cooling. By End-User Industries, the market is categorized into IT and Telecom, Cloud Service Providers, BFSI (Banking, Financial Services, and Insurance), Healthcare, Colocation Providers and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Data Center Liquid Immersion Cooling Market?

A4: The Data Center Liquid Immersion Cooling Market refers to the sector within the IT and data center industry focused on cooling data center hardware through the immersion of electronic components or entire servers in non-conductive liquid. This method offers a highly efficient cooling solution that significantly reduces energy consumption and improves thermal management by eliminating the need for air-based cooling systems. It is gaining traction as data centers seek more sustainable and high-performance cooling methods to accommodate increasing data traffic and compute-intensive applications.

Q5: How big is the Data Center Liquid Immersion Cooling Market?

A5: Data Center Liquid Immersion Cooling Market Size Was Valued at USD 640.86 Million in 2023, and is Projected to Reach USD 5338.65 Million by 2032, Growing at a CAGR of 26.56% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!