Stay Ahead in Fast-Growing Economies.

Browse Reports NowData Catalog Market Size, Share, Growth & Forecast (2024-2032)

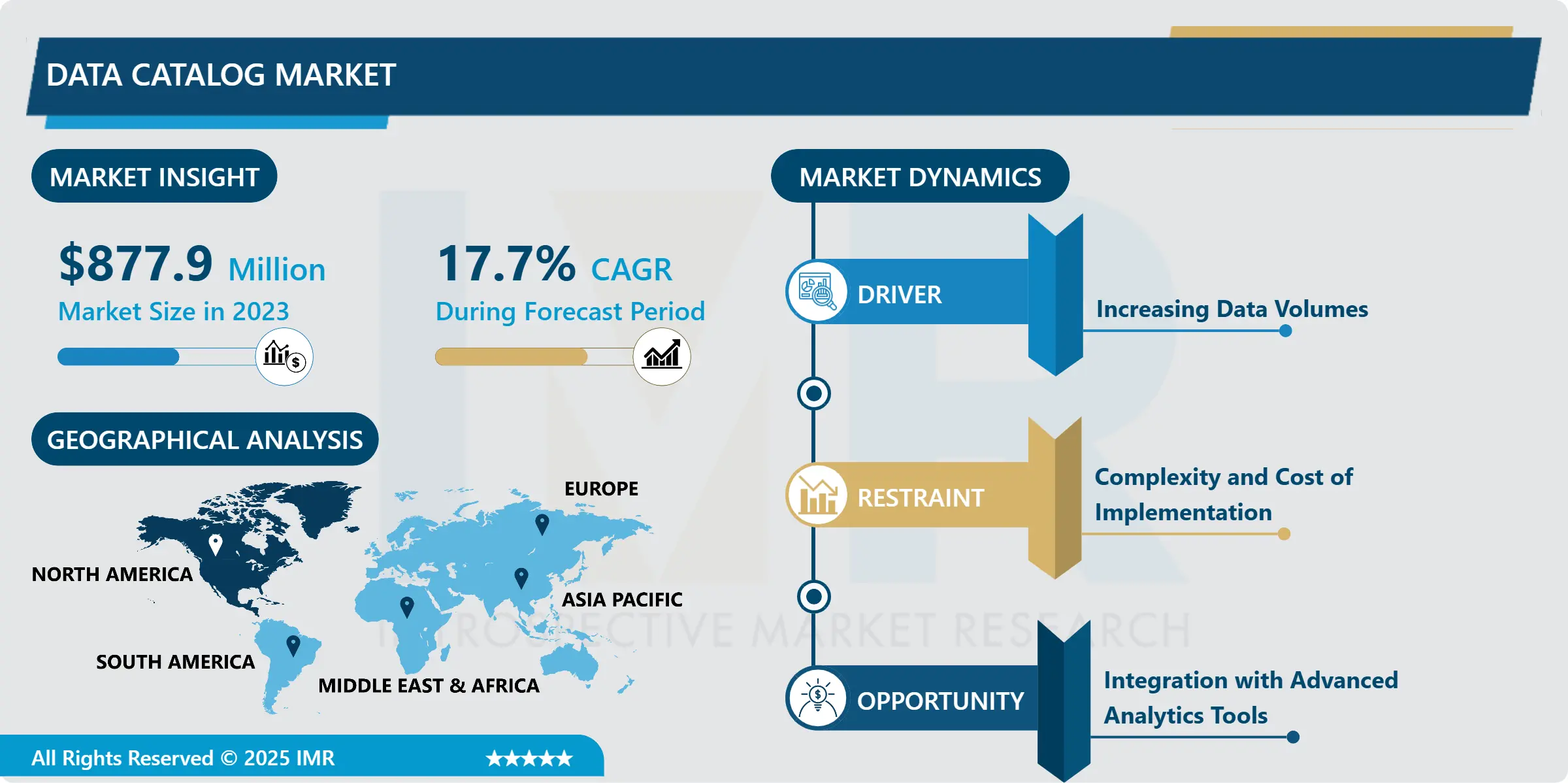

Data Catalog Market Size Was Valued at USD 877.9 Million in 2023, and is Projected to Reach USD 3805.69 Million by 2032, Growing at a CAGR of 17.7% From 2024-2032

IMR Group

Description

Data Catalog Market Synopsis:

Data Catalog Market Size Was Valued at USD 877.9 Million in 2023, and is Projected to Reach USD 3805.69 Million by 2032, Growing at a CAGR of 17.7% From 2024-2032

The Data Catalog Market can be defined as the business space that focuses on products and services that assist businesses in governing, indexing, and making sense of their data sources. These enable features of data discovery, metadata management, data lineage and data governance to help organisations categorise, classify and retrieve data for analysis, reporting and decision making. The market has created a demand for enhanced data visibility and data quality as well as easier access to data, which would enhance the dissemination and use of data among institutions.

The Data Catalog Market is expanding quickly due to the understanding that data resources need to be governed, standardized, and searchable. This market offers products that help organizations index, classify and work with data located in databases, cloud repositories, and big data systems. Especially now that big data remains a reality, the challenge of getting insight into the raw facts becomes an essential requirement. Organisations are deploying data catalog solutions for better data understanding, for data asset quality and for faster decision-making. This is due to increase in cloud computing AI and machine learning, which favour well-structured data environments.

The Data Catalog Market has been categorised into different types such as on premise and on cloud and finds its application across various sectors including banking, financial services & insurance, healthcare, retail, IT & Telecom. Cloud based data catalog solutions have become popular due to their ability to grow as the organization grows, their flexibility, and compatibility with other cloud services. These solutions provide Auto-Tagging that significantly brings down the time needed and efforts to control the associated data. The continuously rising number of regulatory mandates, including GDPR and CCPA on data privacy and compliance is also driving adoption of data catalog solutions as a means to attain data governance and security. The market is expected to continue to grow as more organizations turn to big data and buy advanced analytics and artificial intelligence to analyze insights within their gathered data for further opportunities for business Model innovation.

Data Catalog Market Trend Analysis:

Increasing Demand for Data Catalogs Driven by Big Data and Cloud Adoption

Companies are also beginning to realize the importance of good tools and techniques to manage and improve data quality and to meet compliance requirements and support decision making. With the increase in use of big data and cloud implementation, data catalogs have become more important due to the need for a tool that would help manage, classify and discover data resources within an organization. This trend is most prevailing in industries of healthcare, finance and retail, and other industries where gathering and analyzing information is vital for business outcomes. Such industries require accurate and timely data to make several decisions, meet regulatory standards, and increase growth. These organizations are able to leverage data catalogs to organize, govern, standardize and protect that asset to ensure availability and comprehension.

AI and ML integration with data catalog platforms is improving their usability through the learning capabilities that come with an intelligent system. Some of the advances these include; enhancing functions of data discovery and tagging, automating routines of data classification among others. That is why, while organizations will keep on focusing on data as more valuable resources, the given market is going to remain rather indicative of development along with innovations. This will lead to the development of even more complex solutions to accommodate and solve the challenges posed by the modern data environment, thus offering businesses the potential to extract ever increasing vale from data assets that is secure and adheres to compliance requirements.

Integration of AI and Machine Learning Technologies

The first major trend in the Data Catalog market is connected with the usage of artificial intelligence and machine learning techniques. Data catalogs can help businesses find relevant patterns and trends fast, thanks to the automation of data discovery, classification, and enrichment with the help of AI capabilities integrated into the data catalogs. This integration not only increases the efficiency of data management but also plays a part in enriching data quality by such components as inconsistency or outliers’ recognition. Intelligent data catalogs enable prescriptive cleaning where recommendations are given as to specific patterns, transforms and procedures that would help enhance data quality; this kind of data is reliable for higher order analysis to drive decision making.

Thus, when AI is deployed for the purpose of data cataloging, organizations can extend their data governance feature set. There are advantages such as automating the process of tagging and categorizing the data to ensure ease of use while sorting out data assets. This is especially important in large and numerous data context since the manual preparation can consume time and is frequently associated with errors. There are also the opportunities to help the process of data lineage and audit, which is crucial in contexts of the regulation and accountability. This capability can ultimately assist an organization in the ability to keep data accurate and consistent and show proper handling of data in its operations to the regulatory bodies and more to the public.

Data Catalog Market Segment Analysis:

Data Catalog Market is Segmented on the basis of By Deployment, Enterprise Type, Industry, and Region.

By Deployment, Cloud segment is expected to dominate the market during the forecast period

Cloud deployment means using third party servers based on the internet to host services or software such that users can access them remotely. This deployment model is gradually gaining popularity across industries because of the flexibility of use, easy scalability to growing and expanded functions and, moreover, lower initial costs outlay. Using the available web developers and cloud hosting providers, firms are able to up/down scale their operations without much problem due to little sunk costs or contractual obligations. The capability of accessing applications all over that comes with cloud computing has improved sharing of information across teams and eradiculation of remote operations. This also sharply decreases the need in expensive IT infrastructure and in the overhead associated with establishing and maintaining it, as providers perform routine updates and maintenance automatically. In healthcare sector, retail segment or banking and financial services, IT industry, cloud deployment provides an efficient means to handle the work, ensure data security and conform to industry norms.

Additionally, there are tangible benefits when implementing cloud solutions by the fact that disaster recovery is much easier when in the cloud. They provide easy access to data storage, data backup and data recovery and therefore they suit industries that deal with sensitive data collected from patients and customers respectively. The other two features are automatic update where all System should be constantly on the latest security and update to meet all compliance regulated in the IT Industry. This is very important in order to save on time when there is an interruption of the business and recover from this loss. For example, health services companies can safely store patient records in the cloud to allow doctors and other health care providers to access patient information from any location resulting in better care and cost savings. In the same way, retail businesses are able to use cloud solutions so as to enhance the management of the stock, and the data of their clients, in order to deliver great customer experiences as well as lower operational costs.

By Industry, BFSI segment expected to held the largest share

Given the nature of data that BFSI deals with as well as the essential industry compliance, the sector requires the highest level of security. Cloud and on-premise solutions are about equally valid, albeit selecting the right option is often based on certain requirements of the organization. Cloud solutions provide businesses with the elasticity needed for steady, unpredictable or even volatile transaction and customer data quantities. They offer a flexible way of processing financial transactions and are also able to respond to change in market trends. Many services are provided in the cloud and provide disaster recovery and a business continuity plan, which is necessary when it comes to the risk factors inherent in data loss or system breakdown. But considering today’s distributed working models, many BFSI institution prefer on-premises model for the sake they can control financial, and customer’s data more effectively. Traditional solutions enable the control and protection of data in the organization’s own environment without violating laws and standards.

This solution is especially popular in BFSI institutions that want to maintain close control over their applications and data. These deployments enable management of all the data resources in a manner that is very secure and one that will minimize instances of data leaks. They offer a more conventional way of managing and processing data, while offering a greater amount of flexibility and manageability of the underlying physical and virtual architectures. This is important to facilitate compliance with regulations like GDPR in Europe or similar legislation in all the worlds. While cloud solutions provide flexibility and scalability, BFSI providers tend to consider them less secure to process the valuable financial transactions, a viewpoint that has compelled many of such firms to continue using the on-premise as well as cloud models to balance the compliance, security, and operation requirements most efficiently.

Data Catalog Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The market for Data Catalog in North America is growing immensely because it is highly developed in implementing the advanced analytics, Artificial Intelligence, and Machine Learning solutions. The corporate world has slowly started to realize the importance of data as an asset class, and organizations are now spending more money on technologies that can help them manage, clean, and operationalize their data. Currently, technology vendors of the region are helping in this growth with cloud-based data catalog solutions that solve discovery, governance, and integrative challenges. The advanced market of these technologies has already been established in North America and organizations there are aiming to leverage the advantages of big data of the market.

Specifically, when it comes to cloud-based data catalog solutions the demand is especially high in North America mainly because of the given reason – scale, flexibility, and reasonable cost.achine learning technologies. Companies are increasingly recognizing the value of data as a strategic asset and are investing heavily in data management solutions to enhance data quality, ensure regulatory compliance, and unlock actionable insights. The region’s leading technology providers are playing a crucial role in supporting this growth by offering innovative cloud-based data catalog solutions that streamline data discovery, governance, and integration processes. The early adoption of these technologies in North America has set the stage for accelerated market expansion, with organizations looking to capitalize on the competitive advantages of data-driven decision-making.

Active Key Players in the Data Catalog Market:

Alation, Inc. (U.S.)

Atlan Pte. Ltd. (Singapore)

BigID (U.S.)

Boomi Corporation (U.S.)

Collibra (U.S.)

Informatica Inc. (U.S.)

Okera (U.S.)

QlikTech International AB (U.S.)

Tableau Software, LLC. (U.S.)

TIBCO Software (U.S.)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Catalog Market by Deploymen

4.1 Data Catalog Market Snapshot and Growth Engine

4.2 Data Catalog Market Overview

4.3 Cloud and On-premises

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cloud and On-premises: Geographic Segmentation Analysis

Chapter 5: Data Catalog Market by Enterprise Type

5.1 Data Catalog Market Snapshot and Growth Engine

5.2 Data Catalog Market Overview

5.3 Large Enterprises and SMEs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Large Enterprises and SMEs: Geographic Segmentation Analysis

5.4 Industry

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Industry: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Data Catalog Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALATION INC. (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 COLLIBRA (U.S.)

6.4 INFORMATICA INC. (U.S.)

6.5 ATLAN PTE. LTD. (SINGAPORE)

6.6 BIGID (U.S.)

6.7 QLIKTECH INTERNATIONAL AB (U.S.)

6.8 TIBCO SOFTWARE (U.S.)

6.9 BOOMI CORPORATION (U.S.)

6.10 OKERA (U.S.)

6.11 TABLEAU SOFTWARE LLC. (U.S.)

6.12 OTHER ACTIVE PLAYERS

Chapter 7: Global Data Catalog Market By Region

7.1 Overview

7.2. North America Data Catalog Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Deploymen

7.2.4.1 Cloud and On-premises

7.2.5 Historic and Forecasted Market Size By Enterprise Type

7.2.5.1 Large Enterprises and SMEs

7.2.5.2 Industry

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Data Catalog Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Deploymen

7.3.4.1 Cloud and On-premises

7.3.5 Historic and Forecasted Market Size By Enterprise Type

7.3.5.1 Large Enterprises and SMEs

7.3.5.2 Industry

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Data Catalog Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Deploymen

7.4.4.1 Cloud and On-premises

7.4.5 Historic and Forecasted Market Size By Enterprise Type

7.4.5.1 Large Enterprises and SMEs

7.4.5.2 Industry

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Data Catalog Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Deploymen

7.5.4.1 Cloud and On-premises

7.5.5 Historic and Forecasted Market Size By Enterprise Type

7.5.5.1 Large Enterprises and SMEs

7.5.5.2 Industry

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Data Catalog Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Deploymen

7.6.4.1 Cloud and On-premises

7.6.5 Historic and Forecasted Market Size By Enterprise Type

7.6.5.1 Large Enterprises and SMEs

7.6.5.2 Industry

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Data Catalog Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Deploymen

7.7.4.1 Cloud and On-premises

7.7.5 Historic and Forecasted Market Size By Enterprise Type

7.7.5.1 Large Enterprises and SMEs

7.7.5.2 Industry

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Q1: What would be the forecast period in the Data Catalog Market research report?

A1: The forecast period in the Market research report is 2024-2032.

Q2: Who are the key players in the Data Catalog Market?

A2: Alation, Inc. (U.S.), Collibra (U.S.), Informatica Inc. (U.S.), Atlan Pte. Ltd. (Singapore), BigID (U.S.), QlikTech International AB (U.S.), TIBCO Software (U.S.), Boomi Corporation (U.S.), Okera (U.S.), Tableau Software, LLC. (U.S.) and Other Active Players.

Q3: What are the segments of the Data Catalog Market?

A3: The Data Catalog Market is segmented into By Deployment, Enterprise Type, Industry and region. By Deployment, the market is categorized into Cloud and On-premises. By Enterprise Type, the market is categorized into Large Enterprises and SMEs. By Industry, the market is categorized into BFSI, Healthcare, Manufacturing, Retail, IT and Others (Government, Media & Entertainment). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Data Catalog Market?

A4: The Data Catalog Market refers to the industry involving solutions and tools that help organizations manage, organize, and make sense of their data assets. These platforms provide capabilities for data discovery, metadata management, data lineage, and data governance, enabling businesses to efficiently catalog, classify, and retrieve data for analytics, reporting, and decision-making processes. The market supports improved data visibility, accessibility, and quality, facilitating better data management and utilization across organizations.

Q5: How big is the Data Catalog Market?

A5: Data Catalog Market Size Was Valued at USD 877.9 Million in 2023, and is Projected to Reach USD 3805.69 Million by 2032, Growing at a CAGR of 17.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!