Stay Ahead in Fast-Growing Economies.

Browse Reports NowCrude Transportation Market Industry Overview, Key Insights & Forecast to 2032

Crude transportation market can be described as sector that is connected with carrying of the crude oil from the producer or production area to a refinery site, storage area and distribution hub. This market consists in pipelines and tankers, barges, trucks and rail for transportation based on distance, geographical conditions, output volumes and other requirements. Crude transportation market may be considered large because it serves to meet a fundamental need in the global oil trade by delivering crude oil to consumers via pipelines and other transport infrastructure which is essential to meet the refining and consumer requirements. Higher energy demand and shifts in the energy distribution systems have made the crude transportation market favorable for the future years.

IMR Group

Description

Crude Transportation Market Synopsis

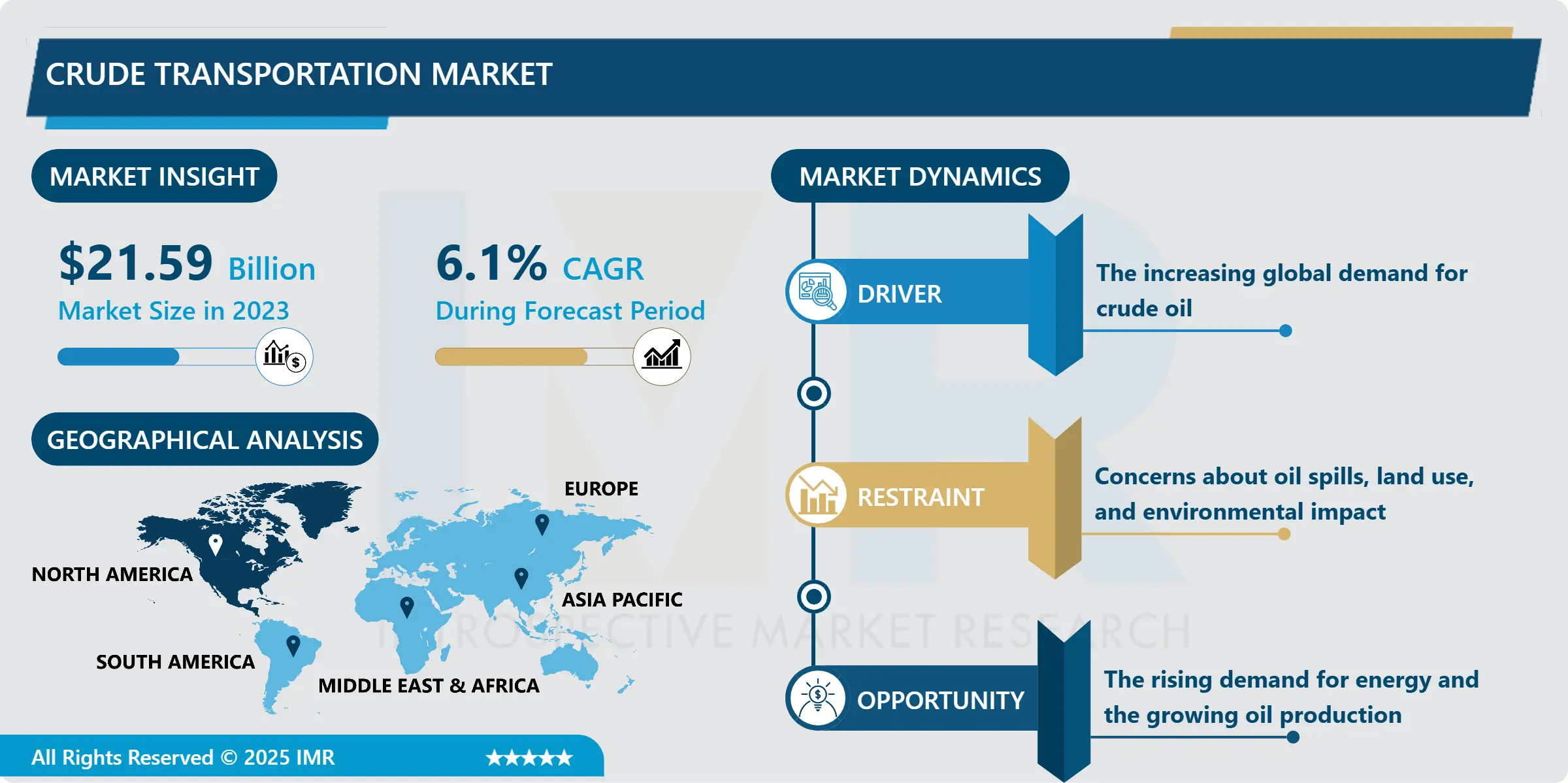

Crude Transportation Market Size Was Valued at USD 21.59 Billion in 2023, and is Projected to Reach USD 36.79 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.

Crude transportation market can be described as sector that is connected with carrying of the crude oil from the producer or production area to a refinery site, storage area and distribution hub. This market consists in pipelines and tankers, barges, trucks and rail for transportation based on distance, geographical conditions, output volumes and other requirements. Crude transportation market may be considered large because it serves to meet a fundamental need in the global oil trade by delivering crude oil to consumers via pipelines and other transport infrastructure which is essential to meet the refining and consumer requirements. Higher energy demand and shifts in the energy distribution systems have made the crude transportation market favorable for the future years.

However, at times crude transportation is referred to as a linkage of the world oil and gas logistics chain being responsible for the safe and timely conveyance of the crude from production areas to the processing and storage facilities. The market is always on the advantages of the escalating energy demands across the global industrialization, population increase, and economic development both among the emerging and the realized economies. Crude oil in transported through pipelines Social attitudes of crude transport mainly through pipelines and through tankers and barges through pipelines, truck and rail through waggons depending on the geographical barriers, the quantity of the crude and the available transport facilities. Aggregating global production and consumption of oil in the increase particularly in areas such as North America, the need for rigid and complex means of transport is best appreciated.

The Crude transportation market is also, in a state of constant growth with new pipeline construction and storage terminal & transportation routes. Some of the key drivers for this market include energy security, transport procurement, and growing emphasis placed on structures in enhancing the transportation of crude oil. Similarly, with advancement in technology as far as automation, digital monitoring and in real-time tracking of the consignment is concerned, integrity of transporting crude oil has been put into a higher pedestal. But there are some challenges which are associated with Market for example environmental challenge, regulatory challenge and unreasonable price in the international market of oil that control the growth of the industry and profitability.

Crude Transportation Market Trend Analysis:

Increasing Investment in Pipeline Infrastructure

A very influential force in the transportation of crude is the construction of pipelines through which crude is transported due to increased demand for the product. As mentioned earlier a pipeline system is found to be cheaper, efficient and safer means of transporting large volume of crude over long distance. As the volumes of crude oil increase especially in the major regions of the globe particularly in North America pipeline initiatives are undertaken so as to enable transportation of the commodities of crude oil to the Oil refineries and export destinations. There are many governments and private concerns that invest billions of dollars on erection of new pipeline systems and reconfiguration of others because they realize the value of the pipeline as critical enablers in retaining energy security and its availability environment.

Expanding Markets in Emerging Economies

One of the factors contributing to growth of the crude transportation industry is the increase in demand for transportation of crude oil in new world economies. Due to industrialization that is currently occurring in Asia-Pacific, Latin America, Africa, some of the main components of crude oil buyers and consumers are experiencing a sharp increase leading to the creation of crude transportation facilities. These regions are among the nations experiencing fast growing demand for energy primarily catalysed by construction of manufacturing plants and transport sectors. Regarding this, there is the need to implement efficiency on Crude pipelines, railway transport and tankers to enable timely transportation of Crude to the refining centers and storage facilities. Besides, many developing countries aim at developing or constructing the desirable oil pipelines as a way of avoiding high energy imports and at the same time promoting economy.

Crude Transportation Market Segment Analysis:

Crude Transportation Market is Segmented on the basis of type, services, oil type, and region.

By Type, Pipelines segment is expected to dominate the market during the forecast period

The pipelines segment is also expected to dominate the crude transportation market across the forecast period because pipelines are more precise, economical, and efficient in conveying crude oil over extended distances. Pipeline transportation is safe, comfortable and least intrusive for the transport of the crude oil especially when the distances between the centers of production and centers of processing are very large. Unfortunately, pipelines are today understood to be the most effective ways of transport of crude oil seeing that they provide the most value in terms of effecting the movement of large volumes of crude oil in a given short span of time and sometimes with little risk as compared with using trucks, rail or even tankers. Moreover, pipeline industrialization and geography for new pipeline project and extension to main network area including North America, Middle East and Russia also contributed to the growth of segment.

By Service, the Transportation and Storage segment is expected to hold the largest share

The Transportation and Storage segment is expected to dominate the crude transportation market share proportionate in the context of the forecast period. It consists of pipe lines for transporting crude through pipes and trucks, rail and tanker for transportation of Murban crude and storage terminals of the crude before processing or distributing. This research sought to address this shortcoming by estimating the present value and cost of constructing new pipelines and storage facilities that will be required when world crude oil production increases. Inventory systems are used in keeping and managing stock fluctuations while transportation systems provide channels that enable crude oil get to the refineries and or the final consumer.

Crude Transportation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America will continue to be the largest consumer of crude transportation during the forecast period due to rising capabilities in USA and Canada for the production of oil and good transportation system. United States has moved to 9th place among the world’s largest producers of oil primarily due to the current Shale oil kind which has in one way contributed to increased demand for carriage of crude products. Therefore, the transportation through pipeline, rail and trucks from the production areas to the processing facility or export terminals is gradually emerging. The US has also been investing on the pipeline system; this has also been illustrated by these top pipeline projects such as the Keystone XL pipeline and the expansion of the Dakota Access pipeline, where the main purpose of transporting crude oil in the United States.

North America is populated with so many market participants in the transportation of oil and gas products. The networks for crude transportation have been enhanced by supportive regulations that promote the development of infrastructure that will be used to transport crude and the aim at attaining energy self-sufficiency in the region

Active Key Players in the Crude Transportation Market

Andeavor Logistics (USA)

Buckeye Partners (USA)

Enbridge Inc. (Canada)

Enterprise Products Partners (USA)

ExxonMobil (USA)

Kinder Morgan, Inc. (USA)

Lukoil (Russia)

Magellan Midstream Partners (USA)

MPLX LP (USA)

National Oilwell Varco (USA)

NuStar Energy (USA)

Phillips 66 Partners (USA)

Plains All American Pipeline (USA)

Royal Dutch Shell (Netherlands)

TC Energy (Canada)

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aerospace Cold Forgings Market by Type

4.1 Aerospace Cold Forgings Market Snapshot and Growth Engine

4.2 Aerospace Cold Forgings Market Overview

4.3 Open Die Forging

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Open Die Forging: Geographic Segmentation Analysis

4.4 Closed Die Forging

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Closed Die Forging: Geographic Segmentation Analysis

4.5 Rolled Ring Forging

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Rolled Ring Forging: Geographic Segmentation Analysis

Chapter 5: Aerospace Cold Forgings Market by Application

5.1 Aerospace Cold Forgings Market Snapshot and Growth Engine

5.2 Aerospace Cold Forgings Market Overview

5.3 Aircraft Structural Components

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Aircraft Structural Components: Geographic Segmentation Analysis

5.4 Engine Components

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Engine Components: Geographic Segmentation Analysis

5.5 Fasteners and Hardware

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Fasteners and Hardware: Geographic Segmentation Analysis

5.6 Landing Gear Components

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Landing Gear Components: Geographic Segmentation Analysis

Chapter 6: Aerospace Cold Forgings Market by End User

6.1 Aerospace Cold Forgings Market Snapshot and Growth Engine

6.2 Aerospace Cold Forgings Market Overview

6.3 Commercial Aerospace

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Commercial Aerospace: Geographic Segmentation Analysis

6.4 Military Aerospace

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Military Aerospace: Geographic Segmentation Analysis

6.5 Spacecraft & Satellites

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Spacecraft & Satellites: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Aerospace Cold Forgings Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AERO METALS INC (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALLEGHENY TECHNOLOGIES INCORPORATED (ATI) (UNITED STATES)

7.4 ARCONIC INC (UNITED STATES)

7.5 BHARAT FORGE LIMITED (INDIA)

7.6 DONG-A FORGING CO. LTD. (SOUTH KOREA)

7.7 FIRTH RIXSON (ALCOA INC) (UNITED STATES)

7.8 FORGING INDUSTRIES INC. (UNITED STATES)

7.9 HOWMET AEROSPACE (UNITED STATES)

7.10 HYUNDAI STEEL COMPANY (SOUTH KOREA)

7.11 KOBE STEEL LTD. (JAPAN)

7.12 METALS USA (UNITED STATES)

7.13 PRECISION FORGING COMPANY (UNITED STATES)

7.14 SAMWOO AEROSPACE CO. LTD.(SOUTH KOREA)

7.15 SHAANXI YIJIA AEROSPACE FORGING CO. LTD. (CHINA)

7.16 STORK AEROSPACE (NETHERLANDS)

7.17 THYSSENKRUPP AG (GERMANY)

7.18 TIMKENSTEEL CORPORATION (UNITED STATES)

7.19 VSMPO-AVISMA CORPORATION (RUSSIA)

7.20 OTHER ACTIVE PLAYERS

Chapter 8: Global Aerospace Cold Forgings Market By Region

8.1 Overview

8.2. North America Aerospace Cold Forgings Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Open Die Forging

8.2.4.2 Closed Die Forging

8.2.4.3 Rolled Ring Forging

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Aircraft Structural Components

8.2.5.2 Engine Components

8.2.5.3 Fasteners and Hardware

8.2.5.4 Landing Gear Components

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Commercial Aerospace

8.2.6.2 Military Aerospace

8.2.6.3 Spacecraft & Satellites

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Aerospace Cold Forgings Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Open Die Forging

8.3.4.2 Closed Die Forging

8.3.4.3 Rolled Ring Forging

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Aircraft Structural Components

8.3.5.2 Engine Components

8.3.5.3 Fasteners and Hardware

8.3.5.4 Landing Gear Components

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Commercial Aerospace

8.3.6.2 Military Aerospace

8.3.6.3 Spacecraft & Satellites

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Aerospace Cold Forgings Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Open Die Forging

8.4.4.2 Closed Die Forging

8.4.4.3 Rolled Ring Forging

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Aircraft Structural Components

8.4.5.2 Engine Components

8.4.5.3 Fasteners and Hardware

8.4.5.4 Landing Gear Components

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Commercial Aerospace

8.4.6.2 Military Aerospace

8.4.6.3 Spacecraft & Satellites

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Aerospace Cold Forgings Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Open Die Forging

8.5.4.2 Closed Die Forging

8.5.4.3 Rolled Ring Forging

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Aircraft Structural Components

8.5.5.2 Engine Components

8.5.5.3 Fasteners and Hardware

8.5.5.4 Landing Gear Components

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Commercial Aerospace

8.5.6.2 Military Aerospace

8.5.6.3 Spacecraft & Satellites

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Aerospace Cold Forgings Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Open Die Forging

8.6.4.2 Closed Die Forging

8.6.4.3 Rolled Ring Forging

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Aircraft Structural Components

8.6.5.2 Engine Components

8.6.5.3 Fasteners and Hardware

8.6.5.4 Landing Gear Components

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Commercial Aerospace

8.6.6.2 Military Aerospace

8.6.6.3 Spacecraft & Satellites

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Aerospace Cold Forgings Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Open Die Forging

8.7.4.2 Closed Die Forging

8.7.4.3 Rolled Ring Forging

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Aircraft Structural Components

8.7.5.2 Engine Components

8.7.5.3 Fasteners and Hardware

8.7.5.4 Landing Gear Components

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Commercial Aerospace

8.7.6.2 Military Aerospace

8.7.6.3 Spacecraft & Satellites

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Crude Transportation Market research report?

A1: The forecast period in the Crude Transportation Market research report is 2024-2032.

Q2: Who are the key players in the Crude Transportation Market?

A2: Andeavor Logistics (USA), Buckeye Partners (USA), Enbridge Inc. (Canada), Enterprise Products Partners (USA), ExxonMobil (USA), Kinder Morgan, Inc. (USA), Lukoil (Russia), Magellan Midstream Partners (USA), MPLX LP (USA), National Oilwell Varco (USA), NuStar Energy (USA), Phillips 66 Partners (USA), Plains All American Pipeline (USA), Royal Dutch Shell (Netherlands), TC Energy (Canada), Other Active Players.

Q3: What are the segments of the Crude Transportation Market?

A3: The Crude Transportation Market is segmented into Type, Service, Oil Type, and region. By Type, the market is categorized into Pipelines, Tanker and Barges, Truck, Rail. By Service, the market is categorized into Transportation & Storage, Ancillary Services. By Oil Type, the market is categorized into Crude Oil, Refined Products. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Crude Transportation Market?

A4: Crude transportation market can be described as a sector that is connected with carrying of the crude oil from the producer or production area to a refinery site, storage area, and distribution hub.

Q5: How big is the Crude Transportation Market?

A5: Crude Transportation Market Size Was Valued at USD 21.59 Billion in 2023, and is Projected to Reach USD 36.79 Billion by 2032, Growing at a CAGR of 6.1 % From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!