Stay Ahead in Fast-Growing Economies.

Browse Reports NowCraft Spirit Market- Global Size, Share & Industry Trends

A few of the essential reasons driving market expansion are rising demand for craft spirits and an increase within the number of craft distilleries, and rising disposable earnings. The millennial populace with impressive acquiring control is anticipated to drive market development.

IMR Group

Description

Craft Spirit Market Synopsis

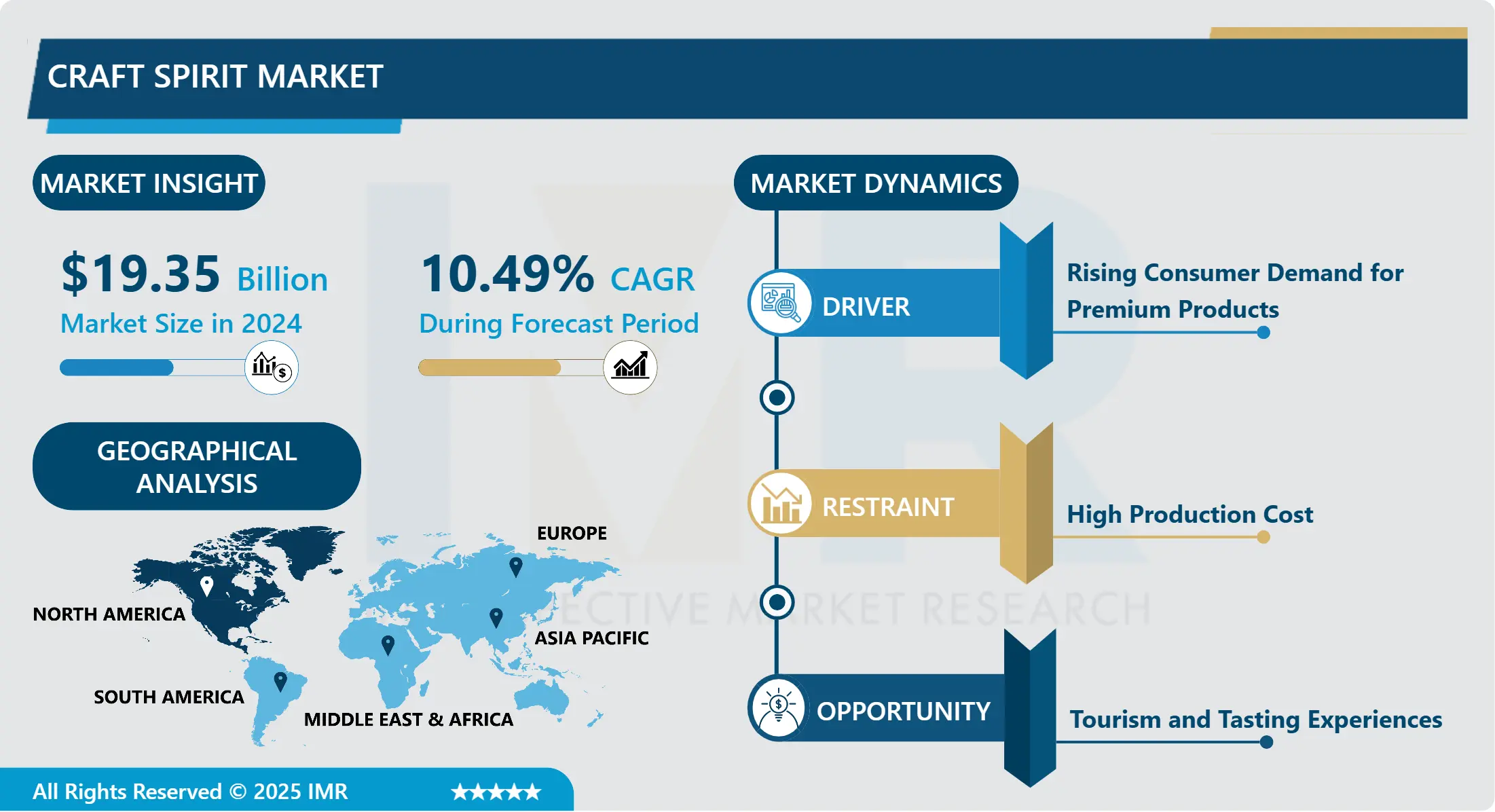

The global Craft Spirit Market was valued at USD 19.35 Billion in 2024 and is likely to reach USD 42.98 Billion by 2032, increasing at a CAGR of 10.49% from 2025 to 2032.

The field of craft spirits includes domestic alcohol production and is produced by distillation and fermentation. Craft spirits require a certain production volume, usually less than 750,000 gallons. A distiller’s license is required for the production of craft spirits, which indicates the volume of production and independent operation.

A few of the essential reasons driving market expansion are rising demand for craft spirits and an increase within the number of craft distilleries, and rising disposable earnings. The millennial populace with impressive acquiring control is anticipated to drive market development. Craft distilleries are creating immersive encounters for clients through visits, tastings, and cocktail classes, that offer assistance to build brand picture and encourage repeat business. Too, the online boom has made it less demanding than ever for consumers to find and buy artisanal spirits from all over the world. This not only permits little distilleries to expand their reach but too helps them pick up a loyal taking after on a worldwide scale. Authorized distillers with a set generation volume make create spirits.

They ought to have separate operations with less than 25% capital from an alcoholic beverage division player and operational control. The item must have a name certified by the Alcohol and Tobacco Tax and Trade Bureau in the United States (TTB). Due to the huge request within the United States, the segment is primarily centered in North America. Due to beneficial endorsement directions, ventures within the United States have extended at a promising rate in later a long time. In 2012, the Alcohol and Tobacco Tax and Trade Bureau (TTB) received 13,867 new applications, up 24.4 percent from 2009 and 82 percent from 2006.

Millennials, those born between the 1980s and the early 2000s, make up a impressive statistic of alcoholic refreshment customers, as they make up a expansive parcel of those who as often as possible visit eateries and bars. They show up to be the foremost effective buyers of a wide extend of nourishments and refreshments, counting create spirits. Additionally, numerous create refineries have closed their tasting rooms within the final few months to comply with neighbourhood and state open wellbeing direction and to secure their representatives. The make brew industry is continually evolving, fueled by development, experimentation, and a enthusiasm for making delightful and special brews. Concurring to an overview of about 300 American distilleries conducted by the Refined Spirits Board of the United States (Disk) and the American Refining Organized in eminent 2021. And, as one might accept, the number of clients for those who seem open securely was restricted. As a result, over 40% of create refineries detailed a critical diminish in on-site deals (i.e., 25% or more). More than a quarter of respondents claimed their tasting rooms were completely closed. Other than, move towards locally-sourced and economical items at the side rising customer interest in create and premium refreshments will boost the create alcohol market development.

Craft Spirit Market Trend Analysis

Craft Spirit Market Growth Driver- Rising Consumer Demand for Premium Products

The demand for premium items within the craft spirits market is altogether impacted by two essential components: quality and authenticity, and local and artisan appeal. Buyers nowadays are more perceiving and look for high-quality items that offer unique flavors and a sense of authenticity. Craft spirits, frequently delivered in little clusters with meticulous consideration to detail, meet this request by offering a superior taste involvement compared to mass-produced choices. These spirits frequently utilize high-quality, locally sourced ingredients, and conventional, time-honoured generation strategies that offer to consumers’ developing intrigued in genuineness. The story behind each bottle, counting the distiller’s energy and the one-of-a-kind production process, includes a layer of offer that resonates with shoppers trying to find more than just a drink—they look for an experience. Furthermore, there’s a burgeoning preference for locally created and artisanal beverages.

This drift is driven by a want to back nearby economies and a developing appreciation for craftsmanship. Customers regularly see neighbourhood create spirits as more authentic and representative of regional flavors and culture, which improves their by and large drinking experience. The artisanal angle of craft spirits, characterized by innovative and assorted item offerings, permits consumers to explore new tastes and appreciate limited-edition releases that are unavailable from bigger, commercial brands. This inclination for nearby and artisanal items not as it were boosting the craft spirits market but moreover fosters a sense of community and association between makers and buyers.

Craft Spirit Market Expansion Opportunity- Tourism and Tasting Experiences

Tourism and tasting encounters play a significant part within the craft spirits market by giving interesting openings for brand engagement and client procurement. Distillery visits and tastings offer consumers a firsthand see at the generation handle, permitting them to see the craftsmanship and devotion that goes into creating each spirit. These visits frequently include guided tastings where visitors can test different items, learn approximately flavor profiles, and get personalized suggestions. This immersive encounter not as it were educating consumers around the brand but too fosters a more profound passionate connection, enhancing brand loyalty. By changing the visit into an intuitively and important occasion, distilleries can produce extra income streams and empower repeat trade.

Support in spirits celebrations and occasions too altogether boosts visibility and pulls in new clients. These social occasions bring together a different gathering of people of enthusiasts, industry experts, and inquisitive newcomers, giving a perfect stage for make soul makers to showcase their items. At celebrations, refineries can offer tastings, conduct workshops, and lock in in coordinate deals, reaching a wide group of onlookers which will not be recognizable with their brand. Furthermore, the festival climate makes a buzz and energy around the items, empowering participants to share their encounters on social media, hence intensifying the brand’s reach. By leveraging these events, craft spirit brands can increment their presentation, attract modern clients, and set up themselves as key players within the industry.

Craft Spirit Market Segment Analysis:

Market Segmented based on Distiller Size, by Product Type, by Distribution Channel, and Region.

By Product Type, Whisky Is Expected to Dominate the Market During the Forecast Period 2024-2032

Whisky, particularly bourbon and single malt varieties, holds a prominent put within the craft spirits market due to a few compelling factors. Whisky’s deep-rooted heritage and solid association with craftsmanship incredibly offer to modern buyers who seek authentic, high-quality items with rich histories. This legacy is often showcased within the meticulous production forms that are passed down through eras, highlighting the devotion and aptitude included in making each bottle. The stories of historic refineries and the traditional methods they utilize resonate with buyers searching for items that offer more than just a drink—they give an association to history and culture. The flavor complexity of whisky may be a major draw for enthusiasts.

The maturing handle in barrels permits whisky to create a complex cluster of flavors, including notes of caramel, vanilla, oak, and flavors, which change based on the sort of wood utilized and the length of aging. This complex flavor profile attracts connoisseurs who appreciate nuanced and sophisticated tastes, encouraging them to investigate distinctive brands and expressions. The trend toward premiumization within the spirits market has altogether boosted the popularity of small-batch and single-barrel whiskies. Consumers are progressively willing to pay a premium for these variations, which regularly offer one-of-a-kind profiles and limited availability.

The restrictiveness and prevalent quality of these whiskies give a sense of luxury and refinement, making them exceedingly looked for after. Whisky has experienced a social revival, stamped by a rise in whisky bars, clubs, and festivals devoted to celebrating this soul. These scenes and occasions make communities of devotees and give stages for tasting and learning about distinctive whiskies, further improving their offer. The social resurgence of whisky, upheld by media scope and social media influencers, has expanded its perceivability and notoriety, drawing in a modern era of whisky consumers who are energetic to explore and savor the wealthy differing qualities of this storied spirit.

By Distribution Channel, On- Trade held the largest share

The on-trade channel, including bars, restaurants, and hotels, gives an experiential consumption environment that’s basic for the craft spirits market. Customers enjoy craft spirits in a social setting, making a more engaging and immersive involvement regularly upgraded by master recommendations from bartenders and mixologists. These settings serve as imperative stages for brand building and expanding mindfulness; experiencing a craft spirit in a stylish bar or upscale restaurant lends an discuss of exclusivity and distinction, upgrading the brand’s generally picture and allure.

On-trade scenes too offer opportunities for education and tasting occasions, such as whiskey flights and cocktail evenings, which permit consumers to test and learn about diverse craft spirits, fostering a deeper appreciation and dependability to the brand. Also, the social nature of bars and restaurants implies that positive encounters rapidly spread through word of mouth and social media. Patrons frequently share their encounters online, giving free exposure and producing buzz around create soul brands, advance enhancing their reach and reputation.

Craft Spirit Market Regional Insights:

North America Region is Expected to Dominate the Market Over the Forecast Period

North America, especially the United States, stands as a powerhouse within the make spirits market due to a meeting of factors. Firstly, the region’s verifiable legacy of small-scale refining, extending back to colonial times, lays a durable establishment for innovation and enterprise within the industry. This spearheading soul cultivates a culture of experimentation and quality craftsmanship, driving the progressing evolution of the craft spirit’s sector. North America, and the United States particularly, benefits from a sizable consumer base with a solid inclination toward premium and artisanal items. The region’s rich populace, coupled with a developing appreciation for experiential and high-quality consumption, gives fertile ground for the make spirits market to thrive. This request energizes both built up and rising refineries to thrust boundaries and raise the measures of make spirits production.

Supportive regulatory situations further bolster North America’s dominance within the make spirits field. Administrative changes, such as the streamlining of make distiller permitting and decreases in charges and expenses for little makers, have effectively dismantled barriers to entry. Thus, the number of create distilleries across the landmass has surged, contributing altogether to the region’s leadership position within the worldwide market. A social move toward supporting nearby businesses and grasping artisanal products has encourage moved the make spirits industry in North America. Shoppers progressively prioritize genuineness, craftsmanship, and special flavor profiles, all of which are trademark qualities of spirits created by littler, independent distilleries. This social ethos cultivates a profound association between makers and customers, driving brand devotion and market development.

Make refineries in North America illustrate adeptness in leveraging imaginative showcasing methodologies and dispersion channels to open up brand perceivability and engagement. From computerized showcasing campaigns and social media engagement to experiential occasions and collaborations, distillers seize openings to put through with customers on numerous levels. The rise of e-commerce stages has encouraged broader showcase get to, empowering make spirits producers to reach customers past their neighbourhood markets. The differences of item offerings from North American craft distilleries adds another dimension to the region’s dominance within the create spirit’s market. With a wide run of spirits, including whiskey, vodka, gin, rum, and strength alcohols, make distillers cater to diverse consumer inclinations and tastes. This breadth of offerings guarantees that there’s something for each sense of taste, assist fuelling the development and development of the make spirits market in the region.

Craft Spirit Market Top Key Players:

Bacardi Limited (Bermuda)

Beam Suntory, Inc. (USA)

Brown-Forman Corporation (USA)

Constellation Brands, Inc. (USA)

Diageo plc (UK)

Edrington Group (Scotland)

Pernod Ricard (France)

Sazerac Company, Inc. (USA)

William Grant & Sons Ltd. (Scotland)

Heaven Hill Brands (USA)

Campari Group (Italy)

Remy Cointreau (France)

Moët Hennessy (France)

Gonzalez Byass (Spain)

Lucas Bols (Netherlands)

Michter’s Distillery (USA)

Catoctin Creek Distilling Company (USA)

Balcones Distilling (USA)

Westward Whiskey (USA)

Kavalan Distillery (Taiwan)

St. George Spirits (USA)

Four Roses Distillery (USA)

The Boston Beer Company (USA)

Tuthilltown Spirits Distillery (USA)

GlenDronach Distillery (Scotland)

Kings County Distillery (USA)

Other Active Players.

Key Industry Developments in the Craft Spirit Market:

In May 2024, made in India spirits are slowly but surely making their mark in the world of fine alcohol. Following the success of Godawan Whisky, India is now basking in the glory of its Cherrapunji Gin, which has just snagged the top honor at the Global Spirits Masters Competition.

In April 2024, Australian drinks firm Mighty Craft has agreed to offload 78 Degrees spirits and Mismatch Brewing for AU$7.2 million (US$4.7m), nearly three years after acquiring the brands in an AU$47m (US$36.3m) deal.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Craft Spirit Market by Distiller Size (2018-2032)

4.1 Craft Spirit Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Large

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium

4.5 Small

Chapter 5: Craft Spirit Market by Product Type (2018-2032)

5.1 Craft Spirit Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Whisky

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Vodka

5.5 Gin

5.6 Rum

5.7 Brandy

5.8 Liqueur

Chapter 6: Craft Spirit Market by Distribution Channel (2018-2032)

6.1 Craft Spirit Market Snapshot and Growth Engine

6.2 Market Overview

6.3 On- Trade Channel

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Off-Trade Channel

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Craft Spirit Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BACARDI LIMITED (BERMUDA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BEAM SUNTORY INC. (USA)

7.4 BROWN-FORMAN CORPORATION (USA)

7.5 CONSTELLATION BRANDS INC. (USA)

7.6 DIAGEO PLC (UK)

7.7 EDRINGTON GROUP (SCOTLAND)

7.8 PERNOD RICARD (FRANCE)

7.9 SAZERAC COMPANY INC. (USA)

7.10 WILLIAM GRANT & SONS LTD. (SCOTLAND)

7.11 HEAVEN HILL BRANDS (USA)

7.12 CAMPARI GROUP (ITALY)

7.13 REMY COINTREAU (FRANCE)

7.14 MOËT HENNESSY (FRANCE)

7.15 GONZALEZ BYASS (SPAIN)

7.16 LUCAS BOLS (NETHERLANDS)

7.17 MICHTER’S DISTILLERY (USA)

7.18 CATOCTIN CREEK DISTILLING COMPANY (USA)

7.19 BALCONES DISTILLING (USA)

7.20 WESTWARD WHISKEY (USA)

7.21 KAVALAN DISTILLERY (TAIWAN)

7.22 ST. GEORGE SPIRITS (USA)

7.23 FOUR ROSES DISTILLERY (USA)

7.24 THE BOSTON BEER COMPANY (USA)

7.25 TUTHILLTOWN SPIRITS DISTILLERY (USA)

7.26 GLENDRONACH DISTILLERY (SCOTLAND)

7.27 KINGS COUNTY DISTILLERY (USA)

Chapter 8: Global Craft Spirit Market By Region

8.1 Overview

8.2. North America Craft Spirit Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Distiller Size

8.2.4.1 Large

8.2.4.2 Medium

8.2.4.3 Small

8.2.5 Historic and Forecasted Market Size by Product Type

8.2.5.1 Whisky

8.2.5.2 Vodka

8.2.5.3 Gin

8.2.5.4 Rum

8.2.5.5 Brandy

8.2.5.6 Liqueur

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 On- Trade Channel

8.2.6.2 Off-Trade Channel

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Craft Spirit Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Distiller Size

8.3.4.1 Large

8.3.4.2 Medium

8.3.4.3 Small

8.3.5 Historic and Forecasted Market Size by Product Type

8.3.5.1 Whisky

8.3.5.2 Vodka

8.3.5.3 Gin

8.3.5.4 Rum

8.3.5.5 Brandy

8.3.5.6 Liqueur

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 On- Trade Channel

8.3.6.2 Off-Trade Channel

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Craft Spirit Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Distiller Size

8.4.4.1 Large

8.4.4.2 Medium

8.4.4.3 Small

8.4.5 Historic and Forecasted Market Size by Product Type

8.4.5.1 Whisky

8.4.5.2 Vodka

8.4.5.3 Gin

8.4.5.4 Rum

8.4.5.5 Brandy

8.4.5.6 Liqueur

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 On- Trade Channel

8.4.6.2 Off-Trade Channel

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Craft Spirit Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Distiller Size

8.5.4.1 Large

8.5.4.2 Medium

8.5.4.3 Small

8.5.5 Historic and Forecasted Market Size by Product Type

8.5.5.1 Whisky

8.5.5.2 Vodka

8.5.5.3 Gin

8.5.5.4 Rum

8.5.5.5 Brandy

8.5.5.6 Liqueur

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 On- Trade Channel

8.5.6.2 Off-Trade Channel

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Craft Spirit Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Distiller Size

8.6.4.1 Large

8.6.4.2 Medium

8.6.4.3 Small

8.6.5 Historic and Forecasted Market Size by Product Type

8.6.5.1 Whisky

8.6.5.2 Vodka

8.6.5.3 Gin

8.6.5.4 Rum

8.6.5.5 Brandy

8.6.5.6 Liqueur

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 On- Trade Channel

8.6.6.2 Off-Trade Channel

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Craft Spirit Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Distiller Size

8.7.4.1 Large

8.7.4.2 Medium

8.7.4.3 Small

8.7.5 Historic and Forecasted Market Size by Product Type

8.7.5.1 Whisky

8.7.5.2 Vodka

8.7.5.3 Gin

8.7.5.4 Rum

8.7.5.5 Brandy

8.7.5.6 Liqueur

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 On- Trade Channel

8.7.6.2 Off-Trade Channel

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Craft Spirit Market research report?

A1: The forecast period in the Craft Spirit Market research report is 2025-2032.

Q2: Who are the key players in the Craft Spirit Market?

A2: Bacardi Limited (Bermuda),Beam Suntory, Inc. (USA),Brown-Forman Corporation (USA),Constellation Brands, Inc. (USA),Diageo plc (UK),Edrington Group (Scotland),Pernod Ricard (France),Sazerac Company, Inc. (USA),William Grant & Sons Ltd. (Scotland),Heaven Hill Brands (USA),Campari Group (Italy),Remy Cointreau (France),Moët Hennessy (France),Gonzalez Byass (Spain),Lucas Bols (Netherlands),Michter’s Distillery (USA),Catoctin Creek Distilling Company (USA),Balcones Distilling (USA),Westward Whiskey (USA),Kavalan Distillery (Taiwan),St. George Spirits (USA),Four Roses Distillery (USA),The Boston Beer Company (USA),Tuthilltown Spirits Distillery (USA),GlenDronach Distillery (Scotland),Kings County Distillery (USA) and Other Active Players.

Q3: What are the segments of the Craft Spirit Market?

A3: The Craft Spirit Market is segmented into Distiller Size, by Product Type, by Distribution Channel and region. By Distiller Size (Large, Medium, Small), By Product Type (Whisky, Vodka, Gin, Rum, Brandy, Liqueur), By Distribution Channel (On-Trade Channel, Off- Trade Channel). By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; South Korea; Malaysia; Thailand; Vietnam; The Philippines; Australia; New Zealand; Rest of APAC), Middle East & Africa (Türkiye; Bahrain; Kuwait; Saudi Arabia; Qatar; UAE; Israel; South Africa), South America (Brazil; Argentina; Rest of SA.).

Q4: What is the Craft Spirit Market?

A4: The field of craft spirits includes domestic alcohol production and is produced by distillation and fermentation. Craft spirits require a certain production volume, usually less than 750,000 gallons. A distiller's license is required for the production of craft spirits, which indicates the volume of production and independent operation.

Q5: How big is the Craft Spirit Market?

A5: The global Craft Spirit Market was valued at USD 19.35 Billion in 2024 and is likely to reach USD 42.98 Billion by 2032, increasing at a CAGR of 10.49% from 2025 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!