Stay Ahead in Fast-Growing Economies.

Browse Reports NowCopper Market Size, Share, Growth & Forecast (2024-2032)

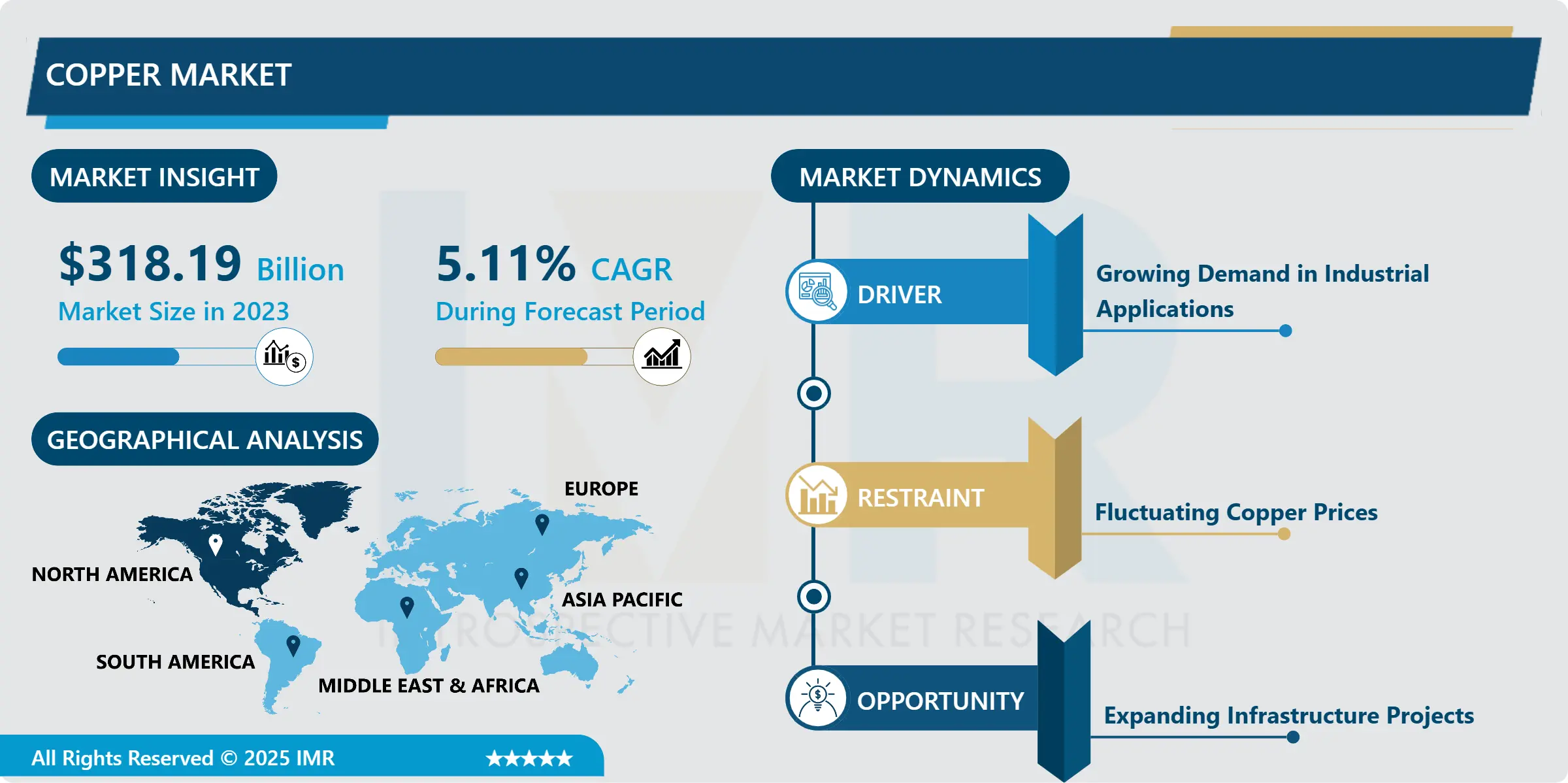

Copper Market Size Was Valued at USD 318.19 Billion in 2023, and is Projected to Reach USD 498.29 Billion by 2032, Growing at a CAGR of 5.11% From 2024-2032.

IMR Group

Description

Copper Market Synopsis:

Copper Market Size Was Valued at USD 318.19 Billion in 2023, and is Projected to Reach USD 498.29 Billion by 2032, Growing at a CAGR of 5.11% From 2024-2032.

Copper market as the business sector that deals with the production, processing, distribution and consumption of copper metal that in one of the most important in electrical wire manufacturing, construction and engineering, electronics, automobiles, and several other industries. Copper is a very important industrial raw material and is obtained mainly from the extraction of ores and; from the recycling of scrap as this form of metal supply is influenced by determinants such as: supply-demand balances, world economic situation, new technologies and policy changes. In the market, products include copper produced directly from ores, known as primary copper and copper produced from recycling scrap copper, called secondary copper and the major participants are mining companies, manufacturers and consumers from several industries.

Copper market is a fluctuating but an important sector in the world market which has high demand in construction, electrical, electronics, automotive, and renewable power industries. Copper is a metal that has multiple uses due to its conductivity and resistance to corrosion hence used in wiring, plumbing industry, in industries used in industrial machineries and as electrical conductors. Therefore, this raw material is closely related to the infrastructure growth, especially in the developing countries; those countries invest a lot of funds in construction, industrialization, and development of innovative technologies. Additionally, the global shift toward EVs, renewable power, and smart grids will drive demand for copper even higher since they use large amounts for electric parts, batteries, and grids.

Over the last few years, the global market of copper has been characterized by fluctuations of supply, demand, geopolitical conflicts, and environmental impacts associated with mining industry. Other ways, which have been revealed include: Mining difficulties, regulations among others, and sustainability concerns. Chile, Peru and China are major sources for copper ores but political turmoil in these countries and environmental restrictions affecting the mining industry can still affect the supply of copper ores. Further, advancement in the technique of copper extraction and recycling is becoming significant in terms of overcoming supply side hurdles and bringing about changes in market. Over the years and as the market evolves, the price of copper will continue to act as a measure of industrial demand as well as the state of the worlds economy. The market fundamentals for copper remain favourable with the projected continued robust growth on the back of growth of applications across key segments such as energy transition technologies and electrification of the transportation sector.

Copper Market Trend Analysis:

Rising Copper Demand Driven by Renewable Energy and Electric Vehicles

One recurring trend implicated in the demand for copper is in the energy sector – a move that can be mainly attributed to more adoption of green energy technologies worldwide. Copper is very essential in the solar PV panels, wind turbines, and EV batteries because of it’s high conductivity. For example, solar power system use copper to transfer power while wind turbine used copper to their generators and their electrical part. Over the years, ports have increased their copper consumption due to the desire of nations and industries for decarbonization to counter climate change, with copper playing a critical role in renewable energy applications. This trend is bound to persist given the incremental amounts that governments across the globe are sinking into green energy projects that will in turn augur well for copper use in these industries.

The demand for copper also has significant drivers, where EVs are important in shaping the future mobility system through their electrification. Due to a high volume of wiring and electric motors, which constitute the EV batteries, demand is expected to spike due to a growing EV market in the automotive industry. The increased adoption of Electric Vehicles, coupled with the increased promotion of electrification across the transport industry, will continue to drive up copper demand. For these reasons, copper has risen to prominence as the crucial component that will help the automotive sector overcome the emissions challenge in the effort to advance EV technology.

Growth Driven by Renewable Energy and Electric Vehicles

With the shift in the world economy towards the use of renewable resources as the primary source of energy, remains influential in the copper business. The governments and organisations are motivated towards investing in the clean energy hence the conspicuous need for copper especially in the renewable infrastructure. Given it is one of the best conductors, it is used in products like windmills, solar panels and EV charging stations among others. This continuously growing need for clean energy solutions provide the guarantee for continuously increase in consumption of copper. Copper plays an important role in the electrical systems, and the increasing demand for renewable energy sources power network also set the copper market on the long-term growth path.

Another ideal opportunity for the copper market is the growth of the electric vehicle market. The electrification of automobiles and the increasing global focus on producing electric vehicles has increased the demand of copper wires, motors and batteries where copper is used in large quantities. Since more governments continue to enforce higher environmental standards while consumers move towards EVs, the use of copper in automotive will continue to grow. The continued growth of electric vehicle adoption along with increased electrification of power infrastructure is expected to greatly increase demand for copper, improving market conditions in the future years.

Copper Market Segment Analysis:

Copper Market is Segmented on the basis of By Type, Form, Application, and Region.

By Type, Primary Copper segment is expected to dominate the market during the forecast period

Secondary copper also referred to as recovery copper is obtained from scrap copper products which have been used in other uses. Recycling is a process in which Copper scrap like wire, electrical parts and some industrial residuals are collected in a system and processed for cleaning and smoothing for re-use. This variety of copper is not greatly different from primary copper in performance and properties but is made often at a considerably lower energy level. Due to increased scrutiny of industries and governments with regards to their use of resources, there is a demand for secondary copper; which is gotten through recycling rather than mining as well as processing raw copper ores.

The increasing concern for environmental concerns and circular economy has seen the attractiveness of secondary copper in industries closed. Copper recycling uses significantly less energy than producing and processing of primary copper hence emit fewer greenhouse gases and uses more of natural resources. Additionally, as recycling and conservation initiatives go on the rise internationally, secondary copper finds itself serving extended functions of waste minimization, and material recycling. It has made recycled copper as one of the significant participants within the copper market for applications such as electrical wires, construction and industrial instruments where the performance requirements fit that of the primary copper at less impact on the socio-economic and natural environment.

By Application, Electrical & Electronics segment expected to held the largest share

Electrical and electronics industries benefit from copper’s high electrical conductivity; its biggest application is in wires, cables and circuit boards. It also keeps a constant distribution of electricity which is very important since many devices rely on power. The call for more and more consumer electronics products that include smartphones, laptops, wearable devices, and portable electronics, has also boosted use of copper through the roof. Thus, as these devices are developed further and become increasingly incorporated into the arteries of modern life so the demand for copper in their construction via the tabular osmurn process will rise. Further, it is impossible to manufacture necessary components of the electronics, e.g. chips and connectors, without copper.

Besides consumer electronics, copper is being used increasingly in the construction of electric vehicles and renewable energy generation networks. Copper has a large role to play in manufacturing motors for EVs, Batteries, and wiring hence it plays a central role in the transition to clean mobility. The outlook of solar and wind energy, both of which use copper for wiring and generator as well as storage infrastructures escalate copper consumption even further. In the same context, the growing usage of energy storage, a technology into which copper plays a critical role, also increases the need for copper. The current boom in the electric vehicle and renewable energy industries is also likely to drive the growth of the copper market in the next years and further solidify its critical role in electrical and electronic applications.

Copper Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

The copper market of North America is pegged on the United States, and Canada markets where the demand for copper is steady in the construction, electrical, and industrial segments. The U.S. is especially attentive to green energy projects, such as solar energy and wind energy since these kinds of energy sources need much copper for wiring and electrical components. This move to harness renewable energy sources has put a lot of growth into the copper market. Moreover, the increasing production of electric vehicles where copper is used in motors and battery infrastructure as well as the requirement of infrastructure growth has added a motion to copper demand. These factors are believed to be perpetuating the market as the region strived to attain higher status of sustainability coupled to advancement in technologies.

Canada therefore is an important member in such a chain as it is among the major copper producers in the region to cater for both local and international market demands. The country’s large copper deposits make it a key exporter further confirming its role in feeding other countries. But the region is also working on the way to recycle copper as opposed to mined copper and fresh copper ore. It is notable that this evolution towards more efficient recycling could change market demand and may one day decrease the demand for new mining operations. The increase in the use of recycled copper may contribute to supply issues but also open up a new field that makes the market structure demanding to analyze the consuming and producing segments of primary and secondary copper sources.

Active Key Players in the Copper Market

Anglo American PLC

Antofagasta PLC

BHP Group

Codelco (Corporación Nacional del Cobre de Chile)

First Quantum Minerals Ltd.

Freeport-McMoRan

Glencore International AG

Rio Tinto Group

Teck Resources Limited

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Copper Market by Type

4.1 Copper Market Snapshot and Growth Engine

4.2 Copper Market Overview

4.3 Primary Copper and Secondary Copper

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Primary Copper and Secondary Copper: Geographic Segmentation Analysis

Chapter 5: Copper Market by Form

5.1 Copper Market Snapshot and Growth Engine

5.2 Copper Market Overview

5.3 Copper Wire

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Copper Wire: Geographic Segmentation Analysis

5.4 Copper Rods

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Copper Rods: Geographic Segmentation Analysis

5.5 Copper Sheets & Plates

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Copper Sheets & Plates: Geographic Segmentation Analysis

5.6 Copper Tubes & Pipes and Copper Powder

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Copper Tubes & Pipes and Copper Powder: Geographic Segmentation Analysis

Chapter 6: Copper Market by Application

6.1 Copper Market Snapshot and Growth Engine

6.2 Copper Market Overview

6.3 Electrical & Electronics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electrical & Electronics: Geographic Segmentation Analysis

6.4 Construction

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Construction: Geographic Segmentation Analysis

6.5 Transportation

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Transportation: Geographic Segmentation Analysis

6.6 Industrial Machinery & Equipment and Consumer Goods

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Industrial Machinery & Equipment and Consumer Goods: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Copper Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CODELCO (CORPORACIÓN NACIONAL DEL COBRE DE CHILE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BHP GROUP

7.4 RIO TINTO GROUP

7.5 FREEPORT-MCMORAN

7.6 GLENCORE INTERNATIONAL AG

7.7 ANGLO AMERICAN PLC

7.8 TECK RESOURCES LIMITED

7.9 ANTOFAGASTA PLC

7.10 FIRST QUANTUM MINERALS LTD

7.11 OTHER ACTIVE PLAYERS

Chapter 8: Global Copper Market By Region

8.1 Overview

8.2. North America Copper Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Primary Copper and Secondary Copper

8.2.5 Historic and Forecasted Market Size By Form

8.2.5.1 Copper Wire

8.2.5.2 Copper Rods

8.2.5.3 Copper Sheets & Plates

8.2.5.4 Copper Tubes & Pipes and Copper Powder

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Electrical & Electronics

8.2.6.2 Construction

8.2.6.3 Transportation

8.2.6.4 Industrial Machinery & Equipment and Consumer Goods

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Copper Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Primary Copper and Secondary Copper

8.3.5 Historic and Forecasted Market Size By Form

8.3.5.1 Copper Wire

8.3.5.2 Copper Rods

8.3.5.3 Copper Sheets & Plates

8.3.5.4 Copper Tubes & Pipes and Copper Powder

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Electrical & Electronics

8.3.6.2 Construction

8.3.6.3 Transportation

8.3.6.4 Industrial Machinery & Equipment and Consumer Goods

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Copper Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Primary Copper and Secondary Copper

8.4.5 Historic and Forecasted Market Size By Form

8.4.5.1 Copper Wire

8.4.5.2 Copper Rods

8.4.5.3 Copper Sheets & Plates

8.4.5.4 Copper Tubes & Pipes and Copper Powder

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Electrical & Electronics

8.4.6.2 Construction

8.4.6.3 Transportation

8.4.6.4 Industrial Machinery & Equipment and Consumer Goods

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Copper Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Primary Copper and Secondary Copper

8.5.5 Historic and Forecasted Market Size By Form

8.5.5.1 Copper Wire

8.5.5.2 Copper Rods

8.5.5.3 Copper Sheets & Plates

8.5.5.4 Copper Tubes & Pipes and Copper Powder

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Electrical & Electronics

8.5.6.2 Construction

8.5.6.3 Transportation

8.5.6.4 Industrial Machinery & Equipment and Consumer Goods

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Copper Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Primary Copper and Secondary Copper

8.6.5 Historic and Forecasted Market Size By Form

8.6.5.1 Copper Wire

8.6.5.2 Copper Rods

8.6.5.3 Copper Sheets & Plates

8.6.5.4 Copper Tubes & Pipes and Copper Powder

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Electrical & Electronics

8.6.6.2 Construction

8.6.6.3 Transportation

8.6.6.4 Industrial Machinery & Equipment and Consumer Goods

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Copper Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Primary Copper and Secondary Copper

8.7.5 Historic and Forecasted Market Size By Form

8.7.5.1 Copper Wire

8.7.5.2 Copper Rods

8.7.5.3 Copper Sheets & Plates

8.7.5.4 Copper Tubes & Pipes and Copper Powder

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Electrical & Electronics

8.7.6.2 Construction

8.7.6.3 Transportation

8.7.6.4 Industrial Machinery & Equipment and Consumer Goods

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Copper Market research report?

A1: The forecast period in the Copper Market research report is 2024-2032.

Q2: Who are the key players in the Copper Market?

A2: Codelco (Corporación Nacional del Cobre de Chile), BHP Group, Rio Tinto Group, Freeport-McMoRan, Glencore International AG, Anglo American PLC, Teck Resources Limited, Antofagasta PLC, First Quantum Minerals Ltd. and Other Active Players.

Q3: What are the segments of the Copper Market?

A3: The Copper Market is segmented into By Type, By Form, By Application and region. By Type, the market is categorized into Primary Copper and Secondary Copper. By Form, the market is categorized into Copper Wire, Copper Rods, Copper Sheets & Plates, Copper Tubes & Pipes and Copper Powder. By Application, the market is categorized into Electrical & Electronics, Construction, Transportation, Industrial Machinery & Equipment and Consumer Goods. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Copper Market?

A4: The copper market refers to the global industry involved in the production, processing, distribution, and consumption of copper, a versatile metal widely used in electrical wiring, construction, electronics, and transportation. As a crucial industrial commodity, copper is sourced primarily through mining and recycling, with its price driven by factors such as supply-demand dynamics, global economic conditions, technological advancements, and geopolitical events. The market encompasses both primary copper (mined from ores) and secondary copper (recycled from scrap), with key players including mining companies, manufacturers, and end-users across various sectors.

Q5: How big is the Copper Market?

A5: Copper Market Size Was Valued at USD 318.19 Billion in 2023, and is Projected to Reach USD 498.29 Billion by 2032, Growing at a CAGR of 5.11% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!