Stay Ahead in Fast-Growing Economies.

Browse Reports NowCoolant Distribution Units (CDU) Market Size & Outlook 2025-2032

CDUs are an integral part of liquid cooling systems designed to increase overall system efficiency and reduce the total cost of ownership for high-density applications in the data center. The CDU circulates and pumps coolant in a closed-loop system within the rack and server chassis and utilizes facility water (in full liquid cooling systems) and the air outside the rack to cool the servers.

IMR Group

Description

Coolant Distribution Units (CDU) Market Synopsis:

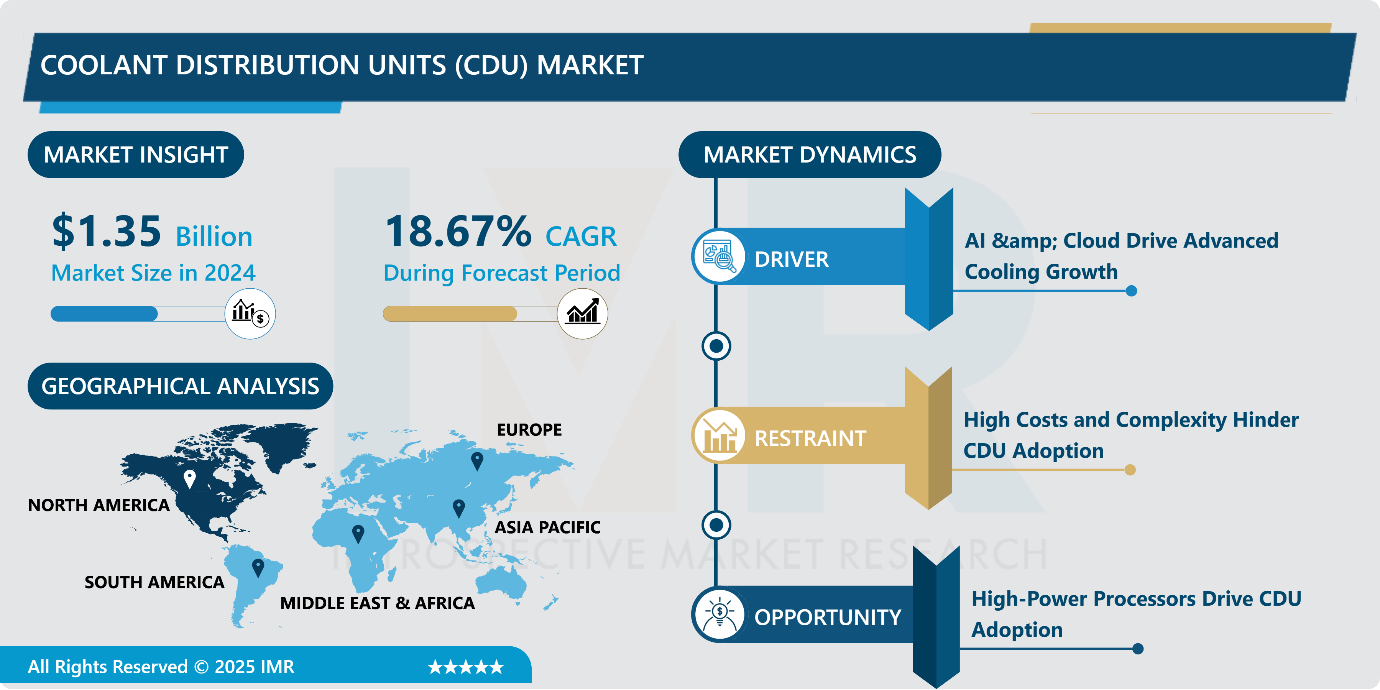

The global Coolant Distribution Units (CDU) Market Size Was Valued at USD 1.35 billion in 2024 and is projected to reach USD 5.31 billion by 2032, growing at a CAGR of 18.67% from 2025 to 2032.

CDUs are an integral part of liquid cooling systems designed to increase overall system efficiency and reduce the total cost of ownership for high-density applications in the data center. The CDU circulates and pumps coolant in a closed-loop system within the rack and server chassis and utilizes facility water (in full liquid cooling systems) and the air outside the rack to cool the servers.

Coolant distribution units create an isolated secondary loop separate from the chilled water supply, enabling strict containment management and precise control of the liquid cooling system’s temperature, pressure, and flow rate. The CDU maintains the secondary loop supply temperature above the dew point of the data center, preventing condensation and ensuring 100% sensible cooling.

The global Coolant Distribution Unit (CDU) market is expanding rapidly as data centers worldwide shift toward cooling solutions to support high-performance computing, AI-driven workloads, and cloud services. As environmental regulations tighten and energy efficiency becomes a top priority, the global demand for CDUs is set to grow, positioning them as a critical technology for the future of liquid cooling infrastructure.

Coolant Distribution Units (CDU) Market Growth and Trend Analysis:

AI & Cloud Drive Advanced Cooling Growth

The rapid expansion of the global data center market, driven by cloud adoption, artificial intelligence (AI), and data sovereignty regulations, is fueling significant growth in cooling technologies, particularly Cooling Distribution Units (CDUs). Data center installed capacity demonstrates a projected 15.9% CAGR until 2027 when it reaches 60.6 GW which increases the need for efficient cooling solutions to support rising power densities.

AWS Microsoft and Google as hyperscalers currently propel hyper-scale data center expansion at a 28.6% CAGR rate thus driving CDU solution advancement needs. Data traffic speed will experience a 24% Compound Annual Growth Rate through 2027 due to IoT, AI, cloud computing, and digital content consumption thereby increasing the importance of reliable cooling infrastructure.

Innovations regarding CDUs receive additional investment from the growing cloud expenditure which growing at a 19% Compound Annual Growth Rate until 2028. The demand for AI combined with high-performance computing (HPC) workloads will expand at a rate of 54.7% CAGR until 2027 while these operations consume 13.5 GW of power. CDU technology continues evolving through liquid cooling developments and energy-saving design innovations to match growing AI workload temperature requirements.

The global data center supply has experienced significant growth from 2019 to 2024, driven primarily by hyperscaler expansion and the increasing demand for AI-driven workloads. In 2019, the installed capacity stood at 21.2 GW, but by 2024, it surged to 38.9 GW, reflecting the rapid digital transformation and the growing need for high-performance computing infrastructure. Looking ahead, the trend is expected to continue, with forecasted capacity reaching 60.6 GW by 2027.

High Costs and Complexity Hinder CDU Adoption

The Coolant Distribution Units (CDU) market encounters substantial limitations due to the high expenses associated with initial investments. The purchase and installation of advanced CDUs seems difficult for primary and medium businesses given their restricted investment capabilities. The installation of complex systems inevitably leads companies to seek skilled personnel during the setup and maintenance stages, which increases total costs. Organizations remain reluctant to allocate substantial capital for this technology due to unpredictable economic conditions and fluctuating market dynamics. The market expansion slows due to potential clients preferring basic cooling solutions or extending their current system operations instead of purchasing advanced CDUs.

High-Power Processors Drive CDU Adoption

The shift towards high-power processors operating at 300–1,000W is driving the demand for more efficient cooling solutions, positioning Coolant Distribution Units (CDUs) as a mainstream thermal management technology soon. With data centers accounting for a substantial share of global energy consumption, operators are seeking energy-efficient alternatives, and CDUs offer a major advantage by reducing electricity usage by 20–30% compared to air-cooling systems.

Challenges in Regulatory Standards and Technical Requirements

At present, the global CDU market faces difficulties because of the different regulatory standards and technical requirements set by individual nations. Manufacturers face difficulties when they try to match their products with multiple regional standards because it delays their market entry while driving up operational expenses. The absence of common industry standards pertaining to data center cooling systems leads to integration difficulties with present setups because of compatibility problems. Regulatory and technical challenges function together to delay widespread industry adoption and theoretical advancements in this sector.

Coolant Distribution Units (CDU) Market Segment Analysis:

Global Coolant Distribution Units (CDU) Market is segmented based on type, cooling technology, application, end-users, and region

By Type, Static CDU segment is expected to dominate the market during the forecast period

Static CDUs are typically fixed installations designed to handle the cooling needs of equipment in a specified location. The global CDU (Coolant Distribution Unit) market is witnessing significant growth, driven by the increasing demand for high-performance computing and the rise of AI-driven workloads. The market shows strong domination of static liquid cooling solutions which provide precise control of coolant flow pressure and temperature to optimize cooling for next-generation GPUs and data center infrastructure.

The incorporation of both the Technology Cooling System (TCS) and Facility Water System (FWS) into a two-loop system increases the efficiency along with the lifespan of cooling solutions through improved water quality and reduced Water Usage Effectiveness (WUE). The quick temporal variability in AI workloads ranges between 4MW to 130MW within milliseconds. The heating regulation capabilities combined with enhanced power handling capabilities of CDUs solidify their position as market leaders in the global liquid cooling industry.

By Cooling Technology, the Liquid segment held the largest share of in projected period

Liquid cooling is increasingly dominating the global Coolant Distribution Units (CDU) market due to its superior efficiency, sustainability, and scalability. The need for increased power capabilities in IT infrastructure exceeds traditional air-cooling methods as rack densities and processing requirements continue to rise. The heat output from CPUs and GPUs now produces levels exceeding air-cooling capacity of 15-25 kW per rack but liquid cooling enables greater than 100 kW per rack performance.

The evolution of data center demands has made liquid cooling emerge as the top choice for facilities performing high-performance computing and AI operations. The presence of contaminants and harsh environmental factors in industrial and edge deployments makes liquid cooling superior by physically separating servers from foreign material and airborne debris. The performance of Coolant Distribution Units (CDUs) becomes essential during changes in operation as these devices control coolant flow, pressure, and temperature to achieve efficient heat extraction. The global CDU market will experience rapid growth because data centers throughout the world increase their investment in liquid cooling for efficiency and sustainability.

Coolant Distribution Units (CDU) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is characterized by a robust technology base and high demand for energy-efficient cooling solutions, which drives the adoption of advanced CDUs in various sectors such as data centers and manufacturing. North America’s dominance in the global cooling distribution unit (CDU) market is closely tied to the rapid growth of its data center industry, driven by AI workloads, hyperscale expansion, and increased cloud adoption.

With AI-related workloads projected to grow at a 38.4% CAGR from 2024 to 2027, the demand for high-density computing is pushing data centers to adopt advanced cooling solutions. Hyperscale data centers, expected to account for 55% of total data center demand by 2027, require scalable and energy-efficient cooling systems to manage rising heat loads.

The rapid growth of hyperscale data center capacity in North America, projected to increase from 16.1 GW in 2019 to 28.3 GW by 2027 at a CAGR of 28.6%, is a key factor driving the region’s dominance in the global Coolant Distribution Units (CDU) market. Hyperscale data center growth to support cloud computing and AI workloads and big-scale enterprise applications produces a parallel increase in durable cooling solution demand especially for CDUs.

Coolant Distribution Units (CDU) Market Active Players:

Asetek (Denmark)

Blueocean (China)

BOYD (USA)

Coolcentric (USA)

CoolIT Systems (Canada)

DCX (Poland)

Delta Electronics (Taiwan)

Emerson (USA)

Envicool (China)

GIGABYTE (Taiwan)

Goaland (China)

Motivair (USA)

Nidec (Japan)

Nortek Air Solutions (USA)

nVent Schroff (USA)

Rittal (Germany)

Schneider Electric (France)

Unisplendour Corporation Limited (China)

Vertiv (USA)

Other Active Players

Key Industry Developments in the Global Coolant Distribution Units (CDU) Market:

In November 2024, a global provider of critical digital infrastructure and continuity solutions, announced a significant expansion of its liquid cooling product portfolio with the introduction of two new Vertiv CoolChip CDU (coolant distribution unit) systems. These systems enable modular, cost-effective liquid cooling deployments in data centers, allowing for the operation of high-density computing for AI alongside traditional air-cooled racks.

In September 2024, Airedale by Modine, the critical cooling specialists, announced the launch of a coolant distribution unit (CDU), in response to increasing demand for high-performance, high-efficiency liquid, and hybrid (air and liquid) cooling solutions in the global data center industry.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Global Coolant Distribution Units (CDU) Market by Type

4.1 Global Coolant Distribution Units (CDU) Market Snapshot and Growth Engine

4.2 Global Coolant Distribution Units (CDU) Market Overview

4.3 Static CDU and Portable CDU

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Static CDU and Portable CDU: Geographic Segmentation Analysis

Chapter 5: Global Coolant Distribution Units (CDU) Market by Cooling Technology

5.1 Global Coolant Distribution Units (CDU) Market Snapshot and Growth Engine

5.2 Global Coolant Distribution Units (CDU) Market Overview

5.3 Liquid Cooling and Air Cooling

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Liquid Cooling and Air Cooling: Geographic Segmentation Analysis

Chapter 6: Global Coolant Distribution Units (CDU) Market by Application

6.1 Global Coolant Distribution Units (CDU) Market Snapshot and Growth Engine

6.2 Global Coolant Distribution Units (CDU) Market Overview

6.3 IT Equipment Cooling

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 IT Equipment Cooling: Geographic Segmentation Analysis

6.4 Process Cooling

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Process Cooling: Geographic Segmentation Analysis

6.5 and Telecommunication Cooling

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Telecommunication Cooling: Geographic Segmentation Analysis

Chapter 7: Global Coolant Distribution Units (CDU) Market by By End-User

7.1 Global Coolant Distribution Units (CDU) Market Snapshot and Growth Engine

7.2 Global Coolant Distribution Units (CDU) Market Overview

7.3 Data Centers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Data Centers: Geographic Segmentation Analysis

7.4 Industrial Applications

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Industrial Applications: Geographic Segmentation Analysis

7.5 and Commercial Spaces

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 and Commercial Spaces: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Global Coolant Distribution Units (CDU) Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ASETEK (DENMARK)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BLUEOCEAN (CHINA)

8.4 BOYD (USA)

8.5 COOLCENTRIC (USA)

8.6 COOLIT SYSTEMS (CANADA)

8.7 DCX (POLAND)

8.8 DELTA ELECTRONICS (TAIWAN)

8.9 EMERSON (USA)

8.10 ENVICOOL (CHINA)

8.11 GIGABYTE (TAIWAN)

8.12 GOALAND (CHINA)

8.13 MOTIVAIR (USA)

8.14 NIDEC (JAPAN)

8.15 NORTEK AIR SOLUTIONS (USA)

8.16 NVENT SCHROFF (USA)

8.17 RITTAL (GERMANY)

8.18 SCHNEIDER ELECTRIC (FRANCE)

8.19 UNISPLENDOUR CORPORATION LIMITED (CHINA)

8.20 VERTIV (USA)

8.21 OTHER ACTIVE PLAYERS.

Chapter 9: Global Global Coolant Distribution Units (CDU) Market By Region

9.1 Overview

9.2. North America Global Coolant Distribution Units (CDU) Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Static CDU and Portable CDU

9.2.5 Historic and Forecasted Market Size By Cooling Technology

9.2.5.1 Liquid Cooling and Air Cooling

9.2.6 Historic and Forecasted Market Size By Application

9.2.6.1 IT Equipment Cooling

9.2.6.2 Process Cooling

9.2.6.3 and Telecommunication Cooling

9.2.7 Historic and Forecasted Market Size By By End-User

9.2.7.1 Data Centers

9.2.7.2 Industrial Applications

9.2.7.3 and Commercial Spaces

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Global Coolant Distribution Units (CDU) Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Static CDU and Portable CDU

9.3.5 Historic and Forecasted Market Size By Cooling Technology

9.3.5.1 Liquid Cooling and Air Cooling

9.3.6 Historic and Forecasted Market Size By Application

9.3.6.1 IT Equipment Cooling

9.3.6.2 Process Cooling

9.3.6.3 and Telecommunication Cooling

9.3.7 Historic and Forecasted Market Size By By End-User

9.3.7.1 Data Centers

9.3.7.2 Industrial Applications

9.3.7.3 and Commercial Spaces

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Global Coolant Distribution Units (CDU) Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Static CDU and Portable CDU

9.4.5 Historic and Forecasted Market Size By Cooling Technology

9.4.5.1 Liquid Cooling and Air Cooling

9.4.6 Historic and Forecasted Market Size By Application

9.4.6.1 IT Equipment Cooling

9.4.6.2 Process Cooling

9.4.6.3 and Telecommunication Cooling

9.4.7 Historic and Forecasted Market Size By By End-User

9.4.7.1 Data Centers

9.4.7.2 Industrial Applications

9.4.7.3 and Commercial Spaces

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Global Coolant Distribution Units (CDU) Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Static CDU and Portable CDU

9.5.5 Historic and Forecasted Market Size By Cooling Technology

9.5.5.1 Liquid Cooling and Air Cooling

9.5.6 Historic and Forecasted Market Size By Application

9.5.6.1 IT Equipment Cooling

9.5.6.2 Process Cooling

9.5.6.3 and Telecommunication Cooling

9.5.7 Historic and Forecasted Market Size By By End-User

9.5.7.1 Data Centers

9.5.7.2 Industrial Applications

9.5.7.3 and Commercial Spaces

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Global Coolant Distribution Units (CDU) Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Static CDU and Portable CDU

9.6.5 Historic and Forecasted Market Size By Cooling Technology

9.6.5.1 Liquid Cooling and Air Cooling

9.6.6 Historic and Forecasted Market Size By Application

9.6.6.1 IT Equipment Cooling

9.6.6.2 Process Cooling

9.6.6.3 and Telecommunication Cooling

9.6.7 Historic and Forecasted Market Size By By End-User

9.6.7.1 Data Centers

9.6.7.2 Industrial Applications

9.6.7.3 and Commercial Spaces

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Global Coolant Distribution Units (CDU) Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Static CDU and Portable CDU

9.7.5 Historic and Forecasted Market Size By Cooling Technology

9.7.5.1 Liquid Cooling and Air Cooling

9.7.6 Historic and Forecasted Market Size By Application

9.7.6.1 IT Equipment Cooling

9.7.6.2 Process Cooling

9.7.6.3 and Telecommunication Cooling

9.7.7 Historic and Forecasted Market Size By By End-User

9.7.7.1 Data Centers

9.7.7.2 Industrial Applications

9.7.7.3 and Commercial Spaces

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Coolant Distribution Units (CDU) Market research report?

A1: The forecast period in the Coolant Distribution Units (CDU) Market research report is 2025-2032.

Q2: Who are the key players in the Coolant Distribution Units (CDU) Market?

A2: Asetek (Denmark), Blueocean (China), BOYD (USA), Coolcentric (USA), CoolIT Systems (Canada), DCX (Poland), Delta Electronics (Taiwan), Emerson (USA), Envicool (China), GIGABYTE (Taiwan), Goaland (China), Motivair (USA), Nidec (Japan), Nortek Air Solutions (USA), nVent Schroff (USA), Rittal (Germany), Schneider Electric (France), Unisplendour Corporation Limited (China), Vertiv (USA), and Other Active Players.

Q3: What are the segments of the Coolant Distribution Units (CDU) Market?

A3: The Coolant Distribution Units (CDU) Market is segmented into Type, Cooling Technology, Application, End-Users, and Region. By Type, it is categorized into Static CDU and Portable CDU. By Cooling Technology, it is categorized into Liquid Cooling and Air Cooling. By Application, it is categorized into IT Equipment Cooling, Process Cooling, and Telecommunication Cooling. By End-User, it is categorized into Data Centers, Industrial Applications, and Commercial Spaces. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What defines the Coolant Distribution Units (CDU) Market?

A4: CDUs are an integral part of liquid cooling systems designed to increase overall system efficiency and reduce the total cost of ownership for high-density applications in the data center. The CDU circulates and pumps coolant in a closed-loop system within the rack and server chassis and utilizes facility water (in full liquid cooling systems) and the air outside the rack to cool the servers.

Q5: How big is the Coolant Distribution Units (CDU) Market?

A5: The Coolant Distribution Units (CDU) Market Size Was Valued at USD 1.35 billion in 2024 and is projected to reach USD 5.31 billion by 2032, growing at a CAGR of 18.67% from 2025 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!