Stay Ahead in Fast-Growing Economies.

Browse Reports NowControlled Substance Market Size, Share, Growth & Forecast (2024-2032)

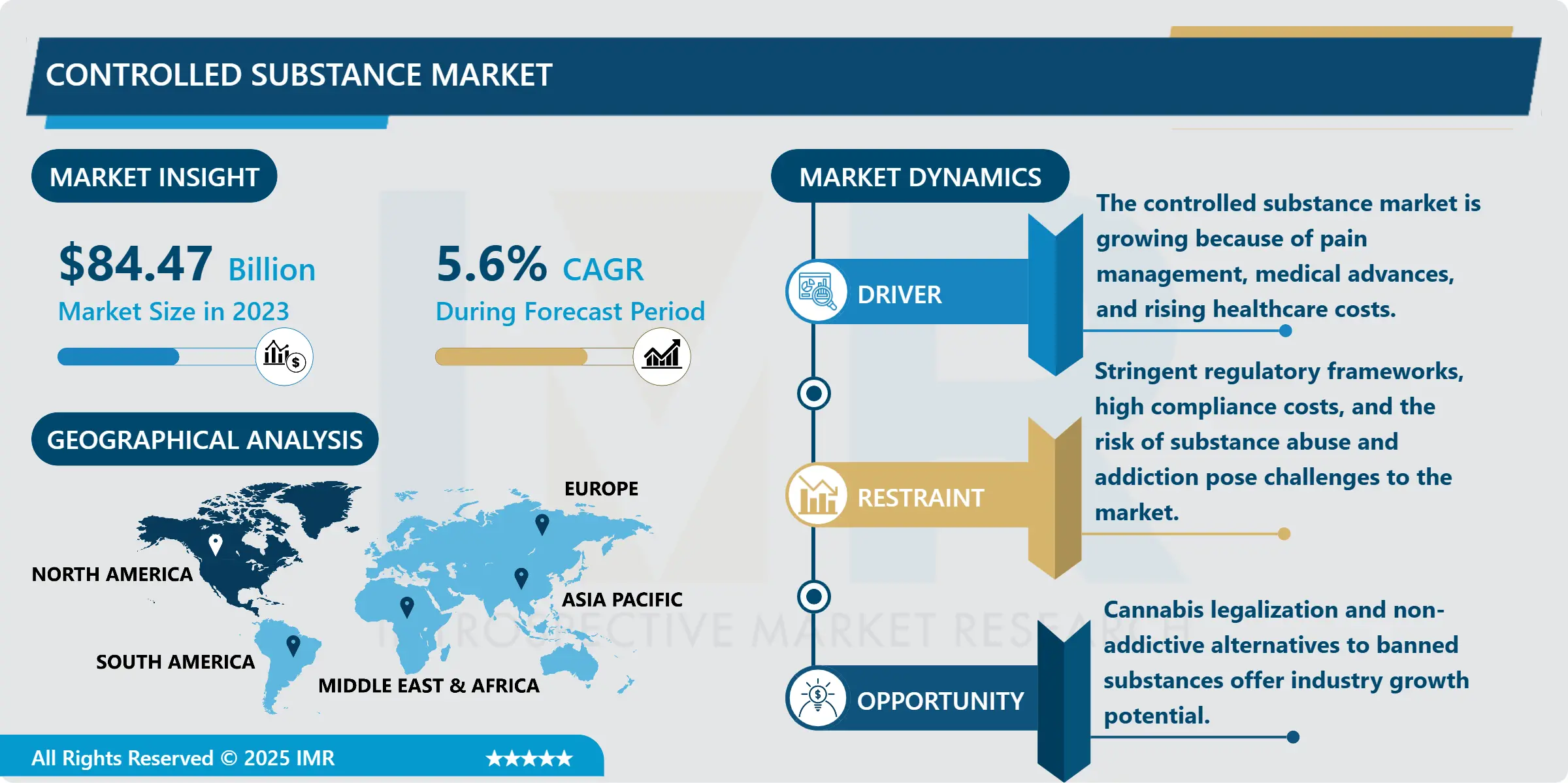

Controlled Substance Market Size Was Valued at USD 84.47 Billion in 2023, and is Projected to Reach USD 142.20 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

IMR Group

Description

Controlled Substance Market Synopsis:

Controlled Substance Market Size Was Valued at USD 84.47 Billion in 2023, and is Projected to Reach USD 142.20 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

The Controlled Substance Market refers to the market for drugs and chemicals regulated by government authorities due to their potential for abuse and addiction. These substances are categorized into schedules, ranging from Schedule I (highest potential for abuse and no medical use) to Schedule V (low potential for abuse and medical use). The market includes pharmaceuticals, medical supplies, and illicit substances that are subject to stringent regulatory oversight to prevent misuse, including opioids, stimulants, and sedatives. As global health systems grapple with rising concerns related to substance abuse, the market is heavily influenced by evolving legal frameworks, healthcare policies, and public health initiatives.

The demand for controlled substances is shaped by the healthcare sector, where many of these substances are used in medical treatments for pain management, anxiety disorders, and other serious conditions. Pharmaceutical companies are required to comply with rigorous regulations set by bodies like the U.S. Drug Enforcement Administration (DEA) and international authorities such as the United Nations Office on Drugs and Crime (UNODC). This has led to increased efforts in drug development and regulation, with a focus on creating safer alternatives to highly addictive substances. Additionally, the opioid crisis in North America has significantly impacted the market, with governments and healthcare organizations implementing stricter controls and measures to reduce misuse.

The market is also impacted by opportunities and challenges stemming from advancements in drug development, regulatory changes, and rising concerns about substance abuse. The growing adoption of prescription monitoring programs, telemedicine, and drug abuse prevention initiatives are addressing both the supply and demand sides of the market. As regulatory frameworks tighten, the focus is shifting toward the development of new drugs that offer therapeutic benefits with lower abuse potential. Furthermore, the rise of the legalization of substances like cannabis in various regions is expected to create new market dynamics, presenting both challenges and opportunities for stakeholders involved in the production, distribution, and regulation of controlled substances.

Controlled Substance Market Trend Analysis:

Increasing Focus on Alternative Pain Management Solutions

The growing concern over opioid misuse and addiction has led to a significant shift towards developing alternative pain management therapies. The Controlled Substance Market is witnessing a rise in the demand for non-addictive pain relief medications, including biologics, non-opioid analgesics, and CBD-based treatments. Pharmaceutical companies are investing in research to develop drugs that provide effective pain relief without the risk of dependency, reflecting a broader trend of promoting safer therapeutic options. This shift is expected to shape the future of the market, particularly as healthcare systems seek to address the opioid crisis while still meeting the needs of patients in pain.

Legalization and Regulation of Cannabis

The legalization of cannabis in several regions, particularly in North America and parts of Europe, is creating a new dimension in the Controlled Substance Market. As governments implement regulations to control the cultivation, distribution, and consumption of cannabis, a legitimate market for medical and recreational cannabis is emerging. This trend is driving significant investments in cannabis research and development, along with innovations in delivery methods, including edibles, oils, and tinctures. With continued policy changes and increasing public acceptance, the legal cannabis market is poised for rapid growth, providing both opportunities and challenges for regulators, healthcare providers, and businesses in the controlled substances space.

Controlled Substance Market Segment Analysis:

Controlled Substance Market is Segmented on the basis of By Drug, Application, Distribution, and Region.

By Drug, Opioids segment is expected to dominate the market during the forecast period

The Controlled Substance Market is segmented by drug types, including opioids, stimulants, depressants, and cannabinoids, each having distinct applications and regulatory controls. Opioids, widely used for pain management, are the largest segment but face scrutiny due to the opioid crisis and rising addiction rates, leading to increased regulation and demand for alternative treatments. Stimulants, such as amphetamines, are used in treating conditions like ADHD and narcolepsy but are also prone to abuse, prompting stringent controls. Depressants, including benzodiazepines, are prescribed for anxiety and sleep disorders but pose risks of dependency, spurring efforts for safer alternatives. Cannabinoids, especially cannabis and its derivatives, are gaining prominence in both medical and recreational markets as many regions legalize or decriminalize their use, creating new dynamics in the controlled substance space. The market’s growth and regulatory landscape are influenced by the therapeutic potential and risks associated with these substances.

By Distribution, Hospital Pharmacy segment expected to held the largest share

The Controlled Substance Market is segmented by distribution channels into hospital pharmacies, retail pharmacies, and online pharmacies, each playing a crucial role in the accessibility and regulation of these substances. Hospital pharmacies are the primary distributors for controlled substances used in inpatient settings, particularly for pain management, anesthesia, and treatment of serious conditions. These pharmacies face stringent regulatory scrutiny to ensure safe handling and administration. Retail pharmacies serve a broader consumer base, providing prescriptions for controlled substances under strict guidelines and often requiring direct supervision for high-risk medications like opioids and benzodiazepines. The rise of online pharmacies has introduced convenience for consumers, offering a growing platform for controlled substance distribution, especially as telemedicine expands; however, it also raises concerns about ensuring compliance with regulations and preventing misuse. The evolving distribution models are significantly shaping the market dynamics, balancing accessibility with regulatory challenges.

Controlled Substance Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the Controlled Substance Market over the forecast period, driven by the region’s stringent regulatory frameworks, high healthcare spending, and ongoing efforts to combat the opioid crisis. The United States, in particular, plays a pivotal role due to its large pharmaceutical market, where both legal and illicit substances are heavily regulated by government bodies like the Drug Enforcement Administration (DEA). Additionally, the increasing focus on opioid alternatives, the legalization of cannabis in several states, and advancements in pain management therapies are influencing market dynamics. As North America continues to address substance abuse issues while fostering innovation in controlled substance regulations and treatments, the region is poised to maintain a leading position in the market.

Active Key Players in the Controlled Substance Market

AbbVie Inc. (USA)

Amgen Inc. (USA)

Aradigm Corporation (USA)

Aspen Holdings (South Africa)

Astellas Pharma Inc. (Japan)

AstraZeneca (United Kingdom)

Bayer AG (Germany)

Boehringer Ingelheim International GmbH (Germany)

Bristol-Myers Squibb Company (USA)

Corium International (USA)

Eli Lilly and Company (USA)

G.W. Pharmaceuticals (United Kingdom)

Gilead Sciences, Inc. (USA)

GSK Plc. (GlaxoSmithKline) (United Kingdom)

Johnson & Johnson (USA)

Lannett (USA)

Merck & Co. Inc (USA)

Novartis Pharmaceuticals Corporation (Switzerland)

Novo Nordisk A/S (Denmark)

Orbis Biosciences (USA)

Pfizer Inc. (USA)

Sanofi – France

Takeda Pharmaceutical Company Limited (Japan)

Teva Pharmaceutical Inc. (Israel)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Controlled Substance Market by Drug

4.1 Controlled Substance Market Snapshot and Growth Engine

4.2 Controlled Substance Market Overview

4.3 Opioids

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Opioids: Geographic Segmentation Analysis

4.4 Stimulant

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Stimulant: Geographic Segmentation Analysis

4.5 Depressants

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Depressants: Geographic Segmentation Analysis

4.6 Cannabinoids

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Cannabinoids: Geographic Segmentation Analysis

Chapter 5: Controlled Substance Market by Application

5.1 Controlled Substance Market Snapshot and Growth Engine

5.2 Controlled Substance Market Overview

5.3 ADHD

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 ADHD: Geographic Segmentation Analysis

5.4 Pain Management

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pain Management: Geographic Segmentation Analysis

5.5 Depression

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Depression: Geographic Segmentation Analysis

5.6 Sleep Disorder

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Sleep Disorder: Geographic Segmentation Analysis

Chapter 6: Controlled Substance Market by Distribution

6.1 Controlled Substance Market Snapshot and Growth Engine

6.2 Controlled Substance Market Overview

6.3 Hospital Pharmacy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital Pharmacy: Geographic Segmentation Analysis

6.4 Retail Pharmacy

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Retail Pharmacy: Geographic Segmentation Analysis

6.5 Online Pharmacy

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Online Pharmacy: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Controlled Substance Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MERCK & CO. INC (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 JOHNSON & JOHNSON (USA)

7.4 ORBIS BIOSCIENCES (USA)

7.5 ARADIGM CORPORATION (USA)

7.6 CORIUM INTERNATIONAL (CALIFORNIA

7.7 USA)

7.8 G.W. PHARMACEUTICALS (UNITED KINGDOM)

7.9 LANNETT (USA)

7.10 OTHER ACTIVE PLAYERS

Chapter 8: Global Controlled Substance Market By Region

8.1 Overview

8.2. North America Controlled Substance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug

8.2.4.1 Opioids

8.2.4.2 Stimulant

8.2.4.3 Depressants

8.2.4.4 Cannabinoids

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 ADHD

8.2.5.2 Pain Management

8.2.5.3 Depression

8.2.5.4 Sleep Disorder

8.2.6 Historic and Forecasted Market Size By Distribution

8.2.6.1 Hospital Pharmacy

8.2.6.2 Retail Pharmacy

8.2.6.3 Online Pharmacy

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Controlled Substance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug

8.3.4.1 Opioids

8.3.4.2 Stimulant

8.3.4.3 Depressants

8.3.4.4 Cannabinoids

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 ADHD

8.3.5.2 Pain Management

8.3.5.3 Depression

8.3.5.4 Sleep Disorder

8.3.6 Historic and Forecasted Market Size By Distribution

8.3.6.1 Hospital Pharmacy

8.3.6.2 Retail Pharmacy

8.3.6.3 Online Pharmacy

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Controlled Substance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug

8.4.4.1 Opioids

8.4.4.2 Stimulant

8.4.4.3 Depressants

8.4.4.4 Cannabinoids

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 ADHD

8.4.5.2 Pain Management

8.4.5.3 Depression

8.4.5.4 Sleep Disorder

8.4.6 Historic and Forecasted Market Size By Distribution

8.4.6.1 Hospital Pharmacy

8.4.6.2 Retail Pharmacy

8.4.6.3 Online Pharmacy

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Controlled Substance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug

8.5.4.1 Opioids

8.5.4.2 Stimulant

8.5.4.3 Depressants

8.5.4.4 Cannabinoids

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 ADHD

8.5.5.2 Pain Management

8.5.5.3 Depression

8.5.5.4 Sleep Disorder

8.5.6 Historic and Forecasted Market Size By Distribution

8.5.6.1 Hospital Pharmacy

8.5.6.2 Retail Pharmacy

8.5.6.3 Online Pharmacy

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Controlled Substance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug

8.6.4.1 Opioids

8.6.4.2 Stimulant

8.6.4.3 Depressants

8.6.4.4 Cannabinoids

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 ADHD

8.6.5.2 Pain Management

8.6.5.3 Depression

8.6.5.4 Sleep Disorder

8.6.6 Historic and Forecasted Market Size By Distribution

8.6.6.1 Hospital Pharmacy

8.6.6.2 Retail Pharmacy

8.6.6.3 Online Pharmacy

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Controlled Substance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug

8.7.4.1 Opioids

8.7.4.2 Stimulant

8.7.4.3 Depressants

8.7.4.4 Cannabinoids

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 ADHD

8.7.5.2 Pain Management

8.7.5.3 Depression

8.7.5.4 Sleep Disorder

8.7.6 Historic and Forecasted Market Size By Distribution

8.7.6.1 Hospital Pharmacy

8.7.6.2 Retail Pharmacy

8.7.6.3 Online Pharmacy

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Controlled Substance Market research report?

A1: The forecast period in the Controlled Substance Market research report is 2024-2032.

Q2: Who are the key players in the Controlled Substance Market?

A2: AbbVie Inc. (USA), Amgen Inc. (USA), Aradigm Corporation (USA), Aspen Holdings (South Africa), Astellas Pharma Inc. (Japan), AstraZeneca (United Kingdom), Bayer AG (Germany), Boehringer Ingelheim International GmbH (Germany), Bristol-Myers Squibb Company (USA), Corium International (USA), Eli Lilly and Company (USA), G.W. Pharmaceuticals (United Kingdom), Gilead Sciences, Inc. (USA), GSK Plc. (GlaxoSmithKline) (United Kingdom), Johnson & Johnson (USA), Lannett (USA), Merck & Co. Inc (USA), Novartis Pharmaceuticals Corporation (Switzerland), Novo Nordisk A/S (Denmark), Orbis Biosciences (USA), Pfizer Inc. (USA), Sanofi (France), Takeda Pharmaceutical Company Limited (Japan), Teva Pharmaceutical Inc. (Israel), Other Active Players.

Q3: What are the segments of the Controlled Substance Market?

A3: The Controlled Substance Market is segmented into By Drug, Application, By Distribution and region. By Drug(Opioids, Stimulant, Depressants, Cannabinoids), By Application(ADHD, Pain Management, Depression, Sleep Disorder), By Distribution(Hospital Pharmacy, Retail Pharmacy, Online Pharmacy). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Controlled Substance Market?

A4: Controlled substances are drugs or chemicals that are regulated by government authorities due to their potential for abuse, addiction, and harm. These substances are classified into different schedules or categories, ranging from Schedule I (substances with no accepted medical use and a high potential for abuse, such as heroin) to Schedule V (substances with a lower potential for abuse and accepted medical use, such as certain cough preparations containing less than 200 milligrams of codeine per 100 milliliters). The regulation of controlled substances aims to balance their legitimate medical use, such as in pain management or treatment of specific conditions, with minimizing the risk of misuse, addiction, and illicit trafficking.

Q5: How big is the Controlled Substance Market?

A5: Controlled Substance Market Size Was Valued at USD 84.47 Billion in 2023, and is Projected to Reach USD 142.20 Billion by 2032, Growing at a CAGR of 5.60% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!