Stay Ahead in Fast-Growing Economies.

Browse Reports NowContract Lifecycle Management Software Market Size, Share, Growth & Forecast (2024-2032)

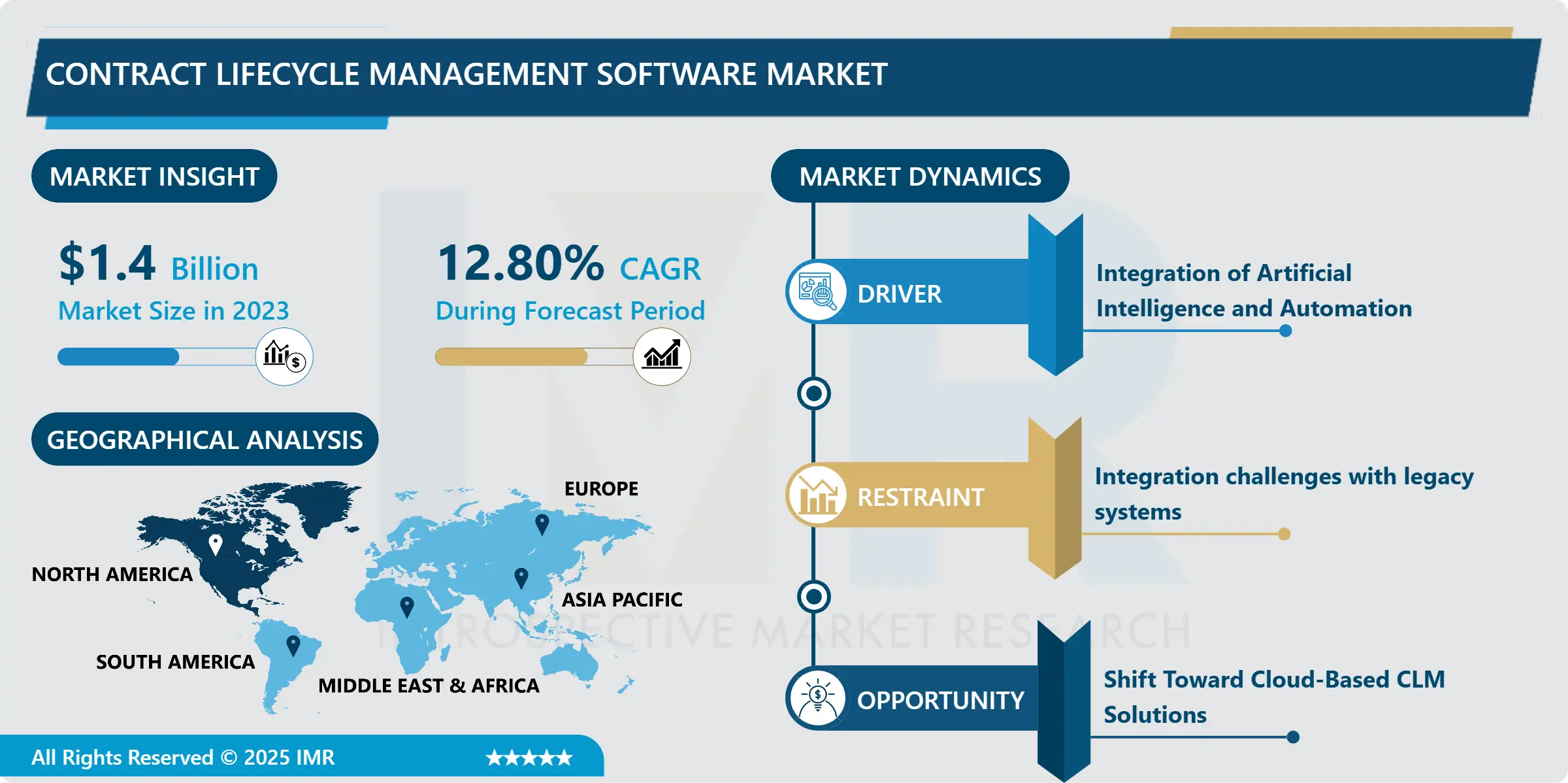

Contract Lifecycle Management Software Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 3.8 Billion by 2032, Growing at a CAGR of 12.80% From 2024-2032.

IMR Group

Description

Contract Lifecycle Management Software Market Synopsis:

Contract Lifecycle Management Software Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 3.8 Billion by 2032, Growing at a CAGR of 12.80% From 2024-2032.

The Contract Lifecycle Management (CLM) Software Market has emerged as a pivotal segment in the enterprise software domain, driven by the increasing demand for streamlined contract management processes across industries. CLM software provides a centralized platform to manage the complete lifecycle of contracts, from creation and negotiation to execution, renewal, and compliance. This software helps organizations mitigate risks, ensure regulatory compliance, and enhance operational efficiency by automating manual processes. Key industries such as banking, healthcare, retail, and manufacturing are integrating CLM solutions to manage high volumes of complex contracts and reduce errors associated with traditional manual handling.

Market growth is fueled by technological advancements, including artificial intelligence (AI), machine learning (ML), and blockchain, which are revolutionizing contract management processes. AI-powered features like automated clause recognition, real-time contract analytics, and predictive insights significantly enhance decision-making capabilities. Additionally, the rise in remote working trends post-pandemic has driven enterprises to adopt cloud-based CLM solutions to facilitate seamless collaboration and contract accessibility from anywhere. The increasing emphasis on data security and privacy is also leading to the integration of robust encryption and compliance management tools within CLM platforms.

Regionally, North America dominates the CLM Software Market due to the presence of major industry players and the high adoption of advanced technologies. However, Asia-Pacific is anticipated to witness the fastest growth owing to rapid digitization and the rising adoption of enterprise solutions among small and medium-sized enterprises (SMEs). As businesses across the globe recognize the strategic importance of efficient contract management, the CLM Software Market is expected to expand further, with vendors focusing on innovative solutions tailored to meet industry-specific needs.

Contract Lifecycle Management Software Market Trend Analysis:

Integration of Artificial Intelligence and Automation

The integration of Artificial Intelligence (AI) and automation in Contract Lifecycle Management (CLM) software is transforming the way businesses handle contracts. AI-powered tools enable automated clause extraction, contract drafting, and risk analysis, significantly reducing manual efforts and errors. Machine learning algorithms analyze historical data to provide predictive insights, helping organizations anticipate risks and make informed decisions. Additionally, automation streamlines approval workflows and contract renewals, accelerating the overall contract management process. This trend is driving higher adoption of CLM solutions across industries seeking to enhance efficiency and improve compliance with evolving regulations.

Shift Toward Cloud-Based CLM Solutions

The increasing adoption of cloud-based CLM software is a defining trend, as organizations prioritize flexibility, scalability, and remote accessibility. Cloud-based platforms enable teams to collaborate on contracts in real time, regardless of location, making them indispensable in today’s hybrid work environments. These solutions also offer seamless integration with other enterprise tools like CRM, ERP, and procurement systems, creating a unified ecosystem for data management. The shift to the cloud is particularly appealing for small and medium-sized enterprises (SMEs) due to its cost-effectiveness and lower infrastructure requirements. Enhanced security features, such as data encryption and compliance with global privacy standards, are further accelerating the transition to cloud-based CLM platforms.

Contract Lifecycle Management Software Market Segment Analysis:

Contract Lifecycle Management Software Market is Segmented on the basis of By Deployment Model, CLM, Enterprises, Industry, and Region.

By Deployment Model, Cloud-Based segment is expected to dominate the market during the forecast period

The Contract Lifecycle Management (CLM) Software Market, segmented by deployment models into cloud-based and on-premise solutions, caters to diverse organizational needs. Cloud-based CLM solutions have gained significant traction due to their scalability, cost-efficiency, and ability to support remote collaboration. These platforms are particularly appealing to small and medium-sized enterprises (SMEs) seeking flexibility without investing heavily in infrastructure. On the other hand, on-premise CLM software remains a preferred choice for organizations in highly regulated industries like healthcare and finance, where data security and compliance with strict regulations are critical. While cloud-based solutions dominate due to the growing adoption of hybrid work environments, on-premise deployment continues to hold relevance for businesses prioritizing control over their IT infrastructure.

By Industry, Automotive segment expected to held the largest share

The Contract Lifecycle Management (CLM) Software Market serves a broad range of industries, including automotive, electrical and electronics, pharmaceutical, retail and e-commerce, manufacturing, BFSI (banking, financial services, and insurance), and others, each with unique contract management needs. In the automotive and manufacturing sectors, CLM solutions are critical for managing complex supply chain agreements and vendor contracts efficiently. Pharmaceutical companies leverage CLM software to ensure compliance with stringent regulatory requirements and streamline R&D partnerships. In retail and e-commerce, the software helps manage supplier contracts and ensure smooth procurement processes. The BFSI sector is a major adopter of CLM solutions due to its reliance on complex financial agreements and the need for strict compliance. As industries increasingly digitize and expand their operations globally, the demand for tailored CLM solutions continues to rise, driving innovation and adoption across all verticals.

Contract Lifecycle Management Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is anticipated to dominate the Contract Lifecycle Management (CLM) Software Market during the forecast period, driven by the region’s early adoption of advanced technologies and the presence of key industry players. Organizations across sectors such as banking, healthcare, IT, and legal in the United States and Canada are increasingly leveraging CLM solutions to enhance operational efficiency, ensure regulatory compliance, and manage complex contract portfolios. The strong emphasis on integrating AI, machine learning, and automation into enterprise software further propels market growth in the region. Additionally, the rising adoption of cloud-based solutions and the region’s robust infrastructure for digital transformation contribute to North America’s leading position in the global CLM Software Market.

Active Key Players in the Contract Lifecycle Management Software Market

BravoSolution SPA (Italy)

Contracked BV (Netherlands)

Contract Logix, LLC (USA)

Coupa Software Inc. (USA)

EASY SOFTWARE AG (Germany)

ESM Solutions Corporation (USA)

Great Minds Software, Inc. (USA)

IBM Corporation (USA)

Icertis, Inc. (USA)

Ivalua Inc. (USA)

Koch Industries, Inc. (USA)

SAP SE (Germany)

Wolters Kluwer N.V. (Netherlands)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Contract Lifecycle Management Software Market by Deployment Model

4.1 Contract Lifecycle Management Software Market Snapshot and Growth Engine

4.2 Contract Lifecycle Management Software Market Overview

4.3 Cloud-Based And On-Premise

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cloud-Based And On-Premise: Geographic Segmentation Analysis

Chapter 5: Contract Lifecycle Management Software Market by CLM Offerings

5.1 Contract Lifecycle Management Software Market Snapshot and Growth Engine

5.2 Contract Lifecycle Management Software Market Overview

5.3 Licensing and Subscription And Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Licensing and Subscription And Services: Geographic Segmentation Analysis

Chapter 6: Contract Lifecycle Management Software Market by Enterprises

6.1 Contract Lifecycle Management Software Market Snapshot and Growth Engine

6.2 Contract Lifecycle Management Software Market Overview

6.3 Large Enterprises And Small and Medium Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Large Enterprises And Small and Medium Enterprises: Geographic Segmentation Analysis

Chapter 7: Contract Lifecycle Management Software Market by Industry

7.1 Contract Lifecycle Management Software Market Snapshot and Growth Engine

7.2 Contract Lifecycle Management Software Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Automotive: Geographic Segmentation Analysis

7.4 Electrical and Electronics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Electrical and Electronics: Geographic Segmentation Analysis

7.5 Pharmaceutical

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pharmaceutical: Geographic Segmentation Analysis

7.6 Retail & E-Commerce

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Retail & E-Commerce: Geographic Segmentation Analysis

7.7 Manufacturing

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Manufacturing: Geographic Segmentation Analysis

7.8 BFSI

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 BFSI: Geographic Segmentation Analysis

7.9 And Others

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 And Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Contract Lifecycle Management Software Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 WOLTERS KLUWER N.V. (NETHERLANDS)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 IBM CORPORATION (USA)

8.4 ICERTIS INC. (USA)

8.5 SAP SE (GERMANY)

8.6 BRAVOSOLUTION SPA (ITALY)

8.7 CONTRACKED BV (NETHERLANDS)

8.8 CONTRACT LOGIX LLC (USA)

8.9 COUPA SOFTWARE INC. (USA)

8.10 EASY SOFTWARE AG (GERMANY)

8.11 ESM SOLUTIONS CORPORATION (USA)

8.12 GREAT MINDS SOFTWARE INC. (USA)

8.13 KOCH INDUSTRIES INC. (USA)

8.14 IVALUA INC. (USA)

8.15 OTHER ACTIVE PLAYERS

Chapter 9: Global Contract Lifecycle Management Software Market By Region

9.1 Overview

9.2. North America Contract Lifecycle Management Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Deployment Model

9.2.4.1 Cloud-Based And On-Premise

9.2.5 Historic and Forecasted Market Size By CLM Offerings

9.2.5.1 Licensing and Subscription And Services

9.2.6 Historic and Forecasted Market Size By Enterprises

9.2.6.1 Large Enterprises And Small and Medium Enterprises

9.2.7 Historic and Forecasted Market Size By Industry

9.2.7.1 Automotive

9.2.7.2 Electrical and Electronics

9.2.7.3 Pharmaceutical

9.2.7.4 Retail & E-Commerce

9.2.7.5 Manufacturing

9.2.7.6 BFSI

9.2.7.7 And Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Contract Lifecycle Management Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Deployment Model

9.3.4.1 Cloud-Based And On-Premise

9.3.5 Historic and Forecasted Market Size By CLM Offerings

9.3.5.1 Licensing and Subscription And Services

9.3.6 Historic and Forecasted Market Size By Enterprises

9.3.6.1 Large Enterprises And Small and Medium Enterprises

9.3.7 Historic and Forecasted Market Size By Industry

9.3.7.1 Automotive

9.3.7.2 Electrical and Electronics

9.3.7.3 Pharmaceutical

9.3.7.4 Retail & E-Commerce

9.3.7.5 Manufacturing

9.3.7.6 BFSI

9.3.7.7 And Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Contract Lifecycle Management Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Deployment Model

9.4.4.1 Cloud-Based And On-Premise

9.4.5 Historic and Forecasted Market Size By CLM Offerings

9.4.5.1 Licensing and Subscription And Services

9.4.6 Historic and Forecasted Market Size By Enterprises

9.4.6.1 Large Enterprises And Small and Medium Enterprises

9.4.7 Historic and Forecasted Market Size By Industry

9.4.7.1 Automotive

9.4.7.2 Electrical and Electronics

9.4.7.3 Pharmaceutical

9.4.7.4 Retail & E-Commerce

9.4.7.5 Manufacturing

9.4.7.6 BFSI

9.4.7.7 And Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Contract Lifecycle Management Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Deployment Model

9.5.4.1 Cloud-Based And On-Premise

9.5.5 Historic and Forecasted Market Size By CLM Offerings

9.5.5.1 Licensing and Subscription And Services

9.5.6 Historic and Forecasted Market Size By Enterprises

9.5.6.1 Large Enterprises And Small and Medium Enterprises

9.5.7 Historic and Forecasted Market Size By Industry

9.5.7.1 Automotive

9.5.7.2 Electrical and Electronics

9.5.7.3 Pharmaceutical

9.5.7.4 Retail & E-Commerce

9.5.7.5 Manufacturing

9.5.7.6 BFSI

9.5.7.7 And Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Contract Lifecycle Management Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Deployment Model

9.6.4.1 Cloud-Based And On-Premise

9.6.5 Historic and Forecasted Market Size By CLM Offerings

9.6.5.1 Licensing and Subscription And Services

9.6.6 Historic and Forecasted Market Size By Enterprises

9.6.6.1 Large Enterprises And Small and Medium Enterprises

9.6.7 Historic and Forecasted Market Size By Industry

9.6.7.1 Automotive

9.6.7.2 Electrical and Electronics

9.6.7.3 Pharmaceutical

9.6.7.4 Retail & E-Commerce

9.6.7.5 Manufacturing

9.6.7.6 BFSI

9.6.7.7 And Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Contract Lifecycle Management Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Deployment Model

9.7.4.1 Cloud-Based And On-Premise

9.7.5 Historic and Forecasted Market Size By CLM Offerings

9.7.5.1 Licensing and Subscription And Services

9.7.6 Historic and Forecasted Market Size By Enterprises

9.7.6.1 Large Enterprises And Small and Medium Enterprises

9.7.7 Historic and Forecasted Market Size By Industry

9.7.7.1 Automotive

9.7.7.2 Electrical and Electronics

9.7.7.3 Pharmaceutical

9.7.7.4 Retail & E-Commerce

9.7.7.5 Manufacturing

9.7.7.6 BFSI

9.7.7.7 And Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Contract Lifecycle Management Software Market research report?

A1: The forecast period in the Contract Lifecycle Management Software Market research report is 2024-2032.

Q2: Who are the key players in the Contract Lifecycle Management Software Market?

A2: Wolters Kluwer N.V. (Netherlands), IBM Corporation (USA), Icertis, Inc. (USA), SAP SE (Germany), BravoSolution SPA (Italy), Contracked BV (Netherlands), Contract Logix, LLC (USA), Coupa Software Inc. (USA), EASY SOFTWARE AG (Germany), ESM Solutions Corporation (USA), Great Minds Software, Inc. (USA), Koch Industries, Inc. (USA), Ivalua Inc. (USA), Other Active Players.

Q3: What are the segments of the Contract Lifecycle Management Software Market?

A3: The Contract Lifecycle Management Software Market is segmented into By Deployment Model, By Enterprises, By Industry and region. By Deployment Model (Cloud-Based And On-Premise), By CLM Offerings (Licensing and Subscription And Services), By Enterprises (Large Enterprises And Small and Medium Enterprises) By Industry (Automotive, Electrical and Electronics, Pharmaceutical, Retail & E-Commerce, Manufacturing, BFSI, And Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Contract Lifecycle Management Software Market?

A4: Contract Lifecycle Management (CLM) Software refers to a specialized digital solution designed to streamline and automate the entire lifecycle of a contract, from creation and negotiation to execution, renewal, and termination. This software provides a centralized platform for managing contracts efficiently, enabling organizations to track, store, and analyze contracts while ensuring compliance with legal and regulatory requirements. By leveraging features such as automated workflows, clause libraries, contract templates, and analytics, CLM software reduces errors, mitigates risks, and improves decision-making. It is widely used across industries to enhance operational efficiency, foster collaboration, and achieve cost savings.

Q5: How big is the Contract Lifecycle Management Software Market?

A5: Contract Lifecycle Management Software Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 3.8 Billion by 2032, Growing at a CAGR of 12.80% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!