Stay Ahead in Fast-Growing Economies.

Browse Reports NowContact Centre Software Market Industry Overview, Key Insights & Forecast to 2032

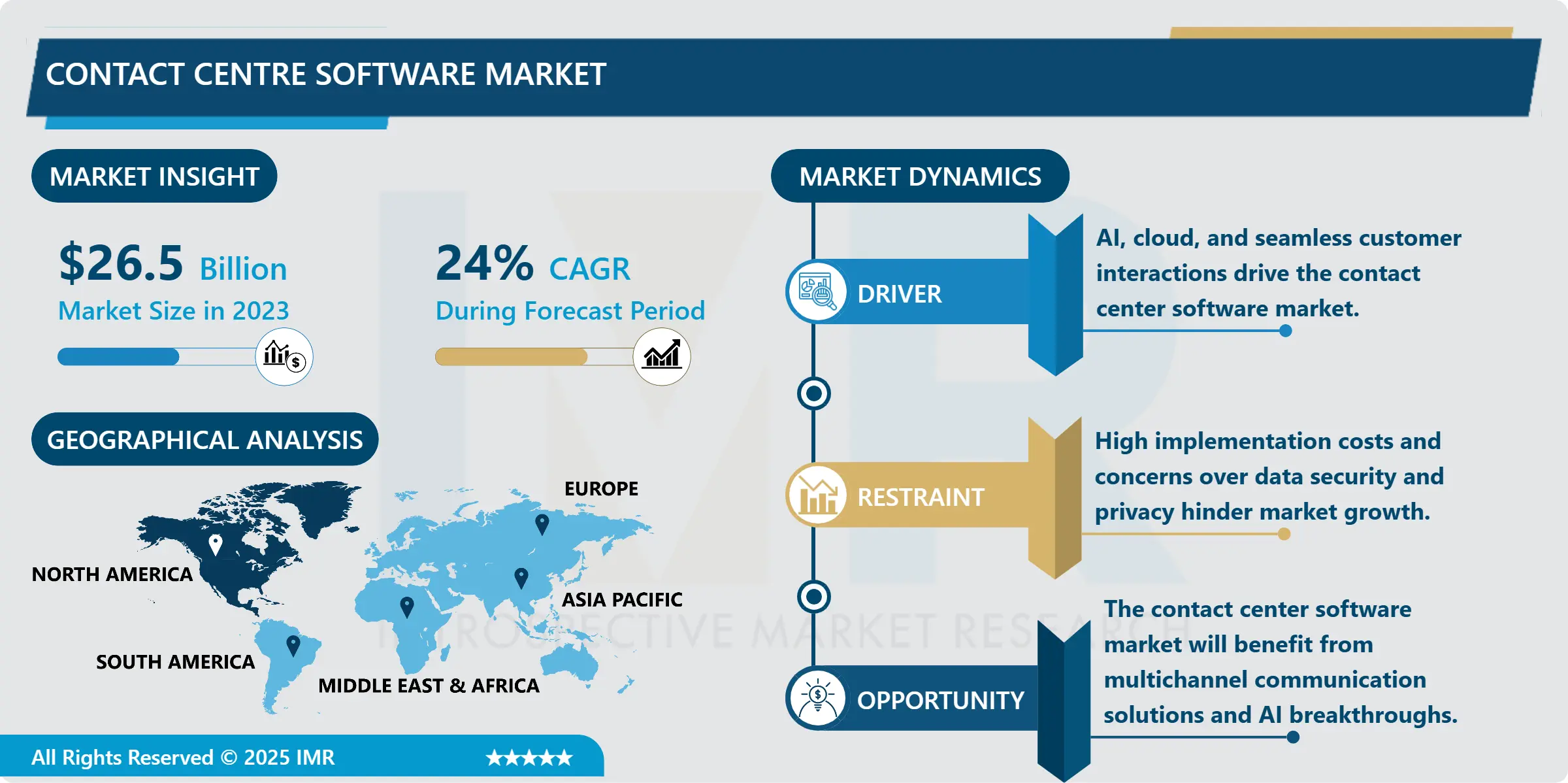

Contact Center Software Market Size Was Valued at USD 26.5 Billion in 2023, and is Projected to Reach USD 148.1 Billion by 2032, Growing at a CAGR of 24% From 2024-2032.

IMR Group

Description

Contact Center Software Market Synopsis:

Contact Center Software Market Size Was Valued at USD 26.5 Billion in 2023, and is Projected to Reach USD 148.1 Billion by 2032, Growing at a CAGR of 24% From 2024-2032.

The contact center software market has witnessed significant growth in recent years due to the increasing demand for improved customer service and the need for businesses to streamline their communication operations. Contact center software enables businesses to manage interactions across various communication channels, including voice, email, chat, and social media, providing a seamless and efficient way to handle customer inquiries, complaints, and support requests. The rapid adoption of cloud-based solutions has further propelled the market, as companies seek scalable and cost-effective options to enhance customer experience while minimizing operational complexities.

In addition to cloud-based platforms, artificial intelligence (AI) and machine learning (ML) have become integral components of modern contact center software. These technologies are being leveraged to automate routine tasks, provide advanced analytics, and enable personalized customer interactions. AI-powered chatbots, for example, can handle initial customer inquiries, directing more complex issues to human agents. Additionally, AI-driven insights help organizations improve service quality by analyzing call data, identifying trends, and predicting customer needs. As the market continues to evolve, innovations in AI and cloud computing are expected to further transform the customer service landscape.

The market is also driven by the growing need for omnichannel support, where businesses provide consistent and personalized experiences across multiple platforms. Customers expect a seamless interaction experience regardless of whether they contact the company through a website, social media, or phone. Contact center software providers are increasingly integrating multiple communication channels into a single platform, allowing agents to manage all interactions from one interface. As businesses focus on enhancing customer engagement and satisfaction, the demand for advanced contact center solutions is likely to continue to rise, creating new growth opportunities in the market.

Contact Center Software Market Trend Analysis:

AI-Powered Automation and Chatbots

One of the prominent trends in the contact center software market is the integration of artificial intelligence (AI) and automation tools, such as chatbots, to handle routine customer queries and tasks. AI-powered chatbots can quickly resolve common inquiries, improving efficiency and allowing human agents to focus on more complex issues. Additionally, AI-driven analytics help businesses monitor performance, predict customer behavior, and enhance decision-making, creating more personalized and timely customer interactions. This trend is expected to accelerate as AI technologies continue to evolve, leading to smarter, more effective customer support solutions.

Omnichannel Communication Integration

The demand for omnichannel communication is another key trend driving the contact center software market. Consumers now expect to engage with businesses seamlessly across multiple channels such as voice, email, chat, social media, and messaging apps. In response, contact center software providers are increasingly offering integrated solutions that unify these channels into a single platform, allowing agents to manage all interactions from one interface. This trend enables businesses to provide a consistent and personalized customer experience, enhancing satisfaction and customer loyalty while improving operational efficiency.

Contact Center Software Market Segment Analysis:

Contact Center Software Market is Segmented on the basis of By Component, Software Type, Deployment Mode, Enterprise Size, Industry Vertical, and Region.

By Component, Solution segment is expected to dominate the market during the forecast period

The contact center software market is segmented by component into solutions and services. Solutions include the software tools and platforms that enable businesses to manage customer interactions, such as cloud-based contact center software, interactive voice response (IVR), omnichannel integration, and analytics. These solutions are designed to improve operational efficiency, enhance customer experience, and support scalability. On the other hand, services refer to the support and professional services that complement the software solutions, including consulting, deployment, training, and ongoing maintenance and support. As businesses increasingly prioritize customer experience, the demand for both advanced solutions and comprehensive services is rising, driving the growth of the market.

By Industry Vertical, Healthcare segment expected to held the largest share

The contact center software market is widely adopted across various industry verticals, each leveraging the technology to enhance customer service and streamline operations. In the BFSI (Banking, Financial Services, and Insurance) sector, contact centers focus on providing real-time support and managing complex transactions securely. The Healthcare industry utilizes contact center software to improve patient engagement, appointment scheduling, and support, while ensuring compliance with regulations. Retail & E-Commerce businesses rely on these solutions to provide personalized customer service, track orders, and handle inquiries. In Government & Education, contact centers are used for citizen support, administrative functions, and addressing student queries. The IT & Telecom sector uses contact centers to manage technical support and customer service at scale. Travel & Hospitality relies on these solutions to assist customers with booking, itinerary changes, and customer service. Other industries also adopt contact center software to improve communication efficiency and enhance customer experience, making it a critical tool for businesses across diverse sectors.

Contact Center Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the contact center software market over the forecast period, driven by the presence of leading software providers, advanced technological infrastructure, and high demand for efficient customer service solutions. The region’s businesses are increasingly adopting cloud-based and AI-powered contact center software to enhance customer engagement and improve operational efficiency. The growing need for omnichannel support and personalized customer experiences is fueling the demand for integrated contact center solutions across industries such as retail, banking, and telecommunications. With continuous advancements in AI, machine learning, and automation technologies, North America is poised to maintain its leadership in the global contact center software market.

Active Key Players in the Contact Center Software Market

8X8 Inc. (USA)

ALE International (France)

Altivon (USA)

Amazon Web Services Inc. (USA)

Ameyo (India)

Amtelco (USA)

Aspect Software (USA)

Avaya Inc. (USA)

Avoxi (USA)

Cisco Systems Inc. (USA)

Enghouse Interactive Inc. (Canada)

Exotel Techcom Pvt. Ltd. (India)

Five9 Inc. (USA)

Genesys (USA)

Microsoft Corporation (USA)

NEC Corporation (Japan)

SAP SE (Germany)

Spok Inc. (USA)

Talkdesk Inc. (USA)

Twilio Inc. (USA)

UiPath (USA)

Unify Inc. (Germany)

VCC Live (Romania)

Others Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cloud PBX Market by Deployment Type

4.1 Cloud PBX Market Snapshot and Growth Engine

4.2 Cloud PBX Market Overview

4.3 Public Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Public Cloud: Geographic Segmentation Analysis

4.4 Private Cloud

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Private Cloud: Geographic Segmentation Analysis

4.5 Hybrid Cloud

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hybrid Cloud: Geographic Segmentation Analysis

Chapter 5: Cloud PBX Market by Organization Size

5.1 Cloud PBX Market Snapshot and Growth Engine

5.2 Cloud PBX Market Overview

5.3 Small and Medium-sized Businesses (SMBs)Large Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Small and Medium-sized Businesses (SMBs)Large Enterprises: Geographic Segmentation Analysis

Chapter 6: Cloud PBX Market by End User

6.1 Cloud PBX Market Snapshot and Growth Engine

6.2 Cloud PBX Market Overview

6.3 (BFSI (Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 (BFSI (Banking: Geographic Segmentation Analysis

6.4 Financial Services

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Financial Services: Geographic Segmentation Analysis

6.5 and Insurance Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Insurance Healthcare: Geographic Segmentation Analysis

6.6 IT and Telecom

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 IT and Telecom: Geographic Segmentation Analysis

6.7 Retail

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Retail: Geographic Segmentation Analysis

6.8 Education

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Education: Geographic Segmentation Analysis

6.9 Manufacturing

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Manufacturing: Geographic Segmentation Analysis

6.10 Government

6.10.1 Introduction and Market Overview

6.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.10.3 Key Market Trends, Growth Factors and Opportunities

6.10.4 Government: Geographic Segmentation Analysis

6.11 Others (Real Estate

6.11.1 Introduction and Market Overview

6.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.11.3 Key Market Trends, Growth Factors and Opportunities

6.11.4 Others (Real Estate: Geographic Segmentation Analysis

6.12 Hospitality

6.12.1 Introduction and Market Overview

6.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.12.3 Key Market Trends, Growth Factors and Opportunities

6.12.4 Hospitality: Geographic Segmentation Analysis

6.13 etc.)

6.13.1 Introduction and Market Overview

6.13.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.13.3 Key Market Trends, Growth Factors and Opportunities

6.13.4 etc.): Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cloud PBX Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 8X8 (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALCATEL-LUCENT ENTERPRISE (FRANCE)

7.4 AVAYA (USA)

7.5 CISCO SYSTEMS (USA)

7.6 CLOUD TALK (SLOVAKIA)

7.7 DIALPAD (USA)

7.8 FUSION CONNECT (USA)

7.9 GENESYS (USA)

7.10 GO TO (USA)

7.11 MITEL (CANADA)

7.12 NEXTIVA (USA)

7.13 PANASONIC (JAPAN)

7.14 RINGCENTRAL (USA)

7.15 TALK DESK (USA)

7.16 VONAGE (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Cloud PBX Market By Region

8.1 Overview

8.2. North America Cloud PBX Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Deployment Type

8.2.4.1 Public Cloud

8.2.4.2 Private Cloud

8.2.4.3 Hybrid Cloud

8.2.5 Historic and Forecasted Market Size By Organization Size

8.2.5.1 Small and Medium-sized Businesses (SMBs)Large Enterprises

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 (BFSI (Banking

8.2.6.2 Financial Services

8.2.6.3 and Insurance Healthcare

8.2.6.4 IT and Telecom

8.2.6.5 Retail

8.2.6.6 Education

8.2.6.7 Manufacturing

8.2.6.8 Government

8.2.6.9 Others (Real Estate

8.2.6.10 Hospitality

8.2.6.11 etc.)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cloud PBX Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Deployment Type

8.3.4.1 Public Cloud

8.3.4.2 Private Cloud

8.3.4.3 Hybrid Cloud

8.3.5 Historic and Forecasted Market Size By Organization Size

8.3.5.1 Small and Medium-sized Businesses (SMBs)Large Enterprises

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 (BFSI (Banking

8.3.6.2 Financial Services

8.3.6.3 and Insurance Healthcare

8.3.6.4 IT and Telecom

8.3.6.5 Retail

8.3.6.6 Education

8.3.6.7 Manufacturing

8.3.6.8 Government

8.3.6.9 Others (Real Estate

8.3.6.10 Hospitality

8.3.6.11 etc.)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cloud PBX Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Deployment Type

8.4.4.1 Public Cloud

8.4.4.2 Private Cloud

8.4.4.3 Hybrid Cloud

8.4.5 Historic and Forecasted Market Size By Organization Size

8.4.5.1 Small and Medium-sized Businesses (SMBs)Large Enterprises

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 (BFSI (Banking

8.4.6.2 Financial Services

8.4.6.3 and Insurance Healthcare

8.4.6.4 IT and Telecom

8.4.6.5 Retail

8.4.6.6 Education

8.4.6.7 Manufacturing

8.4.6.8 Government

8.4.6.9 Others (Real Estate

8.4.6.10 Hospitality

8.4.6.11 etc.)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cloud PBX Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Deployment Type

8.5.4.1 Public Cloud

8.5.4.2 Private Cloud

8.5.4.3 Hybrid Cloud

8.5.5 Historic and Forecasted Market Size By Organization Size

8.5.5.1 Small and Medium-sized Businesses (SMBs)Large Enterprises

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 (BFSI (Banking

8.5.6.2 Financial Services

8.5.6.3 and Insurance Healthcare

8.5.6.4 IT and Telecom

8.5.6.5 Retail

8.5.6.6 Education

8.5.6.7 Manufacturing

8.5.6.8 Government

8.5.6.9 Others (Real Estate

8.5.6.10 Hospitality

8.5.6.11 etc.)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cloud PBX Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Deployment Type

8.6.4.1 Public Cloud

8.6.4.2 Private Cloud

8.6.4.3 Hybrid Cloud

8.6.5 Historic and Forecasted Market Size By Organization Size

8.6.5.1 Small and Medium-sized Businesses (SMBs)Large Enterprises

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 (BFSI (Banking

8.6.6.2 Financial Services

8.6.6.3 and Insurance Healthcare

8.6.6.4 IT and Telecom

8.6.6.5 Retail

8.6.6.6 Education

8.6.6.7 Manufacturing

8.6.6.8 Government

8.6.6.9 Others (Real Estate

8.6.6.10 Hospitality

8.6.6.11 etc.)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cloud PBX Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Deployment Type

8.7.4.1 Public Cloud

8.7.4.2 Private Cloud

8.7.4.3 Hybrid Cloud

8.7.5 Historic and Forecasted Market Size By Organization Size

8.7.5.1 Small and Medium-sized Businesses (SMBs)Large Enterprises

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 (BFSI (Banking

8.7.6.2 Financial Services

8.7.6.3 and Insurance Healthcare

8.7.6.4 IT and Telecom

8.7.6.5 Retail

8.7.6.6 Education

8.7.6.7 Manufacturing

8.7.6.8 Government

8.7.6.9 Others (Real Estate

8.7.6.10 Hospitality

8.7.6.11 etc.)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Contact Center Software Market research report?

A1: The forecast period in the Contact Center Software Market research report is 2024-2032.

Q2: Who are the key players in the Contact Center Software Market?

A2: Amazon Web Services Inc. (USA), 8X8 Inc. (USA), Ameyo (India), Altivon (USA), ALE International (France), Amtelco (USA), Enghouse Interactive Inc. (Canada), Aspect Software (USA), Avaya Inc. (USA), Avoxi (USA), Cisco Systems Inc. (USA), Exotel Techcom Pvt. Ltd. (India), Five9 Inc. (USA), Microsoft Corporation (USA), NEC Corporation (Japan), Genesys (USA), Spok Inc. (USA), SAP SE (Germany), Talkdesk Inc. (USA), Twilio Inc. (USA), UiPath (USA), Unify Inc. (Germany), VCC Live (Romania), Other Active Players.

Q3: What are the segments of the Contact Center Software Market?

A3: The Contact Center Software Market is segmented into By Component, By Software Type, By Deployment Mode, By Enterprise Size, By Industry Vertical and region. By Component (Solution and Services), By Software Type (Intelligent Call Routing, IVR, Workforce Management, Reporting & Analytics, Security Functions, Intelligent Virtual Assistant, and Others), By Deployment Mode (Cloud and On-premise), By Enterprise Size (Large Enterprises and SMEs), By Industry Vertical (BFSI, Healthcare, Retail & E-Commerce, Government & Education, IT & Telecom, Travel & Hospitality, and Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Contact Center Software Market?

A4: Contact center software refers to a suite of digital tools and platforms designed to manage and optimize customer interactions across various communication channels, including voice calls, email, live chat, social media, and messaging apps. This software enables businesses to streamline customer support operations by providing features such as call routing, automated workflows, real-time analytics, and integration with customer relationship management (CRM) systems. Contact center software enhances the efficiency of customer service teams, ensuring timely responses and personalized experiences while improving overall customer satisfaction and operational productivity.

Q5: How big is the Self-Testing Market?

A5: Contact Center Software Market Size Was Valued at USD 26.5 Billion in 2023, and is Projected to Reach USD 148.1 Billion by 2032, Growing at a CAGR of 24% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!