Stay Ahead in Fast-Growing Economies.

Browse Reports NowConstruction Equipment Rental Market Insights, Dynamics, and Growth Forecast (2024-2032)

The Construction Equipment Rental Market can be described as the industry involved in the leasing of construction and infrastructure equipment and machinery in the construction industry and its related sectors.

IMR Group

Description

Construction Equipment Rental Market Synopsis:

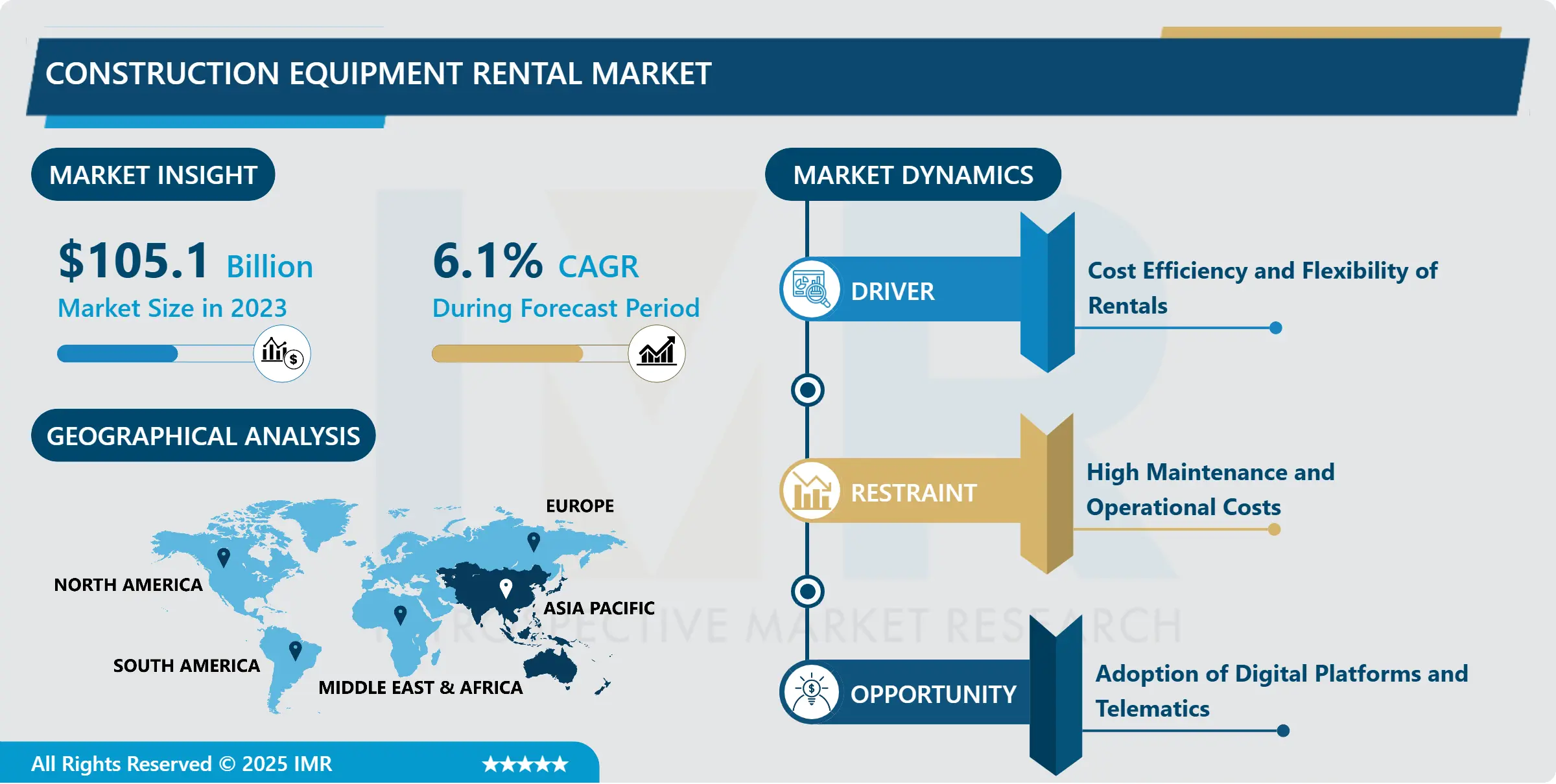

Construction Equipment Rental Market Size Was Valued at USD 105.10 Billion in 2023, and is Projected to Reach USD 179.08 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

The Construction Equipment Rental Market can be described as the industry involved in the leasing of construction and infrastructure equipment and machinery in the construction industry and its related sectors. These rental services help business to obtain important fleet including cranes, excavators, and bulldozers without having to embark on an expensive process of acquiring them. The market encompasses rental services of different types of equipment for operation in construction, mining, oil & gas and manufacturing industrie.

The primary force behind the market for construction equipment rentals is the exponential expansion of the construction sector all across the world. That is so because of urbanization and development of infrastructure in emerging economies they require construction equipment. Leasing these machines means lower overhead expenses for the firm while all is set to have optimum access to the best technology and appropriate large-scale machines for the job.

Construction equipment can be rented instead of being bought as it has major cost benefits than the later. It also helps the companies reduce their initial massive investments, have low costs for equipment maintenance, and gain more versatile work. It shows that rental services are scalable which enable the business to acquire certain machinery at a certain time without having to own it so thus improving its cash flow and operations.

Construction Equipment Rental Market Trend Analysis

Technological Integration

Technological features such as telematics, GPS, and the IoT are being integrated in to the construction equipment rental market more and more. These technologies assist rental companies to track overall usage, condition and maintenance of the equipment in their fleets real time, thus improving fleet management, equipment utilization, customer satisfaction and overall rental yields.

There is another unstable trend on the market – an increase in the popularity of environmentally friendly construction equipment, including electric and hybrid. As the government introduces stricter rules on environmental conservation, construction firms are using rental services to access equipment which has better environmental performance than traditional equipment that uses diesel.

Expansion in Emerging Markets

It is forecasted that the growth of the construction equipment rental business will have a tendency towards the emerging economies including Asia-Pacific, Latin America, and Middle East. These regions are experiencing faster pace of construction and infrastructure development and therefore it means that more rental facilities are likely to be required.

Another key opportunity is the growing availability of digital platforms, on which equipment rental bookings and management have become simplicity. These sites allow users to view the price offered and the supply of the services, book rental services, making it easier for the clients and also introducing new income sources to rental businesses.

Construction Equipment Rental Market Segment Analysis:

Construction Equipment Rental Market is Segmented on the basis of Equipment Type, Application, End User, and Region.

By Equipment Type, Earthmoving Equipment segment is expected to dominate the market during the forecast period

Market segmentation is done based on equipment type and major segment as earthmoving equipment, material handling equipment, concrete & road construction equipment, cranes & lifting equipment and others. Each own equipment category meets various needs in constructing projects- transportation of huge materials, lifting and maneuvering of equipments etc, in order to meet as many needs as possible in a certain project.

By Application, Residential segment expected to held the largest share

The construction equipment rental market is also segmented by application according to the field of Residential, Commercial and Industrial. In the Residential segment, equipment is hired for apartment buildings and housing complexes, and Commercial segment consist of equipments hire requirements of office complexes, shopping complexes, etc. The Industrial segment deals with large structures industries, both construction and maintenance dealings with large machineries.

Construction Equipment Rental Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is a leading region for the construction equipment rental market around the world, especially as a result of the incessant urbanization and the massive development of infrastructures in countries such as China, India, Japan, and Australia. Owing to accelerating investment in residential, commercial and industrial construction, rental construction equipment is on the rise. Authorities in the region are concentrating on the development of complex infrastructure including transport systems, smart cities, and energy industries, all of which increase demand for a range of rental equipment. The construction industry of this region also enjoys favourable government policies on public private partnerships for construction and infrastructure development.

This, coupled with increasing demand from a growing middle class and faster rate of industrialization especially in urban areas is a main reason to this market. Rental companies are now aiming at offering cheap and viable solutions in line with the requirements of the construction, mining, oil & gas and manufacturing industries. Although modern technology is increasingly used in the sector, the use of telematics and environmentally friendly, energy-saving equipment is also increasing in developed countries such as Japan and China. Moreover, the digital platform for rental services is increasing, and it is making convenient for businesses in the region for renting services.

Active Key Players in the Construction Equipment Rental Market

Ahern Rentals (USA)

Ashtead Group (UK)

Cramo (Finland)

Hertz Equipment Rental (USA)

Kobelco Construction Equipment (Japan)

Loxam (France)

Manitou Group (France)

Sunbelt Rentals (USA)

United Rentals (USA)

Zoomlion (China)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Construction Equipment Rental Market by Equipment Type

4.1 Construction Equipment Rental Market Snapshot and Growth Engine

4.2 Construction Equipment Rental Market Overview

4.3 Earthmoving Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Earthmoving Equipment: Geographic Segmentation Analysis

4.4 Material Handling Equipment

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Material Handling Equipment: Geographic Segmentation Analysis

4.5 Concrete & Road Construction Equipment

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Concrete & Road Construction Equipment: Geographic Segmentation Analysis

4.6 Cranes & Lifting Equipment

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Cranes & Lifting Equipment: Geographic Segmentation Analysis

4.7 Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Others: Geographic Segmentation Analysis

Chapter 5: Construction Equipment Rental Market by Application

5.1 Construction Equipment Rental Market Snapshot and Growth Engine

5.2 Construction Equipment Rental Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Residential: Geographic Segmentation Analysis

5.4 Commercial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial: Geographic Segmentation Analysis

5.5 Industrial

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Industrial: Geographic Segmentation Analysis

Chapter 6: Construction Equipment Rental Market by End User

6.1 Construction Equipment Rental Market Snapshot and Growth Engine

6.2 Construction Equipment Rental Market Overview

6.3 Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Construction: Geographic Segmentation Analysis

6.4 Oil & Gas

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Oil & Gas: Geographic Segmentation Analysis

6.5 Mining

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Mining: Geographic Segmentation Analysis

6.6 Manufacturing

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Manufacturing: Geographic Segmentation Analysis

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Construction Equipment Rental Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 UNITED RENTALS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 LOXAM (FRANCE)

7.4 HERTZ EQUIPMENT RENTAL (USA)

7.5 ASHTEAD GROUP (UK)

7.6 AHERN RENTALS (USA)

7.7 SUNBELT RENTALS (USA)

7.8 CRAMO (FINLAND)

7.9 KOBELCO CONSTRUCTION EQUIPMENT (JAPAN)

7.10 ZOOMLION (CHINA)

7.11 MANITOU GROUP (FRANCE)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Construction Equipment Rental Market By Region

8.1 Overview

8.2. North America Construction Equipment Rental Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Equipment Type

8.2.4.1 Earthmoving Equipment

8.2.4.2 Material Handling Equipment

8.2.4.3 Concrete & Road Construction Equipment

8.2.4.4 Cranes & Lifting Equipment

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Residential

8.2.5.2 Commercial

8.2.5.3 Industrial

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Construction

8.2.6.2 Oil & Gas

8.2.6.3 Mining

8.2.6.4 Manufacturing

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Construction Equipment Rental Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Equipment Type

8.3.4.1 Earthmoving Equipment

8.3.4.2 Material Handling Equipment

8.3.4.3 Concrete & Road Construction Equipment

8.3.4.4 Cranes & Lifting Equipment

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Residential

8.3.5.2 Commercial

8.3.5.3 Industrial

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Construction

8.3.6.2 Oil & Gas

8.3.6.3 Mining

8.3.6.4 Manufacturing

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Construction Equipment Rental Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Equipment Type

8.4.4.1 Earthmoving Equipment

8.4.4.2 Material Handling Equipment

8.4.4.3 Concrete & Road Construction Equipment

8.4.4.4 Cranes & Lifting Equipment

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Residential

8.4.5.2 Commercial

8.4.5.3 Industrial

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Construction

8.4.6.2 Oil & Gas

8.4.6.3 Mining

8.4.6.4 Manufacturing

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Construction Equipment Rental Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Equipment Type

8.5.4.1 Earthmoving Equipment

8.5.4.2 Material Handling Equipment

8.5.4.3 Concrete & Road Construction Equipment

8.5.4.4 Cranes & Lifting Equipment

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Residential

8.5.5.2 Commercial

8.5.5.3 Industrial

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Construction

8.5.6.2 Oil & Gas

8.5.6.3 Mining

8.5.6.4 Manufacturing

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Construction Equipment Rental Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Equipment Type

8.6.4.1 Earthmoving Equipment

8.6.4.2 Material Handling Equipment

8.6.4.3 Concrete & Road Construction Equipment

8.6.4.4 Cranes & Lifting Equipment

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Residential

8.6.5.2 Commercial

8.6.5.3 Industrial

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Construction

8.6.6.2 Oil & Gas

8.6.6.3 Mining

8.6.6.4 Manufacturing

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Construction Equipment Rental Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Equipment Type

8.7.4.1 Earthmoving Equipment

8.7.4.2 Material Handling Equipment

8.7.4.3 Concrete & Road Construction Equipment

8.7.4.4 Cranes & Lifting Equipment

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Residential

8.7.5.2 Commercial

8.7.5.3 Industrial

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Construction

8.7.6.2 Oil & Gas

8.7.6.3 Mining

8.7.6.4 Manufacturing

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Construction Equipment Rental Market research report?

A1: The forecast period in the Construction Equipment Rental Market research report is 2024-2032.

Q2: Who are the key players in the Construction Equipment Rental Market?

A2: United Rentals (USA), Loxam (France), Hertz Equipment Rental (USA), Ashtead Group (UK), Ahern Rentals (USA), Sunbelt Rentals (USA), Cramo (Finland), Kobelco Construction Equipment (Japan), Zoomlion (China), Manitou Group (France) and Other Active Players.

Q3: What are the segments of the Construction Equipment Rental Market?

A3: The Construction Equipment Rental Market is segmented into by Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete & Road Construction Equipment, Cranes & Lifting Equipment, Others), Application (Residential, Commercial, Industrial), End User (Construction, Oil & Gas, Mining, Manufacturing, Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Construction Equipment Rental Market?

A4: The Construction Equipment Rental Market can be described as the industry involved in the leasing of construction and infrastructure equipment and machinery in the construction industry and its related sectors. These rental services help business to obtain important fleet including cranes, excavators, and bulldozers without having to embark on an expensive process of acquiring them. The market encompasses rental services of different types of equipment for operation in construction, mining, oil & gas and manufacturing industrie.

Q5: How big is the Construction Equipment Rental Market?

A5: Construction Equipment Rental Market Size Was Valued at USD 105.10 Billion in 2023, and is Projected to Reach USD 179.08 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!