Stay Ahead in Fast-Growing Economies.

Browse Reports NowConstruction Drone Market Size, Share, Growth & Forecast (2024-2032)

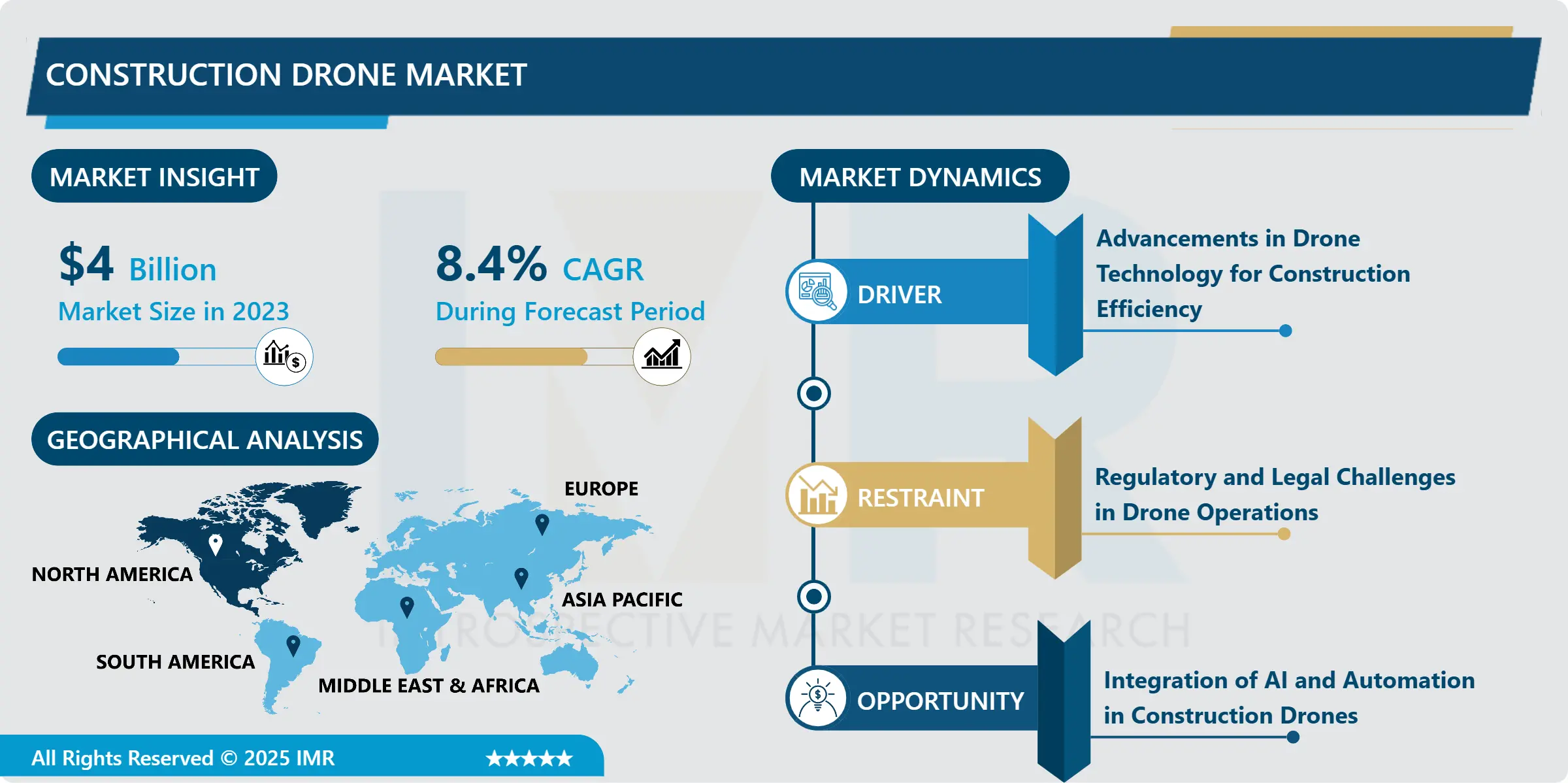

Construction Drone Market Size Was Valued at USD 4.00 Billion in 2023, and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 8.40% From 2024-2032.

IMR Group

Description

Construction Drone Market Synopsis:

Construction Drone Market Size Was Valued at USD 4.00 Billion in 2023, and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 8.40% From 2024-2032.

Construction drone market is referred to the fourth revolution, which is the Construction UAVs or drones for surveying, mapping, inspection, monitoring and material delivery within the construction projects. They contribute to increased performance, decreased expenses and increased safety through offering a clear vision of the construction site and timely data and accurate construction work.

Higher accuracy and efficiency coupled with quality production are the main factors that drive the construction drone industry. They allow for real-time data capturing, can help construction companies to cut down the periods spent on surveys or assessments of sites. The ability to obtain precise 3D imaging and high quality of aerial views proves to be useful in terms of planning the actual projects given that nowadays many projects are enormous.

The other factor that has been adopted is the safety and risk management which is rapidly gaining more importance. Especially in construction sites there are several dangers for workers and drones come in handy in that they avoid the exposure of workers to these risks as they offer an opportunity to inspect difficult terrains, high rise buildings or other risky sites. When it comes to performing construction works, the use of drones comes with efforts of reducing cases of accidents and time wastage.

Construction Drone Market Trend Analysis

Integration of drones with advanced technologies

The trends that run today, one of the main ones is the use of modern technologies – LiDAR and AI with construction drones. Drones with LiDAR technology give more accurate 3D models and topography surveys which improves construction surveys. Special software and artificial intelligence are applied to the analysis of data obtained with drones; also, it helps to enhance the decision-making of the requirements for project planning, inspections, and progress control.

Other current practice is the real-time monitoring and data analysis of construction sites using drones. Project managers can now use thermal cameras, high-definition cameras, and other sensors mounted on drones for continuous site monitoring and determine progress, probable problems and delays on a project. This trend is expected to transform when drones are developed to a point where they can perform several tasks without supervision.

Expansion of government regulations and policies in favor of UAV adoption presents

The construction drones market has vast future prospects in emerging markets and untapped markets such as Asia-Pacific & Latin America that is growing at an exponential rate in the construction sector. In these regions, the solution offering the application of drones for site surveying is cheaper and less reliant on expensive manual workforce and equipment compared to conventional counterparts. Since many construction companies operate in these regions are gradually adopting drones, it created for significant investments in UAV technology which will foster the growth of market.

Furthermore, new UAV initiatives and growing governmental support, promulgating the use of construction drones also provide the market opportunities. As drone technology gains broad acceptance in the market, governments are developing more specific rules regulating drone operations, which will prompt more construction businesses to employ drones. These rules prevent the misuse of drones, and also open up a window of opportunity for companies manufacturing drones and those who offer drone services.

Construction Drone Market Segment Analysis:

Construction Drone Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Fixed-wing Drones segment is expected to dominate the market during the forecast period

There are basically three types of drones- fixed wing drones, rotary blade drones, and hybrid drones. Thus, fixed-wing UAS are extended for field surveys and mainly used when large construction areas need to be mapped within a shorter period. Rotary-wing UAVs, specifically quadcopters, are more portable and usually are employed for inspections and sites’ monitoring because they are able to stay still and circle the object of interest. A hybrid drone is a mixture between a fixed and a rotary-wing aircraft with improved capabilities to be used in more diversified construction cases.

By Application, Surveying and Mapping segment expected to held the largest share

The construction drone market has varying uses, as surveying and mapping, inspection and monitoring, construction site mapping, aerial photography, and material transferring. Surveillance and mapping through drones enable production of comprehensive 3D models and topographical information thus enhancing site planning. They are used for inspection purposes, whereby such drones give an aerial view of the structural condition of a structure that may be hard to access. Reconnaissance and supervision drones are used for tracking the construction progress, schedule compliance as well as for reporting to the stakeholders. Furthermore, they have started being used for filming, photography, various advertisement and promotional shoots, for capturing better images of large areas and for delivery services reducing manpower and enhancing distribution services.

Construction Drone Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is the largest construction drone market owing to a higher level of technology integration and growth of construction industry in countries such as the United States of America and Canada. The use of drone technology in construction is actively embraced, none more so than the United States that has considerably invested in the technology for different construction uses.

The region has experienced increasing support from the government and appropriate legislation, and has recently enhanced its attention toward the infrastructure and smart cities. This trend, alongside with the growth of the construction drones’ market in North America and technological progress, which enhances the drones’ capacity, keeps the region leading.

Active Key Players in the Construction Drone Market

3D Robotics (USA)

AeroVironment (USA)

Delair (France)

DJI Innovations (China)

Kespry (USA)

Parrot SA (France)

Quantum Systems (Germany)

senseFly (Switzerland)

Skycatch (USA)

Trimble Inc. (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Construction Drone Market by Type

4.1 Construction Drone Market Snapshot and Growth Engine

4.2 Construction Drone Market Overview

4.3 Fixed-wing Drones

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Fixed-wing Drones: Geographic Segmentation Analysis

4.4 Rotary-wing Drones

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Rotary-wing Drones: Geographic Segmentation Analysis

4.5 Hybrid Drones

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Hybrid Drones: Geographic Segmentation Analysis

Chapter 5: Construction Drone Market by Application

5.1 Construction Drone Market Snapshot and Growth Engine

5.2 Construction Drone Market Overview

5.3 Surveying and Mapping

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Surveying and Mapping: Geographic Segmentation Analysis

5.4 Inspection

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Inspection: Geographic Segmentation Analysis

5.5 Monitoring and Management

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Monitoring and Management: Geographic Segmentation Analysis

5.6 Construction Site Mapping

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Construction Site Mapping: Geographic Segmentation Analysis

5.7 Aerial Photography

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Aerial Photography: Geographic Segmentation Analysis

5.8 Material Delivery

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Material Delivery: Geographic Segmentation Analysis

Chapter 6: Construction Drone Market by End User

6.1 Construction Drone Market Snapshot and Growth Engine

6.2 Construction Drone Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential: Geographic Segmentation Analysis

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Construction Drone Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DJI INNOVATIONS (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PARROT SA (FRANCE)

7.4 SENSEFLY (SWITZERLAND)

7.5 DELAIR (FRANCE)

7.6 3D ROBOTICS (USA)

7.7 AEROVIRONMENT (USA)

7.8 TRIMBLE INC. (USA)

7.9 QUANTUM SYSTEMS (GERMANY)

7.10 SKYCATCH (USA)

7.11 KESPRY (USA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Construction Drone Market By Region

8.1 Overview

8.2. North America Construction Drone Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Fixed-wing Drones

8.2.4.2 Rotary-wing Drones

8.2.4.3 Hybrid Drones

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Surveying and Mapping

8.2.5.2 Inspection

8.2.5.3 Monitoring and Management

8.2.5.4 Construction Site Mapping

8.2.5.5 Aerial Photography

8.2.5.6 Material Delivery

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Residential

8.2.6.2 Commercial

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Construction Drone Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Fixed-wing Drones

8.3.4.2 Rotary-wing Drones

8.3.4.3 Hybrid Drones

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Surveying and Mapping

8.3.5.2 Inspection

8.3.5.3 Monitoring and Management

8.3.5.4 Construction Site Mapping

8.3.5.5 Aerial Photography

8.3.5.6 Material Delivery

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Residential

8.3.6.2 Commercial

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Construction Drone Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Fixed-wing Drones

8.4.4.2 Rotary-wing Drones

8.4.4.3 Hybrid Drones

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Surveying and Mapping

8.4.5.2 Inspection

8.4.5.3 Monitoring and Management

8.4.5.4 Construction Site Mapping

8.4.5.5 Aerial Photography

8.4.5.6 Material Delivery

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Residential

8.4.6.2 Commercial

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Construction Drone Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Fixed-wing Drones

8.5.4.2 Rotary-wing Drones

8.5.4.3 Hybrid Drones

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Surveying and Mapping

8.5.5.2 Inspection

8.5.5.3 Monitoring and Management

8.5.5.4 Construction Site Mapping

8.5.5.5 Aerial Photography

8.5.5.6 Material Delivery

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Residential

8.5.6.2 Commercial

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Construction Drone Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Fixed-wing Drones

8.6.4.2 Rotary-wing Drones

8.6.4.3 Hybrid Drones

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Surveying and Mapping

8.6.5.2 Inspection

8.6.5.3 Monitoring and Management

8.6.5.4 Construction Site Mapping

8.6.5.5 Aerial Photography

8.6.5.6 Material Delivery

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Residential

8.6.6.2 Commercial

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Construction Drone Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Fixed-wing Drones

8.7.4.2 Rotary-wing Drones

8.7.4.3 Hybrid Drones

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Surveying and Mapping

8.7.5.2 Inspection

8.7.5.3 Monitoring and Management

8.7.5.4 Construction Site Mapping

8.7.5.5 Aerial Photography

8.7.5.6 Material Delivery

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Residential

8.7.6.2 Commercial

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Construction Drone Market research report?

A1: The forecast period in the Construction Drone Market research report is 2024-2032.

Q2: Who are the key players in the Construction Drone Market?

A2: DJI Innovations (China), Parrot SA (France), senseFly (Switzerland), Delair (France), 3D Robotics (USA), AeroVironment (USA), Trimble Inc. (USA), Quantum Systems (Germany), Skycatch (USA), Kespry (USA) and Other Active Players.

Q3: What are the segments of the Construction Drone Market?

A3: The Construction Drone Market is segmented into by Type (Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones), Application (Surveying and Mapping, Inspection, Monitoring and Management, Construction Site Mapping, Aerial Photography, Material Delivery), End User (Residential, Commercial, Industrial). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Construction Drone Market?

A4: Construction drone market is referred to the fourth revolution, which is the Construction UAVs or drones for surveying, mapping, inspection, monitoring and material delivery within the construction projects. They contribute to increased performance, decreased expenses and increased safety through offering a clear vision of the construction site and timely data and accurate construction work.

Q5: How big is the Construction Drone Market?

A5: Construction Drone Market Size Was Valued at USD 4.00 Billion in 2023, and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 8.40% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!