Stay Ahead in Fast-Growing Economies.

Browse Reports NowComputer System Validation Market Insights, Dynamics, and Growth Forecast (2024-2032)

CSV market in context means the development and implementation of software qualification in compliance with specific global regulatory compliance requirements for industries related to pharmaceuticals, biotechnology, healthcare and life sciences.

IMR Group

Description

Computer System Validation Market Synopsis:

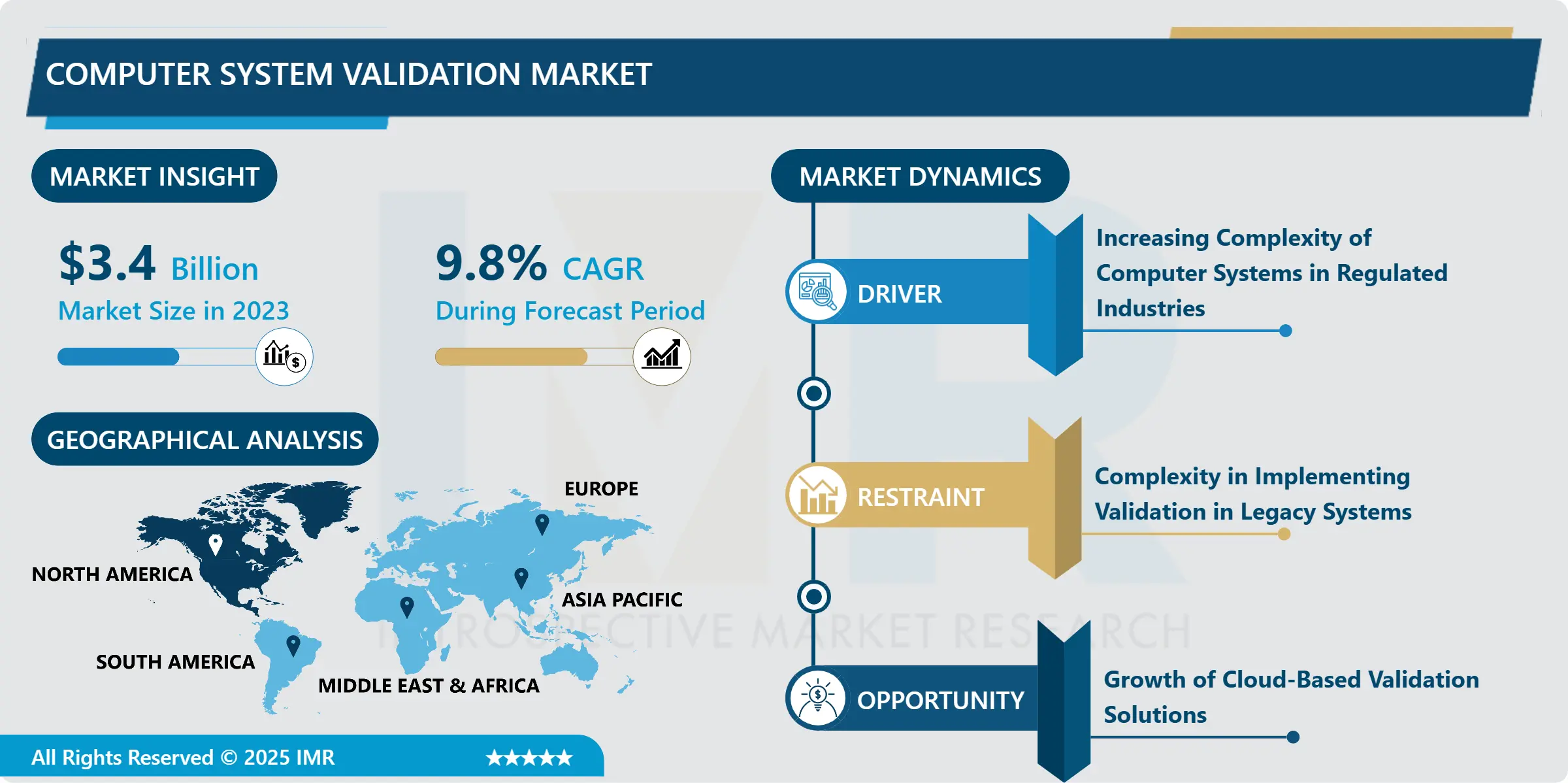

Computer System Validation Market Size Was Valued at USD 3.40 Billion in 2023, and is Projected to Reach USD 7.88 Billion by 2032, Growing at a CAGR of 9.80% From 2024-2032.

CSV market in context means the development and implementation of software qualification in compliance with specific global regulatory compliance requirements for industries related to pharmaceuticals, biotechnology, healthcare and life sciences. The three main practices used in this validation process include checking that systems are implemented, controlled, and documented to be functional, secure, and compliant with regulations that make products produced by these systems safe and of good quality.

Higher regulatory requirements and regulatory expectations in areas of business or field including pharmacy, bioengineering, and health services have greatly contributed to the requirement for systematic computer system validation. The FDA and EMA demanded corporates to validate the viability of the computer systems used in executing their tasks to ensure that they meet the existing quality, security and accuracy requirement. Thus, there is an increased future requirement for more extensive validation services and strategies to minimize organizational conformity hazards and disruption.

That is why, based on the progress in the field of computing, many new technologies such as clouds, automatons, artificial intelligence, and others enhance the computer systems and need better validation. These new technologies compel organisations to test their systems to ensure that the various systems are compliant, secure as well as reliable. Whenever organisations move to higher levels of process improvement, the validation step is a key component that ensures the various systems are performing correctly.

Computer System Validation Market Trend Analysis

Adoption of Cloud-Based Validation Solutions

The application of this concept has become popular in the Computer System Validation market. They also present advantages such as flexibility, affordability and convenience that enable firms to simplify the validation procedure. These solutions must also be capable of interfacing with other current and emerging cloud computing technologies and standards as well as support internal/external collaboration and data sharing whilst being compliant to the industry regulations. With the advancement in the uptake of the cloud solutions comes the need for a comprehensive validation service.

Increased use is being put on automation for computer system validation. There are increases in speed of validation, decrease in human errors, and a decrease in costs of operation with continued compliance. It can also be self-operational to offer real time control and where there is a problem, it will be identified instantly. This trend is havinghtable transforming the market as it enhances validation procedures’ efficiency and effectiveness.

Emerging Markets and Regulatory Expansion

Furthermore, with Asia Pacific and Latin America emerging as growing markets for computer system validation is on the rise. These regions are now rapidly industrializing particularly in pharmaceuticals and health products and services where regulation is tightening. The companies of these regions are opting for CSV solutions to validate compliance with the international standards, which has service providers a favourable market scope.

AI and machine learning is an integrating concept with computer system validation still being an opportunity in its development. By using power technologies, the volume and speed of validation can be increased as well as potential problems found faster than using conventional approaches. These include forecasting future validation requirements, giving new chances for the proactive handling of systems and compliance as the organization faces new and continuously changing conditions.

Computer System Validation Market Segment Analysis:

Computer System Validation Market is Segmented on the basis of type, Component, Validation Type, End User, and Region.

By Type, Software Validation segment is expected to dominate the market during the forecast period

Software validation mainly target the assurance that the software applications fulfils the regulatory, functional, and security needs. This segment is a prerequisite for the software to perform as expected in its intended environment, and it is defection-free and conforms with prescribed regulatory requirements. Hardware validation means identifying whether the equipment and HW infrastructure match specified requirements and behave properly. This includes the integrity, reliability, and compatibility of the system as a whole, as well as hardware systems and sub systems to ensure all elements of the hardware are conformal with regulatory requirements. Process validation is the way of how an organisation can prove that its specific activities, including manufacturing or production ones, are standardised and reproducible. Regarding CSV, this kind of checking guarantees the proper and thorough execution of all operations of computer systems with regulations into consideration.

By Validation Type, Retrospective Validation segment expected to held the largest share

Retrospective validation is commonly a process of validating different systems with reference to historical data. They are normally conducted after implementation of the system to verify compliance and this is without a lot of changes on the system. This type of validation takes place at a stage before the new system is put into practice. It also includes activities concerning the level of the system before it is implemented to meet the proposed goals and requirements and legal standards. This is important in making sure that new systems remain compliant to the letter when they are let out of the ‘Barn’. Concurrent validation means that the systems being designed are validated at the same time that they are being implemented. It enables an organisation to check during employment that the systems are sustained in the instances mentioned above without the need to halt operations to undertake a check if the system is complying. Periodic validation means continuous or recurrent validation of the systems which are already implemented. This means that systems remain compliant with regulatory and functional specifications at specific intervals especially when upgrades or alterations are being undertaken.

Computer System Validation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America especially the United States holds the largest market share for the Computer System Validation caused by strict regulatory requirement set by FDA and other regulatory agencies which put high demands on Computer System Validation processes. Furthermore, the increased number of pharmaceuticals and biotechnology and healthcare industries in North America pushes up demand for validation services beyond this figure.

The advancement in technology, especially the supporting government policies to industries that depend on computer systems are to continue to propel the growth of this market in the region. Essentials players’ location in North America also speaks for it, thus allowing for creating relevant local solutions that complies with local legal requirements and standards.

Active Key Players in the Computer System Validation Market

Accenture (Ireland)

Cognizant Technology Solutions (USA)

Computer Systems Validation Services (UK)

Dassault Systèmes (France)

IBM Corporation (USA)

IQVIA (USA)

Labcorp Drug Development (USA)

PAREXEL International (USA)

Veeva Systems (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Computer System Validation Market by Type

4.1 Computer System Validation Market Snapshot and Growth Engine

4.2 Computer System Validation Market Overview

4.3 Software Validation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Software Validation: Geographic Segmentation Analysis

4.4 Hardware Validation

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Hardware Validation: Geographic Segmentation Analysis

4.5 Process Validation

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Process Validation: Geographic Segmentation Analysis

Chapter 5: Computer System Validation Market by Component

5.1 Computer System Validation Market Snapshot and Growth Engine

5.2 Computer System Validation Market Overview

5.3 Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Services: Geographic Segmentation Analysis

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Geographic Segmentation Analysis

5.5 Validation Tools

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Validation Tools: Geographic Segmentation Analysis

Chapter 6: Computer System Validation Market by Validation Type

6.1 Computer System Validation Market Snapshot and Growth Engine

6.2 Computer System Validation Market Overview

6.3 Retrospective Validation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Retrospective Validation: Geographic Segmentation Analysis

6.4 Prospective Validation

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Prospective Validation: Geographic Segmentation Analysis

6.5 Concurrent Validation

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Concurrent Validation: Geographic Segmentation Analysis

6.6 Periodic Validation

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Periodic Validation: Geographic Segmentation Analysis

Chapter 7: Computer System Validation Market by End User

7.1 Computer System Validation Market Snapshot and Growth Engine

7.2 Computer System Validation Market Overview

7.3 Pharmaceutical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Pharmaceutical: Geographic Segmentation Analysis

7.4 Healthcare

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Healthcare: Geographic Segmentation Analysis

7.5 Life Sciences

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Life Sciences: Geographic Segmentation Analysis

7.6 Biotechnology

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Biotechnology: Geographic Segmentation Analysis

7.7 Food & Beverages

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Food & Beverages: Geographic Segmentation Analysis

7.8 Other Industries

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Other Industries: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Computer System Validation Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IQVIA (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DASSAULT SYSTÈMES (FRANCE)

8.4 LABCORP DRUG DEVELOPMENT (USA)

8.5 COMPUTER SYSTEMS VALIDATION SERVICES (UK)

8.6 VEEVA SYSTEMS (USA)

8.7 COGNIZANT TECHNOLOGY SOLUTIONS (USA)

8.8 TUV RHEINLAND (GERMANY)

8.9 ACCENTURE (IRELAND)

8.10 PAREXEL INTERNATIONAL (USA)

8.11 IBM CORPORATION (USA)

8.12 OTHER ACTIVE PLAYERS

Chapter 9: Global Computer System Validation Market By Region

9.1 Overview

9.2. North America Computer System Validation Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Software Validation

9.2.4.2 Hardware Validation

9.2.4.3 Process Validation

9.2.5 Historic and Forecasted Market Size By Component

9.2.5.1 Services

9.2.5.2 Software

9.2.5.3 Validation Tools

9.2.6 Historic and Forecasted Market Size By Validation Type

9.2.6.1 Retrospective Validation

9.2.6.2 Prospective Validation

9.2.6.3 Concurrent Validation

9.2.6.4 Periodic Validation

9.2.7 Historic and Forecasted Market Size By End User

9.2.7.1 Pharmaceutical

9.2.7.2 Healthcare

9.2.7.3 Life Sciences

9.2.7.4 Biotechnology

9.2.7.5 Food & Beverages

9.2.7.6 Other Industries

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Computer System Validation Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Software Validation

9.3.4.2 Hardware Validation

9.3.4.3 Process Validation

9.3.5 Historic and Forecasted Market Size By Component

9.3.5.1 Services

9.3.5.2 Software

9.3.5.3 Validation Tools

9.3.6 Historic and Forecasted Market Size By Validation Type

9.3.6.1 Retrospective Validation

9.3.6.2 Prospective Validation

9.3.6.3 Concurrent Validation

9.3.6.4 Periodic Validation

9.3.7 Historic and Forecasted Market Size By End User

9.3.7.1 Pharmaceutical

9.3.7.2 Healthcare

9.3.7.3 Life Sciences

9.3.7.4 Biotechnology

9.3.7.5 Food & Beverages

9.3.7.6 Other Industries

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Computer System Validation Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Software Validation

9.4.4.2 Hardware Validation

9.4.4.3 Process Validation

9.4.5 Historic and Forecasted Market Size By Component

9.4.5.1 Services

9.4.5.2 Software

9.4.5.3 Validation Tools

9.4.6 Historic and Forecasted Market Size By Validation Type

9.4.6.1 Retrospective Validation

9.4.6.2 Prospective Validation

9.4.6.3 Concurrent Validation

9.4.6.4 Periodic Validation

9.4.7 Historic and Forecasted Market Size By End User

9.4.7.1 Pharmaceutical

9.4.7.2 Healthcare

9.4.7.3 Life Sciences

9.4.7.4 Biotechnology

9.4.7.5 Food & Beverages

9.4.7.6 Other Industries

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Computer System Validation Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Software Validation

9.5.4.2 Hardware Validation

9.5.4.3 Process Validation

9.5.5 Historic and Forecasted Market Size By Component

9.5.5.1 Services

9.5.5.2 Software

9.5.5.3 Validation Tools

9.5.6 Historic and Forecasted Market Size By Validation Type

9.5.6.1 Retrospective Validation

9.5.6.2 Prospective Validation

9.5.6.3 Concurrent Validation

9.5.6.4 Periodic Validation

9.5.7 Historic and Forecasted Market Size By End User

9.5.7.1 Pharmaceutical

9.5.7.2 Healthcare

9.5.7.3 Life Sciences

9.5.7.4 Biotechnology

9.5.7.5 Food & Beverages

9.5.7.6 Other Industries

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Computer System Validation Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Software Validation

9.6.4.2 Hardware Validation

9.6.4.3 Process Validation

9.6.5 Historic and Forecasted Market Size By Component

9.6.5.1 Services

9.6.5.2 Software

9.6.5.3 Validation Tools

9.6.6 Historic and Forecasted Market Size By Validation Type

9.6.6.1 Retrospective Validation

9.6.6.2 Prospective Validation

9.6.6.3 Concurrent Validation

9.6.6.4 Periodic Validation

9.6.7 Historic and Forecasted Market Size By End User

9.6.7.1 Pharmaceutical

9.6.7.2 Healthcare

9.6.7.3 Life Sciences

9.6.7.4 Biotechnology

9.6.7.5 Food & Beverages

9.6.7.6 Other Industries

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Computer System Validation Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Software Validation

9.7.4.2 Hardware Validation

9.7.4.3 Process Validation

9.7.5 Historic and Forecasted Market Size By Component

9.7.5.1 Services

9.7.5.2 Software

9.7.5.3 Validation Tools

9.7.6 Historic and Forecasted Market Size By Validation Type

9.7.6.1 Retrospective Validation

9.7.6.2 Prospective Validation

9.7.6.3 Concurrent Validation

9.7.6.4 Periodic Validation

9.7.7 Historic and Forecasted Market Size By End User

9.7.7.1 Pharmaceutical

9.7.7.2 Healthcare

9.7.7.3 Life Sciences

9.7.7.4 Biotechnology

9.7.7.5 Food & Beverages

9.7.7.6 Other Industries

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Computer System Validation Market research report?

A1: The forecast period in the Computer System Validation Market research report is 2024-2032.

Q2: Who are the key players in the Computer System Validation Market?

A2: IQVIA (USA), Dassault Systèmes (France), Labcorp Drug Development (USA), Computer Systems Validation Services (UK), Veeva Systems (USA), Cognizant Technology Solutions (USA), TUV Rheinland (Germany), Accenture (Ireland), PAREXEL International (USA), IBM Corporation (USA) and Other Active Players.

Q3: What are the segments of the Computer System Validation Market?

A3: The Computer System Validation Market is segmented into by Type (Software Validation, Hardware Validation, Process Validation), Component (Services, Software, Validation Tools), Validation Type (Retrospective Validation, Prospective Validation, Concurrent Validation, Periodic Validation), End User (Pharmaceutical, Healthcare, Life Sciences, Biotechnology, Food & Beverages, Other Industries). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Computer System Validation Market?

A4: CSV market in context means the development and implementation of software qualification in compliance with specific global regulatory compliance requirements for industries related to pharmaceuticals, biotechnology, healthcare and life sciences. The three main practices used in this validation process include checking that systems are implemented, controlled, and documented to be functional, secure, and compliant with regulations that make products produced by these systems safe and of good quality.

Q5: How big is the Computer System Validation Market?

A5: Computer System Validation Market Size Was Valued at USD 3.40 Billion in 2023, and is Projected to Reach USD 7.88 Billion by 2032, Growing at a CAGR of 9.80% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!