Stay Ahead in Fast-Growing Economies.

Browse Reports NowClean Coal Market – Opportunities & Growth Forecast 2025-2032

Clean coal refers to various technologies designed to mitigate the environmental impact of coal usage, primarily through methods such as wet scrubbers for sulfur dioxide removal, coal washing to eliminate impurities, and digitalization to enhance efficiency. The main practice of clean coal employs carbon capture and storage (CCS) technology, which captures carbon emissions from coal burning and then safely buries them underground. Technologically, CCS functions properly, yet maintaining economic feasibility requires a big monetary investment to construct supporting infrastructure. The promotion of clean coal to enhance coal sustainability led to its temporary political status as a futuristic solution because coal naturally produces environmental pollution.

IMR Group

Description

Clean Coal Market Synopsis:

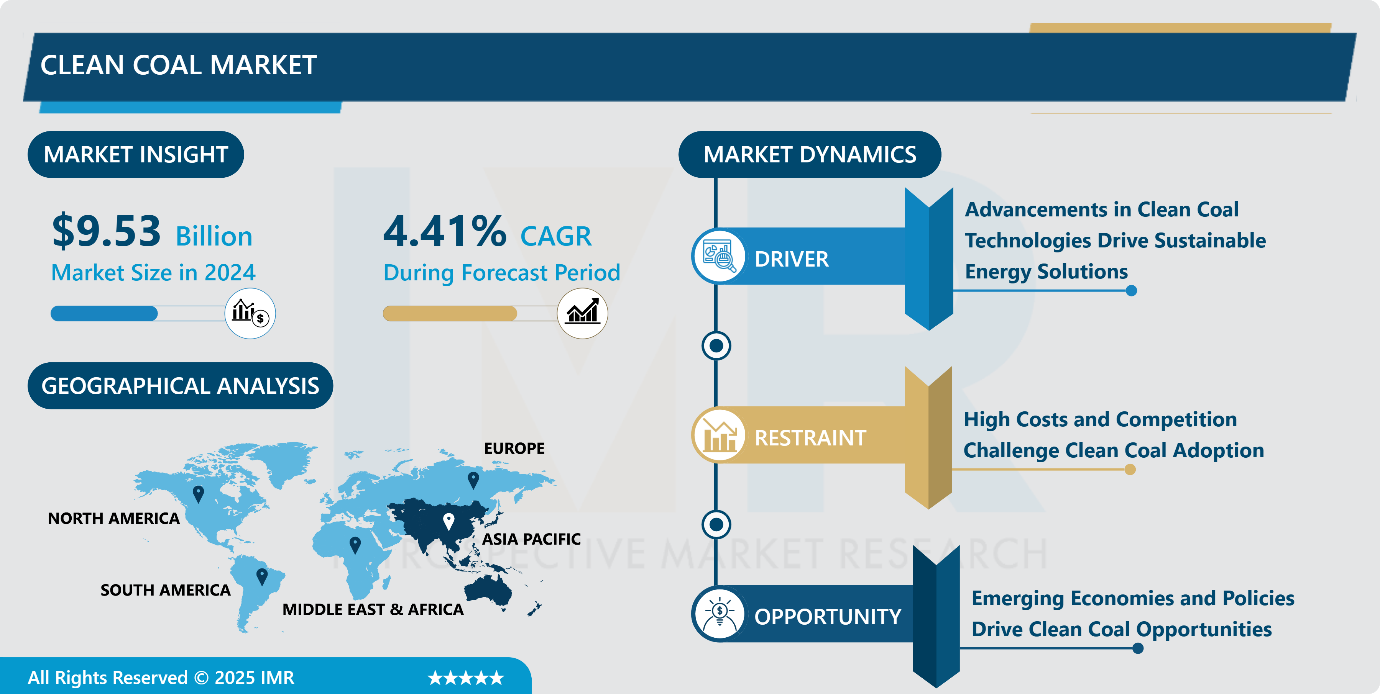

Clean Coal Market Size Was Valued at USD 9.53 Billion in 2024, and is Projected to Reach USD 13.46 Million by 2032, Growing at a CAGR of 4.41% from 2025-2032.

Clean coal refers to various technologies designed to mitigate the environmental impact of coal usage, primarily through methods such as wet scrubbers for sulfur dioxide removal, coal washing to eliminate impurities, and digitalization to enhance efficiency. The main practice of clean coal employs carbon capture and storage (CCS) technology, which captures carbon emissions from coal burning and then safely buries them underground. Technologically, CCS functions properly, yet maintaining economic feasibility requires a big monetary investment to construct supporting infrastructure. The promotion of clean coal to enhance coal sustainability led to its temporary political status as a futuristic solution because coal naturally produces environmental pollution.

The global coal market demonstrates coal consumption reduction patterns because nations focus on renewable energy adoption and enforce environmental standards, along with CCS retrofitting costs being high. The demand for coal energy remains high across numerous countries, particularly in developing economies, because it provides both affordable access and availability. While governments and industries maintain an ongoing discussion about clean coal, they balance their energy requirements against environmental considerations.

Clean Coal Market Growth and Trend Analysis:

Growth Driver

Advancements in Clean Coal Technologies Drive Sustainable Energy Solutions

The global clean coal market is experiencing rapid advancements in high-efficiency, low-emission (HELE) technologies, including ultra-supercritical (USC) and integrated gasification combined cycle (IGCC). Carbon capture, utilization, and storage (CCUS) stands as a primary method to reduce emissions in coal-fired facilities. Both oxy-fuel combustion and fluidized bed combustion models demonstrate growing potential as clean methods for using coal. The coal-to-liquid (CTL) and coal-to-gas (CTG) conversion technologies have begun developing methods to generate sustainable fuel products.

Smart technology brought better operational effectiveness to coal-fired power plants. As a new emerging trend, the production of hydrogen from coal enters the market while applying carbon capture capabilities. Scientists continue to conduct research that explores environmentally friendly approaches to using coal with biomass co-firing. Several enhanced coal processing methods enhance both fuel quality and decrease environmental air pollution emissions. The private sector and governments are actively investing in advanced clean coal technologies. Technology developments in carbon recycling together with utilization practices, will direct the sustainable use of coal during future times.

High Costs and Competition Challenge Clean Coal Adoption

The adoption of clean coal is hindered by the high upfront capital investment required for implementing advanced technologies like carbon capture and storage (CCS). Additionally, environmental concerns about coal mining and long-term sustainability persist, limiting widespread acceptance. Regulatory policies in various countries also create uncertainty around the economic viability of clean coal projects. Finally, the market faces competition from rapidly advancing renewable energy sources, which are often seen as more sustainable alternatives.

Opportunities

Emerging Economies and Policies Drive Clean Coal

There is a significant opportunity in emerging economies where coal remains a primary energy source, offering a pathway to reduce carbon emissions while maintaining energy security. Governments worldwide are increasingly supporting research and development for clean coal solutions through funding and policy initiatives. The integration of clean coal technology with existing infrastructure provides a cost-effective solution for mitigating climate change. Additionally, growing demand for carbon-neutral energy solutions presents a chance for clean coal to play a critical role in achieving climate goals.

Technical Hurdles and Public Perception Challenge Clean Coal’s Future

One major challenge for the clean coal market is the technical complexity and scalability of carbon capture and storage (CCS) systems, which are essential for reducing emissions. Another challenge is public perception and environmental concerns, as coal remains a controversial energy source due to its pollution history. The long-term economic viability of clean coal remains uncertain, especially in a world that is increasingly shifting toward renewable energy.

Clean Coal Market Segment Analysis:

Clean Coal Market is segmented based on Type of Technology, Application, Product Form, Service Type, and Region

By Type, the Carbon Capture and Storage (CCS) Segment is Expected to Dominate the Market During the Forecast Period

Carbon Capture and Storage (CCS) has become the dominant technology in the global clean coal market due to its effectiveness in reducing greenhouse gas emissions. CCS serves as an essential key for the sustainable development of coal-powered power generation. Organizations select CCS frequently because this technology supports international climate regulations and greenhouse gas reduction initiatives. Through emission storage facilities, coal power plants reduce their effect on the environment.

Governments, together with industries, have chosen CCS as their primary option to obtain clean coal technology. The massive deployment of this technology enables energy organizations to lower their carbon footprint by maintaining their use of coal reserves for power generation. The market dominance of CCS derives from the strict regulatory standards that it enables plants to achieve. The world views CCS as the top clean coal technology because of its present leadership position.

By Application, the Power Generation Segment Held the Largest Share in the projected period

The power generation segment is dominating the global clean coal market due to its increasing adoption of advanced clean coal technologies aimed at reducing carbon emissions and improving efficiency. The rising power generation demands and government regulations about environmental protection have driven power producers to look into cleaner coal technologies, which include supercritical and ultra-supercritical combustion systems as well as integrated gasification combined cycle (IGCC) and carbon capture and storage (CCS).

The new technological developments have made clean coal the preferred option for generating electricity by improving efficiency while reducing emissions in power plants. Segment dominance in the market receives additional support from government programs and research initiatives designed to enable sustainable energy production. The power generation sector maintains its position as the leader in clean coal technology adoption by advancing towards cleaner sources while relying on coal as the source for base power requirements.

Clean Coal Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

The Asia-Pacific region’s dominance in the global clean coal market is closely linked to its record-breaking coal production levels. In 2024, global coal output is expected to exceed 9 Bt, with China, India, and Indonesia leading the surge. The countries boost their fuel production to satisfy increasing energy needs while establishing investments in clean coal solutions, which support sustainable development.

China expands its clean coal projects, which include carbon capture and storage (CCS) and high-efficiency, low-emission (HELE) technologies, despite safety-related restrictions in provincial areas. The Indian government supports domestic clean coal production through policies targeting Coal India and other operators to achieve better coal technologies. The high coal production figures from Indonesia rise due to domestic and international market demand, while the nation invests in advanced processing technologies.

The increase in coal production, together with clean coal innovations, shows how the Asia-Pacific region influences worldwide coal utilization patterns. Regional governments provide backing to sustainable coal consumption methods despite substantial coal resources and energy security needs, which positions the area ahead in achieving industrial sustainability.

Clean Coal Market Active Players:

Alpha Natural Resources (U.S.)

Alstom SA (France)

Anglo American (U.K.)

Arch Coal (U.S.)

BHP Billiton (Australia)

China National Coal Group (China)

China Pingmei Shenma Group (China)

Coal India (India)

Datong Coal Group (China)

General Electric Company (U.S.)

Hamon Research–Cottrell (Belgium)

KBR Inc. (U.S.)

Peabody (U.S.)

RWE AG (Germany

Shell PLC (U.K.)

Shenhua Group (China)

Siemens Energy AG (Germany)

SUEK (Russia)

Xishan Coal Electricity Group (China)

Yanzhou Coal Mining (China)

Other Active Players

Key Industry Developments in the Clean Coal Market:

In February 2025, the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) released their H2 2024 biannual review of China’s coal projects, which finds that coal is still holding strong despite skyrocketing clean energy additions in 2024.

In July 2024, the government launched the National Coal Gasification Mission to achieve coal gasification and liquefaction of 100 million tonnes of coal by 2030. In line with the mission document, Coal India Ltd has signed pacts with BHEL, GAIL, and IOCL to take up coal gasification projects in the country.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Clean Coal Market by Type of Technology

4.1 Clean Coal Market Snapshot and Growth Engine

4.2 Clean Coal Market Overview

4.3 Carbon Capture and Storage (CCS)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Carbon Capture and Storage (CCS): Geographic Segmentation Analysis

4.4 Integrated Gasification Combined Cycle (IGCC)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Integrated Gasification Combined Cycle (IGCC): Geographic Segmentation Analysis

Chapter 5: Clean Coal Market by Application

5.1 Clean Coal Market Snapshot and Growth Engine

5.2 Clean Coal Market Overview

5.3 Power Generation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Power Generation: Geographic Segmentation Analysis

5.4 Industrial Applications

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Industrial Applications: Geographic Segmentation Analysis

Chapter 6: Clean Coal Market by End-User Industry

6.1 Clean Coal Market Snapshot and Growth Engine

6.2 Clean Coal Market Overview

6.3 Electric Utilities

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electric Utilities: Geographic Segmentation Analysis

6.4 Manufacturing

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Manufacturing: Geographic Segmentation Analysis

Chapter 7: Clean Coal Market by Product Form

7.1 Clean Coal Market Snapshot and Growth Engine

7.2 Clean Coal Market Overview

7.3 Coal Briquettes

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Coal Briquettes: Geographic Segmentation Analysis

7.4 Pulverized Coal

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Pulverized Coal: Geographic Segmentation Analysis

Chapter 8: Clean Coal Market by Service Type

8.1 Clean Coal Market Snapshot and Growth Engine

8.2 Clean Coal Market Overview

8.3 Consulting Services

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Consulting Services: Geographic Segmentation Analysis

8.4 Engineering Services

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Engineering Services: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Clean Coal Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ALPHA NATURAL RESOURCES (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ALSTOM SA (FRANCE)

9.4 ANGLO AMERICAN (U.K.)

9.5 ARCH COAL (U.S.)

9.6 BHP BILLITON (AUSTRALIA)

9.7 CHINA NATIONAL COAL GROUP (CHINA)

9.8 CHINA PINGMEI SHENMA GROUP (CHINA)

9.9 COAL INDIA (INDIA)

9.10 DATONG COAL GROUP (CHINA)

9.11 GENERAL ELECTRIC COMPANY (U.S.)

9.12 HAMON RESEARCH–COTTRELL (BELGIUM)

9.13 KBR INC. (U.S.)

9.14 PEABODY (U.S.)

9.15 RWE AG (GERMANY)

9.16 SHELL PLC (U.K.)

9.17 SHENHUA GROUP (CHINA)

9.18 SIEMENS ENERGY AG (GERMANY)

9.19 SUEK (RUSSIA)

9.20 XISHAN COAL ELECTRICITY GROUP (CHINA)

9.21 YANZHOU COAL MINING (CHINA)

9.22 OTHER ACTIVE PLAYERS

Chapter 10: Global Clean Coal Market By Region

10.1 Overview

10.2. North America Clean Coal Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Type of Technology

10.2.4.1 Carbon Capture and Storage (CCS)

10.2.4.2 Integrated Gasification Combined Cycle (IGCC)

10.2.5 Historic and Forecasted Market Size By Application

10.2.5.1 Power Generation

10.2.5.2 Industrial Applications

10.2.6 Historic and Forecasted Market Size By End-User Industry

10.2.6.1 Electric Utilities

10.2.6.2 Manufacturing

10.2.7 Historic and Forecasted Market Size By Product Form

10.2.7.1 Coal Briquettes

10.2.7.2 Pulverized Coal

10.2.8 Historic and Forecasted Market Size By Service Type

10.2.8.1 Consulting Services

10.2.8.2 Engineering Services

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Clean Coal Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Type of Technology

10.3.4.1 Carbon Capture and Storage (CCS)

10.3.4.2 Integrated Gasification Combined Cycle (IGCC)

10.3.5 Historic and Forecasted Market Size By Application

10.3.5.1 Power Generation

10.3.5.2 Industrial Applications

10.3.6 Historic and Forecasted Market Size By End-User Industry

10.3.6.1 Electric Utilities

10.3.6.2 Manufacturing

10.3.7 Historic and Forecasted Market Size By Product Form

10.3.7.1 Coal Briquettes

10.3.7.2 Pulverized Coal

10.3.8 Historic and Forecasted Market Size By Service Type

10.3.8.1 Consulting Services

10.3.8.2 Engineering Services

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Clean Coal Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Type of Technology

10.4.4.1 Carbon Capture and Storage (CCS)

10.4.4.2 Integrated Gasification Combined Cycle (IGCC)

10.4.5 Historic and Forecasted Market Size By Application

10.4.5.1 Power Generation

10.4.5.2 Industrial Applications

10.4.6 Historic and Forecasted Market Size By End-User Industry

10.4.6.1 Electric Utilities

10.4.6.2 Manufacturing

10.4.7 Historic and Forecasted Market Size By Product Form

10.4.7.1 Coal Briquettes

10.4.7.2 Pulverized Coal

10.4.8 Historic and Forecasted Market Size By Service Type

10.4.8.1 Consulting Services

10.4.8.2 Engineering Services

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Clean Coal Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Type of Technology

10.5.4.1 Carbon Capture and Storage (CCS)

10.5.4.2 Integrated Gasification Combined Cycle (IGCC)

10.5.5 Historic and Forecasted Market Size By Application

10.5.5.1 Power Generation

10.5.5.2 Industrial Applications

10.5.6 Historic and Forecasted Market Size By End-User Industry

10.5.6.1 Electric Utilities

10.5.6.2 Manufacturing

10.5.7 Historic and Forecasted Market Size By Product Form

10.5.7.1 Coal Briquettes

10.5.7.2 Pulverized Coal

10.5.8 Historic and Forecasted Market Size By Service Type

10.5.8.1 Consulting Services

10.5.8.2 Engineering Services

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Clean Coal Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Type of Technology

10.6.4.1 Carbon Capture and Storage (CCS)

10.6.4.2 Integrated Gasification Combined Cycle (IGCC)

10.6.5 Historic and Forecasted Market Size By Application

10.6.5.1 Power Generation

10.6.5.2 Industrial Applications

10.6.6 Historic and Forecasted Market Size By End-User Industry

10.6.6.1 Electric Utilities

10.6.6.2 Manufacturing

10.6.7 Historic and Forecasted Market Size By Product Form

10.6.7.1 Coal Briquettes

10.6.7.2 Pulverized Coal

10.6.8 Historic and Forecasted Market Size By Service Type

10.6.8.1 Consulting Services

10.6.8.2 Engineering Services

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Clean Coal Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Type of Technology

10.7.4.1 Carbon Capture and Storage (CCS)

10.7.4.2 Integrated Gasification Combined Cycle (IGCC)

10.7.5 Historic and Forecasted Market Size By Application

10.7.5.1 Power Generation

10.7.5.2 Industrial Applications

10.7.6 Historic and Forecasted Market Size By End-User Industry

10.7.6.1 Electric Utilities

10.7.6.2 Manufacturing

10.7.7 Historic and Forecasted Market Size By Product Form

10.7.7.1 Coal Briquettes

10.7.7.2 Pulverized Coal

10.7.8 Historic and Forecasted Market Size By Service Type

10.7.8.1 Consulting Services

10.7.8.2 Engineering Services

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What is the Forecast Period Covered in the Clean Coal Market Research Report?

A1: The projected forecast period for the Clean Coal Market Research Report is 2025-2032.

Q2: Who are the Key Players in the Clean Coal Market?

A2: Alpha Natural Resources (U.S.), Alstom SA (France), Anglo American (U.K.), Arch Coal (U.S.), BHP Billiton (Australia), China National Coal Group (China), China Pingmei Shenma Group (China), Coal India (India), Datong Coal Group (China), General Electric Company (U.S.), Hamon Research–Cottrell (Belgium), KBR Inc. (U.S.), Peabody (U.S.), RWE AG (Germany), Shell PLC (U.K.), Shenhua Group (China), Siemens Energy AG (Germany), SUEK (Russia), Xishan Coal Electricity Group (China), Yanzhou Coal Mining (China), and Other Active Players.

Q3: How is the Clean Coal Market segmented?

A3: The Clean Coal Market is segmented into Type of Technology, Application, Product Form, Service Type, and Region. By Type of Technology, it is categorized into Carbon Capture and Storage (CCS), Integrated Gasification Combined Cycle (IGCC). By Application, it is categorized into Power Generation, Industrial Applications. End-User Industry, is categorized into Electric Utilities, Manufacturing. By Product Form, it is categorized into Coal Briquettes, Pulverized Coal. By Service Type, it is categorized into Consulting Services, Engineering Services. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; ; Spain; Rest of Western Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Türkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil; Argentina, etc.).

Q4: What defines the Clean Coal Market?

A4: Clean coal refers to various technologies designed to mitigate the environmental impact of coal usage, primarily through methods such as wet scrubbers for sulfur dioxide removal, coal washing to eliminate impurities, and digitalization to enhance efficiency. The main practice of clean coal employs carbon capture and storage (CCS) technology, which captures carbon emissions from coal burning and then safely buries them underground.

Q5: What is the market size of the Clean Coal Market?

A5: Clean Coal Market Size Was Valued at USD 9.53 Billion in 2024, and is Projected to Reach USD 13.46 Million by 2032, Growing at a CAGR of 4.41% from 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!