Stay Ahead in Fast-Growing Economies.

Browse Reports NowCinnamon Market-Global Size & Upcoming Industry Trends

The cinnamon market refers to the global trade and consumption patterns of cinnamon, a popular spice derived from the inner bark of several tree species belonging to the genus Cinnamomum. Cinnamon is primarily used in cooking and baking for its distinctive flavor and aroma, as well as in traditional medicine and various industries for its potential health benefits and fragrance. The market encompasses the cultivation, processing, distribution, and consumption of cinnamon products such as ground cinnamon, cinnamon sticks, and cinnamon extracts.

IMR Group

Description

Cinnamon Market Synopsis

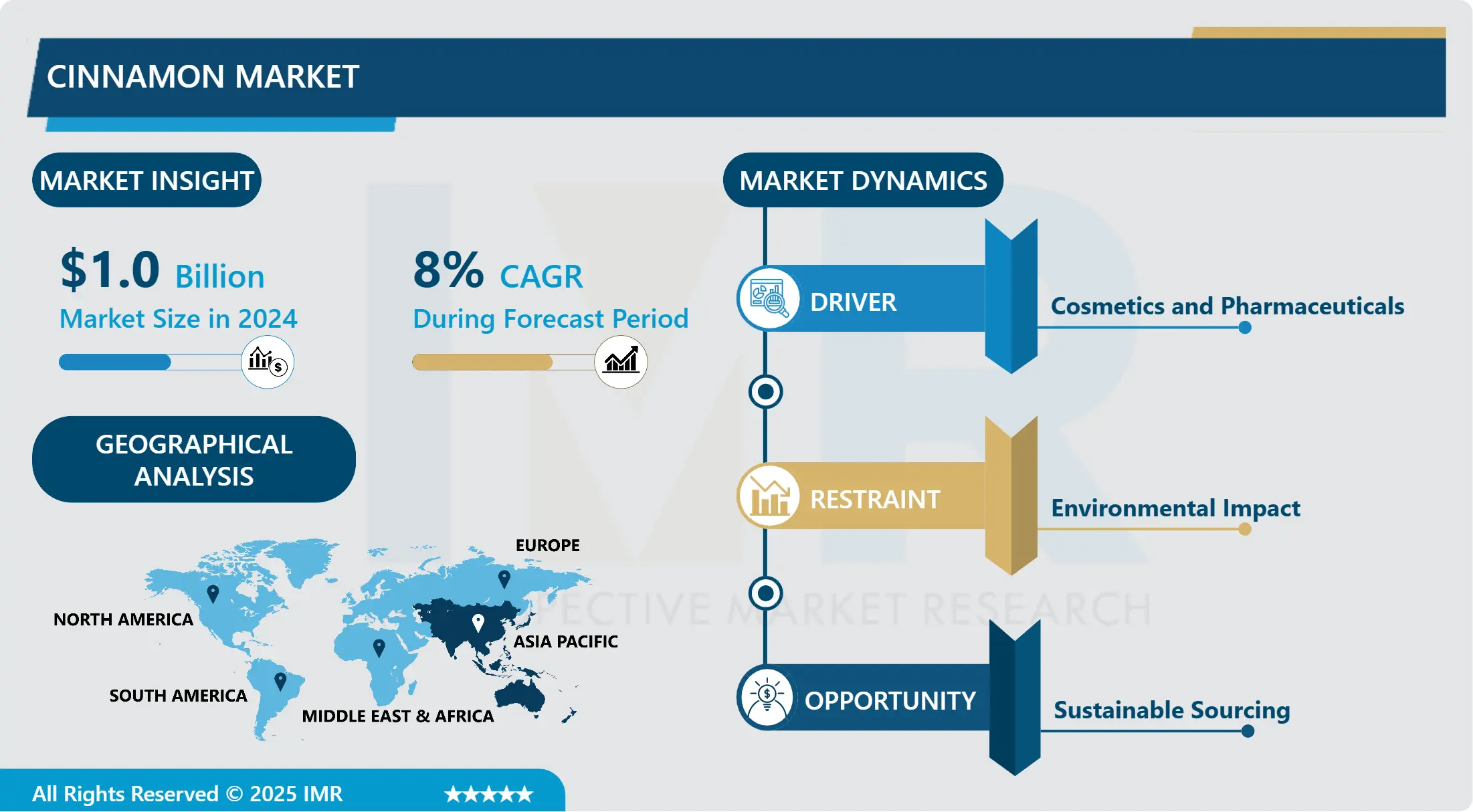

Cinnamon Market Size Was Valued at USD 1.0 Billion in 2024 and is Projected to Reach USD 1.85 Billion by 2032, Growing at a CAGR of 8% From 2025-2032.

The cinnamon market refers to the global trade and consumption patterns of cinnamon, a popular spice derived from the inner bark of several tree species belonging to the genus Cinnamomum. Cinnamon is primarily used in cooking and baking for its distinctive flavor and aroma, as well as in traditional medicine and various industries for its potential health benefits and fragrance. The market encompasses the cultivation, processing, distribution, and consumption of cinnamon products such as ground cinnamon, cinnamon sticks, and cinnamon extracts. Key factors influencing the cinnamon market include global demand trends driven by culinary preferences, health-conscious consumption patterns, and expanding applications in cosmetics and pharmaceuticals. Geographic factors, such as production capabilities in countries like Sri Lanka, Indonesia, China, and Vietnam, also play a significant role in shaping market dynamics and pricing trends within the cinnamon industry.

The growing customer desire for natural and organic food items is behind the robust rise of the worldwide cinnamon market. The spice known as cinnamon, which comes from the inner bark of trees of the genus Cinnamomum, has become extremely famous all over the world because of its unique flavor and many health advantages. Its strong antioxidant qualities, capacity to reduce blood sugar, and possible anti-inflammatory effects make it a desirable component for use in both medical and culinary applications.

The market for cinnamon is broad and includes both whole and powdered varieties, each serving a different niche in the food and beverage, pharmaceutical, and personal care product sectors. Thanks to rising consumer knowledge of its health-promoting qualities, there has been a noticeable increase in the use of cinnamon in functional foods and beverages in recent years. Additionally, because of its inherent taste enhancer properties and aromatic features, cinnamon is commonly employed in the confectionery industry.

Geographically, Asia Pacific is the region that produces and consumes the most cinnamon, mostly because of the region’s ideal climate for growing the crop and the significant output that comes from nations like China, Vietnam, and Indonesia. Closely behind in terms of demand are North America and Europe, where the food sector is a major driver and cinnamon is increasingly being used in complementary and alternative medicine.

The market for cinnamon is facing a number of obstacles despite its rising popularity, such as price instability brought on by weather conditions that affect crop yields and export restrictions imposed by key producing nations. Market participants must take strategic measures in order to guarantee a steady supply chain and constant product quality in light of these difficulties.

In the future, the market for cinnamon is expected to expand due to continuing advancements in processing methods that improve the quality and shelf life of the product. In response to the growing customer demand for ingredients supplied sustainably, manufacturers are likewise concentrating on sustainable sourcing processes and certifications. In addition, the growing popularity of natural and organic food items is anticipated to propel market growth as customers look for healthier options when making food selections.

In summary, the market for cinnamon exhibits encouraging development prospects due to its diverse range of uses, health advantages, and shifting consumer inclination towards natural ingredients. It will be imperative for players to adopt strategic measures to tackle obstacles and leverage nascent trends in order to leverage the market’s potential and maintain enduring profitability.

Cinnamon Market Trend Analysis

Cinnamon Market Growth Driver- Growing Consumer Interest in Cinnamon

The rise in consumer interest in cinnamon can be attributed to its potent antioxidant properties, which are increasingly valued for their health benefits. Antioxidants help combat oxidative stress in the body, potentially lowering the risk of chronic diseases like cardiovascular conditions and cancer. Cinnamon, particularly the Ceylon variety known for its higher levels of antioxidants compared to cassia, has garnered attention for its ability to improve overall health outcomes.

In developed markets such as North America and Europe, there’s a discernible trend towards incorporating more natural ingredients into daily diets. Cinnamon fits well into this narrative as consumers seek alternatives to synthetic additives and processed foods. Its perceived ability to aid in blood sugar control is particularly appealing to those managing conditions like diabetes. As awareness spreads about cinnamon’s potential anti-inflammatory effects, driven by scientific studies and consumer testimonials, demand continues to grow across both retail and foodservice sectors. This shift underscores a broader movement towards holistic health practices and sustainable lifestyles, influencing purchasing decisions and product development strategies in the global cinnamon market.

Cinnamon Market Expansion Opportunity- Expanding Versatility of Cinnamon

Because of its fragrant character and its medicinal benefits, cinnamon is popular in sectors other than food. Cinnamon’s unique perfume lends a warm, inviting scent to cosmetics and personal care products, increasing their attractiveness to customers. Moreover, it is a sought-after component in cosmetics formulations due to its purported skin advantages, which include possible antibacterial and anti-inflammatory characteristics. Since cinnamon has a natural appeal and is thought to be effective in boosting skin health, it is frequently incorporated in treatments that target acne treatment, skin regeneration, and even hair care.

The bioactive components of cinnamon, such as cinnamaldehyde and cinnamic acid, are being researched in the pharmaceutical industry for possible therapeutic uses. Their potential anti-cancer, antibacterial, and antioxidant properties have been shown by research, which may have implications for medication development in the future. Additionally, there is interest in cinnamon’s possible application in diabetes treatment products due to its capacity to improve insulin sensitivity and control blood sugar levels. Because of these adaptable qualities, cinnamon is becoming more and more used in a variety of sectors, spurring innovation and market expansion outside of the realm of food and drink.

Cinnamon Market Segment Analysis:

Cinnamon Market Segmented based on Type, Application, Nature, Form, Distribution Channel, and Region.

By Type, Cassia Cinnamon segment is expected to dominate the market during the forecast period

Cassia Cinnamon, scientifically known as Cinnamomum cassia, is renowned for its robust flavor profile and accessibility, making it the most widely preferred type in the global market. Originating primarily from China, Vietnam, and Indonesia, Cassia Cinnamon stands out for its lower cost compared to its counterpart, Ceylon Cinnamon. This affordability has positioned it favorably in both consumer and industrial markets, where cost-effective solutions without compromising quality are paramount.

In culinary applications, Cassia Cinnamon’s strong, spicy-sweet flavor enhances a wide array of dishes, from desserts like cinnamon rolls and apple pies to savory dishes such as curries and stews. Its aromatic qualities are also valued in beverages like mulled wine and hot cinnamon tea, where it adds depth and warmth. Beyond its culinary uses, Cassia Cinnamon has a long history of medicinal applications, particularly in traditional Chinese medicine and Ayurveda. It is believed to have anti-inflammatory properties and may aid in blood sugar control and digestion, contributing to its widespread adoption in health and wellness products globally.

The versatility of Cassia Cinnamon extends to industrial applications as well, where its robust flavor profile makes it ideal for use in food processing, confectionery, and flavorings. Its affordability and availability in various forms—such as sticks, powder, and extracts further enhance its utility across different sectors. Overall, Cassia Cinnamon’s dominance in the global market underscores not only its culinary appeal and medicinal benefits but also its economic significance in various industries worldwide.

By Form, Powder segment held the largest share in 2024

The reason powdered cinnamon has the most market share in the cinnamon sector is because it’s easy to incorporate into many culinary applications and is convenient and versatile. Powdered cinnamon, as opposed to sticks or other forms, provides a ready-to-use option that reduces preparation time and effort. Its supremacy in the market is fueled by its convenience, which is highly favored by professional chefs, home cooks, and food producers alike.

Powdered cinnamon is a basic ingredient in baking, adding warm, spicy tones to cakes, cookies, breads, and pastries. Because of its fine texture, the cinnamon taste in the finished goods is consistently and delightfully distributed throughout the batter or dough. In a similar vein, powdered cinnamon is used in cooking to enhance the flavor and complexity of sauces, marinades, and meat rubs in both savory and sweet meals. Its adaptability also extends to the production of drinks, where it’s frequently used in both hot and cold beverages, including smoothies and cocktails, as well as hot drinks like coffee, chocolate, and chai tea.

In addition to its culinary uses, powdered cinnamon is preferred over sticks or other forms due to its shelf stability and extended storage life. This satisfies the demands of food manufacturers that need uniform quality and flavor characteristics throughout their product lines by making it simpler to transport and store in bulk. In addition, the fine powder form makes it possible to measure and regulate the quantity of cinnamon used precisely, guaranteeing the right flavor and aroma in a variety of food and beverage compositions.

Ultimately, the dominance of powdered cinnamon in this market segment highlights its crucial position in the culinary world, providing consumers and professionals in the food business with convenience, adaptability, and consistent quality that satisfy a range of demands.

Cinnamon Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Because of their ideal climates for growing premium cinnamon, Sri Lanka and Indonesia stand out as major participants in the worldwide market for cinnamon in the Asia Pacific region. The “Pearl of the Indian Ocean,” Sri Lanka, has a long history of growing cinnamon and is well-known for its Ceylon cinnamon, which is frequently regarded as having a better flavor and scent. The country’s coastline areas offer the perfect blend of tropical humidity and well-drained soil that cinnamon plants require to flourish.

However, one of the biggest producers of cassia cinnamon—a kind prized for both its inexpensive price and strong flavor—is Indonesia. The country’s status as a major supplier of cinnamon is mostly due to its extensive agricultural lands and the favorable climate in areas like Sumatra and Java. The production of cinnamon in Indonesia is enhanced by a wealth of knowledge and infrastructure in the cultivation of spices, as well as by the backing of local farming communities and government programs that strive to improve agricultural output.

In addition to controlling the majority of the production, Sri Lanka and Indonesia are essential to supplying the world’s need for cinnamon. Food and beverage, pharmaceutical, and cosmetic sectors, among others, rely on the consistent supply of cinnamon goods sourced from their well-established infrastructure for cultivation, processing, and exports. With the growing worldwide awareness of cinnamon’s health advantages, these nations are well-positioned to hold their key positions in the dynamic Asia Pacific cinnamon market environment.

Active Key Players in the Cinnamon Market

Risun Bio-Tech Inc.

Cinnatopia

Monterey Bay Spice Company

The Organic Cinnamon

Ceylon Spice Company

Elite Spice

Natural Spices of Grenada

McCormick & Company

Lemur International Inc.

New Lanka Cinnamon Pvt. Ltd.

G.P. de Silva & Sons International (Pvt.) Ltd.

FutureCeuticals

Kahawatte Plantations PLC

High Plains Spice Company

Great American Spice Co.

Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cinnamon Market by Type (2018-2032)

4.1 Cinnamon Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cassia Cinnamon

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ceylon Cinnamon

4.5 Saigon Cinnamon

4.6 Korintje Cinnamon

Chapter 5: Cinnamon Market by Application (2018-2032)

5.1 Cinnamon Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

Chapter 6: Cinnamon Market by Nature (2018-2032)

6.1 Cinnamon Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Organic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Conventional

Chapter 7: Cinnamon Market by Form (2018-2032)

7.1 Cinnamon Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Whole

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Extract

7.5 Powder

7.6 Oil

Chapter 8: Cinnamon Market by Distribution Channel (2018-2032)

8.1 Cinnamon Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Business-to-Business

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Business-to-Consumer

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Cinnamon Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 RISUN BIO-TECH INCCINNATOPIA

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MONTEREY BAY SPICE COMPANY

9.4 THE ORGANIC CINNAMON

9.5 CEYLON SPICE COMPANY

9.6 ELITE SPICE

9.7 NATURAL SPICES OF GRENADA

9.8 MCCORMICK & COMPANY

9.9 LEMUR INTERNATIONAL INCNEW LANKA CINNAMON PVT. LTDG.P. DE SILVA & SONS INTERNATIONAL (PVT.) LTDFUTURECEUTICALS

9.10 KAHAWATTE PLANTATIONS PLC

9.11 HIGH PLAINS SPICE COMPANY

9.12 GREAT AMERICAN SPICE COOTHER KEY PLAYERS

9.13

Chapter 10: Global Cinnamon Market By Region

10.1 Overview

10.2. North America Cinnamon Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Cassia Cinnamon

10.2.4.2 Ceylon Cinnamon

10.2.4.3 Saigon Cinnamon

10.2.4.4 Korintje Cinnamon

10.2.5 Historic and Forecasted Market Size by Application

10.2.5.1 Residential

10.2.5.2 Commercial

10.2.6 Historic and Forecasted Market Size by Nature

10.2.6.1 Organic

10.2.6.2 Conventional

10.2.7 Historic and Forecasted Market Size by Form

10.2.7.1 Whole

10.2.7.2 Extract

10.2.7.3 Powder

10.2.7.4 Oil

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Business-to-Business

10.2.8.2 Business-to-Consumer

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Cinnamon Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Cassia Cinnamon

10.3.4.2 Ceylon Cinnamon

10.3.4.3 Saigon Cinnamon

10.3.4.4 Korintje Cinnamon

10.3.5 Historic and Forecasted Market Size by Application

10.3.5.1 Residential

10.3.5.2 Commercial

10.3.6 Historic and Forecasted Market Size by Nature

10.3.6.1 Organic

10.3.6.2 Conventional

10.3.7 Historic and Forecasted Market Size by Form

10.3.7.1 Whole

10.3.7.2 Extract

10.3.7.3 Powder

10.3.7.4 Oil

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Business-to-Business

10.3.8.2 Business-to-Consumer

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Cinnamon Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Cassia Cinnamon

10.4.4.2 Ceylon Cinnamon

10.4.4.3 Saigon Cinnamon

10.4.4.4 Korintje Cinnamon

10.4.5 Historic and Forecasted Market Size by Application

10.4.5.1 Residential

10.4.5.2 Commercial

10.4.6 Historic and Forecasted Market Size by Nature

10.4.6.1 Organic

10.4.6.2 Conventional

10.4.7 Historic and Forecasted Market Size by Form

10.4.7.1 Whole

10.4.7.2 Extract

10.4.7.3 Powder

10.4.7.4 Oil

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Business-to-Business

10.4.8.2 Business-to-Consumer

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Cinnamon Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Cassia Cinnamon

10.5.4.2 Ceylon Cinnamon

10.5.4.3 Saigon Cinnamon

10.5.4.4 Korintje Cinnamon

10.5.5 Historic and Forecasted Market Size by Application

10.5.5.1 Residential

10.5.5.2 Commercial

10.5.6 Historic and Forecasted Market Size by Nature

10.5.6.1 Organic

10.5.6.2 Conventional

10.5.7 Historic and Forecasted Market Size by Form

10.5.7.1 Whole

10.5.7.2 Extract

10.5.7.3 Powder

10.5.7.4 Oil

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Business-to-Business

10.5.8.2 Business-to-Consumer

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Cinnamon Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Cassia Cinnamon

10.6.4.2 Ceylon Cinnamon

10.6.4.3 Saigon Cinnamon

10.6.4.4 Korintje Cinnamon

10.6.5 Historic and Forecasted Market Size by Application

10.6.5.1 Residential

10.6.5.2 Commercial

10.6.6 Historic and Forecasted Market Size by Nature

10.6.6.1 Organic

10.6.6.2 Conventional

10.6.7 Historic and Forecasted Market Size by Form

10.6.7.1 Whole

10.6.7.2 Extract

10.6.7.3 Powder

10.6.7.4 Oil

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Business-to-Business

10.6.8.2 Business-to-Consumer

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Cinnamon Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Cassia Cinnamon

10.7.4.2 Ceylon Cinnamon

10.7.4.3 Saigon Cinnamon

10.7.4.4 Korintje Cinnamon

10.7.5 Historic and Forecasted Market Size by Application

10.7.5.1 Residential

10.7.5.2 Commercial

10.7.6 Historic and Forecasted Market Size by Nature

10.7.6.1 Organic

10.7.6.2 Conventional

10.7.7 Historic and Forecasted Market Size by Form

10.7.7.1 Whole

10.7.7.2 Extract

10.7.7.3 Powder

10.7.7.4 Oil

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Business-to-Business

10.7.8.2 Business-to-Consumer

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Cinnamon Market research report?

A1: The forecast period in the Cinnamon Market research report is 2025-2032.

Q2: Who are the key players in the Cinnamon Market?

A2: Risun Bio-Tech Inc., Cinnatopia, Monterey Bay Spice Company, The Organic Cinnamon, Ceylon Spice Company, Elite Spice, Natural Spices of Grenada, McCormick & Company, Lemur International Inc., New Lanka Cinnamon Pvt. Ltd., G.P. de Silva & Sons International (Pvt.) Ltd., FutureCeuticals, Kahawatte Plantations PLC, High Plains Spice Company, Great American Spice Co. and Other Active Players.

Q3: What are the segments of the Cinnamon Market?

A3: The Cinnamon Market is segmented into By Type, By Application, By Nature , By Form, By Distribution Channel and region. By Type, the market is categorized into Cassia Cinnamon, Ceylon Cinnamon, Saigon Cinnamon and Korintje Cinnamon. By Application, the market is categorized into Residential and Commercial. By Nature, the market is categorized into Organic and Conventional.By Form, the market is categorized into Whole, Extract, Powder and Oil. By Distribution Channel, the market is categorized into Business-to-Business and Business-to-Consumer. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; South Korea; Malaysia; Thailand; Vietnam; The Philippines; Australia; New Zealand; Rest of APAC), Middle East & Africa (Türkiye; Bahrain; Kuwait; Saudi Arabia; Qatar; UAE; Israel; South Africa), South America (Brazil; Argentina; Rest of SA.).

Q4: What is the Cinnamon Market?

A4: The cinnamon market refers to the global trade and consumption patterns of cinnamon, a popular spice derived from the inner bark of several tree species belonging to the genus Cinnamomum. Cinnamon is primarily used in cooking and baking for its distinctive flavor and aroma, as well as in traditional medicine and various industries for its potential health benefits and fragrance. The market encompasses the cultivation, processing, distribution, and consumption of cinnamon products such as ground cinnamon, cinnamon sticks, and cinnamon extracts. Key factors influencing the cinnamon market include global demand trends driven by culinary preferences, health-conscious consumption patterns, and expanding applications in cosmetics and pharmaceuticals. Geographic factors, such as production capabilities in countries like Sri Lanka, Indonesia, China, and Vietnam, also play a significant role in shaping market dynamics and pricing trends within the cinnamon industry.

Q5: How big is the Cinnamon Market?

A5: Cinnamon Market Size Was Valued at USD 1.0 Billion in 2024 and is Projected to Reach USD 1.85 Billion by 2032, Growing at a CAGR of 8% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!